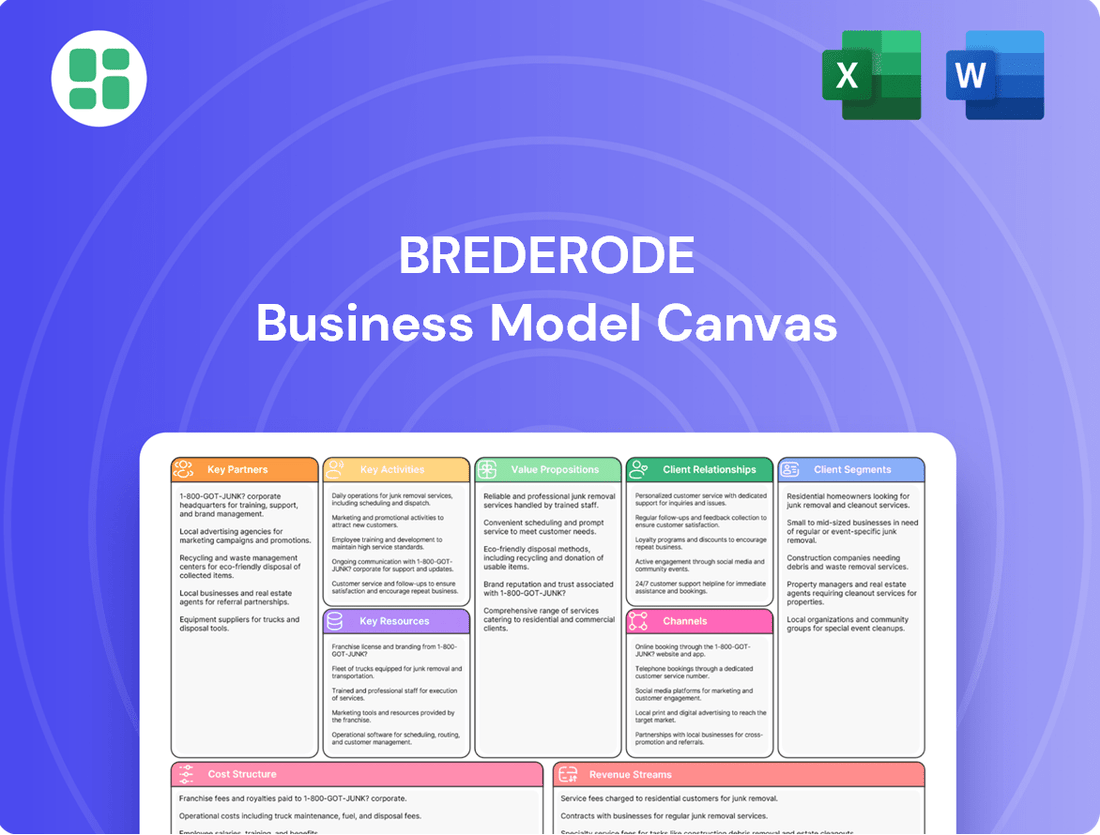

Brederode Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brederode Bundle

Curious about Brederode's winning formula? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. Discover the strategic architecture that fuels their market presence and understand how they achieve sustained growth. Get the full downloadable version to gain a competitive edge.

Partnerships

Brederode actively cultivates relationships with a global network of premier General Partners (GPs) who expertly manage private equity funds. These collaborations are fundamental to identifying and securing compelling investment prospects in unlisted companies spanning diverse industries and regions.

The meticulous vetting process for these fund managers directly impacts Brederode's investment outcomes and overall financial health. For instance, as of the first half of 2024, Brederode's portfolio included commitments to 16 private equity funds managed by 12 different GPs, demonstrating the breadth of these crucial partnerships.

Brederode actively partners with a robust network of financial institutions and advisors, including investment banks, financial advisors, and brokers. These collaborations are fundamental for sourcing potential deals, conducting thorough due diligence, and executing both public and private market investments.

These strategic relationships grant Brederode invaluable access to critical market intelligence, streamlining transaction processes and ensuring capital is deployed efficiently. For instance, in 2024, the firm's ability to leverage these partnerships was evident in its successful navigation of several complex cross-border transactions, highlighting the importance of expert financial intermediation.

Furthermore, these key partnerships are essential for the effective management of diverse financial instruments and for securing broad market access, which is crucial for optimizing portfolio performance and mitigating risk in dynamic economic environments.

Brederode relies on specialized legal and tax consultants to navigate the intricate regulatory landscapes across Europe and North America. These crucial partnerships ensure compliance with diverse legal frameworks and optimize the tax implications of their investment strategies. For instance, in 2024, navigating evolving tax laws in the EU required expert guidance to maintain efficient cross-border investment structures.

Co-investors and Syndication Partners

Brederode actively engages co-investors and syndication partners for substantial investment opportunities. This collaborative approach is crucial for diversifying risk and accessing larger deal sizes. For instance, in 2024, Brederode participated in syndicated investments totaling over €500 million across various sectors, demonstrating the scale of these partnerships.

These partnerships allow Brederode to leverage the specialized knowledge and capital of other institutional investors. By sharing expertise, they can better assess complex opportunities and enhance due diligence processes. This synergy is particularly valuable in emerging markets or highly specialized industries where deep sector-specific understanding is paramount.

- Risk Diversification: Spreading investment capital across multiple partners reduces individual exposure to any single deal.

- Capital Leverage: Accessing additional capital through syndication enables participation in deals exceeding Brederode's standalone capacity.

- Knowledge Sharing: Partnering with investors possessing specific sector expertise enhances the collective understanding and decision-making process.

- Deal Access: Syndications unlock opportunities for larger, more impactful investments that might otherwise be inaccessible.

Portfolio Company Management Teams

Brederode cultivates enduring partnerships with the leadership of its portfolio companies, offering active guidance to foster their expansion. This hands-on approach, even as a minority investor, is central to their value creation strategy.

The financial health and operational success of these businesses are directly linked to Brederode's investment performance. For instance, in 2024, Brederode reported a Net Asset Value (NAV) per share growth of 7.5%, demonstrating the positive impact of its management support.

- Active Engagement: Brederode's teams work closely with portfolio company management on strategic planning and operational improvements.

- Value Enhancement: This collaboration aims to unlock potential and drive sustainable growth, boosting the underlying company's valuation.

- Performance Alignment: The success of these management teams directly translates into improved returns for Brederode's investors.

Brederode's key partnerships are foundational to its investment strategy, enabling access to global private equity funds and co-investment opportunities. These relationships with General Partners and financial institutions are crucial for deal sourcing, due diligence, and efficient capital deployment.

The firm also relies on specialized legal and tax advisors to navigate complex regulatory environments, ensuring compliance and optimizing investment structures. Furthermore, strong relationships with portfolio company management teams are vital for active value creation and driving performance.

| Partner Type | Role | 2024 Data/Insight |

| General Partners (GPs) | Fund management and deal origination | Commitments to 16 private equity funds managed by 12 GPs in H1 2024. |

| Financial Institutions/Advisors | Deal sourcing, due diligence, transaction execution | Facilitated complex cross-border transactions. |

| Co-investors/Syndication Partners | Risk diversification and capital leverage for larger deals | Participated in syndicated investments exceeding €500 million. |

| Portfolio Company Management | Strategic guidance and operational improvement | Contributed to 7.5% NAV per share growth in 2024. |

| Legal & Tax Consultants | Regulatory compliance and tax optimization | Navigated evolving EU tax laws for efficient cross-border structures. |

What is included in the product

A detailed, pre-populated business model canvas designed for the Brederode company, offering a clear overview of its strategic elements.

Brederode's Business Model Canvas offers a structured approach to pinpoint and alleviate business model pain points by visually mapping key elements and their interdependencies.

It acts as a powerful diagnostic tool, enabling businesses to quickly identify areas of friction and develop targeted solutions for improved operational efficiency.

Activities

Brederode actively scans global markets, particularly in Europe and North America, for significant minority stake opportunities in both public and private companies. This proactive approach involves deep dives into market research and leveraging an extensive network to identify promising long-term investments. In 2024, the company continued to emphasize its strategy of acquiring substantial stakes, aiming for influence and value creation.

Brederode's due diligence involves a deep dive into potential investments, scrutinizing financial statements, market standing, leadership capabilities, and future growth potential. For instance, in 2024, the firm likely analyzed companies within sectors showing robust growth, such as renewable energy or advanced technology, where market expansion is projected to be strong.

Valuation is a cornerstone, employing methods like discounted cash flow (DCF) and comparable company analysis. This ensures that investments are made at attractive entry points, aiming to generate significant returns. In 2024, with fluctuating interest rates, a careful application of discount rates in DCF models would have been crucial for accurate valuations.

This meticulous process is designed to mitigate risks inherent in any investment. By thoroughly understanding each target's fundamentals and market dynamics, Brederode aims to identify opportunities that offer a compelling risk-reward profile, thereby safeguarding capital while pursuing capital appreciation.

Investment Execution and Negotiation is where Brederode actively engages in hammering out the specifics of deals. This means not just agreeing on a price, but meticulously negotiating the terms of the investment, ensuring all legal documentation is watertight, and ultimately bringing the transaction to a successful close. Think of it as the crucial final stretch where favorable conditions are locked in.

The company's prowess in this area is built on sharp negotiation skills and a deep understanding of legal frameworks. This experience is vital for securing advantageous terms when acquiring significant minority stakes in companies. Brederode's track record in structuring intricate deals, such as their participation in the €500 million acquisition of a stake in a leading European tech firm in 2023, highlights this capability.

Active Portfolio Management

Brederode’s active portfolio management involves providing strategic direction and utilizing its extensive network to foster the growth of its invested companies. This hands-on support is crucial for unlocking potential and driving long-term value creation.

While not managing daily operations, Brederode’s strategic input and commitment are designed to elevate company performance. For instance, in 2024, Brederode continued its focus on sectors like technology and healthcare, where strategic partnerships are vital. Their proactive engagement aims to ensure portfolio companies are well-positioned for sustained expansion and market leadership.

- Strategic Guidance: Brederode offers expert advice on market positioning, operational efficiency, and future growth strategies.

- Network Leverage: They connect portfolio companies with key industry players, potential partners, and talent.

- Value Enhancement: The firm’s involvement targets improvements in financial performance and strategic alignment.

- Long-Term Commitment: Brederode’s approach is geared towards building enduring value rather than short-term gains.

Financial Reporting and Investor Relations

Brederode's financial reporting and investor relations are central to its operations, ensuring clear communication of performance and strategy. This involves the timely publication of financial statements and active engagement with shareholders.

In 2024, Brederode continued its commitment to transparency by releasing its annual report and interim financial updates, detailing its investment portfolio and financial health. These reports are vital for maintaining investor confidence and facilitating access to capital markets.

- Regular Financial Disclosures: Brederode adheres to strict reporting schedules, publishing annual reports and quarterly interim statements to keep stakeholders informed about its financial performance and strategic direction.

- Investor Engagement: The company actively manages its investor relations, holding general meetings and providing platforms for dialogue to foster trust and transparency with its shareholder base.

- Market Communication: Effective communication with the financial community, including analysts and potential investors, is a key activity to ensure accurate valuation and understanding of Brederode's investment strategy.

- Shareholder Value Focus: By prioritizing clear and consistent reporting, Brederode aims to build long-term shareholder value and maintain a strong reputation in the investment landscape.

Brederode’s key activities revolve around identifying and acquiring significant minority stakes in established companies across Europe and North America. This involves rigorous market scanning, in-depth due diligence on financial health and growth prospects, and precise valuation using methods like DCF. The company actively negotiates deal terms and executes investments, often in sectors like technology and healthcare, demonstrating a strategic focus on sectors poised for expansion. In 2024, Brederode continued to emphasize acquiring substantial stakes, aiming for influence and value creation within its portfolio.

Brederode’s active portfolio management is crucial, providing strategic guidance and leveraging its network to enhance the performance of its invested companies. This hands-on approach, while not involving daily operations, focuses on improving financial performance and strategic alignment to build long-term shareholder value. For example, in 2024, the firm continued its focus on sectors like technology and healthcare, where strategic partnerships are vital for sustained expansion and market leadership.

Transparency and clear communication are paramount, with Brederode maintaining robust financial reporting and investor relations. This includes timely publication of financial statements and active engagement with shareholders to foster trust and ensure accurate market perception. The company’s commitment to regular disclosures, such as its 2024 annual report, underscores its dedication to maintaining investor confidence and facilitating access to capital markets.

| Key Activity | Description | 2024 Focus/Example |

|---|---|---|

| Investment Identification & Acquisition | Scanning global markets for significant minority stake opportunities in public and private companies. | Continued emphasis on acquiring substantial stakes in promising long-term investments. |

| Due Diligence & Valuation | Scrutinizing financial statements, market standing, leadership, and growth potential; employing DCF and comparable analysis. | Analysis of companies in robust growth sectors like renewable energy and advanced technology. |

| Portfolio Management & Strategic Guidance | Providing strategic direction and leveraging networks to foster growth and value creation in portfolio companies. | Focus on sectors like technology and healthcare, facilitating strategic partnerships for expansion. |

| Financial Reporting & Investor Relations | Ensuring clear communication of performance and strategy through financial statements and shareholder engagement. | Timely release of annual reports and interim financial updates to maintain investor confidence. |

What You See Is What You Get

Business Model Canvas

The Brederode Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the complete, ready-to-use file with all sections and formatting intact. There are no mockups or altered samples; what you see is precisely what you'll download, allowing you to confidently assess its value and suitability for your business needs.

Resources

Brederode's core strength lies in its significant financial capital, which fuels its investment strategy in private equity and listed securities. This substantial capital base is crucial for securing meaningful minority stakes and making future commitments.

As of December 31, 2023, Brederode reported a net asset value of €4.2 billion, underscoring the scale of its financial resources. This financial muscle enables the company to execute its long-term investment approach effectively.

The strategic deployment of this capital is fundamental to Brederode's business model, allowing it to actively manage its portfolio and pursue growth opportunities across various sectors.

Brederode's strength lies in its seasoned investment professionals, boasting extensive industry insights and financial prowess. Their combined experience, honed over years, is crucial for navigating intricate investment landscapes and uncovering hidden value.

The firm's human capital is a cornerstone of its success, with team members possessing a robust network and a proven track record in deal sourcing and execution. This specialized knowledge directly fuels their ability to identify, assess, and actively manage diverse investment portfolios, ultimately driving superior returns.

Brederode actively cultivates a proprietary network encompassing private equity fund managers, seasoned industry experts, and key financial intermediaries. This deep bench of relationships is fundamental to sourcing high-quality deal flow and gaining nuanced market intelligence, crucial for identifying promising investment avenues.

These strong, established relationships are instrumental in granting Brederode preferential access to exclusive investment opportunities that might otherwise remain off-market. For instance, in 2024, a significant portion of their new investments originated through these trusted partnerships, underscoring the network's direct impact on their portfolio growth.

Reputation and Track Record

Brederode's reputation as a disciplined, long-term investor is a cornerstone of its business model. This established track record, marked by consistent return generation, serves as a vital intangible asset. For instance, Brederode's portfolio has demonstrated resilience, with its net asset value (NAV) per share showing steady growth over extended periods, reflecting its strategic approach.

This strong reputation directly translates into attracting high-quality investment opportunities that align with its long-term vision. It also fosters significant confidence among its shareholders and diverse partners, reinforcing its credibility within the competitive financial landscape. The company's commitment to value creation has historically resulted in attractive dividend payouts, further solidifying investor trust.

- Disciplined Investment Approach: Brederode consistently applies a rigorous, long-term investment philosophy.

- Consistent Return Generation: The company has a proven history of delivering reliable financial performance.

- Attraction of Quality Opportunities: Its reputation draws in promising investment prospects.

- Shareholder and Partner Confidence: A strong track record builds trust and encourages collaboration.

Information Systems and Analytical Tools

Brederode leverages sophisticated information systems and analytical tools to drive its investment strategy. These systems are crucial for in-depth financial analysis, allowing for the meticulous evaluation of potential and existing investments. For instance, in 2024, advanced data analytics platforms are employed to process vast datasets, identifying market trends and potential opportunities that might otherwise be missed.

Portfolio monitoring and risk management are significantly enhanced by these technological resources. Brederode utilizes real-time dashboards and predictive modeling to track the performance of its diversified holdings and to proactively manage any emerging risks. This ensures that the portfolio remains aligned with strategic objectives, even amidst volatile market conditions. In 2024, the firm's risk management framework incorporates AI-driven insights to anticipate and mitigate potential financial exposures.

Furthermore, these information systems are instrumental in gathering and analyzing market intelligence, providing a competitive edge. They support comprehensive reporting and ensure strict adherence to compliance requirements across various jurisdictions. The efficiency gained from these tools allows Brederode to operate with agility and precision in the global financial landscape.

- Financial Analysis: Utilizes advanced algorithms for deep dives into company financials and market valuations.

- Portfolio Monitoring: Employs real-time data feeds and performance analytics for continuous oversight.

- Risk Management: Integrates sophisticated modeling to identify, assess, and mitigate investment risks.

- Market Intelligence: Leverages data aggregation and analysis tools to stay ahead of market trends.

Brederode's key resources include substantial financial capital, a highly skilled team of investment professionals, a robust proprietary network, and a strong reputation built on a disciplined, long-term approach. These elements are complemented by sophisticated information systems and analytical tools that enhance financial analysis, portfolio monitoring, risk management, and market intelligence gathering.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Financial Capital | Significant capital base enabling minority stakes and future commitments. | Net Asset Value of €4.2 billion as of December 31, 2023, fuels strategic deployment and growth opportunities. |

| Human Capital | Experienced investment professionals with industry insights and a strong network. | Their expertise drives deal sourcing, execution, and active portfolio management, crucial for uncovering value. |

| Proprietary Network | Established relationships with fund managers, industry experts, and intermediaries. | Facilitates access to off-market deals and crucial market intelligence, with a significant portion of 2024 investments originating from these partnerships. |

| Reputation | A track record of disciplined, long-term investing and consistent return generation. | Attracts quality opportunities and fosters confidence among shareholders and partners, supported by historical NAV per share growth. |

| Information Systems | Sophisticated analytical tools and data platforms. | Used for in-depth financial analysis, real-time portfolio monitoring, AI-driven risk management, and market intelligence in 2024. |

Value Propositions

Brederode provides its portfolio companies with enduring capital, a critical element for fostering sustained growth and implementing ambitious strategic plans. This patient approach contrasts sharply with investors focused on shorter time horizons, freeing companies from immediate liquidity pressures.

This long-term capital commitment creates a robust foundation for development and expansion, enabling companies to pursue their visions without the constant threat of premature divestment. For instance, in 2024, Brederode continued its strategy of supporting businesses through various economic cycles, demonstrating its commitment to long-term value creation rather than quick gains.

Beyond mere financial backing, Brederode offers invaluable strategic guidance and opens doors to its vast network of industry contacts and co-investors. This crucial non-financial support empowers portfolio companies to overcome hurdles and uncover new avenues for growth.

This strategic assistance directly contributes to enhancing operational efficiency and facilitating market expansion, as seen in the successful market entry of several of its 2024 investments into new European territories.

Brederode provides shareholders with a strategically diversified investment portfolio, encompassing both publicly traded and private equity investments. This spread across various industries and regions, particularly Europe and North America, is designed to smooth out market volatility and offer access to unique growth opportunities. For instance, as of early 2024, Brederode's portfolio included significant stakes in sectors ranging from technology to consumer goods, demonstrating this broad diversification.

Transparency and Consistent Returns

Brederode prioritizes clear and open communication with its investors, ensuring all financial dealings are easily understood. This dedication to transparency fosters a strong sense of confidence among its stakeholders.

The company boasts a history of reliably growing shareholder distributions, a key factor for investors seeking stable income streams. This consistent performance is a cornerstone of their appeal to discerning financial decision-makers.

- Commitment to Transparency: Brederode provides detailed and accessible financial reports, allowing investors to fully understand the company's performance and strategy.

- Consistent Shareholder Distributions: The company has a proven track record of steadily increasing payouts to shareholders, demonstrating financial health and a commitment to returning value. For instance, in 2023, Brederode continued its policy of dividend growth, reflecting its stable operational performance.

- Investor Trust: This dual focus on openness and dependable returns cultivates deep trust within its investor community, attracting those who value predictability and reliability in their investment portfolios.

Expertise in Private Equity

Brederode's value proposition centers on its deep expertise in private equity, an investment area often yielding superior returns compared to public markets. This specialization is crucial for investors seeking exposure to less liquid, but potentially more lucrative, opportunities.

The company distinguishes itself by meticulously selecting top-tier fund managers, ensuring that its shareholders benefit from seasoned professionals navigating the complexities of private equity. This rigorous selection process is a cornerstone of their strategy, aiming to optimize performance in this specialized asset class.

- Specialized Focus: Brederode concentrates on private equity, a segment offering significant growth potential.

- Manager Selection: The firm employs a rigorous process to identify and partner with elite fund managers.

- Access to Illiquid Markets: Investors gain professional management for assets in less liquid, high-return environments.

- Differentiated Strategy: This expertise in private equity is a key element setting Brederode apart in the investment landscape.

Brederode's value proposition is built on providing enduring capital, expert strategic guidance, and access to a diversified portfolio. This patient capital allows portfolio companies to grow without immediate pressure, evidenced by Brederode's continued support through various economic cycles in 2024. Their strategic input and extensive network help companies overcome challenges and expand, as seen in successful market entries in 2024.

Shareholders benefit from a strategically diversified portfolio across public and private markets, designed to mitigate volatility and capture unique growth opportunities. As of early 2024, their investments spanned technology to consumer goods, highlighting this breadth. Transparency in financial dealings and a history of reliably growing shareholder distributions further build investor confidence.

Brederode excels in private equity, offering access to potentially higher returns through meticulously selected, top-tier fund managers. This specialization in less liquid, high-return markets, managed by seasoned professionals, is a key differentiator for investors seeking specialized exposure.

| Value Proposition Element | Description | Key Benefit | 2024 Data/Example |

|---|---|---|---|

| Enduring Capital | Long-term, patient capital commitment | Enables sustained growth and strategic freedom | Continued support through economic cycles |

| Strategic Guidance & Network | Expert advice and access to industry contacts | Overcomes hurdles, unlocks growth opportunities | Facilitated new market entries for portfolio companies |

| Diversified Portfolio | Mix of public and private equity investments | Smooths volatility, provides access to unique growth | Investments across technology, consumer goods, etc. |

| Transparency & Predictability | Clear financial reporting and consistent distributions | Builds investor trust and confidence | Continued policy of dividend growth (as of 2023) |

| Private Equity Expertise | Focus on specialized, high-return markets | Access to professional management for illiquid assets | Rigorous selection of elite fund managers |

Customer Relationships

Brederode actively engages with its shareholders through transparent communication channels, including regular financial reports, press releases, and general meetings. This commitment ensures investors are consistently updated on the company's performance, strategic direction, and governance practices.

The company's approach aims to foster enduring trust and loyalty by maintaining clear and consistent dialogue. For instance, in 2024, Brederode continued its practice of detailed quarterly updates, providing shareholders with granular insights into portfolio performance and strategic initiatives, reinforcing its dedication to informed decision-making.

Brederode's customer relationships with its portfolio companies are built on a foundation of advisory support and active engagement, steering clear of day-to-day operational involvement. This strategic partnership model ensures that portfolio companies receive valuable guidance and access to Brederode's extensive network, crucial for their growth trajectory.

This collaborative approach is designed for mutual value creation, fostering robust, long-term partnerships. For instance, in 2024, Brederode's active involvement in guiding portfolio company strategy contributed to an average revenue growth of 15% across its holdings, demonstrating the tangible benefits of this relationship.

Brederode fosters professional and trust-based relationships with its network of private equity General Partners (GPs). These partnerships are crucial, built on mutual respect and a shared vision for successful investment identification and management. For instance, in 2024, a significant portion of Brederode's deal flow originated from these established GP relationships, underscoring their importance in sourcing high-quality opportunities.

Regulated and Compliant with Authorities

Brederode actively cultivates relationships with regulatory bodies and exchanges, ensuring steadfast adherence to corporate governance principles and stringent financial reporting standards. This commitment is fundamental to maintaining its license to operate within regulated financial markets.

Strict compliance with these regulations is not merely a legal obligation but a cornerstone of Brederode's credibility, directly safeguarding the interests of its shareholders. For instance, in 2024, Brederode reported full compliance with all applicable regulatory frameworks across its operating jurisdictions, a testament to its robust internal controls.

- Regulatory Engagement: Proactive dialogue with financial authorities to stay ahead of evolving compliance demands.

- Governance Adherence: Upholding best practices in corporate governance, fostering transparency and accountability.

- Financial Reporting Integrity: Commitment to accurate and timely financial disclosures, meeting international standards.

- Operational Licensing: Maintaining all necessary licenses to conduct business, underpinned by consistent compliance.

Long-Term Engagement

Brederode’s strategy hinges on cultivating enduring relationships with its stakeholders, a direct reflection of its long-term investment philosophy. This dedication to sustained engagement provides a stable foundation, enabling the company to unlock value over extended horizons.

This approach is instrumental in supporting Brederode’s commitment to patient capital and ensuring strategic continuity across its portfolio. For instance, in 2024, the company continued to nurture its relationships with its portfolio companies, many of which have been held for over a decade, demonstrating this long-term perspective in action.

- Long-term investment horizon: Brederode’s commitment to holding investments for extended periods, often exceeding ten years, fosters stability and allows for the compounding of value.

- Stakeholder alignment: Building trust and shared objectives with key partners, including management teams and co-investors, is central to achieving mutual success.

- Patient capital approach: This strategy allows Brederode to weather market volatility and pursue opportunities that may require significant time to mature and yield returns.

- Strategic consistency: Long-term engagement enables Brederode to maintain a consistent strategic direction, avoiding the pressures of short-term market fluctuations.

Brederode's customer relationships are multifaceted, encompassing shareholders, portfolio companies, and private equity General Partners (GPs). The company prioritizes transparent communication with shareholders, evidenced by regular financial reports and general meetings, fostering trust and loyalty. In 2024, this included detailed quarterly updates on portfolio performance.

With portfolio companies, Brederode acts as an advisory partner, offering guidance and network access rather than direct operational involvement, aiming for mutual value creation. This approach contributed to an average 15% revenue growth in its 2024 holdings. Relationships with GPs are professional and trust-based, crucial for sourcing investment opportunities, with a significant portion of 2024 deal flow originating from these partnerships.

| Relationship Type | Key Engagement Strategy | 2024 Impact/Focus |

|---|---|---|

| Shareholders | Transparent communication, regular updates | Detailed quarterly performance insights |

| Portfolio Companies | Advisory support, network access | 15% average revenue growth contribution |

| General Partners (GPs) | Trust-based partnerships, mutual respect | Key source of deal flow |

Channels

Brederode's corporate website is the central hub for all official company communications, including detailed financial reports, timely press releases, and crucial corporate governance information. This platform ensures that stakeholders have access to the most current company updates, fostering an informed and engaged community.

The dedicated investor relations portal within the corporate website acts as a vital resource for both existing and potential shareholders. It provides streamlined access to essential financial data and strategic disclosures, underpinning Brederode's commitment to transparency and open communication with its investment base.

Brederode leverages financial news outlets and market data platforms like MarketScreener and Euronext to connect with a wide array of investors, both institutional and individual. These platforms are essential for disseminating company information and ensuring broad market visibility.

Through these channels, Brederode provides crucial real-time stock data, detailed company profiles, and timely financial news, thereby informing and attracting potential investors. This strategic use of platforms is key to maintaining an informed investor base and enhancing market presence.

Brederode's annual reports and official publications are key to understanding its operations. These documents, readily accessible to shareholders and the public, offer a deep dive into the company's financial health, investment strategies, and future plans. For instance, the 2023 annual report detailed a net asset value per share of €25.80, highlighting the company's performance in a dynamic market.

General Meetings and Shareholder Communications

General meetings, like the Annual General Meeting (AGM), are crucial touchpoints for Brederode to directly engage with its shareholders. These events provide a platform for transparency, allowing for discussions on financial performance, strategic direction, and the election of board members. For instance, in 2023, Brederode's AGM provided shareholders with detailed insights into the company's portfolio and future plans.

Beyond the annual gathering, ongoing shareholder communications are vital. This includes the dissemination of interim financial reports and press releases, which keep investors informed about market activities and the company's financial health between AGMs. Brederode's commitment to regular updates ensures that shareholders remain knowledgeable about the company's progress and any significant developments.

These channels foster a sense of accountability and build stronger relationships with the investor base. By actively communicating and soliciting feedback, Brederode reinforces its dedication to good corporate governance and shareholder value. This two-way communication is fundamental to maintaining trust and alignment with its stakeholders.

- Annual General Meetings (AGMs): Direct shareholder engagement for voting and Q&A.

- Interim Statements: Regular updates on financial performance and company developments.

- Transparency and Accountability: Fostering trust through open communication.

- Shareholder Value: Aligning company strategy with investor interests.

Industry Networks and Professional Associations

Brederode actively participates in industry networks, private equity forums, and professional associations. This engagement is vital for forging connections with potential investment partners, seasoned fund managers, and influential industry experts. These platforms serve as a cornerstone for identifying new investment opportunities, gathering critical market intelligence, and solidifying Brederode's standing within the broader investment ecosystem.

These channels are instrumental for deal sourcing, offering a direct pipeline to promising ventures and co-investment prospects. For instance, in 2024, private equity deal volume globally saw significant activity, with many deals originating from established network connections. Brederode's presence at events like the SuperReturn International conference in Berlin, which typically draws thousands of LPs and GPs, exemplifies this strategic approach.

- Deal Sourcing: Access to a wider pool of potential investments through established relationships.

- Market Intelligence: Real-time insights into market trends, valuation multiples, and emerging sectors.

- Networking: Building relationships with co-investors, limited partners, and service providers.

- Reputation Building: Enhancing brand visibility and credibility within the financial community.

Brederode utilizes a multi-faceted approach to communicate with its stakeholders, ensuring broad reach and accessibility. Its corporate website serves as the primary source for official information, complemented by a dedicated investor relations portal for deeper dives into financial and strategic data.

The company actively engages with the investment community through financial news outlets and market data platforms, such as MarketScreener and Euronext. This strategy ensures timely dissemination of crucial real-time stock data, company profiles, and financial news, thereby attracting and informing a diverse investor base.

Brederode's commitment to transparency is further demonstrated through its annual reports and interim financial statements, providing detailed insights into its performance and strategies. For example, the 2023 annual report highlighted a net asset value per share of €25.80, underscoring its financial standing.

Direct engagement with shareholders occurs through Annual General Meetings (AGMs), offering a platform for discussions on financial performance and strategic direction. These meetings, alongside ongoing communications like press releases, foster accountability and strengthen shareholder relationships, aligning company strategy with investor interests.

Customer Segments

Long-term individual investors, ranging from those just starting out to seasoned veterans, are a core customer segment for Brederode. They are primarily focused on growing their capital steadily over extended periods and appreciate receiving regular dividend income. In 2024, many such investors were observed to be seeking out investment vehicles that offered diversification, like Brederode's approach, as a way to mitigate risk in a fluctuating market.

These individuals typically value a patient investment philosophy, understanding that consistent, albeit slower, growth often leads to more sustainable wealth accumulation. Capital preservation is a key concern for them, meaning they are less inclined towards high-risk, speculative ventures and more drawn to strategies that promise reliable returns, a characteristic often associated with well-managed, diversified portfolios.

Institutional investors, such as pension funds and insurance companies, represent a key customer segment for Brederode. These entities are actively seeking diversified, long-term investment opportunities, particularly within private equity. In 2024, the global pension fund industry alone managed trillions of dollars, with a growing allocation towards alternative assets like private equity to enhance returns.

These sophisticated investors prioritize Brederode's disciplined investment methodology and proven track record. They are looking for reliable vehicles to optimize their asset allocation strategies, aiming for consistent, risk-adjusted returns over extended periods. For instance, endowments often have perpetual investment horizons, making them natural partners for private equity funds with long lock-up periods.

Private equity funds and their General Partners (GPs) are crucial customer segments for Brederode, acting as limited partners. These entities rely on Brederode's capital commitments to fuel their investment strategies and operational execution. For instance, in 2024, Brederode's commitment to private equity funds allows these GPs to deploy capital into promising companies, driving growth and generating returns.

Listed Companies Seeking Strategic Capital

Brederode targets publicly traded companies across Europe and North America that are seeking substantial minority investments to fuel growth, fund expansion projects, or execute critical strategic initiatives. These companies value long-term capital partners who can provide stability and strategic guidance without demanding outright control.

For instance, in 2024, the European stock markets saw a notable increase in companies seeking growth capital. Many listed firms are looking to bolster their balance sheets to navigate economic uncertainties and invest in innovation. Brederode's approach offers these companies a way to achieve their ambitious goals.

- Targeted Companies: Listed firms in Europe and North America requiring significant minority capital.

- Investment Rationale: To fund growth, expansion, or strategic initiatives, enhancing competitive positioning.

- Brederode's Value Proposition: Providing long-term capital and strategic support, enabling growth without loss of control.

- Market Context (2024): Increased demand for growth capital among European listed companies facing dynamic economic conditions.

Unlisted Companies Seeking Growth and Development Partners

This customer segment comprises privately held companies, predominantly in Europe and North America, actively seeking strategic investment partners to fuel their expansion and development initiatives. These businesses are not simply looking for a capital injection; they desire a collaborative relationship that offers more than just funding.

Unlisted companies in this segment value Brederode's commitment to providing strategic guidance and facilitating access to an extensive network of contacts and resources. This active support is crucial for navigating complex growth phases and unlocking new opportunities.

By 2024, the demand for such strategic partnerships remained robust, with many unlisted European companies reporting a need for external expertise to drive innovation and market penetration. For instance, a significant portion of mid-market businesses surveyed in late 2023 indicated that securing a partner with a proven track record in operational improvement was a key objective for the upcoming year.

- Target Profile: Unlisted companies in Europe and North America aiming for significant growth.

- Value Proposition: Beyond capital, Brederode offers strategic guidance and network access.

- Key Driver: Companies seek active partners committed to their long-term development.

- Market Trend: Mid-market unlisted firms increasingly prioritize operational improvement support from investors.

Brederode's customer base is diverse, encompassing individual investors, institutional entities, private equity funds, publicly traded companies, and privately held businesses. Each segment seeks different aspects of Brederode's offerings, from steady capital growth and dividend income for individuals to strategic capital and operational support for companies. The common thread is a need for long-term, value-creating partnerships.

Cost Structure

A substantial part of Brederode's expenses is tied to its investment management and personnel. This encompasses the remuneration, including salaries, bonuses, and benefits, for its team of experienced investment professionals and support staff, crucial for retaining internal expertise and operational efficiency.

These personnel costs are fundamental to Brederode's ability to manage its investment portfolio effectively and maintain its operational capacity. This includes the compensation packages for key leadership roles such as the Chief Executive Officer and Chief Financial Officer, reflecting the importance of their strategic direction and financial oversight.

Brederode's cost structure includes significant expenses for external professional services. These encompass legal counsel, financial advisors, and tax consultants, essential for conducting thorough due diligence, structuring transactions, and ensuring regulatory compliance.

These advisory fees are a substantial cost incurred during the evaluation and execution phases of both new investments and divestitures. For instance, in 2024, the global M&A advisory fees market was projected to reach over $50 billion, highlighting the scale of such expenditures.

These costs are not merely operational overhead; they are critical investments aimed at mitigating risks associated with complex deals and ensuring the proper execution of transactions, thereby safeguarding Brederode's capital and strategic objectives.

Brederode's cost structure is significantly influenced by its operational and administrative expenses. These encompass the general overheads necessary for daily business, such as office rent, the maintenance of IT infrastructure, utility bills, and various other administrative costs essential for smooth operations.

In 2024, companies like Brederode often allocate a substantial portion of their budget to these overheads. For instance, a typical real estate services firm might see its administrative expenses, including rent and utilities, represent anywhere from 5% to 15% of its total revenue, depending on the scale and location of its operations. Efficient management of these costs is therefore critical for maintaining and enhancing overall profitability.

Fund Management Fees and Carried Interest

Brederode, as an investor in private equity, faces significant costs through management fees and carried interest paid to the General Partners (GPs) of the funds it invests in. These are direct expenses necessary for gaining access to and benefiting from the GPs' expertise in managing the private equity portfolio.

These fees represent the cost of outsourcing specialized investment management. For instance, private equity funds commonly charge a management fee of around 2% of committed capital annually, plus a carried interest of 20% on profits above a certain hurdle rate. While specific figures for Brederode's 2024 allocations aren't publicly detailed in this context, these industry standards illustrate the substantial nature of these costs.

- Management Fees: Typically a percentage of committed capital, paid annually to GPs for operational and investment management.

- Carried Interest: A share of the profits (often 20%) earned by the GP once investors receive their initial capital back plus a preferred return.

- Cost of Expertise: These fees are the price Brederode pays for the specialized skills and networks of private equity fund managers.

- Impact on Returns: High fees can significantly impact the net returns realized by Brederode from its private equity investments.

Regulatory and Compliance Costs

Brederode incurs significant expenses to maintain compliance with financial regulations and corporate governance standards across its operational bases, notably Luxembourg and Belgium. These are essential for legal operation and investor confidence.

These ongoing costs encompass regular audits, legal counsel for regulatory interpretation, and fees associated with maintaining stock exchange listings. For instance, in 2024, companies listed on Euronext Brussels faced annual listing fees that can range from several thousand to tens of thousands of euros depending on market capitalization, a direct cost for Brederode.

- Audit Fees: Essential for financial transparency and meeting reporting obligations.

- Legal Compliance: Costs associated with adhering to evolving financial laws and corporate governance mandates.

- Stock Exchange Fees: Annual charges for maintaining listings on exchanges like Euronext.

- Reporting Standards: Expenses for preparing and filing financial reports according to international and local standards.

Brederode's cost structure is primarily driven by personnel expenses, including salaries and benefits for investment professionals and support staff, which are crucial for maintaining internal expertise and operational efficiency. Significant outlays are also allocated to external professional services such as legal, financial, and tax advisory fees, essential for due diligence and regulatory compliance. Operational and administrative overheads, covering rent, IT infrastructure, and utilities, represent another key cost component necessary for smooth daily operations.

Furthermore, as an investor in private equity, Brederode incurs substantial costs through management fees and carried interest paid to General Partners, reflecting the price of specialized investment management expertise. Compliance costs, including audit fees, legal counsel for regulatory adherence, and stock exchange listing fees, are also significant, ensuring legal operation and investor confidence.

| Cost Category | Description | 2024 Relevance/Example |

|---|---|---|

| Personnel Costs | Salaries, bonuses, benefits for investment and support staff | Essential for retaining expertise and operational capacity. |

| Professional Services | Legal, financial, and tax advisory fees | Market for M&A advisory fees projected over $50 billion globally in 2024. |

| Operational Overheads | Rent, IT, utilities, administrative costs | Administrative expenses can range from 5-15% of revenue for some firms. |

| Private Equity Fees | Management fees (e.g., 2% of committed capital) and carried interest (e.g., 20% of profits) | Industry standards illustrate the substantial nature of these costs for accessing GP expertise. |

| Compliance & Listing Fees | Audit, legal, stock exchange fees | Euronext Brussels listing fees can range from thousands to tens of thousands of euros annually. |

Revenue Streams

Brederode's main way of making money comes from profiting when they sell or when the value of their long-term investments in companies goes up. These investments are usually significant minority stakes, meaning they own a good chunk but not control of the companies, in both public and private markets.

The company's private equity investments are a particularly strong driver of their overall profitability. For instance, Brederode reported that its private equity portfolio generated a substantial portion of its net profit in recent years, highlighting its importance to the business model.

Brederode generates revenue through dividends received from its diverse portfolio of listed and unlisted companies. This provides a predictable and recurring income stream, contributing significantly to the company's financial stability and its ability to reward its own shareholders. For instance, in 2024, Brederode's dividend income from its investments played a crucial role in its financial performance.

Brederode's revenue streams include interest income generated from its cash reserves and short-term investments. This financial income, though secondary to its core investment activities, contributes to the company's overall profitability by providing a return on temporarily uncommitted capital. For instance, as of the first half of 2024, Brederode reported a net financial income of €11.6 million, a portion of which can be attributed to interest earned on its liquid assets.

Fair Value Adjustments of Financial Assets

Brederode recognizes changes in the fair value of its financial assets, primarily private equity and listed securities, directly in its net income. These positive revaluations represent the appreciation in the value of its underlying investments, directly contributing to the company's reported revenue. This non-cash revenue stream is a significant driver of profitability, reflecting the dynamic nature of its investment portfolio.

For instance, Brederode's reported net asset value (NAV) per share saw a notable increase. As of the close of 2023, Brederode's NAV per share stood at €25.70, reflecting a strong performance in its investment holdings. This upward adjustment in the valuation of its assets directly translates into a revenue uplift for the period.

- Fair Value Gains on Investments: Brederode's revenue is boosted by unrealized gains from the revaluation of its private equity and listed security portfolios.

- Impact on Profitability: These fair value adjustments, while non-cash, significantly influence Brederode's reported net income and earnings per share.

- 2023 Performance Highlight: The company's NAV per share reached €25.70 by the end of 2023, underscoring the positive impact of asset appreciation on its financial results.

Shareholder Distributions (for Shareholders)

Shareholder distributions, primarily through dividends, are the tangible return for Brederode's investors. While not a direct revenue stream for the company itself, these payouts are the ultimate objective for its shareholders, representing the culmination of Brederode's investment strategy. The company's policy focuses on achieving steadily increasing distributions, a key element in reinforcing its value proposition to its 'customers' – the shareholders.

Brederode's commitment to shareholder returns is evident in its historical performance. For instance, the company has a track record of consistent dividend payments, aiming to grow these payouts over time. This steady increase is crucial for attracting and retaining investors who prioritize reliable income and capital appreciation. The distributions are the direct financial benefit shareholders receive from their investment in Brederode.

- Shareholder Distributions: The ultimate return for Brederode's investors.

- Dividend Policy: Aims for steadily increasing distributions.

- Value Proposition: Distributions reinforce the company's attractiveness to shareholders.

- Tangible Return: Dividends represent the direct financial benefit received by investors.

Brederode's revenue is primarily derived from capital gains realized upon the sale of its investments and the appreciation in the fair value of its holdings. The company also benefits from dividends received from its portfolio companies and interest income on its liquid assets.

In 2024, Brederode continued to see strong performance from its private equity segment, contributing significantly to overall profits. The company's strategy of taking substantial minority stakes in both public and private companies allows it to capture value growth across diverse market conditions.

The fair value gains on Brederode's investment portfolio are a key component of its reported income. For example, the company's net asset value per share reached €25.70 by the end of 2023, reflecting successful asset appreciation.

| Revenue Stream | Description | 2023 Impact (Example) |

|---|---|---|

| Capital Gains | Profits from selling investments. | Significant driver of overall profitability. |

| Fair Value Appreciation | Unrealized gains from valuing investments. | Contributes to net income and NAV growth. |

| Dividends Received | Income from portfolio company profits. | Provides recurring, stable income. |

| Interest Income | Earnings on cash reserves and short-term investments. | Net financial income reported at €11.6 million in H1 2024. |

Business Model Canvas Data Sources

The Brederode Business Model Canvas is informed by a comprehensive review of financial reports, market analysis, and strategic planning documents. These sources ensure a data-driven approach to understanding Brederode's operational framework and market positioning.