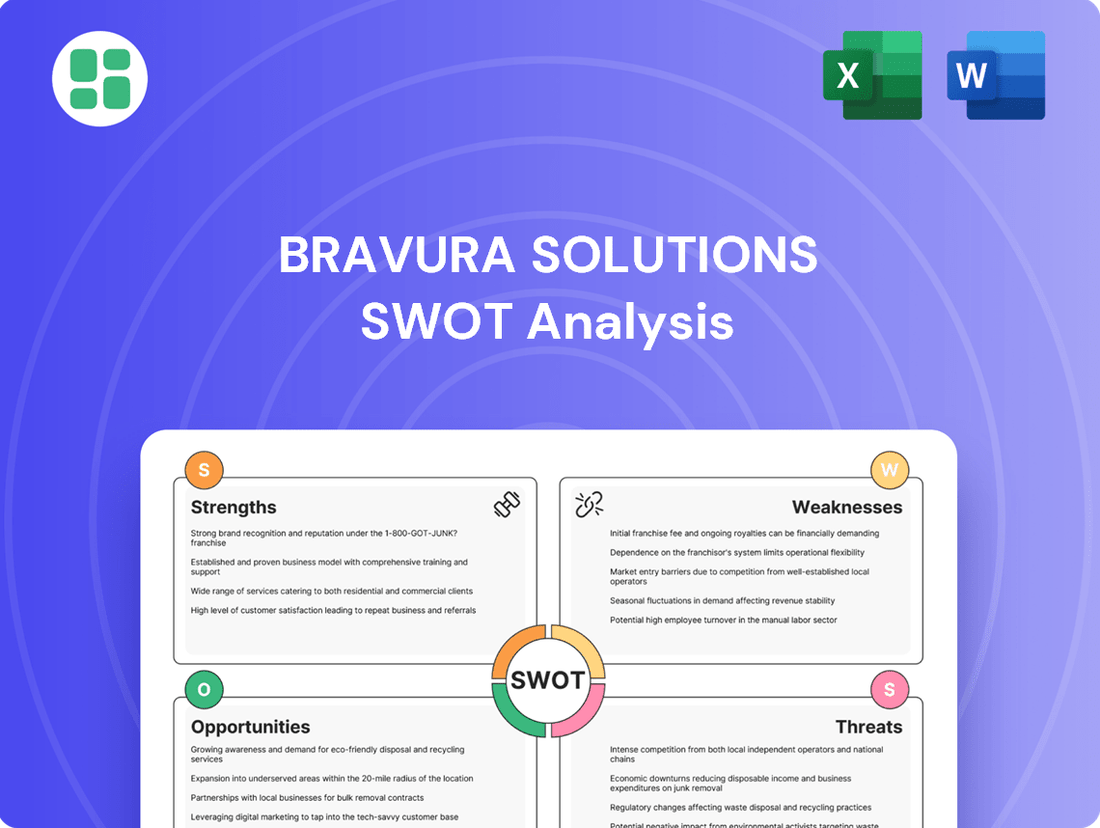

Bravura Solutions SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bravura Solutions Bundle

Bravura Solutions demonstrates strong market presence and technological innovation, but faces competitive pressures and regulatory shifts. Understanding these dynamics is crucial for navigating the evolving financial technology landscape.

Want the full story behind Bravura Solutions' competitive advantages, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

Bravura Solutions has demonstrated a remarkable financial turnaround, achieving profitability and raising its FY25 financial outlook. This recovery is underpinned by strong revenue growth and a significant increase in EBITDA, signaling improved operational performance.

The company’s financial health has strengthened considerably, allowing for the reinstatement of dividend payments to shareholders. This move reflects confidence in sustained profitability and a healthy balance sheet, a key indicator of financial stability.

Bravura Solutions boasts over two decades of deep industry expertise, establishing itself as a premier provider of specialized software for wealth management, life insurance, and funds administration. This extensive experience allows them to deeply understand the intricate needs of these complex financial sectors.

Their comprehensive Sonata platform, alongside other tailored solutions, delivers end-to-end processing capabilities. This empowers financial institutions to streamline and efficiently manage their most complex operational processes, a critical advantage in today's fast-paced market.

For instance, in 2023, Bravura Solutions reported significant growth in its wealth management segment, driven by the adoption of its advanced platforms. This adoption reflects the market's recognition of their ability to handle substantial transaction volumes and regulatory complexities, a testament to their robust offerings.

Bravura Solutions boasts a significant global market presence, serving a wide array of clients across key financial hubs. Their operations are particularly robust in the Asia-Pacific (APAC) region and extend strongly into Europe, the Middle East, and Africa (EMEA). This expansive reach underscores their ability to cater to the complex demands of major financial institutions on an international scale.

Successful Strategic Transformation Execution

Bravura Solutions has demonstrated a strong ability to execute its strategic transformation, notably the 'Energise, Build and Grow' initiative. This has involved significant operational enhancements and a concerted effort to reduce costs, which has directly contributed to rebuilding client confidence.

The successful implementation of this strategy has translated into tangible financial improvements. For instance, their revenue saw a notable increase in the fiscal year ending June 30, 2024, reaching AUD 305 million, a 10% rise compared to the previous year, underscoring the effectiveness of their strategic direction and its positive impact on market standing.

This strategic focus has bolstered Bravura's market position, allowing them to navigate challenges and capitalize on opportunities more effectively. The company's ability to pivot and execute such a comprehensive transformation highlights a core organizational strength.

Key aspects of this successful transformation include:

- Operational Efficiency Improvements: Streamlining processes and enhancing service delivery.

- Cost Reduction Initiatives: Implementing measures to improve profitability and financial health.

- Client Trust Rebuilding: Proactive engagement and delivery to restore and strengthen client relationships.

- Financial Performance Uplift: Demonstrable revenue growth and improved profitability directly linked to strategic execution.

Focus on Innovation and Regulatory Compliance

Bravura Solutions' commitment to innovation is a significant strength, with a strategic focus on key growth areas such as data analytics, artificial intelligence (AI) automation, digitization, and digital advice. This forward-thinking approach is exemplified by strategic partnerships, such as their collaboration with AMP to develop advanced digital advice solutions, positioning them at the forefront of evolving financial services technology.

The company’s solutions are engineered to navigate and adapt to intricate and constantly changing regulatory landscapes. This capability provides a distinct competitive advantage, ensuring clients can maintain compliance while embracing new technologies and market opportunities.

- Innovation Focus: Product themes include data, AI automation, digitization, and digital advice.

- Strategic Partnerships: Collaboration with AMP for digital advice solutions highlights innovation drive.

- Regulatory Adaptability: Solutions designed for complex and evolving regulatory environments.

Bravura Solutions leverages deep industry expertise, honed over two decades, to offer specialized software for wealth management, life insurance, and funds administration. Their comprehensive Sonata platform and tailored solutions provide end-to-end processing, enabling financial institutions to streamline complex operations efficiently.

The company demonstrates strong innovation, focusing on data analytics, AI automation, digitization, and digital advice, exemplified by their partnership with AMP for advanced digital advice solutions. Furthermore, their solutions are designed to navigate complex and evolving regulatory landscapes, offering clients a competitive edge in compliance and technological adoption.

Bravura Solutions has achieved a significant financial turnaround, marked by profitability and an improved FY25 outlook, driven by strong revenue growth and increased EBITDA. This financial health has enabled the reinstatement of dividend payments, reflecting confidence in sustained performance and a stable balance sheet.

Their strategic 'Energise, Build and Grow' initiative has yielded tangible results, including a 10% revenue increase to AUD 305 million for the fiscal year ending June 30, 2024, and improvements in operational efficiency and cost reduction, which have rebuilt client trust.

| Metric | FY24 (AUD Million) | FY23 (AUD Million) | YoY Change |

|---|---|---|---|

| Revenue | 305 | 277.3 | +10.0% |

| EBITDA | 60.5 | 35.2 | +71.9% |

What is included in the product

Provides a comprehensive analysis of Bravura Solutions's internal strengths and weaknesses, alongside external opportunities and threats, to inform strategic decision-making.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities.

Weaknesses

Bravura Solutions experienced a difficult financial period in FY22-23, reporting a net loss of $54.4 million. This underperformance necessitated significant corporate restructuring, including a substantial workforce reduction. While the company has shown signs of recovery, this historical financial weakness could continue to affect investor sentiment and client trust if not consistently addressed with sustained positive results.

Bravura Solutions' financial performance can be sensitive to fluctuations in professional services fees. For instance, initial guidance for Fiscal Year 2025 pointed to a revenue dip, partly attributed to a reduction in these fees and one-off license charges.

While the company has since upgraded its overall outlook, a significant dependence on project-based or non-recurring revenue streams inherently introduces a degree of volatility. This contrasts with the more predictable nature of recurring subscription-based revenue models.

Bravura Solutions operates in a fiercely competitive financial software landscape, contending with major players like FNZ, GBST, SS&C Technologies, Temenos, FIS, and Avaloq. This crowded market demands constant innovation and unique offerings to hold onto market share and maintain strong pricing power.

Potential for Regional Headwinds

Bravura Solutions could encounter challenges in specific geographic markets. For instance, the EMEA region, which is a significant market for the company, might experience budget constraints from clients. This could directly affect Bravura's revenue in the short term.

These regional economic or political conditions are often beyond the company's immediate influence, posing a risk to its performance. For example, a slowdown in the European financial sector, which is a key customer base, could lead to delayed or reduced spending on Bravura's software solutions.

- Regional Economic Sensitivity: Bravura's revenue streams are tied to the financial health of its clients in various regions, making it susceptible to localized economic downturns.

- Client Budgetary Constraints: Suspensions or reductions in client IT budgets, particularly in markets like EMEA, can directly impact near-term revenue growth and project pipelines.

- Geopolitical Factors: Unforeseen political instability or regulatory changes in key operating regions could disrupt business operations and client relationships.

- Market Concentration Risk: Over-reliance on specific regional markets, such as EMEA, can amplify the impact of localized headwinds on overall company performance.

Recent Leadership Transition

The recent announcement that Bravura Solutions' Group CEO will step down in April 2025 introduces a notable weakness in leadership stability. This transition, even with an interim CEO in place, can potentially create temporary uncertainty regarding the company's strategic path and the smooth execution of its operational plans.

Leadership changes, especially at the CEO level, often bring a period of adjustment. For Bravura Solutions, this could manifest as a temporary pause or re-evaluation of ongoing projects and long-term strategic initiatives, potentially impacting market confidence and investor sentiment in the short to medium term.

- Leadership Uncertainty: The departure of the Group CEO in April 2025 creates a leadership vacuum, potentially leading to a period of strategic drift.

- Potential for Disruption: Significant leadership transitions can disrupt operational momentum and the implementation of key business strategies.

- Interim Appointment: While an interim CEO has been appointed, this often signifies a transitional phase rather than a permanent, stable leadership solution.

Bravura Solutions faces intense competition from established players like FNZ and SS&C Technologies, necessitating continuous innovation to maintain market share and pricing power. The company's revenue can be sensitive to fluctuations in professional services fees, as indicated by initial FY25 guidance suggesting a dip partly due to reduced fees and one-off license charges, though this outlook has since improved.

| Competitor | Market Position | Key Offerings |

|---|---|---|

| FNZ | Leading global platform provider | Wealth management, investment, insurance solutions |

| SS&C Technologies | Major financial services software provider | Investment, accounting, compliance, and trading solutions |

| Temenos | Global leader in banking software | Core banking, digital banking, wealth management solutions |

Same Document Delivered

Bravura Solutions SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis for Bravura Solutions. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after purchase.

Opportunities

The financial services sector is in the midst of a significant digital overhaul, with a growing need for cloud computing, artificial intelligence, automation, and sophisticated digital solutions. This trend creates a fertile ground for companies like Bravura Solutions that specialize in these transformative technologies.

Bravura's strategic alignment with these market shifts positions it for substantial expansion. For instance, the global cloud computing market in financial services was projected to reach $60 billion by 2024, a testament to the industry's digital drive.

This increasing demand for digital transformation directly translates into opportunities for Bravura to offer its expertise in areas like wealth management platforms and digital customer engagement, capitalizing on the industry's push for modernization and efficiency.

Bravura Solutions has significant opportunities for geographical market expansion, especially by targeting high-growth regions in wealth management and insurance technology. For instance, the APAC wealth management market is projected to grow substantially, with assets under management expected to reach over $10 trillion by 2027, presenting a prime area for Bravura to increase its footprint.

Deepening its existing presence in the EMEA region also offers considerable growth potential. The European wealth management sector alone saw a 7% increase in assets under management in 2023, reaching approximately €25 trillion, indicating a robust market where Bravura can further solidify its position and capture additional market share.

Bravura Solutions can significantly boost its market position by forming strategic alliances and pursuing mergers or acquisitions. These moves would allow the company to enhance its existing capabilities, diversify its product portfolio, and gain access to new customer segments. For instance, the partnership with AMP for digital advice has already showcased the power of collaboration in driving synergistic growth.

Regulatory Driven Modernization

The evolving regulatory environment, exemplified by initiatives like the UK's pensions dashboards, is a significant tailwind for Bravura Solutions. These mandates compel financial firms to update outdated systems, a process where Bravura's specialized knowledge in regulatory compliance becomes highly valuable. This trend is expected to drive substantial demand for modernization solutions across the industry.

Bravura is well-positioned to benefit from this regulatory-driven modernization. For instance, the UK government has committed significant resources to the pensions dashboards program, aiming to provide consumers with a consolidated view of their retirement savings. This creates a direct opportunity for Bravura to offer its platform and services to financial institutions needing to integrate their data.

- Increased Demand for Legacy System Modernization: Regulatory changes are forcing financial institutions to upgrade their core systems.

- Bravura's Regulatory Expertise: The company's strong track record in compliance solutions makes it a preferred partner for these upgrades.

- Growth in Pensions and Retirement Services: The push for greater transparency and accessibility in pensions, such as through digital dashboards, directly benefits providers of related technology.

- Market Opportunity: The global wealth management market is projected to reach $72.5 trillion by 2027, with regulatory compliance being a key driver for technology investment.

Enhanced Client Engagement and Retention

Bravura Solutions can significantly boost client engagement and retention by emphasizing solutions that accelerate time-to-market for financial products. For instance, by streamlining the launch of new investment funds or insurance policies, Bravura helps its clients gain a competitive edge. This focus on client success directly translates into stronger, more enduring partnerships.

Cost efficiencies achieved through automation are another key opportunity. Many financial institutions are under pressure to reduce operational expenses. Bravura's ability to automate processes like policy administration or trade settlement can deliver tangible savings, making them an indispensable partner. In 2024, many firms reported significant cost reductions through automation, with some seeing up to a 20% decrease in processing times for routine tasks.

Supporting clients through regulatory change is crucial. The financial services industry is constantly evolving with new compliance requirements. Bravura's expertise in adapting its platforms to meet these demands ensures clients remain compliant and avoid penalties. This proactive approach to regulatory challenges solidifies Bravura's value proposition and fosters deep client loyalty, contributing to long-term revenue stability.

- Accelerated Time-to-Market: Helping clients launch new financial products faster.

- Cost Efficiencies: Delivering savings through automation of administrative and processing tasks.

- Regulatory Compliance: Assisting clients in navigating and adhering to complex financial regulations.

- Strengthened Relationships: Building loyalty by consistently proving value and support.

Bravura Solutions is poised to capitalize on the increasing demand for digital transformation within financial services, driven by advancements in cloud, AI, and automation. The company's expertise in wealth management and digital engagement solutions aligns perfectly with the industry's push for modernization. For instance, the global cloud computing market in financial services was projected to reach $60 billion by 2024, highlighting the significant opportunities available.

Geographical expansion presents a key avenue for growth, particularly in high-potential regions like APAC, where wealth management assets are expected to exceed $10 trillion by 2027. Deepening its presence in the EMEA region, which saw a 7% increase in assets under management in 2023, also offers substantial market share potential. Strategic partnerships and acquisitions, such as the collaboration with AMP, further enhance Bravura's capabilities and market reach.

The evolving regulatory landscape, including initiatives like the UK's pensions dashboards, creates a strong demand for system modernization, an area where Bravura's compliance expertise is highly valued. This regulatory push is expected to drive significant investment in upgrading outdated financial systems. Bravura's ability to help clients accelerate time-to-market for new products and achieve cost efficiencies through automation further solidifies its competitive advantage and client relationships.

| Opportunity Area | Market Data/Projection | Bravura's Relevance |

|---|---|---|

| Digital Transformation | Global FinServ Cloud Market: $60B (2024 Projection) | Specializes in cloud, AI, automation for financial services. |

| Geographical Expansion (APAC) | APAC Wealth Management Assets: >$10T (2027 Projection) | Targets high-growth regions for wealth management tech. |

| Regulatory Modernization | UK Pensions Dashboards Initiative | Leverages expertise in compliance and system upgrades. |

| Accelerated Time-to-Market | Industry focus on faster product launches | Streamlines new product deployment for clients. |

Threats

The financial software sector is a crowded arena, featuring both long-standing giants and nimble fintech disruptors. This intense rivalry puts pressure on pricing, can lengthen the time it takes to close deals, and risks market share erosion if Bravura Solutions doesn't consistently innovate and stand out.

For instance, the global fintech market was valued at approximately $11.3 trillion in 2023 and is projected to grow significantly. This growth attracts new entrants, intensifying competition for Bravura. In 2024, many companies in this space are focusing on AI-driven solutions and cloud-native platforms, areas where Bravura must maintain parity or risk falling behind.

The relentless march of technology, especially in fields like artificial intelligence and cloud computing, presents a significant challenge for Bravura Solutions. If the company's product development lags behind these rapid advancements, it risks becoming outdated.

For instance, the global AI market is projected to reach $1.8 trillion by 2030, according to some estimates, highlighting the immense pressure to integrate cutting-edge AI capabilities. Failure to innovate quickly could see Bravura lose ground to more agile competitors, impacting its market share and relevance.

The complex and constantly shifting regulatory environment in financial services poses a significant threat to Bravura Solutions. Failure to keep pace with evolving compliance requirements, such as those emerging from the 2024 and 2025 legislative agendas impacting data privacy and cybersecurity, could lead to substantial fines and operational disruptions.

Non-compliance not only carries financial penalties but also risks severe reputational damage, impacting client trust and market standing. For instance, a hypothetical regulatory breach in 2024 could result in millions in fines and a prolonged period of negative press, directly affecting Bravura's ability to secure new business.

Economic Downturns and Client Budget Cuts

Economic downturns pose a significant threat to Bravura Solutions. Broader economic instability, including recessions or sector-specific slowdowns, can prompt financial institutions to reduce IT expenditures or postpone critical software upgrades. This directly impacts Bravura's revenue streams and overall profitability, especially in markets experiencing economic challenges.

For instance, a slowdown in global economic growth, projected by the IMF to be around 2.9% for 2024, could lead to decreased spending on new technology solutions by banks and wealth managers. This environment could also see existing clients delaying upgrades or seeking more cost-effective alternatives, pressuring Bravura's sales pipeline and contract renewals.

- Reduced IT Budgets: Financial institutions may cut discretionary spending on new software implementations due to economic uncertainty.

- Delayed Projects: Major IT projects, including those involving Bravura's platforms, could be put on hold to conserve capital.

- Increased Price Sensitivity: Clients might become more price-sensitive, leading to pressure on Bravura's pricing and margins.

- Impact on New Business: A challenging economic climate could slow down the acquisition of new clients as their own investment capacity diminishes.

Cybersecurity Risks and Data Breaches

Bravura Solutions, as a key software provider for financial institutions, faces significant cybersecurity risks. Threats like data breaches and ransomware attacks are ever-present dangers, potentially compromising sensitive client information. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report, a figure that underscores the potential financial fallout for companies like Bravura.

A major security incident could have devastating consequences for Bravura's reputation. Such events can severely erode the trust of its clients, who rely on the integrity and security of its platforms. This loss of confidence can translate into lost business and long-term damage to its market standing.

- Data Breach Impact: A successful cyberattack could lead to substantial financial penalties and remediation costs, potentially running into millions of dollars.

- Reputational Damage: Client trust is paramount in the financial sector; a breach would severely tarnish Bravura's image and client retention.

- Operational Disruption: Ransomware attacks could halt critical operations, impacting service delivery to financial institutions and causing significant downtime.

The intense competition within the financial software sector, fueled by rapid technological advancements and new market entrants, presents a significant threat to Bravura Solutions. Companies must continually innovate to stay relevant, as failure to do so can lead to market share erosion and pricing pressures. The global fintech market's rapid expansion, projected to continue its upward trajectory through 2025, means Bravura must adapt quickly to emerging trends like AI and cloud-native platforms to avoid falling behind competitors.

The ever-changing regulatory landscape in financial services poses a substantial risk, demanding constant vigilance and adaptation from Bravura Solutions. Non-compliance with evolving data privacy and cybersecurity mandates, particularly those anticipated in 2024 and 2025, could result in severe financial penalties and reputational damage, impacting client trust and new business acquisition.

Economic downturns directly impact Bravura's revenue streams, as financial institutions often reduce IT spending during periods of instability. This can lead to delayed projects, increased price sensitivity among clients, and a slowdown in new client acquisition, as businesses conserve capital and seek more cost-effective solutions, potentially affecting Bravura's sales pipeline and contract renewals throughout 2024 and 2025.

Cybersecurity threats, including data breaches and ransomware, remain a critical concern for Bravura Solutions, given the sensitive nature of client data. The escalating costs associated with data breaches, which averaged $4.45 million globally in 2024, highlight the potential financial and reputational fallout. A significant security incident could severely damage client trust, leading to lost business and long-term harm to Bravura's market standing.

| Threat Category | Specific Risk | Potential Impact | 2024/2025 Data Point |

|---|---|---|---|

| Competition | Market Share Erosion | Reduced revenue, pricing pressure | Global fintech market expected to see continued high growth in 2024-2025. |

| Regulation | Non-compliance Fines | Financial penalties, reputational damage | Increased focus on data privacy regulations globally in 2024-2025. |

| Economic Factors | Reduced IT Budgets | Lower sales, delayed projects | Global economic growth forecasts for 2024 suggest a moderate pace, potentially impacting IT spending. |

| Cybersecurity | Data Breach Costs | Financial losses, loss of client trust | Average cost of a data breach reached $4.45 million in 2024. |

SWOT Analysis Data Sources

This Bravura Solutions SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence, and expert industry commentary to provide a robust and accurate strategic overview.