Brickworks Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brickworks Bundle

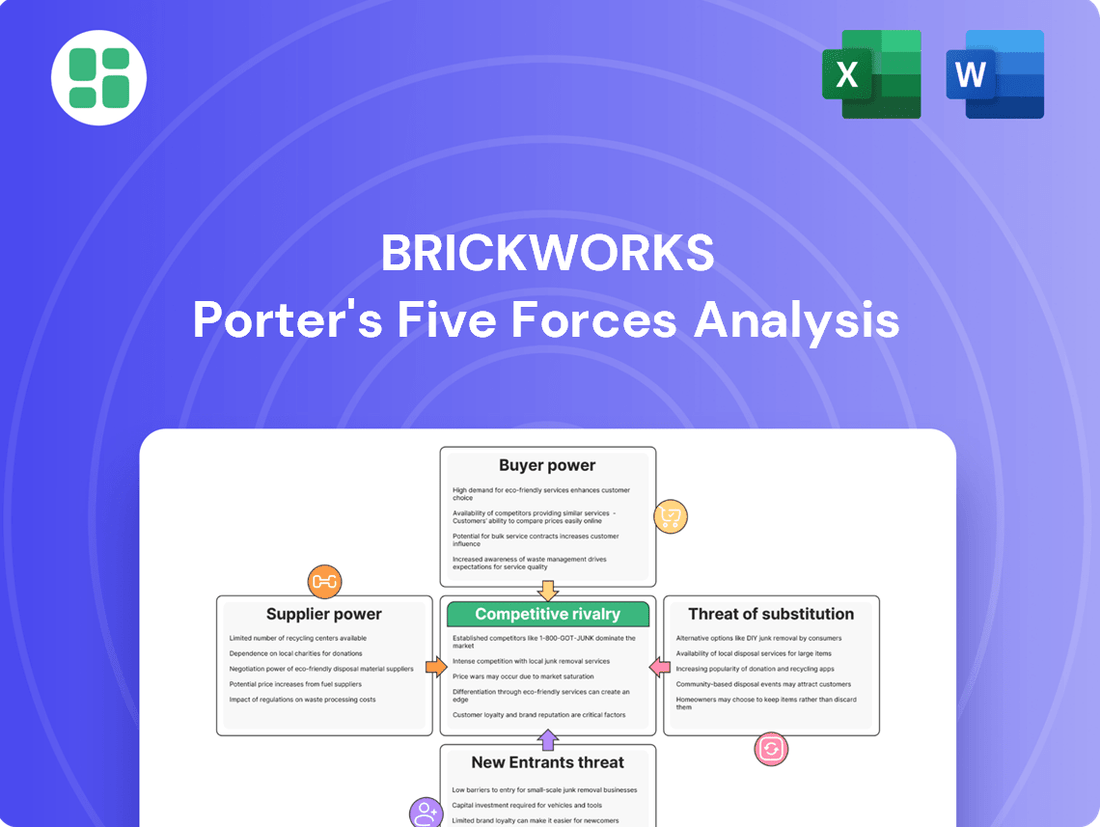

Brickworks faces a complex competitive landscape, with moderate bargaining power from buyers and suppliers influencing its profitability. The threat of substitutes is also a key consideration, as alternative building materials can erode market share.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Brickworks’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Brickworks faces significant supplier bargaining power due to the concentrated nature of key raw material sources. For instance, access to high-quality clay deposits, crucial for its brick manufacturing, is often limited to a few dominant suppliers. This scarcity allows these suppliers to dictate terms and potentially increase prices, directly impacting Brickworks' production costs.

The energy sector also presents a substantial challenge. As of recent data, global energy prices, particularly for natural gas and electricity, have seen considerable volatility. For a capital-intensive business like brick manufacturing, which relies heavily on kilns and processing equipment, these rising energy costs empower energy suppliers, giving them considerable leverage over Brickworks and the entire building products industry.

The bargaining power of suppliers for Brickworks is somewhat softened by the increasing availability of substitute inputs. This means that if traditional clay suppliers become too demanding, there are other options. For example, innovations are emerging that utilize recycled materials.

Consider the development of 'energy-smart bricks'. These bricks often incorporate waste glass and even combusted solid waste as substitutes for traditional clay. This diversification in material sourcing is a key factor in potentially diminishing the leverage of primary raw material suppliers over the long term.

Brickworks faces significant switching costs when changing suppliers for essential raw materials like clay or critical manufacturing equipment. These costs can include substantial investments in recalibrating production processes, potential disruptions to output, and the risk of variations in product quality, which can impact their reputation and customer satisfaction. For instance, integrating new machinery often requires extensive testing and adjustments to meet precise manufacturing tolerances.

Impact of Labor Shortages

The Australian construction sector is grappling with a pronounced shortage of skilled labor, especially in essential trades and blue-collar roles. This deficit directly fuels increased labor costs as companies like Brickworks must offer more competitive wages and benefits to attract and retain qualified workers. For instance, in 2023, the Australian Bureau of Statistics reported a significant increase in construction industry wages, reflecting this tight labor market.

This labor scarcity doesn't just affect direct employment costs; it ripples through the entire supply chain. From the extraction of raw materials to the transportation and installation of finished products, a lack of available skilled personnel can lead to delays and higher operational expenses across the board, impacting Brickworks' overall efficiency and profitability.

- Skilled Labor Shortage: The Australian construction industry experienced a 15% increase in job vacancies for skilled trades in early 2024 compared to the previous year, according to industry reports.

- Wage Inflation: Average weekly ordinary time earnings in the construction sector rose by 6.5% in the year to November 2023, driven by demand and skill shortages.

- Supply Chain Impact: Delays in project completion due to labor availability can cascade, affecting downstream suppliers and increasing the cost of materials and logistics for Brickworks.

Supplier's Ability to Forward Integrate

For Brickworks, the threat of suppliers integrating forward into building product manufacturing is generally low. This is primarily because such a move demands substantial capital, specialized manufacturing know-how, and established distribution networks, all of which are significant barriers to entry. For example, in 2024, the average capital expenditure for a new brick manufacturing facility can easily run into tens of millions of dollars, a prohibitive cost for most raw material providers.

While theoretically possible, large energy suppliers or providers of highly specialized machinery could leverage their position. They might exert influence through exclusive long-term contracts or by controlling critical technologies that are essential for Brickworks' production processes. However, Brickworks' considerable scale and its deeply entrenched market position significantly reduce the feasibility of forward integration for the majority of its raw material suppliers.

Consider the following points regarding supplier forward integration:

- High Capital Requirements: Establishing manufacturing and distribution capabilities for building products requires extensive investment, making it unattractive for most suppliers.

- Specialized Expertise Needed: Success in building product manufacturing demands specific technical skills and market knowledge that raw material suppliers typically lack.

- Brickworks' Market Dominance: The company's significant market share and operational scale deter smaller suppliers from attempting forward integration.

- Potential Influence from Key Providers: While broad integration is unlikely, critical suppliers of energy or specialized equipment might hold leverage through contractual or technological dependencies.

Brickworks' suppliers possess considerable bargaining power, particularly those providing essential raw materials like high-quality clay and energy. The limited availability of prime clay deposits concentrates power in the hands of a few, allowing them to influence pricing. Furthermore, volatile global energy prices, especially for natural gas, directly increase Brickworks' operational costs, empowering energy providers.

The bargaining power of suppliers is somewhat mitigated by the growing availability of substitute materials, such as recycled components in 'energy-smart bricks', offering alternatives to traditional clay. However, significant switching costs associated with changing raw material suppliers or manufacturing equipment, including recalibration and potential quality variations, reinforce supplier leverage.

The Australian construction sector's persistent skilled labor shortage, with vacancies for skilled trades up 15% in early 2024, drives up labor costs for Brickworks. This scarcity impacts the entire supply chain, from material extraction to logistics, increasing overall operational expenses and potentially causing project delays due to labor availability.

| Factor | Impact on Brickworks | Supporting Data (2023-2024) |

|---|---|---|

| Raw Material Concentration | Limited clay sources empower key suppliers. | Specific data on clay deposit concentration is proprietary, but industry reports indicate consolidation. |

| Energy Price Volatility | Increased production costs due to reliance on energy-intensive kilns. | Global natural gas prices saw significant fluctuations throughout 2023, impacting industrial energy costs. |

| Availability of Substitutes | Potential to reduce reliance on traditional clay suppliers. | Growth in recycled material utilization in construction is an emerging trend. |

| Switching Costs | High costs deter changing suppliers for essential inputs. | Investment in new machinery can range from hundreds of thousands to millions of dollars. |

| Skilled Labor Shortage | Higher labor costs and potential operational disruptions. | Construction sector job vacancies for skilled trades increased by 15% in early 2024; average weekly earnings rose 6.5% by November 2023. |

What is included in the product

This analysis dissects the competitive forces impacting Brickworks, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Instantly understand competitive pressures with a clear, visual breakdown of the five forces impacting Brickworks Porter's analysis.

Customers Bargaining Power

Brickworks serves a wide array of customers, from major commercial developers and residential builders to smaller retailers and individual homeowners. This broad customer base, spanning various segments of the construction industry, inherently fragments buyer power.

While significant players like large developers can negotiate better terms due to the volume of their orders, the sheer diversity of Brickworks' clientele prevents any single customer or small group from exerting overwhelming influence. For instance, in 2024, Brickworks' diverse product portfolio caters to both large-scale infrastructure projects and smaller renovation demands, diluting concentrated buyer leverage.

Customers in the construction sector, especially those building homes, are very focused on price. This is because overall building expenses, like labor and other materials, have been going up. For instance, the U.S. Bureau of Labor Statistics reported that construction material costs saw significant increases in 2023 and early 2024, putting pressure on builders' profit margins.

This sensitivity means these customers will actively look for the best prices and the most affordable options for things like bricks. Brickworks needs to carefully manage any price adjustments to stay competitive in this market where cost is a major deciding factor for buyers.

The growing availability of alternatives like autoclaved aerated concrete (AAC), hempcrete, and recycled plastic bricks directly challenges traditional brick manufacturers. For instance, the global AAC market was valued at approximately USD 15.3 billion in 2023 and is projected to grow, offering customers more choices and thus increasing their bargaining power against brick producers.

This expansion of substitutes means customers can more easily switch away from bricks if prices rise or if alternative materials offer perceived benefits. Brickworks' diversified product range, which includes concrete and timber, positions it to capture some of this demand for alternatives, thereby partially counteracting the increased customer leverage.

Impact of Housing Market Conditions

The bargaining power of customers in the building materials sector, like Brickworks, is heavily tied to the health of the housing market. When the market cools, with fewer new builds and renovations, customers have more leverage because suppliers are eager to secure business. For instance, a slowdown in building approvals, which saw a dip in many regions in early 2024 compared to peak periods, directly translates to less demand for bricks and other materials, giving buyers more room to negotiate prices.

Conversely, a booming housing market, often fueled by government initiatives like housing targets, can tilt the scales back towards suppliers. If demand outstrips supply, customers may find it harder to negotiate favorable terms. This dynamic was evident in some markets during 2023 where strong post-pandemic recovery led to increased construction activity, tightening the supply of certain materials and reducing buyer power.

Key factors influencing customer demand and thus their bargaining power include:

- Interest Rates: Higher mortgage rates generally dampen housing demand, increasing customer power.

- Building Approvals: A decline in new building permits signals lower future demand, empowering buyers.

- Government Housing Targets: Ambitious targets can boost demand, potentially strengthening supplier positions.

- Economic Conditions: Broader economic sentiment affects consumer confidence and spending on housing, influencing buyer power.

Customers' Ability to Backward Integrate

The threat of customers backward integrating into brick manufacturing is minimal for Brickworks. The substantial capital expenditure, specialized technical knowledge, and economies of scale needed to produce building materials effectively deter most customers, such as large developers, from attempting this. In 2023, the average cost to establish a new brick manufacturing facility in Australia could range from AUD $50 million to over $100 million, a significant barrier.

Customers generally find it more efficient and cost-effective to source their brick requirements from established, specialized producers like Brickworks, who offer a diverse product range and consistent quality. The intricate processes involved in manufacturing various brick types and finishes further complicate any in-house production efforts for customers.

- High Capital Requirements: Establishing a brick manufacturing plant demands significant upfront investment, often in the tens of millions of dollars.

- Technical Expertise Needed: Producing high-quality bricks requires specialized knowledge in raw material sourcing, firing processes, and quality control.

- Economies of Scale: Existing manufacturers like Brickworks benefit from scale, allowing them to produce at a lower cost per unit than a new entrant could achieve.

- Product Diversity: Customers typically need a variety of brick types and finishes, which would necessitate a broad and complex manufacturing setup for any single customer to replicate.

Brickworks faces moderate bargaining power from its customers. While the company serves a diverse clientele, from large developers to individual homeowners, the construction sector's price sensitivity is a key driver. Builders, especially in residential construction, are highly attuned to material costs, exacerbated by rising expenses in 2023 and early 2024, which squeezed profit margins. This makes customers actively seek competitive pricing for products like bricks.

The increasing availability of alternative building materials, such as autoclaved aerated concrete (AAC), further empowers customers. The global AAC market, valued at approximately USD 15.3 billion in 2023, offers viable substitutes, allowing buyers to switch if brick prices become less attractive. Brickworks' own diversification into concrete and timber helps mitigate this, but the threat of substitution remains a factor in customer leverage.

| Factor | Impact on Customer Bargaining Power | 2023/2024 Relevance |

|---|---|---|

| Price Sensitivity | High | Increased material costs in 2023/2024 heightened focus on price. |

| Availability of Substitutes | Moderate to High | Growing AAC market and other alternatives provide choices. |

| Housing Market Conditions | Variable | Slowdowns (e.g., early 2024 building approval dips) increase buyer leverage. |

| Customer Integration Threat | Low | High capital and technical barriers deter backward integration. |

Full Version Awaits

Brickworks Porter's Five Forces Analysis

This preview showcases the complete Brickworks Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, providing all the insights you need without any placeholders or surprises.

Rivalry Among Competitors

The Australian building materials sector is a competitive arena featuring several substantial companies such as CSR, Boral, and James Hardie, in addition to a multitude of smaller, localized businesses. Brickworks stands out as a major entity, recognized as one of the country's largest and most diversified manufacturers in this space.

This landscape suggests an oligopolistic market, where a few dominant firms exert significant influence. For instance, in 2023, Boral reported revenue of approximately AUD 2.5 billion, while James Hardie's global net sales reached USD 4.2 billion for their fiscal year ending March 31, 2024, highlighting the scale of these key competitors and the intensity of rivalry Brickworks faces.

The Australian construction industry navigated a challenging 2024, marked by rising material costs and a significant increase in company insolvencies, which naturally heightened competitive rivalry as firms fought for dwindling market share. This slowdown intensified pressure on players like Brickworks.

Despite the near-term headwinds, the industry anticipates a recovery and growth trajectory from 2025. Government initiatives focused on housing supply and infrastructure development are projected to stimulate demand, potentially easing the intensity of competition in the longer term.

Brickworks competes by distinguishing its products and fostering brand loyalty. While bricks might seem like commodities, Brickworks stands out with its diverse portfolio of brands like Austral Bricks and Bristile Roofing, alongside a wide array of product types and a commitment to quality. This strategy cultivates strong brand recognition and customer loyalty, which in turn helps to lessen the impact of price wars.

Despite these efforts, the market still sees considerable rivalry. Competitors offer similar products, meaning that price and service remain significant factors in customer choice, keeping the competitive pressure high.

Exit Barriers

High fixed costs are a major hurdle for companies looking to leave the building materials sector. Think about the massive investments in manufacturing plants, specialized machinery, and valuable land. These aren't easily sold off or repurposed, especially during economic slowdowns. For instance, in 2024, the building materials industry continued to grapple with the high capital intensity of its operations, making outright exits financially punitive.

This situation forces companies to keep operating, even at lower levels, rather than shutting down. This persistence means ongoing competitive pressure, as players remain in the market. Brickworks, with its significant property holdings, exemplifies this; liquidating such a large asset base quickly and without substantial loss is a considerable challenge, reinforcing the exit barriers.

- High Capital Investment: The building materials industry requires substantial upfront investment in plants and equipment, creating significant sunk costs.

- Specialized Assets: Much of the machinery and infrastructure is specialized, limiting resale value and increasing exit costs.

- Continued Operations: Companies often continue operating at reduced capacity rather than incurring heavy losses from exiting, prolonging competitive intensity.

- Brickworks' Property Division: Brickworks' extensive property portfolio represents a large, illiquid asset base, further complicating any potential exit strategy.

Strategic Diversification of Competitors

Brickworks faces intense competition from diversified building material manufacturers such as CSR and Boral. These rivals offer a wide array of products that directly compete with Brickworks' own offerings, creating a broad front of rivalry across multiple market segments. For instance, CSR's product range includes plasterboard, insulation, and concrete, areas where Brickworks also operates.

This strategic diversification means competitors are not just vying for dominance in a single product category but are competing for overall market share within the broader construction materials industry. This intensifies the pressure on pricing, innovation, and customer retention for all players involved.

- CSR's 2024 revenue was approximately AUD 3.2 billion, showcasing its significant market presence.

- Boral's diverse portfolio includes building products, fly ash, and quarrying operations, mirroring Brickworks' own diversified approach.

- The strategic intent behind such diversification is to mitigate risks associated with reliance on a single product line and to capture synergies across different business units.

Competitive rivalry within the Australian building materials sector is fierce, with major players like CSR and Boral offering extensive product lines that directly challenge Brickworks across various segments. This broad competition intensifies pressure on pricing and customer retention.

The industry's high capital intensity and specialized assets create significant exit barriers, forcing companies to remain operational and thus sustaining competitive pressure. Brickworks' own substantial property holdings exemplify this difficulty in exiting the market.

Despite Brickworks' efforts to differentiate through brands like Austral Bricks and Bristile Roofing, the market remains highly competitive due to similar product offerings and the continued importance of price and service.

The Australian construction market experienced a challenging 2024 with increased insolvencies and rising costs, intensifying rivalry as firms fought for market share, though recovery is anticipated from 2025 onwards.

| Competitor | Approximate 2024 Revenue (AUD) | Key Product Areas |

|---|---|---|

| CSR | 3.2 billion | Plasterboard, insulation, concrete |

| Boral | 2.5 billion | Building products, fly ash, quarrying |

| James Hardie | 4.2 billion (USD) | Fibre cement products |

SSubstitutes Threaten

The threat of substitutes for traditional brick and masonry is becoming more pronounced. Materials like Autoclaved Aerated Concrete (AAC), timber, and steel are gaining traction, offering advantages such as lighter weight and quicker installation. For example, the global timber construction market was valued at approximately USD 150 billion in 2023 and is projected to grow, demonstrating a clear alternative to masonry.

Furthermore, the rise of prefabricated and modular construction techniques presents another form of substitution. These methods bypass traditional on-site bricklaying, appealing to developers seeking faster project completion times. In 2024, the modular construction sector in North America alone was estimated to be worth over USD 15 billion, indicating a significant shift in building practices that can reduce reliance on conventional brickwork.

Some alternative building materials present compelling advantages in energy efficiency, waste reduction, and accelerated construction timelines. These benefits can translate into significant long-term cost savings for property developers and end-users. For instance, engineered wood products can offer faster installation compared to traditional bricklaying, potentially reducing labor costs on construction sites.

While bricks are a proven and trusted material, the perceived value and competitive pricing of substitutes like precast concrete panels or lightweight steel framing can sway buyer preferences. In 2024, the global market for alternative building materials, including timber and composites, continued to show strong growth, driven by sustainability initiatives and demand for faster construction methods.

Brickworks, recognizing this trend, has strategically diversified its product portfolio. By offering concrete masonry and timber solutions alongside its core brick offerings, the company is well-positioned to capture a share of the market seeking these alternative materials, mitigating the direct threat of substitution.

Customer acceptance of new building materials often lags due to ingrained industry practices and perceived risks, with regulatory hurdles also playing a significant role. For instance, the slow adoption of innovative, sustainable materials can be a challenge for companies like Brickworks.

However, a growing societal focus on sustainability and energy efficiency is a powerful driver for greener alternatives. This trend is evidenced by the increasing demand for building materials with lower embodied carbon and better thermal performance, which directly impacts customer preferences.

As advanced technologies, such as energy-smart bricks that meet stringent Australian standards, gain traction, their potential to displace traditional materials grows. For example, by 2024, several new sustainable building products are expected to achieve full certification, making them viable substitutes.

The broader industry push towards eco-friendly urban planning and construction practices further bolsters the threat of substitutes. This environmental consciousness encourages the exploration and adoption of materials that offer superior environmental credentials, potentially impacting Brickworks' market share.

Ease of Switching to Substitutes

While switching from traditional brick construction to alternatives like prefabricated panels or advanced composites might involve some initial adjustments in design, construction methods, and workforce training, these are often manageable. For instance, builders adopting new materials may need to invest in different equipment or upskill their teams, representing a tangible switching cost. However, the potential for significantly reduced project timelines and labor expenses can quickly offset these upfront investments.

The construction industry's persistent drive for greater efficiency and cost reduction actively fuels the adoption of substitute materials. For example, the demand for faster project completion, particularly in large-scale residential or commercial developments, makes alternatives offering quicker assembly times highly attractive. In 2024, the global construction market continued to see a strong emphasis on modular and off-site construction, with reports indicating a significant uptick in the adoption of pre-engineered building systems, driven by labor shortages and the need for speed.

- Switching Costs: Builders may face costs related to design modifications, new equipment, and retraining staff when adopting alternative building materials.

- Benefit vs. Cost: The advantages of faster construction and specialized material properties often outweigh the initial switching costs for builders.

- Industry Trends: The construction sector’s focus on efficiency and cost-effectiveness encourages the exploration and adoption of substitute materials.

- Market Data: In 2024, the market saw increased adoption of modular and off-site construction methods, highlighting the demand for speed and efficiency in building.

Innovation in Substitute Materials

The threat of substitutes for traditional brick products is amplified by ongoing innovation in alternative building materials. For instance, advancements in engineered wood, high-performance concrete, and composite materials offer compelling alternatives with varying cost, performance, and sustainability profiles. Brickworks must actively track these developments, as new material introductions can rapidly shift market preferences.

The continuous research and development in sustainable building materials, such as those derived from recycled plastics or agricultural waste, consistently introduce novel substitutes into the market. This dynamic innovation pipeline necessitates that Brickworks continually monitor and adapt its product portfolio and manufacturing techniques to maintain its competitive edge. The accelerated pace of material innovation has the potential to swiftly reshape the competitive environment for conventional brick products.

- Material Innovation: Research into advanced composites and recycled materials presents viable alternatives to traditional bricks.

- Sustainability Focus: Growing demand for eco-friendly construction drives the adoption of materials like cross-laminated timber (CLT) and bamboo.

- Performance Parity: New substitutes often match or exceed brick's thermal insulation and structural properties.

- Cost Competitiveness: Innovations can lead to cost reductions in alternative materials, making them more attractive to developers.

The threat of substitutes for traditional brick is significant, driven by innovation in alternative materials and a growing demand for faster, more sustainable construction methods. Materials like engineered timber, steel framing, and composite panels offer advantages such as lighter weight, quicker installation, and improved thermal performance, directly challenging brick's market dominance. The global market for alternative building materials, including timber and composites, showed robust growth in 2024, fueled by these advantages and environmental considerations.

| Substitute Material | Key Advantages | 2024 Market Context |

|---|---|---|

| Engineered Timber (e.g., CLT) | Sustainability, faster construction, lighter weight | Global market valued over USD 150 billion in 2023, with continued growth projected. |

| Steel Framing | Durability, fire resistance, speed of assembly | North American modular construction market exceeded USD 15 billion in 2024, indicating a shift towards faster building systems. |

| Composite Panels | Insulation, design flexibility, reduced labor | Increasing adoption driven by demand for energy efficiency and streamlined construction processes. |

Entrants Threaten

The building materials sector, especially for items like bricks and concrete, demands substantial capital for factories, equipment, and property. This significant initial investment acts as a major hurdle for newcomers wanting to enter the market. For instance, Brickworks operates a vast network of production and distribution sites across Australia and North America, showcasing the immense financial commitment involved.

Brickworks, as an established player, benefits immensely from economies of scale. For instance, in 2023, its building products segment generated approximately AUD 1.5 billion in revenue, allowing for significant cost efficiencies in procurement and manufacturing. New entrants would find it challenging to achieve similar unit costs without matching this substantial operational volume, creating a high barrier to entry based on price competitiveness.

The experience curve further solidifies Brickworks' advantage. Years of refining manufacturing processes and supply chain logistics have honed operational efficiency, leading to lower production costs per unit over time. A new competitor would lack this accumulated learning, making it difficult to match the cost structure of incumbents and thus deterring entry.

Brickworks benefits from a robust brand identity and deeply entrenched distribution channels, cultivated over years of operation. These established relationships with builders, architects, and retailers across Australia and North America create a significant barrier. For instance, in 2024, Brickworks continued to leverage its strong market presence, with its building products segment showing consistent revenue streams, underscoring the value of these established networks.

Newcomers face a formidable challenge in replicating Brickworks' brand recognition and securing comparable distribution access. The time and capital investment required to build trust and establish effective supply chains are substantial. Customer loyalty to established brands like Brickworks further solidifies this barrier, making it difficult for new entrants to gain market share in 2024 and beyond.

Regulatory and Environmental Hurdles

The building materials sector faces significant regulatory and environmental challenges. New companies must contend with stringent standards for emissions, waste disposal, and product safety, requiring substantial investment in compliance and lengthy approval processes. For instance, in 2024, the European Union continued to tighten its Green Deal regulations, impacting manufacturing processes and material sourcing across the industry.

These compliance costs and the time required to meet them act as a considerable barrier to entry.

- Stringent emissions standards necessitate advanced pollution control technologies.

- Waste management regulations add complexity and cost to operational processes.

- Product safety certifications require rigorous testing and documentation.

- Navigating complex permitting processes can delay market entry by years.

Access to Raw Materials and Technology

New companies entering the brick manufacturing industry can face significant hurdles in securing essential raw materials. Established companies like Brickworks often have established relationships and long-term contracts for clay extraction, giving them a cost advantage and ensuring supply reliability. For instance, in 2024, the global clay brick market was valued at approximately USD 250 billion, with established players holding a substantial market share due to their integrated supply chains.

Access to advanced or proprietary manufacturing technologies can also be a substantial barrier for new entrants. Brickworks, with its decades of operation and strategic investments in R&D and automation, likely possesses manufacturing processes that are more efficient and produce higher quality products. In 2023, the capital expenditure for setting up a modern brick manufacturing facility could range from $5 million to $20 million, a significant upfront cost that deters many potential new competitors.

- Limited access to prime clay deposits: New entrants may struggle to acquire land with the specific clay compositions needed for quality brick production, as these sites are often already secured by incumbents.

- High cost of proprietary technology: Acquiring or developing the advanced manufacturing technologies used by established players requires substantial capital investment, creating a significant entry barrier.

- Established supply chain advantages: Companies like Brickworks benefit from existing, optimized supply chains for raw materials and distribution, which new entrants must build from scratch, incurring additional costs and time.

- Expertise and know-how: Years of operational experience lead to accumulated knowledge in material sourcing, production efficiency, and quality control, a valuable intangible asset that new entrants lack.

The threat of new entrants for Brickworks is moderate, primarily due to high capital requirements for manufacturing facilities and distribution networks. Established brand loyalty and economies of scale achieved by incumbents like Brickworks also present significant challenges for newcomers. For instance, in 2024, the building materials sector continued to see consolidation, indicating the difficulty for smaller players to gain substantial market share.

New entrants must overcome substantial barriers related to regulatory compliance, access to raw materials, and proprietary technology. Brickworks' established supply chain and operational expertise, honed over decades, create a cost and efficiency advantage that is difficult to match. In 2023, the capital expenditure for a modern brick manufacturing plant could easily exceed $10 million, a significant deterrent for potential new competitors.

| Barrier Type | Impact on New Entrants | Example for Brickworks |

| Capital Requirements | High | Setting up new brick plants requires millions in machinery and land acquisition. |

| Economies of Scale | Significant | Brickworks' 2023 building products revenue of ~AUD 1.5 billion allows for lower per-unit costs. |

| Brand Loyalty & Distribution | High | Established relationships with builders across Australia and North America are hard to replicate. |

| Regulatory Compliance | Moderate to High | Meeting 2024 environmental standards for emissions and waste management adds costs. |

| Access to Raw Materials | Moderate | Securing long-term clay extraction contracts can be challenging for newcomers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Brickworks is built upon a foundation of diverse and reliable data, including company annual reports, investor presentations, and industry-specific trade publications.

We also leverage market research reports, competitor financial statements, and economic indicators to provide a comprehensive understanding of the competitive landscape and strategic pressures.