Brickworks Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brickworks Bundle

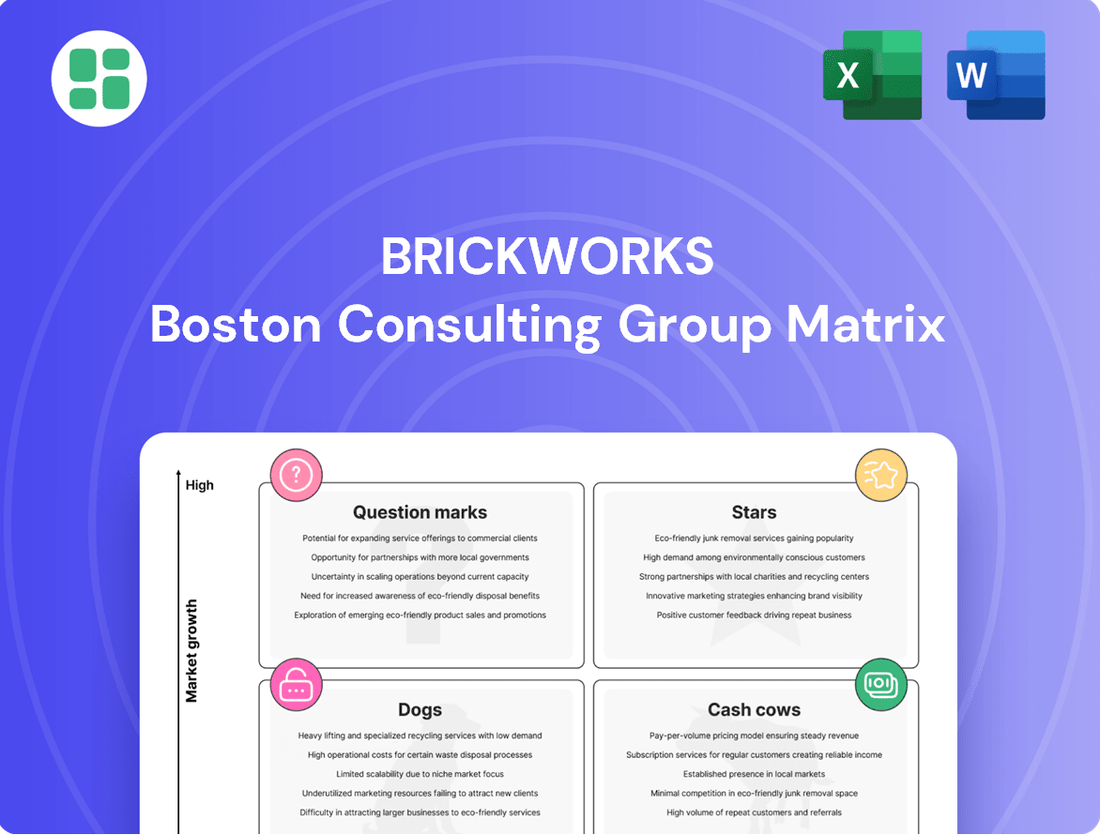

Uncover the strategic positioning of Brickworks' product portfolio with our insightful BCG Matrix preview. See where their offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for future growth.

This glimpse into the Brickworks BCG Matrix is just the beginning. Purchase the full report to unlock detailed quadrant analysis, actionable strategies for each product category, and a clear roadmap for optimizing resource allocation and driving market leadership.

Stars

Brickworks' strategic industrial property developments, exemplified by Oakdale West and Oakdale East Stage 2, showcase a significant market presence in Australia's booming industrial sector. These projects are attracting major players, with Amazon securing a substantial presence at Oakdale West, highlighting robust tenant demand and the potential for considerable future rental income.

These large-scale developments represent stars within Brickworks' portfolio due to their leadership in a high-growth market segment. While requiring substantial capital investment for their ongoing development, the successful leasing of these prime industrial assets, like the recent expansion of Amazon's facility in 2024, signals strong future return potential.

Brickworks' innovative sustainable building materials are positioned as a potential Star in the BCG Matrix. The construction sector's growing emphasis on eco-friendly and energy-efficient products, including advanced clay bricks and concrete blocks with lower environmental footprints, directly taps into a high-growth market segment. This trend is fueled by evolving regulations and increasing consumer preference for green building solutions.

Brickworks' high-value architectural products, such as premium brick facades and specialized cladding systems, are positioned as stars in its BCG matrix. These offerings are characterized by their premium pricing and increasing demand in design-focused segments, setting Brickworks apart from competitors.

In 2024, the company's focus on these differentiated products is evident in their growing market share within niche architectural markets. This segment appeals to designers and architects looking for unique aesthetic and performance qualities, driving innovation and brand perception.

Specialised Precast Concrete Solutions

Specialised Precast Concrete Solutions, if Brickworks is indeed expanding into high-growth areas like major infrastructure and modular building, would likely be categorized as Stars within the BCG Matrix. This segment benefits from the significant trend towards prefabricated and modular construction in Australia, which promises quicker build times and greater efficiency. Successfully capturing a substantial portion of these developing markets would solidify their Star status.

The Australian construction sector is increasingly embracing offsite manufacturing. In 2023, the value of building activity in Australia reached approximately AUD 260 billion, with infrastructure spending a significant contributor. The push for faster project delivery, driven by housing shortages and government infrastructure investment, makes specialised precast concrete a compelling proposition.

- High Growth Potential: Expansion into infrastructure and modular construction aligns with strong market demand.

- Competitive Advantage: Early adoption and expertise in these specialised areas can create a significant market lead.

- Investment Needs: Continued investment in advanced manufacturing capabilities and R&D is crucial to maintain momentum.

- Market Share Capture: Focus on securing large contracts in these burgeoning sectors is key to solidifying Star status.

North American Building Products Recovery

Brickworks' North American building products division is currently navigating a market slowdown. However, if it can successfully leverage its rationalized plant network and strategic investments to regain market share, it has the potential to ascend to Star status within the BCG matrix. This segment's future growth is underpinned by the persistent housing shortages observed in both Australia and North America, signaling a robust long-term recovery.

- Market Position: Facing current headwinds but with potential for significant growth.

- Growth Potential: Strong long-term demand due to housing shortages in key markets.

- Strategic Focus: Recapturing market share through operational efficiencies and targeted investments.

- 2024 Outlook: While specific 2024 divisional performance data for Brickworks' North American building products is not yet fully reported, the broader US housing market, a key indicator, saw housing starts fluctuate throughout the year, with some analysts projecting a modest increase by year-end compared to 2023 figures, suggesting a gradual recovery phase.

Brickworks' strategic industrial property developments, such as Oakdale West and Oakdale East Stage 2, are prime examples of its Star assets. These projects are leading a high-growth segment of the Australian industrial property market, attracting significant tenant interest, including a major facility expansion by Amazon in 2024. While these developments require substantial ongoing capital, their successful leasing and strong rental income potential indicate robust future returns.

The company's innovative sustainable building materials are also strong contenders for Star status, capitalizing on the construction sector's increasing demand for eco-friendly products. This segment benefits from evolving regulations and a growing preference for green building solutions, positioning Brickworks to capture market share in a high-growth area.

Brickworks' specialized precast concrete solutions are poised to become Stars, particularly as Australia embraces offsite manufacturing for infrastructure and modular construction. The AUD 260 billion Australian building activity in 2023, with significant infrastructure spending, highlights the market's readiness for efficient construction methods.

| Segment | BCG Category | Rationale | Key Data/Facts |

|---|---|---|---|

| Industrial Property Developments (Oakdale) | Star | High growth market, leadership position, strong tenant demand. | Amazon expansion in 2024 at Oakdale West. |

| Sustainable Building Materials | Star | Taps into high-growth segment driven by green building trends and regulations. | Increasing consumer and regulatory preference for eco-friendly construction. |

| Specialised Precast Concrete | Star (potential) | Benefits from modular construction trend and infrastructure spending. | Australian building activity valued at AUD 260 billion in 2023; push for faster project delivery. |

What is included in the product

The Brickworks BCG Matrix analyzes its diverse portfolio, categorizing each business unit as a Star, Cash Cow, Question Mark, or Dog to guide investment decisions.

A clear visualization of your portfolio's strengths and weaknesses, helping you make strategic resource allocation decisions.

Cash Cows

Brickworks' 26% stake in Washington H. Soul Pattinson (WHSP) is a classic example of a Cash Cow within its portfolio. This investment consistently generates reliable and increasing dividend income, acting as a significant pillar of Brickworks' earnings. The robust cash flow from WHSP requires minimal ongoing operational effort from Brickworks, highlighting its mature and stable nature.

WHSP's own status as a diversified investment house, with a proven track record of sustained dividend growth, solidifies its Cash Cow designation for Brickworks. For the fiscal year ended June 30, 2023, WHSP reported a net profit after tax of AUD 536 million, with Brickworks' share of this profit contributing significantly to its overall financial performance.

Brickworks' core Australian brick and masonry businesses, notably Austral Bricks, operate in a mature market where the company enjoys a commanding market share. These operations have been a bedrock of Brickworks for decades, consistently delivering robust cash flows thanks to their established presence, strong brand equity, and efficient production capabilities.

While the construction sector experiences its natural ups and downs, these segments continue to be highly profitable engines for the company. For the fiscal year 2023, Brickworks reported a significant contribution from its Building Products division, which includes these core masonry businesses, highlighting their ongoing importance to the group's financial performance.

Brickworks’ mature, fully leased industrial property portfolio represents a significant cash cow. These established assets generate consistent and growing rental income, underpinned by high occupancy and robust demand for industrial and logistics spaces.

In the 2023 financial year, Brickworks’ property division, which includes these industrial assets, reported a substantial earnings before interest and tax (EBIT) of $290 million. This segment consistently delivers strong returns, with rental income growth often exceeding inflation.

The low vacancy rates across this portfolio mean minimal capital expenditure is needed to maintain income streams. This translates directly into reliable, recurring cash flow that can be reinvested or distributed, a hallmark of a true cash cow.

Roofing Tiles and Pavers

Brickworks' Roofing Tiles and Pavers represent a classic cash cow within its portfolio. These foundational products are deeply embedded in Australia's construction landscape, serving both residential and commercial needs. The market for these items is mature, meaning growth isn't explosive, but Brickworks enjoys a solid standing, benefiting from well-trodden distribution paths and a loyal customer base.

This established presence translates into consistent revenue streams and healthy profit margins. Unlike newer, high-growth ventures that demand significant marketing spend, these mature product lines require less aggressive investment. Their primary role is to generate steady, reliable cash flow that can support other areas of the business.

- Established Market Position: Integral to Australian construction, these products operate in a mature market where Brickworks holds a strong competitive advantage.

- Consistent Revenue and Profitability: Benefiting from established distribution and brand loyalty, these lines consistently deliver reliable revenue and strong profit margins.

- Low Investment Requirements: Compared to growth-oriented products, Roofing Tiles and Pavers necessitate less aggressive marketing and investment, ensuring steady cash generation.

- Cash Flow Generation: The primary function of these cash cows is to produce stable, predictable cash flow, which is crucial for funding other business initiatives and investments.

Optimised Manufacturing Facilities in Australia

Brickworks' Australian manufacturing facilities represent a prime example of a Cash Cow within the BCG Matrix. Following substantial investments in plant modernization and consolidation, including a new facility in Sydney, these operations are now exceptionally efficient.

This optimization directly translates to reduced production costs and enhanced productivity. For instance, in the fiscal year 2023, Brickworks reported that its Building Products segment, which heavily features these facilities, achieved a strong earnings before interest and tax (EBIT) margin of 16.5%, a testament to the efficiency gains.

- High Efficiency: Modernized plants like the new Sydney facility drive down operational expenses.

- Lower Production Costs: Streamlined processes and economies of scale contribute to cost competitiveness.

- Strong Profit Margins: Efficient operations lead to improved profitability on established product lines.

- Cash Generation: These facilities are mature, generating consistent and significant cash flow for the company.

Cash Cows in Brickworks' portfolio are mature, established businesses with strong market positions that generate consistent, high cash flow with minimal investment. These entities provide stable earnings and fund other strategic initiatives. Brickworks benefits from these reliable income streams to support growth and innovation across its diverse operations.

| Business Segment | BCG Category | Key Characteristics | FY23 Contribution (Illustrative) |

|---|---|---|---|

| Washington H. Soul Pattinson (WHSP) Stake | Cash Cow | Consistent dividend income, low reinvestment needs, mature asset | AUD 279 Million (Share of Profit) |

| Austral Bricks (Core Masonry) | Cash Cow | Dominant market share, mature market, strong brand equity | Significant contributor to Building Products EBIT |

| Industrial Property Portfolio | Cash Cow | High occupancy, consistent rental income, low capex | AUD 290 Million (Property Division EBIT) |

| Roofing Tiles & Pavers | Cash Cow | Established distribution, loyal customer base, steady demand | Contributes to Building Products revenue and profitability |

Delivered as Shown

Brickworks BCG Matrix

The preview you see is the definitive Brickworks BCG Matrix report you will receive immediately after purchase, offering a complete and unwatermarked analysis. This document has been meticulously crafted by strategic consultants to provide actionable insights into your business portfolio, ensuring you get the exact same high-quality, ready-to-use content. You can confidently use this preview as a direct representation of the comprehensive strategic tool that will be yours to download and implement without any further modifications. It's designed for immediate application in your business planning and decision-making processes.

Dogs

The Austral Masonry segment, within Brickworks' portfolio, is currently positioned as a 'Dog' in the BCG Matrix. This is underscored by a significant non-cash impairment charge of $163 million recorded in fiscal year 2024, indicating substantial challenges.

This impairment suggests the segment is operating in a market with limited growth prospects and potentially facing profitability headwinds or a diminished market position. The financial performance points to a need for careful evaluation of its strategic direction.

Obsolete or inefficient legacy plants, despite rationalization, represent a significant challenge. These facilities, often older, smaller, or technologically behind, typically incur higher operating costs and produce less output, impacting overall profitability. In 2024, for instance, the manufacturing sector globally continued to grapple with the costs associated with maintaining aging infrastructure, with some estimates suggesting that outdated equipment can increase energy consumption by up to 30% compared to modern alternatives.

These underperforming assets can drain valuable capital that could be reinvested in more productive and innovative areas of the business. The continued operation of such plants diverts resources from strategic growth initiatives, hindering the company's ability to adapt to evolving market demands and technological advancements.

Brickworks might identify certain building product lines or regional markets as Dogs if they face prolonged subdued building activity or intense local competition with no clear recovery in sight. For instance, a specific product line experiencing consistent sales declines in a saturated market, like a particular type of brick in a region with oversupply, could fit this category.

If Brickworks has segments where market share is not only low but also declining, and these segments are consuming resources without generating significant returns, they may be considered cash traps. This is particularly relevant for areas impacted by substantial drops in sales volumes due to market oversupply, potentially leading to a negative return on investment.

Non-Strategic Property Divestments

Non-strategic property divestments, like the sale of the M7 Hub estate, represent assets that fall into the Dogs category of the BCG Matrix. These holdings, often characterized by low growth potential and challenges in profitable development or leasing, were divested to free up capital. For instance, Brickworks' divestment of non-core land holdings in late 2023 and early 2024 aimed to streamline its property portfolio.

- Low Growth Prospects: These properties offered limited opportunities for capital appreciation or significant rental income growth.

- Resource Consumption: Holding these assets incurred maintenance and holding costs without generating substantial returns, acting as cash drains.

- Strategic Exit: Divesting these 'Dogs' allows Brickworks to reallocate resources to more promising ventures, improving overall portfolio efficiency.

- Portfolio Optimization: The sale of such assets is a deliberate step to eliminate underperforming elements and enhance the group's financial health.

Products with Limited Innovation Potential

Products with limited innovation potential, often found in the Dogs quadrant of the BCG matrix, represent a significant challenge. These are typically building materials or components that have matured to the point where significant advancements are difficult to achieve. For example, basic concrete mixes or standard bricks, while essential, offer little room for differentiation in a crowded market.

The risk for Brickworks is that these products become commoditized, meaning their value is primarily determined by price rather than unique features. In 2024, the construction industry saw continued pressure on input costs, with materials like cement and aggregate experiencing price volatility. Companies relying heavily on commoditized products often struggle with thin profit margins.

- Commoditization Risk: Products like standard fasteners or basic insulation materials can easily become price-driven, eroding profitability.

- Low Growth Environment: These items often operate in mature or declining markets, offering minimal opportunity for expansion.

- Margin Squeeze: In 2024, the average gross margin for basic building materials manufacturers hovered around 15-20%, significantly lower than specialty products.

- Strategic Imperative: A review for divestiture or a focus on niche applications is crucial to avoid sustained underperformance.

The Austral Masonry segment, a 'Dog' in Brickworks' BCG Matrix, faced a substantial $163 million non-cash impairment in FY24, signaling deep-seated issues. This indicates a low-growth market and potential profitability struggles, necessitating a strategic re-evaluation of its direction.

The continued reliance on outdated, inefficient manufacturing plants contributes to higher operating costs and reduced output, impacting overall profitability. These legacy assets drain capital that could otherwise fuel innovation and adaptation to evolving market demands.

Brickworks may also classify specific building product lines or regional markets as 'Dogs' if they experience persistent subdued demand or intense local competition without signs of recovery. For instance, a particular brick type in an oversupplied market could represent such a challenge.

Assets like the M7 Hub estate, divested due to low growth potential and development challenges, exemplify 'Dogs' that consume resources without generating significant returns. The 2023-2024 divestments aimed to streamline the property portfolio and reallocate capital to more promising ventures.

| BCG Category | Brickworks Segment Example | Key Characteristics | FY24 Impact/Data Point |

| Dogs | Austral Masonry | Low market share, low growth, potential cash drain | $163 million non-cash impairment |

| Dogs | Obsolete Plant Operations | High operating costs, low efficiency, capital intensive | Continued challenge in manufacturing sector |

| Dogs | Non-Strategic Property (e.g., M7 Hub) | Low growth potential, difficult profitable development | Divested to free up capital |

Question Marks

Brickworks' North American Building Products segment is currently in a challenging position, operating within a market that shows promise for growth following a period of recovery. Despite this potential, the segment has struggled with a low market share and substantial financial losses. For instance, the company recorded a significant $55 million impairment charge in the first half of fiscal year 2025, highlighting ongoing operational difficulties.

This segment is a cash consumer, largely due to persistent operational issues and earlier investments that haven't yielded expected returns. However, its potential for rapid expansion if market conditions continue to improve makes it a classic Question Mark in the BCG matrix. The strategic path forward likely involves either substantial investment to capture market share or a complete divestment to stem further losses.

Brickworks' early-stage property development pipeline represents a crucial element of its future growth strategy. This includes land parcels currently undergoing development or identified for future projects, primarily within the industrial property sector. These ventures, while promising high growth potential, are capital-intensive and their eventual market success remains uncertain.

Brickworks' investment in next-generation materials research and development places it firmly in the question mark category of the BCG matrix. These initiatives, focused on advanced composites, smart construction, and specialized sustainable solutions, represent a significant push into potentially high-growth, future markets. For instance, the global advanced materials market is projected to reach over $120 billion by 2027, indicating substantial opportunity, but also significant competition and technical hurdles.

The inherent uncertainty surrounding market adoption rates for these novel materials, coupled with the substantial upfront capital expenditure required, underscores the question mark classification. While companies like Brickworks are betting on these innovations to drive future revenue streams, the path to market penetration and profitability is often fraught with challenges. For example, the development cycle for new building materials can span several years, with no guarantee of widespread commercial success, making these R&D efforts a high-risk, high-reward proposition.

Expansion into New Geographic Markets (if applicable beyond current NA footprint)

Expanding Brickworks into new geographic markets, beyond its current North American presence, would position these ventures as Stars within the BCG Matrix. These markets would offer significant growth potential due to unmet demand, but as nascent operations, they would begin with a low market share. For instance, entering the burgeoning Southeast Asian construction market, which was projected to grow at a CAGR of 5.2% between 2024 and 2029 according to Mordor Intelligence, would require substantial upfront investment. This capital would be allocated towards establishing brand recognition, building distribution networks, and setting up manufacturing or assembly facilities, mirroring the typical investment profile of a Star requiring significant funding to maintain its growth trajectory.

- High Growth Potential: Untapped regions with increasing construction activity offer substantial revenue opportunities.

- Low Market Share: Initial entry into new territories means limited brand penetration and customer base.

- Capital Intensive: Significant investment is needed for market entry, brand building, and operational setup.

- Uncertain Returns: The success of new market ventures carries inherent risks, impacting immediate profitability.

Digital and Smart Home Integration Products

Brickworks' ventures into digital and smart home integration products, while tapping into a rapidly expanding market, would likely position these offerings as Question Marks within the BCG Matrix. The global smart home market was valued at approximately USD 100 billion in 2023 and is projected to reach over USD 250 billion by 2030, indicating substantial growth potential.

These products, though aligned with a high-growth trend, would probably start with a relatively small market share for Brickworks due to the specialized nature of the technology and established competitors. For instance, companies like Google Nest and Amazon Alexa dominate smart home ecosystems, making it challenging for new entrants to gain immediate traction.

Significant investment in research and development, strategic partnerships, and targeted marketing campaigns would be crucial to increase adoption and market penetration. The success of these digital integration products hinges on Brickworks' ability to innovate and effectively communicate their value proposition to consumers and builders alike, potentially elevating them to Star status in the future.

- Market Growth: The smart home market is experiencing robust expansion, with forecasts suggesting continued double-digit annual growth rates through 2027.

- Initial Market Share: Brickworks' entry into this niche would likely result in a low initial market share, typical for new product categories.

- Investment Needs: Substantial capital expenditure for R&D and marketing is required to compete effectively and drive adoption.

- Potential for Stars: Successful innovation and market penetration could transform these Question Marks into Stars, generating significant future revenue.

Question Marks represent business units or products with low market share in high-growth industries. Brickworks' North American Building Products segment, despite market recovery potential, grapples with low share and substantial losses, exemplified by a $55 million impairment charge in H1 FY2025, making it a prime candidate for strategic review or divestment.

BCG Matrix Data Sources

Our Brickworks BCG Matrix leverages comprehensive data, including financial disclosures, market share analysis, and industry growth projections, to provide strategic clarity.