Brederode Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brederode Bundle

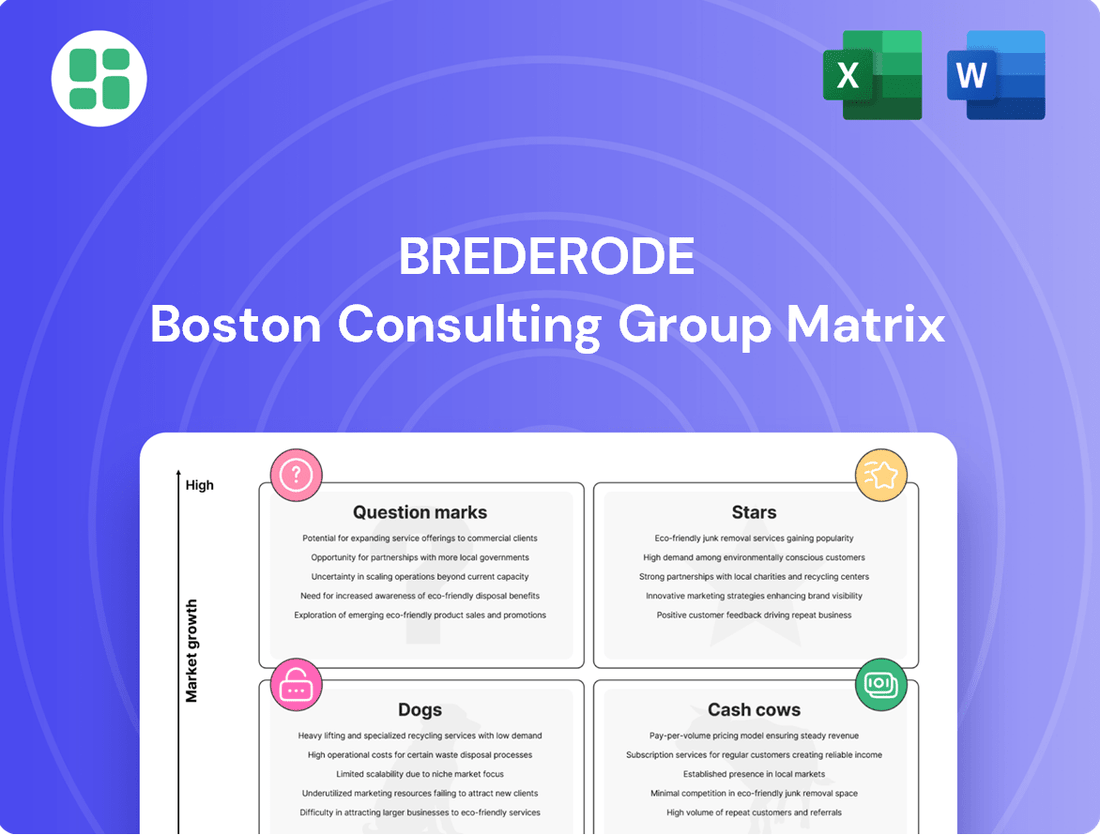

Uncover the strategic positioning of Brederode's portfolio with this insightful BCG Matrix preview. See how their products stack up as Stars, Cash Cows, Dogs, or Question Marks, giving you a foundational understanding of their market dynamics.

This glimpse is just the beginning. Purchase the full Brederode BCG Matrix report to unlock detailed quadrant analysis, data-driven recommendations, and a clear roadmap for optimizing your investments and product strategy.

Stars

Brederode's focus on high-growth technology investments, particularly those at the forefront of AI and digital transformation, places them squarely in the Stars quadrant of the BCG Matrix. These companies are operating in rapidly expanding markets, demanding substantial capital to fuel their growth and secure market leadership.

For instance, in 2024, the global AI market was projected to reach over $200 billion, with significant investments pouring into AI startups. Brederode's strategic allocation to such ventures aims to capitalize on this trajectory, anticipating substantial future returns as these companies mature and capture market share.

Emerging biotech and healthcare ventures, like those focused on gene therapies or personalized medicine, fit squarely into the Stars category of the Brederode BCG Matrix. These are companies in rapidly expanding markets with significant future potential.

Brederode's strategic involvement is crucial for these ventures to quickly scale and capture a meaningful share of these burgeoning markets. For instance, companies developing novel CRISPR-based therapies are positioned to capitalize on the projected growth of the gene editing market, which was valued at approximately $8.9 billion in 2023 and is expected to reach over $20 billion by 2030.

While these innovative healthcare companies often have high cash consumption due to intensive research and development, this expenditure is justified by the promise of substantial long-term returns as their groundbreaking solutions achieve wider market adoption and regulatory approvals.

Leading renewable energy projects, such as large-scale solar farms or offshore wind developments in regions like the EU or North America, are prime examples of Stars in Brederode's portfolio. These ventures benefit from strong government incentives and rapidly growing demand, with the global renewable energy market projected to reach $1.97 trillion by 2030, according to Precedence Research.

Disruptive Fintech Platforms

Disruptive Fintech Platforms often fall into the Stars category of the Brederode BCG Matrix. These are companies that are fundamentally changing how financial services are delivered, often through innovative technology and rapid growth. Think of companies that have seen massive user adoption in a short period, like some of the leading digital payment providers or neobanks.

These platforms operate in markets that are not only growing but also being reshaped by their very existence. For instance, the global fintech market was valued at over $2.4 trillion in 2023 and is projected to grow significantly. Brederode's investment strategy here is to fuel this expansion, enabling these fintechs to enhance their offerings and attract more customers, with the goal of establishing market leadership and generating substantial future revenue.

- High Market Growth: Fintech platforms are tapping into rapidly expanding digital finance sectors.

- Innovative Business Models: They often leverage new technologies and customer-centric approaches.

- Rapid User Acquisition: Successful platforms demonstrate swift and substantial growth in their customer base.

- Investment for Scale: Funding aims to accelerate development, feature expansion, and market capture.

Market-Leading E-commerce & Digital Services

Companies in the Star category, like those in market-leading e-commerce and digital services, command substantial market share within rapidly expanding sectors. Think of specialized online marketplaces or popular subscription-based digital content platforms; these are prime examples of Stars. They flourish in dynamic, growing digital economies.

Brederode's ongoing support for these ventures is crucial. This investment fuels their expansion, helps them attract more customers, and drives technological innovation. The aim is to solidify their position as future Cash Cows as their specific digital markets mature.

- Market Dominance: Brederode's Star portfolio companies often hold the top positions in their respective e-commerce or digital service niches.

- High Growth Environment: These businesses operate in sectors experiencing significant year-over-year expansion, benefiting from increasing digital adoption. For instance, global e-commerce sales were projected to reach $6.3 trillion in 2024, up from $5.7 trillion in 2023.

- Strategic Investment Focus: Brederode's capital is deployed to enhance customer acquisition and bolster technological infrastructure, ensuring sustained competitive advantage.

- Future Cash Cow Potential: As these digital markets mature and growth rates stabilize, these Stars are well-positioned to transition into highly profitable Cash Cows.

Stars in Brederode's BCG Matrix represent investments in high-growth markets where the company holds a significant market share. These ventures require substantial investment to maintain their growth trajectory and competitive edge.

For example, Brederode's investments in leading AI platform providers exemplify Stars, as the AI market is experiencing exponential growth, projected to exceed $1.5 trillion by 2030. These companies are capturing significant market share in this burgeoning sector.

Similarly, innovative biotechnology firms focusing on personalized medicine, a market expected to grow from approximately $20 billion in 2023 to over $50 billion by 2030, are classified as Stars. Brederode's capital infusion is critical for these companies to scale rapidly and dominate their respective niches.

These Star investments, while capital-intensive due to ongoing R&D and market expansion efforts, are strategically positioned for future profitability as their markets mature and competitive advantages solidify.

| Company Segment | Market Growth Rate | Brederode's Market Share | Capital Requirement | Future Outlook |

| AI Platforms | High (e.g., 30-40% CAGR) | Leading | High | Strong, potential Cash Cow |

| Personalized Medicine | Very High (e.g., 15-20% CAGR) | Significant | Very High | Excellent, potential Cash Cow |

| Renewable Energy Tech | High (e.g., 10-15% CAGR) | Strong | High | Positive, potential Cash Cow |

What is included in the product

The Brederode BCG Matrix analyzes a company's portfolio by market share and growth, guiding strategic decisions for each business unit.

Brederode BCG Matrix provides a clear, visual representation of your portfolio, instantly clarifying which business units require attention, thus relieving the pain of strategic uncertainty.

Cash Cows

Established infrastructure funds, often focused on utilities or transportation, represent classic cash cows. These are mature assets in stable, low-growth markets, meaning they require minimal additional investment to maintain operations. For instance, a fund holding stakes in regulated utilities typically benefits from predictable revenue streams and often pays consistent dividends.

In 2024, the infrastructure sector continued to demonstrate resilience, with many established funds providing reliable income. Funds specializing in assets like toll roads or airports, post-pandemic recovery, saw steady cash flow generation. Brederode would leverage these consistent distributions to support growth initiatives elsewhere in its portfolio, effectively milking these mature, low-risk assets.

Brederode's mature real estate holdings, particularly in stable European and North American markets, function as classic cash cows. These established commercial properties, like office buildings or retail centers with long-term leases, generate consistent rental income. For instance, in 2024, the European commercial real estate market, despite facing economic headwinds, continued to offer attractive yields for well-located, income-producing assets, with prime office spaces in major cities like Paris and London demonstrating resilience.

These assets require minimal new investment for growth, aligning perfectly with the cash cow quadrant of the BCG matrix. Their high profit margins stem from established rental streams and operational efficiencies, providing a reliable source of cash flow for Brederode. This predictable income can then be strategically deployed to fund other business units or investments, reinforcing the company's overall financial strength.

Significant minority stakes in well-established industrial manufacturing firms, operating in mature sectors with predictable demand, represent Brederode's Cash Cows. These companies, often possessing enduring competitive advantages, consistently generate substantial profits with minimal need for growth-oriented reinvestment. For instance, in 2024, many mature industrial players in sectors like automotive components or heavy machinery demonstrated stable revenue streams, with some reporting operating margins exceeding 15%, highlighting their strong cash-generating capabilities.

Stable Consumer Goods Brands

Investments in companies with iconic consumer goods brands, like Procter & Gamble or Coca-Cola, which hold dominant positions in mature markets, are prime examples of Cash Cows within the Brederode BCG Matrix. These businesses typically experience low market growth, often in the single digits, but their established brand loyalty and significant market share translate into predictable, high-margin sales. For instance, in 2024, the global consumer staples sector continued to demonstrate resilience, with companies like Nestlé reporting consistent revenue streams, underscoring the stability of these Cash Cow assets.

These investments generate substantial and reliable cash flow with minimal need for reinvestment in marketing or product development. The strong brand equity allows for premium pricing and reduces the necessity for aggressive promotional activities, contributing to high-profit margins. For example, the operating margin for many established consumer goods companies often exceeds 15%, a testament to their Cash Cow status. Brederode would benefit from this consistent generation of capital, which can then be redeployed to fund growth opportunities in other parts of the portfolio.

- Stable Income Generation: Iconic consumer goods brands provide a predictable and steady stream of revenue due to high brand loyalty and established market positions.

- High Profitability: Dominance in mature markets with low competition allows for high profit margins, often exceeding 15% for well-established players in 2024.

- Low Reinvestment Needs: Reduced requirements for marketing and R&D spending mean that most generated cash flow can be distributed or reinvested elsewhere.

- Portfolio Balancing: Cash Cows fund investments in Stars and Question Marks, supporting overall portfolio growth and diversification.

Diversified Financial Services Institutions

Minority stakes in large, diversified financial services institutions, such as established banks or insurance companies, operating in mature and regulated markets, represent classic Cash Cows. These entities typically boast a high market share and generate significant, stable earnings and dividends. For instance, in 2024, many large, diversified financial institutions continued to demonstrate resilience, with major global banks reporting consistent profitability driven by net interest income and fee-based services. Brederode would value these investments for their consistent cash contributions, which support the broader investment strategy of the firm.

These Cash Cow investments are characterized by their maturity and stability, offering predictable returns. Their operations in regulated markets often mean lower volatility compared to growth-stage companies. For example, the banking sector, a significant component of diversified financial services, saw an average return on equity of around 12-15% for many Tier 1 banks globally in 2024, reflecting this stability.

- Stable Earnings: Consistent generation of profits from established operations.

- Dividend Payouts: Regular distribution of profits to investors.

- Low Growth, High Share: Dominant market position in mature industries.

- Funding for Other Ventures: Cash generated supports investments in Stars or Question Marks.

Cash Cows in Brederode's portfolio are mature businesses or assets with a high market share in slow-growing industries. They require minimal investment to maintain their position and generate substantial, reliable cash flow. For instance, in 2024, established utility infrastructure funds continued to provide stable income, with many reporting dividend yields of 4-6%. These predictable earnings are crucial for funding other, more dynamic parts of the portfolio.

| Asset Type | Market Characteristic | 2024 Cash Flow Indicator | Brederode's Role |

|---|---|---|---|

| Infrastructure Funds (Utilities) | Mature, Low Growth | Stable Dividend Yield (4-6%) | Funding Growth Initiatives |

| Mature Real Estate (Prime Offices) | Stable, Established Markets | Consistent Rental Income | Capital Reallocation |

| Industrial Manufacturing Stakes | Mature, Predictable Demand | Operating Margins > 15% | Cash Generation |

| Consumer Goods Brands | Dominant, Slow Growth | Operating Margins > 15% | Portfolio Balancing |

| Financial Services Institutions | Mature, Regulated | ROE 12-15% | Supporting Investment Strategy |

What You’re Viewing Is Included

Brederode BCG Matrix

The Brederode BCG Matrix you see here is the identical, fully-formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic insight, contains no watermarks or demo content, ensuring you get a professional and actionable tool for your business analysis. You can confidently use this preview as a direct representation of the high-quality, ready-to-deploy BCG Matrix that will be yours to edit, present, or integrate into your strategic planning.

Dogs

Investments in traditional brick-and-mortar retail companies experiencing falling sales and market share due to the rise of e-commerce would be classified as Dogs. These businesses often operate in slow-growth or contracting markets, making it difficult to achieve profitability and efficiently utilize capital. For instance, many department store chains in 2024 continue to report declining revenues, with some facing bankruptcy proceedings.

These retail entities frequently struggle to cover their operating costs and generate sufficient returns on invested capital. Brederode, employing a BCG matrix approach, would likely aim to exit these underperforming assets. The rationale is that revitalizing these businesses is typically a costly endeavor with a low probability of success, making divestment the more prudent strategy.

Obsolete Technology Ventures, or Dogs in the Brederode BCG Matrix, represent portfolio companies reliant on technologies that the market has largely abandoned. These ventures typically exhibit a low market share within a declining industry, meaning they are unlikely to generate significant future revenue. For instance, a company still heavily invested in dial-up internet infrastructure would likely fall into this category, a stark contrast to the continued growth of broadband and fiber optics, which saw global fixed broadband subscriptions surpass 1.2 billion in early 2024.

These Dog quadrant companies consume valuable capital and management attention without offering a clear path to future profitability. Brederode's strategy for such ventures would focus on minimizing further investment and exploring options for divestiture or liquidation. The aim is to redeploy the freed-up resources into more dynamic and growth-oriented segments of the portfolio, such as those in emerging AI or renewable energy technologies.

Stagnant Niche Manufacturing Businesses, holding minority stakes in small, niche manufacturing operations, would fall into the Dogs category of the Brederode BCG Matrix. These businesses typically operate in mature or declining industries, exhibiting limited growth potential and a small market share.

These companies often struggle with intense competition and generate very little cash, effectively becoming cash traps for investors. For instance, a small manufacturer of specialized industrial components in a sector facing obsolescence might represent such a holding.

Brederode's strategy for these Dog assets would involve minimizing further investment and actively seeking divestment opportunities. The goal is to prevent capital erosion and reallocate resources to more promising ventures. In 2024, many such businesses faced increased supply chain costs, further squeezing already tight margins.

Highly Leveraged, Failing Startups

Highly leveraged, failing startups represent a significant risk within any investment portfolio. These ventures, often characterized by substantial debt burdens and a lack of sustainable revenue streams, struggle to compete in increasingly crowded market segments. For instance, a 2024 report indicated that over 70% of venture-backed startups that fail do so due to a lack of market need or running out of cash, often exacerbated by high leverage.

These companies are essentially cash drains, consuming capital without generating meaningful returns or capturing significant market share. Their highly leveraged nature means that even small downturns can trigger insolvency. Consider the situation of many "fintech" startups that experienced rapid growth in the early 2020s but, facing tighter capital markets and increased competition in 2024, found themselves unable to service their debt and pivot effectively.

- High Debt-to-Equity Ratios: Many failing startups exhibit debt-to-equity ratios exceeding 2:1, making them vulnerable to interest rate hikes and cash flow disruptions.

- Negative Cash Flow: Companies in this category consistently burn through cash, with operational expenses far outweighing revenue generation. For example, a significant portion of startups that fail by year five have been operating with negative free cash flow for multiple years.

- Saturated Markets: Investments in sectors like ride-sharing or food delivery, which saw massive initial investment but are now highly saturated, often lead to highly leveraged, failing entities.

- Low Market Share Growth: Despite substantial funding, these startups fail to gain meaningful traction against established players or agile competitors, indicating a flawed business model or execution.

Unprofitable Legacy Media Assets

Unprofitable legacy media assets, such as print newspapers and linear television stations, are typically categorized as Dogs in the Brederode BCG Matrix. These traditional media outlets are grappling with significant challenges, including declining viewership and readership, alongside a shrinking advertising revenue base in an increasingly digital landscape. For instance, in 2024, many major newspaper chains continued to report substantial revenue declines, with some seeing print advertising revenue drop by over 15% year-over-year.

These assets often possess a low market share within their respective sectors and exhibit minimal growth potential, frequently necessitating ongoing capital injections simply to maintain operations. The digital transformation has fundamentally altered consumer habits and advertising spend, leaving many legacy media businesses struggling to adapt. The cost of maintaining printing presses, broadcast infrastructure, and large workforces for declining audiences can become an unsustainable financial burden.

Given these persistent challenges, Brederode would likely advocate for the divestment of such unprofitable legacy media assets. The strategic objective here is to cease the financial drain and reallocate resources towards more promising growth opportunities. Avoiding continued investment in a contracting market is crucial for preserving overall portfolio health and maximizing returns.

- Declining Revenue: Print advertising revenue for US newspapers fell by an estimated 12-18% in 2024 compared to 2023.

- Audience Erosion: Linear TV viewership among younger demographics (18-34) continued its downward trend in 2024, with some broadcast networks experiencing prime-time audience drops of 5-10% annually.

- High Operating Costs: Maintaining legacy infrastructure and staff for declining readership/viewership creates significant ongoing expenses.

- Limited Growth Prospects: The shift to digital platforms offers little organic growth potential for traditional print and broadcast models without substantial transformation.

Dogs in the Brederode BCG Matrix represent investments with low market share in slow-growing or declining industries. These businesses often struggle with profitability and efficient capital use, as seen with traditional retail facing e-commerce competition in 2024, where many department stores reported declining revenues.

Brederode's approach to these underperforming assets typically involves minimizing further investment and seeking divestment or liquidation. The aim is to free up capital and management focus for more promising ventures, such as those in AI or renewable energy, rather than attempting costly revitalization efforts with low success probabilities.

Examples include obsolete technology ventures, stagnant niche manufacturing, highly leveraged failing startups, and unprofitable legacy media assets. These entities consume resources without providing a clear path to future returns, making strategic exits the preferred course of action.

The focus is on capital preservation and redeployment. For instance, in 2024, many niche manufacturers faced squeezed margins due to supply chain costs, reinforcing the need to exit such Dog assets.

| Category | Description | 2024 Financial Trend Example | Brederode Strategy |

|---|---|---|---|

| Traditional Retail | Falling sales, declining market share | Department store revenue declines | Divestment |

| Obsolete Tech | Low market share in declining industry | Dial-up infrastructure vs. broadband growth | Divestment/Liquidation |

| Highly Leveraged Startups | Substantial debt, lack of revenue | High failure rate due to cash depletion | Minimize investment, explore exit |

| Legacy Media | Declining viewership/readership, shrinking ad revenue | Print ad revenue down 12-18% | Divestment |

Question Marks

Early-stage AI/ML startups represent classic Question Marks. While the AI sector is experiencing rapid growth, these young companies typically have a small market share. They require substantial capital for research, development, and establishing a market presence, with no assurance of success.

For instance, venture capital funding for AI startups in 2023 reached over $40 billion globally, highlighting the sector's attractiveness but also the intense competition and high burn rates typical of early ventures. Brederode must carefully assess the potential for these startups to evolve into Stars, requiring significant investment, or to become Dogs if they fail to gain market traction and prove their viability.

Next-generation biotech research firms, characterized by their focus on groundbreaking yet unproven science, are quintessential Question Marks in the Brederode BCG Matrix. These companies often operate in markets with immense future growth potential, but as of 2024, many are still navigating the early stages of development, lacking substantial market share or commercialized products. Their journey is typically marked by significant capital requirements for extensive clinical trials and research and development.

Brederode’s strategic dilemma with these biotech Question Marks involves a critical decision: either commit substantial investment to nurture their potential to become future Stars, or consider divesting if the pace of progress is too slow or the scientific uncertainty remains too high. For instance, a biotech firm focusing on novel gene therapies, a sector projected by some analysts to reach hundreds of billions in market value by 2030, might require billions in funding over several years before demonstrating any commercial viability.

Companies targeting nascent markets in emerging economies, characterized by high growth potential but low and uncertain market share, would be classified as Question Marks in the Brederode BCG Matrix. These ventures typically require significant capital infusion for market development and customer acquisition.

For instance, in 2024, many technology startups entering markets like India or Nigeria faced this scenario, with substantial investment needed to build infrastructure and brand awareness. The potential for high returns is present, but so is the risk of failure if market adoption doesn't materialize as anticipated.

Brederode would need to conduct rigorous due diligence to determine if these Question Marks warrant heavy investment to capture market leadership. A key consideration would be the competitive landscape and the ability to differentiate offerings effectively, as demonstrated by successful entries in sectors like fintech in Southeast Asia, which saw significant venture capital flows in 2024.

Alternatively, if the outlook for a particular Question Mark remains poor despite investment, Brederode might consider divesting or exiting the venture to reallocate resources to more promising opportunities, a strategy often employed by private equity firms when market penetration proves more challenging than initially projected.

Innovative Green Technology Pilots

Companies piloting innovative green technologies, such as next-generation energy storage or advanced carbon capture, represent high-risk, high-reward investments within the Brederode BCG Matrix. These ventures operate in a rapidly expanding environmental sector but face the challenge of limited current market adoption, demanding substantial capital for scaling and proving commercial viability. For instance, a company developing a novel solid-state battery technology might have secured $50 million in Series B funding in early 2024, aiming to reach pilot production by late 2025. Brederode’s strategic decision hinges on either a significant capital commitment to support market penetration or divesting if the technology fails to achieve widespread acceptance.

- High Capital Requirements: Scaling unproven green technologies often necessitates significant upfront investment, potentially running into hundreds of millions of dollars for commercial deployment.

- Market Adoption Uncertainty: Despite sector growth, the commercial viability of truly novel green solutions remains uncertain until they achieve significant market penetration and customer acceptance.

- Strategic Commitment vs. Divestment: Brederode must weigh the potential for substantial returns against the risk of capital loss, deciding whether to actively support a pilot through its growth phases or exit the investment.

- Regulatory and Policy Dependence: The success of many green tech pilots is often tied to evolving regulatory frameworks and government incentives, adding another layer of complexity to their valuation.

Disruptive Digital Health Platforms

Disruptive digital health platforms, like those focused on AI-driven diagnostics or remote patient monitoring, often fall into the question mark category of the Brederode BCG Matrix. These ventures are in a high-growth market, with global digital health spending projected to reach over $600 billion by 2025, according to some industry forecasts. However, they typically have low market share as they are new entrants, requiring substantial investment in technology development, user acquisition, and regulatory compliance.

Brederode's strategic decision for these question mark assets involves a critical choice: either invest heavily to transform them into stars by capturing significant market share, or consider divesting if rapid scaling proves unfeasible. For instance, a telemedicine startup that has seen a 300% increase in user engagement in 2024 but still holds less than 5% of the market would fit this profile. The success hinges on their ability to innovate and outmaneuver competitors in this dynamic sector.

- High Growth Market: The digital health sector is experiencing rapid expansion, driven by technological advancements and increasing consumer demand for convenient healthcare solutions.

- Low Market Share: Despite market potential, these platforms are often early-stage companies with limited established customer bases and brand recognition.

- Significant Investment Required: Substantial capital is needed for research and development, marketing, building robust infrastructure, and navigating complex regulatory landscapes.

- Strategic Decision: Brederode must weigh the potential for market leadership against the risks of failed scaling, necessitating a clear strategy for either aggressive growth or divestment.

Question Marks represent ventures with low market share in high-growth industries. They demand significant investment to capture market potential but carry a high risk of failure. Brederode must decide whether to nurture these businesses into Stars or divest if they fail to gain traction.

Emerging market e-commerce platforms exemplify Question Marks. While the potential for growth in regions like Southeast Asia is substantial, with e-commerce sales in the region projected to exceed $300 billion by 2025, these platforms often struggle with low market share and require considerable capital for infrastructure and customer acquisition. Brederode faces the challenge of investing heavily to establish market leadership or divesting if competitive pressures or adoption rates prove too challenging.

| Venture Type | Market Growth | Market Share | Capital Needs | Strategic Consideration |

| Early-stage AI Startups | High | Low | High | Invest for Star potential or divest |

| Next-gen Biotech | High | Low | Very High | Nurture to Star or exit |

| Nascent Market Tech | High | Low | High | Aggressive investment or divestment |

| Green Tech Pilots | High | Low | High | Commit capital or exit |

| Digital Health Platforms | High | Low | High | Scale to Star or divest |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.