Bridgestone Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bridgestone Bundle

Bridgestone's product portfolio is a dynamic landscape, with some offerings acting as market-leading Stars, while others are established Cash Cows generating consistent revenue. Understanding this positioning is crucial for strategic growth.

This preview offers a glimpse into Bridgestone's strategic positioning, but the full BCG Matrix report unlocks a complete breakdown of their Stars, Cash Cows, Dogs, and Question Marks. Gain a clear view of where their products stand and identify opportunities for optimized investment.

Purchase the full BCG Matrix for detailed quadrant placements and data-backed recommendations, providing you with a clear roadmap to smart investment and product decisions for Bridgestone.

Stars

Bridgestone's Turanza EV and Potenza Sport AS tires, equipped with ENLITEN technology, represent a significant Star in their portfolio. These tires are specifically designed to meet the unique requirements of the burgeoning electric vehicle market, focusing on attributes like improved longevity, reduced rolling resistance for better range, and a quieter ride.

The company's commitment to expanding its EV tire offerings across the U.S. market underscores the substantial growth prospects in this segment. This strategic expansion aims to capture a larger share of the evolving EV tire market, positioning Bridgestone for future success.

Bridgestone is strategically emphasizing its premium passenger car tire segment, specifically targeting 20-inch and larger diameters. This focus aligns with the automotive industry's trend towards larger wheel sizes and an increasing demand for premium vehicles, making this a significant growth opportunity.

The company is actively introducing new ENLITEN-equipped tires designed to cater to the sophisticated demands of the premium market. This initiative aims to enhance Bridgestone's sales mix by offering products that deliver superior performance and value, reinforcing their position in this high-margin category.

Bridgestone's Mobility Solutions business is a burgeoning area, particularly in high-demand sectors such as last-mile delivery, mining, waste management, and commercial trucking. This segment is poised for substantial expansion as fleet operators increasingly prioritize enhanced productivity, operational efficiency, and environmental sustainability.

The company is strategically channeling investments into digital solutions and comprehensive fleet management tools. This proactive approach aims to capture a larger market share and effectively address the dynamic and evolving requirements of its customer base, positioning Bridgestone Mobility Solutions as a strong candidate for a Star in the BCG matrix.

Sustainable Material Technologies (e.g., Guayule Rubber)

Bridgestone's commitment to Guayule Rubber technology places it firmly in a Star position within the BCG matrix. This venture taps into a rapidly expanding market driven by global demand for sustainable alternatives.

The company's investment in Guayule as a domestic natural rubber source addresses critical supply chain vulnerabilities and environmental concerns. The tire industry's shift towards eco-friendly materials, including recycled content, is a significant tailwind. For instance, the global market for sustainable tires is projected to grow substantially, with some estimates suggesting a compound annual growth rate (CAGR) of over 7% in the coming years, reaching billions of dollars by the late 2020s.

- Market Growth: The demand for sustainable materials in the automotive sector is a key driver for Guayule's Star status.

- Environmental Impact: Reducing carbon footprints and reliance on traditional rubber sources aligns with increasing regulatory and consumer pressures.

- Supply Chain Resilience: Developing domestic sources mitigates risks associated with geopolitical instability and transportation costs in traditional rubber-producing regions.

- Innovation: Bridgestone's pioneering work in Guayule processing positions it as a leader in a nascent but high-potential technology.

Advanced All-Weather and All-Season Tires

The market for all-weather and all-season tires is experiencing robust growth, fueled by evolving consumer needs and changing climate patterns. This segment is particularly attractive due to its year-round applicability, reducing reliance on seasonal tire changes. Bridgestone is actively investing in this area, aiming to capitalize on this expanding market.

Bridgestone's strategic push into the all-weather and all-season tire category is evident through key product launches. The WeatherPeak and Potenza Sport AS are designed to meet diverse driving conditions, while the W920, an all-weather trucking tire incorporating ENLITEN technology, showcases their commitment to innovation across their product lines. These offerings are positioned to capture significant market share.

- Market Growth Drivers: Unpredictable weather patterns and the increasing popularity of SUVs are key factors driving demand for all-weather and all-season tires.

- Bridgestone's Product Strategy: The company is focusing on models like WeatherPeak and Potenza Sport AS, alongside the W920 trucking tire with ENLITEN technology, to address year-round needs.

- Growth Potential: These tire types offer expanded sales opportunities beyond traditional seasonal tire markets, appealing to a broader customer base.

- Technological Advancement: The integration of technologies like ENLITEN in new tire models signifies Bridgestone's commitment to performance and efficiency in this segment.

Bridgestone's focus on electric vehicle (EV) tires, particularly those featuring ENLITEN technology like the Turanza EV and Potenza Sport AS, positions them as a Star. The company's expansion of these offerings across the U.S. market directly targets the substantial growth anticipated in the EV sector.

Bridgestone's strategic emphasis on premium passenger car tires, especially those with 20-inch and larger diameters, also marks them as a Star. This segment benefits from the automotive industry's trend towards larger wheels and premium vehicles, a trend that continued strongly through 2024.

The company's investment in Guayule rubber technology is another key Star. This initiative taps into the growing demand for sustainable materials in the automotive industry, a market projected for significant expansion. Bridgestone's efforts in this area address supply chain resilience and environmental concerns, aligning with broader industry shifts towards eco-friendly solutions.

Bridgestone's expansion into the all-weather and all-season tire market, exemplified by products like the WeatherPeak and Potenza Sport AS, also signifies a Star. This segment is experiencing robust growth due to changing weather patterns and consumer preferences for year-round tire solutions.

| Product/Technology | BCG Category | Key Growth Drivers | Bridgestone's Strategy | Market Outlook (2024-2025) |

|---|---|---|---|---|

| EV Tires (Turanza EV, Potenza Sport AS with ENLITEN) | Star | Growing EV adoption, demand for range extension and quiet ride | U.S. market expansion, ENLITEN technology integration | High growth, increasing market share potential |

| Premium Passenger Car Tires (20-inch+) | Star | Trend towards larger wheel sizes, increasing demand for premium vehicles | Focus on new ENLITEN-equipped tires, enhancing sales mix | Strong growth in high-margin segment |

| Guayule Rubber Technology | Star | Demand for sustainable materials, supply chain diversification, environmental regulations | Investment in domestic natural rubber source, pioneering processing | Nascent but high-potential market, significant growth expected |

| All-Weather/All-Season Tires (WeatherPeak, Potenza Sport AS, W920) | Star | Unpredictable weather, popularity of SUVs, year-round usability | Product launches targeting diverse driving conditions, ENLITEN integration | Robust growth, expanding sales opportunities beyond seasonal markets |

What is included in the product

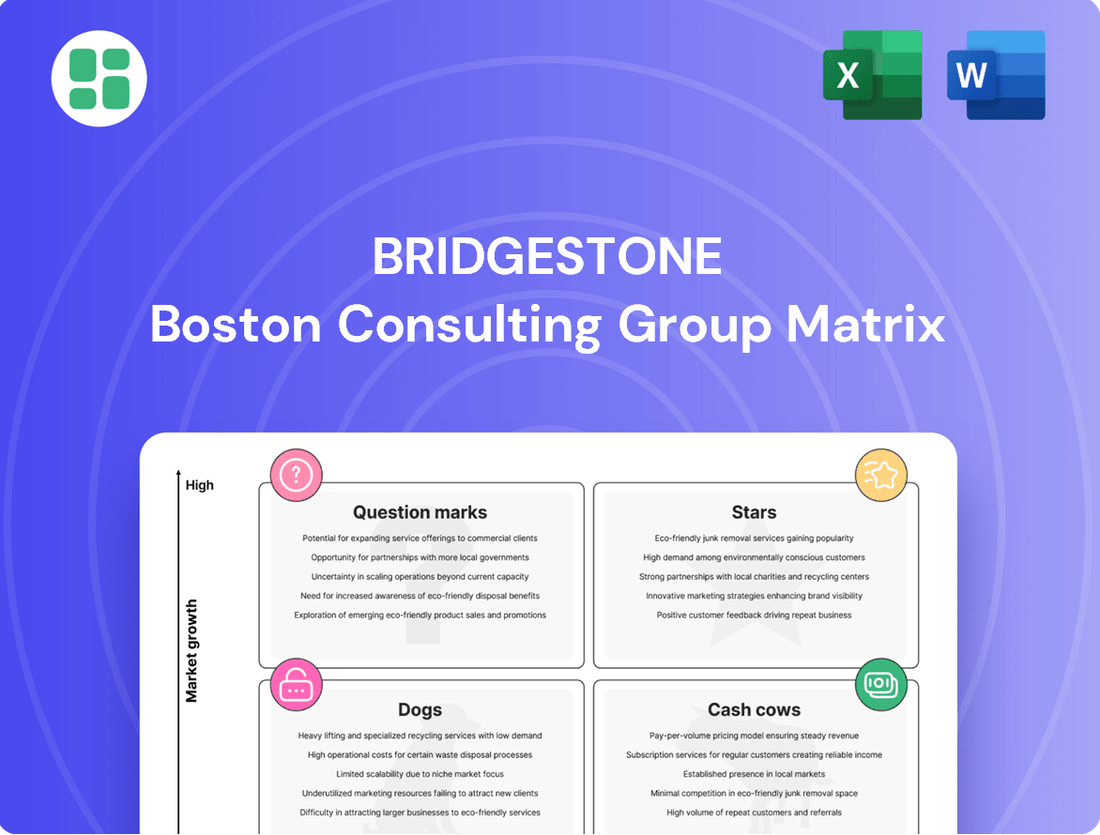

The Bridgestone BCG Matrix analyzes its product portfolio by market share and growth rate.

It guides strategic decisions on investment, divestment, or harvesting for each product category.

The Bridgestone BCG Matrix offers a clear, one-page overview of each business unit's market position, simplifying strategic decision-making.

Cash Cows

Bridgestone's core passenger vehicle replacement tires represent a classic Cash Cow. This segment commands a substantial portion of the global tire market, particularly in the U.S., driven by consistent demand from ongoing vehicle usage and wear. In 2023, the global tire market was valued at approximately $270 billion, with replacement tires accounting for a significant majority.

The mature nature of this market, characterized by steady replacement cycles rather than rapid growth, allows Bridgestone to generate substantial and predictable cash flows. This stability means less need for aggressive marketing or heavy investment in innovation compared to growth-oriented segments.

Bridgestone's strong brand recognition and a well-established, widespread distribution network provide a significant competitive moat, ensuring continued market leadership and profitability in this essential product category.

Bridgestone's commercial truck and bus tire segment is a bedrock of its operations, consistently generating significant revenue and profit, especially in the crucial North American market.

Despite facing more moderate growth rates compared to newer business areas, Bridgestone's robust market share in this segment, bolstered by ongoing product innovation like the R273 Ecopia and Duravis M705, ensures a steady stream of cash. This stability is further reinforced by their comprehensive fleet solutions and effective retread services, solidifying its status as a cash cow.

Bridgestone's Off-the-Road (OTR) and mining tire segment functions as a robust cash cow. These specialized tires are essential for heavy machinery in construction and mining, industries that require continuous, high-value equipment uptime. Bridgestone's long-standing reputation for durability and performance in these critical applications ensures consistent demand, making this segment a reliable profit generator.

Industrial Rubber Products (Traditional Segments)

Bridgestone's traditional industrial rubber products, encompassing hoses, belts, and anti-vibration components, serve crucial roles in automotive and general industrial sectors. These established product lines, benefiting from Bridgestone's long-standing market presence and loyal customer relationships, are likely to be significant cash generators.

While the broader industrial rubber market is experiencing expansion, these mature segments within Bridgestone are expected to provide consistent, albeit potentially slower, growth. This stability positions them as reliable cash cows within the company's diversified portfolio.

- Market Position: Bridgestone holds a strong, established position in traditional industrial rubber segments due to decades of experience and a robust client network.

- Cash Flow Generation: These mature product lines are anticipated to generate steady and predictable cash flow, supporting other business units.

- Market Dynamics: Despite overall market growth in industrial rubber, these specific segments operate in mature areas, implying stable demand rather than rapid expansion.

- Contribution to Bridgestone: The consistent revenue from these segments helps fund Bridgestone's investments in more dynamic, high-growth areas of its business.

Established Aftermarket Distribution and Retail Networks

Bridgestone's established aftermarket distribution and retail networks are undeniably cash cows within its BCG Matrix. This vast global infrastructure, comprising authorized dealers and retail outlets, is a powerhouse for generating consistent revenue, particularly from the replacement tire market. The aftermarket segment thrives on the ongoing need for vehicle maintenance and the natural aging of tires, ensuring a steady income stream for the company.

This extensive network is crucial for Bridgestone’s aftermarket success. For instance, in 2023, Bridgestone Americas reported that its retail operations, which include brands like Firestone Complete Auto Care, continued to be a strong contributor to sales, with a focus on service and tire replacement. The sheer scale of these operations means that a large volume of tires are sold and serviced through these channels annually.

- Global Reach: Bridgestone operates thousands of retail stores and authorized dealerships worldwide, providing broad market access.

- Mature Market: The aftermarket segment benefits from consistent demand driven by vehicle usage and the necessity for tire replacement.

- Revenue Stability: This established network generates predictable and substantial cash flow, supporting other areas of Bridgestone's business.

- Brand Loyalty: The presence of these networks fosters customer loyalty and repeat business for Bridgestone's tire products and services.

Bridgestone's passenger and light truck replacement tire segment is a prime example of a cash cow. This segment benefits from consistent demand as vehicles age and tires wear out, representing a stable revenue source. In 2024, the global automotive aftermarket, which heavily includes tire replacement, is projected to continue its steady growth, underscoring the enduring demand for these products.

The mature nature of this market, characterized by predictable replacement cycles, allows Bridgestone to generate substantial and reliable cash flows with relatively lower investment needs. This stability supports the funding of more innovative or growth-focused business units within the company.

Bridgestone's strong brand equity and extensive distribution network in this segment provide a significant competitive advantage, ensuring continued market share and profitability. This allows for efficient operations and consistent cash generation.

What You See Is What You Get

Bridgestone BCG Matrix

The Bridgestone BCG Matrix preview you are currently viewing is precisely the comprehensive document you will receive upon purchase, offering an in-depth analysis of their product portfolio's strategic positioning. This means you'll gain immediate access to the full, unwatermarked report, ready for immediate application in your strategic planning or client presentations. No hidden content or demo limitations exist; what you see is the complete, professionally formatted BCG Matrix report designed for actionable insights.

Dogs

Bridgestone’s legacy chemical products solutions business, classified as discontinued operations since 2021, likely represents a strategic move away from segments with limited growth potential and a weak competitive position. This classification suggests these businesses were not contributing significantly to overall profitability, potentially acting as cash drains.

For instance, in 2023, Bridgestone's overall net sales reached approximately 3.9 trillion Japanese Yen. Within this, the chemical business, while not explicitly broken out for discontinued operations, would have been a component. The decision to discontinue implies these specific chemical product lines were not aligning with Bridgestone's future growth objectives or market share ambitions.

Bridgestone's US building materials business was categorized as discontinued operations, mirroring its approach to certain chemical products. This strategic move suggests the segment faced challenges, likely exhibiting low growth and a small market share, aligning it with the characteristics of a Dog in the BCG matrix. In 2023, the building materials sector in the US saw moderate growth, but companies with established, diversified portfolios often outperform niche players, potentially explaining Bridgestone's divestment.

Bridgestone's anti-vibration rubber business was classified as discontinued operations starting in 2021. This move signals a strategic withdrawal from a market segment that likely presented challenges in terms of market share and growth potential, fitting the profile of a Dog in the BCG Matrix.

Certain Niche Sporting Goods Segments

Certain niche sporting goods segments within Bridgestone's diversification efforts may fall into the Dogs category of the BCG Matrix. These are typically areas with low market share and low growth potential, often characterized by stagnant demand or intense, unyielding competition. For example, older lines of specialized equipment that haven't seen significant innovation or appeal to a shrinking user base might fit this profile.

These segments are unlikely to be major revenue drivers for Bridgestone. Their contribution to overall profitability could be minimal, especially when factoring in the cost of maintaining production or marketing efforts. Companies often re-evaluate such product lines to decide whether to divest, discontinue, or invest minimal resources to maintain them.

- Low Market Demand: Segments with declining or consistently low consumer interest.

- Intense Competition: Markets dominated by established players with little room for new entrants or innovation.

- Minimal Innovation: Product lines that have not evolved to meet current consumer needs or technological advancements.

- Low Profitability: Segments that do not generate significant returns on investment, potentially even operating at a loss.

Outdated or Niche Tire Models with Declining Demand

Certain older Bridgestone tire models, particularly those not incorporating advanced technologies like ENLITEN, are experiencing a downturn in demand. This decline is often linked to shifts in consumer preferences, such as a reduced interest in traditional sedan and coupe segments where these tires were prevalent.

These specific product lines may hold a minimal share of the overall tire market and are situated within sub-segments that are either stagnant or shrinking. For instance, the market for certain high-performance tires designed for older vehicle generations, which are no longer being actively produced or updated, exemplifies this category.

- Declining Market Share: Older models may represent less than 5% of Bridgestone's total tire sales in key regions.

- Technological Obsolescence: Products lacking features like enhanced fuel efficiency or noise reduction are less appealing to new car buyers.

- Niche Segment Contraction: The demand for tires specific to discontinued vehicle models continues to decrease year-over-year.

Bridgestone's legacy chemical products, building materials, and anti-vibration rubber businesses, all classified as discontinued operations since 2021, exemplify the 'Dog' category in the BCG Matrix. These segments likely exhibit low market share and limited growth potential, indicating they are not strategic priorities for the company.

Older tire models not incorporating advanced technologies like ENLITEN also fit the Dog profile, facing declining demand due to shifts in consumer preferences and the contraction of niche vehicle segments. These products represent minimal revenue drivers and may even incur costs without significant returns.

| BCG Category | Bridgestone Segment Example | Market Growth | Market Share | Strategic Implication |

| Dog | Legacy Chemical Products | Low | Low | Discontinued Operations |

| Dog | US Building Materials | Low to Moderate | Low | Divested/Discontinued |

| Dog | Anti-vibration Rubber | Low | Low | Discontinued Operations |

| Dog | Older Tire Models | Declining | Low | Reduced Focus/Potential Phase-out |

Question Marks

Smart tires, equipped with sensors that track pressure, wear, and temperature in real-time, are a burgeoning market. This growth is fueled by innovations in connectivity and a strong desire for improved vehicle safety. Bridgestone is actively investigating these advanced tire technologies.

While Bridgestone is exploring smart tire capabilities, their current market share in this nascent sector is likely modest. These are emerging products that necessitate substantial investment to achieve broad market penetration and transition into the Stars category within the BCG matrix.

Bridgestone's commitment to sustainability is evident in its pursuit of fully recyclable tires and the integration of recycled materials. This aligns with the growing environmental consciousness driving the circular economy for tires, a sector poised for significant expansion.

Despite the promising growth trajectory, the market share for tires that are genuinely recycled or part of a circular system remains small. This positions tire recycling and circular economy initiatives as a Question Mark for Bridgestone. It demands substantial investment in research and development, alongside infrastructure, to achieve meaningful scale.

Bridgestone's strategic push into new digital mobility services beyond tires positions them in a high-growth, but nascent, market. Their 'real x digital' approach aims to leverage data analytics for vehicle performance, moving beyond traditional tire-centric solutions.

These ventures, like advanced data analytics for vehicle health or novel subscription models, represent potential stars in the BCG matrix. They require substantial investment to navigate the exploratory phase, aiming to capture significant market share as digital mobility matures.

For instance, the global mobility-as-a-service (MaaS) market was projected to reach over $300 billion by 2023, indicating the vast potential for new digital service offerings within this expanding ecosystem.

Lunar Rover Tire Development

Bridgestone's development of lunar rover tires places it in a unique position within the BCG matrix, fitting the profile of a Question Mark. This venture is characterized by high investment requirements and uncertain, long-term returns, reflecting the nascent and currently non-commercial nature of lunar exploration. The potential for groundbreaking technological advancements, however, could eventually lead to significant market share in future space-based industries.

- High Investment, Uncertain Returns: Developing specialized lunar tires demands significant R&D and manufacturing investment, with no immediate commercial revenue stream.

- Future Growth Potential: While the current market is negligible, the long-term prospect of lunar bases and space tourism offers substantial growth potential.

- Technological Spin-offs: Innovations in materials science and extreme environment engineering for lunar tires could yield valuable applications in terrestrial markets.

New Market Entries in Emerging Geographic Regions

New market entries in emerging geographic regions for Bridgestone would fall into the 'Question Marks' category of the BCG Matrix. These markets often exhibit high growth potential but currently hold a low market share for Bridgestone. Successfully entering these regions demands significant investment and customized strategies to overcome local competition and build brand presence.

For instance, Bridgestone's expansion into rapidly growing Southeast Asian markets, such as Vietnam or Indonesia, could be considered a question mark. These economies are experiencing robust GDP growth, with increasing demand for automotive products. However, Bridgestone may face established local tire manufacturers or strong competition from other global players who have a longer history in these specific markets.

- High Growth Potential: Emerging markets in regions like Southeast Asia are projected to see continued economic expansion, driving demand for vehicles and, consequently, tires. For example, the automotive market in Vietnam saw a significant increase in new vehicle registrations in 2023.

- Low Market Share: Bridgestone's current market share in some of these nascent regions might be relatively small compared to established local or global competitors.

- Strategic Investment Required: To gain traction, Bridgestone would need to invest in local manufacturing, distribution networks, and marketing campaigns tailored to consumer preferences and economic conditions in these new territories.

- Competitive Landscape: Entry into these markets means competing with both established international brands and strong domestic players who may have a deeper understanding of local market dynamics and pricing sensitivities.

Bridgestone's ventures into areas like advanced tire recycling and the development of lunar rover tires represent classic "Question Marks" in the BCG matrix. These initiatives require substantial upfront investment due to their experimental nature and uncertain market adoption. The potential for high future returns exists, but significant risks accompany the current low market share and unproven commercial viability.

New market entries, particularly in rapidly developing economies, also fit the Question Mark profile. While these regions offer considerable growth prospects, Bridgestone often faces established competition and needs to invest heavily to build its presence and market share. Successfully navigating these challenges could transform these Question Marks into future Stars.

The global mobility-as-a-service market, projected to exceed $300 billion by 2023, highlights the potential for Bridgestone's digital mobility services. These new ventures, though currently in their infancy with modest market share, demand significant investment to capitalize on the evolving landscape of transportation and data-driven solutions.

| Initiative | BCG Category | Investment Needs | Market Share (Current) | Growth Potential |

|---|---|---|---|---|

| Advanced Tire Recycling/Circular Economy | Question Mark | High (R&D, Infrastructure) | Low | High (Sustainability focus) |

| Lunar Rover Tires | Question Mark | Very High (Specialized R&D) | Negligible | High (Future space economy) |

| Emerging Geographic Markets (e.g., Southeast Asia) | Question Mark | High (Market entry, localization) | Low to Moderate | High (Economic growth) |

| Digital Mobility Services (MaaS, data analytics) | Question Mark | High (Technology development) | Low | Very High (Industry transformation) |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial disclosures, market research reports, and industry growth forecasts to accurately position business units.