Brickworks SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brickworks Bundle

Brickworks possesses significant strengths in its established brand and diverse product portfolio, but faces challenges from fluctuating raw material costs and increasing competition. Understanding these internal capabilities and external market forces is crucial for strategic planning.

Want the full story behind Brickworks' market position and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Brickworks boasts a robust and diversified business model, spanning building products, a substantial property division, and strategic investments. This multi-pronged approach offers significant resilience, allowing the company to weather economic cycles affecting individual sectors and maintain overall stability. For instance, in the fiscal year 2023, Brickworks reported a significant uplift in its building products segment, contributing positively to the group's overall performance despite potential headwinds in other areas.

Brickworks boasts a robust property division, a key strength highlighted by its substantial net rental income, which reached $153 million in the first half of fiscal year 2024. This division capitalizes on extensive land holdings, including strategic joint ventures with Goodman Group, to develop prime industrial and commercial real estate. The company is actively pursuing development opportunities, with a strong pipeline of projects and significant lease enquiry for large facilities, indicating continued growth potential and sustained profitability from its property assets.

Brickworks' significant, enduring investment in Washington H. Soul Pattinson (WHSP), a diversified investment company, is a key strength. This holding generates consistent earnings and provides exposure to a wide range of assets, acting as a buffer against fluctuations in Brickworks' core building products business, thereby bolstering its financial resilience. For instance, as of the first half of 2024, Brickworks' shareholding in WHSP was valued at approximately AUD 1.7 billion, contributing a significant portion to its overall asset base.

The strategic rationale for this investment is further reinforced by the proposed merger between WHSP and Milton Corporation, which Brickworks also has an interest in. This consolidation, anticipated to be completed in late 2024, is expected to create a larger, more liquid entity, enhancing the value and strategic importance of Brickworks' stake. This move is projected to improve capital efficiency and offer greater financial flexibility for Brickworks.

Completed Capital Expenditure and Plant Rationalization

Brickworks has successfully concluded a significant, multi-year capital expenditure program. This strategic investment in modernizing its facilities, coupled with the rationalization of its manufacturing footprint, particularly in North America, has demonstrably boosted operational efficiency. For instance, the company's North American building products segment saw a notable improvement in its cost structure following these initiatives.

These completed projects have streamlined production and reduced overheads, creating a more agile and cost-effective manufacturing base. This optimization is crucial for the building products division, positioning it to leverage anticipated upturns in market demand. The company's ability to execute such large-scale capital projects and plant consolidations strengthens its competitive advantage.

- Operational Efficiency Gains: Completed capital expenditure program enhances productivity and reduces waste across manufacturing sites.

- Cost Reduction: Plant rationalization, especially in North America, has led to lower operating expenses.

- Market Recovery Preparedness: The optimized production network is well-positioned to capitalize on future market growth in building products.

- Enhanced Competitiveness: A leaner, more efficient operational structure improves Brickworks' standing against competitors.

Commitment to Sustainability and ESG

Brickworks' dedication to sustainability is a significant strength, clearly outlined in their detailed sustainability reports and ambitious targets for reducing greenhouse gas emissions. For instance, the company has set a goal to achieve net-zero operational emissions by 2050, with interim targets for significant reductions by 2030. This commitment is not just aspirational; it translates into tangible improvements, such as a notable decrease in their Total Recordable Injury Frequency Rate (TRIFR) over the past few years, reflecting a robust safety culture. Their strong performance in Environmental, Social, and Governance (ESG) risk ratings, often placing them among the top companies in their sector, further solidifies this strength. This focus not only appeals to an increasingly environmentally and socially conscious customer base but also attracts investors prioritizing sustainable operations, enhancing brand loyalty and long-term value.

The company's proactive approach to ESG is further demonstrated by specific initiatives and achievements:

- Greenhouse Gas Emission Reduction: Brickworks has publicly committed to reducing its Scope 1 and Scope 2 emissions by 30% by 2030 against a 2020 baseline.

- Workplace Safety Improvements: The company reported a TRIFR of 2.8 in FY23, a reduction from previous years, underscoring a continuous focus on employee well-being.

- ESG Risk Ratings: Brickworks has consistently achieved high ESG ratings from independent agencies, often placing in the top quartile for the building materials sector, indicating robust governance and operational practices.

- Sustainable Product Development: The company is investing in developing and promoting products with lower environmental impact, such as those incorporating recycled materials and energy-efficient manufacturing processes.

Brickworks' diversified business model provides significant resilience, with its building products and property divisions performing strongly. The company's substantial investment in Washington H. Soul Pattinson (WHSP) further bolsters its financial stability, offering consistent earnings and broad asset exposure. This strategic holding is set to grow in value with the anticipated merger of WHSP and Milton Corporation in late 2024, enhancing Brickworks' financial flexibility.

The company has completed a major capital expenditure program, optimizing its manufacturing footprint and boosting operational efficiency, particularly in North America. This strategic move has streamlined production and reduced overheads, positioning the building products division to capitalize on future market upturns. These enhancements contribute to a stronger competitive advantage.

Brickworks' commitment to sustainability is a key strength, evidenced by ambitious emission reduction targets and a strong safety record. Their high ESG ratings reflect robust governance and operational practices, appealing to environmentally conscious customers and investors. Initiatives like reducing greenhouse gas emissions and developing sustainable products further solidify this advantage.

What is included in the product

Analyzes Brickworks’s competitive position through key internal and external factors, detailing its strengths in market leadership and brand recognition, alongside weaknesses in diversification and potential supply chain vulnerabilities, while exploring opportunities in sustainable building and threats from economic downturns and new entrants.

Offers a clear, actionable framework to identify and address potential roadblocks in Brickworks' operations.

Weaknesses

Brickworks' building products divisions in Australia and North America have recently faced significant headwinds, with subdued demand impacting revenues. This downturn is a direct consequence of challenging macroeconomic conditions, including elevated interest rates and high construction costs, which have collectively suppressed consumer sentiment and new project starts.

For instance, the company's 2024 fiscal year results indicated a notable slowdown in these segments. The impact of these external pressures is clearly visible in declining sales volumes and, in certain instances, profitability challenges within its core manufacturing operations.

Brickworks has faced challenges with non-cash impairments, notably in its North American building products segment. For instance, the company reported a significant impairment of $103 million in its FY23 results, primarily affecting its Australian building products division, though similar pressures have been observed in North America. These write-downs, while not directly impacting cash flow, highlight underlying issues with asset valuations and market conditions.

Brickworks has experienced an increase in its net debt, with figures showing a rise in recent reporting periods. This has also led to a slight uptick in its gearing ratio, indicating a greater reliance on borrowed funds.

While the company's liquidity remains robust and its banking covenants are comfortably within limits, the growing debt load could potentially constrain its financial agility for future strategic initiatives, such as new investments or acquisitions.

Prudent capital management is therefore crucial for Brickworks, especially given the inherent uncertainties and potential volatility within the current economic landscape.

Vulnerability to Housing Market Downturns

Brickworks' building products segment is closely tied to the health of the residential construction sector. This means that when new home building slows down, demand for their core products like bricks, blocks, and roofing tiles naturally decreases. This inherent vulnerability to the ups and downs of the construction cycle is a significant weakness.

The company's performance is directly impacted by residential construction activity and housing approvals, which have recently experienced cyclical lows. For instance, in the fiscal year 2023, new housing commencements in Australia, a key market for Brickworks, saw a notable decline compared to previous periods. This slowdown directly affects sales volumes for their building materials.

- Dependence on Residential Construction: The company's revenue is heavily reliant on new housing starts, making it susceptible to downturns in this sector.

- Impact of Housing Approvals: Fluctuations in government approvals for new housing projects directly influence demand for Brickworks' products.

- Cyclical Nature of the Industry: The construction industry is inherently cyclical, meaning Brickworks faces periods of both high and low demand, impacting profitability.

- Exposure to Market Slowdowns: A prolonged slowdown in new housing commencements can significantly reduce sales of bricks, masonry blocks, and roofing tiles.

Operational Challenges in North America

Brickworks' North American building products division has encountered significant headwinds, reporting losses due to a sharper-than-expected downturn in market conditions. This has led to temporary plant closures aimed at inventory control, which in turn has negatively affected plant efficiency and increased per-unit manufacturing costs.

The competitive landscape in the crucial single-family residential sector across key North American regions remains intense, further exacerbating these operational difficulties and pressuring profitability.

- Market Decline: The North American market experienced a more significant contraction than initially forecast, directly impacting sales volumes.

- Operational Adjustments: Temporary plant stoppages were implemented to align production with reduced demand, impacting overall plant utilization.

- Cost Pressures: Lower production runs and inventory management challenges have elevated manufacturing costs per unit.

- Competitive Environment: Sustained high competition, particularly in the single-family housing market, continues to exert downward pressure on pricing and margins.

Brickworks' significant reliance on the residential construction sector makes it vulnerable to industry downturns. For example, a decline in new housing approvals, as seen in fiscal year 2023 in Australia, directly translates to reduced demand for their building materials, impacting sales volumes and profitability.

The company's North American building products division has faced substantial challenges, including market contractions and intense competition, leading to operational adjustments like temporary plant closures. These actions, while necessary for inventory management, have unfortunately driven up per-unit manufacturing costs and hampered overall plant efficiency.

Brickworks has also experienced non-cash impairments, with a notable $103 million impairment reported in FY23, primarily affecting its Australian building products division. This highlights underlying issues with asset valuations and the impact of challenging market conditions on the book value of its assets.

An increasing net debt and a rising gearing ratio, though still within comfortable banking covenants, could potentially limit future strategic financial flexibility for acquisitions or new investments, especially in the current uncertain economic climate.

What You See Is What You Get

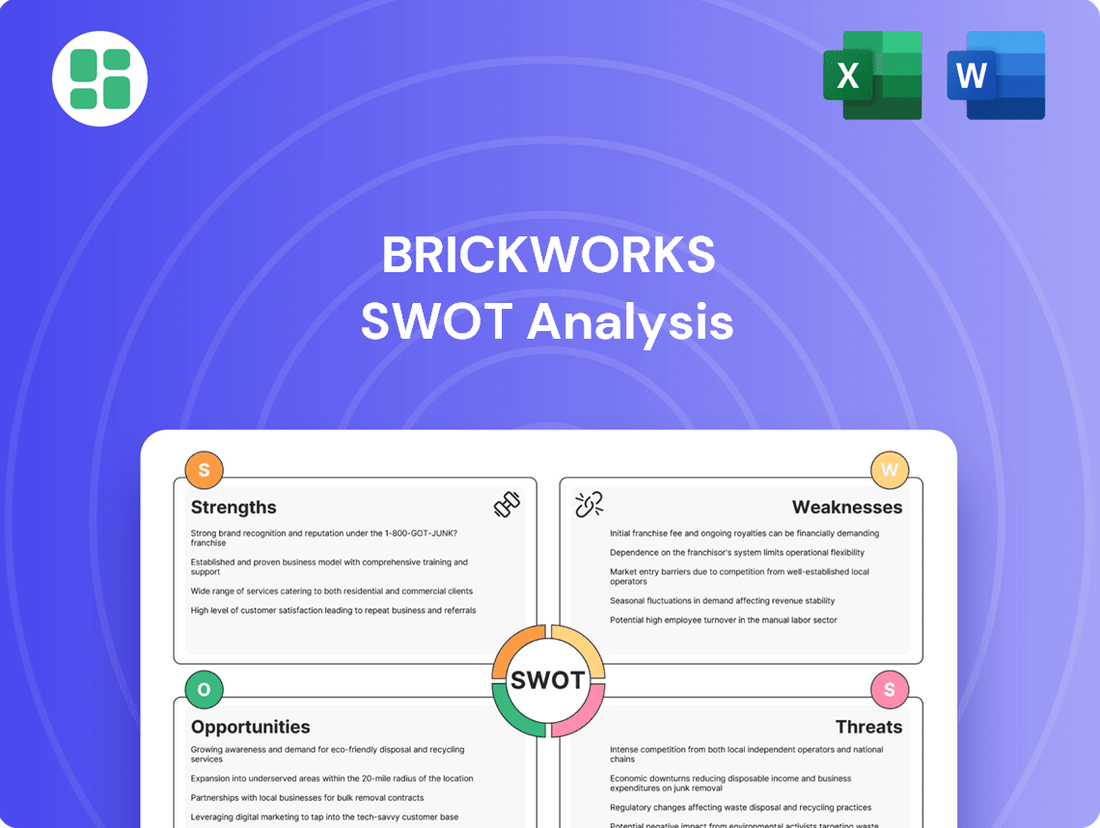

Brickworks SWOT Analysis

This is the actual Brickworks SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats. You can trust that the content you see here is representative of the full, detailed report you will download.

Opportunities

The proposed $14 billion merger with Washington H. Soul Pattinson, announced in late 2024, represents a monumental opportunity for Brickworks. This consolidation aims to forge a larger, more diversified ASX-listed entity with enhanced capitalisation. For context, Washington H. Soul Pattinson's market capitalization stood at approximately $12 billion as of December 2024.

This strategic move is poised to streamline Brickworks' corporate structure, a move anticipated to boost its market liquidity. The combined entity will offer investors greater exposure to a wider array of investment strategies, potentially smoothing out cyclical impacts and fostering more consistent long-term value creation.

Market forecasts indicate a positive outlook for the building product sectors in Australia and North America, with anticipated recovery starting in 2026 and gaining momentum into 2027. This projected upswing is underpinned by persistent housing shortages and government programs designed to stimulate new home construction, offering a significant medium-term advantage for Brickworks' primary building products segment.

Brickworks is well-positioned to capitalize on its extensive undeveloped land holdings, with a robust property development pipeline set to generate substantial future rental income and development profits. The company's strategic focus on industrial logistics facilities, driven by strong structural demand, underpins this growth.

The completion of significant projects, such as the Amazon distribution center at Oakdale West, is expected to unlock considerable value. Furthermore, the ongoing development of Oakdale East Stage 2 is a key component of this expansion, promising to further enhance Brickworks' property portfolio and future earnings potential.

Strategic Acquisitions in Fragmented Markets

Brickworks has a demonstrated history of making successful, focused acquisitions within the fragmented US bricks and building products sectors, establishing itself as a major player. This capability allows the company to actively seek further consolidation, thereby increasing its market presence and achieving greater operational efficiencies.

For instance, in fiscal year 2023, Brickworks completed the acquisition of certain assets from a competitor, further solidifying its position in key US markets. This strategic move is expected to contribute positively to revenue growth in the upcoming fiscal years.

- Proven Acquisition Expertise: Brickworks has a strong track record of integrating acquired businesses, enhancing market share and realizing cost synergies.

- Market Consolidation Potential: The fragmented nature of the US building products industry presents ongoing opportunities for strategic acquisitions.

- Growth Acceleration: Acquisitions serve as a key lever for accelerating revenue growth and expanding geographic reach.

Leveraging Green Building and Sustainability Trends

The growing global emphasis on environmental responsibility presents a prime opportunity for Brickworks. As demand escalates for sustainable and eco-friendly construction materials, the company is well-positioned to capitalize on this trend. By further investing in green manufacturing processes and developing products with reduced embodied carbon or incorporating recycled content, Brickworks can effectively meet evolving consumer and regulatory preferences.

This strategic focus on sustainability not only reinforces Brickworks' existing commitments but also unlocks access to new and expanding market segments. For instance, the green building sector is projected to grow significantly. The global green building market size was valued at USD 1,075.5 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 9.4% from 2024 to 2030, according to Grand View Research. This growth indicates a substantial market for companies like Brickworks that prioritize eco-conscious solutions.

- Expanding Product Lines: Developing and marketing new ranges of low-carbon bricks, recycled-content pavers, and other sustainable building materials.

- Strengthening Brand Reputation: Enhancing brand perception as an environmentally responsible leader in the construction materials industry.

- Meeting Regulatory Demands: Aligning with increasing government regulations and building codes that favor sustainable construction practices.

- Attracting ESG Investors: Appealing to a growing base of investors focused on Environmental, Social, and Governance (ESG) criteria.

The proposed merger with Washington H. Soul Pattinson, valued at $14 billion and announced in late 2024, presents a significant opportunity to create a larger, more diversified entity with enhanced capital. This strategic consolidation aims to improve market liquidity and offer investors broader exposure to various investment strategies, potentially mitigating cyclical impacts and fostering stable long-term value.

Positive market forecasts for Australian and North American building products, anticipating recovery from 2026, offer a distinct advantage. This upturn is driven by persistent housing shortages and government initiatives supporting new home construction, aligning well with Brickworks' core building products segment.

Brickworks' substantial undeveloped land holdings and a robust property development pipeline are set to generate significant future rental income and development profits, particularly in industrial logistics facilities. Key projects like the Amazon distribution center at Oakdale West and the ongoing Oakdale East Stage 2 development are expected to unlock considerable value and enhance the company's property portfolio.

The company's proven expertise in acquiring and integrating businesses within the fragmented US bricks and building products sectors allows for further strategic consolidation. This approach can increase market presence and operational efficiencies, as demonstrated by successful fiscal year 2023 acquisitions that are projected to boost revenue in upcoming years.

The growing global demand for sustainable construction materials presents a prime opportunity for Brickworks. Investing in green manufacturing and developing eco-friendly products can meet evolving consumer and regulatory preferences, tapping into the projected growth of the green building sector, which was valued at USD 1,075.5 billion in 2023 and is expected to grow at a CAGR of 9.4% from 2024 to 2030.

Threats

Persistent macroeconomic challenges, including elevated interest rates and ongoing inflation, continue to pose a significant threat. For instance, as of early 2024, inflation remained a concern, impacting input costs for Brickworks. These conditions can dampen both consumer and business confidence, directly affecting demand for construction materials and property development.

A potential slowdown in global economic growth, a widely anticipated scenario for 2024-2025, further exacerbates these risks. This could lead to reduced construction activity and slower sales volumes, impacting Brickworks' profitability across its diverse business segments.

A prolonged slump in new housing starts, especially in Australia, presents a considerable risk for Brickworks. Factors like extended planning delays and persistent affordability issues could impede the expected market rebound.

This slowdown directly impacts sales volumes and profitability within the building products division. For instance, Australian housing finance commitments for new dwellings saw a notable decrease of 10.5% in the March quarter of 2024 compared to the previous year, underscoring the sensitivity of this market.

The building products market, especially in North America, is fiercely competitive, particularly within the single-family residential construction segment. This intense rivalry often translates into significant pricing pressure, directly impacting Brickworks' capacity to sustain or enhance its profit margins. For instance, in 2024, many building product manufacturers reported tighter margins due to aggressive pricing strategies from competitors seeking to gain market share.

Operational and Supply Chain Cost Volatility

Brickworks faces ongoing threats from fluctuating operational and supply chain costs, particularly concerning energy and raw materials. For instance, while natural gas prices have seen some stabilization in early 2024 compared to previous peaks, the market remains susceptible to geopolitical events and supply-demand imbalances, directly impacting kiln operations.

These cost volatilities, coupled with potential supply chain disruptions, could significantly pressure profit margins. If demand softens, Brickworks may struggle to pass on these escalating costs to customers, thereby eroding profitability. Productivity gains are a constant focus, but unforeseen cost hikes can still present a challenge.

- Energy Cost Sensitivity: Brickworks' reliance on natural gas for its manufacturing processes makes it vulnerable to price swings. For example, a 10% increase in natural gas prices could translate to a material increase in operating expenses.

- Raw Material Price Fluctuations: The cost of key raw materials, such as clay and additives, can also be volatile, impacting the cost of goods sold.

- Supply Chain Vulnerabilities: Global events or localized issues can disrupt the flow of materials and finished goods, leading to increased logistics costs and potential production delays.

- Margin Erosion Risk: The inability to fully pass on higher input costs to customers, especially in a soft demand environment, directly threatens Brickworks' profit margins.

Increasing Regulatory and Environmental Compliance Burden

Brickworks faces a growing challenge from increasingly stringent environmental and regulatory compliance demands across its Australian and North American operations. These evolving regulations, covering areas like emissions and waste management, can lead to higher operational costs and potential fines for non-adherence. For instance, in 2023, the Australian government continued to implement policies aimed at reducing carbon emissions, which could necessitate significant investment in cleaner technologies for Brickworks' manufacturing facilities.

The financial implications of these regulatory shifts are substantial. Companies like Brickworks must allocate capital towards upgrading equipment and processes to meet new standards, directly impacting profitability. Failure to comply not only incurs financial penalties but also carries the significant risk of reputational damage, which can erode customer trust and market share.

- Evolving Regulations: Brickworks must navigate a complex web of environmental laws in Australia and North America, which are subject to frequent updates.

- Increased Compliance Costs: Adhering to stricter standards, such as those related to greenhouse gas emissions or water usage, requires ongoing investment in technology and operational changes.

- Potential Penalties: Non-compliance can result in substantial fines, impacting the company's bottom line and financial stability.

- Reputational Risk: Environmental incidents or perceived non-compliance can severely damage Brickworks' brand image and stakeholder relationships.

Intensifying competition in key markets, particularly in North America's single-family residential sector, poses a threat through aggressive pricing strategies that can compress profit margins. This competitive landscape means Brickworks must constantly innovate and manage costs effectively to maintain its market position.

The company's sensitivity to energy costs, especially natural gas for kiln operations, remains a significant vulnerability. For example, fluctuations in energy prices directly impact operational expenses, and the ability to pass these costs onto customers is limited in softer demand environments.

A slowdown in new housing starts, especially in Australia, directly affects sales volumes for building products. Australian housing finance commitments for new dwellings decreased by 10.5% in the March quarter of 2024 year-on-year, highlighting this market's sensitivity.

Brickworks also faces increasing costs and complexity from evolving environmental regulations in both Australia and North America, requiring ongoing investment in compliance and potentially impacting profitability.

| Threat Category | Specific Risk | Impact on Brickworks | Supporting Data/Example |

|---|---|---|---|

| Market Conditions | Intensified Competition | Margin Compression | Aggressive pricing in North American single-family residential construction (2024) |

| Operational Costs | Energy Price Volatility | Increased Operating Expenses | Reliance on natural gas for kilns; potential inability to pass costs on |

| Market Conditions | Housing Market Slowdown (Australia) | Reduced Sales Volumes | 10.5% YoY decrease in Australian housing finance commitments (Q1 2024) |

| Regulatory Environment | Stricter Environmental Compliance | Higher Operational Costs, Capital Investment | Need for investment in cleaner technologies due to emissions regulations |

SWOT Analysis Data Sources

This Brickworks SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded and accurate strategic overview.