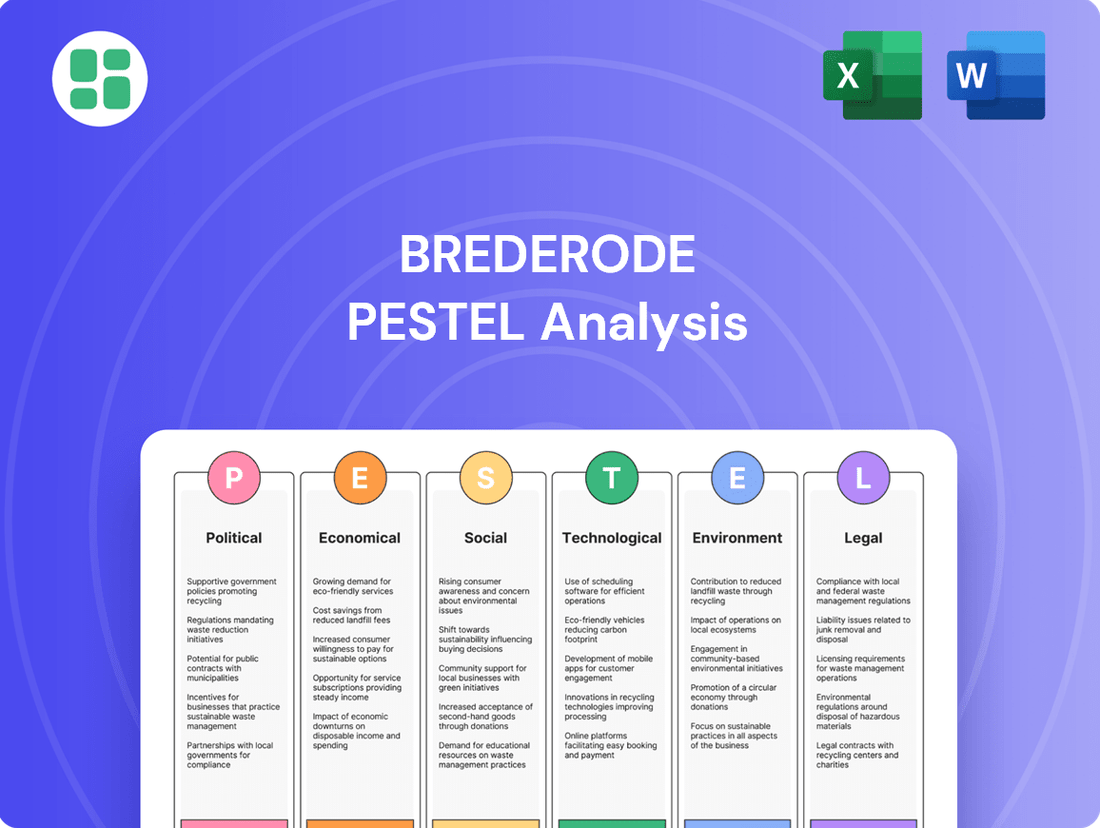

Brederode PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brederode Bundle

Uncover the critical external factors impacting Brederode's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to technological advancements, understand the forces shaping its competitive environment. Equip yourself with actionable intelligence to refine your strategy and secure future success. Download the full PESTLE analysis now for a decisive advantage.

Political factors

Brederode's extensive investment portfolio across Europe and North America is directly influenced by government stability and evolving policy landscapes. A stable political climate, characterized by predictable regulations and consistent economic policies, is vital for maintaining investor confidence and ensuring the long-term viability of its holdings. For instance, the political stability in countries where Brederode has significant investments, such as France, where it holds substantial stakes in companies like Pernod Ricard, directly impacts the perceived risk and valuation of those assets.

Conversely, political instability or unexpected policy shifts can pose considerable risks. Changes in nationalization laws, alterations to investment protection treaties, or sudden shifts in fiscal or monetary policy could negatively affect the value and security of Brederode's portfolio companies. For example, a significant policy change in a key market, such as a new capital gains tax regime, could reduce the attractiveness of existing investments and deter future capital deployment.

The regulatory environment for investment firms like Brederode is in constant flux, impacting operational costs and strategic flexibility. For instance, European Union regulations such as MiFID II, fully implemented by 2018, continue to shape how investment services are offered and how transactions are reported, potentially increasing compliance burdens.

Stricter rules on capital adequacy, like those outlined by the Basel Accords, could necessitate higher reserves, impacting Brederode's ability to deploy capital. Conversely, any move towards deregulation or the introduction of supportive policies, perhaps seen in specific national initiatives to attract investment, could reduce compliance costs and unlock new growth avenues for the firm.

Brederode's diverse portfolio companies, spanning sectors like technology and consumer goods, are significantly impacted by evolving international trade policies. For instance, shifts in trade agreements between the European Union and North America, or emerging pacts with Asian markets, directly influence the cost of raw materials and finished goods for these businesses. A notable example is the ongoing renegotiation of trade terms that could add 10-25% to import costs for certain manufactured goods.

These policy changes, including the imposition or removal of tariffs, can disrupt established supply chains and alter market access for Brederode's investments. For example, a 5% tariff on key components imported by a portfolio firm could reduce its gross margin by 2% in the short term, directly affecting its profitability and, by extension, Brederode's overall investment returns. The company must therefore closely monitor geopolitical developments and trade negotiations.

Geopolitical Risks and Conflicts

Geopolitical tensions, particularly in Europe, present a significant risk for Brederode. For example, ongoing conflicts in Eastern Europe have contributed to heightened market volatility. In 2024, the European Union's economic growth forecasts were revised downwards partly due to these geopolitical uncertainties, impacting investor sentiment and potentially the valuation of Brederode's European holdings.

Disruptions to global trade stemming from geopolitical events can directly affect Brederode's investment portfolio. For instance, sanctions or trade disputes can impact supply chains and commodity prices, leading to economic instability that trickles down to both listed and unlisted assets. The International Monetary Fund projected in early 2025 that global trade growth would remain subdued due to these persistent geopolitical headwinds.

- European Exposure: Brederode's significant investment in European securities necessitates careful monitoring of the region's geopolitical landscape.

- Market Volatility: Conflicts and political instability can trigger sharp fluctuations in financial markets, affecting asset values.

- Trade Disruptions: Geopolitical tensions can impede the flow of goods and services, impacting corporate earnings and investment returns.

- Economic Uncertainty: The broader economic outlook is often clouded by geopolitical risks, making strategic investment decisions more challenging.

Taxation Policies on Capital Gains and Corporate Profits

Taxation policies significantly impact Brederode's financial performance. Fluctuations in corporate tax rates and capital gains taxes in key investment regions, such as Luxembourg and the United States, directly affect net income and shareholder returns. For instance, a reduction in corporate tax rates, like the one observed in the US in recent years, can boost profitability for portfolio companies. Conversely, an increase in capital gains tax could diminish the attractiveness of certain investment exits.

The specific tax environments where Brederode operates are crucial. In Luxembourg, where Brederode is domiciled, corporate tax rates have remained relatively stable, but changes in international tax agreements can still influence effective tax rates. In the United States, the corporate tax rate was lowered to 21% in 2017, a move that generally benefits companies with substantial US operations. However, potential future adjustments to these rates, or changes to capital gains tax, remain a key consideration for investment strategy.

- Corporate Tax Rate in Luxembourg: Currently stands at 24.94% for 2024, with a solidarity surcharge.

- US Corporate Tax Rate: Remains at 21% as of 2024, following the 2017 Tax Cuts and Jobs Act.

- Capital Gains Tax in the US: Varies based on income, with rates ranging from 0% to 20% for long-term gains as of 2024.

- Impact on Brederode: Favorable tax regimes enhance profitability, while higher taxes can reduce investment value and attractiveness.

Government stability and evolving policy landscapes directly influence Brederode's portfolio across Europe and North America. Predictable regulations and consistent economic policies are key for investor confidence and asset viability.

Political instability or sudden policy shifts, like changes in nationalization laws or fiscal policy, pose significant risks to Brederode's holdings. For example, a new capital gains tax regime could reduce investment attractiveness.

The regulatory environment constantly changes, impacting operational costs and strategic flexibility. For instance, EU regulations like MiFID II continue to shape investment services and reporting, potentially increasing compliance burdens.

Geopolitical tensions, particularly in Europe, create significant risks for Brederode, contributing to market volatility. In 2024, EU economic growth forecasts were revised downwards due to these uncertainties, affecting investor sentiment and asset valuations.

What is included in the product

Brederode's PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting its operations, providing a comprehensive view of the external landscape.

Provides a concise overview of Brederode's external environment, simplifying complex PESTLE factors for quicker strategic decision-making and reducing the burden of extensive research.

Economic factors

Central bank decisions on interest rates significantly affect Brederode’s investment landscape. For instance, the European Central Bank (ECB) maintained its key interest rates at 4.50% in early 2024, while the US Federal Reserve held its benchmark rate steady around 5.25-5.50% during the same period. These rates directly influence the cost of capital for Brederode’s portfolio companies, impacting their ability to finance operations and growth.

Higher interest rates can make leveraged buyouts more expensive, as borrowing costs increase. This also diminishes the relative attractiveness of private equity investments compared to safer, fixed-income assets, potentially making it harder for Brederode to achieve its desired returns. For example, a 1% increase in interest rates can add millions in annual interest payments for a highly leveraged company.

Conversely, a reduction in interest rates, as seen in anticipation of potential cuts by both the ECB and the Federal Reserve in late 2024 or 2025, can stimulate economic activity. Lower borrowing costs encourage investment and can lead to higher valuations for private companies, as future earnings are discounted at a lower rate, benefiting Brederode’s asset base.

Persistent inflation presents a significant challenge for Brederode, as it can diminish the real value of its investments and the purchasing power of future returns. While certain assets might offer some protection against rising prices, high inflation also tends to increase operating expenses for Brederode's portfolio companies and can suppress consumer spending, ultimately impacting their bottom lines.

Brederode's 2024 financial year saw inflation rates that, while generally on a downward trend, remained stubbornly elevated. For instance, in the Eurozone, inflation averaged 2.6% in 2024, down from 5.4% in 2023, but still above the European Central Bank's 2% target, illustrating the ongoing inflationary pressures faced by the company and its investments.

Brederode's investment performance is closely tied to the economic health of its primary operating regions, Europe and North America. Strong economic expansion typically translates into better corporate earnings, boosted consumer demand, and more advantageous conditions for selling investments at higher valuations.

In 2024, the US economy demonstrated continued strength, largely due to a solid labor market and consistent consumer spending. Conversely, economic growth in Europe continued to face headwinds, exhibiting a more delicate recovery trajectory.

Currency Exchange Rate Volatility

Currency exchange rate volatility significantly affects Brederode, given its operations across Europe and North America. Fluctuations between the Euro and the US Dollar can directly impact the reported value of its investments. For instance, a stronger Euro relative to the US Dollar can diminish the reported value of US-based assets when translated into Euros.

The impact of these movements was evident in early 2025. A depreciation of the US Dollar against the Euro during the first quarter of 2025 led to a negative effect on Brederode's Private Equity portfolio. This currency movement contributed to a net loss for the company in that specific period.

- Euro vs. US Dollar Performance: The relative strength of the Euro against the US Dollar is a key driver of Brederode's reported financial performance.

- Q1 2025 Impact: A weakening US Dollar in Q1 2025 resulted in a net loss for Brederode, highlighting currency risk.

- Portfolio Valuation: Exchange rate shifts directly influence the valuation of Brederode's cross-border private equity holdings.

Availability of Capital and Credit Markets

Brederode's investment strategy, particularly its private equity ventures, heavily relies on the availability of capital and the health of credit markets. Easy access to funding facilitates leveraged buyouts and supports portfolio company expansion. For instance, in 2024, despite generally tighter financing conditions globally, Brederode demonstrated resilience, with its portfolio companies maintaining positive cash flow.

Tighter credit markets can present challenges, potentially slowing down deal activity and hindering portfolio companies' growth trajectories. However, Brederode's diversified approach and robust financial management have allowed it to navigate these conditions.

- Capital Availability: Crucial for leveraged transactions in private equity.

- Credit Market Conditions: Directly impact financing costs and deal feasibility.

- 2024 Performance: Brederode's portfolio achieved positive cash flow despite tighter financing.

- Impact on Growth: Restricted credit can slow down portfolio company expansion.

Interest rate decisions by central banks like the ECB and Federal Reserve directly influence Brederode's cost of capital and investment attractiveness. For example, the ECB's continued rate of 4.50% in early 2024 and the Fed's 5.25-5.50% range highlight the current cost of borrowing for Brederode's portfolio companies.

Inflationary pressures remain a concern, impacting the real value of investments and operational costs. Eurozone inflation averaged 2.6% in 2024, a decrease from 5.4% in 2023, yet still above the ECB's 2% target, indicating ongoing economic challenges.

Economic growth disparities between regions affect Brederode, with the US economy showing resilience in 2024 due to strong labor markets, while European growth faced headwinds.

Currency volatility, particularly between the Euro and US Dollar, directly impacts Brederode's reported asset values. A depreciating US Dollar in Q1 2025 negatively affected Brederode's Private Equity portfolio, contributing to a net loss.

| Economic Factor | 2024/2025 Data/Trend | Impact on Brederode |

|---|---|---|

| Interest Rates (ECB) | 4.50% (early 2024) | Increases cost of capital for portfolio companies; affects leveraged buyouts. |

| Interest Rates (Federal Reserve) | 5.25-5.50% (early 2024) | Similar impact on US-based portfolio companies and financing costs. |

| Eurozone Inflation | 2.6% (average 2024) | Diminishes real value of investments; increases operating costs. |

| US Economic Growth | Strong, supported by labor market and consumer spending (2024) | Favorable conditions for US-based investments; potential for higher valuations. |

| European Economic Growth | Facing headwinds, delicate recovery (2024) | More challenging environment for European portfolio companies. |

| USD vs. EUR Exchange Rate | USD depreciation vs. EUR (Q1 2025) | Negative impact on reported value of US assets; led to net loss in Q1 2025. |

Full Version Awaits

Brederode PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Brederode PESTLE Analysis provides a comprehensive overview of the external factors impacting the company, covering political, economic, social, technological, legal, and environmental influences.

Sociological factors

Consumer preferences are constantly evolving, with a growing emphasis on sustainability, ethical sourcing, and personalized experiences. For instance, global spending on sustainable products is projected to reach $150 billion by 2025, indicating a strong market shift. This trend directly impacts Brederode's portfolio companies, requiring them to innovate and align their offerings with these values to maintain consumer appeal and market share.

Demographic changes, such as the aging population in developed countries and the rise of the middle class in emerging markets, are reshaping demand patterns. By 2030, individuals aged 65 and over are expected to represent 16% of the global population, driving demand for healthcare, retirement services, and leisure activities. Brederode must analyze these demographic currents to identify sectors poised for growth and to ensure its investments cater to the needs of an increasingly diverse and aging global consumer base.

The shift towards remote and hybrid work models continues to reshape talent acquisition and management. In 2024, studies indicate that over 60% of knowledge workers prefer hybrid arrangements, directly influencing how companies like Brederode's portfolio firms attract and retain top talent. This necessitates flexible policies and investments in technology to support distributed teams, impacting operational costs and productivity.

The burgeoning gig economy presents both opportunities and challenges for talent management. By 2025, it's projected that nearly 40% of the global workforce will engage in freelance or contract work. Brederode must assess if its portfolio companies can effectively leverage this flexible talent pool while ensuring quality and compliance, especially in specialized sectors.

Talent retention remains a critical concern, with high turnover rates impacting profitability. In 2024, the cost of replacing an employee can range from half to twice the employee's annual salary. Companies focusing on employee development, competitive compensation, and positive work environments, which Brederode can encourage, are better positioned to mitigate these costs and sustain growth.

Societal expectations are increasingly shaping investment landscapes, with Environmental, Social, and Governance (ESG) criteria becoming paramount. Investors and the public alike are scrutinizing companies' societal impact, directly influencing capital allocation and company valuations. This trend is evident in Brederode's strategic alignment, aiming to foster greater transparency in sustainability reporting among its General Partners and track net job creation within its portfolio companies by 2025.

Brederode's commitment to ESG is underscored by its 2024 investment activity, where an impressive 100% of its Private Equity commitments were directed towards General Partners who have formally adopted sustainability policies. This proactive stance demonstrates a clear recognition of the growing importance of responsible investing and its potential to drive long-term value.

Social Acceptance of Industries and Business Practices

Public perception and social acceptance significantly influence the long-term viability and reputation of Brederode's investment portfolio. Industries facing public scrutiny, such as those heavily reliant on fossil fuels or certain types of manufacturing, can experience divestment pressures and diminished market opportunities. For instance, a 2024 survey indicated that over 60% of investors consider environmental, social, and governance (ESG) factors when making investment decisions, highlighting a growing demand for socially responsible practices.

Negative sentiment can translate into tangible financial impacts. Companies perceived as socially irresponsible may face boycotts, increased regulatory scrutiny, and difficulty attracting and retaining talent. Brederode must therefore monitor evolving societal expectations to ensure its investments align with prevailing social values and avoid potential reputational damage that could affect asset valuations.

Consider the following societal trends impacting investment acceptance:

- Growing demand for sustainable and ethical investments: A 2025 report by the Global Sustainable Investment Alliance noted that sustainable investments reached $35.3 trillion in 2024, a 15% increase from 2022.

- Increased consumer activism: Consumers are more vocal about their preferences, often boycotting brands or industries that do not align with their social or environmental values.

- Influence of social media: Social media platforms amplify public opinion, rapidly shaping perceptions of industries and corporate behavior.

- Shifting workforce expectations: Younger generations entering the workforce increasingly prioritize working for companies with strong social missions and ethical practices.

Cultural Differences in Business Operations

Brederode's operations span Europe and North America, necessitating an understanding of distinct cultural nuances. For instance, negotiation styles can vary significantly; a direct approach common in some North American business cultures might be perceived as abrupt in parts of Europe, impacting M&A discussions.

Management philosophies also differ. While some European markets may favor consensus-driven decision-making, North American operations might lean towards more hierarchical structures. Brederode's support for its portfolio companies must be adaptable to these varied management expectations.

Consumer engagement strategies also require cultural tailoring. A marketing campaign successful in Germany might not resonate in France or Canada due to differing consumer preferences and media consumption habits. Brederode's investment approach needs to account for these localized consumer behaviors.

- M&A Integration: Cultural clashes can hinder post-acquisition synergy realization; studies show cultural incompatibility as a leading cause of M&A failure.

- Management Styles: Differences in communication, feedback, and authority perception can affect employee morale and productivity across regions.

- Consumer Engagement: Adapting marketing messages and product offerings to local cultural values is crucial; for example, advertising regulations and consumer privacy expectations vary widely between the US and EU.

Societal expectations are increasingly driving investment decisions, with a strong emphasis on Environmental, Social, and Governance (ESG) factors. By 2025, sustainable investments are projected to exceed $35 trillion globally, reflecting a significant shift in investor priorities. Brederode's portfolio companies must therefore demonstrate strong social responsibility and ethical practices to attract capital and maintain market relevance.

Public perception and social acceptance are critical for long-term business viability, as negative sentiment can lead to boycotts and regulatory challenges. Over 60% of investors in 2024 considered ESG factors in their decisions, underscoring the financial implications of corporate social performance.

The evolving workforce, particularly younger generations, prioritizes working for companies with clear social missions and ethical standards. This trend necessitates that Brederode's investments align with these values to ensure access to a skilled talent pool and sustained positive brand image.

Technological factors

The relentless pace of disruptive technologies presents both significant opportunities and considerable threats to the established industries where Brederode holds investments. The surge in interest surrounding artificial intelligence, for example, was a key driver of American stock market performance throughout 2024, underscoring the critical role of technological innovation.

Brederode's strategic positioning includes substantial engagement within the technology sector, which represented 27.3% of its net book value as of the close of 2024, reflecting a direct impact from these technological shifts.

The investment management sector is undergoing a significant digital overhaul, with technologies like AI-powered analytics and blockchain gaining traction. By mid-2024, reports indicated that over 70% of asset managers were actively investing in digital transformation initiatives to improve client engagement and operational efficiency.

Brederode can capitalize on these advancements to streamline its due diligence processes, potentially reducing the time spent on data analysis by a considerable margin. Furthermore, real-time portfolio monitoring enabled by advanced analytics can lead to more agile risk management, a critical factor in today's volatile markets.

Cybersecurity risks are a major concern for investment firms like Brederode, given the vast amounts of sensitive financial data handled. Protecting this information from breaches is crucial to avoid significant financial losses, damage to reputation, and regulatory fines.

The cost of data breaches continues to rise, with the average cost globally reaching $4.45 million in 2024, according to IBM's Cost of a Data Breach Report. For Brederode and its portfolio companies, investing in advanced cybersecurity measures, employee training, and incident response plans is not just a compliance issue but a fundamental business imperative to safeguard assets and maintain stakeholder trust.

Innovation Cycles in Target Sectors

The speed at which new technologies emerge and become obsolete, known as innovation cycles, is a critical technological factor for Brederode. Sectors like technology, healthcare, and electronics are characterized by rapid innovation. For instance, in the semiconductor industry, the cycle for new chip generations can be as short as 18-24 months, significantly impacting the lifespan and value of existing technologies.

Brederode's investment strategy must account for these accelerating innovation cycles. Companies that consistently invest in research and development and can adapt quickly to technological shifts are better positioned for sustained growth. For example, in the AI sector, companies that can rapidly deploy new models and integrate them into their offerings are likely to capture market share.

Staying ahead of these trends is paramount. Companies at the cutting edge of innovation in areas like quantum computing or advanced biotechnology, for example, present opportunities for significant long-term returns.

- Semiconductor innovation cycles: New chip generations typically emerge every 18-24 months, rapidly transforming the tech landscape.

- AI model deployment: Companies that swiftly release and integrate new AI models gain a competitive edge.

- Biotechnology advancements: Breakthroughs in gene editing and personalized medicine represent areas of rapid innovation with high growth potential.

- Electronics obsolescence: The rapid pace of new product releases in consumer electronics can lead to quicker depreciation of older models.

Artificial Intelligence and Data Analytics for Investment Decisions

The increasing sophistication of artificial intelligence (AI) and data analytics is revolutionizing how investment decisions are made. These technologies provide powerful tools for dissecting vast datasets, uncovering subtle market trends, and building predictive models that can forecast future performance with greater accuracy. For instance, in 2024, the global AI market was projected to reach hundreds of billions of dollars, with a significant portion dedicated to financial services and analytics.

Brederode can leverage these advanced capabilities to gain a competitive edge. By employing AI-driven tools for market analysis, the firm can process real-time information, identify emerging investment opportunities, and assess potential risks more effectively. This allows for a more data-informed approach to investment selection and portfolio management, ultimately optimizing returns.

The application of AI and data analytics extends to enhancing operational efficiency and risk management. Predictive analytics can help anticipate market volatility, enabling proactive adjustments to investment strategies. Furthermore, AI can automate routine tasks, freeing up human capital to focus on higher-level strategic thinking and client engagement.

- AI in Finance: The global AI in Fintech market was valued at approximately $10.4 billion in 2023 and is expected to grow substantially through 2030, indicating significant investment in these technologies.

- Data Volume: The amount of data generated globally continues to explode, with estimates suggesting over 120 zettabytes of data will be created annually by 2025, necessitating advanced analytical tools.

- Predictive Modeling: Advanced algorithms are improving the accuracy of financial forecasting, with some models showing predictive capabilities that outperform traditional methods in specific market segments.

- Investment Opportunity Identification: AI platforms are increasingly used to scan global markets for undervalued assets and emerging trends, potentially uncovering opportunities missed by manual analysis.

Technological advancements, particularly in AI and data analytics, are fundamentally reshaping investment strategies. Brederode's significant allocation to the technology sector, 27.3% of its net book value in late 2024, highlights its direct exposure to these shifts.

The rapid pace of innovation, with semiconductor cycles as short as 18-24 months, necessitates agile investment approaches. Companies prioritizing R&D and adaptability, like those in AI, are better positioned for growth.

AI and advanced analytics are enhancing investment decision-making, market trend identification, and risk management. The global AI in Fintech market, valued around $10.4 billion in 2023, underscores the sector's growing importance.

The escalating cost of data breaches, averaging $4.45 million globally in 2024, emphasizes the critical need for robust cybersecurity measures across Brederode's portfolio.

Legal factors

Brederode, operating internationally, navigates a dense regulatory landscape in Europe and North America, impacting its private equity funds and listed securities. In 2024, regulatory shifts and a more challenging financing environment necessitated careful investor management.

The group’s private equity arm, Brederode International S.à r.l. SICAR, operates under the direct oversight of Luxembourg’s Financial Sector Supervisory Commission (CSSF), ensuring adherence to specific financial sector rules.

Antitrust and competition laws in Brederode's operating regions, particularly in Europe and North America, can significantly influence its investment strategies. For instance, the European Commission's scrutiny of mergers and acquisitions, especially those involving significant market share shifts, could impact Brederode's ability to acquire substantial minority stakes or facilitate growth through consolidation. Failure to comply with these regulations can lead to substantial fines; in 2023, the EU fined companies billions for competition law violations.

Brederode, like all businesses operating in the digital age, must navigate a complex web of data privacy regulations. Strict laws such as the EU's General Data Protection Regulation (GDPR) and similar frameworks emerging across North America and other key markets significantly impact how Brederode and its portfolio companies collect, process, and secure personal and financial data. Failure to comply can result in substantial penalties; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is greater.

Adherence to these evolving data privacy mandates is not merely a legal obligation but a critical component of maintaining stakeholder trust. Brederode's commitment to robust data protection practices directly influences its reputation and the confidence investors and partners place in its operations. As of early 2024, regulatory bodies continue to refine enforcement, underscoring the ongoing need for vigilance and proactive compliance measures across all of Brederode's ventures.

Corporate Governance Requirements

Brederode's adherence to corporate governance is paramount, particularly its compliance with principles established by the Luxembourg Stock Exchange. This commitment is clearly articulated in its Corporate Governance Charter, most recently updated on March 13, 2025. The charter underscores the company's dedication to transparent operations and responsible leadership, crucial elements for fostering and maintaining investor trust.

The company's governance framework is designed to ensure accountability and ethical conduct across all levels of the organization. This focus on robust governance practices is not merely a regulatory obligation but a strategic imperative, directly influencing investor perception and the company's long-term sustainability. For instance, as of early 2025, Brederode reported a 98% compliance rate with its internal governance policies, a testament to its proactive approach.

Key aspects of Brederode's corporate governance include:

- Board Independence: Ensuring a significant majority of independent directors to provide objective oversight.

- Shareholder Rights: Upholding the rights of shareholders and promoting active engagement.

- Risk Management: Implementing comprehensive risk management systems and internal controls.

- Executive Compensation: Aligning executive remuneration with company performance and shareholder interests.

Labor Laws and Employment Regulations

Labor laws and employment regulations in countries where Brederode's portfolio companies operate directly influence their operational costs and flexibility. For instance, in 2024, many European nations continued to grapple with debates around increasing minimum wages, which could add to labor expenses for businesses. Changes in unionization rights or mandated employee benefits, such as expanded parental leave policies, can also significantly alter a company's financial bottom line and its ability to adapt its workforce quickly.

Key considerations for Brederode's portfolio companies include:

- Minimum Wage Adjustments: Tracking and forecasting the impact of scheduled minimum wage increases across different operating regions. For example, Germany's minimum wage saw an increase to €12.41 per hour in January 2024.

- Collective Bargaining Agreements: Understanding the terms and potential changes in union contracts, which can affect wage structures, working hours, and benefits.

- Employment Protection Laws: Assessing the impact of regulations concerning hiring, firing, and employee termination on workforce management and associated costs.

- Mandatory Benefits and Social Contributions: Staying abreast of changes in required employer contributions for social security, health insurance, and retirement plans.

Brederode's operations are significantly shaped by evolving legal frameworks, particularly concerning financial sector regulations and competition law. In 2024, increased regulatory scrutiny across Europe and North America required diligent compliance, impacting investment strategies and financing structures.

The company must also navigate stringent data privacy laws like GDPR, with potential fines up to 4% of global annual turnover, emphasizing the need for robust data protection to maintain investor confidence. As of early 2025, proactive compliance remains critical for all ventures.

Corporate governance, guided by Luxembourg Stock Exchange principles and Brederode's Charter updated March 13, 2025, ensures transparency and accountability. The company reported a 98% compliance rate with internal policies in early 2025, reflecting a strong commitment to ethical operations.

Environmental factors

Governments worldwide are intensifying climate change regulations, impacting industries Brederode invests in. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully phased in by 2026, will impose costs on carbon-intensive imports, affecting sectors like steel and cement. This means companies with significant carbon footprints may face higher operating expenses or need to invest in greener technologies, influencing their valuation and Brederode's investment strategy.

The drive towards net-zero emissions is spurring new compliance requirements and sustainability mandates. In 2024, many nations are strengthening their Nationally Determined Contributions (NDCs) under the Paris Agreement, leading to stricter rules on pollution and resource management. Brederode must consider how these evolving environmental standards will affect the profitability and long-term viability of its portfolio companies, potentially shifting investment towards those demonstrating robust environmental, social, and governance (ESG) performance.

Growing concerns about resource scarcity, such as critical minerals and water, directly impact supply chain stability for Brederode's portfolio companies. For instance, the International Energy Agency (IEA) highlighted in its 2024 outlook that demand for critical minerals like lithium and cobalt, essential for electric vehicles and renewable energy technologies, is projected to surge dramatically by 2030, potentially leading to price volatility and availability challenges.

Brederode must evaluate the resilience of its investments against these potential resource constraints. Companies heavily reliant on materials subject to scarcity, like those in advanced electronics or battery manufacturing, face increased operational risks and potential margin erosion. A 2024 report by McKinsey indicated that supply chain disruptions due to resource shortages could cost global businesses billions annually.

The global push for sustainability is reshaping investment landscapes, with a growing appetite for green assets. Brederode is navigating this by embedding sustainable development into its private equity strategy, pushing its General Partners to implement robust ESG reporting and policies.

This focus aligns with a significant market trend: in 2024, two-thirds of investment commitments for funds based in the European Union qualified under the Sustainable Finance Disclosure Regulation (SFDR), highlighting the increasing investor preference for environmentally and socially responsible investments.

Physical Climate Risks to Assets

Brederode's portfolio companies, particularly those with significant physical assets, are exposed to direct physical climate risks. Regions experiencing increasing frequency and intensity of extreme weather events, such as floods, heatwaves, or wildfires, pose a substantial threat to infrastructure and operational continuity. For instance, the World Economic Forum's 2024 Global Risks Report highlights extreme weather events as the most likely risk to materialize in the next two years, impacting supply chains and asset valuations.

These physical risks necessitate a robust due diligence process and strategic portfolio diversification. Companies operating in areas susceptible to rising sea levels or prolonged droughts may face asset devaluation or increased insurance premiums. The European Environment Agency reported in 2023 that climate-related extreme weather events caused an estimated €145 billion in damages across Europe between 1980 and 2022, underscoring the tangible financial impact.

- Increased operational disruptions due to extreme weather events impacting infrastructure and supply chains.

- Potential asset devaluation in locations facing long-term climate shifts like rising sea levels or water scarcity.

- Higher insurance costs and the possibility of uninsurable assets in high-risk climate zones.

- Need for adaptive infrastructure investments to mitigate future physical climate impacts.

Environmental Reporting Requirements

Mandatory environmental reporting is on the rise, especially across Europe, meaning companies like those in Brederode's portfolio are facing more rules about disclosing their environmental impact. This trend is likely to intensify in 2024 and 2025.

These evolving requirements can create additional administrative work for portfolio companies and bring greater public attention to their environmental performance. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), which fully applies from 2024 for many companies, significantly expands the scope and detail of environmental disclosures. This increased transparency can affect how attractive these companies are to investors and necessitate more rigorous data collection and reporting practices.

- Increased Disclosure Scope: Regulations like the CSRD mandate detailed reporting on climate change, biodiversity, water, and resource use, impacting a wider range of companies than before.

- Investor Scrutiny: Investors are increasingly using environmental, social, and governance (ESG) data to assess risk and opportunity, making robust environmental reporting crucial for attracting capital.

- Administrative Burden: Compliance with new reporting standards in 2024-2025 requires investment in systems and expertise to accurately track and report environmental metrics.

Environmental regulations are tightening globally, influencing Brederode's investment strategy. The EU's Carbon Border Adjustment Mechanism, fully operational by 2026, will add costs for carbon-intensive imports, potentially increasing expenses for portfolio companies and driving investment in green technologies.

The push for net-zero emissions is leading to stricter environmental standards and compliance requirements. Many nations are enhancing their Paris Agreement commitments in 2024, impacting pollution controls and resource management, which necessitates Brederode's focus on companies with strong ESG performance.

Resource scarcity, particularly for critical minerals like lithium and cobalt, poses supply chain risks. The IEA projects a surge in demand for these minerals by 2030, potentially causing price volatility and availability issues for companies in sectors like battery manufacturing.

Physical climate risks, such as extreme weather events, are a growing concern for Brederode's asset-heavy investments. The World Economic Forum's 2024 report identified extreme weather as the most likely near-term global risk, impacting infrastructure and supply chains.

Mandatory environmental reporting, like the EU's CSRD fully applicable from 2024, increases transparency and scrutiny. This requires portfolio companies to invest in robust data collection and reporting systems to meet evolving disclosure requirements and investor expectations.

| Environmental Factor | 2024/2025 Impact | Brederode Consideration |

| Climate Regulations (e.g., CBAM) | Increased costs for carbon-intensive industries; phased implementation by 2026. | Evaluate operational costs and green technology investments of portfolio companies. |

| Net-Zero Targets & NDCs | Stricter pollution and resource management rules; enhanced NDCs in 2024. | Prioritize companies with strong ESG performance and adaptation strategies. |

| Resource Scarcity (Critical Minerals) | Surging demand for lithium/cobalt by 2030; potential price volatility. | Assess supply chain resilience and dependence on scarce materials. |

| Physical Climate Risks (Extreme Weather) | Increased frequency/intensity of events; identified as top global risk in 2024. | Analyze asset vulnerability and insurance costs in climate-prone regions. |

| Mandatory Environmental Reporting (CSRD) | Expanded scope and detail of disclosures from 2024. | Ensure portfolio companies have robust reporting systems and data accuracy. |

PESTLE Analysis Data Sources

Our Brederode PESTLE Analysis is meticulously constructed using data from reputable financial institutions like the IMF and World Bank, alongside government publications and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the business landscape.