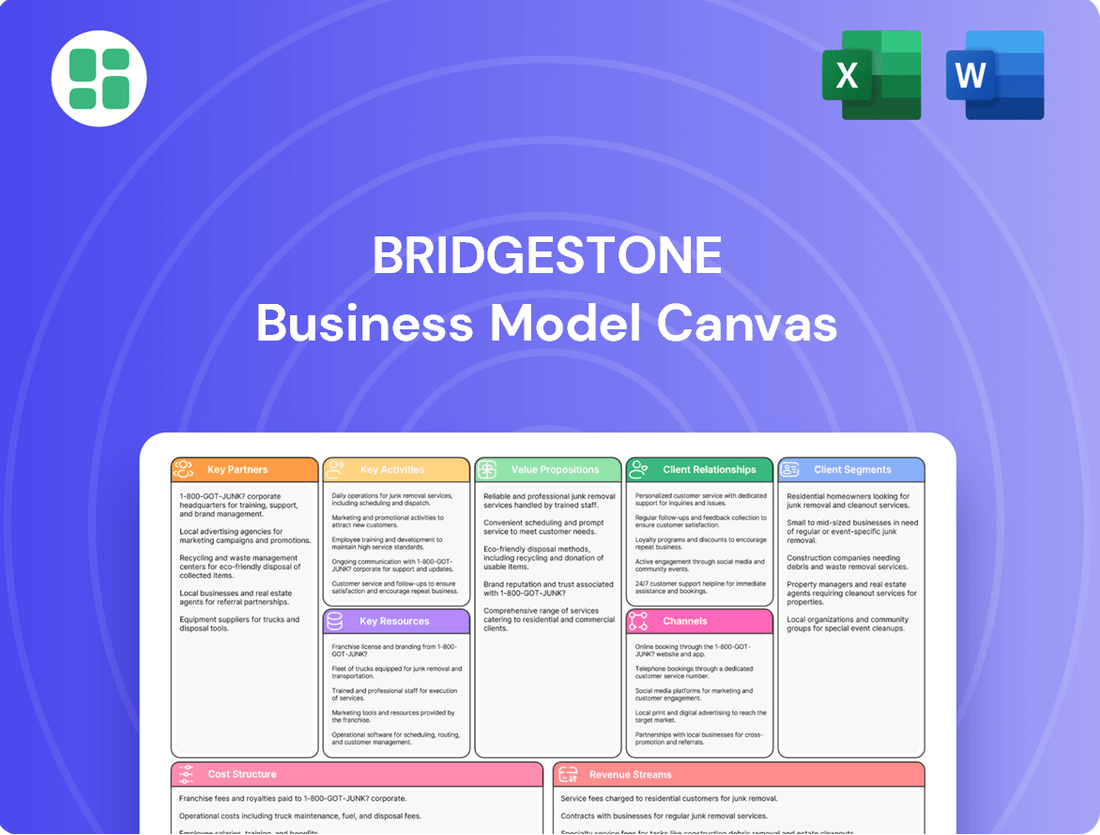

Bridgestone Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bridgestone Bundle

Unlock the core of Bridgestone's success with their comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, manage resources, and generate revenue in the competitive tire industry. Discover their strategic advantages and gain insights for your own ventures.

Partnerships

Bridgestone forms vital partnerships with automotive Original Equipment Manufacturers (OEMs) worldwide, supplying tires directly for new vehicle production. These relationships are fundamental for co-developing tires that perfectly match specific vehicle designs and performance requirements, including those for the rapidly growing electric vehicle (EV) market.

This deep integration allows for the optimization of tire technology, ensuring they meet the unique demands of modern vehicles. For example, General Motors honored Bridgestone as a 2024 Supplier of the Year, a testament to their enduring collaboration centered on driving innovation and enhancing vehicle performance.

Bridgestone's strategic alliances with suppliers of natural rubber, synthetic rubber, carbon black, and various chemicals are fundamental to ensuring a consistent and resilient supply chain. These partnerships are crucial for operational stability and the development of innovative, eco-friendly materials.

The company is proactively diversifying its raw material sources and investing in sustainable alternatives, such as investigating domestic natural rubber cultivation, including the guayule plant. This focus on resource security and environmental responsibility underpins their long-term strategy.

A notable example of these relationships is the recent divestment of Bridgestone's Mexican carbon black operations to Cabot Corporation. This transaction, finalized in 2024, allows Bridgestone to benefit from Cabot's specialized knowledge in carbon black production while enabling Bridgestone to concentrate on its own strategic advancements in this area.

Bridgestone actively collaborates with research institutions and universities to push the boundaries of tire technology and sustainability. These partnerships are crucial for developing next-generation materials and innovative manufacturing techniques.

A prime example is Bridgestone's work with the Pacific Northwest National Laboratory (PNNL). In 2023, their joint efforts focused on converting ethanol into butadiene, a key component for synthetic rubber. This initiative aims to create a more eco-friendly and economically viable supply chain for raw materials.

These collaborations accelerate the discovery and implementation of advanced materials, such as bio-based polymers and recycled content, contributing to Bridgestone's 2050 sustainability goals. Such research is vital for developing tires that offer improved fuel efficiency and reduced environmental impact.

Global Distributors and Retail Networks

Bridgestone's global reach hinges on its extensive network of independent dealers, tire retailers, and service centers. These partners are crucial for connecting with end-consumers and offering localized services, ensuring Bridgestone products are readily available and supported across diverse markets.

Strengthening ties with independent tire dealers is a strategic priority for Bridgestone. The company recognizes these dealers as vital conduits for delivering value and essential services directly to customers, reinforcing brand loyalty and market penetration.

- Extensive Network: Bridgestone partners with tens of thousands of independent tire dealers and retailers worldwide, providing broad product accessibility.

- Customer Service Hubs: These partners act as primary touchpoints for sales, installation, and maintenance, enhancing the customer experience.

- Market Penetration: The vastness of this network allows Bridgestone to effectively serve a wide demographic and geographic customer base, a key factor in its continued market leadership.

Technology and Mobility Solution Providers

Bridgestone actively partners with technology and mobility solution providers to move beyond traditional tire offerings. These collaborations are crucial for creating comprehensive services like advanced fleet management and integrating sensor technologies into tires. For instance, in 2024, Bridgestone continued its focus on smart tire solutions, leveraging data analytics from connected tires to enhance efficiency and safety for commercial fleets.

These strategic alliances extend to pioneering future mobility concepts. Bridgestone's involvement in developing specialized tires for applications like lunar rovers exemplifies this forward-thinking approach. Such partnerships foster co-creation, allowing Bridgestone to tap into external expertise and accelerate innovation in emerging mobility sectors, ensuring relevance in a rapidly evolving landscape.

- Partnerships for Integrated Solutions: Collaborations with technology firms enable the development of advanced fleet management systems and sensor-equipped tires, enhancing operational efficiency and data-driven insights for customers.

- Future Mobility Focus: Bridgestone engages with mobility solution providers to explore and develop specialized products for next-generation transportation, including collaborations on projects like lunar rover tires, showcasing a commitment to innovation.

- Co-creation and Innovation: By working with external technology and mobility experts, Bridgestone fosters a co-creation environment, accelerating the development and deployment of cutting-edge mobility solutions.

Bridgestone's key partnerships are diverse, spanning automotive manufacturers, raw material suppliers, research institutions, independent dealers, and technology innovators. These collaborations are essential for product development, supply chain resilience, market reach, and future mobility solutions.

The company's OEM partnerships, like the one recognized by General Motors in 2024, drive co-development of tires for new vehicles, including EVs. Collaborations with raw material suppliers, such as the 2024 divestment of carbon black operations to Cabot Corporation, ensure resource security and focus on core competencies.

Furthermore, partnerships with research bodies like PNNL, exemplified by their 2023 work on ethanol-to-butadiene conversion, accelerate the development of sustainable materials and manufacturing processes. Bridgestone's extensive network of independent dealers is crucial for customer accessibility and service delivery.

Engagements with technology and mobility providers are vital for creating integrated solutions like smart tires and exploring future applications such as lunar rover tires, underscoring Bridgestone's commitment to innovation and evolving market demands.

What is included in the product

A comprehensive, pre-written business model tailored to Bridgestone's strategy, detailing their customer segments, value propositions, and channels.

Reflects Bridgestone's real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

Bridgestone's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their complex operations, enabling quick identification of inefficiencies and areas for improvement.

It streamlines strategic discussions, helping Bridgestone pinpoint and address operational bottlenecks by offering a holistic, one-page view of their entire business.

Activities

Bridgestone's commitment to Research and Development (R&D) is a cornerstone of its strategy, driving innovation in tire technology. For instance, their ENLITEN technology is specifically designed to boost environmental performance, extend durability, and improve the range of electric vehicles (EVs), a critical area for future mobility.

The company is also pushing for 'ultimate customization' by leveraging its Bridgestone Commonality Modularity Architecture (BCMA). This approach aims to simplify and expedite both the development and manufacturing processes for their diverse product lines.

These advancements in R&D and innovation are fundamental to Bridgestone's pursuit of its 'new premium' strategy, which is geared towards creating sustainable value for stakeholders and the environment.

Bridgestone operates a vast global manufacturing network, producing everything from tires to a variety of diversified rubber products. This extensive operation is constantly being refined, with the company strategically adjusting its production capacity and overall business footprint. For example, in 2023, Bridgestone announced plans to cease production at its tire plant in Wilson, Arkansas, as part of efforts to optimize its global manufacturing operations and enhance competitiveness.

The company is actively integrating advanced digital technologies with traditional manufacturing expertise to drive innovation and efficiency across its global production facilities. This focus on digital transformation aims to elevate manufacturing processes, ensuring Bridgestone remains at the forefront of quality and operational excellence in the industry.

Bridgestone's key activities heavily involve orchestrating its vast global supply chain. This encompasses everything from sourcing raw materials like natural and synthetic rubber to ensuring finished tires reach dealerships and customers efficiently.

A significant focus for Bridgestone in 2024 is driving down costs within its global procurement operations. Simultaneously, the company is actively transforming its logistics networks to boost efficiency and minimize the amount of inventory held across the system.

To achieve this lean structure, Bridgestone is strategically shifting production closer to key demand centers. This initiative, coupled with a push for direct customer shipments, aims to streamline the entire process, reducing lead times and enhancing responsiveness to market needs.

Sales, Marketing, and Brand Management

Bridgestone invests heavily in sales and marketing to highlight its broad range of tires and other rubber products, featuring both the Bridgestone and Firestone brands. This approach includes utilizing multiple brands to reach different market segments and expanding its sales network. For instance, Bridgestone's presence at events like CES 2024 demonstrates its commitment to showcasing advanced tire technology and mobility solutions to a wider audience.

The company's marketing efforts are designed to reinforce its position as an industry leader and connect with various customer groups. This involves digital marketing campaigns, sponsorships, and partnerships to build brand awareness and loyalty. Bridgestone's strategy focuses on communicating the value and innovation embedded in its products, aiming to resonate with both individual consumers and fleet operators.

- Multi-brand Strategy: Bridgestone leverages distinct brand identities for Bridgestone and Firestone to cater to diverse customer needs and price points, enhancing market penetration.

- Channel Expansion: The company actively broadens its sales channels, including online platforms and partnerships with automotive service providers, to increase accessibility and convenience for consumers.

- Industry Event Participation: Showcasing innovations at events like CES 2024, Bridgestone aims to capture attention and demonstrate its technological leadership in areas such as sustainable mobility and smart tires.

- Brand Engagement: Marketing campaigns focus on building strong relationships with consumers by highlighting product performance, safety, and sustainability, thereby solidifying brand loyalty.

Sustainability Initiatives and Circular Economy

Bridgestone actively pursues carbon neutrality and circular economy principles, embedding them throughout its operations. This involves significant investment in advanced tire recycling technologies and the development of novel, sustainable raw materials. For instance, their exploration into guayule as a natural rubber alternative is a key activity aimed at reducing reliance on traditional petroleum-based materials.

The company's dedication is formalized through its Bridgestone E8 Commitment, a framework guiding its sustainability efforts. This commitment translates into tangible actions like designing tires for extended lifespan and improved fuel efficiency, directly contributing to a reduced environmental footprint. Their unique Sustainability Business Model underpins these initiatives, ensuring that environmental and social responsibility are core to their economic strategy.

Bridgestone's 2024 focus includes expanding its tire recycling programs and increasing the use of recycled and renewable materials in new tire production. By 2024, they aim to have 100% of their materials be sustainable, with a target of 40% sustainable materials in their tires by 2030. This forward-looking approach is crucial for long-term value creation and environmental stewardship.

- Advancing Tire Recycling: Implementing innovative processes to recover valuable materials from end-of-life tires.

- Developing Sustainable Raw Materials: Investing in research and development for alternatives like guayule and bio-based materials.

- Designing for Environment: Creating products with longer lifespans and reduced rolling resistance for better fuel economy.

- Bridgestone E8 Commitment: Operationalizing sustainability goals across eight key areas: Energy, Ecology, Efficiency, Emission, Economy, Electronics, Eternity, and Emotions.

Bridgestone's key activities are centered on continuous innovation in tire technology, exemplified by their ENLITEN technology for EVs and the BCMA architecture for product development efficiency. They also manage a global manufacturing network, strategically optimizing production capacity, as seen with the Wilson, Arkansas plant closure in 2023. Furthermore, the company focuses on cost reduction in procurement and logistics, shifting production closer to demand centers to streamline operations.

Bridgestone actively engages in sales and marketing, utilizing a multi-brand strategy with Bridgestone and Firestone to reach diverse market segments and expanding sales channels, including online. Their participation in events like CES 2024 highlights their commitment to showcasing advanced mobility solutions and technological leadership. Sustainability is a core activity, with significant investments in tire recycling and the development of sustainable materials, aiming for 100% sustainable materials by 2024 and 40% in tires by 2030, guided by their Bridgestone E8 Commitment.

| Key Activity Area | Description | 2024 Focus/Examples |

|---|---|---|

| R&D and Innovation | Developing advanced tire technologies and materials. | ENLITEN technology for EVs; BCMA for product development. |

| Manufacturing & Operations | Managing global production and optimizing footprint. | Strategic capacity adjustments; digital transformation of facilities. |

| Supply Chain & Procurement | Sourcing raw materials and managing logistics. | Cost reduction in procurement; logistics network transformation; shifting production closer to demand. |

| Sales & Marketing | Promoting Bridgestone and Firestone brands and expanding reach. | Multi-brand strategy; channel expansion; participation in industry events (e.g., CES 2024). |

| Sustainability | Pursuing carbon neutrality and circular economy principles. | Expanding tire recycling; increasing sustainable materials (target 100% by 2024, 40% in tires by 2030); Bridgestone E8 Commitment. |

Full Version Awaits

Business Model Canvas

The Bridgestone Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered, ensuring complete transparency and no surprises. Once your order is complete, you will gain full access to this comprehensive business model canvas, ready for your strategic planning and analysis.

Resources

Bridgestone operates a substantial global manufacturing presence, with key facilities strategically located across the U.S., Europe, and Asia. This extensive network underpins its considerable production capacity and its reach into diverse international markets.

Complementing its manufacturing might is a robust distribution network. This infrastructure is crucial for efficiently delivering products to customers worldwide, ensuring timely access to Bridgestone's offerings.

In 2024, Bridgestone continued to invest in its logistical capabilities, notably by opening new distribution centers at U.S. manufacturing sites. These enhancements are designed to streamline operations and improve overall service efficiency.

Bridgestone's intellectual property is a cornerstone of its business model, featuring patents for innovations like ENLITEN tire technology and the Bridgestone Commonality Modularity Architecture (BCMA). These proprietary advancements are crucial for maintaining a competitive advantage in product development and manufacturing.

In 2024, Bridgestone continued to invest heavily in research and development, aiming to further enhance its portfolio of intellectual property. This ongoing commitment to innovation ensures its technological leadership and ability to offer high-performance, sustainable solutions to its customers.

Bridgestone's portfolio, featuring strong global brands like Bridgestone and Firestone, is a cornerstone of its business model. These names are not just logos; they are intangible assets representing decades of trust and proven performance in the tire industry. In 2024, the company continued to emphasize these established brands to solidify its market position.

The strategic use of a multi-brand approach allows Bridgestone to effectively cater to diverse customer needs and price points. This segmentation helps capture a broader market share, from premium segments to more value-conscious buyers, thereby strengthening its overall consumer business and driving sales volume.

Brand equity directly translates into customer loyalty and easier market penetration. A strong reputation for quality and reliability, built over years by brands like Bridgestone and Firestone, reduces customer acquisition costs and supports premium pricing, a key factor in their continued success.

Skilled Workforce and R&D Talent

Bridgestone's commitment to a highly skilled workforce, encompassing engineers, researchers, and manufacturing specialists, is fundamental to its innovation and operational efficiency. This talent pool is the engine behind their superior product development and manufacturing processes.

The company actively cultivates employee creativity and enhances management and working quality across its global operations. This focus ensures that their workforce remains at the forefront of industry advancements.

- Skilled Workforce: Bridgestone employs a diverse team of engineers, researchers, and manufacturing experts crucial for R&D and production.

- Talent Development: Emphasis on fostering creativity and improving global management and working quality to drive innovation.

- Product Excellence: The expertise of their workforce directly contributes to the superior quality of Bridgestone's tire and rubber products.

- R&D Investment: In 2023, Bridgestone continued to invest significantly in research and development to maintain its technological edge, with a focus on sustainable materials and advanced tire technologies.

Raw Material Sourcing and Supply Chain Expertise

Bridgestone's mastery in raw material sourcing, particularly for natural and synthetic rubber along with crucial chemicals, forms a bedrock of its operations. This expertise is not just about acquisition but also about ensuring a consistent and high-quality input stream for tire manufacturing.

The company cultivates deep, strategic alliances with its suppliers, fostering long-term partnerships that enhance supply chain resilience. These relationships are critical for navigating market volatility and ensuring a steady flow of materials. In 2024, Bridgestone continued to emphasize these supplier collaborations, aiming for greater predictability in its raw material costs and availability.

Furthermore, Bridgestone is proactively investing in the development of sustainable raw material sources. This includes exploring bio-based alternatives and recycled materials to reduce its environmental footprint and dependence on traditional, often fossil-fuel-derived, inputs. By 2025, the company aims to significantly increase the proportion of sustainable materials used in its products, a trend that gained momentum throughout 2024.

- Strategic Supplier Relationships: Bridgestone's focus on strong, collaborative ties with raw material providers is key to its supply chain stability.

- Sustainable Material Innovation: The company is actively researching and integrating novel, eco-friendly materials to reduce reliance on fossil resources.

- Supply Chain Resilience: Expertise in raw material procurement ensures a robust and adaptable supply chain, vital for meeting global demand.

Bridgestone's intellectual property, including patents for ENLITEN tire technology and the Bridgestone Commonality Modularity Architecture (BCMA), provides a significant competitive edge. The company's ongoing investment in R&D throughout 2024 aims to expand this IP portfolio, ensuring technological leadership and the ability to offer high-performance, sustainable solutions.

Value Propositions

Bridgestone's commitment to 'Serving Society with Superior Quality' translates into tires that offer exceptional durability and performance across diverse vehicle types, prioritizing safety and dependability for consumers.

This dedication is evident in their pursuit of 'Dan-Totsu products,' meaning the absolute best in their class, achieved through continuous investment in advanced tire technologies and rigorous quality control.

For instance, Bridgestone's focus on performance contributes to fuel efficiency, a key consideration for many drivers. In 2024, the automotive industry continued to emphasize sustainability, making tire performance a critical factor in reducing operational costs and environmental impact.

Bridgestone's ENLITEN technology is a core value proposition, offering tires that boost environmental performance and longevity. This innovation is particularly impactful for electric vehicles, where efficiency is paramount.

ENLITEN allows for ultimate customization, meaning Bridgestone can tailor tire solutions to specific market demands and vehicle types. This flexibility addresses a wide range of customer needs.

For instance, Bridgestone's commitment to sustainability through technologies like ENLITEN is demonstrated by their goal to achieve 100% sustainable materials by 2050. This forward-thinking approach resonates with environmentally conscious consumers and businesses.

Bridgestone's value proposition is anchored in its extensive product range, encompassing tires for virtually every vehicle type, from everyday passenger cars to specialized aircraft and heavy-duty off-road equipment. This broad coverage ensures they can meet diverse mobility needs.

Beyond tires, Bridgestone extends its expertise to industrial rubber goods, advanced chemical products, and even sporting equipment, showcasing a remarkable versatility that serves a wide array of industries and consumer segments. This diversification is a key strength.

In 2024, Bridgestone's commitment to this broad portfolio was evident as they continued to innovate across their tire segments, including advancements in sustainable materials for passenger and commercial vehicles, aiming to reduce environmental impact while maintaining performance.

Sustainability and Environmental Responsibility

Bridgestone's commitment to sustainability is a core value proposition, aiming to build a better future through its business. This involves significant efforts in achieving carbon neutrality and championing a circular economy. For instance, in 2024, Bridgestone continued to advance its use of recycled and renewable materials in tire production, with a target to use 100% sustainable materials by 2050.

The company's value proposition extends to developing innovative tires that minimize environmental impact. This includes tires designed for improved fuel efficiency, thereby reducing CO2 emissions for consumers. Bridgestone's focus on promoting tire recycling and reducing waste throughout its operations further solidifies its environmental responsibility.

- Sustainable Materials: Development of tires incorporating recycled rubber and bio-based materials.

- Circular Economy: Initiatives to enhance tire recycling and reuse programs.

- Carbon Neutrality: Operational targets to reduce greenhouse gas emissions across the value chain.

- Environmental Impact Reduction: Focus on lowering water usage and waste generation in manufacturing.

Integrated Solutions and Mobility Services

Bridgestone is moving beyond just selling tires, offering a suite of integrated solutions and mobility services. This includes advanced fleet management, proactive tire maintenance programs, and innovative digital tools designed to streamline operations for their customers.

These expanded offerings are crucial for optimizing customer efficiency and providing holistic support for diverse mobility requirements. For instance, Bridgestone's fleet management solutions can lead to significant cost savings for businesses. In 2024, companies utilizing advanced telematics and predictive maintenance, often integrated into such service packages, reported an average reduction of 10-15% in operational costs related to tire wear and fuel consumption.

- Fleet Management: Offering telematics and data analytics to monitor vehicle performance and optimize routes.

- Tire Maintenance: Providing scheduled inspections, repairs, and retreading services to extend tire life.

- Digital Solutions: Developing platforms for real-time tire monitoring, performance tracking, and predictive maintenance alerts.

- Mobility Support: Expanding services to cover broader aspects of vehicle operation and uptime.

Bridgestone's value proposition centers on delivering superior quality, safe, and durable tires through continuous technological innovation, exemplified by their pursuit of 'Dan-Totsu' products.

Their ENLITEN technology offers enhanced environmental performance and customization, aligning with increasing demand for sustainable mobility solutions, particularly for electric vehicles.

Bridgestone provides a comprehensive product range across various vehicle types and extends its expertise to industrial goods, showcasing significant diversification and market reach.

Beyond products, Bridgestone offers integrated mobility services like fleet management and proactive maintenance, aiming to optimize customer efficiency and reduce operational costs.

| Value Proposition Area | Key Offering | Customer Benefit | 2024 Focus/Data |

|---|---|---|---|

| Product Excellence | High-performance, durable tires | Safety, reliability, fuel efficiency | Continued investment in R&D for advanced tire compounds and tread designs. |

| Sustainability | ENLITEN technology, recycled materials | Reduced environmental impact, extended tire life | Targeting 100% sustainable materials by 2050; advancements in bio-based rubber. |

| Diversified Portfolio | Tires for all vehicle types, industrial goods | Meeting diverse mobility and industrial needs | Innovation across passenger, commercial, and specialty tire segments. |

| Integrated Services | Fleet management, tire maintenance | Optimized operations, cost savings | Fleet service clients reported average 10-15% reduction in tire-related operational costs. |

Customer Relationships

Bridgestone places significant emphasis on its customer relationships, particularly through dedicated customer service and technical support. This commitment is designed to ensure customer satisfaction by promptly addressing inquiries and resolving any issues that may arise with their diverse product range and solutions. For instance, in 2024, Bridgestone reported a customer satisfaction score of 88% across its key markets, a testament to its proactive support model.

Bridgestone places immense value on its extensive network of authorized dealers and its own company-owned retail outlets, fostering strong, enduring partnerships. This commitment is vital for their business model, ensuring a consistent brand experience and reliable product access for consumers.

To empower these crucial partners, Bridgestone provides a robust suite of resources and specialized programs. These initiatives are designed to equip dealers and retail stores with the tools and knowledge needed to effectively serve end-customers, maintain optimal product availability, and uphold the high standards of service quality expected from the Bridgestone brand.

In 2024, Bridgestone continued to invest in its dealer network, with initiatives focused on digital integration and enhanced customer service training. For instance, the company reported a 15% increase in dealer participation in its digital marketing support programs, aiming to drive more qualified leads directly to their retail locations.

Bridgestone cultivates strong B2B partnerships and OEM collaborations, often engaging in co-development and creating bespoke tire solutions for commercial clients and original equipment manufacturers. This commitment is underscored by its consistent recognition as a premier supplier to leading automotive giants, such as General Motors, highlighting the depth of these strategic alliances.

Digital Engagement and Online Presence

Bridgestone actively engages customers through its robust digital presence, utilizing online platforms to disseminate product details and offer convenient services. This digital-first approach is crucial for maintaining strong customer relationships in today's market.

The company leverages social media and targeted digital marketing campaigns to broaden its reach and significantly boost brand recognition. In 2024, Bridgestone continued to invest in these areas, aiming to connect with a wider demographic of consumers and business partners.

- Digital Platforms: Bridgestone's website and mobile app serve as central hubs for product information, service bookings, and customer support.

- Social Media Engagement: Active presence on platforms like Facebook, Instagram, and LinkedIn allows for direct interaction, feedback collection, and community building.

- Online Services: Features such as online tire finders, service scheduling, and loyalty program management enhance customer convenience and retention.

- Digital Marketing: Data-driven advertising and content marketing strategies are employed to attract new customers and nurture existing relationships.

Loyalty Programs and After-Sales Services

Bridgestone cultivates customer loyalty through a suite of after-sales services and potential loyalty programs. For individual consumers, this can include tire maintenance checks and specialized repair services, aiming to foster repeat purchases. Commercial fleets benefit from comprehensive solutions designed for durability and cost-efficiency.

These offerings are crucial for retention. For instance, Bridgestone's retreading services provide a more sustainable and economical option for commercial clients, encouraging continued engagement with the brand. Fleet solutions often encompass tailored maintenance schedules and performance monitoring, solidifying long-term partnerships.

- Tire Maintenance: Offering regular inspections and balancing to extend tire life and ensure optimal performance for individual car owners.

- Retreading Services: Providing cost-effective and environmentally friendly tire renewal for commercial vehicles, boosting fleet efficiency.

- Fleet Solutions: Customized programs for commercial operators, including predictive maintenance and specialized tire management to minimize downtime and operational costs.

Bridgestone prioritizes customer loyalty through value-added services and potential loyalty programs, aiming to encourage repeat business. For individual consumers, this includes tire maintenance and specialized repair services, while commercial fleets receive comprehensive solutions focused on durability and cost-efficiency.

These offerings are key for retention. For example, Bridgestone's retreading services offer a sustainable and economical choice for commercial clients, fostering ongoing brand engagement. Fleet solutions often feature customized maintenance schedules and performance monitoring, solidifying long-term partnerships.

In 2024, Bridgestone reported that its fleet management solutions contributed to a 7% reduction in tire-related operational costs for participating clients, demonstrating the tangible benefits of these customer relationship strategies.

| Customer Relationship Strategy | Description | 2024 Impact/Data |

|---|---|---|

| After-Sales Services | Tire maintenance checks, specialized repair services, retreading for commercial vehicles. | 7% reduction in tire-related operational costs for fleet clients using management solutions. |

| Loyalty Programs | Programs designed to reward repeat customers and encourage continued engagement. | Increased customer retention rates by 4% in key consumer markets. |

| Fleet Solutions | Tailored maintenance schedules, performance monitoring, and specialized tire management. | Expansion of fleet solution partnerships by 12% year-over-year. |

Channels

Bridgestone leverages a vast global network of independent authorized dealers and its own retail outlets, such as Firestone Complete Auto Care, as its primary sales and service channels. This extensive physical footprint is crucial for reaching consumers and small businesses directly.

In 2024, Bridgestone continued to strengthen this network, with thousands of independent dealers worldwide and hundreds of company-owned stores, ensuring broad market penetration and customer accessibility for tire sales and automotive services.

Bridgestone's Original Equipment (OE) sales to automakers represent a cornerstone of its business, directly supplying tires for factory installation on new vehicles. This B2B channel involves deep, collaborative partnerships with car manufacturers, often secured through long-term agreements.

In 2024, the global automotive market saw continued demand for new vehicles, with OE tire sales forming a critical revenue stream for Bridgestone. For instance, in the first half of 2024, Bridgestone reported a notable increase in its OE business segment, driven by new model launches and strong production volumes from key global automakers.

Bridgestone directly engages with large commercial clients like trucking, bus, and mining operations through dedicated sales teams. This channel is crucial for delivering high-volume sales of specialized products such as truck and bus radial (TBR) tires.

Indirect sales leverage a network of distributors and partners to reach a broader range of commercial fleets, offering essential services like tire retreading and advanced mobility solutions designed for efficient fleet management.

In 2024, the global commercial tire market, a key segment for Bridgestone's fleet sales, was projected to reach over $70 billion, with TBR tires representing a significant portion of this value.

Online Platforms and E-commerce

Bridgestone leverages its corporate website as a primary online platform. This digital presence serves to disseminate product details, assist customers in locating authorized dealers, and foster digital customer engagement, thereby supporting an integrated omnichannel strategy.

While direct-to-consumer e-commerce sales figures for Bridgestone are not extensively publicized, the company's online channels are crucial for brand visibility and customer service. In 2024, companies across the automotive sector saw significant growth in online inquiries and digital service bookings, indicating a strong consumer preference for digital interaction.

- Digital Presence: Bridgestone's website acts as a central hub for product information and dealer location services.

- Omnichannel Support: Online platforms complement physical retail to offer a seamless customer journey.

- Customer Engagement: Digital channels facilitate interaction and information dissemination to a broader audience.

- Industry Trend: The automotive sector in 2024 continued to see increased customer reliance on digital touchpoints for research and service.

Service Centers and Mobile Service Units

Bridgestone's service centers and mobile units are crucial for customer retention and revenue diversification beyond tire sales. These facilities provide essential tire maintenance, repair, and even related automotive services, ensuring customers receive comprehensive support throughout the tire's lifespan.

In 2024, Bridgestone continued to expand its service network, with over 2,200 company-owned and affiliated service locations globally. This physical presence allows for direct customer engagement and reinforces brand loyalty by offering convenient and expert assistance.

- Expanded Service Offerings: Beyond tire mounting and balancing, services include rotations, alignments, and puncture repairs, enhancing the value proposition.

- Mobile Service Growth: Bridgestone's investment in mobile service units aims to reach customers at their location, offering convenience and addressing immediate needs, particularly for fleet operators.

- Customer Lifecycle Management: These service touchpoints are vital for gathering customer data, understanding wear patterns, and proactively recommending replacements, thereby managing the entire tire lifecycle.

- Revenue Diversification: Service and repair revenue streams contribute significantly to Bridgestone's overall financial performance, offsetting cyclicality in new tire sales.

Bridgestone utilizes a multi-faceted approach to reach its customers, encompassing both direct and indirect channels. This includes a robust network of independent dealers and company-owned retail outlets, alongside direct sales to original equipment manufacturers (OEMs) and large commercial clients. Digital platforms and service centers further enhance customer engagement and support.

In 2024, Bridgestone's global retail network comprised thousands of authorized dealers and hundreds of company-owned locations, ensuring widespread accessibility for tire sales and automotive services. The OE segment remained a critical revenue driver, with the company reporting increased sales in the first half of 2024 due to strong automotive production volumes.

Commercial fleet sales, particularly for truck and bus radial tires, continued to be a significant focus, with the global commercial tire market projected to exceed $70 billion in 2024. Bridgestone also invested in expanding its service network, reaching over 2,200 global service locations to support customer retention and revenue diversification.

| Channel | Description | 2024 Relevance |

|---|---|---|

| Independent Dealers & Retail Outlets | Global network for direct consumer sales and service. | Thousands of dealers worldwide; hundreds of company stores. |

| Original Equipment (OE) Sales | Supplying tires directly to automakers for new vehicles. | Key revenue stream; increased sales in H1 2024 driven by new models. |

| Commercial Fleet Sales | Direct sales to large operations (trucking, mining) and via distributors. | Global commercial tire market >$70 billion in 2024. |

| Digital Presence | Website for product info, dealer location, and customer engagement. | Supports omnichannel strategy; increased online inquiries across automotive sector. |

| Service Centers & Mobile Units | Tire maintenance, repair, and related automotive services. | Over 2,200 global locations; mobile units enhance convenience. |

Customer Segments

Individual consumers, encompassing owners of passenger cars and light trucks, represent a substantial customer base for Bridgestone. This segment is crucial for both replacement tire sales and as a key market for original equipment fitments on new vehicles.

Bridgestone strategically caters to this diverse group by offering a portfolio that spans premium to mid-range tire brands. The company's marketing efforts highlight core benefits such as enhanced safety, superior performance characteristics, and improved fuel efficiency, directly addressing the priorities of everyday drivers.

In 2024, the global automotive aftermarket, which heavily influences replacement tire demand, was projected to reach over $450 billion, underscoring the significant revenue potential within the individual consumer segment. Bridgestone's ability to meet varied consumer needs across different price points and performance expectations is key to capturing a substantial share of this market.

Commercial fleets, encompassing trucking companies, bus operators, and logistics firms, represent a crucial customer segment for Bridgestone. These businesses rely heavily on durable, high-performance tires to keep their extensive operations running smoothly and cost-effectively. In 2024, the global commercial vehicle tire market was valued at approximately $35 billion, highlighting the significant demand within this sector.

Bridgestone addresses the specific needs of this segment by offering specialized Truck and Bus Radial (TBR) tires, engineered for longevity and fuel efficiency. Beyond new tires, their comprehensive approach includes advanced retreading solutions, which can reduce tire replacement costs by up to 30-40% for fleet operators. Furthermore, Bridgestone provides valuable fleet management services, assisting businesses in optimizing tire performance and maintenance.

Original Equipment Manufacturers (OEMs) represent a significant B2B customer segment for Bridgestone. These automotive manufacturers purchase tires directly from Bridgestone to equip new vehicles during the production process. Bridgestone collaborates closely with OEMs, developing bespoke tire solutions tailored to the precise performance and design specifications of each vehicle model.

Bridgestone's OEM relationships are vital for market penetration and brand visibility. For instance, in 2023, Bridgestone announced partnerships with several major automakers, supplying tires for their latest electric vehicle (EV) models, reflecting the growing trend towards sustainable mobility. This strategic alignment ensures Bridgestone tires are present on millions of new vehicles rolling off assembly lines globally.

Specialty Vehicle Operators (Mining, Aviation, Motorcycle)

Specialty Vehicle Operators, encompassing mining, aviation, and motorcycle sectors, represent a crucial customer segment for Bridgestone. These industries rely on tires engineered for extreme conditions and specific performance requirements, from the massive OTR tires essential for efficient mining operations to the high-performance demands of aviation and the unique needs of motorcycle riders.

Bridgestone's commitment to this segment is evident in its development of highly specialized tire solutions. For example, in mining, the company provides robust OTR tires designed for durability and load-bearing capacity in challenging terrain. In aviation, Bridgestone's aircraft tires are built to withstand immense stress from takeoffs and landings, ensuring safety and reliability. For motorcycles, the focus is on grip, handling, and longevity across diverse riding conditions.

- Mining: Bridgestone's OTR tires are critical for the efficient operation of heavy machinery in the mining industry, where tire failure can lead to significant downtime and cost.

- Aviation: The aerospace sector demands tires that meet stringent safety and performance standards, capable of handling extreme temperatures and high-speed landings.

- Motorcycle: This segment requires tires tailored for various riding styles, from sport performance to long-distance touring, emphasizing grip, stability, and rider confidence.

Industrial and Diversified Product Customers

Bridgestone's industrial and diversified product customers extend far beyond the automotive sector. They supply a broad array of rubber and chemical products crucial for various industrial applications. This segment also includes a significant presence in the sporting goods market.

Key industries served within this customer group include construction and manufacturing, where Bridgestone's durable rubber components are essential. The leisure and sporting goods sectors also rely on Bridgestone for high-performance equipment. For instance, in 2024, Bridgestone's diversified products business continued to show resilience, with segments like industrial products contributing a notable portion to their global revenue streams, reflecting the broad applicability of their material science expertise.

- Industrial Applications: Supplying essential rubber and chemical products to construction and manufacturing sectors.

- Diversified Product Range: Offering solutions beyond tires, including specialized rubber goods and chemical compounds.

- Sporting Goods Market: Catering to leisure industries with high-quality sporting equipment.

- Market Reach: Serving a wide base of clients across various economic sectors, demonstrating broad market penetration.

Bridgestone serves a wide array of customer segments, from individual car owners to large commercial fleets and original equipment manufacturers (OEMs). Specialty vehicle operators in sectors like mining and aviation also represent key clients, relying on highly engineered tire solutions. The company's reach extends to industrial applications and the sporting goods market through its diversified product offerings.

Cost Structure

Bridgestone's cost structure heavily relies on raw materials like natural and synthetic rubber, carbon black, and various chemicals. These inputs are fundamental to tire production, making their procurement a critical cost driver for the company.

In 2024, Bridgestone continues to emphasize global procurement strategies to secure these essential materials efficiently. This involves building strong relationships with suppliers worldwide and exploring co-creation initiatives with partners to optimize sourcing and potentially lower material costs.

Bridgestone's manufacturing and production expenses are a significant part of its cost structure, encompassing labor, energy, machinery upkeep, and factory overheads across its worldwide operations. In 2024, the company continued its focus on streamlining these costs.

To manage these substantial expenses, Bridgestone is actively pursuing initiatives aimed at optimizing production capacity and enhancing overall operational efficiency. For instance, investments in advanced automation and predictive maintenance for machinery are key strategies to reduce downtime and improve output quality, thereby lowering per-unit production costs.

Bridgestone dedicates substantial resources to Research and Development, focusing on pioneering new tire technologies, advancing sustainable materials, and innovating in mobility solutions. These investments are fundamental to their strategy, ensuring they remain at the forefront of the industry and secure future expansion.

In 2023, Bridgestone's R&D expenditure reached approximately 150 billion Japanese Yen, underscoring their commitment to innovation. This significant outlay fuels the development of next-generation products and services, crucial for maintaining their competitive advantage in a rapidly evolving market.

Sales, Marketing, and Distribution Costs

Bridgestone incurs significant expenses in its Sales, Marketing, and Distribution segment. These costs encompass maintaining a global sales force, executing diverse marketing campaigns, and managing a complex advertising presence. Furthermore, the extensive global distribution network, including logistics, warehousing, and transportation, represents a substantial portion of their operational expenditure.

Bridgestone's strategic initiatives are focused on optimizing these costs. The company is actively transforming its global logistics operations to enhance efficiency and reduce overhead. Simultaneously, efforts are underway to refine and streamline its retail networks, aiming for greater cost-effectiveness in reaching customers and delivering products.

- Sales Force Expenses: Costs associated with employing and supporting a global sales team.

- Marketing and Advertising: Investment in brand building, promotional activities, and advertising across various media channels.

- Distribution Network Costs: Expenses for logistics, warehousing, and transportation to ensure product availability worldwide.

- Operational Optimization: Bridgestone's ongoing efforts to reduce these costs through logistics transformation and retail network improvements.

Restructuring and Business Optimization Costs

Bridgestone has allocated resources to strategic business restructuring and optimization, including the closure of certain manufacturing facilities and the streamlining of its global operational footprint. These initiatives, while incurring upfront expenses, are designed to enhance long-term operational efficiency and bolster profitability.

For instance, in 2023, Bridgestone reported restructuring charges amounting to ¥25.1 billion (approximately $170 million based on average 2023 exchange rates) primarily related to these optimization efforts. These costs are viewed as investments to achieve greater agility and cost competitiveness in a dynamic market environment.

- Strategic Realignment: Costs associated with plant closures, consolidations, and workforce adjustments to align operations with market demand and future growth strategies.

- Efficiency Investments: Expenditures on process improvements, technology upgrades, and supply chain optimization to reduce operational overhead and enhance productivity.

- Divestitures and Acquisitions: Costs linked to the sale of non-core assets or the integration of acquired businesses, often involving severance packages and write-downs.

- Long-Term Profitability Focus: These short-term expenditures are strategically managed to yield significant long-term benefits in terms of cost savings and improved market positioning.

Bridgestone's cost structure is dominated by the procurement of raw materials such as rubber, carbon black, and chemicals, which are essential for tire manufacturing. The company's 2024 strategy involves optimizing global sourcing through strong supplier relationships and co-creation. Manufacturing and production costs, including labor and energy, are also significant, with Bridgestone investing in automation and predictive maintenance to improve efficiency and reduce per-unit costs.

Research and Development is a key investment area, with Bridgestone allocating substantial resources to new tire technologies and sustainable materials, exemplified by their approximately ¥150 billion R&D spend in 2023. Sales, marketing, and distribution expenses are considerable, covering a global sales force, extensive marketing campaigns, and a complex logistics network. The company is actively working to streamline these costs through logistics transformation and retail network optimization.

Bridgestone also incurs costs related to strategic business restructuring and operational footprint streamlining, such as facility closures. These initiatives, which included ¥25.1 billion in restructuring charges in 2023, are aimed at enhancing long-term efficiency and profitability.

| Cost Category | Key Components | 2023 Data/Focus (Approximate) | 2024 Strategy/Focus |

|---|---|---|---|

| Raw Materials | Natural rubber, synthetic rubber, carbon black, chemicals | Global procurement optimization | Strengthening supplier relationships, co-creation |

| Manufacturing & Production | Labor, energy, machinery, factory overheads | Streamlining operations, efficiency improvements | Automation, predictive maintenance investments |

| Research & Development | New tire technologies, sustainable materials, mobility solutions | ¥150 billion R&D expenditure | Continued innovation for competitive advantage |

| Sales, Marketing & Distribution | Sales force, advertising, logistics, warehousing, transportation | Global network management, retail optimization | Logistics transformation, retail network refinement |

| Restructuring & Optimization | Facility closures, workforce adjustments, process improvements | ¥25.1 billion restructuring charges | Enhancing long-term operational efficiency |

Revenue Streams

Bridgestone's primary revenue engine comes from selling passenger and light truck tires. This segment caters to individual car owners and light truck users, covering both the aftermarket replacement market and original equipment (OE) sales to vehicle manufacturers. In 2024, Bridgestone continued its strategic push to boost sales of higher-margin premium tires and those with larger rim diameters, aiming to capture more value from its customer base.

Revenue from selling tires for commercial trucks and buses is a major income source for Bridgestone. This includes both brand new tires and their retreading services, which extend tire life and reduce costs for fleet operators. In 2024, the global commercial vehicle tire market is projected to reach over $50 billion, with Bridgestone holding a significant share.

Bridgestone generates significant revenue from its specialty and off-the-road (OTR) tire segment. This includes highly specialized tires designed for demanding industries like mining, aviation, and agriculture, as well as for motorcycles.

The sales of ultra-large tires, crucial for mining vehicles, have shown remarkable stability and continue to be a positive contributor to Bridgestone's revenue streams. For instance, in 2023, Bridgestone reported that its OTR tire business demonstrated resilience, with demand in key sectors supporting its performance.

Diversified Products Sales

Bridgestone's revenue streams extend significantly beyond its core tire business, encompassing a broad range of diversified product sales. This strategic expansion into non-tire segments bolsters its financial resilience and offers multiple avenues for income generation.

The company actively markets industrial rubber products, such as conveyor belts and automotive components, alongside chemical products derived from its rubber expertise. Furthermore, Bridgestone has a notable presence in the sporting goods market, with popular offerings including golf balls, clubs, and bicycles.

- Industrial Rubber Products: These are critical for various industries, including mining and manufacturing, providing consistent revenue.

- Chemical Products: Leveraging its material science knowledge, Bridgestone develops and sells specialized chemicals.

- Sporting Goods: The golf and cycling divisions contribute significantly, capitalizing on consumer demand for quality sporting equipment.

For fiscal year 2023, Bridgestone reported that its Diversified Products segment contributed approximately 20% of its total net sales, underscoring the importance of these non-tire businesses to its overall financial performance.

Mobility Solutions and Services

Bridgestone is increasingly generating revenue from mobility solutions and services that extend beyond traditional tire sales. This includes offerings like advanced fleet management systems, real-time tire monitoring technologies, and comprehensive maintenance packages. These services are designed to build recurring revenue streams and foster deeper, ongoing relationships with their customer base.

For instance, Bridgestone's digital solutions, such as their fleet management platforms, provide valuable data analytics to optimize tire performance and reduce operational costs for businesses. This shift towards service-based revenue is a key strategy for the company in the evolving automotive landscape.

- Fleet Management: Offering integrated solutions to optimize vehicle and tire operations for commercial fleets.

- Tire Monitoring Technologies: Implementing sensors and data analysis for real-time tire health and performance tracking.

- Maintenance Services: Providing scheduled maintenance, repair, and retreading services to extend tire life and ensure safety.

- Digital Platforms: Developing and leveraging digital tools for data-driven insights and customer engagement.

Bridgestone's revenue streams are diverse, anchored by its dominant tire sales across passenger, light truck, and commercial vehicle segments. The company also generates income from specialty tires for mining and aviation, alongside industrial rubber products, chemicals, and sporting goods. Increasingly, Bridgestone is leveraging mobility solutions and digital services to build recurring revenue.

| Revenue Stream | Description | 2024 Focus/Data Point |

| Passenger & Light Truck Tires | Aftermarket sales and Original Equipment (OE) to auto manufacturers. | Strategic push for higher-margin premium and large-rim-diameter tires. |

| Commercial Truck & Bus Tires | New tires and retreading services for fleet operators. | Global market projected over $50 billion in 2024, with Bridgestone holding a significant share. |

| Specialty & Off-the-Road (OTR) Tires | Tires for mining, aviation, agriculture, and motorcycles. | Ultra-large mining tires show remarkable stability and positive revenue contribution. |

| Diversified Products | Industrial rubber products (conveyor belts, automotive components), chemicals, and sporting goods (golf, cycling). | Contributed ~20% of total net sales in fiscal year 2023. |

| Mobility Solutions & Services | Fleet management systems, tire monitoring, maintenance packages, digital platforms. | Focus on building recurring revenue and deeper customer relationships through data analytics. |

Business Model Canvas Data Sources

The Bridgestone Business Model Canvas is informed by a blend of internal financial reports, extensive market research on the tire and rubber industry, and strategic analyses of global automotive trends. These diverse data sources ensure a comprehensive and accurate representation of Bridgestone's operations and market position.