Bridgestone SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bridgestone Bundle

Bridgestone, a global leader in tire manufacturing, boasts significant strengths in brand recognition and technological innovation, but faces intense competition and evolving market demands. Understanding these dynamics is crucial for any stakeholder.

Discover the complete picture behind Bridgestone’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Bridgestone's global market leadership is undeniable, with operations spanning 24 countries and a firmly established position as one of the world's largest tire manufacturers. This extensive reach, built over decades since its founding in 1931, translates into substantial brand equity and strong customer recognition.

The company's enduring reputation for quality is consistently reinforced by prestigious accolades, such as being named a General Motors Supplier of the Year for ten consecutive years. This ongoing recognition underscores Bridgestone's commitment to excellence and reliability in the automotive sector.

Bridgestone is strategically emphasizing its premium tire segment, especially high-rim diameter (HRD) tires, which are 18 inches and larger. These tires offer significantly better profit margins for the company.

This strategic direction is clearly outlined in Bridgestone's 2024-2026 Mid Term Business Plan, which targets a greater penetration of premium products in both new car manufacturing (original equipment) and the aftermarket (replacement) sectors. For instance, in 2023, the premium tire segment represented a substantial portion of their sales, with HRD tires showing consistent growth.

By concentrating on these higher-value products, Bridgestone aims to enhance its overall profitability and solidify its position in an automotive market increasingly favoring larger wheel sizes and advanced tire technologies.

Bridgestone's commitment to advanced technology is a significant strength, particularly with its ENLITEN tire technology. This suite focuses on improving both performance and sustainability, a key differentiator in the current market. For instance, ENLITEN technology can reduce the rolling resistance of tires, leading to better fuel efficiency for vehicles.

The company's investment in BCMA, or Bridgestone Commonality Modularity Architecture, is another major advantage. This platform streamlines the design and manufacturing process, allowing for greater efficiency and cost reduction. BCMA facilitates the development of 'Dan-Totsu' products, meaning Bridgestone can offer highly customized solutions that also drive down operational expenses.

Furthermore, Bridgestone is actively developing digital solutions to enhance customer experience. This includes personalized tire recommendations powered by data analytics, which can improve customer satisfaction and loyalty. This forward-thinking approach positions Bridgestone to adapt to evolving consumer demands for tailored and digitally-integrated products.

Strong Commitment to Sustainability

Bridgestone demonstrates a profound dedication to sustainability, clearly outlined in its 'Bridgestone E8 Commitment.' This initiative sets ambitious targets, including achieving carbon neutrality by 2050 and sourcing 100% renewable and recycled materials for its tires.

The company is actively investing in and developing sustainable materials. For instance, Bridgestone utilized over 65% recycled and renewable materials in its tires for the 2025 World Solar Challenge, showcasing practical application of its environmental goals. Furthermore, Bridgestone is making significant strides in advancing tire recycling technologies, aiming to close the loop on material usage.

- Bridgestone E8 Commitment: A comprehensive sustainability framework.

- Carbon Neutrality Goal: Targeting achievement by 2050.

- Material Sourcing: Aiming for 100% renewable and recycled materials.

- Sustainable Material Innovation: Over 65% recycled/renewable materials used in 2025 World Solar Challenge tires.

Robust Global Supply Chain and Production Optimization

Bridgestone's commitment to optimizing its global supply chain is a significant strength, exemplified by initiatives like 'B-Direct.' This strategy prioritizes local production for local sales, targeting 90% for passenger and light truck tires and 80% for truck and bus tires worldwide. This localized approach not only boosts agility and mitigates geopolitical risks but also drives cost efficiencies throughout the entire value chain.

Further bolstering its production capabilities, Bridgestone is actively expanding capacity in key growth markets. For instance, the company is making substantial investments in India, recognizing its potential as a crucial hub for future tire demand and manufacturing. This strategic expansion ensures Bridgestone can effectively meet increasing regional demand and capitalize on emerging market opportunities.

- B-Direct Initiative: Focuses on local production for local sales, aiming for high localization rates.

- Geopolitical Risk Mitigation: Localized production reduces vulnerability to global supply chain disruptions.

- Cost Optimization: Streamlines operations and reduces transportation expenses.

- Growth Market Expansion: Increased production capacity in regions like India to meet rising demand.

Bridgestone's global reach and brand recognition are cornerstones of its strength, supported by operations in 24 countries and a legacy dating back to 1931. This extensive market presence is complemented by a strong reputation for quality, evidenced by consistent accolades like being named a General Motors Supplier of the Year for ten consecutive years. The company's strategic focus on premium tire segments, particularly high-rim diameter (HRD) tires, which offer better profit margins, is a key driver for enhanced profitability and market positioning.

Technological innovation is a significant advantage, with ENLITEN tire technology improving both performance and sustainability, such as reducing rolling resistance for better fuel efficiency. The Bridgestone Commonality Modularity Architecture (BCMA) platform streamlines design and manufacturing, enabling cost reduction and the development of customized solutions. Furthermore, Bridgestone is investing in digital solutions for personalized customer experiences, leveraging data analytics to boost satisfaction and loyalty.

Bridgestone's commitment to sustainability, outlined in its 'Bridgestone E8 Commitment,' targets carbon neutrality by 2050 and 100% renewable and recycled materials. The company actively uses sustainable materials, incorporating over 65% recycled and renewable materials in its 2025 World Solar Challenge tires. This dedication extends to advancing tire recycling technologies to create a circular economy.

The company's supply chain optimization through the B-Direct initiative, focusing on local production for local sales, enhances agility and mitigates geopolitical risks while driving cost efficiencies. Strategic capacity expansion in growth markets, such as significant investments in India, positions Bridgestone to meet rising regional demand and capitalize on emerging opportunities.

| Strength | Description | Supporting Data/Examples |

| Global Market Leadership & Brand Equity | Extensive operations and strong brand recognition built over decades. | Operations in 24 countries; founded in 1931. |

| Reputation for Quality | Consistent recognition for excellence and reliability. | General Motors Supplier of the Year for 10 consecutive years. |

| Focus on Premium Products | Strategic emphasis on high-margin premium tires, especially HRD tires. | Targeting greater penetration of premium products in OE and aftermarket sectors as per 2024-2026 Mid Term Business Plan. |

| Technological Innovation | Development of advanced tire technologies and efficient manufacturing platforms. | ENLITEN technology for performance and sustainability; BCMA platform for efficiency. |

| Sustainability Commitment | Ambitious environmental goals and active development of sustainable materials and recycling. | Bridgestone E8 Commitment; Carbon Neutrality by 2050; over 65% recycled/renewable materials in 2025 World Solar Challenge tires. |

| Supply Chain Optimization | Localized production strategy and expansion in growth markets. | B-Direct initiative aiming for high localization rates; investments in India. |

What is included in the product

Delivers a strategic overview of Bridgestone’s internal and external business factors, highlighting its strengths in brand reputation and market share while acknowledging opportunities in sustainable technologies and potential threats from raw material price volatility.

Offers a clear, actionable framework for identifying and addressing Bridgestone's strategic challenges and opportunities.

Weaknesses

Bridgestone faced a noticeable dip in its operating and net profit during fiscal year 2024 and the initial half of 2025. This downturn was significantly influenced by substantial restructuring expenses and a reduction in unit sales within specific geographical markets.

These strategic restructuring initiatives, while designed to bolster long-term operational efficiency, naturally exerted a short-term drag on the company's financial results. Bridgestone is actively engaged in its 'business rebuilding second stage' program to navigate and rectify these financial pressures.

Bridgestone's significant reliance on the automotive sector, despite efforts to diversify, presents a notable weakness. This dependence means the company's financial performance is closely tied to the health of new vehicle sales and overall economic conditions. For instance, a downturn in the global automotive market directly impacts demand for Bridgestone's core tire products.

The evolving automotive landscape, including a slower-than-expected transition to electric vehicles in some markets and a general decline in new vehicle tire demand in certain regions, has already begun to affect Bridgestone's sales volumes. This trend highlights how shifts within the automotive industry can pose a direct challenge to the company's revenue streams and growth prospects.

Bridgestone tires are frequently seen as a premium, high-priced option. This perception can be a hurdle in markets where cost is a primary driver for consumers, or when facing off against competitors offering more budget-friendly tires. For instance, while Bridgestone aims for quality, this high-price image might alienate shoppers solely focused on price, potentially impacting sales volume in certain segments.

Challenges in Specific Regional Markets

Bridgestone has encountered substantial headwinds in certain regional markets, notably Latin America. In Brazil and Argentina, the company experienced significant business deterioration, a situation exacerbated by a contraction in unit sales and increased competition from lower-priced tire imports.

Further complicating matters, Bridgestone's Asian markets also saw a sales decline in the second quarter of 2024. While overall profitability saw an increase during this period, driven by a more favorable sales mix and effective expense management, the dip in Asian sales highlights ongoing regional vulnerabilities.

Addressing these specific market challenges necessitates the implementation of tailored restructuring initiatives and distinct market strategies. For instance, the company's Q2 2024 results indicated a need for localized approaches to regain market share and mitigate the impact of competitive pressures.

- Latin America Deterioration: Significant business decline in Brazil and Argentina due to lower unit sales and low-cost tire influx.

- Asia Sales Dip: Declining sales in Asia during Q2 2024, despite overall profit gains from sales mix and cost control.

- Strategic Imperative: Need for targeted restructuring and region-specific strategies to overcome these market weaknesses.

Supply Chain and Raw Material Volatility

Bridgestone faces challenges from fluctuating raw material costs, such as natural rubber and synthetic rubber, which are key components in tire manufacturing. For instance, in early 2024, natural rubber prices saw significant upward movement due to weather patterns and increased demand from Asia, directly impacting Bridgestone's cost of goods sold.

Despite efforts to enhance global procurement strategies and optimize logistics networks, the company remains susceptible to unforeseen supply chain disruptions. These can range from geopolitical events to natural disasters, potentially leading to production delays and increased operational expenses. Bridgestone's 2024 financial reports indicated that while logistics efficiency improved, the overall impact of supply chain volatility contributed to a slight increase in production costs in certain regions.

- Exposure to Natural Rubber Price Fluctuations: Natural rubber prices, a critical input, can be highly volatile, impacting Bridgestone's production costs.

- Supply Chain Vulnerabilities: Global events can disrupt the flow of raw materials and finished goods, affecting operational efficiency and profitability.

- Impact on Profitability: Unforeseen increases in raw material prices and logistics costs can squeeze profit margins if not effectively managed through pricing adjustments or cost efficiencies.

- Vulnerability to Market Swings: Despite cost improvement initiatives, Bridgestone's profitability remains sensitive to external market price shifts for its essential inputs.

Bridgestone's premium pricing strategy, while indicative of quality, can limit market penetration in price-sensitive regions or against budget-focused competitors. This perception may alienate consumers prioritizing cost savings, potentially capping sales volume in specific market segments.

The company's significant reliance on the automotive sector makes it vulnerable to industry downturns and shifts in consumer preferences, such as the pace of EV adoption. For example, a slowdown in new vehicle sales directly impacts demand for Bridgestone's core tire products.

Regional market challenges, particularly in Latin America and parts of Asia, present ongoing weaknesses. Deterioration in markets like Brazil and Argentina, driven by reduced unit sales and increased competition from lower-cost imports, necessitates targeted strategies to regain market share.

Bridgestone's profitability is susceptible to fluctuations in raw material costs, such as natural rubber, and potential supply chain disruptions. For instance, rising natural rubber prices in early 2024 directly impacted the cost of goods sold.

Preview Before You Purchase

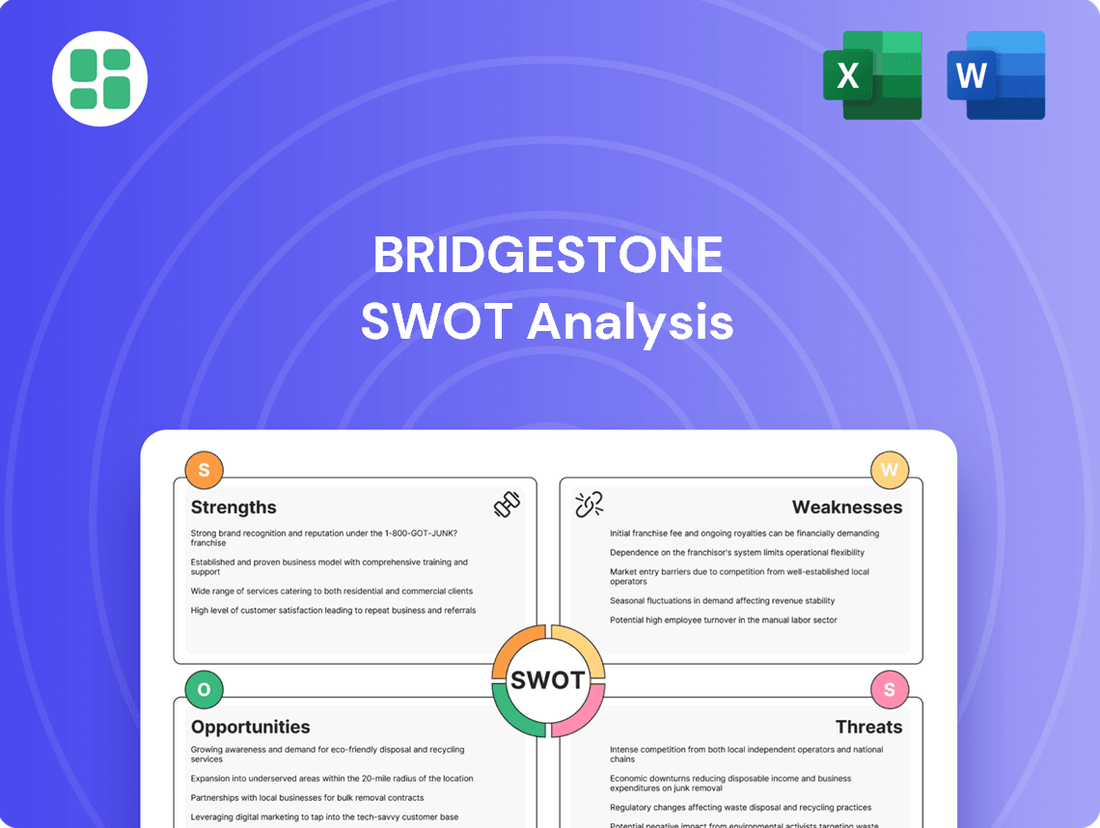

Bridgestone SWOT Analysis

The preview below is taken directly from the full Bridgestone SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of their strategic positioning.

This is a real excerpt from the complete Bridgestone SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific needs.

You’re viewing a live preview of the actual Bridgestone SWOT analysis file. The complete version becomes available after checkout, ensuring you have all the detailed insights.

Opportunities

The accelerating global shift towards electric vehicles (EVs) presents a substantial growth avenue for Bridgestone. EVs, with their unique torque and weight profiles, necessitate tires engineered for specific performance attributes like reduced rolling resistance and enhanced durability. Bridgestone is actively capitalizing on this trend by broadening its EV tire offerings, including models like the Turanza EV, and incorporating advanced ENLITEN technology to address these specialized requirements. This strategic expansion is well-timed, given forecasts predicting a significant increase in EV sales worldwide.

Bridgestone sees significant opportunities in emerging markets like India, projecting a 25% revenue increase in these regions between 2024 and 2026. This growth is supported by plans to expand production capacity, specifically targeting the premium tire segment to meet rising consumer demand.

By concentrating on these high-potential markets, Bridgestone aims to capture a larger share of the global tire industry. This strategic focus on emerging economies is crucial for reinforcing its competitive standing and driving sustained revenue growth in the coming years.

Bridgestone is strategically shifting its focus to become a comprehensive mobility solutions provider, moving beyond traditional tire manufacturing. This pivot involves significant investment in digital ecosystems and advanced tire technologies to offer value-added services. For instance, their digital platforms aim to enhance fleet management and provide personalized tire recommendations, as seen in their ongoing digital transformation initiatives.

The company is actively developing and integrating digital solutions to improve operational efficiency and customer engagement. This includes offering services like retread solutions and advanced tire monitoring, which are crucial for modern fleet operations. Bridgestone's commitment to digitalization is evident in their efforts to create a seamless experience for customers, from purchase to ongoing tire management.

Strategic Partnerships and Co-creation for Circular Economy

Bridgestone's strategic partnerships are key to its circular economy ambitions. Collaborating with entities like Cabot Corporation for essential materials such as carbon black not only fortifies its supply chain but also bolsters its competitive edge in the market. This type of alliance is crucial for navigating the complexities of raw material sourcing in an increasingly resource-conscious world.

The company is actively engaged in co-creation projects focused on tire recycling. The ultimate goal is to 'renew' tires back into valuable raw materials, a process that directly supports Bridgestone's broader sustainability objectives and unlocks new avenues for value creation within the circular economy framework. This innovative approach is vital for transforming waste streams into economic opportunities.

- Supply Chain Resilience: Partnerships like the one with Cabot Corporation for carbon black enhance Bridgestone's access to critical raw materials, reducing reliance on volatile markets and ensuring production continuity.

- Circular Economy Innovation: Co-creation initiatives are driving the commercialization of advanced tire recycling technologies, aiming to convert end-of-life tires into high-quality raw materials, thereby closing the loop in the product lifecycle.

- Value Creation: By transforming waste into resources, Bridgestone is not only meeting environmental goals but also developing new business models and revenue streams, demonstrating the economic viability of circular practices.

- Competitiveness Enhancement: These strategic alliances and innovative recycling efforts contribute to Bridgestone's overall competitiveness by improving efficiency, reducing costs associated with virgin materials, and meeting growing consumer demand for sustainable products.

Portfolio Optimization and Business Rebuilding

Bridgestone's strategic restructuring, including optimizing its global business footprint and divesting non-core assets, offers a significant opportunity. This initiative aims to streamline operations, enhance overall profitability, and create a more agile organization. For instance, the company's ongoing efforts to refine its portfolio, as seen in various divestitures and strategic realignments throughout 2024 and into 2025, are designed to unlock value and improve financial performance.

By focusing on its core premium tire and diversified product businesses, Bridgestone can cultivate a leaner structure. This sharpened focus is expected to improve management efficiency and working practices, laying a stronger foundation for future growth and increased shareholder value. The company's commitment to this rebuilding phase underscores its dedication to adapting to evolving market demands and strengthening its competitive position.

Key aspects of this opportunity include:

- Portfolio Rationalization: Divesting underperforming or non-strategic assets to concentrate resources on high-growth, high-margin segments.

- Operational Efficiency Gains: Streamlining supply chains, manufacturing processes, and administrative functions to reduce costs and boost productivity.

- Enhanced Profitability Focus: Directing investment and management attention towards core businesses that offer the greatest potential for returns.

- Improved Financial Health: Strengthening the balance sheet through divestments and operational improvements, potentially leading to better credit ratings and access to capital.

Bridgestone is well-positioned to capitalize on the growing demand for sustainable and specialized tires, particularly for electric vehicles. The company's investment in advanced technologies like ENLITEN and its expansion into emerging markets, like India, where a 25% revenue increase is projected between 2024 and 2026, are key drivers of future growth. Furthermore, Bridgestone's strategic pivot towards becoming a comprehensive mobility solutions provider, integrating digital platforms and circular economy initiatives, opens up new revenue streams and enhances customer value.

Threats

Bridgestone contends with formidable rivals such as Michelin, Goodyear, and Continental, alongside a growing number of local and Tier 2 manufacturers offering more budget-friendly tire options. This intense competitive landscape pressures pricing strategies and market positioning.

The increasing volume of low-priced tire imports, particularly evident in key regions like Europe and South America, presents a substantial threat to Bridgestone's market share and overall profitability. For instance, in 2024, the European tire market saw a notable increase in imports from lower-cost manufacturing hubs, impacting established players' revenue streams.

Bridgestone faces significant threats from the volatility of raw material prices, particularly for natural rubber and synthetic components. For instance, the price of natural rubber, a key input, saw considerable fluctuations in 2024, impacting production costs. These price swings directly affect Bridgestone's ability to maintain stable profit margins.

Furthermore, broader supply chain disruptions, exacerbated by geopolitical tensions and logistical challenges throughout 2024 and into early 2025, pose a constant risk to consistent production and timely delivery. Adapting to these unpredictable events requires ongoing strategic flexibility and robust risk management to ensure operational continuity.

Economic downturns pose a significant threat to Bridgestone. A global economic slowdown, as seen with persistent inflation and interest rate hikes in late 2023 and into 2024, can directly reduce demand for new vehicles and replacement tires. This translates to lower sales volumes for the company.

Furthermore, during periods of economic uncertainty, consumers tend to become more price-sensitive. This shift in consumer behavior can lead to a greater preference for lower-cost tire alternatives, potentially eroding Bridgestone's market share, particularly given its emphasis on premium products.

Structural Changes in the Automotive Industry

The automotive sector is undergoing significant structural transformations beyond the electric vehicle (EV) transition. Evolving manufacturing techniques, the rise of new mobility services like ride-sharing and autonomous driving, and potential shifts away from traditional vehicle ownership models all pose challenges. These changes could directly impact the volume and specifications of tires required by automakers. For instance, the increasing adoption of shared mobility could lead to higher mileage on tires, demanding greater durability and longevity from Bridgestone's offerings. In 2024, the global automotive market is expected to see continued growth in EV sales, projected to reach over 15 million units, and the expansion of mobility-as-a-service platforms is reshaping urban transportation.

Bridgestone must proactively adapt its product development and overall business strategy to these fundamental industry shifts. This includes investing in research and development for tires optimized for EVs, which often have different weight distribution and torque characteristics than internal combustion engine vehicles. Furthermore, exploring new business models that cater to fleet operators and mobility service providers will be crucial. The company's ability to innovate in tire technology, such as developing more sustainable and high-performance compounds, will be key to maintaining its competitive edge in this dynamic environment.

- Evolving Manufacturing: Automation and advanced materials in vehicle production necessitate tire adaptations.

- New Mobility Models: Ride-sharing and autonomous vehicles may increase tire wear and demand specialized performance.

- Ownership Trends: A potential decline in private car ownership could alter overall tire volume requirements.

- EV Specifics: The growing EV market requires tires designed for instant torque, heavier weight, and often lower rolling resistance.

Regulatory and Geopolitical Risks (e.g., Tariffs)

Bridgestone faces significant threats from evolving government policies and geopolitical tensions. For instance, the imposition of tariffs, like those impacting the US market, directly increases the cost of imported materials and finished goods, potentially squeezing profit margins. The company's global footprint means it's susceptible to a range of export/import duties and trade disputes that can disrupt its intricate supply chains.

The uncertain global outlook necessitates a proactive approach to mitigate these risks. Bridgestone's strategy to bolster local production in key markets, such as its investments in North American manufacturing facilities, aims to reduce reliance on international trade flows and buffer against sudden policy shifts. This diversification is crucial for maintaining operational stability and profitability in a volatile international landscape.

For example, the ongoing trade friction between major economic blocs in 2024 and projected into 2025 continues to create uncertainty for global manufacturers like Bridgestone. While specific tariff rates fluctuate, the general trend towards protectionism in certain regions poses a persistent challenge. The company's ability to adapt its sourcing and production strategies will be key to navigating these regulatory headwinds.

Key considerations for Bridgestone regarding regulatory and geopolitical risks include:

- Impact of US-China trade relations on raw material costs and market access.

- Potential for new import/export regulations in key European markets.

- Geopolitical instability affecting energy prices and transportation costs.

- Changes in environmental regulations impacting manufacturing processes and product standards.

Intense competition from both established global players and increasingly competitive budget brands presents a significant threat, pressuring Bridgestone's pricing power and market share. The influx of lower-cost imports, particularly in regions like Europe, directly impacted sales volumes in 2024, forcing strategic adjustments to maintain profitability.

Fluctuations in raw material costs, especially for natural rubber and synthetic compounds, directly impacted Bridgestone's production expenses throughout 2024, affecting profit margins. Supply chain disruptions, amplified by geopolitical events and logistical hurdles extending into early 2025, continue to pose risks to consistent production and timely delivery.

Economic downturns, characterized by persistent inflation and interest rate hikes seen through 2024, reduce consumer spending on new vehicles and replacement tires. This economic sensitivity, coupled with a consumer shift towards more affordable options, directly challenges Bridgestone's premium market positioning.

The automotive industry's rapid evolution, including the rise of electric vehicles (EVs) and new mobility services, necessitates significant adaptation in tire technology and business models. For instance, the projected over 15 million EV sales globally in 2024 highlights the demand for specialized EV tires, which Bridgestone must prioritize to remain competitive.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from Bridgestone's official financial reports, comprehensive market research studies, and expert industry analysis to provide a well-rounded perspective.