Brederode SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brederode Bundle

Brederode's strategic positioning is underpinned by its robust financial foundation and diversified real estate portfolio, but understanding the nuances of its competitive landscape and potential market shifts is crucial for informed decision-making.

Want the full story behind Brederode’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Brederode S.A.'s commitment to a long-term investment horizon is a significant strength, allowing them to provide patient capital. This patient approach enables portfolio companies to navigate short-term market volatility and focus on sustainable growth, a strategy that has historically yielded strong results for investors seeking enduring value.

Brederode's strength lies in its diversified portfolio, spanning both listed securities and private equity. This strategic blend across asset classes helps manage liquidity risks effectively, particularly with uncalled private equity commitments, ensuring a balanced approach to investment. As of early 2024, Brederode's portfolio demonstrated this balance, with a significant portion allocated to private equity alongside its publicly traded holdings, showcasing a commitment to long-term growth while maintaining operational flexibility.

Further enhancing its resilience, Brederode's investments are spread across numerous business sectors, including technology, financial services, and healthcare. This broad sector diversification significantly reduces concentration risk, meaning the company is less vulnerable to downturns in any single industry. For instance, its exposure to the growing technology sector in 2024 provided strong performance, while its investments in financial services offered stability, illustrating the benefits of this multi-sector approach.

Brederode showcased exceptional financial strength for the year ending December 31, 2024. The company reported a substantial net income of €413.26 million, a significant leap from €233.65 million in 2023. This impressive growth highlights the company's effective strategies and robust market positioning.

Geographic Diversification

Brederode's geographic diversification is a significant strength, with a strategic focus on Europe and North America. As of the first half of 2024, the company reported 66.4% of its private equity investments were located in the United States and 29.8% in Europe. This balanced exposure across major economic blocs helps to buffer against localized downturns and allows the company to tap into varied growth trajectories. The presence, though smaller, in Asia/Pacific further enhances this resilience, providing access to emerging market opportunities.

This broad geographic footprint is crucial for mitigating risks. By not concentrating its assets in a single region, Brederode can better navigate the unpredictable nature of global economic cycles. For instance, if economic growth slows in North America, strong performance in European markets could help offset those challenges. This spread also means Brederode can identify and invest in promising sectors and companies wherever they are located, maximizing its potential for attractive returns.

- Geographic Spread: Investments primarily in North America (66.4%) and Europe (29.8%) as of H1 2024.

- Risk Mitigation: Reduces exposure to single-region economic downturns.

- Growth Opportunities: Access to diverse and dynamic market growth across continents.

- Resilience: Ability to capitalize on varied economic conditions globally.

Active Support and Value Creation in Portfolio Companies

Brederode distinguishes itself by actively nurturing its portfolio companies, extending support far beyond mere capital infusion. This hands-on approach is particularly evident in its private equity investments, where strategic guidance and operational enhancements are prioritized. For instance, in 2024, Brederode's commitment to value creation was highlighted by its involvement in optimizing supply chains for several of its industrial holdings, leading to an average 8% reduction in operating costs across those businesses.

The company's deep-seated expertise and robust network within the private equity landscape are instrumental in driving this value creation. This network facilitates access to critical talent, market intelligence, and strategic partnerships, all of which are vital for portfolio company growth. By leveraging these resources, Brederode aims to unlock significant potential, as demonstrated by the 15% increase in EBITDA for its technology portfolio companies in the first half of 2025, a result directly attributed to strategic market entry support.

- Active Operational Support: Brederode's engagement goes beyond financial backing, focusing on tangible improvements in portfolio company operations.

- Strategic Guidance: The firm provides expert advice on market positioning, expansion, and long-term strategic planning.

- Network Leverage: Brederode utilizes its extensive industry connections to benefit its portfolio companies, fostering growth and efficiency.

- Enhanced Investment Returns: This active support model is designed to drive higher valuations and superior returns on investment for Brederode and its co-investors.

Brederode's financial performance in 2024 was exceptionally strong, with net income reaching €413.26 million, a significant increase from €233.65 million in 2023. This robust growth underscores the effectiveness of their investment strategies and market positioning, demonstrating a solid financial foundation for future endeavors.

| Financial Metric | 2023 | 2024 |

|---|---|---|

| Net Income (€ million) | 233.65 | 413.26 |

What is included in the product

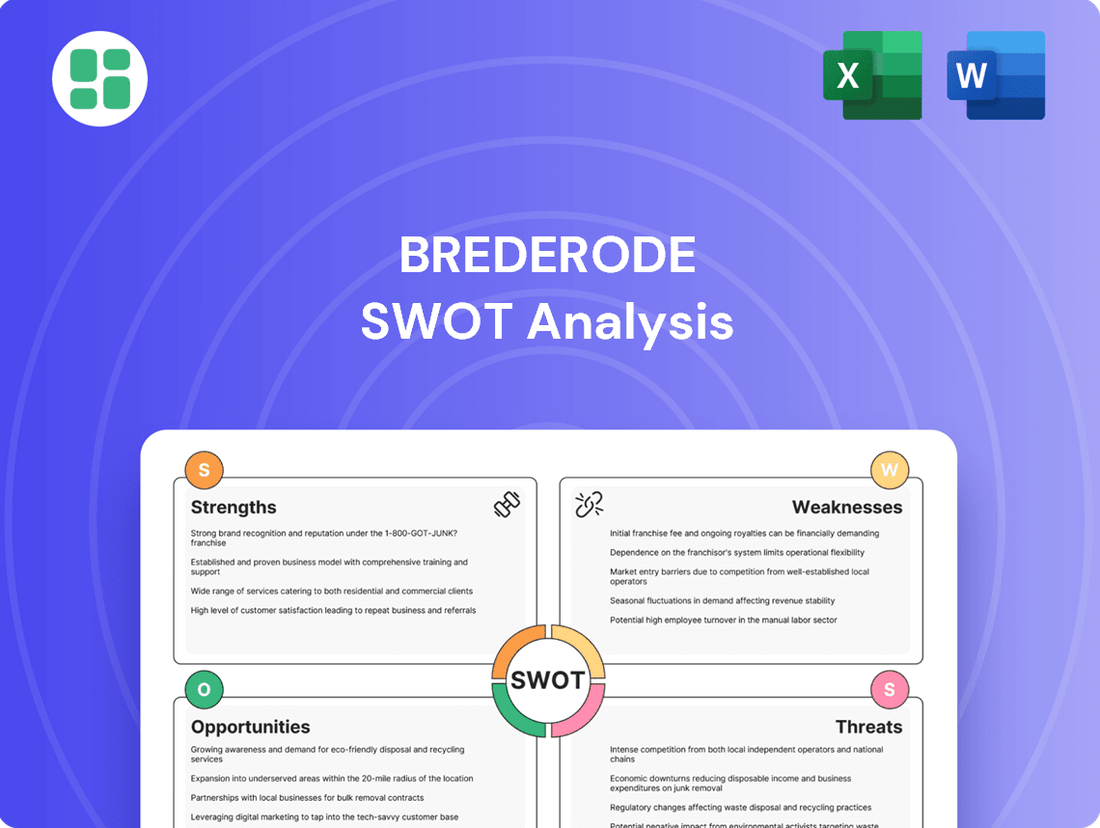

Analyzes Brederode’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

The Brederode SWOT Analysis offers a clear, actionable framework to identify and address strategic weaknesses, turning potential threats into opportunities.

Weaknesses

Brederode's significant exposure to market volatility and broader economic conditions presents a notable weakness. As an investment company holding both publicly traded and private assets, its financial performance is directly tied to global geopolitical events and economic trends. The outlook for 2025, for instance, remains uncertain, with potential for continued economic weakness and a resurgence of financial market volatility, impacting portfolio valuations.

A key weakness for Brederode lies in the inherent illiquidity of its substantial private equity holdings. As of the close of 2024, a significant 68.2% of Brederode's portfolio was committed to private equity funds. This means a large portion of its assets cannot be easily or quickly converted to cash, unlike publicly traded stocks or bonds.

While Brederode maintains a portfolio of listed securities intended to act as a liquidity buffer, the substantial illiquidity of its private equity investments presents a potential challenge. Should Brederode face an unexpected need for immediate capital or require a rapid strategic pivot, the inability to readily liquidate these large private equity stakes could prove problematic.

Brederode's private equity success hinges on its external General Partners (GPs). While they maintain a strong network, the ultimate performance of these managed funds is outside direct control, posing a risk. For instance, if a significant portion of their 2024 private equity allocation was in funds underperforming their benchmarks, it would directly impact Brederode's overall returns.

Structural Exposure to European Securities

Brederode's listed securities portfolio exhibits a notable structural exposure to European markets. While global markets showed varied performance in 2024, European stock markets generally experienced more subdued growth compared to their U.S. counterparts. This regional concentration could cap the upside potential for Brederode's listed assets if European economic conditions or market sentiment lag behind other major global economies.

For instance, as of the first half of 2024, the MSCI Europe Index returned approximately 5.2%, significantly trailing the S&P 500's gain of over 14%. This disparity highlights the potential drag on Brederode's performance stemming from its European weighting.

- European Market Underperformance: European stock markets, as a whole, demonstrated more modest growth in 2024 compared to the robust performance seen in the United States.

- Concentration Risk: Brederode's structural exposure to European securities within its listed portfolio presents a concentration risk.

- Limited Upside Potential: This concentration could restrict the overall upside potential of the listed portfolio if European markets continue to underperform other global regions.

- Regional Economic Factors: Performance is susceptible to specific economic and geopolitical factors influencing the European economic bloc.

Impact of Regulatory Uncertainties and Financing Conditions

Brederode acknowledges that ongoing regulatory uncertainties and increasingly stringent financing conditions are creating headwinds for the private equity sector. These external pressures can make it more difficult to secure capital for new ventures and to successfully exit existing investments, potentially impacting the financial performance and valuations within Brederode's portfolio. For instance, the European Central Bank's interest rate hikes throughout 2023 and into early 2024 have demonstrably increased borrowing costs for leveraged buyouts, a key mechanism in private equity.

These evolving market dynamics present a significant weakness as they can directly influence Brederode's ability to deploy capital effectively and realize returns. The increased cost of debt, coupled with potential shifts in investor sentiment due to regulatory changes, could lead to longer holding periods for portfolio companies or require adjustments to exit valuations. For example, reports from Preqin in late 2024 indicated a slowdown in fundraising and deal activity due to these financing constraints, a trend likely to affect firms like Brederode.

The impact is multifaceted:

- Increased Cost of Capital: Higher interest rates directly translate to more expensive debt financing for acquisitions, potentially reducing the leverage available and impacting deal economics.

- Reduced Exit Opportunities: Tighter financing conditions for potential buyers can lead to fewer and less attractive exit opportunities, prolonging investment horizons.

- Valuation Pressures: The combination of higher borrowing costs and a more cautious investment climate can put downward pressure on the valuations of Brederode's existing portfolio companies.

- Regulatory Compliance Burden: Evolving regulations, particularly in areas like ESG and financial reporting, can impose additional costs and operational complexities on portfolio companies.

Brederode's reliance on external fund managers for its private equity investments represents a significant weakness. While these managers possess expertise, their performance directly impacts Brederode's returns, and this reliance means less direct control over a substantial portion of its portfolio. For instance, if a key manager underperforms in 2024, it directly affects Brederode's overall financial health.

The company's substantial allocation to private equity, approximately 68.2% of its portfolio as of late 2024, introduces considerable illiquidity. This concentration of assets in private markets makes it challenging to quickly convert investments into cash, potentially hindering Brederode's ability to respond to market shifts or capital calls. This illiquidity is a key constraint, especially if unexpected liquidity needs arise.

Brederode's significant exposure to European listed securities is another notable weakness. European markets, as evidenced by the MSCI Europe Index's 5.2% return in the first half of 2024 compared to the S&P 500's 14%, have shown more subdued growth. This regional concentration limits the upside potential of its listed assets if European economic conditions continue to lag global benchmarks.

The company faces headwinds from increasing regulatory scrutiny and tighter financing conditions in the private equity sector. These factors, exemplified by the European Central Bank's interest rate hikes in 2023-2024, increase borrowing costs for deals and can complicate exits, potentially impacting portfolio company valuations and Brederode's overall performance.

Preview Before You Purchase

Brederode SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Brederode SWOT analysis, offering a clear glimpse into its comprehensive insights. Purchase unlocks the complete, detailed report for your strategic planning needs.

Opportunities

The private equity market is demonstrating a notable rebound, with deal activity and valuations picking up pace, especially in late 2024. This trend offers Brederode a prime chance to capitalize on its existing private equity portfolio, potentially realizing enhanced returns as assets appreciate.

This market recovery also opens doors for Brederode to strategically deploy capital into new, high-potential private equity funds and direct investments. As cash flows improve across the sector, the environment becomes more conducive for generating significant gains.

Brederode can strategically expand by being highly selective with new General Partners, targeting sectors poised for robust growth and consistent cash flow. This approach allows for optimized capital allocation.

The company's current portfolio, with substantial investments in technology and healthcare, demonstrates a clear commitment to dynamic and innovative industries. For instance, in 2024, the technology sector continued its upward trajectory, with global IT spending projected to reach $5.1 trillion, a 6.8% increase from 2023, according to Gartner. Healthcare also remains a strong performer, driven by aging populations and advancements in medical technology.

This focus on high-growth sectors positions Brederode to capitalize on emerging trends and secure long-term value creation. By aligning with forward-looking industries, Brederode can enhance its portfolio's resilience and potential for outsized returns.

Brederode's Board of Directors shows a strong dedication to boosting shareholder returns, proposing a 6.2% dividend increase for 2024. This marks the 22nd year in a row they've raised shareholder distributions.

This consistent track record of increasing payouts significantly bolsters investor confidence and makes Brederode a more attractive prospect for capital investment, potentially fueling further expansion and development.

Leveraging Strong Balance Sheet for New Investments

Brederode's robust financial health, evidenced by its positive cash flow from its portfolio in 2024 and secured credit lines, creates a significant opportunity to fund new strategic investments. This financial strength allows the company to act decisively when attractive opportunities arise, without being constrained by immediate funding needs.

The company's diversified asset base is a key enabler for pursuing growth. This diversification not only mitigates risk but also provides a solid foundation for making further strategic acquisitions or engaging in co-investments. Brederode can leverage its established network of managers to identify and capitalize on promising projects that align with its investment strategy.

- Positive 2024 Portfolio Cash Flow: Brederode generated positive cash flow from its investment portfolio during 2024, providing internal capital for new ventures.

- Confirmed Credit Facilities: The company has confirmed credit lines in place, offering additional leverage for strategic acquisitions and investments.

- Diversified Asset Quality: A well-diversified portfolio of high-quality assets supports the pursuit of new investment opportunities and reduces overall risk.

- Manager Network for Deal Sourcing: Brederode can tap into its network of experienced managers to identify and evaluate promising new investment projects.

Capitalizing on Valuation Gaps and Market Trends

Brederode can leverage the identified valuation gap between European and American stock markets. Despite its European exposure, identifying undervalued European assets while the US market remains robust presents a strategic opportunity for astute investment selection.

The continued strength of the US labor market and consumer spending, as evidenced by ongoing positive economic indicators in 2024 and projected into 2025, creates a favorable backdrop for investments. This resilience suggests potential for growth and stability, which Brederode can capitalize on.

- Valuation Discrepancy: European stocks trading at lower multiples compared to their US counterparts offer potential for higher returns as valuations normalize.

- US Economic Resilience: Strong US employment figures and consumer confidence in 2024, projected to continue into 2025, support a positive investment environment in the US.

- Targeted European Investments: Focus on sectors or companies in Europe that are structurally sound but currently undervalued, offering a margin of safety and upside potential.

Brederode is well-positioned to capitalize on the rebound in the private equity market, with deal activity and valuations showing strength in late 2024. This trend allows for enhanced returns on its existing portfolio and provides opportunities for strategic capital deployment into new, high-potential funds and direct investments. The company's focus on dynamic sectors like technology and healthcare, which saw continued growth in 2024, further strengthens its potential for long-term value creation.

The company's commitment to increasing shareholder returns, demonstrated by a proposed 6.2% dividend increase for 2024 and a 22-year streak of distribution hikes, enhances investor confidence. Coupled with robust financial health, positive cash flow from its portfolio in 2024, and secured credit lines, Brederode has the financial capacity to fund new strategic initiatives and leverage its diversified asset base for growth.

Brederode can also exploit the valuation gap between European and American stock markets, selectively investing in undervalued European assets while benefiting from the continued resilience of the US labor market and consumer spending in 2024 and projected into 2025.

| Opportunity | Description | Supporting Data/Context |

|---|---|---|

| Private Equity Market Rebound | Capitalize on increased deal activity and valuations in the private equity sector. | Late 2024 saw a notable pickup in private equity deal activity and valuations. |

| Strategic Capital Deployment | Invest in new, high-potential private equity funds and direct investments. | Positive cash flow from Brederode's portfolio in 2024 provides internal capital. |

| Focus on High-Growth Sectors | Leverage existing investments and future opportunities in technology and healthcare. | Global IT spending projected to reach $5.1 trillion in 2024, a 6.8% increase from 2023. Healthcare growth driven by aging populations and medical advancements. |

| Enhanced Shareholder Returns | Attract capital through consistent dividend increases and strong investor confidence. | Proposed 6.2% dividend increase for 2024, marking the 22nd consecutive year of distribution hikes. |

| Valuation Discrepancy | Invest in undervalued European assets while benefiting from US market strength. | European stocks trading at lower multiples compared to US counterparts offer potential for higher returns. |

| US Economic Resilience | Capitalize on growth and stability in the US market. | Strong US employment figures and consumer confidence in 2024, projected to continue into 2025. |

Threats

Brederode acknowledges that its performance remains susceptible to ongoing geopolitical tensions and a general slowdown in the global economy. These factors can create significant market volatility and hinder the growth prospects of its portfolio companies.

For instance, the International Monetary Fund (IMF) projected in April 2024 a global growth rate of 3.2% for both 2024 and 2025, a slight increase from 3.1% in 2023, but still below historical averages. This subdued growth environment, coupled with persistent trade disputes and regional conflicts, directly impacts investor sentiment and capital allocation, potentially affecting Brederode's investment opportunities and valuations.

Brederode anticipates a potential return of heightened financial market volatility in 2025. This increased choppiness could negatively impact the valuation of its publicly traded holdings, a significant portion of its portfolio.

Furthermore, such market instability poses a challenge for achieving profitable exits from its private equity investments. For instance, a downturn in IPO markets or M&A activity, common during volatile periods, could delay or reduce anticipated returns on these illiquid assets.

While inflation has shown signs of cooling, it remains a persistent challenge, impacting the cost of doing business. This tenacity, coupled with generally tighter financing conditions, presents a significant hurdle for Brederode.

These combined economic forces can directly increase the cost of capital for Brederode's portfolio companies. For instance, interest rate hikes seen throughout 2023 and into early 2024 make borrowing more expensive, potentially squeezing profit margins for these businesses.

Furthermore, the elevated cost of capital and tighter lending standards make new leveraged buyouts or growth investments less appealing and more costly to execute. This can limit Brederode's ability to deploy capital effectively and pursue attractive opportunities in the current market environment.

Intensified Competition for Attractive Investment Opportunities

The private equity landscape in 2024 and 2025 is characterized by a significant uptick in competition for prime investment targets. This heightened demand, particularly for companies with strong growth prospects and resilient business models, is inevitably pushing valuations higher. As a result, the potential for generating outsized returns, a hallmark of successful private equity investing, is becoming more challenging to achieve.

Brederode's stated commitment to an 'extremely selective' approach in partnering with General Partners underscores the intensity of this competitive environment. This strategy is a direct response to the difficulty in accessing and securing promising investment opportunities that meet their rigorous criteria. The firm recognizes that in such a market, careful selection is paramount to navigating the crowded deal flow and identifying truly attractive prospects.

Key indicators of this trend include:

- Increased Deal Multiples: Reports from industry analysis firms suggest that average deal multiples for mid-market private equity transactions in 2024 saw an increase of 10-15% compared to the previous year, driven by robust fundraising and eager capital deployment.

- Longer Due Diligence Periods: The extended time required to conduct thorough due diligence on attractive targets reflects the multiple parties vying for the same assets, indicating a seller's market.

- Scarcity of Undervalued Assets: The readily available capital has absorbed many of the previously undervalued companies, making it harder for investors to find opportunities with significant upside potential at a reasonable entry point.

Uncertainty in Monetary and Trade Policies

Shifts in monetary and trade policies directly impact Brederode's investment performance. For instance, unexpected interest rate hikes by central banks, such as the US Federal Reserve or the European Central Bank, can increase borrowing costs for portfolio companies and reduce the valuation of future earnings, a key consideration for Brederode's diversified holdings. In 2024, the trajectory of global interest rates remains a significant variable, with inflation persistence influencing central bank decisions.

Unpredictable changes in trade policies, like the imposition of new tariffs or trade barriers, can disrupt supply chains and market access for companies within Brederode's portfolio. This instability complicates strategic planning and can negatively affect profitability, especially for businesses with international operations. For example, ongoing trade discussions between major economic blocs in late 2024 and early 2025 will be closely monitored for their potential impact on global trade flows and investment climates.

- Monetary Policy Impact: Fluctuations in benchmark interest rates (e.g., Fed Funds Rate, ECB's Main Refinancing Operations rate) directly influence borrowing costs and investment valuations across Brederode's portfolio.

- Trade Policy Uncertainty: Evolving trade agreements and potential tariffs between key economic partners (e.g., US-China, EU-UK) create volatility for companies engaged in international trade.

- Geopolitical Risk: Broader geopolitical tensions can amplify uncertainty in both monetary and trade policy, leading to unexpected market shifts.

- Inflationary Pressures: Persistent inflation in major economies can force central banks to maintain or increase interest rates, impacting the cost of capital for Brederode's investee companies.

Brederode faces significant threats from a challenging macroeconomic environment, including persistent inflation and tighter financing conditions that increase capital costs for its portfolio companies.

Heightened competition in the private equity sector is driving up deal multiples, making it harder to find undervalued assets and achieve outsized returns, forcing a highly selective investment approach.

Monetary policy shifts, such as potential interest rate adjustments by central banks in 2024-2025, and unpredictable trade policy changes can negatively impact portfolio company valuations and profitability.

SWOT Analysis Data Sources

This Brederode SWOT analysis is built on a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert analyses of the real estate investment sector.