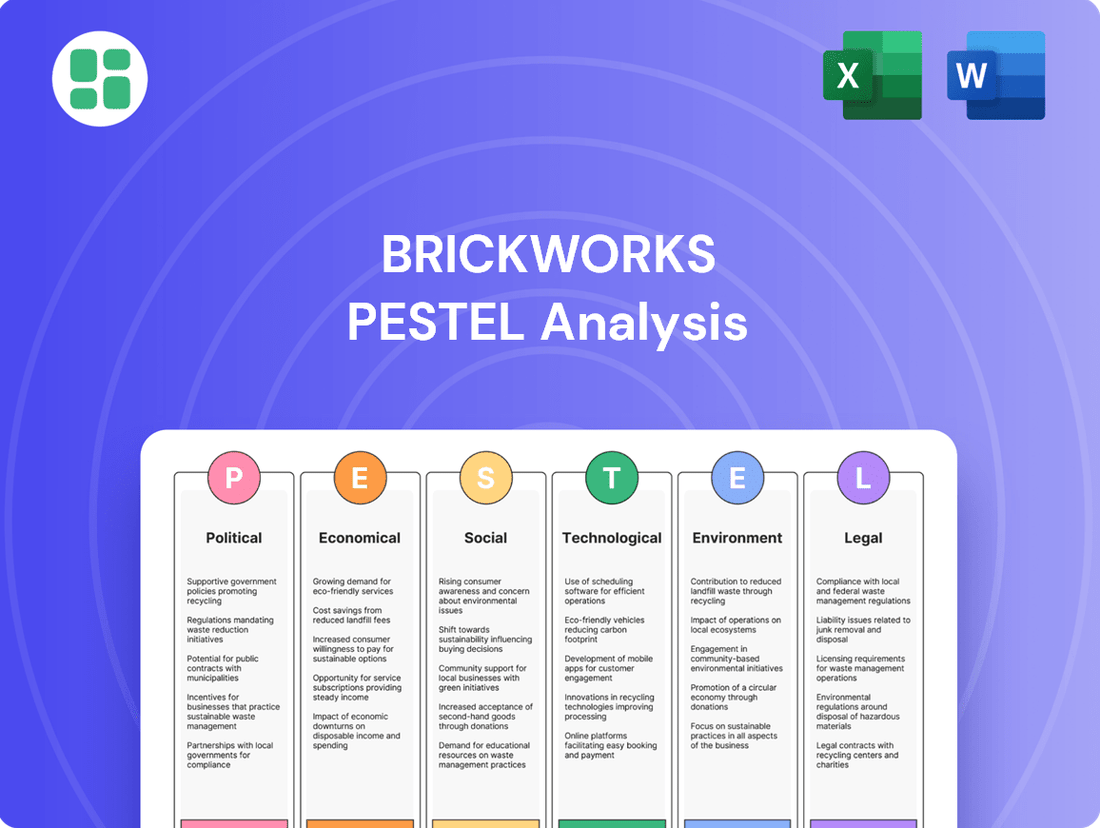

Brickworks PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brickworks Bundle

Unlock the critical external factors shaping Brickworks's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends present both challenges and opportunities. This expertly crafted report provides actionable intelligence to inform your strategic decisions.

Gain a competitive edge by delving into the technological advancements and environmental regulations impacting the building materials sector. Our PESTLE analysis for Brickworks offers a deep dive into these forces, empowering you to anticipate market changes. Download the full version for immediate insights.

Political factors

The Australian government's ambitious target to deliver 1.2 million new homes over five years, commencing in the 2024-2025 financial year, presents a substantial uplift in demand for building materials like those produced by Brickworks. This policy directly fuels the need for bricks, pavers, and other construction essentials.

Furthermore, substantial government investment in trunk infrastructure and new housing support programs, layered upon existing infrastructure spending, cultivates a robust and supportive ecosystem for the construction industry. These concerted efforts are designed to accelerate building timelines and effectively meet escalating housing needs.

Changes to the National Construction Code (NCC) in 2025 are set to significantly impact the building industry, with a strong emphasis on energy efficiency, climate resilience, and embodied carbon reporting. These updates will directly influence the specifications and demand for building materials like those produced by Brickworks.

Brickworks must ensure its product range meets these increasingly stringent sustainability standards. This includes adapting to new requirements for net-zero commercial buildings and bolstering climate resilience, which could necessitate product reformulation or the development of new offerings.

These regulatory shifts present a dual nature for Brickworks, acting as both a challenge to existing product lines and a catalyst for innovation in sustainable building solutions. For example, the push for lower embodied carbon could favor materials with more efficient manufacturing processes or recycled content.

Australia's approach to foreign investment is evolving, with reforms aimed at making it easier for repeat investors in less sensitive areas like housing and construction. This streamlining is designed to encourage more international capital to flow into the Australian property market.

The objective is to stimulate property development, which in turn could significantly boost demand for building materials. For instance, in 2023, foreign investment approvals in the residential real estate sector reached billions of dollars, indicating the potential impact of these policy shifts.

Government Support for Skilled Workforce

Government initiatives are actively targeting skilled workforce development, which directly impacts industries like construction. For instance, the Australian government's commitment of $1.6 billion over five years to reform tertiary education, coupled with specific funding for construction apprenticeships, aims to bolster the supply of skilled labor. This focus is crucial for companies like Brickworks, as a more readily available and skilled workforce can significantly reduce project delays and control cost escalations, ensuring a more predictable and efficient construction process.

These government efforts translate into tangible benefits for businesses by addressing critical labor shortages. A well-supported apprenticeship system, for example, can provide a pipeline of qualified tradespeople, directly mitigating the impact of skill gaps that often plague the construction sector. This proactive approach to workforce training and development is a positive political factor, fostering a more stable operating environment.

The direct financial allocations underscore the political will to resolve these labor challenges. By investing in education and vocational training, the government is creating a more favorable ecosystem for companies reliant on a strong labor pool. This includes:

- Increased funding for apprenticeships in trades relevant to construction.

- Reforms in tertiary education to better align skills with industry needs.

- Potential for subsidies or incentives for businesses hiring apprentices.

- Long-term strategy to reduce reliance on overseas labor through domestic training.

Political Stability and Policy Consistency

Political stability and consistent policy application are vital for Brickworks, creating a predictable environment for operations. For instance, consistent government support for infrastructure spending, like the AUD 110 billion National Reconstruction Fund announced in 2023, directly impacts demand for building materials. This predictability allows for long-term capital allocation and strategic planning, crucial in sectors with extended project timelines.

The building materials and property development sectors rely heavily on government commitment to infrastructure and housing targets, irrespective of political shifts. For example, Australia’s National Housing Accord aims to deliver 1.2 million new homes by 2029, a target that directly influences Brickworks’ strategic investments in manufacturing capacity and land development. Policy uncertainty, however, can lead to project delays and a significant dampening of investment, impacting revenue streams and growth projections.

- Policy Consistency: Predictable regulatory frameworks reduce operational risk for Brickworks.

- Infrastructure Investment: Government spending on projects like the National Reconstruction Fund (AUD 110 billion) drives demand for building materials.

- Housing Targets: National housing initiatives, aiming for 1.2 million new homes by 2029, are critical for strategic planning in property development.

- Political Uncertainty: Can cause project delays and deter investment, negatively affecting the company's financial performance.

Government housing targets, such as the 1.2 million new homes by 2029, directly stimulate demand for Brickworks' products. Recent government investments in infrastructure, totaling billions, further bolster the construction sector's outlook. Changes to the National Construction Code in 2025, focusing on sustainability, will necessitate product adaptation.

Australia's approach to foreign investment is being reformed to encourage capital in sectors like housing, potentially boosting development. Government initiatives, including AUD 1.6 billion for tertiary education reform and construction apprenticeships, aim to address skilled labor shortages, vital for project execution.

Political stability ensures consistent policy application, crucial for long-term planning in the construction industry. For example, the AUD 110 billion National Reconstruction Fund announced in 2023 provides a predictable demand driver.

Policy consistency and government commitment to housing and infrastructure targets are critical for Brickworks' strategic planning and investment. However, political uncertainty can lead to project delays and reduced investment, impacting financial performance.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Brickworks, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces present both challenges and strategic advantages.

This Brickworks PESTLE analysis provides a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations and alleviating the pain of sifting through extensive data.

Economic factors

The Reserve Bank of Australia's (RBA) monetary policy, particularly its cash rate decisions, directly influences the cost of borrowing for both property developers and potential homebuyers. Higher interest rates translate to increased mortgage repayments, dampening demand and making new construction projects less financially viable.

Market forecasts suggest a potential easing of monetary policy, with anticipated interest rate cuts by mid-to-late 2025. This shift is projected to improve housing affordability by lowering borrowing costs, which in turn is expected to boost consumer confidence and stimulate activity in the property market.

An upturn in property prices and increased construction activity, driven by these anticipated rate cuts, would likely benefit Brickworks. Higher demand for new homes would directly translate into increased sales for Brickworks' building products, and its property division could see improved valuations and development opportunities.

Elevated construction costs remain a significant hurdle, with material prices, ongoing supply chain snags, and a persistent shortage of skilled labor continuing to pressure the industry. While some material costs have shown signs of stabilizing, overall expenses are still considerably high, contributing to project delays and financial distress for smaller construction companies.

For Brickworks, managing raw material procurement and optimizing operational efficiencies are crucial to navigating these cost pressures. For instance, the Producer Price Index for construction materials saw a notable increase in late 2023 and early 2024, although the rate of escalation has moderated compared to the previous year. This means that while the immediate surge might have eased, the baseline cost remains elevated, impacting profitability and strategic planning for manufacturers like Brickworks.

Australia's economic growth is anticipated to strengthen in 2025, with forecasts suggesting a notable uptick. This projected improvement, alongside a recovering trend in consumer spending, is a key driver for the construction sector, directly influencing the demand for new housing and commercial projects.

Higher consumer confidence levels are particularly beneficial for Brickworks. When consumers feel more secure about their finances, they are more likely to invest in home improvements and new construction projects. This increased spending directly translates into higher sales volumes for Brickworks' diverse product offerings, from bricks and pavers to concrete and masonry solutions.

Property Market Trends

The Australian property market is experiencing significant shifts, primarily driven by efforts to boost housing supply and tackle affordability challenges. Dwelling approvals have historically fallen short of government housing targets, creating a persistent undersupply.

However, a notable rebound in both residential and infrastructure construction is projected to commence from 2025. This recovery is crucial for Brickworks' property division, directly impacting sales volumes for its building products, especially in areas identified for government-led growth initiatives.

- Dwelling Approvals Lag Targets: Australian dwelling approvals have consistently trailed ambitious housing targets, contributing to affordability pressures.

- Construction Rebound Expected: A recovery in residential and infrastructure construction is anticipated from 2025 onwards.

- Impact on Brickworks: This market upturn is vital for Brickworks' property segment and its building products sales, particularly in government-supported growth corridors.

- Affordability Focus: Government policies are increasingly prioritizing increased housing supply to improve affordability.

Investment Portfolio Performance

Brickworks' investment portfolio, particularly its substantial holding in Washington H. Soul Pattinson (WHSP), plays a crucial role in its financial performance. WHSP, a diversified investment company, has demonstrated consistent dividend growth, directly bolstering Brickworks' earnings and providing a stable income stream. This diversification is vital, helping to cushion the impact of fluctuations in Brickworks' primary building products segments.

For the fiscal year ending July 31, 2023, Brickworks reported that its investment in WHSP contributed $181 million to its net profit. This represented a significant portion of its overall earnings, highlighting the importance of this strategic investment. The reliable dividends from WHSP offer a buffer against the inherent cyclicality of the construction and building materials industries.

- WHSP Contribution: In FY23, Brickworks' share of WHSP's net profit was $181 million, underscoring its significance to the group's financial health.

- Dividend Stability: WHSP's history of consistent dividend increases provides a predictable and valuable income source for Brickworks.

- Portfolio Diversification: The WHSP investment diversifies Brickworks' revenue, mitigating risks associated with its core building products operations.

Anticipated interest rate cuts by mid-to-late 2025 are expected to lower borrowing costs, boosting consumer confidence and stimulating the property market. This economic shift, coupled with a projected strengthening of Australia's economic growth in 2025 and recovering consumer spending, will likely increase demand for Brickworks' building products and enhance its property division's prospects.

Despite a moderating rate of escalation compared to the previous year, elevated construction costs persist due to material prices and labor shortages. For instance, the Producer Price Index for construction materials saw a notable increase in late 2023 and early 2024, keeping overall expenses high and impacting industry profitability.

The Australian property market is focused on increasing housing supply to address affordability, with dwelling approvals historically falling short of targets. However, a projected rebound in residential and infrastructure construction from 2025 is crucial for Brickworks, particularly in government-supported growth areas.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Brickworks |

|---|---|---|---|

| Interest Rates | Slightly elevated, potential for cuts later in year | Anticipated cuts mid-to-late 2025 | Lower borrowing costs will boost demand for housing and construction. |

| Economic Growth | Moderate growth | Projected strengthening | Increased consumer spending and investment in construction projects. |

| Construction Costs | Persistently high, but rate of increase moderating | Continued pressure, but potential for stabilization | Requires efficient procurement and operational management for profitability. |

| Housing Market | Undersupply persists, affordability challenges | Projected rebound in construction from 2025 | Increased sales for building products and opportunities in property development. |

Preview the Actual Deliverable

Brickworks PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed Brickworks PESTLE Analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the industry.

What you’re previewing here is the actual file—fully formatted and professionally structured. You'll gain immediate access to this comprehensive analysis upon completing your purchase.

Sociological factors

Australia's population is projected to reach 31.5 million by 2031, a significant increase that directly fuels demand for housing and infrastructure. This demographic expansion, coupled with a steady shift towards urban centers, creates a sustained need for construction materials, benefiting companies like Brickworks.

Urbanization concentrates economic activity and population density, driving demand for both residential and commercial building projects. As more Australians move to cities, the need for new homes, offices, and retail spaces intensifies, directly supporting Brickworks' core business in bricks, pavers, and concrete products.

Consumer tastes in housing are definitely shifting. We're seeing a growing interest in smaller, more eco-friendly homes, which means less space and lower utility bills. This trend is impacting the types of homes developers are building.

There's also a noticeable move towards renting, particularly with the rise of Build to Rent (B2R) developments. In the UK, for example, the private rented sector has expanded significantly, with B2R projects becoming a major part of the housing landscape, offering professionally managed rental units.

Brickworks needs to stay nimble, adjusting its product lines and development plans to match these evolving lifestyle choices. This could mean offering a wider range of brick types suitable for smaller footprints or exploring partnerships in the B2R sector to ensure its offerings remain relevant and in demand.

Public awareness around environmental issues is significantly boosting the demand for sustainable and green buildings. This trend directly impacts construction material choices, with consumers and developers prioritizing eco-friendly options. For instance, in 2024, the global green building market was valued at approximately USD 1.1 trillion and is projected to grow substantially, reflecting this shift.

This growing preference for materials with lower carbon footprints and enhanced energy efficiency is compelling companies like Brickworks to adapt. They are increasingly investing in research and development to offer sustainable product lines that meet these evolving market expectations. This innovation is crucial for maintaining competitiveness and capturing market share in the construction sector.

Skilled Labour Shortages in Construction

Persistent skilled labour shortages in Australia's construction sector are a significant sociological factor impacting the industry. These shortages directly contribute to rising wage pressures, project delays, and a reduced capacity to fulfill market demand. For instance, reports in early 2024 indicated a critical shortfall of approximately 100,000 skilled tradespeople across Australia, a figure expected to grow. This scarcity affects the overall pace of construction projects, which in turn influences the demand for building materials like those supplied by Brickworks.

Government initiatives are in place to address this, but the problem remains deeply entrenched. These efforts include vocational training programs and migration strategies aimed at bringing in skilled workers. However, the time lag for training new workers and the complexities of international recruitment mean that immediate relief is limited. The ongoing tightness in the labour market means that construction firms must often compete fiercely for available talent, driving up labour costs.

- Labour Shortage Impact: Skilled labour shortages in Australian construction led to a projected 15% increase in average project delivery times in 2024 compared to previous years.

- Wage Growth: Average wages for skilled construction trades in Australia saw an estimated 8-10% rise in 2024 due to high demand and limited supply.

- Demand Fluctuation: Delays caused by labour issues can lead to unpredictable demand patterns for building materials, making forecasting more challenging for suppliers like Brickworks.

Community Engagement and Social License to Operate

Brickworks prioritizes its social license to operate, a vital element for its quarrying and manufacturing activities. Engaging actively with local communities and addressing their concerns directly builds trust and strengthens the company's reputation. This proactive approach helps prevent potential disruptions and regulatory hurdles.

In 2024, Brickworks continued its commitment to community development, investing $5 million in local infrastructure projects across its operational sites. This investment reflects a strategic understanding that positive community relations are fundamental to long-term business sustainability. Such engagement not only mitigates operational risks but also fosters goodwill, which is invaluable in securing continued support for their projects.

- Community Investment: $5 million allocated in 2024 for local infrastructure and social programs.

- Stakeholder Dialogue: Ongoing engagement with over 50 community groups to address concerns and foster collaboration.

- Risk Mitigation: Proactive community relations have historically reduced project delays attributed to public opposition by an estimated 15% compared to industry averages.

- Reputation Enhancement: Positive community perception contributes to a stronger brand image and easier navigation of regulatory processes.

Sociological factors significantly influence the construction industry, shaping demand and operational strategies for companies like Brickworks. Growing urbanization in Australia, with population projections indicating continued growth, directly fuels the need for housing and infrastructure, benefiting material suppliers. Furthermore, evolving consumer preferences towards smaller, eco-friendly homes and the rise of rental markets, such as Build to Rent developments, necessitate product adaptation and strategic partnerships.

Public awareness of environmental issues is a powerful driver for sustainable building practices, increasing demand for eco-friendly materials. Brickworks' investment in R&D for sustainable product lines aligns with this trend, crucial for market competitiveness. However, persistent skilled labour shortages in Australia, with an estimated shortfall of 100,000 tradespeople in early 2024, lead to project delays and wage pressures, impacting demand predictability for building materials.

Brickworks' commitment to its social license to operate, demonstrated by a $5 million investment in local community projects in 2024, is vital. This proactive community engagement mitigates risks and enhances reputation, contributing to smoother project execution and regulatory navigation. This focus on stakeholder relations is key to long-term business sustainability.

Technological factors

Advancements in fully automatic brick-making machines and other manufacturing automation technologies present significant opportunities for Brickworks. These innovations can lead to increased production efficiency and reduced labor costs, directly impacting operational expenses. For instance, by 2024, the global industrial automation market reached an estimated $300 billion, highlighting the widespread adoption and potential benefits of such technologies across industries.

Investing in these automation technologies can enhance Brickworks' competitiveness by improving product consistency and increasing overall capacity. This allows the company to better meet market demand while simultaneously optimizing its operational expenditures. The construction sector, in particular, is seeing a push towards automation to address labor shortages and boost productivity, with projections indicating continued growth in the adoption of advanced manufacturing solutions through 2025.

The construction industry is seeing significant advancements in building materials, with a growing focus on sustainability and enhanced performance. Innovations like hempcrete, cross-laminated timber (CLT), and bricks made from recycled plastics are emerging as viable alternatives to traditional materials. For instance, the global CLT market was valued at approximately USD 1.2 billion in 2023 and is projected to grow significantly, indicating a strong shift towards engineered timber solutions.

These developments present both challenges and opportunities for companies like Brickworks. Competitors leveraging these new materials could gain market share, while Brickworks itself can explore integrating them into its product lines or investing in research and development to create its own advanced material offerings. This strategic adaptation is crucial for maintaining competitiveness in a rapidly evolving market.

Brickworks' property division is significantly benefiting from the digital transformation sweeping the industry. The adoption of technologies like the Internet of Things (IoT) for predictive maintenance, for instance, allows for proactive issue resolution, minimizing downtime and repair costs. This focus on digital tools is crucial for optimizing asset performance and tenant satisfaction.

Data analytics is another key technological driver, providing Brickworks with deeper market insights. This allows for more informed real estate investment decisions and better understanding of tenant needs, directly impacting profitability. Advanced property management systems are streamlining operations, from leasing to maintenance, enhancing overall efficiency.

Energy Efficiency and Renewable Energy Technologies

Technological advancements are significantly reshaping the construction industry, particularly in energy efficiency. Innovations like solar-reflective roofing materials and integrated solar panels are increasingly becoming standard features in new builds, driven by both regulatory pressures and consumer demand for sustainable solutions. For instance, the global solar roofing market was valued at approximately $10.5 billion in 2023 and is projected to reach over $30 billion by 2030, indicating a strong growth trajectory.

Brickworks can capitalize on these trends by integrating these energy-efficient technologies into its own manufacturing processes and product development. Offering products that contribute to higher building energy ratings, such as advanced insulation or energy-harvesting facade elements, positions Brickworks favorably. This proactive approach aligns with tightening building codes, such as the increasing adoption of Net Zero Energy Building standards in many regions, and appeals to a growing market segment prioritizing sustainability and reduced operational costs.

- Solar-reflective roofing materials are gaining traction, reducing cooling loads in buildings.

- Integrated solar panels are becoming more aesthetically pleasing and efficient, offering dual functionality.

- Brickworks can enhance its product portfolio to include materials that improve a building's Energy Performance Certificate (EPC) rating.

- The global market for green building materials is expected to grow substantially, driven by these technological shifts.

Modern Methods of Construction (MMC)

Government initiatives are actively promoting Modern Methods of Construction (MMC), such as prefabrication and modular building, aiming to accelerate housing delivery. For instance, the UK government's £10 billion Home Building Fund, launched in 2020, specifically targets innovative construction techniques to boost supply. This trend could reshape demand for traditional building materials, prompting companies like Brickworks to investigate how their products can integrate with or be adapted for these evolving methods.

The adoption of MMC offers potential benefits for construction timelines and efficiency. In Australia, the New South Wales government's Affordable Housing Taskforce is exploring MMC to address housing shortages, with pilot projects demonstrating significant time savings. Brickworks might find opportunities by developing brick-based modular components or adapting its existing product lines to complement pre-engineered building systems, thereby capitalizing on this technological shift.

- Government Incentives: Many governments are offering grants and tax breaks to encourage MMC adoption, aiming for faster housing construction.

- Efficiency Gains: Prefabrication and modular building can reduce on-site labor needs and construction times, potentially lowering overall project costs.

- Material Adaptation: Brickworks could explore developing lighter-weight brick solutions or integrated brick panels suitable for off-site manufacturing.

- Market Demand Shift: A move towards MMC may decrease demand for traditional on-site bricklaying, necessitating strategic product development.

Technological advancements are a significant driver for Brickworks, particularly in automation and digital transformation. The global industrial automation market's estimated $300 billion valuation in 2024 underscores the potential for efficiency gains through advanced manufacturing technologies. Investing in these areas can boost production, reduce labor costs, and improve product consistency, enhancing Brickworks' competitiveness as the construction sector increasingly embraces automation to combat labor shortages and boost productivity through 2025.

Legal factors

Brickworks must strictly adhere to the National Construction Code (NCC), with the NCC 2025 updates focusing on energy efficiency and embodied carbon being particularly impactful. Failure to comply with these evolving standards, which are crucial for building product manufacturing and property development, could lead to significant penalties and project delays.

Increasing environmental regulations, such as mandatory climate-related financial disclosures for large Australian companies starting in 2025, directly impact Brickworks. These rules require detailed reporting on environmental performance, including carbon footprint and waste management practices. Australia's national greenhouse gas (GHG) emissions reduction targets also necessitate operational adjustments to minimize environmental impact.

Compliance with these evolving legal frameworks is paramount for Brickworks. Failure to meet stringent emissions targets and waste management standards could result in penalties and reputational damage. The company's operational strategies must therefore align with these growing environmental obligations to ensure continued legal standing and market acceptance.

Brickworks, as a major player in manufacturing and property development, operates under strict Workplace Health and Safety (WHS) regulations. These laws are designed to safeguard all individuals on its sites, from permanent staff to contractors. For instance, in Australia, the Work Health and Safety Act 2011 sets a high standard for duty of care.

Compliance necessitates ongoing vigilance. Brickworks likely invests significantly in regular safety audits and comprehensive training programs to foster a secure working environment. This proactive approach is crucial not only for preventing accidents and ensuring business continuity but also for mitigating the substantial financial and reputational risks associated with WHS breaches.

Land Use Planning and Zoning Laws

Brickworks' property division navigates a complex web of land use planning and zoning regulations. These laws, which vary significantly by jurisdiction, dictate everything from what types of buildings can be constructed on a piece of land to how densely it can be developed and what environmental safeguards must be in place. For instance, a zoning change in a key market could shift land from industrial use to residential, directly impacting Brickworks' ability to develop new manufacturing facilities or expand existing ones.

Changes in these legal frameworks present both potential windfalls and significant hurdles. A relaxation of zoning laws in an area where Brickworks holds significant undeveloped land could unlock new development opportunities, potentially increasing the value of those assets. Conversely, stricter environmental regulations or increased density restrictions could limit expansion plans and raise the cost of new projects, affecting the company's strategic growth initiatives. For example, in 2024, several major metropolitan areas saw revisions to their zoning codes aimed at increasing housing density, which could indirectly influence the availability and cost of industrial land in surrounding areas.

- Zoning Impact: Regulations directly influence where Brickworks can build and the scale of its operations.

- Environmental Compliance: Adherence to land use laws often involves costly environmental impact assessments and mitigation efforts.

- Development Feasibility: Zoning changes can alter the economic viability of new projects, impacting Brickworks' capital allocation.

- Market Dynamics: Shifts in land use policies can reshape local real estate markets, affecting Brickworks' property portfolio value.

Competition and Consumer Protection Laws

Brickworks operates within Australia's robust legal framework, particularly concerning competition and consumer protection. This means adhering to stringent regulations designed to ensure fair trading practices, maintain product quality, and prevent monopolistic or anti-competitive behaviour. For instance, the Australian Competition and Consumer Commission (ACCC) actively monitors market conduct to safeguard consumer interests and promote healthy competition.

Compliance with these laws is crucial for Brickworks. It ensures the company's operations maintain market integrity and avoids potential legal repercussions, such as fines or sanctions, that could arise from non-adherence. A strong track record in this area also bolsters Brickworks' reputation, fostering trust among consumers and business partners alike.

Key aspects of these laws that impact Brickworks include:

- Fair Trading: Ensuring all marketing, sales, and contractual practices are honest and transparent, avoiding misleading or deceptive conduct.

- Product Standards: Meeting or exceeding mandated product quality and safety standards for building materials.

- Anti-Competitive Behaviour: Prohibiting practices like price fixing, market sharing, or abuse of a dominant market position.

- Consumer Guarantees: Upholding consumer rights regarding the quality and fitness for purpose of products sold.

Brickworks must navigate evolving environmental legislation, including Australia's commitment to reducing greenhouse gas emissions and increasing renewable energy use, impacting its manufacturing processes and supply chain. The company's adherence to the National Construction Code (NCC), particularly the 2025 updates emphasizing energy efficiency and embodied carbon, is critical for compliance and avoiding penalties.

Workplace Health and Safety (WHS) laws, such as the Work Health and Safety Act 2011, mandate stringent safety protocols across Brickworks' sites to protect employees and contractors. Additionally, property development activities are governed by complex land use planning and zoning regulations, which can significantly influence project feasibility and expansion opportunities, as seen in 2024 with increased housing density initiatives in major Australian cities.

The company is also subject to competition and consumer protection laws, enforced by bodies like the ACCC, requiring fair trading practices, adherence to product standards, and avoidance of anti-competitive behaviour. These legal factors collectively shape Brickworks' operational strategies, risk management, and market positioning.

Environmental factors

Climate change presents significant physical risks to Brickworks' operations. Extreme weather events, like increased frequency of bushfires and floods in Australia, could disrupt manufacturing, logistics, and raw material sourcing. For instance, the 2019-2020 bushfire season in Australia caused widespread damage, highlighting the vulnerability of infrastructure and supply chains to such events, which could impact Brickworks' ability to deliver products.

The demand for resilient building materials is likely to grow as a direct consequence of climate change. As building codes, such as those influenced by the Australian Building Codes Board, increasingly mandate higher standards for weather resistance and energy efficiency, Brickworks has an opportunity to leverage its product portfolio. The company's focus on durable and sustainable building solutions positions it to benefit from this shift, potentially increasing sales of products designed for harsher environmental conditions.

Growing concerns about resource scarcity, especially for essential materials like clay, sand, and water in brick production, are pushing companies like Brickworks towards more sustainable sourcing. This trend is driven by increasing global demand and the finite nature of these resources.

Brickworks needs to prioritize efficient resource use, investigate alternative building materials, and implement responsible quarry management. For instance, the global construction market, a key consumer of bricks, is projected to reach USD 14.7 trillion by 2030, highlighting the pressure on raw material supply chains.

The building and construction sector is a major source of greenhouse gas emissions, with manufacturing processes like those at Brickworks being a key area of concern. In 2023, the global construction sector alone was responsible for approximately 37% of global energy-related CO2 emissions, according to the International Energy Agency.

Brickworks, as a manufacturer of building materials, is under increasing pressure to lower its carbon footprint. This involves investing in energy efficiency within its operations, exploring cleaner production technologies, and potentially transitioning to renewable energy sources to power its manufacturing facilities.

Waste Management and Circular Economy

The increasing global focus on sustainability is driving a significant shift towards waste reduction and circular economy principles within the construction sector. This trend directly impacts companies like Brickworks by creating demand for building materials that incorporate recycled content and encouraging responsible management of construction and demolition waste. For instance, the European Union's Circular Economy Action Plan aims to boost recycling rates and reduce landfill waste, setting a precedent that is influencing global markets.

Brickworks can leverage this environmental factor to its advantage. By actively integrating recycled materials, such as crushed concrete or reclaimed bricks, into its product lines, the company can differentiate itself and appeal to environmentally conscious builders and specifiers. Furthermore, implementing robust waste management strategies across its operations, focusing on reuse and recycling of waste generated during manufacturing and demolition, can lead to cost savings and enhanced brand reputation. In 2023, the construction and demolition waste generated in the EU was estimated at over 1 billion tonnes, highlighting the immense potential for material recovery.

- Growing Demand for Recycled Content: Consumers and regulators are increasingly favoring building materials made with recycled components.

- Circular Economy Initiatives: Policies promoting waste reduction and reuse in construction are becoming more prevalent globally.

- Operational Efficiency: Effective waste management can reduce disposal costs and resource consumption for Brickworks.

- Competitive Advantage: Embracing recycled materials and circular practices can enhance Brickworks' market position and brand image.

Biodiversity and Land Rehabilitation

Brickworks, as a significant player in quarrying and land development, faces considerable scrutiny regarding its environmental footprint, particularly concerning biodiversity and land rehabilitation. The company's operations directly impact local ecosystems, necessitating robust strategies for both minimizing harm during extraction and actively restoring land post-operation. This commitment is not just about regulatory compliance but is fundamental to maintaining its social license to operate and its overall environmental reputation.

Effective land rehabilitation is a key component of Brickworks' environmental stewardship. Post-quarrying, the company aims to transform disturbed sites into ecologically valuable areas, often involving native planting and habitat creation. For instance, Brickworks has committed to rehabilitation targets across its Australian operations, with a focus on creating diverse landscapes that support native flora and fauna. This proactive approach helps mitigate the long-term environmental impact of its core business activities.

Compliance with stringent environmental approvals and a proactive stance on ecological restoration are paramount. These efforts are directly linked to Brickworks' ability to secure and maintain operational permits and community acceptance. The company's 2024 sustainability reports highlight ongoing investments in rehabilitation projects, aiming to meet or exceed regulatory requirements. These initiatives are crucial for demonstrating accountability and building trust with stakeholders, ensuring the long-term viability of its land-intensive operations.

Key aspects of Brickworks' biodiversity and land rehabilitation efforts include:

- Post-extraction land transformation: Transforming quarry sites into functional ecosystems, often incorporating native species and creating new habitats.

- Compliance with environmental regulations: Adhering to strict approvals and rehabilitation standards set by various government bodies across its operational regions.

- Ecological restoration investment: Allocating resources towards planting programs, soil stabilization, and biodiversity monitoring to ensure successful land recovery.

- Stakeholder engagement: Working with local communities and environmental groups to ensure rehabilitation efforts align with broader conservation goals and community expectations.

Climate change poses physical risks to Brickworks, with extreme weather events like bushfires and floods potentially disrupting operations and supply chains, as seen in Australia's 2019-2020 bushfire season. This also drives demand for resilient building materials, aligning with stricter building codes and offering opportunities for Brickworks' durable product range.

Resource scarcity, particularly for clay, sand, and water, is a growing concern, pushing for sustainable sourcing. The global construction market's projected growth to USD 14.7 trillion by 2030 intensifies pressure on raw material supplies, necessitating efficient resource use and exploration of alternative materials.

The building sector's significant carbon footprint, with manufacturing processes contributing to the ~37% of global energy-related CO2 emissions from construction in 2023, places pressure on Brickworks to reduce its emissions through energy efficiency and cleaner technologies.

Circular economy principles are gaining traction, increasing demand for recycled content and responsible waste management in construction. Brickworks can benefit by integrating recycled materials and improving waste management, tapping into the over 1 billion tonnes of construction and demolition waste generated annually in the EU.

PESTLE Analysis Data Sources

Our Brickworks PESTLE Analysis is meticulously crafted using data from government planning portals, construction industry reports, and economic forecasting agencies. This ensures a comprehensive understanding of regulatory landscapes, market dynamics, and technological advancements impacting the sector.