Bridgestone Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bridgestone Bundle

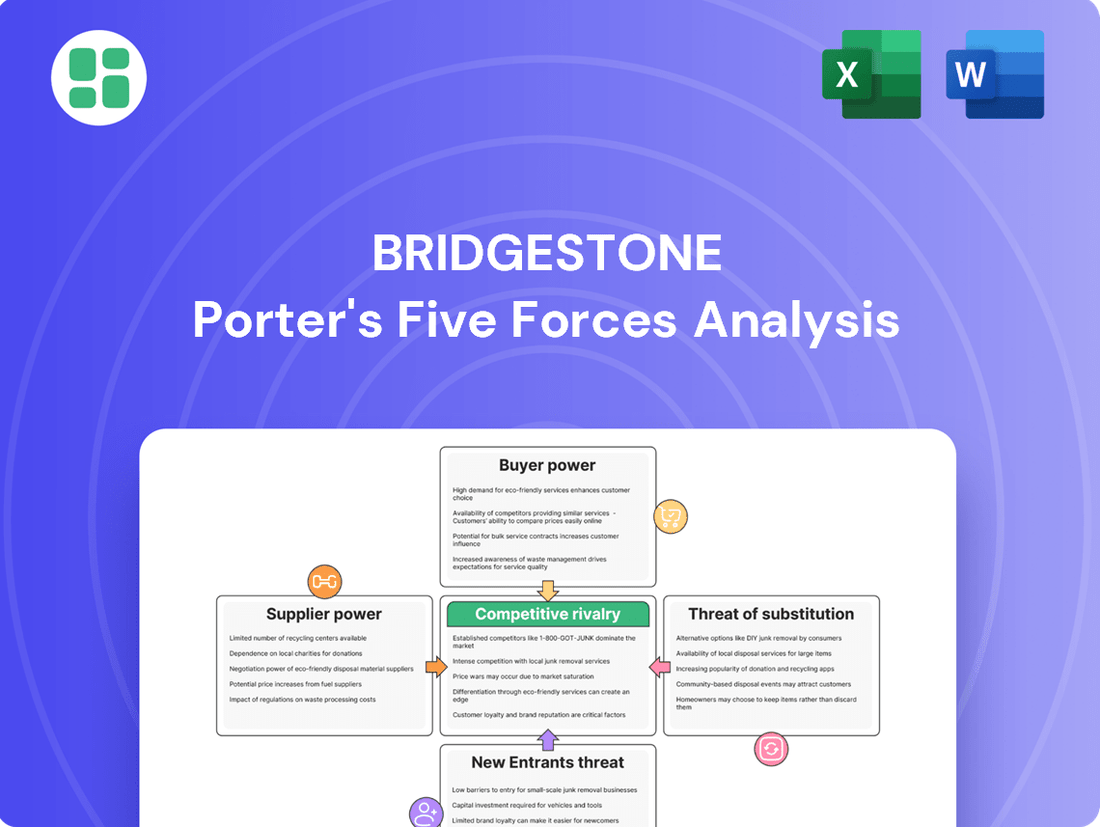

Bridgestone operates in a dynamic automotive sector, where understanding the competitive landscape is crucial for success. A Porter's Five Forces analysis reveals how factors like supplier power, buyer negotiation, and the threat of substitutes significantly shape Bridgestone's strategic options.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bridgestone’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Bridgestone's profitability is heavily influenced by the fluctuating costs of essential inputs like natural rubber, synthetic rubber, carbon black, and steel. For example, natural rubber prices climbed to a seven-year peak in early 2024, directly increasing manufacturing expenses for tire makers.

This inherent price instability in raw materials underscores the critical need for Bridgestone to implement sophisticated supply chain management and hedging strategies to buffer against unpredictable cost swings and maintain competitive pricing.

Bridgestone's reliance on a limited number of specialized suppliers for critical components, such as advanced polymers or unique chemical compounds, can grant these suppliers significant bargaining power. While basic raw materials may have numerous sources, the scarcity of niche inputs means Bridgestone has fewer alternatives, potentially leading to higher costs or less favorable contract terms.

For instance, the development of next-generation tire technologies often requires highly specific materials. If only a few global chemical manufacturers can produce these advanced polymers with the required purity and performance characteristics, they can command premium pricing. This concentration of expertise in a few hands is a key driver of supplier leverage.

Bridgestone's strategic initiatives, like its significant investments in research and development for sustainable materials, are designed to mitigate this risk. By actively pursuing diversification of its raw material sourcing, including bio-oils and novel rubber compounds, the company aims to reduce its dependence on traditional, concentrated supplier bases and thereby strengthen its own negotiating position.

Bridgestone's push into advanced materials for 'new premium' and sustainable tires significantly elevates the bargaining power of its suppliers. Companies providing specialized components for innovations like Enliten technology or tires optimized for electric vehicles hold considerable sway.

For instance, as Bridgestone aims to increase the use of sustainable materials, suppliers of recycled or bio-based rubber compounds become more critical. In 2023, Bridgestone announced a target to use 100% sustainable materials by 2050, highlighting the growing reliance on suppliers who can meet these stringent environmental demands.

Switching Costs for Bridgestone

Switching suppliers for critical or specialized materials can incur substantial costs for Bridgestone. These costs often include re-tooling manufacturing equipment, conducting extensive re-testing of new materials, and undergoing lengthy re-certification processes. Such expenses can make Bridgestone somewhat reliant on its existing supplier relationships, thereby granting those suppliers a degree of bargaining power.

To mitigate this reliance, Bridgestone actively employs dual-sourcing strategies. This approach helps prevent over-dependence on a single supplier and builds resilience against potential supply chain disruptions. For instance, in 2024, Bridgestone continued to diversify its sourcing for key synthetic rubber components, aiming to secure competitive pricing and ensure continuity of supply.

- High Switching Costs: Bridgestone faces significant expenses when changing suppliers for specialized raw materials, impacting its flexibility.

- Supplier Dependence: The costs associated with switching create a level of dependence on established suppliers, enhancing their bargaining power.

- Mitigation through Dual Sourcing: Bridgestone's strategy of sourcing from multiple suppliers reduces its vulnerability to any single supplier's influence.

- 2024 Sourcing Focus: The company's efforts in 2024 to diversify its supply chain for critical inputs like synthetic rubber underscore this strategic approach.

Supplier's Ability to Forward Integrate

The bargaining power of raw material suppliers in the tire industry is generally low when considering their ability to forward integrate. This is because moving into complex tire manufacturing requires immense capital, specialized knowledge, and established distribution channels, all significant barriers to entry. For instance, Bridgestone, a major player, invests billions annually in research, development, and manufacturing infrastructure, creating a high hurdle for raw material providers to overcome.

This difficulty in forward integration significantly curtails a primary avenue through which suppliers could exert greater influence. Without the capacity to produce finished tires, raw material suppliers remain largely dependent on tire manufacturers for their sales. This dynamic limits their leverage in price negotiations and other terms of trade, reinforcing the buyer power of companies like Bridgestone.

- High Capital Requirements: Establishing tire manufacturing facilities demands billions of dollars in investment, making it prohibitive for most raw material suppliers.

- Technological Expertise: Tire production involves complex engineering and manufacturing processes that require specialized knowledge and skilled labor.

- Distribution Networks: Accessing global markets necessitates robust and extensive distribution and logistics networks, which are challenging for raw material providers to build.

Bridgestone's bargaining power with suppliers is influenced by the concentration of specialized material providers and the high costs associated with switching. For instance, companies supplying advanced polymers for next-generation tires can command premium pricing due to limited alternatives, as seen with Bridgestone's 2023 target to use 100% sustainable materials by 2050, increasing reliance on specialized eco-friendly suppliers.

The difficulty for raw material suppliers to forward integrate into tire manufacturing, due to immense capital requirements and specialized knowledge, generally limits their bargaining power. Bridgestone's substantial annual investments in R&D and infrastructure create significant barriers to entry for potential competitors in tire production.

Bridgestone's strategy of dual-sourcing for critical inputs, such as synthetic rubber in 2024, aims to mitigate supplier leverage by fostering competition and ensuring supply chain resilience against disruptions.

The bargaining power of suppliers is tempered by Bridgestone's scale and its ability to switch, although high switching costs for specialized materials do grant certain suppliers leverage. For example, the rising cost of natural rubber, reaching a seven-year peak in early 2024, directly impacted Bridgestone's input costs.

| Factor | Impact on Bridgestone | Example/Data Point |

|---|---|---|

| Supplier Concentration (Specialized Materials) | Increases supplier bargaining power | Limited global producers of advanced polymers for EV tires |

| Switching Costs | Increases supplier bargaining power | Re-tooling and re-certification for new materials |

| Supplier Forward Integration Difficulty | Decreases supplier bargaining power | Billions in capital required for tire manufacturing |

| Raw Material Price Volatility | Increases supplier leverage indirectly | Natural rubber prices hit 7-year peak in early 2024 |

| Bridgestone's Mitigation Strategies | Decreases supplier bargaining power | Dual-sourcing of synthetic rubber (2024); 100% sustainable materials by 2050 (2023 announcement) |

What is included in the product

This analysis examines the competitive intensity within the tire industry, evaluating Bridgestone's position against rivals, buyer and supplier power, potential new entrants, and the threat of substitute products.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Customers in the replacement tire market often show a strong sensitivity to price, particularly for common tire types. This is because numerous brands offer products that are quite similar in quality, leading to intense competition on cost. For a company like Bridgestone, this means maintaining competitive pricing is crucial, even as they aim to capture market share in more premium tire categories.

Original Equipment Manufacturer (OEM) customers, like major car brands, hold substantial bargaining power. Their massive purchase volumes mean they can demand and secure favorable pricing and terms from tire manufacturers like Bridgestone. For instance, in 2024, the automotive industry's reliance on consistent, high-quality tire supply for new vehicle production gives these OEMs considerable leverage in negotiations.

For individual consumers, the cost of switching between tire brands is generally quite low. This means customers can readily opt for alternatives based on factors like price, performance, or simply what's available at their local shop. This ease of switching directly influences their bargaining power.

Bridgestone actively works to mitigate this by fostering strong brand loyalty through various programs. They also focus on developing premium and differentiated products, aiming to create value that transcends simple price comparisons and encourages customers to stick with their brand.

Influence of Online Retail and Large Distributors

The growing influence of online tire retailers and large, consolidated dealer groups significantly amplifies customer bargaining power. This shift offers consumers greater price transparency and a broader selection of brands, forcing manufacturers like Bridgestone to compete more intensely on value and service. For instance, the global online tire market was valued at approximately $80 billion in 2023 and is projected to grow substantially, indicating a strong consumer preference for accessible and competitive online purchasing options.

Bridgestone's strategy must therefore focus on strengthening its relationships with its established dealer network, ensuring they can offer competitive pricing and superior customer experiences. Simultaneously, enhancing Bridgestone's own digital presence and direct-to-consumer channels is crucial to capture market share and mitigate the power of intermediaries.

- Increased Price Transparency: Online platforms allow customers to easily compare prices across multiple brands and retailers, putting pressure on manufacturers to offer competitive pricing.

- Wider Brand Access: Consumers are no longer limited to local inventory; they can access a vast array of tire brands and models online, increasing their choices and leverage.

- Consolidated Dealer Groups: Large dealer chains possess significant purchasing volume, enabling them to negotiate better terms with manufacturers and pass savings onto consumers.

Demand for Specialized and Sustainable Tires

The increasing demand for specialized tires, particularly those designed for electric vehicles (EVs) or those emphasizing sustainability, significantly bolsters customer bargaining power. Customers seeking these specific attributes can exert more influence over tire manufacturers.

Bridgestone's strategic focus on developing EV-optimized tires, which often feature lower rolling resistance and enhanced durability, directly addresses this trend. In 2024, the company continued to expand its range of eco-friendly tire options, responding to growing consumer preference for environmentally conscious products.

- EV Tire Market Growth: The global EV tire market is projected to see substantial growth, with estimates suggesting it could reach over $50 billion by 2028, indicating a strong customer pull for these specialized products.

- Sustainability Focus: Consumer surveys in 2024 indicated a growing willingness among drivers to pay a premium for tires made from recycled or sustainable materials, empowering customers who prioritize eco-friendly choices.

- Bridgestone's Investment: Bridgestone has been investing heavily in research and development for sustainable materials and tire technologies, aiming to capture market share by aligning with these customer demands.

Customers possess significant bargaining power due to the availability of substitute products and low switching costs, especially in the replacement tire market where price sensitivity is high. This power is amplified by online retailers offering greater price transparency and consolidated dealer groups leveraging bulk purchasing. Bridgestone counters this by innovating with specialized tires, like those for EVs, and focusing on brand loyalty to differentiate its offerings.

| Factor | Impact on Bridgestone | Customer Action |

|---|---|---|

| Price Sensitivity (Replacement Market) | Requires competitive pricing strategies. | Shops for best deals on common tire types. |

| Low Switching Costs | Encourages brand loyalty programs. | Easily moves to competitor brands. |

| Online Retailers & Dealer Groups | Pressures pricing and service levels. | Compares prices and accesses wider selections. |

| Demand for Specialized Tires (e.g., EV) | Drives innovation and product development. | Seeks out tires with specific performance attributes. |

What You See Is What You Get

Bridgestone Porter's Five Forces Analysis

This preview showcases the complete Bridgestone Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the tire industry. The document you see here is precisely what you'll receive immediately after purchase, ensuring no discrepancies or missing information. You'll gain instant access to this professionally formatted analysis, ready for immediate application and strategic decision-making.

Rivalry Among Competitors

The global tire market operates as an oligopoly, with a handful of dominant companies like Michelin, Bridgestone, Goodyear, and Continental holding significant market share. This structure fosters fierce competition, especially in well-established markets, where companies actively vie for market position through aggressive pricing and product innovation.

In 2024, these major players continue to invest heavily in research and development to differentiate their offerings, focusing on areas like fuel efficiency, durability, and electric vehicle compatibility. This intense rivalry means that even small shifts in market share can have substantial financial implications for these global giants.

Bridgestone operates in a capital-intensive industry where significant investments in manufacturing plants and machinery create substantial fixed costs. This necessitates high capacity utilization to spread these costs and achieve economies of scale, a critical factor for profitability in the tire sector.

To ensure their factories run efficiently, tire manufacturers like Bridgestone often engage in aggressive pricing to secure sales volumes. For instance, in 2024, the global tire market experienced intense competition, with some reports indicating price pressures in key segments as companies vied for market share amidst fluctuating raw material costs.

Companies in the tire industry fiercely compete by differentiating their products through innovation and technology. This often involves significant investment in research and development to create advanced features such as smart tires that monitor pressure and temperature, tires with low rolling resistance to improve fuel efficiency, and those made from sustainable materials. For instance, Bridgestone's ENLITEN technology, which focuses on lightweight, low-rolling-resistance, and sustainable materials, exemplifies this drive. The company is also actively developing EV-specific tires, catering to the growing electric vehicle market, a key area for differentiation and maintaining a competitive edge.

Extensive Distribution Networks and Brand Loyalty

Bridgestone, like other established tire manufacturers, benefits from deeply entrenched distribution channels and significant brand recognition. These networks, built over many years, provide a substantial barrier to entry for new competitors. In 2023, Bridgestone reported net sales of approximately 3.5 trillion Japanese Yen, underscoring the scale of its operations and reach.

Fostering and maintaining brand loyalty is paramount in the highly competitive tire market. Consumers often prioritize trusted brands for safety and performance. Bridgestone's consistent investment in marketing and product innovation, including its focus on sustainable materials, reinforces this loyalty. For instance, the company aims to increase the proportion of sustainable raw materials used in its tires to 100% by 2050.

- Extensive Global Reach: Bridgestone operates in over 150 countries, a testament to its well-developed distribution infrastructure.

- Brand Equity: Strong brand reputation translates into customer preference and pricing power.

- Customer Retention: Loyalty programs and consistent product quality encourage repeat purchases.

- Market Penetration: Established networks allow for efficient market penetration and service delivery.

Regional Market Dynamics and Emerging Players

While global giants like Bridgestone, Michelin, and Goodyear dominate, the tire industry's competitive landscape is increasingly shaped by regional dynamics. The Asia-Pacific region, in particular, has become a hotbed of activity, driven by robust economic growth and expanding automotive sectors.

This regional surge is fueling the rise of formidable local players. For instance, Chinese tire manufacturers have significantly increased their global market share, leveraging cost advantages and expanding production capacities. By the end of 2023, China's tire output represented a substantial portion of global production, with companies like Sailun and Linglong Tire making significant inroads into international markets.

Similarly, Indian tire companies are also emerging as competitive forces, benefiting from a large domestic market and growing export opportunities. This intensified regional competition necessitates that global players like Bridgestone continually refine their strategies to navigate diverse market demands and local competitive pressures effectively.

- Asia-Pacific's Dominance: The region accounts for a significant and growing share of global tire production and consumption, driven by its expanding automotive industry.

- Rise of Chinese Manufacturers: Chinese tire companies have rapidly gained market share globally, often competing on price and scale.

- Indian Tire Sector Growth: Indian manufacturers are also increasing their presence, supported by a strong domestic market and export ambitions.

- Strategic Adaptation Required: Global tire giants must adapt their strategies to address these evolving regional competitive dynamics and capitalize on emerging opportunities.

Competitive rivalry within the tire industry is intense, characterized by a few dominant global players and the increasing influence of regional manufacturers, particularly from Asia. This dynamic forces companies like Bridgestone to constantly innovate and manage costs to maintain market share.

In 2024, the market continues to see aggressive strategies, with major players heavily investing in R&D for EV tires and sustainable materials, as evidenced by Bridgestone's ENLITEN technology. This focus on differentiation is crucial as companies like Sailun and Linglong Tire from China gain traction globally, often through competitive pricing and expanding production.

Bridgestone's net sales of approximately 3.5 trillion Japanese Yen in 2023 highlight its scale, but this scale also means high fixed costs, driving the need for high capacity utilization and strategic pricing to secure sales volumes amid fluctuating raw material costs.

The rise of regional competitors, especially from China and India, adds another layer of complexity. These companies leverage cost advantages and growing domestic markets to expand internationally, requiring global players to adapt their strategies to diverse market demands and local competitive pressures.

| Competitor | Estimated 2024 Market Share (Global) | Key Strategy Focus |

|---|---|---|

| Bridgestone | ~15% | EV Tires, Sustainability (ENLITEN), Brand Loyalty |

| Michelin | ~17% | High-Performance Tires, Innovation, Sustainability |

| Goodyear | ~10% | North American Market, OE Contracts, Tire Technology |

| Continental | ~8% | Automotive Technology Integration, OE Business, European Market |

| Sailun (China) | Growing rapidly, ~2-3% | Cost-Competitiveness, Production Scale, Global Expansion |

| Linglong Tire (China) | Growing rapidly, ~2-3% | Aggressive Pricing, Capacity Expansion, International Markets |

SSubstitutes Threaten

The most significant emerging substitute for traditional pneumatic tires is the airless or non-pneumatic tire. These innovative tires are engineered to eliminate the risk of punctures and significantly reduce maintenance needs, offering a compelling alternative for certain applications.

While still in the early phases of market penetration, particularly within specialized sectors such as construction, military operations, and potentially electric vehicles (EVs), these tires are steadily improving in competitiveness. Michelin, a major player in the tire industry, is actively investing in the research, development, and testing of these advanced tire technologies.

The threat of substitutes for traditional tires is influenced by the increasing durability and longevity of these very products. Continuous advancements in material science and tire design mean that pneumatic tires are lasting longer than ever before. For instance, Bridgestone's own innovations in tread compounds and construction aim to extend tire life, which, while beneficial for consumers, can reduce the frequency of replacement purchases. This trend, rather than a direct substitute product, acts as a force that can impact sales volume for tire manufacturers like Bridgestone over the long term.

Retreading and repair services present a significant threat of substitutes, particularly within the commercial vehicle sector. These services allow for the extension of a tire's lifespan by refurbishing worn-out casings, offering a considerably more economical option compared to buying brand-new tires. This directly impacts demand for new tire units, as fleet operators can reduce their purchasing frequency.

Alternative Mobility Solutions and Reduced Vehicle Ownership

Long-term shifts towards alternative transportation, such as enhanced public transit networks and the growing popularity of cycling, present a significant substitution threat. These trends can directly decrease the reliance on personal vehicles, thereby impacting the demand for replacement tires.

The proliferation of ride-sharing services further exacerbates this threat by offering convenient mobility without the need for individual vehicle ownership. For instance, in 2024, cities globally saw continued growth in ride-sharing usage, with some reporting double-digit percentage increases in active users compared to pre-pandemic levels, directly impacting car usage patterns.

- Reduced Personal Vehicle Dependency: Increased adoption of shared mobility and public transport directly lowers the number of privately owned cars in use.

- Shifting Consumer Preferences: A growing segment of consumers, particularly younger demographics, prioritize access over ownership, favoring flexible mobility solutions.

- Impact on Tire Replacement Market: Fewer privately owned vehicles translate into a smaller addressable market for replacement tires over the long term.

Focus on Digital Solutions and Mobility Services

Bridgestone's strategic pivot towards digital solutions and mobility services, like advanced fleet management and connected tire technologies, presents an interesting dynamic in the threat of substitutes. While not direct replacements for the physical tire, these offerings shift value towards data-driven services and integrated solutions. For instance, Bridgestone's involvement in mobility-as-a-service platforms aims to capture value from the entire transportation ecosystem, potentially reducing reliance on traditional tire sales as the sole revenue driver.

This diversification can act as a buffer against substitutes by offering a more holistic value proposition. By providing services that enhance operational efficiency and reduce total cost of ownership for fleet operators, Bridgestone can solidify customer loyalty. For example, in 2024, the global fleet management market was projected to reach over $30 billion, indicating a significant opportunity for companies offering integrated digital solutions.

- Diversification into Mobility Services: Bridgestone is expanding beyond tire manufacturing into areas like fleet management and data analytics.

- Value Proposition Shift: The company is moving from selling a product to offering comprehensive solutions that enhance operational efficiency.

- Mitigating Substitute Impact: These new services can reduce the threat of traditional substitutes by creating stickier customer relationships.

- Market Growth: The global fleet management market, valued in the tens of billions of dollars, highlights the potential of these digital ventures.

The threat of substitutes for traditional tires is multifaceted, encompassing both direct product alternatives and shifts in transportation paradigms. Airless tires, while still emerging, offer a puncture-proof and low-maintenance option, particularly gaining traction in specialized sectors. Furthermore, increased tire durability and the prevalence of retreading services directly reduce the demand for new tire purchases, impacting sales volume for manufacturers like Bridgestone.

The growing adoption of ride-sharing services and enhanced public transportation networks, coupled with a consumer preference for access over ownership, significantly diminishes reliance on personal vehicles. This trend, evident in 2024 with continued growth in ride-sharing usage in major urban centers, directly shrinks the addressable market for replacement tires. Bridgestone's strategic expansion into mobility services and digital solutions aims to counter these threats by offering integrated value propositions beyond traditional tire sales.

| Substitute Type | Description | Impact on Bridgestone | Relevant Data/Trends (2024) |

|---|---|---|---|

| Airless Tires | Puncture-proof, low-maintenance alternative. | Potential reduction in new tire sales for specific applications. | Continued R&D investment by major players like Michelin. |

| Retreading & Repair | Extends tire lifespan economically. | Decreased purchase frequency for new tires, especially in commercial sectors. | Economical option for fleet operators. |

| Alternative Transportation | Public transit, cycling, reduced personal vehicle dependency. | Shrinking market for replacement tires due to fewer privately owned vehicles. | Continued growth in ride-sharing services globally. |

| Mobility Services | Digital solutions, fleet management, connected tires. | Shifts value to data-driven services, creating customer loyalty. | Global fleet management market projected to exceed $30 billion. |

Entrants Threaten

The tire manufacturing industry demands enormous upfront capital. Building a modern tire plant, including specialized machinery and research facilities, can easily run into hundreds of millions, if not billions, of dollars. For instance, setting up a new, large-scale tire production line would require significant investment in advanced robotics and quality control systems, a cost prohibitive for most newcomers.

Existing giants like Bridgestone leverage substantial economies of scale. Their vast production volumes allow them to negotiate better raw material prices and spread fixed costs over more units, leading to lower per-unit production costs. This cost advantage makes it incredibly challenging for new entrants to match pricing, even with efficient operations.

In 2024, the global tire market is valued at over $250 billion, with major players operating multiple large-scale, highly automated facilities. This scale allows established companies to optimize supply chains and achieve cost efficiencies that are difficult for smaller, newer operations to replicate, thus posing a significant threat to potential new entrants.

Bridgestone's formidable brand loyalty and deeply entrenched distribution networks present a significant barrier to new entrants. Decades of consistent quality and marketing have cultivated trust, making consumers hesitant to switch. For instance, Bridgestone's global sales reached approximately ¥3.77 trillion (around $25 billion USD at current exchange rates) in 2023, highlighting the scale of its established market presence.

The tire industry's technological complexity, particularly in areas like advanced rubber compounds and sustainable materials, presents a substantial hurdle for potential new entrants. Bridgestone's commitment to innovation, exemplified by its ENLITEN technology which aims to reduce tire weight and rolling resistance, necessitates considerable upfront investment in research and development. For instance, the global tire market, valued at approximately $270 billion in 2024, sees major players consistently reinvesting in R&D to maintain a competitive edge, making it difficult for smaller, less-resourced companies to enter and compete effectively.

Strict Regulatory and Safety Standards

The tire industry is heavily regulated, with strict safety, performance, and environmental standards that vary across different regions. For instance, the U.S. National Highway Traffic Safety Administration (NHTSA) mandates rigorous tire testing, and the European Union's Tire Labeling regulation requires specific performance information.

- High Capital Investment: New entrants must invest heavily in research and development, advanced manufacturing facilities, and extensive testing to meet these global compliance requirements.

- Testing and Certification Costs: Obtaining necessary certifications for safety and performance, such as ECE R117 for rolling sound emissions in Europe, adds significant upfront costs and time delays.

- Established Brands' Advantage: Existing players like Bridgestone have already made these investments and have established processes, creating a considerable barrier for newcomers to overcome in terms of compliance and market entry.

Access to Raw Materials and Supply Chain Integration

Newcomers face significant hurdles in securing essential raw materials like natural rubber and synthetic polymers. Established tire manufacturers, such as Bridgestone, have cultivated deep-rooted supplier relationships and often possess greater bargaining power due to their scale. For instance, in 2024, the global natural rubber market experienced price volatility, with benchmarks fluctuating significantly, making it harder for new entrants to lock in stable, cost-effective supply agreements compared to incumbents with established contracts.

Supply chain integration presents another formidable barrier. Bridgestone, with its extensive network of manufacturing facilities and distribution channels developed over decades, benefits from economies of scale and logistical efficiencies. A new entrant would need substantial capital investment to replicate this intricate global supply chain, facing challenges in negotiating favorable terms with logistics providers and managing inventory across diverse markets. The complexity of managing a global supply chain for automotive components in 2024, with ongoing geopolitical and trade considerations, amplifies this difficulty.

- Supplier Relationships: Incumbents leverage long-term contracts and volume commitments, securing preferential pricing and supply assurance.

- Vertical Integration: Some established players have partial or full control over key raw material sources or processing, reducing reliance on external suppliers.

- Logistical Expertise: Decades of experience in global logistics and distribution provide incumbents with cost advantages and supply chain resilience.

- Capital Requirements: Building a comparable supply chain infrastructure requires massive upfront investment, a significant deterrent for new market entrants.

The threat of new entrants in the tire industry is significantly mitigated by the sheer volume of capital required to establish a competitive presence. Building and equipping modern tire manufacturing plants, complete with advanced robotics and research capabilities, represents an investment in the hundreds of millions, if not billions, of dollars, a threshold few new companies can meet.

Established players like Bridgestone benefit from substantial economies of scale, which translate into lower per-unit costs through bulk purchasing of raw materials and efficient overhead allocation. This cost advantage is difficult for newcomers to overcome, especially in a market where pricing is a key competitive factor.

Furthermore, the tire sector is characterized by high technological intensity, demanding continuous investment in research and development for areas such as advanced rubber compounds and sustainable materials. Bridgestone's own innovation in technologies like ENLITEN, aimed at reducing tire weight and rolling resistance, underscores the R&D commitment necessary to remain competitive, a significant barrier for less-resourced entrants.

The global tire market, valued at approximately $270 billion in 2024, sees incumbents consistently reinvesting in R&D. This ongoing investment, coupled with established brand loyalty and extensive distribution networks, creates a formidable barrier to entry for new companies attempting to gain market share.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | Setting up advanced manufacturing facilities and R&D centers. | Prohibitive upfront investment. | New plant costs can exceed $500 million. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | Difficulty matching competitor pricing. | Major players operate multiple large-scale, automated facilities. |

| Technology & R&D | Continuous investment in material science and product innovation. | Requires significant and ongoing R&D expenditure. | Bridgestone's ENLITEN technology development. |

| Brand Loyalty & Distribution | Established customer trust and widespread sales networks. | Challenges in customer acquisition and market penetration. | Bridgestone's 2023 sales of ~$25 billion USD. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bridgestone leverages data from their annual reports, investor presentations, and official company statements. We also incorporate industry-specific market research reports and analyses from reputable automotive and tire sector publications to provide a comprehensive view of the competitive landscape.