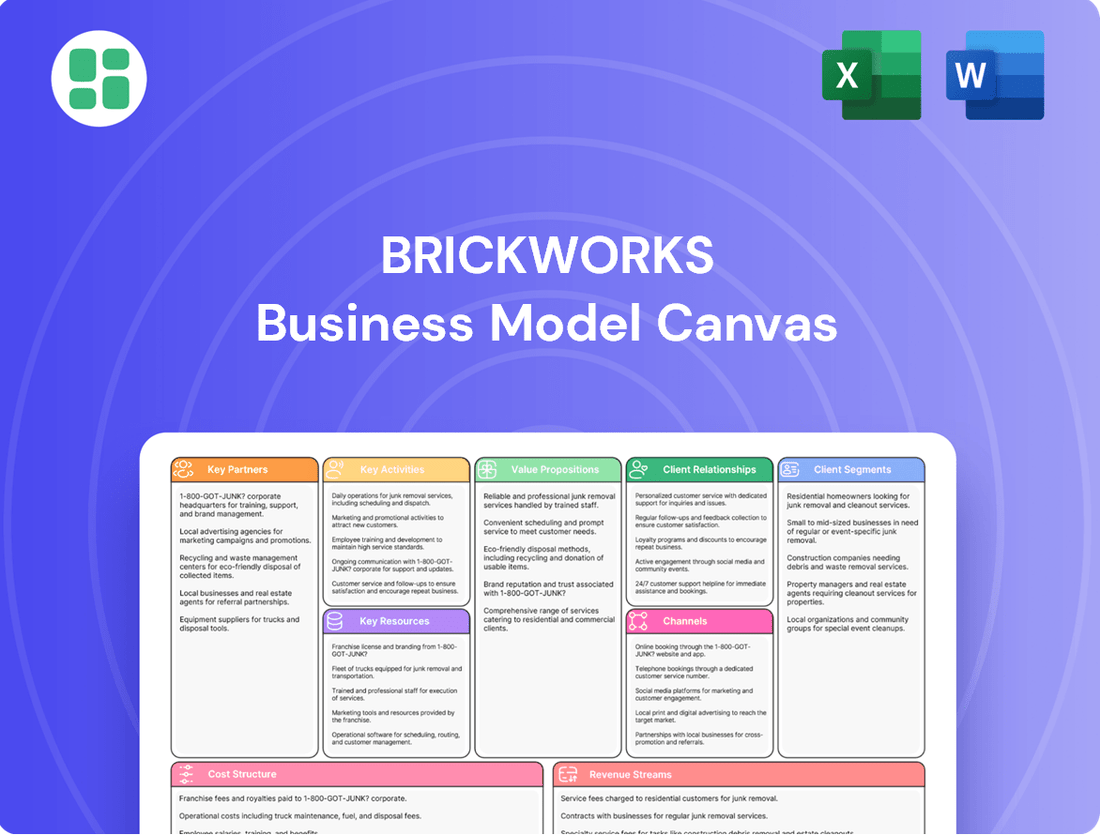

Brickworks Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brickworks Bundle

Unlock the strategic DNA of Brickworks with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, deliver value, and generate revenue in a dynamic market. Discover the core components that drive their success and gain actionable insights for your own ventures.

Partnerships

Brickworks maintains a pivotal 50:50 joint venture with Goodman Group, a partnership that has been instrumental in their industrial property development strategy. This collaboration focuses on transforming surplus land assets into high-quality industrial facilities, capitalizing on Goodman Group's extensive experience in property development and management.

Brickworks depends on a robust network of suppliers for crucial raw materials such as clay, sand, and aggregates. These materials are the bedrock for their extensive product lines, including bricks, masonry blocks, and roofing tiles.

A stable and economically viable supply chain is paramount for uninterrupted manufacturing and competitive pricing. For instance, in the fiscal year 2023, Brickworks reported that its cost of goods sold was $788.8 million, highlighting the significant impact of raw material procurement on its financial performance.

Brickworks' key partnerships are deeply rooted with major construction companies and property developers. These entities are crucial as they represent significant customers, driving substantial sales of Brickworks' building materials for a wide array of projects, from new homes to large commercial and industrial complexes.

These relationships are often characterized by substantial, high-volume sales agreements. For instance, in the 2023 financial year, Brickworks reported that its Building Products division, which serves these partners, generated approximately AUD 1.6 billion in revenue, highlighting the scale of these collaborations.

Beyond just supply, these partnerships can evolve into collaborative efforts. This might involve working together on specific development projects, potentially influencing product innovation or ensuring a steady supply chain for large-scale construction endeavors.

Logistics and Distribution Partners

Brickworks relies on a robust network of logistics and distribution partners to ensure its diverse building materials, from bricks and pavers to roofing and concrete, reach customers efficiently across Australia and North America. These collaborations are fundamental to managing inventory levels and guaranteeing timely deliveries to construction sites and retail locations.

In 2024, optimizing the supply chain remained a key focus. For instance, Brickworks' Australian operations leverage partnerships with national freight carriers and regional transport companies to manage the movement of goods. Similarly, in North America, strategic alliances with trucking firms and warehousing providers are crucial for their market presence.

- National Freight Carriers: Essential for broad reach across Australia, facilitating bulk transport from manufacturing hubs.

- Regional Transport Companies: Crucial for last-mile delivery and serving specific geographic markets efficiently.

- Warehousing and Storage Providers: Key for maintaining inventory strategically, ensuring product availability.

- Specialized Logistics Services: Utilized for handling oversized or specialized building products, ensuring safe transit.

Research and Innovation Collaborators

Brickworks actively partners with leading research institutions like Western Sydney University to drive innovation in building materials. These collaborations are crucial for developing next-generation products and sustainable manufacturing techniques. For example, in 2024, Brickworks announced a significant joint research project focused on advanced concrete formulations, aiming to reduce the carbon footprint of construction by up to 30%.

Furthermore, strategic alliances with technology providers are essential for enhancing operational efficiency and product performance. These partnerships allow Brickworks to integrate cutting-edge manufacturing technologies, such as AI-driven quality control systems. This focus on technological advancement is reflected in their 2024 capital expenditure, with a notable portion allocated to upgrading their production facilities for greater automation and energy efficiency.

- Research Institutions: Collaborations with universities like Western Sydney University to pioneer new building material technologies.

- Technology Providers: Partnerships to integrate advanced manufacturing processes and digital solutions into operations.

- Sustainability Focus: Joint efforts to develop environmentally friendly products and reduce manufacturing's ecological impact.

- Innovation Pipeline: Investments in R&D through these partnerships to maintain a competitive edge in the building materials market.

Brickworks' key partnerships extend to major construction firms and property developers who act as significant customers, driving substantial sales of their building materials. These relationships are often formalized through large-volume sales agreements, underscoring their importance to Brickworks' revenue streams. For instance, the Building Products division, serving these partners, generated approximately AUD 1.6 billion in revenue in fiscal year 2023, demonstrating the scale of these collaborations.

What is included in the product

A detailed, pre-structured business model canvas that outlines Brickworks' operational strategy, customer focus, and value delivery mechanisms.

This canvas provides a clear overview of Brickworks' key resources, activities, partnerships, and revenue streams, facilitating strategic analysis and decision-making.

It streamlines complex business planning, eliminating the frustration of scattered ideas and unstructured documents.

This tool resolves the pain of inefficient strategy development by providing a clear, visual framework for all key business elements.

Activities

Manufacturing Building Products is Brickworks' central operation, focusing on producing a wide array of construction materials like bricks, blocks, roofing tiles, and precast concrete. This involves overseeing numerous production sites across Australia and North America, with a strong emphasis on operational efficiency and maintaining high product quality.

In the fiscal year 2023, Brickworks' Building Products segment reported revenue of $2.0 billion, demonstrating the significant scale of its manufacturing activities. The company operates 43 manufacturing facilities, underscoring its extensive production capacity and commitment to serving diverse construction needs.

Brickworks is deeply involved in developing and managing a significant portfolio of industrial and commercial properties, leveraging its substantial land assets. This core activity involves pinpointing promising development sites, guiding construction from inception to completion, and attracting and retaining tenants for large-scale industrial spaces within its property trusts.

In 2024, Brickworks continued to execute its property development strategy, with its property trusts holding approximately $7.1 billion in assets under management. This segment is crucial for generating recurring rental income and capital appreciation.

Brickworks actively sells and distributes its building products through a multi-channel approach. This includes a dedicated direct sales team, company-operated showrooms for customer engagement, and a broad network of independent distributors and retailers to ensure wide market reach.

In the fiscal year 2023, Brickworks reported strong performance in its building products segment, with revenue growth driven by effective sales and distribution strategies. The company's focus on customer accessibility across diverse market segments continues to be a key driver of its success.

Investment Management

Brickworks' investment management centers on its substantial holding in Washington H. Soul Pattinson (WHSP). This strategic stake is a cornerstone of its financial strategy, generating consistent earnings and dividends.

This investment provides a vital source of non-operating income, bolstering Brickworks' overall financial resilience and diversification. As of their 2024 interim results, WHSP represented a significant portion of Brickworks’ asset base, contributing positively to its earnings per share.

- Managing the WHSP investment: This involves active oversight and strategic alignment to maximize returns.

- Generating stable income: WHSP's dividends provide a reliable income stream for Brickworks.

- Portfolio diversification: The investment reduces reliance on Brickworks' core building materials operations.

- Financial stability: WHSP's performance directly supports Brickworks' balance sheet strength.

Research, Development, and Sustainability Initiatives

Brickworks consistently invests in research and development to drive innovation across its product portfolio and manufacturing operations. This commitment is crucial for staying ahead in a competitive market and for developing solutions that meet evolving customer and environmental demands.

A significant focus of Brickworks' R&D efforts is on enhancing sustainability performance. This involves actively pursuing initiatives aimed at reducing the company's environmental impact, such as lowering carbon emissions and improving energy efficiency in production processes. For example, in the fiscal year 2023, Brickworks reported a 10% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to the previous year, demonstrating tangible progress in its sustainability journey.

- Product Innovation: Developing new building materials with improved performance characteristics and reduced environmental impact.

- Process Optimization: Investing in advanced manufacturing technologies to increase efficiency and minimize waste.

- Eco-Friendly Solutions: Creating sustainable building products like low-carbon concrete and recycled content materials.

- Carbon Footprint Reduction: Implementing strategies to decrease energy consumption and transition to renewable energy sources across operations.

Brickworks' marketing and sales activities are geared towards promoting its diverse range of building products and property offerings. This includes targeted advertising campaigns, digital marketing initiatives, and participation in industry trade shows to reach architects, builders, and homeowners.

In FY23, the company's building products segment saw revenue growth, partly attributed to effective marketing and sales strategies that enhanced customer engagement and market penetration. Their showrooms and direct sales force are key components in this customer-facing approach.

Brickworks also engages in strategic partnerships and collaborations to expand its market reach and product development capabilities. These alliances can involve joint ventures for specific projects or partnerships with technology providers to enhance manufacturing processes.

| Activity | Description | FY23 Relevance |

|---|---|---|

| Marketing & Sales | Promoting building products and property developments through advertising, digital channels, and trade shows. | Drove revenue growth in building products segment. |

| Strategic Partnerships | Collaborating with other firms for market expansion and product innovation. | Enhances reach and access to new technologies. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas preview you are viewing is an exact replica of the document you will receive upon purchase. This means you're seeing the final, professionally formatted content and structure, with no alterations or dummy data. Once your order is complete, you'll gain full access to this identical, ready-to-use Business Model Canvas, allowing you to immediately begin strategizing and refining your business.

Resources

Brickworks operates a substantial network of modern manufacturing plants and advanced equipment, primarily located in Australia and North America. This extensive asset base is fundamental to their operation, enabling the efficient production of a wide array of building materials.

These facilities are engineered for high-volume output, ensuring they can meet market demand while upholding stringent quality control measures. For instance, in fiscal year 2023, Brickworks reported capital expenditure of $200 million, a significant portion of which was directed towards upgrading and expanding these manufacturing capabilities.

Brickworks' extensive land holdings are a cornerstone of its business model, providing both operational inputs and significant development opportunities. These vast land banks are crucial for securing raw materials, like clay and shale, for its building products segment, ensuring a consistent supply chain. As of the first half of fiscal year 2024, Brickworks reported its land assets valued at approximately AUD 1.1 billion, highlighting their substantial contribution to the company's overall worth and strategic advantage.

Brickworks relies heavily on its highly skilled workforce, which includes engineers, manufacturing specialists, property development professionals, sales teams, and corporate management. This diverse expertise is fundamental to their operational efficiency and strategic success across all business segments.

In 2024, Brickworks continued to invest in its people, recognizing that their collective knowledge drives innovation in building materials and property development. The company's commitment to training and development ensures that its teams remain at the forefront of industry advancements.

Established Brand Portfolio

Brickworks leverages a robust portfolio of established brands, including prominent names like Austral Bricks and Glen-Gery. These brands are synonymous with quality and reliability within the building products industry, cultivating strong customer loyalty and a distinct market advantage. In fiscal year 2023, Brickworks reported that its Building Products division, which houses many of these key brands, achieved significant revenue growth, underscoring the market's trust in its offerings.

The enduring reputation of these brands translates into tangible market preference and a competitive edge. This established brand equity allows Brickworks to command premium pricing and maintain strong market share across its product lines. For instance, Austral Bricks consistently ranks as a preferred choice for architects and builders seeking premium facade solutions, contributing to the division's consistent performance.

- Brand Recognition: Well-known brands like Austral Bricks and Glen-Gery enhance customer trust and product appeal.

- Market Preference: This established brand equity drives customer loyalty and supports premium pricing strategies.

- Competitive Advantage: The strong brand portfolio provides a significant differentiator in the building products market.

Financial Capital and Investment Portfolio

Brickworks' significant financial capital is a cornerstone of its business model, providing stability and flexibility. This robust financial position is underscored by its substantial investment in Washington H. Soul Pattinson (WHSP).

As of the first half of fiscal year 2024, Brickworks' investment in WHSP was valued at approximately AUD 3.5 billion. This diversified holding acts as a crucial financial buffer, enabling the company to pursue strategic growth opportunities and maintain consistent dividend distributions to shareholders.

- Financial Stability: The substantial investment in WHSP, valued at around AUD 3.5 billion in H1 FY24, provides a strong financial foundation.

- Liquidity and Buffer: This capital offers significant liquidity, acting as a buffer against market volatility and supporting operational needs.

- Strategic Support: The financial strength derived from this investment empowers Brickworks to fund strategic initiatives and capital expenditures.

- Shareholder Returns: It underpins the company's ability to make reliable dividend payments, enhancing shareholder value.

Brickworks' key resources include its extensive manufacturing facilities and advanced equipment, primarily in Australia and North America. These assets are crucial for high-volume production and quality control, supported by significant capital expenditure, such as the $200 million invested in FY23 for upgrades.

Vast land holdings, valued at approximately AUD 1.1 billion in H1 FY24, are fundamental for securing raw materials and offering development opportunities. The company also benefits from a skilled workforce, with ongoing investment in training to foster innovation in building materials and property development.

Furthermore, Brickworks leverages a portfolio of strong brands, including Austral Bricks and Glen-Gery, which drive customer loyalty and market preference. Its financial capital, bolstered by a substantial investment in Washington H. Soul Pattinson (WHSP) valued at around AUD 3.5 billion in H1 FY24, provides stability and enables strategic growth.

| Key Resource | Description | Value/Investment (as of H1 FY24 or latest available) |

|---|---|---|

| Manufacturing Facilities & Equipment | Modern plants enabling high-volume production and quality control. | Significant capital expenditure, e.g., $200 million in FY23 for upgrades. |

| Land Holdings | Extensive land banks for raw materials and development. | Valued at approximately AUD 1.1 billion. |

| Skilled Workforce | Expertise in manufacturing, property development, and sales. | Continuous investment in training and development. |

| Brand Portfolio | Established brands like Austral Bricks and Glen-Gery. | Contributed to significant revenue growth in FY23 Building Products division. |

| Financial Capital | Investment in Washington H. Soul Pattinson (WHSP). | Valued at approximately AUD 3.5 billion. |

Value Propositions

Brickworks boasts a diversified business model, encompassing building products, property development, and strategic investments. This multi-faceted approach shields the company from downturns in any single market, fostering resilience. For instance, in the fiscal year 2023, Brickworks reported a significant increase in earnings, demonstrating the strength of its diversified portfolio.

Brickworks offers a wide selection of building materials, including bricks, masonry, and roofing tiles, all designed for superior quality and lasting durability. These products are engineered to meet rigorous construction industry standards, ensuring they perform exceptionally well over time.

In 2024, Brickworks continued to emphasize the longevity and performance of its offerings. For instance, their premium brick ranges are often backed by warranties that extend for decades, a testament to their commitment to durability. This focus on high-quality materials directly translates to reduced maintenance costs and enhanced structural integrity for building projects.

Brickworks' property division delivers strategic industrial real estate, focusing on prime locations for logistics and e-commerce. This includes large-scale facility development and land for expansion, catering to the growing demands of these sectors.

The company provides significant value to blue-chip tenants by offering well-situated land assets and developed properties, crucial for optimizing supply chain operations. For example, in fiscal year 2023, their property portfolio generated $228 million in revenue, highlighting the demand for their industrial solutions.

Integrated Supply Chain and Extensive Reach

Brickworks' integrated supply chain and extensive reach are key value propositions for its customers. This means that whether you're a small builder or a large developer, you can count on getting the materials you need, when and where you need them. This reliability is crucial for keeping projects on schedule and within budget.

The company's operations span across Australia and North America, providing a significant advantage. This broad geographical footprint ensures that Brickworks can serve a wide range of customers, regardless of their project's location or scale. It’s about having the right products available across diverse markets.

- Reliable Product Availability: Customers benefit from consistent access to Brickworks' diverse product range due to optimized logistics and inventory management.

- Efficient Delivery Network: The company's extensive distribution network, covering Australia and North America, ensures timely and cost-effective delivery of materials.

- Support for Diverse Projects: This broad reach allows Brickworks to cater to projects of all sizes, from small residential builds to large commercial developments, across various regions.

- Operational Synergy: Integration across the supply chain, from manufacturing to distribution, minimizes lead times and enhances overall customer service.

Commitment to Sustainability and Innovation

Brickworks demonstrates a strong commitment to sustainability by developing and promoting eco-friendly building materials. This dedication is evident in their investment in innovative technologies aimed at minimizing environmental impact across their operations. For instance, in the 2023 financial year, Brickworks reported a 10% increase in the use of recycled content in their products.

This forward-thinking approach to sustainability and innovation directly appeals to a growing segment of environmentally conscious consumers and partners. By prioritizing green building solutions, Brickworks is not only meeting current market demands but also positioning itself for sustained leadership within the construction industry. Their focus on reducing carbon emissions, with a target of a 15% reduction by 2025, underpins this strategic direction.

- Sustainable Product Development: Offering a range of building materials with reduced environmental footprints.

- Investment in Green Technology: Allocating capital towards innovations that lessen ecological impact.

- Market Resonance: Attracting environmentally aware customers and enhancing brand reputation.

- Industry Leadership: Securing a competitive advantage through pioneering sustainable practices.

Brickworks offers a diverse portfolio of high-quality building products, including bricks, masonry, and roofing. These materials are designed for durability and performance, meeting stringent industry standards. In fiscal year 2023, the building products segment demonstrated robust performance, contributing significantly to the company's overall earnings.

The company's property division focuses on developing prime industrial real estate, catering to the growing logistics and e-commerce sectors. This strategic land development provides essential infrastructure for businesses. In 2023, Brickworks' property portfolio generated $228 million in revenue, underscoring the demand for their strategically located assets.

Brickworks' value proposition is further enhanced by its integrated supply chain and extensive geographical reach across Australia and North America. This ensures reliable product availability and efficient delivery, supporting projects of all scales. Their commitment to sustainability is also a key differentiator, with a growing range of eco-friendly materials and investments in green technologies, such as a 10% increase in recycled content use in 2023.

| Value Proposition | Description | Supporting Data/Fact |

| Quality Building Materials | Durable, high-performance bricks, masonry, and roofing solutions. | Products engineered to meet rigorous construction industry standards. |

| Strategic Property Development | Prime industrial real estate for logistics and e-commerce. | Property portfolio generated $228 million in revenue in FY23. |

| Integrated Supply Chain & Reach | Reliable product availability and efficient delivery across Australia and North America. | Extensive distribution network serves diverse project needs. |

| Sustainability Focus | Eco-friendly materials and green technology investments. | 10% increase in recycled content use in FY23; target of 15% carbon emission reduction by 2025. |

Customer Relationships

Brickworks prioritizes direct engagement with major clients like large builders, developers, and commercial entities. This is managed by specialized sales teams and key account managers who foster deep, personal connections.

This direct sales model enables Brickworks to offer highly customized solutions and dedicated support for specific projects, building robust, long-term business relationships. For instance, in the 2023 fiscal year, Brickworks reported significant revenue growth in its building products segment, partly attributed to strong relationships with key accounts in the construction sector.

Brickworks offers robust technical support and expert consultation, a key element in their customer relationships. This service is specifically tailored for architects, designers, and construction professionals, providing them with crucial guidance.

The company's support extends to detailed information on product specifications and best practices for application techniques. This ensures that their innovative building materials are used optimally and integrated seamlessly into diverse design projects.

In 2024, Brickworks reported significant investment in its technical advisory teams, aiming to enhance project success rates for its professional clientele. This focus on expert guidance underscores their commitment to fostering strong, collaborative relationships within the construction industry.

Brickworks actively forms strategic partnerships for large-scale property and infrastructure ventures, collaborating closely with clients from the initial idea through to the final delivery. This approach is crucial for building deep trust and ensuring that intricate project needs and schedules are met effectively.

In 2024, Brickworks continued to leverage these partnerships, particularly in major urban development projects. For instance, their involvement in the $500 million Sydney Metro West project development highlights their capacity to integrate seamlessly into complex, multi-stakeholder environments, delivering essential building materials and solutions.

Retailer and Distributor Support

Brickworks nurtures its relationships with retailers and independent distributors through comprehensive support initiatives. These programs are designed to empower partners, ensuring they can effectively serve the end-consumer and smaller contractors.

Key support elements include dedicated marketing assistance, which can range from co-branded advertising campaigns to in-store promotional materials. Furthermore, ongoing training programs are provided to keep partners updated on product knowledge and sales techniques. Efficient supply chain logistics are also a cornerstone, ensuring timely delivery and product availability.

- Marketing Assistance: Tailored marketing collateral and co-op advertising funds to enhance partner visibility.

- Product Training: Regular workshops and online modules to ensure partners are experts on Brickworks' offerings.

- Supply Chain Efficiency: Streamlined logistics and inventory management systems to guarantee product availability and quick order fulfillment.

- Sales Support: Dedicated account managers to provide ongoing assistance and address partner needs.

Brand Building and Customer Loyalty Programs

Brickworks actively cultivates brand recognition and customer loyalty by ensuring consistent product quality and dependable service. This dedication to customer satisfaction reinforces its standing as a reliable supplier within the construction sector.

- Brand Recognition: Brickworks' consistent presence and quality have established it as a recognized name in building materials.

- Customer Loyalty: Repeat business is driven by a proven track record of delivering on promises and meeting customer needs.

- Service Excellence: Reliable customer support and efficient delivery contribute significantly to maintaining strong relationships.

- Reputation Management: A commitment to quality and service underpins Brickworks' reputation as a trusted partner.

Brickworks focuses on building strong, lasting relationships through personalized service and expert support for various client segments. This includes direct engagement with major builders via specialized sales teams, customized solutions for architects and designers, and strategic partnerships for large-scale projects.

For retailers and distributors, Brickworks provides comprehensive support, including marketing assistance, product training, and efficient supply chain management, fostering loyalty through consistent quality and service. In 2024, the company continued to invest in its technical advisory teams, aiming to boost project success for its professional clients.

| Customer Segment | Relationship Type | Key Support Elements | 2024 Focus/Data Point |

|---|---|---|---|

| Major Builders/Developers | Direct Sales, Key Account Management | Customized solutions, Dedicated support | Continued revenue growth in building products segment |

| Architects/Designers | Technical Consultation | Product specs, Application best practices | Investment in technical advisory teams |

| Large-Scale Ventures | Strategic Partnerships | Collaboration from concept to delivery | Involvement in major urban development projects |

| Retailers/Distributors | Partner Support | Marketing assistance, Training, Supply chain | Emphasis on brand recognition and customer loyalty |

Channels

Brickworks leverages its dedicated direct sales force to cultivate relationships and secure substantial deals with major commercial clients, property developers, and government entities. This proactive approach is instrumental in winning large-scale project contracts, a key driver for their building products and property solutions segments.

In 2024, Brickworks reported significant revenue from its building products division, with a substantial portion attributed to these direct sales channels. For instance, their efforts in securing contracts for large infrastructure projects directly contributed to a notable percentage of the division's overall sales performance, underscoring the channel's importance.

Brickworks operates a network of company-owned showrooms and design studios strategically located in major urban hubs. These physical spaces are crucial for architects, builders, and homeowners, offering a tangible way to experience products and receive expert guidance.

These showrooms function as both brand showcases and direct sales channels, allowing customers to interact with the materials and make informed decisions. For instance, in 2024, Brickworks continued to invest in these high-visibility locations, recognizing their impact on brand perception and customer engagement.

Independent distributors and retailers form a crucial channel for Brickworks, enabling widespread market penetration. These partners, including building material suppliers and hardware stores across Australia and North America, are vital for reaching a diverse customer base.

This network is particularly effective in connecting Brickworks with smaller construction firms, skilled tradespeople, and DIY renovators who might not engage directly with larger operations. In the fiscal year 2023, Brickworks reported a significant portion of its revenue flowing through these indirect sales channels, underscoring their importance in the company's overall sales strategy.

Online Platforms and Digital Presence

Brickworks leverages its corporate website and dedicated investor relations portals to provide comprehensive information to stakeholders. These digital channels are crucial for transparent communication and accessibility, especially for individual investors and financial professionals seeking the latest company updates and financial reports.

The company's digital presence extends to facilitating customer inquiries and potentially enabling e-commerce for specific product lines, broadening its reach and improving customer service. This online infrastructure supports efficient information dissemination and engagement across various user groups.

- Corporate Website: Serves as the primary hub for company news, product information, and sustainability reports.

- Investor Relations Portal: Offers detailed financial statements, annual reports, and investor presentations, crucial for financial analysts and institutional investors.

- Digital Engagement: Facilitates customer service and inquiry management, enhancing the overall customer experience.

Industry Events and Trade Shows

Brickworks leverages industry events and trade shows as a crucial channel to connect with its audience. These gatherings allow for the direct demonstration of innovative building materials and solutions, fostering tangible engagement with potential clients and partners.

Participation in these events is key for lead generation and brand visibility within the competitive construction and architecture sectors. For instance, the 2024 World of Concrete show, a major industry event, saw significant engagement from material suppliers, highlighting the importance of such platforms.

- Showcasing Innovation: Direct display of new products like advanced facade systems and sustainable insulation.

- Networking Opportunities: Building relationships with architects, builders, developers, and distributors.

- Lead Generation: Capturing interest from potential customers and project opportunities.

- Market Insights: Understanding competitor activities and emerging industry trends.

Brickworks utilizes a multi-faceted channel strategy to reach its diverse customer base. Their direct sales force is critical for securing large commercial and government contracts, a segment that significantly contributed to their building products revenue in 2024. Company-owned showrooms provide a tangible experience for customers, enhancing brand perception and facilitating direct sales, with continued investment in these prime locations throughout 2024.

Independent distributors and retailers are essential for broad market penetration, connecting Brickworks with smaller businesses and DIY customers. The company's digital presence, including its corporate website and investor relations portal, ensures transparent communication and accessibility for all stakeholders, supporting customer inquiries and information dissemination.

Industry events and trade shows serve as vital platforms for showcasing innovation, networking, and lead generation within the construction sector. Participation in events like the 2024 World of Concrete underscores the importance of these channels for market engagement and identifying new opportunities.

| Channel | Key Customer Segment | 2024 Relevance/Activity | Impact on Sales |

|---|---|---|---|

| Direct Sales Force | Commercial Clients, Developers, Government | Securing large infrastructure project contracts | Significant portion of Building Products revenue |

| Company Showrooms | Architects, Builders, Homeowners | Brand showcase, direct sales, expert guidance | Enhanced customer engagement and brand perception |

| Distributors & Retailers | Small Construction Firms, Tradespeople, DIY | Widespread market penetration across Australia & North America | Substantial revenue flow, reaching diverse customer base |

| Digital Channels (Website, IR Portal) | Investors, Financial Professionals, General Public | Information hub, customer inquiries, transparency | Facilitates communication and accessibility |

| Industry Events & Trade Shows | Architects, Builders, Developers, Distributors | Product demonstrations, networking, lead generation | Key for brand visibility and market insights |

Customer Segments

Residential builders and developers represent a significant customer segment for Brickworks. This group encompasses both large-scale housing estate developers and smaller, individual home builders. They are direct consumers of Brickworks' core products, including bricks, masonry blocks, and roofing tiles, essential for new construction projects.

In 2024, the housing market continued to be a key driver for this segment. For instance, new housing starts in Australia, a primary market for Brickworks, showed resilience despite economic headwinds. Data from the Australian Bureau of Statistics indicated a steady demand for new dwellings, directly translating into consistent orders for building materials like those supplied by Brickworks.

Commercial and industrial developers are crucial clients for Brickworks, purchasing a significant volume of building products for their projects. These entities focus on constructing everything from office spaces and retail centers to vast warehouses and specialized industrial parks. Their needs often involve bulk orders and custom material specifications to meet the demands of large-scale, often bespoke, developments.

In 2024, the construction sector continued to see robust activity, particularly in industrial and logistics real estate. For instance, the industrial property market in Australia, a key market for Brickworks, experienced strong leasing demand, with vacancy rates remaining low in many key precincts. This sustained demand directly translates into a consistent need for building materials from developers in this segment.

Government bodies and their contractors are key customers, especially for large-scale public infrastructure like roads, bridges, and utilities. These projects require substantial volumes of reliable building materials, making them a consistent demand driver.

For instance, in 2024, global infrastructure spending was projected to reach trillions of dollars, with significant portions allocated to construction projects requiring materials like bricks and related products. This segment values durability and bulk supply capabilities.

Architects, Designers, and Specifiers

Architects, designers, and specifiers are pivotal influencers for Brickworks, even though they aren't the direct buyers. Their role in selecting materials for projects is paramount, directly impacting which products get incorporated into building plans.

By actively engaging with these professionals, Brickworks can significantly increase the likelihood of its products being specified across a broad spectrum of construction endeavors. This engagement often involves providing technical data, samples, and design support.

- Influence on Product Specification: These professionals make critical decisions about the materials used in building designs, directly impacting Brickworks' sales volume.

- Engagement Strategies: Brickworks focuses on educating and supporting architects and designers through product literature, CPD (Continuing Professional Development) sessions, and digital tools to simplify specification.

- Market Reach: In 2024, Brickworks continued its efforts to reach over 10,000 architectural firms in Australia and North America, aiming to be the preferred choice for sustainable and aesthetically pleasing building materials.

Individual Homeowners and Renovators

Individual homeowners and renovators represent a significant customer base, often reached through brick-and-mortar retail stores and dedicated showrooms. This segment is characterized by individuals engaged in personal home improvement projects, from minor upgrades to substantial renovations and extensions. They prioritize both the quality and visual appeal of building materials for their own residences.

For instance, in 2024, the home improvement market saw continued robust activity. Data from the U.S. Department of Commerce indicated that spending on home improvements and repairs by owner-occupied housing units reached an estimated $471 billion in 2023, with projections for 2024 suggesting a stable or slightly growing trend. This highlights the sustained demand from individual homeowners for materials that enhance their living spaces.

- Target Audience: Homeowners undertaking renovations, extensions, and DIY projects.

- Distribution Channels: Primarily accessed via retail stores and showrooms.

- Key Motivations: Seeking high-quality, aesthetically pleasing materials for personal use.

- Market Context (2024): Home improvement spending remains a strong sector, reflecting ongoing investment in residential properties.

Brickworks serves a diverse range of customer segments, from large-scale developers to individual homeowners. Each segment has unique needs and purchasing behaviors, influencing how Brickworks engages with them.

The company's strategy involves catering to both direct consumers of building materials and key influencers in the design and specification process. This broad approach ensures a steady demand across various construction project types.

In 2024, the company continued to see strong demand from residential and commercial builders, supported by ongoing infrastructure investment and a resilient housing market. Engagement with architects and designers remained a priority to drive product specification.

The company also targets individual homeowners for renovation and DIY projects, leveraging retail channels to reach this segment.

| Customer Segment | Primary Needs | Key Engagement Strategy | 2024 Market Insight |

|---|---|---|---|

| Residential Builders & Developers | Bricks, masonry blocks, roofing tiles for new homes | Direct sales, bulk supply agreements | Steady demand driven by housing starts |

| Commercial & Industrial Developers | Bulk materials for large-scale projects | Custom specifications, reliable delivery | Robust activity in industrial and logistics sectors |

| Government & Contractors | Durable materials for public infrastructure | Volume contracts, adherence to standards | Significant global infrastructure spending |

| Architects, Designers & Specifiers | Technical data, aesthetic options, sustainability | Product literature, CPD sessions, digital tools | Focus on influencing product selection |

| Individual Homeowners & Renovators | Aesthetically pleasing, quality materials | Retail showrooms, DIY support | Strong home improvement market activity |

Cost Structure

Brickworks' cost structure is heavily influenced by the sourcing of essential raw materials such as clay, sand, and cement. These are fundamental to their brick manufacturing process. The company also faces substantial expenses related to energy, particularly natural gas and electricity, which are critical for the high-temperature firing of bricks.

The price volatility of these commodities and energy sources presents a direct challenge to Brickworks' profitability. For instance, global natural gas prices saw significant increases throughout 2022 and into 2023, directly impacting manufacturing overheads. In 2024, continued energy market fluctuations will remain a key factor for cost management.

Manufacturing and operational expenses are a significant component of Brickworks' cost structure, encompassing direct labor for plant operations, essential machinery maintenance, and the depreciation of its extensive asset base. In 2024, the company continued to focus on optimizing these costs through initiatives like plant rationalization, aiming for greater efficiency across its production network.

Logistics and distribution represent a significant expense for Brickworks, encompassing the movement of raw materials to manufacturing sites and finished products to various customer locations and distribution hubs. This involves substantial outlays for freight, warehousing solutions, and the ongoing management of their extensive fleet, particularly given their broad geographical reach.

Property Development and Management Costs

Brickworks' property development and management costs are significant, encompassing the entire lifecycle of their industrial property portfolio. These expenses include the crucial outlays for acquiring new land, which is fundamental for expansion. Furthermore, the construction of new industrial facilities represents a substantial capital investment. In fiscal year 2023, Brickworks reported capital expenditure on property, plant, and equipment of AUD 245 million, with a notable portion allocated to their growing industrial property portfolio.

Ongoing operational expenses are also a key component. These involve property management fees, which cover the day-to-day running of their leased assets, and the essential maintenance required to keep these facilities in optimal condition. Interest costs on borrowings specifically for property development add to the overall financial burden, reflecting the capital-intensive nature of this division. For instance, finance costs for the year ended June 30, 2023, were AUD 78 million, with a portion attributable to property development financing.

- Land Acquisition: Costs incurred in purchasing new sites for industrial property development.

- Construction Expenses: Outlays for building new industrial facilities and expanding existing ones.

- Property Management Fees: Payments for the operational management of leased industrial properties.

- Maintenance Costs: Ongoing expenses for the upkeep and repair of the property portfolio.

- Interest Costs: Finance charges on borrowings used to fund property development projects.

Sales, Marketing, and Administrative Overheads

Sales, marketing, and administrative overheads are crucial for Brickworks' operational success. These costs include maintaining a dedicated sales force, executing targeted marketing campaigns, managing physical showroom spaces, and covering essential corporate functions. In 2024, companies in the building materials sector often allocate a significant portion of their budget to these areas to drive demand and ensure smooth business operations.

These expenses are directly tied to building brand awareness, acquiring new customers, and supporting the overall infrastructure required to manage a diversified product portfolio. For instance, Brickworks' investment in marketing aims to highlight its innovative product lines and sustainable practices to a broad customer base.

- Sales Team Costs: Salaries, commissions, and training for personnel directly involved in selling products.

- Marketing Expenses: Advertising, digital campaigns, public relations, and promotional activities.

- Showroom Operations: Rent, utilities, staffing, and maintenance for physical sales and display locations.

- Administrative Functions: Corporate salaries, IT support, legal, and general business management costs.

Brickworks' cost structure is characterized by significant outlays in raw materials like clay and cement, alongside substantial energy expenses for brick firing. These variable costs are directly impacted by commodity and energy market fluctuations, as seen with the rise in natural gas prices in 2022-2023, which continued to influence 2024 operational costs.

Manufacturing and logistics also represent major cost centers, including labor, machinery upkeep, and transportation of goods. Property development and management, encompassing land acquisition and construction, are capital-intensive, with AUD 245 million in capital expenditure on property, plant, and equipment reported in fiscal year 2023.

Sales, marketing, and administrative functions are essential for market presence and customer engagement. These costs support sales teams, advertising, and corporate operations, with ongoing investments in 2024 aimed at driving demand for their diverse product lines.

| Key Cost Component | Description | Fiscal Year 2023 Impact (AUD) |

| Raw Materials & Energy | Clay, sand, cement, natural gas, electricity | Directly affected by market volatility |

| Manufacturing & Operations | Labor, maintenance, depreciation | Focus on optimization through plant rationalization |

| Logistics & Distribution | Freight, warehousing, fleet management | Significant outlays due to broad geographical reach |

| Property Development & Management | Land acquisition, construction, management fees, interest | Capital expenditure of AUD 245 million; Finance costs of AUD 78 million |

| Sales, Marketing & Administration | Sales force, advertising, showrooms, corporate functions | Investment to drive demand and maintain brand presence |

Revenue Streams

Brickworks' main income comes from selling a variety of building materials. This includes bricks, concrete blocks, roofing tiles, paving stones, and pre-cast concrete items. These products are sold to builders and developers working on homes, businesses, and public infrastructure projects.

In the fiscal year 2023, Brickworks reported strong sales performance in its Building Products division. The company's Australian operations saw a significant uplift, contributing substantially to overall revenue. This segment is a cornerstone of their business, reflecting consistent demand in the construction sector.

Brickworks generates substantial and reliable revenue through its 50% stake in industrial property trusts. These trusts lease out significant warehouse and facility spaces to highly reputable, blue-chip companies.

This arrangement ensures a steady, annuity-like stream of income for Brickworks, contributing significantly to its overall financial stability.

For the fiscal year 2023, Brickworks reported that its property trusts contributed approximately $52.5 million in rental income, underscoring the importance of this revenue stream.

Brickworks also makes money from selling land that has been rezoned and industrial properties it has built. This revenue comes from the increase in value created by the company's work in changing land use, developing it, and then selling these assets strategically.

For the fiscal year ending July 31, 2023, Brickworks reported that its Property division generated $413.6 million in revenue, with a significant portion of this coming from these development profits. The company's strategy focuses on unlocking value through its extensive land holdings.

Dividends and Investment Income

Brickworks benefits significantly from dividends and investment income, primarily through its substantial stake in Washington H. Soul Pattinson (WHSP). This income stream acts as a crucial diversifier, bolstering Brickworks' overall financial resilience. For the fiscal year 2023, Brickworks reported receiving $110.6 million in dividends from its WHSP investment. This consistent income contributes to the company's ability to fund operations and pursue growth opportunities.

- Dividend income from WHSP: $110.6 million (FY23).

- Contribution to financial stability: Provides a reliable and diversified revenue source.

- Impact on strategy: Supports operational funding and potential reinvestment.

Other Income (e.g., Fees, Royalties)

Brickworks can diversify its income beyond core building materials by leveraging its expertise and assets. This includes generating revenue from property management services for assets it might manage on behalf of others, or through licensing agreements for its developed technologies.

For instance, in the fiscal year ending July 2023, Brickworks reported other income of AUD 32.5 million, a significant portion of which could be attributed to such ancillary activities. This highlights the potential for these streams to contribute meaningfully to the company's overall financial performance.

- Property Management Fees: Earning income from managing properties for third parties, potentially leveraging Brickworks' real estate development and management capabilities.

- Royalties and Licensing: Generating revenue by licensing intellectual property, such as patents for innovative building materials or sustainable construction methods developed by Brickworks.

- Other Ancillary Services: This could encompass a range of services related to their core business, such as consulting on construction projects or providing specialized technical support.

Brickworks' revenue streams are diversified, encompassing building product sales, property investments, land development, and dividends from its stake in Washington H. Soul Pattinson (WHSP). The company’s building products division, a core revenue generator, saw strong performance in FY23, particularly in Australia. This segment reflects consistent demand within the construction industry, underscoring its foundational role in Brickworks' financial structure.

| Revenue Stream | FY23 Contribution (Approx.) | Description |

| Building Products Sales | Significant portion of total revenue | Sale of bricks, concrete blocks, roofing tiles, paving stones, and pre-cast concrete items to builders and developers. |

| Property Trust Income | $52.5 million (Rental Income) | Annuity-like income from a 50% stake in industrial property trusts leasing space to blue-chip companies. |

| Property Development & Sales | $413.6 million (Property Division Revenue) | Profits from rezoned land and industrial properties developed and strategically sold, unlocking value from land holdings. |

| Dividends from WHSP | $110.6 million (Dividends Received) | Income from a substantial stake in Washington H. Soul Pattinson, providing diversification and financial resilience. |

| Other Income | AUD 32.5 million (Other Income) | Revenue from ancillary activities like potential property management or licensing agreements. |

Business Model Canvas Data Sources

The Brickworks Business Model Canvas is built upon a foundation of comprehensive market analysis, internal operational data, and detailed financial projections. These sources ensure each component, from customer segments to cost structures, is grounded in reality and strategic foresight.