Brederode Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brederode Bundle

Brederode's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the ever-present threat of new entrants. Understanding these dynamics is crucial for navigating its market effectively. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Brederode’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Brederode's strategy of concentrating its capital commitments with a select group of General Partners (GPs) inherently strengthens the bargaining power of these key players. With significant allocations to a limited number of top-tier funds, these GPs possess a strong negotiating position. For instance, if Brederode's total commitments in 2024 to its top 5 GPs represented over 60% of its total private equity portfolio, these GPs would have considerable leverage.

The established track records and exclusive access to proprietary deal flow enjoyed by these leading GPs further enhance their influence. This scarcity of high-quality, in-demand investment opportunities means Brederode has fewer viable alternatives for deploying its capital effectively. Consequently, these GPs can dictate terms, potentially impacting management fees or carried interest arrangements.

This concentration underscores the critical nature of these few relationships in shaping Brederode's private equity investment outcomes. The reliance on a small cohort of GPs means that their demands and conditions have a disproportionately large impact on the firm's ability to execute its investment strategy and achieve its return objectives.

The scarcity of high-quality deal flow significantly amplifies the bargaining power of suppliers, which in Brederode's case, are the sellers of companies and fund managers offering exclusive investment opportunities. When attractive, mature businesses with predictable cash flows are in short supply, those holding such assets or possessing access to them gain considerable leverage. This dynamic was evident in 2024, where private equity firms reported increased competition for prime assets, leading to higher acquisition multiples and a more challenging environment for buyers like Brederode to secure favorable terms.

Brederode's reliance on specialized external service providers for crucial functions like due diligence and legal counsel significantly shapes supplier bargaining power. When these providers possess unique, in-demand skills, their leverage grows, potentially increasing fees.

For instance, the global market for specialized financial advisory services, including M&A due diligence, saw robust growth leading up to 2025, with many firms reporting record deal volumes. This high demand for niche expertise empowers these providers, as Brederode may face limited alternatives for acquiring such critical insights, impacting the cost-effectiveness of its investment evaluations.

Availability of Alternative Capital Sources for GPs

General Partners (GPs) possess considerable leverage when seeking capital, as they are not limited to a single source like Brederode. They can tap into a diverse pool of institutional investors, including pension funds, endowments, and insurance companies, as well as sovereign wealth funds and well-capitalized family offices. This wide array of potential Limited Partners (LPs) significantly strengthens the GP's position.

The broader private equity market in 2024 has continued to demonstrate robust fundraising activity. For instance, Preqin data indicates that private equity funds raised over $1.2 trillion globally in 2023, and projections for 2024 suggest a sustained, albeit potentially more selective, fundraising environment. This ample availability of capital, often referred to as dry powder, means GPs can afford to be selective about their partners and the terms they accept.

This broad access to capital directly translates into enhanced bargaining power for GPs. They can negotiate more favorable terms regarding management fees, carried interest, and governance structures, as they have viable alternatives if Brederode’s terms are not competitive. The ability to secure capital from multiple avenues reduces dependency on any single LP, allowing GPs to dictate more advantageous fund conditions.

- Diversified Capital Sources: GPs can raise capital from institutional investors, sovereign wealth funds, and family offices, reducing reliance on any single LP.

- Robust Fundraising Environment: Significant global dry powder in private equity, exceeding $1.2 trillion raised in 2023, provides GPs with ample alternatives.

- Negotiating Power: Broad capital access empowers GPs to negotiate favorable fund terms, including fees and carried interest, setting conditions rather than accepting them.

Brand and Track Record of Top Funds

Established private equity funds with long-standing, successful track records command significant demand from Limited Partners, including institutions like Brederode. This high demand, driven by a proven ability to generate alpha, allows these top-tier funds to dictate terms. For instance, in 2023, the average management fee for private equity funds remained around 2%, with carried interest typically at 20%, though top-performing funds could negotiate more favorable terms for themselves.

Brederode's strategy of investing in these sought-after funds means it often finds itself in a competitive bidding environment for allocations. The strong brand and consistent performance of these General Partners (GPs) translate directly into their bargaining power. This allows GPs to set terms, such as higher management fees or a larger share of profits (carried interest), which Brederode must accept to gain access to these attractive investment opportunities.

- High Demand for Top-Tier Funds: Limited Partners actively seek out funds with a history of outperformance, creating intense competition for available capital.

- GP Bargaining Power: Proven track records empower General Partners to set favorable terms regarding fees and profit sharing.

- Brederode's Position: As an investor in these funds, Brederode faces the reality of accepting GP-dictated terms to secure access to exclusive investment opportunities.

The bargaining power of suppliers, particularly General Partners (GPs) in the private equity space, is significantly influenced by the scarcity of high-quality investment opportunities. When attractive assets are limited, GPs holding them or having access gain considerable leverage, as seen in 2024 with increased competition for prime assets driving up acquisition multiples.

Brederode's reliance on specialized external service providers for crucial functions like due diligence also empowers these suppliers. The robust growth and high demand for niche expertise in financial advisory services leading up to 2025 mean these providers can command higher fees due to Brederode's limited alternatives.

Furthermore, GPs benefit from diversified capital sources, including institutional investors, sovereign wealth funds, and family offices, reducing their dependence on any single Limited Partner like Brederode. This broad access to capital, supported by over $1.2 trillion raised globally by private equity funds in 2023, allows GPs to negotiate more favorable terms.

Established private equity funds with proven track records also wield significant bargaining power. This demand allows them to dictate terms, such as management fees and carried interest, which investors like Brederode often must accept to gain access to these sought-after opportunities.

| Supplier Type | Key Leverage Factor | Impact on Brederode | 2024/2025 Market Trend |

|---|---|---|---|

| General Partners (GPs) | Scarcity of high-quality deal flow; proven track records | Ability to dictate terms (fees, carried interest); limited alternatives for Brederode | Increased competition for prime assets; sustained demand for top-tier funds |

| Specialized Service Providers (e.g., Due Diligence) | Unique, in-demand skills; high market demand | Potential for increased fees; limited alternatives for critical insights | Robust growth in financial advisory services; record deal volumes reported |

What is included in the product

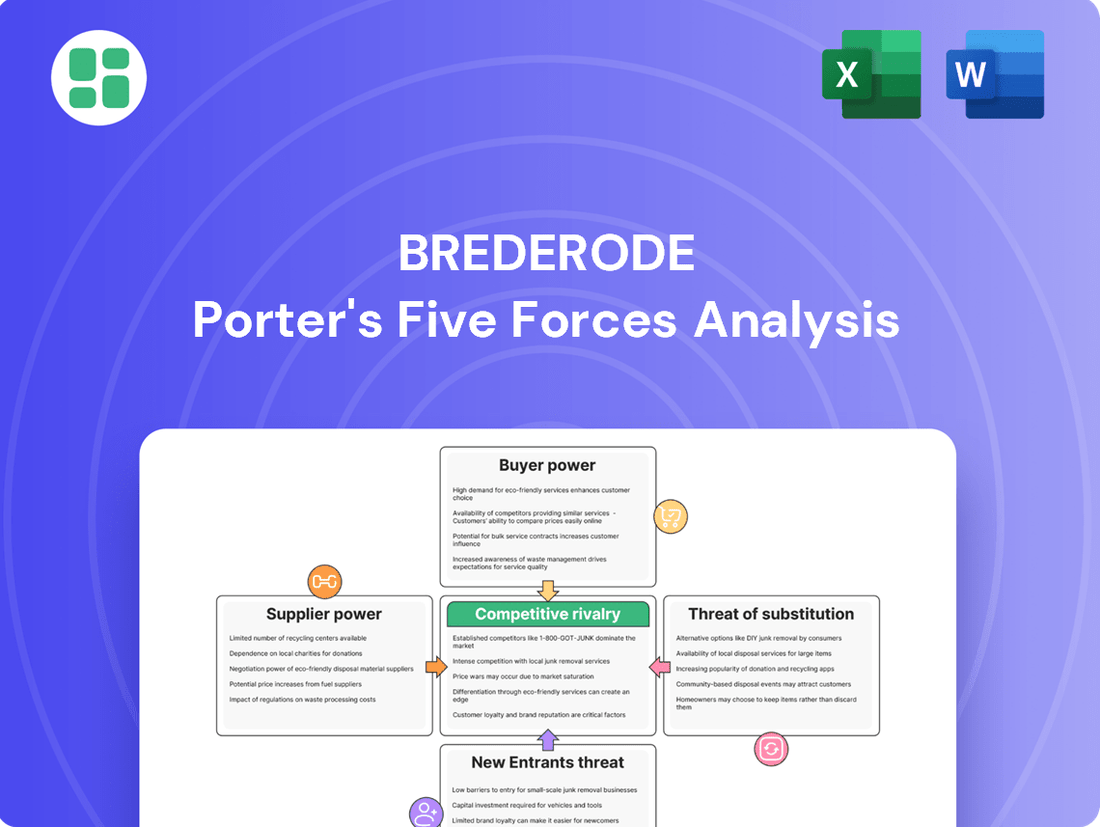

Brederode's Porter's Five Forces Analysis dissects the competitive intensity within its industry, examining buyer and supplier power, the threat of new entrants and substitutes, and the rivalry among existing competitors to inform strategic decisions.

Instantly identify and quantify competitive threats, allowing for proactive strategy adjustments to mitigate market pressures.

Customers Bargaining Power

Companies looking for capital, particularly those that align with Brederode's buyout focus, now have a vast selection of funding avenues. Beyond Brederode and its related entities, alternatives such as rival private equity firms, venture capital groups, strategic corporate investors, and public market listings (IPOs) are readily available.

The availability of diverse debt financing options further expands this landscape. This abundance of choices significantly strengthens the bargaining position of potential investee companies, allowing them to secure more advantageous terms regarding valuation and corporate governance.

For instance, in 2024, the global private equity market saw significant activity, with capital raised by PE firms reaching hundreds of billions of dollars, indicating robust competition for deals. This competitive environment directly translates to better negotiation power for companies seeking investment.

Even with economic headwinds, investors continue to seek out high-quality assets that promise stable cash flows and robust growth potential. This persistent demand is a key factor influencing the bargaining power of customers in many sectors.

The private equity landscape in 2024 saw a notable uptick in deal activity, with projections for 2025 remaining optimistic. This suggests that attractive acquisition targets are frequently met with multiple interested buyers, intensifying competition.

When desirable companies attract numerous bids, sellers are in a stronger position to negotiate higher valuations and more favorable terms. This dynamic directly enhances their bargaining power when dealing with potential investors like Brederode.

While Brederode invests heavily in due diligence, target companies inherently hold more detailed internal knowledge. This information asymmetry can allow them to present a more favorable picture, potentially influencing Brederode's valuation and negotiation stance. For instance, in 2024, the average cost of conducting comprehensive due diligence for a private equity firm can range from 0.5% to 2% of the deal value, a significant investment that can empower the seller.

Ability of Target Companies to Opt for Organic Growth

The ability of target companies to pursue organic growth significantly influences their bargaining power with potential investors like Brederode. Companies that can fund expansion through retained earnings, debt financing, or strategic alliances without diluting equity are less reliant on external equity. For instance, in 2024, many mature companies across various sectors demonstrated robust free cash flow generation, enabling them to reinvest profits rather than seeking outside capital.

This internal financing capacity strengthens a company's negotiation stance. They are not pressured into accepting less favorable terms or valuations from private equity firms if they have a clear path to growth funded internally. This was evident in the market sentiment during 2024, where companies with strong balance sheets and predictable earnings were often able to dictate terms more effectively.

- Reduced Dependency: Companies can self-fund growth, lessening the need for external equity.

- Negotiating Leverage: Internal funding power allows companies to resist unfavorable investment terms.

- Strategic Flexibility: Options like debt or partnerships offer growth avenues without equity dilution.

- Market Conditions (2024): Strong free cash flow in many sectors empowered companies to self-finance expansion.

Exit Pressure on Fund Managers

Brederode's investments in private equity funds mean its General Partners (GPs) face significant pressure from their Limited Partners (LPs) to exit investments and return capital. This situation directly influences the bargaining power of buyers, who are effectively Brederode's customers in these exit scenarios.

The imperative for GPs to achieve successful sales of portfolio companies, driven by LP demands, can shift negotiation leverage towards the buyers. This is particularly true when considering the growing backlog of delayed exits, which intensifies the urgency for GPs to complete transactions.

In 2024, the private equity industry continued to grapple with a challenging exit environment. Data from Preqin indicated that global private equity dry powder remained substantial, yet the pace of exits slowed compared to previous years, creating a more buyer-favorable market. This environment amplifies the bargaining power of customers looking to acquire portfolio companies.

- Increased LP Pressure: Limited Partners are increasingly vocal about capital repatriation, pushing GPs to prioritize exits.

- Delayed Exits: A backlog of unrealized investments means GPs are more motivated to close deals, even at less favorable terms.

- Buyer Leverage: The combination of LP pressure and exit delays empowers buyers, who can negotiate more aggressively for portfolio company acquisitions.

Customers, in this context being the companies seeking investment from Brederode, possess significant bargaining power due to the sheer volume of alternative capital sources available. The competitive landscape for investment capital is robust, with numerous private equity firms, venture capital groups, and even public markets vying for attractive deals.

This abundance of funding options means that companies are not solely reliant on Brederode. They can explore multiple avenues, allowing them to compare terms and select the most advantageous offers. For instance, in 2024, global private equity fundraising remained strong, with hundreds of billions of dollars raised, indicating intense competition for investment opportunities.

Companies that demonstrate strong financial health and growth potential, often evidenced by robust free cash flow generation as seen in many sectors during 2024, are particularly well-positioned. This internal financial strength reduces their dependency on any single investor, enhancing their ability to negotiate favorable valuations and governance terms.

The bargaining power of these customer companies is further amplified by their intrinsic knowledge of their own operations. This information asymmetry, coupled with the significant costs associated with thorough due diligence by investors (which can range from 0.5% to 2% of deal value in 2024), allows companies to present their case effectively and potentially influence investor valuations.

What You See Is What You Get

Brederode Porter's Five Forces Analysis

This preview shows the exact Brederode Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. This detailed analysis is fully formatted and ready for your strategic decision-making.

Rivalry Among Competitors

Brederode navigates a fiercely competitive environment, facing rivals ranging from colossal global private equity giants to nimble, niche buyout funds. This broad spectrum of competitors, including venture capital firms, sovereign wealth funds, direct-investing institutional investors, and influential family offices, all target similar long-term investment prospects across Europe and North America.

In 2024, the private equity industry saw significant activity. For instance, global private equity firms raised an estimated $700 billion in new capital, a figure that underscores the sheer volume of dry powder available to compete for deals. This intense competition drives up valuations, making it more challenging for firms like Brederode to secure attractive entry points for their investments.

The private equity landscape in 2024 is characterized by a significant amount of dry powder, meaning uncalled capital readily available for investment. This abundance of capital, estimated to be in the trillions globally, intensifies competition among firms like Brederode's rivals.

This substantial capital availability directly translates into heightened competitive rivalry. Firms are eager to deploy their funds, leading to more aggressive bidding for attractive target companies. For Brederode, this means facing tougher competition in securing deals, potentially driving up acquisition prices and impacting entry multiples.

Private equity deal activity experienced a significant rebound in 2024, especially for prime assets, with expectations for continued strength into 2025. This renewed vigor, fueled by improving economic sentiment and investor confidence, intensifies buyer competition.

This heightened competition naturally narrows the gap between what buyers are willing to pay and what sellers expect, known as the bid-ask spread. Consequently, transaction multiples are on the rise, presenting a significant hurdle for Brederode in identifying and securing investments that genuinely add value. For instance, global M&A activity in the first half of 2024 reached over $2 trillion, a substantial increase from the previous year, indicating this trend.

Differentiation of Investment Strategies

Competitors in the investment landscape actively differentiate themselves through a variety of means. These include specializing in particular sectors, concentrating on specific geographic regions, focusing on different deal sizes, leveraging unique operational expertise, and employing distinct value creation strategies. This diverse approach means Brederode must constantly adapt.

For instance, while Brederode has historically focused on long-term minority stakes and buyout strategies, other investment firms might target entirely different market niches. This forces Brederode to continually refine its unique value proposition. It's about demonstrating clear advantages to both portfolio companies and fund managers to maintain its competitive edge.

- Sector Specialization: Some firms focus solely on technology or healthcare, building deep expertise.

- Geographic Focus: Others concentrate on emerging markets or specific continents.

- Deal Size: Competitors may exclusively pursue large-cap buyouts or smaller growth equity investments.

- Value Creation: Strategies range from hands-on operational improvements to financial engineering.

Pressure to Exit and Return Capital

The private equity landscape in 2024 is characterized by a significant backlog of assets that have been held beyond typical investment horizons. This situation creates substantial pressure on all firms, including Brederode's rivals, to actively pursue exits and return invested capital to their Limited Partners (LPs). For instance, Preqin data from early 2024 indicated that the average age of private equity-backed companies awaiting exit had reached a new high, pushing LPs to demand faster capital deployment and returns.

This mounting pressure to liquidate existing holdings can translate into more aggressive strategies for sourcing new deals and a potential acceptance of lower realized returns during divestments. Consequently, the competitive intensity extends beyond the initial acquisition phase into the critical exit process, forcing firms to vie not only for attractive investment opportunities but also for the most advantageous divestment scenarios. The urgency to return capital can lead to a more crowded exit market, potentially impacting valuations and deal certainty for all participants.

- Increased Exit Pressure: Private equity firms are facing a growing need to exit investments due to longer holding periods.

- Return Capital Demand: Limited Partners are increasingly pushing for the return of their capital, intensifying the pressure on fund managers.

- Aggressive Deal Sourcing: The need to deploy capital and the pressure to show activity can lead to more aggressive new investment strategies.

- Lower Return Acceptance: Some firms may accept lower returns on exits to meet LP demands and clear their books.

Brederode faces intense competition from a wide array of players, including large global private equity firms, specialized buyout funds, venture capital, sovereign wealth funds, and family offices, all vying for similar long-term investment opportunities. This rivalry is amplified by the substantial capital available for deployment. In 2024, global private equity firms raised approximately $700 billion, a figure that fuels aggressive bidding and drives up acquisition prices, making favorable entry points harder to secure.

The landscape is further complicated by competitors differentiating themselves through sector specialization, geographic focus, deal size, operational expertise, and value creation strategies. This forces Brederode to continually refine its unique value proposition to stand out. For example, while Brederode might focus on minority stakes, others may exclusively pursue large-cap buyouts.

Moreover, a significant backlog of assets held beyond typical investment horizons in 2024 creates pressure for firms to exit investments and return capital to Limited Partners. This urgency can lead to more aggressive deal sourcing and a potential acceptance of lower realized returns during divestments, intensifying competition across the entire investment lifecycle.

| Competitor Type | 2024 Capital Raised (Est.) | Key Differentiators |

|---|---|---|

| Global Private Equity Firms | $700 Billion | Scale, broad sector focus, operational expertise |

| Niche Buyout Funds | Varies (significant dry powder) | Deep sector specialization, focused geographic markets |

| Venture Capital Firms | Varies (significant dry powder) | Early-stage focus, disruptive technology, high-growth potential |

| Sovereign Wealth Funds | Varies (substantial long-term capital) | Long-term horizon, diversification, strategic partnerships |

SSubstitutes Threaten

Companies today have a wider array of debt financing options than ever before. Traditional bank loans remain a staple, but the landscape has significantly broadened with syndicated loans and the burgeoning private credit market. This increased availability of debt acts as a substitute for equity investment.

The private credit market, in particular, has surged, offering businesses flexible and often faster access to capital. For instance, global private debt fundraising reached approximately $1.5 trillion in 2023, demonstrating its substantial growth. This expansion means companies can fund their growth and operations through debt, reducing their need for equity capital from firms like Brederode.

For mature, high-growth companies, an Initial Public Offering (IPO) or direct listing presents a compelling substitute for private equity funding. This route allows companies to access substantial capital directly from public investors, often while maintaining more autonomy. The IPO market in 2024 has shown signs of increased activity, with several notable tech companies going public, and this trend is expected to continue into 2025.

Companies can counter the threat of substitutes by forging strategic partnerships and engaging in corporate venturing. These collaborations, including alliances and joint ventures, offer capital, market access, and operational know-how. For instance, in 2024, corporate venture capital (CVC) investments globally reached an estimated $100 billion, demonstrating a significant avenue for growth and innovation that can serve as an alternative to traditional funding or strategic moves.

Organic Growth and Retained Earnings

Well-established companies with robust cash flows possess a significant advantage. They can fund their expansion plans internally by reinvesting their retained earnings. This self-funding capability allows them to maintain complete ownership and control over their growth trajectory, effectively bypassing the need for external equity capital from investment firms like Brederode. For instance, in 2024, many mature companies in sectors like technology and consumer staples generated substantial free cash flow, enabling them to pursue strategic initiatives without diluting ownership.

This organic growth strategy directly impacts the threat of substitutes for private equity. By not needing external investment, these cash-rich companies reduce the pool of potential acquisition targets or investment opportunities for firms like Brederode. The ability to self-finance limits the market penetration of private equity, as many strong, established players are less likely to be available for investment or acquisition.

- Organic funding via retained earnings bypasses the need for external equity.

- Companies with strong cash flows can self-fund expansion, limiting PE targets.

- In 2024, mature companies in stable sectors demonstrated significant retained earnings capacity.

Alternative Private Capital Structures

Beyond traditional private equity, companies can explore alternative private capital structures. These include venture debt, growth equity with more flexible terms than typical buyouts, and continuation vehicles that enable existing investors to maintain their exposure. For instance, the market for continuation funds saw significant activity in 2023, with over $20 billion deployed, offering an alternative exit route for LPs seeking liquidity.

These diverse structures present viable substitutes to Brederode's established investment models, such as long-term minority stakes or buyout funds. They offer varying degrees of flexibility and control, allowing companies to access capital without necessarily ceding the same level of control or adhering to the same exit timelines as traditional private equity. This can be particularly appealing for businesses that value operational independence or have longer growth horizons.

The increasing sophistication and availability of these alternative private capital solutions mean that companies have more options than ever when seeking financing. This directly impacts the bargaining power of established players like Brederode by increasing the threat of substitutes. Companies can now more readily find capital providers whose structures align better with their specific strategic and financial objectives.

The growth in secondary market transactions, which often involve continuation vehicles, highlights this trend. In 2024, it's projected that the secondary market will continue to expand, potentially reaching over $100 billion in transaction volume, further underscoring the availability of alternative capital pathways.

The threat of substitutes arises when alternative solutions can fulfill the same customer needs, potentially drawing business away from existing offerings. For Brederode, this means considering how companies can achieve their growth and financing objectives through means other than traditional private equity investments.

Companies can leverage public markets through Initial Public Offerings (IPOs) or direct listings, accessing capital from a broad investor base. For example, the IPO market saw a notable uptick in 2024, with several tech companies successfully listing, indicating a robust alternative for capital raising. This public market access offers liquidity and can provide substantial funding without the direct involvement of private equity firms.

Furthermore, the expanding private credit market offers a viable substitute for equity financing. This sector has grown significantly, with global private debt fundraising reaching approximately $1.5 trillion in 2023. Such debt financing provides companies with capital for operations and growth, reducing their reliance on equity capital and thus diminishing the attractiveness of private equity deals.

Companies with strong internal cash generation can also self-fund their expansion. In 2024, many established companies, particularly in stable sectors, generated substantial retained earnings. This organic funding allows them to pursue strategic initiatives without diluting ownership or seeking external equity, effectively bypassing the need for private equity investment.

| Financing Alternative | Key Characteristic | 2023/2024 Data Point |

| Public Markets (IPOs/Direct Listings) | Access to broad investor base, liquidity | Increased IPO activity in 2024 |

| Private Credit Market | Debt financing, flexible terms | Global fundraising ~ $1.5 trillion in 2023 |

| Organic Funding (Retained Earnings) | Self-funding, maintains ownership | Strong retained earnings capacity in mature companies (2024) |

Entrants Threaten

Entering the long-term investment and private equity arena, especially for buyout strategies, demands immense capital. New players must secure substantial funds, a significant hurdle for those lacking a proven history or robust relationships with Limited Partners.

For instance, as of the first quarter of 2024, global private equity dry powder stood at approximately $2.5 trillion, indicating ample capital is available for well-positioned entrants capable of attracting investor commitments.

Success in private equity, particularly for firms like Brederode, hinges on an established track record and a solid reputation. Limited Partners (LPs) and high-quality deal flow are attracted to firms with a history of successful investments and profitable exits. For instance, in 2023, the private equity industry saw fundraising levels adjust, with LPs becoming more discerning and prioritizing established managers with demonstrable performance.

New entrants often struggle to compete because they lack this crucial historical performance data. Brederode, with its decades of experience, has cultivated a strong reputation that new firms simply cannot replicate overnight. This makes it challenging for newcomers to gain the trust and credibility necessary to secure capital and attractive investment opportunities, creating a significant barrier to entry.

Access to proprietary deal flow and established networks presents a significant barrier for new entrants. Brederode, for instance, leverages decades of cultivated relationships across various industries to identify attractive investment opportunities. In 2024, the private equity market continued to see intense competition for quality assets, with many deals going through competitive auction processes, which can drive up valuations and make it harder for newcomers to secure favorable terms.

Specialized Expertise and Operational Capabilities

Brederode's investment strategy hinges on providing deep operational, financial, and strategic support to its portfolio companies. This active involvement requires a significant investment in specialized expertise.

New entrants looking to replicate this model must either develop these complex capabilities in-house or acquire them, both of which represent substantial financial and time commitments. For instance, building a team with the proven track record of identifying undervalued assets and implementing value-creation strategies, akin to Brederode's approach, can take years and millions in recruitment and training.

This high bar for specialized knowledge and proven operational execution acts as a considerable barrier, deterring many potential new players from entering the market effectively. The ability to not just invest capital but also actively manage and grow businesses is a critical differentiator.

- High Cost of Expertise Acquisition: Developing or acquiring the necessary operational, financial, and strategic talent is a significant upfront investment for new entrants.

- Time to Build Capabilities: Establishing a reputation and track record in post-investment management and value creation is a lengthy process.

- Differentiator in Value Creation: Specialized expertise allows firms like Brederode to unlock value that passive investors cannot, creating a competitive advantage.

Regulatory and Compliance Burdens

The investment industry, especially in regions like Europe and North America where Brederode is active, is heavily regulated. For instance, in 2023, the European Securities and Markets Authority (ESMA) continued to emphasize stringent oversight of financial services firms, impacting operational costs and strategic planning for new entrants.

Navigating these complex and evolving regulatory landscapes, including licensing, compliance with directives like MiFID II, and anti-money laundering (AML) regulations, presents a significant hurdle. These requirements can add millions in upfront costs and ongoing operational expenses, acting as a substantial barrier to entry.

The increasing scrutiny on financial transactions and the need for robust compliance infrastructure mean that potential new firms must invest heavily in technology and skilled personnel. This financial and operational commitment deters many aspiring players from entering the market.

- Regulatory Hurdles: Compliance with frameworks like GDPR and evolving financial conduct rules adds significant operational complexity.

- Licensing Costs: Obtaining necessary licenses in key markets can cost hundreds of thousands to millions of dollars.

- Increased Scrutiny: Enhanced due diligence and reporting requirements necessitate substantial investment in compliance technology and personnel.

- Capital Requirements: Regulators often mandate minimum capital reserves, further raising the financial barrier for new investment firms.

The threat of new entrants in the long-term investment and private equity sector, where firms like Brederode operate, is considerably low due to several formidable barriers. These include the massive capital requirements, the necessity of a proven track record and reputation, access to proprietary deal flow, and the complex regulatory environment. For instance, global private equity dry powder remained substantial, exceeding $2.5 trillion in early 2024, but attracting this capital as a new entrant without a history of success is exceptionally difficult, as LPs in 2023 became even more selective, favoring established managers.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Private equity buyouts demand significant capital, with global dry powder around $2.5 trillion in Q1 2024. | New firms struggle to raise sufficient funds without a proven track record. |

| Reputation & Track Record | LPs favor firms with a history of successful investments and profitable exits. | New entrants lack the credibility to attract LPs and quality deal flow. |

| Deal Flow & Networks | Established firms leverage decades of relationships for proprietary deal access. | Newcomers face intense competition for assets, often in auction processes. |

| Specialized Expertise | Active management and value creation require deep operational and strategic capabilities. | Building or acquiring this expertise is a costly and time-consuming endeavor. |

| Regulatory Compliance | Navigating complex regulations (e.g., MiFID II, AML) incurs high upfront and ongoing costs. | Licensing, compliance, and capital reserve mandates create substantial financial hurdles. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and publicly available financial filings to provide a comprehensive view of competitive dynamics.