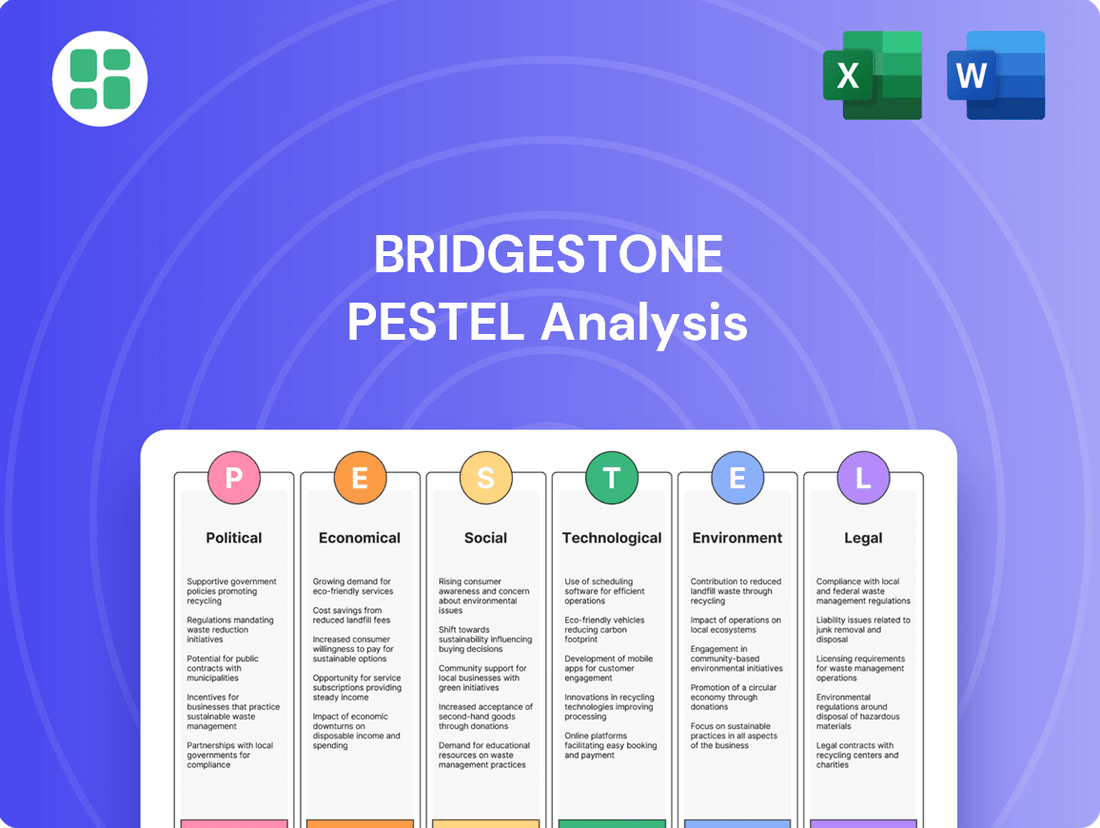

Bridgestone PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bridgestone Bundle

Navigate the complex global landscape impacting Bridgestone with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are shaping the tire industry and Bridgestone's strategic direction. Gain the foresight needed to anticipate challenges and capitalize on opportunities.

Unlock actionable intelligence for your business strategy. Our expert-crafted PESTLE analysis provides a deep dive into the external factors influencing Bridgestone's operations and market position. Download the full version now to gain a competitive edge and make informed decisions.

Political factors

Bridgestone's extensive global operations mean that shifts in international trade policies, including tariffs and import/export regulations, directly affect its business. For instance, the ongoing trade tensions and discussions surrounding potential tariffs on automotive parts and finished vehicles, particularly between major economies like the US and China, create significant headwinds.

Such policy changes can disrupt Bridgestone's intricate supply chains, impacting the cost of raw materials and finished goods. For example, if new tariffs are implemented on tires imported into a key market, Bridgestone may face increased costs, potentially necessitating price adjustments that could affect sales volumes.

The company actively monitors these developments to devise flexible strategies. By assessing the potential impact of various tariff scenarios, Bridgestone aims to mitigate adverse effects on its sales performance and overall profitability in its diverse markets.

Geopolitical shifts, especially in developing economies, bring uncertainty that Bridgestone is managing by diversifying its operational footprint. While the Asia-Pacific region continues to be a significant market, its growth trajectory is not uniform. Policies such as China's 'Made in China 2025' initiative could exacerbate oversupply issues, potentially impacting profitability.

To mitigate these risks and ensure steadier income, Bridgestone is strategically increasing its emphasis on more stable regions like the United States and Europe. This rebalancing act aims to buffer against unpredictable economic and political events in other markets, thereby securing more reliable revenue streams for the company.

Government incentives for green mobility, particularly for electric vehicles (EVs) and sustainable transportation, significantly shape the tire industry. Policies like the European Union's 'Fit for 55' package, aiming for a 55% reduction in greenhouse gas emissions by 2030, are a prime example. This initiative directly boosts demand for specialized EV tires designed for lower rolling resistance and higher torque, while also encouraging Bridgestone to invest in eco-friendly production processes and materials.

Domestic Industrial Policies

Domestic industrial policies, particularly those encouraging local manufacturing or enforcing specific production standards, can significantly influence Bridgestone's global operations and supply chain. For instance, government incentives for domestic tire production could encourage investment in local facilities, while stringent environmental regulations might necessitate upgrades to existing plants.

Bridgestone has been actively optimizing its business footprint, a strategy that often aligns with or responds to national industrial policies. This has included significant actions such as plant closures and workforce reductions in various regions. For example, in 2023, Bridgestone Americas announced plans to cease production at its plant in Graniteville, South Carolina, impacting approximately 800 employees, as part of a broader effort to streamline operations.

These strategic adjustments are driven by the need to bolster competitiveness and create greater value in a dynamic market. By consolidating production and focusing on more efficient facilities, Bridgestone aims to adapt to evolving market demands and competitive pressures, which are often shaped by national industrial strategies. The company's ongoing commitment to business footprint optimization reflects a proactive approach to navigating the complexities of global manufacturing and policy environments.

Key aspects of Bridgestone's footprint optimization initiatives include:

- Operational Streamlining: Consolidating production to more efficient and strategically located facilities.

- Cost Reduction: Implementing measures to lower manufacturing and operational expenses.

- Market Responsiveness: Aligning production capacity with current and future market demands.

- Competitiveness Enhancement: Investing in advanced technologies and processes in key manufacturing hubs.

Regulatory Environment for Autonomous Vehicles

The regulatory landscape for autonomous vehicles (AVs) is rapidly shifting across the globe, directly influencing tire development and market demand for companies like Bridgestone. As AI becomes more integrated into vehicle systems for self-driving capabilities, regulators are grappling with safety standards and operational frameworks. This evolving environment presents both challenges and opportunities for tire manufacturers.

Consumer trust in AV safety is a key consideration, with ongoing discussions about the ethical implications of AI decision-making in critical situations. However, the potential benefits of AVs, such as improved road safety and efficiency, are widely acknowledged, particularly in fast-growing markets like Asia-Pacific. For instance, China has been actively promoting AV development and testing, with significant investments in smart infrastructure to support these technologies.

- Global AV Regulation Pace: While the US and Europe have established some frameworks, many countries are still defining their AV regulatory approaches, creating a fragmented market for tire suppliers.

- AI Integration Benefits: AI in AVs is projected to reduce accidents by up to 90% according to some industry estimates, driving demand for specialized tires that can communicate with vehicle systems.

- Asia-Pacific Focus: Markets like South Korea and Japan are making substantial progress in AV testing and deployment, indicating strong future demand for AV-specific tire solutions.

Bridgestone's investment in smart tire technology and virtual development processes positions them to adapt to these regulatory changes and meet the specific requirements of AVs. Their focus on sensors and data transmission within tires can provide crucial information for autonomous systems, ensuring optimal performance and safety in this new era of mobility.

Government policies concerning environmental sustainability and emissions standards, such as the EU's ambitious 'Fit for 55' package targeting a 55% greenhouse gas reduction by 2030, directly influence Bridgestone's product development and manufacturing processes. These regulations are increasingly driving demand for tires optimized for electric vehicles, emphasizing lower rolling resistance and enhanced durability. Bridgestone's strategic investments in eco-friendly materials and production technologies are a direct response to this evolving regulatory landscape, aiming to align with global decarbonization efforts and capitalize on the growing green mobility market.

The global regulatory environment for autonomous vehicles (AVs) is rapidly evolving, with varying approaches across different regions. For instance, while the US and Europe have begun to establish some AV regulatory frameworks, many other nations are still in the process of defining their guidelines, leading to a fragmented market for specialized AV tires. Bridgestone's development of smart tire technology, incorporating sensors for data transmission to autonomous systems, positions them to adapt to these diverse and emerging regulations, ensuring optimal performance and safety in this new mobility paradigm.

International trade policies, including tariffs and import/export regulations, significantly impact Bridgestone's global supply chains and profitability. For example, ongoing trade discussions and potential tariffs on automotive components between major economies create uncertainty. Bridgestone actively monitors these shifts to develop flexible strategies, mitigating the adverse effects of potential tariff increases on raw material costs and finished goods prices, thereby safeguarding sales performance and profitability across its diverse international markets.

What is included in the product

The Bridgestone PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

This comprehensive review offers actionable insights for stakeholders to navigate the external landscape and capitalize on emerging opportunities.

A clear, actionable summary of Bridgestone's PESTLE factors, highlighting key opportunities and threats to inform strategic decision-making.

Economic factors

The global tire industry is on a strong growth trajectory, with projections indicating a market value of $142.7 billion in 2024. This expansion is expected to continue at a compound annual growth rate of 5% until 2032, potentially reaching $211.6 billion.

A primary driver for this significant market growth is the sustained increase in passenger vehicle sales across the globe. As more cars are produced and sold, the demand for replacement tires and original equipment tires naturally rises.

Bridgestone, holding the position of the second-largest tire company worldwide by market share, is well-positioned to capitalize on this burgeoning market. The company's substantial presence and established operations will allow it to benefit directly from the overall expansion of the automotive and tire sectors.

Bridgestone's operating environment is significantly shaped by the volatility of raw material prices, particularly for key inputs like synthetic rubber and carbon black. For instance, crude oil prices, a major determinant of these costs, saw considerable fluctuations throughout 2024, impacting Bridgestone's cost of goods sold. These price swings directly affect the company's profitability, making proactive cost management and supply chain optimization essential for meeting financial objectives.

Interest rate trends in major economies like the U.S. and Europe significantly impact corporate borrowing costs and capital expenditure decisions. For Bridgestone, a stable or declining interest rate environment can unlock opportunities for more affordable financing, enabling strategic investments in areas like advanced tire technology and sustainable manufacturing processes.

Central banks, including the Federal Reserve and the European Central Bank, have signaled a potential shift towards an easing cycle by 2026. This outlook suggests that Bridgestone could benefit from lower borrowing costs, enhancing its financial flexibility and supporting its long-term resilience against economic headwinds.

This financial flexibility is crucial for Bridgestone to maintain its competitive edge. For instance, if Bridgestone can secure capital at lower rates, it can invest more aggressively in R&D, potentially leading to innovations that capture market share. This strategic advantage is particularly important in the automotive sector, where technological advancements drive demand and profitability.

Regional Market Dynamics and Demand Shifts

Bridgestone is navigating varied regional market dynamics. In the United States, the company is experiencing robust performance, bolstered by a strong economy and increased demand from e-commerce logistics, which significantly drives tire sales. For instance, U.S. tire shipments for replacement markets saw a notable increase in late 2024, reflecting this sustained demand.

Europe presents a different challenge, with Bridgestone's tire business in a rebuilding phase. This is a response to a difficult business environment and increased competition from lower-priced imports. The company's strategy in Europe, as of early 2025, centers on strengthening its position in premium tire segments and expanding its solutions-based offerings to counter these pressures.

These contrasting regional trends highlight the importance of Bridgestone's adaptive strategies.

- U.S. Market Strength: Driven by economic resilience and e-commerce logistics growth, leading to increased tire demand.

- European Challenges: Facing a 'rebuilding' phase due to a tough business climate and competitive import pressures.

- Strategic Focus: Prioritizing premium tire segments and solutions businesses to address diverse regional market conditions.

- Data Point: U.S. replacement tire shipments showed a positive trend in Q4 2024, underscoring the market's strength.

Cost Optimization and Business Restructuring

Bridgestone is strategically focusing on cost optimization and business restructuring through its 2024-2026 Mid Term Business Plan. These efforts are designed to build a leaner operational framework by 2025, enhancing the company's competitive edge in a dynamic market.

Key initiatives include reducing plant capacity and workforce, a move projected to yield substantial cost savings. These measures are crucial for fortifying Bridgestone's financial health and navigating current economic headwinds.

- Plant Capacity Reduction: Bridgestone is streamlining its manufacturing footprint to improve efficiency.

- Workforce Adjustments: The company is implementing workforce reductions as part of its restructuring.

- Lean Structure Target: Aims to establish a lean operational structure by the end of 2025.

- Financial Strengthening: Projected cost savings are intended to bolster the company's financial performance.

Economic factors significantly influence Bridgestone's performance, with raw material price volatility, particularly for synthetic rubber derived from crude oil, directly impacting its cost of goods sold. Furthermore, interest rate trends in key markets like the U.S. and Europe affect borrowing costs and capital expenditure, with a projected easing cycle by 2026 offering potential benefits for Bridgestone's financial flexibility and investment capacity.

Bridgestone is actively managing these economic dynamics through its 2024-2026 Mid Term Business Plan, which includes cost optimization and business restructuring initiatives. These efforts, such as plant capacity reduction and workforce adjustments, aim to create a leaner operational framework by 2025, enhancing the company's resilience and competitive positioning in the face of economic fluctuations.

| Economic Factor | Impact on Bridgestone | Bridgestone's Response/Outlook |

|---|---|---|

| Raw Material Prices (e.g., Crude Oil) | Affects cost of goods sold, impacting profitability. | Proactive cost management and supply chain optimization are essential. |

| Interest Rates | Influences borrowing costs and capital expenditure decisions. | Potential easing cycle by 2026 could lower financing costs, supporting strategic investments. |

| Global Economic Growth | Drives demand for passenger vehicles and replacement tires. | Strong growth in markets like the U.S. boosts sales; European market requires strategic adjustments. |

What You See Is What You Get

Bridgestone PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bridgestone PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy. It provides a detailed overview of the external forces shaping the global automotive and tire industry.

Sociological factors

Consumers are increasingly prioritizing sustainability, with a growing demand for eco-friendly tires. This is pushing tire manufacturers like Bridgestone to innovate by incorporating recycled materials, bio-based rubber, and adopting greener production methods. For instance, a 2024 report indicated that 65% of consumers consider sustainability a key factor in their purchasing decisions, directly influencing tire choices.

Bridgestone is actively responding to this shift, investing in the development of tires that emphasize resource efficiency. Their ambitious goal is to achieve 100% sustainable materials in all their products by 2050, a commitment that reshapes their product development pipeline and marketing approaches to highlight these environmental benefits.

The global surge in electric and hybrid vehicle adoption directly impacts tire manufacturers like Bridgestone. Consumers are increasingly seeking tires optimized for these new powertrains, demanding features like reduced rolling resistance to maximize battery range and improved wear resistance due to the heavier weight of EVs. Bridgestone's development of specialized EV tires, such as the Turanza EV, and its focus on quiet operation through noise-reducing tread designs demonstrate a strategic response to these evolving consumer preferences.

Drivers are increasingly looking for tires that can handle various weather conditions, boosting the demand for all-season and specialized tires. This shift influences what Bridgestone offers, pushing them to create innovative rubber compounds and tread patterns that adapt to different temperatures.

For instance, Bridgestone's WeatherPeak tire, designed for year-round performance, has seen significant consumer interest, demonstrating this market trend. In 2024, the global all-season tire market was valued at approximately $85 billion, with projections indicating continued growth driven by consumer preference for convenience and safety across different climates.

Mobility-as-a-Service (MaaS) and Vehicle Ownership Trends

Younger demographics, especially in emerging markets like India and Southeast Asia, are increasingly open to ditching personal car ownership for Mobility-as-a-Service (MaaS) options. This shift is driven by factors like cost-effectiveness and convenience. For instance, ride-sharing and subscription services are gaining traction, potentially impacting traditional tire sales volumes.

This evolving consumer preference presents a significant challenge and opportunity for tire manufacturers like Bridgestone. As vehicle ownership declines in favor of shared mobility, the demand for tires might not grow at the same pace as the total number of miles traveled.

- 2024 data suggests a growing adoption of MaaS: In major urban centers, ride-sharing and micro-mobility services are seeing increased usage, with some reports indicating a 15-20% year-over-year growth in MaaS platform engagement in select regions.

- Shifting consumer attitudes: A recent survey indicated that over 30% of Gen Z consumers in urban US areas would consider giving up car ownership for a comprehensive MaaS subscription.

- Impact on tire demand: If this trend accelerates, it could lead to a decrease in the number of tires sold directly to individual consumers, necessitating a pivot towards fleet-based sales and service models.

Emphasis on Safety and Performance

Consumer preferences are increasingly leaning towards tires that offer both exceptional safety and robust performance. This trend directly shapes how companies like Bridgestone approach product development, pushing for advancements in design and material science. For instance, Bridgestone's ENLITEN technology is a prime example of this, engineered to enhance safety and deliver superior tire performance, all while catering to the growing electric vehicle market and sustainability goals.

The emphasis on safety and performance isn't just a passing fad; it's a fundamental driver of innovation in the tire industry. Consumers are willing to invest in products that promise greater reliability and a better driving experience. Bridgestone's commitment to these attributes, as seen with ENLITEN, positions them to meet these evolving demands effectively.

- Safety First: Consumers prioritize tire safety features, influencing design choices.

- Performance Driven: Tire performance remains a key factor in purchasing decisions.

- Technological Integration: Innovations like ENLITEN aim to satisfy both safety and performance demands.

- EV Compatibility: Technologies are being developed to meet the specific needs of electric vehicles, including performance and safety.

Societal shifts towards sustainability are profoundly influencing consumer choices, with a significant portion of buyers now prioritizing eco-friendly products. This trend is compelling tire manufacturers like Bridgestone to invest heavily in sustainable materials and manufacturing processes, aiming for a greener future. For example, a 2024 industry survey revealed that over 60% of consumers consider environmental impact when making purchasing decisions.

The growing popularity of electric vehicles (EVs) is another key sociological factor, driving demand for specialized tires that enhance battery range and manage the increased weight of EVs. Bridgestone's development of low-rolling-resistance tires, such as their Turanza EV line, directly addresses this evolving consumer preference for efficient and quiet electric mobility solutions.

Shifting attitudes towards car ownership, particularly among younger demographics in urban areas, are leading to increased adoption of Mobility-as-a-Service (MaaS) options like ride-sharing and subscriptions. This trend could potentially alter traditional tire sales models, pushing companies to adapt to fleet-based services. Reports from 2024 indicate a 15-20% year-over-year growth in MaaS platform engagement in several key urban centers.

Consumer demand for enhanced safety and performance in tires remains a constant, pushing innovation in material science and tread design. Bridgestone's ENLITEN technology exemplifies this, focusing on delivering superior safety and performance, especially for the burgeoning EV market, ensuring drivers feel confident in all conditions.

Technological factors

Bridgestone is at the forefront of technological advancements in the tire industry, particularly with the development of smart tires. These innovative tires incorporate sensors to constantly monitor crucial data like tire pressure, temperature, and tread depth. This real-time information is vital for proactive vehicle maintenance and driver safety.

Connectivity is a key aspect of Bridgestone's smart tire strategy. By linking these tires to vehicle systems and user-friendly mobile applications, drivers receive timely alerts and diagnostics. This connectivity aims to enhance overall safety, improve fuel efficiency by ensuring optimal tire pressure, and extend the lifespan of tires through better monitoring and management.

Bridgestone is significantly advancing its tire development by integrating artificial intelligence, particularly through 'driver-in-the-loop' simulators and virtual development. This technological leap enables quicker evaluation of design choices and more accurate replication of tire performance characteristics.

By combining AI with subjective driver feedback, Bridgestone aims to accelerate its development cycles, bringing new products to market faster and boosting overall operational efficiency. This approach is crucial for staying competitive in the rapidly evolving automotive sector.

Evidence of this focus is seen in Bridgestone's patent activity during Q2 2024, which included innovations in AI specifically for personalized tire recommendations. This highlights a strategic move towards leveraging AI for customer-centric solutions and data-driven product customization.

Bridgestone's proprietary ENLITEN technology is a significant technological advancement, focusing on improving both environmental sustainability and core tire performance, making them particularly suitable for electric vehicles (EVs).

This innovation underpins Bridgestone's strategic direction, enabling the creation of high-quality tires that provide enhanced fuel efficiency, extended durability, and the flexibility to be customized for a wide array of vehicles and driving scenarios.

By integrating ENLITEN, Bridgestone is positioning itself to meet the evolving demands of the automotive sector, particularly the growing EV market which requires tires optimized for lower rolling resistance and longer lifespan.

Sustainable Materials and Circular Economy Innovations

Bridgestone is heavily invested in technological advancements for sustainable resource utilization. Their ambitious targets include achieving 100% sustainable materials in all products by 2050 and a significant 40% ratio of recycled and renewable materials by 2030. This commitment drives innovation in areas like bio-derived raw materials and enhanced natural rubber productivity.

These technological pursuits are vital for Bridgestone's strategy to minimize resource depletion and actively contribute to a circular economy. The company is also focusing on improving retread and recycling technologies, further solidifying its dedication to a more sustainable future.

- Sustainable Materials Target: 100% by 2050.

- Recycled/Renewable Material Ratio: 40% by 2030.

- Key Innovation Areas: Bio-derived materials, natural rubber productivity, retreading, and recycling.

- Strategic Goal: Minimize resource depletion and foster a circular economy.

Virtual Tire Development and Digitalization

Bridgestone is heavily invested in the complete digitalization of its tire development process, utilizing virtual testing and advanced simulations. This technological shift allows engineers to accurately replicate tire performance in a digital environment, significantly reducing the reliance on physical prototypes.

This virtual approach is not just about efficiency; it's a strategic move to accelerate innovation. By minimizing the need for extensive physical testing, Bridgestone can bring new tire designs to market faster. For example, the company has reported that this digital transformation can reduce the number of physical tires required for testing by up to 12,000 units annually.

Key benefits of this technological factor include:

- Accelerated Product Innovation: Faster iteration cycles for new tire designs.

- Reduced Development Costs: Significant savings from fewer physical prototypes.

- Enhanced Sustainability: Less material waste through reduced physical testing.

- Improved Performance Simulation: Greater accuracy in predicting tire behavior under various conditions.

Bridgestone's technological focus is heavily on smart tires, integrating sensors for real-time data on pressure, temperature, and tread depth, crucial for safety and maintenance.

Connectivity through mobile apps enhances driver alerts and diagnostics, aiming for improved safety and fuel efficiency.

The company is leveraging AI and virtual simulations, like driver-in-the-loop simulators, to accelerate design evaluation and product development, as evidenced by their Q2 2024 patent activity in AI for personalized tire recommendations.

Bridgestone's ENLITEN technology is key for EV tires, enhancing fuel efficiency and durability, while their commitment to sustainability includes targets of 100% sustainable materials by 2050 and 40% recycled/renewable materials by 2030.

| Technology Focus | Key Features | Strategic Impact |

| Smart Tires | Integrated sensors (pressure, temp, tread) | Enhanced safety, proactive maintenance |

| AI & Virtual Development | Driver-in-the-loop simulators, virtual testing | Accelerated innovation, reduced physical prototypes (up to 12,000 units/year saved) |

| ENLITEN Technology | Improved fuel efficiency, durability, EV suitability | Meeting EV market demands, enhanced performance |

| Sustainable Materials | 100% by 2050, 40% recycled/renewable by 2030 | Circular economy, resource conservation |

Legal factors

Bridgestone operates under a complex web of environmental regulations worldwide, impacting everything from how its tires are made to their eventual disposal. These laws dictate everything from waste management protocols to the chemicals used in production and the acceptable levels of CO2 emissions. The company's commitment to navigating this landscape is demonstrated by its goal for all manufacturing sites to achieve ISO 14001 certification by the end of 2024, a standard for environmental management systems.

Tire manufacturers like Bridgestone are bound by stringent global regulations concerning product safety and performance. These standards, covering critical areas such as tire pressure limits, load-bearing capacities, and wet-weather traction, are paramount for safeguarding consumers. For instance, the UNECE Regulation No. 117, which addresses tire noise and rolling resistance, continues to influence tire design and manufacturing processes across major markets.

Bridgestone's commitment to research and development, exemplified by its ENLITEN technology, actively supports its ability to not only meet but often surpass these increasingly rigorous regulatory demands. This proactive approach ensures their product offerings remain compliant and competitive in a landscape where safety and efficiency are non-negotiable.

Bridgestone operates under a strict ethics and compliance framework, actively addressing anti-bribery and anti-trust concerns, areas facing heightened global regulatory attention. The company's commitment is reinforced through its Code of Conduct and Global Anti-Bribery Policy, guiding employees to uphold ethical and legal standards worldwide.

In 2023, Bridgestone reported no significant fines or penalties related to anti-bribery or anti-trust violations, underscoring the effectiveness of its compliance programs. This focus is crucial as regulators, such as the U.S. Department of Justice and the European Commission, continue to vigorously enforce these regulations across industries.

Data Privacy and Cybersecurity Laws

As vehicles increasingly integrate smart technologies and connected features, data privacy and cybersecurity laws are becoming paramount. Bridgestone's expansion into connected fleet solutions and AI-driven analytics means it must navigate a complex web of data protection regulations to maintain customer trust and ensure the secure operation of its systems. The automotive sector, in general, faces significant cybersecurity threats, making compliance a critical operational imperative.

The increasing volume of data collected by smart tires and connected vehicles necessitates strict adherence to global data privacy frameworks. For instance, the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018 and continues to be a benchmark, imposes stringent rules on how personal data is collected, processed, and stored. Bridgestone's commitment to data security is therefore directly linked to its ability to operate and innovate in these evolving markets.

- GDPR Fines: Non-compliance with GDPR can result in fines of up to 4% of annual global turnover or €20 million, whichever is higher.

- Cybersecurity Investments: The automotive industry is projected to spend billions on cybersecurity solutions in the coming years, with estimates suggesting global spending could reach over $30 billion by 2027, highlighting the scale of the challenge.

- Data Breach Costs: The average cost of a data breach in the automotive sector can be substantial, impacting reputation and incurring significant remediation expenses.

Sustainable Procurement Policies and Supply Chain Due Diligence

Bridgestone mandates that its suppliers meet stringent legal requirements concerning hazardous substances, aligning with national and regional environmental regulations. This commitment is further solidified by its Global Sustainable Procurement Policy, updated in January 2024. This policy explicitly forbids corrupt practices and demands strict adherence to competition laws, ensuring ethical and legal integrity throughout its supply chain.

The company's focus on supply chain due diligence is a direct response to increasing legal scrutiny and stakeholder expectations regarding corporate responsibility. For instance, the European Union's Corporate Sustainability Due Diligence Directive, expected to be fully implemented by 2027, will impose significant legal obligations on companies like Bridgestone to identify, prevent, and mitigate adverse human rights and environmental impacts in their value chains.

- Regulatory Compliance: Suppliers must comply with regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe, which governs the use of chemical substances.

- Anti-Corruption Laws: Adherence to laws such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act is non-negotiable for Bridgestone's partners.

- Competition Law: Suppliers are expected to operate within fair market practices, avoiding anti-competitive agreements or abuses of dominant market positions.

- Supply Chain Transparency: Evolving legislation globally is pushing for greater transparency, requiring companies to disclose their supply chain practices and potential risks.

Bridgestone navigates a complex legal landscape, from product safety standards like UNECE Regulation No. 117 to environmental mandates affecting manufacturing and disposal. The company's proactive stance on compliance is evident in its pursuit of ISO 14001 certification for its plants by the end of 2024, demonstrating a commitment to environmental management. Furthermore, Bridgestone actively addresses anti-bribery and anti-trust concerns, reinforcing its ethical framework through its Code of Conduct and Global Anti-Bribery Policy, with no significant penalties reported in 2023.

The increasing integration of smart technologies in vehicles brings data privacy and cybersecurity laws to the forefront. Bridgestone's expansion into connected fleet solutions requires adherence to stringent data protection regulations, such as Europe's GDPR, to maintain customer trust and ensure system security. This is critical as the automotive sector faces substantial cybersecurity threats, with global spending on solutions projected to exceed $30 billion by 2027.

Bridgestone's supplier requirements include adherence to hazardous substance regulations like REACH and anti-corruption laws such as the U.S. FCPA. The upcoming EU Corporate Sustainability Due Diligence Directive, expected by 2027, will further mandate supply chain transparency and risk mitigation for companies like Bridgestone, emphasizing responsible business practices.

Environmental factors

Bridgestone is aggressively pursuing circular economy principles, aiming for 40% recycled and renewable materials by 2030 and a complete shift to sustainable materials by 2050. This commitment underpins their strategy to minimize waste and maximize resource utilization across their operations.

Key initiatives include reducing virgin material use, expanding tire retreading programs, and investing in advanced recycling technologies. These efforts are crucial for meeting their ambitious sustainability targets and adapting to evolving environmental regulations.

Bridgestone is aggressively pursuing carbon neutrality, aiming for a 50% reduction in CO2 emissions by 2030 and full carbon neutrality by 2050. This target encompasses their entire operational footprint, not just tire production.

Their Sustainability Business Model directly integrates carbon neutrality goals into their core business strategy, demonstrating a commitment to sustainable practices throughout the product lifecycle.

Bridgestone is actively working to reduce its environmental impact, particularly concerning water usage. The company is implementing strategies to lower water intake in its manufacturing operations by focusing on efficient use and recycling. This commitment reflects a broader understanding of water as a critical natural resource.

A key initiative involves enhancing the efficiency of cooling water usage and optimizing production processes. For instance, in 2023, Bridgestone reported a 1.5% reduction in water withdrawal intensity across its global operations compared to 2022, demonstrating tangible progress in resource conservation.

Waste Reduction and Recycling Initiatives

Bridgestone is actively pursuing waste reduction and recycling across its global operations. A key focus is minimizing waste generated during tire manufacturing, with a target of achieving zero waste to landfill status at many facilities. This commitment is underpinned by the widespread promotion of the reduce-reuse-recycle (3R) concept throughout their business processes.

In 2023, Bridgestone reported a significant reduction in waste generation, with specific initiatives leading to a 5% decrease in manufacturing waste compared to the previous year. Their recycling efforts extend beyond internal processes, engaging with external partners to ensure responsible waste management. For instance, Bridgestone Americas recycled over 1.5 million tires in 2023 through various collection and repurposing programs.

- Waste Reduction Targets: Bridgestone aims for zero waste to landfill at key manufacturing sites globally.

- Recycling Programs: The company actively participates in and develops programs for recycling both manufacturing waste and end-of-life tires.

- 3R Promotion: The reduce-reuse-recycle philosophy is integrated into daily operations and employee training.

- Performance Data: In 2023, Bridgestone Americas recycled approximately 1.5 million tires, demonstrating tangible progress in their environmental stewardship.

Biodiversity and Nature Positivity Initiatives

Bridgestone is actively pursuing nature positivity, aiming to transition towards a regenerative business model. This involves aligning their operations with global biodiversity frameworks and actively contributing to local community well-being through Water, Sanitation, and Hygiene (WASH) initiatives.

The company's commitment is underscored by their participation in various environmental programs. For instance, in 2023, Bridgestone announced its intention to achieve carbon neutrality by 2050, a goal that inherently links to biodiversity preservation through reduced environmental impact.

- Biodiversity Framework Alignment: Bridgestone's strategy incorporates principles from international biodiversity agreements, seeking to minimize its ecological footprint.

- Regenerative Business Model: The company is exploring and implementing practices that go beyond sustainability, aiming to restore and enhance natural ecosystems.

- WASH Initiatives: Bridgestone supports WASH projects, recognizing the critical link between environmental health, human well-being, and biodiversity.

- 2023 Environmental Performance: While specific 2024 biodiversity metrics are still emerging, Bridgestone's 2023 sustainability report highlighted efforts in reforestation and water conservation across its global sites.

Bridgestone's environmental strategy is deeply integrated into its business, focusing on circularity and carbon neutrality. The company aims for 40% recycled and renewable materials by 2030 and carbon neutrality by 2050, demonstrating a significant commitment to reducing its ecological footprint.

These goals are supported by concrete actions like reducing virgin material use and expanding tire retreading. In 2023, Bridgestone Americas recycled over 1.5 million tires, showcasing tangible progress in waste management and resource utilization.

Furthermore, Bridgestone is actively working to conserve water, with a 1.5% reduction in water withdrawal intensity reported in 2023 compared to the previous year. The company also targets zero waste to landfill at key manufacturing sites, reinforcing its dedication to environmental stewardship.

| Environmental Goal | Target Year | 2023 Progress/Data |

|---|---|---|

| Recycled/Renewable Materials | 2030 | Aiming for 40% |

| Carbon Neutrality | 2050 | Aiming for 50% CO2 reduction by 2030 |

| Water Withdrawal Intensity | Ongoing | 1.5% reduction in 2023 (vs. 2022) |

| Tire Recycling (Americas) | Ongoing | 1.5 million tires recycled in 2023 |

PESTLE Analysis Data Sources

Our Bridgestone PESTLE analysis is built on a robust foundation of data from leading global economic institutions, environmental agencies, and reputable market research firms. We incorporate insights from official government publications, industry-specific reports, and technological trend forecasts to ensure comprehensive coverage of all PESTLE factors.