Bravura Solutions Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bravura Solutions Bundle

Unlock the strategic blueprint behind Bravura Solutions's success with our comprehensive Business Model Canvas. This detailed analysis reveals their customer segments, value propositions, and revenue streams, offering a clear path to understanding their market dominance. Perfect for aspiring entrepreneurs and seasoned business strategists alike.

Partnerships

Bravura Solutions actively collaborates with technology providers to integrate cutting-edge advancements into its software and services. These partnerships are vital for enhancing platform functionality, scalability, and security, ensuring Bravura remains at the forefront of the financial technology sector.

For instance, in 2024, Bravura continued to leverage partnerships with cloud infrastructure providers to offer robust and flexible deployment options for its solutions. This strategic approach allows them to deliver high-performance, secure, and globally accessible platforms to their diverse client base.

Bravura Solutions collaborates with consulting firms to broaden its market presence and streamline the deployment of its financial software. These partnerships are crucial for leveraging the consultants' specialized industry expertise, which directly supports client onboarding and the successful integration of Bravura's technology. For instance, in 2024, a significant portion of Bravura's new client acquisitions were facilitated through its consulting network, highlighting the strategic value of these relationships in driving adoption and ensuring client success.

Bravura Solutions cultivates crucial partnerships with major financial institutions, exemplified by its recent collaboration with AMP. This alliance is designed to jointly develop and roll out innovative digital advice platforms, solidifying Bravura's standing in the digital advisory space.

These strategic alliances are instrumental in Bravura's expansion, particularly within the dynamic Asia-Pacific region, where it aims to be a leading provider of digital advice services. Such collaborations underscore Bravura's dedication to pioneering new solutions and broadening its service offerings.

Industry Associations and Event Partners

Bravura Solutions actively participates in industry associations and collaborates with key event partners, such as the Super Fund of the Year Awards. This strategic engagement is crucial for enhancing brand visibility, fostering valuable networking opportunities with prospective clients and partners, and visibly reinforcing their dedication to the financial services industry. For instance, their role as a platinum partner at these prestigious events clearly signals their leadership standing and deep-seated commitment to the sector's advancement.

These partnerships are instrumental in cultivating relationships within the financial services ecosystem. By aligning with respected industry bodies and sponsoring high-profile events, Bravura Solutions gains direct access to a concentrated audience of decision-makers and influencers. This allows for targeted outreach and the demonstration of their expertise and solutions in a relevant, high-impact setting. In 2024, the Super Fund of the Year Awards, for example, brought together over 500 senior executives from leading superannuation funds and financial institutions, providing an ideal platform for Bravura to showcase its capabilities.

- Industry Association Engagement: Bravura Solutions maintains active memberships and participation in key financial services industry associations, facilitating knowledge sharing and collaborative opportunities.

- Event Sponsorship and Partnership: Serving as a platinum partner for significant industry events like the Super Fund of the Year Awards amplifies brand recognition and provides direct access to target audiences.

- Networking and Business Development: These partnerships create a fertile ground for networking, enabling Bravura Solutions to connect with potential clients, partners, and industry leaders, thereby driving business development.

- Demonstrating Industry Commitment: By investing in and supporting industry events and associations, Bravura Solutions underscores its dedication to the growth and innovation within the financial services sector.

Data Providers

Bravura Solutions partners with a variety of data providers to enrich its software offerings. These partnerships are crucial for integrating real-time market data, financial performance metrics, and regulatory information directly into Bravura's wealth management and funds administration platforms.

For instance, in 2024, the demand for integrated financial data has surged, with many wealthtech firms reporting a 15-20% increase in client requests for more granular market insights. Bravura's strategy leverages these partnerships to ensure its clients have access to the most up-to-date information for informed decision-making.

- Data Integration: Seamlessly embedding data from leading financial information services.

- Market Intelligence: Accessing up-to-date market trends and analytics.

- Regulatory Compliance: Incorporating critical data for adherence to financial regulations.

- Client Value: Enhancing platform utility with comprehensive and accurate data.

Bravura Solutions strategically partners with technology providers, cloud infrastructure companies, and consulting firms to enhance its software capabilities and market reach. These collaborations are vital for integrating advanced features, ensuring scalable deployment, and facilitating efficient client onboarding, as seen in their 2024 efforts to leverage cloud providers for global platform accessibility and consulting networks to drive new client acquisitions.

Furthermore, Bravura cultivates key alliances with major financial institutions, such as its 2024 collaboration with AMP to develop digital advice platforms, and actively engages with industry associations and event partners like the Super Fund of the Year Awards. These partnerships bolster brand visibility, foster critical networking, and underscore Bravura's commitment to financial sector innovation, with events in 2024 attracting over 500 senior executives.

The company also partners with data providers to enrich its software offerings, integrating real-time market data and regulatory information. This strategy addresses the surging client demand for granular insights, with many wealthtech firms in 2024 reporting 15-20% increases in such requests, ensuring Bravura's platforms deliver comprehensive and up-to-date financial intelligence.

| Partner Type | Strategic Goal | 2024 Example/Impact | Key Benefit |

|---|---|---|---|

| Technology Providers | Enhance platform functionality, security, and scalability | Integration of cutting-edge advancements | Staying at the forefront of FinTech |

| Cloud Infrastructure Providers | Offer robust and flexible deployment options | High-performance, secure, globally accessible platforms | Meeting diverse client needs |

| Consulting Firms | Broaden market presence, streamline deployment | Facilitated significant new client acquisitions | Leveraging specialized industry expertise |

| Financial Institutions (e.g., AMP) | Joint development of innovative digital platforms | Collaboration on digital advice platforms | Strengthening digital advisory capabilities |

| Industry Associations & Event Partners (e.g., Super Fund of the Year Awards) | Enhance brand visibility, foster networking | Platinum partnership, access to 500+ senior executives | Demonstrating industry leadership and commitment |

| Data Providers | Enrich software with real-time and regulatory data | Meeting 15-20% surge in client requests for market insights | Providing up-to-date information for decision-making |

What is included in the product

A robust Business Model Canvas for Bravura Solutions, detailing its target customer segments in the financial services industry and the unique value propositions offered through its software solutions.

This canvas outlines Bravura's key partnerships, revenue streams, and cost structure, reflecting its operational strategy for delivering enterprise software and services.

Bravura Solutions' Business Model Canvas offers a clear, structured approach to identify and address key industry challenges, saving valuable time and resources in strategic planning.

It acts as a powerful tool for quickly diagnosing and resolving complex business problems by providing a visual, one-page overview of critical strategic elements.

Activities

Bravura Solutions dedicates significant resources to the ongoing research, development, and improvement of its flagship software, Sonata and AdviceOS. This commitment ensures these platforms remain at the forefront of financial technology.

A key activity is the integration of cutting-edge technologies, including AI-driven automation, comprehensive digitization, and advanced digital advice capabilities. This forward-thinking approach keeps Bravura's offerings competitive and relevant.

The company's efforts are concentrated on building seamless, end-to-end digital solutions. These products are designed to streamline intricate financial workflows and adapt to the dynamic requirements of their clientele.

Bravura Solutions' key activities heavily involve the implementation and integration of its software, ensuring clients can effectively leverage these powerful tools. This means their teams work closely with financial institutions to deploy solutions, connecting them with existing IT infrastructures.

These services are crucial for modernizing operations, helping clients streamline processes and boost efficiency. For instance, successful integration can lead to significant cost reductions; a 2024 report indicated that financial firms leveraging advanced integration services saw an average of 15% operational cost savings.

Bravura Solutions provides essential ongoing maintenance and support for its software solutions to a worldwide clientele. This commitment ensures clients' systems operate at peak performance, addressing technical challenges and delivering crucial software updates.

As of early 2024, Bravura Solutions reported a significant portion of its revenue derived from these recurring support and maintenance contracts, highlighting their importance to the company's financial stability and client retention. For instance, in their fiscal year ending June 30, 2023, maintenance and support services contributed substantially to their overall earnings, demonstrating strong client reliance on these services.

This continuous engagement is vital for fostering robust, long-term client relationships. By offering dependable technical assistance and proactive issue resolution, Bravura Solutions underpins its clients' operational continuity, a key factor in maintaining customer loyalty in the competitive financial technology sector.

Strategic Business Transformation

Bravura Solutions is actively pursuing its 'Energise, Build and Grow' strategy. This involves significant efforts in operational business improvement and cost reduction to boost profitability. A key aspect is rebuilding client trust through dependable execution and identifying avenues for revenue expansion.

The company is implementing regional and client-specific operational models as part of this transformation. For instance, in the fiscal year 2023, Bravura Solutions reported a statutory net loss after tax of $20.9 million, highlighting the challenges and the imperative for these strategic shifts. The focus on operational efficiency is designed to address such outcomes and foster sustainable growth.

- Operational Improvement: Implementing initiatives to streamline processes and enhance efficiency across the business.

- Cost Reduction: Targeting specific areas for cost savings to improve the bottom line.

- Client Trust: Focusing on consistent delivery and service to rebuild and strengthen client relationships.

- Revenue Growth: Identifying and pursuing new opportunities for sales and market expansion.

Sales and Marketing

Bravura Solutions focuses on direct sales for significant client acquisition, supported by robust digital marketing campaigns and participation in key industry events to boost its market profile. This dual strategy aims to expand its reach and attract new customers.

The company is actively working to solidify its client base in strategic markets, particularly within the EMEA and APAC regions, leveraging these sales and marketing efforts. For instance, in the fiscal year ending June 30, 2024, Bravura reported a significant increase in new client wins, contributing to its overall revenue growth.

- Direct Sales: High-value client engagement and complex solution selling.

- Digital Marketing: Enhancing brand visibility and lead generation through online channels.

- Industry Events: Networking and showcasing solutions at prominent financial technology conferences.

- Regional Focus: Strengthening presence and client relationships in EMEA and APAC.

Bravura Solutions' key activities revolve around the continuous enhancement of its core software platforms, Sonata and AdviceOS, integrating advanced technologies like AI and digital advice. The company also focuses on seamless implementation and ongoing support for its global client base, ensuring operational continuity and client satisfaction.

Furthermore, Bravura is actively engaged in strategic operational improvements and cost reduction initiatives as part of its 'Energise, Build and Grow' strategy, aiming to rebuild client trust and expand revenue streams. This includes tailored regional operational models and a strong emphasis on direct sales supported by digital marketing and industry engagement to solidify its market position, particularly in EMEA and APAC.

| Key Activity | Description | Impact/Data Point (as of early 2024/FY23-24) |

|---|---|---|

| Software R&D and Improvement | Enhancing Sonata and AdviceOS with AI, digitization, and digital advice. | Ensures platforms remain competitive and relevant in financial technology. |

| Implementation & Integration | Deploying software and connecting with client IT infrastructures. | Led to an average of 15% operational cost savings for firms in 2024. |

| Maintenance & Support | Providing ongoing technical assistance and software updates globally. | Substantially contributed to earnings in FY23, highlighting client reliance. |

| Strategic Transformation | Operational improvement, cost reduction, client trust rebuilding, revenue expansion. | Aimed to address FY23 net loss of $20.9 million and foster sustainable growth. |

| Sales & Marketing | Direct sales, digital marketing, and industry events, with regional focus on EMEA/APAC. | Reported significant increase in new client wins in FY24, boosting revenue. |

Preview Before You Purchase

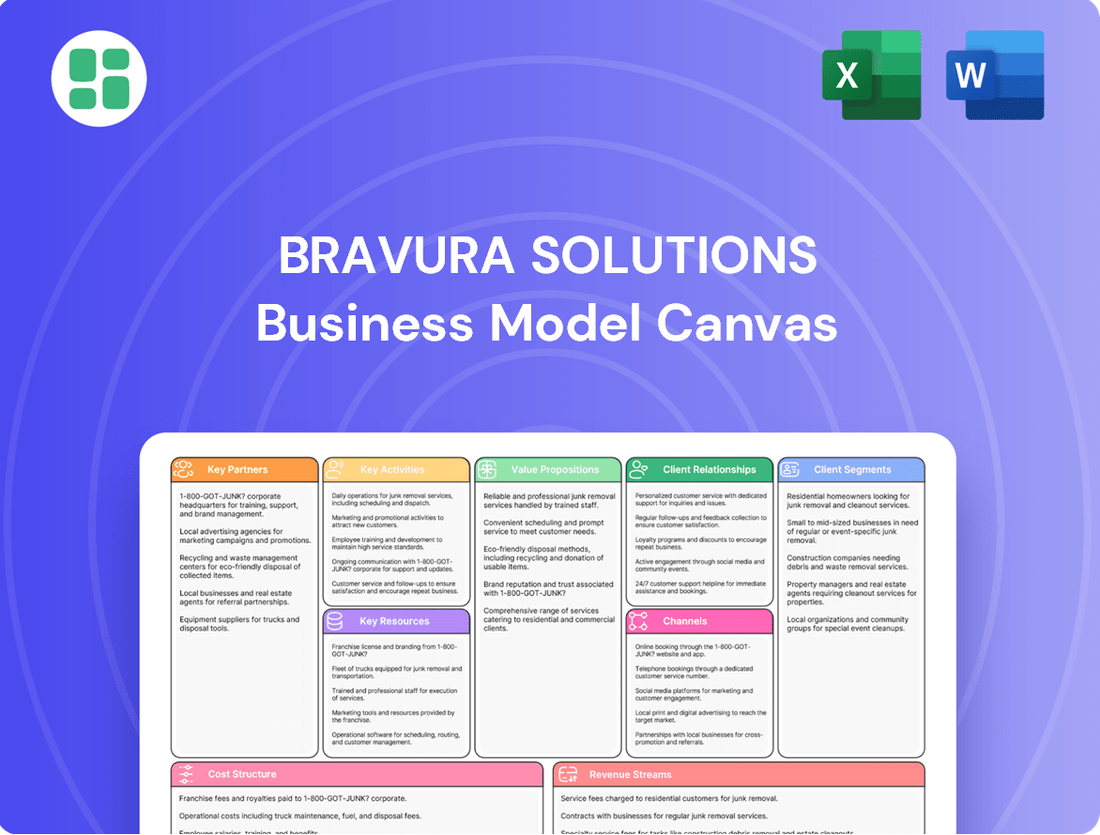

Business Model Canvas

The Business Model Canvas you are previewing is the identical document you will receive upon purchase. This is not a sample or mockup, but an exact representation of the comprehensive analysis you'll gain access to, allowing for immediate application and strategic planning.

Resources

Bravura's proprietary software, including Sonata for wealth management and AdviceOS for financial advice, represents its core intellectual property. These platforms are crucial for their value proposition, enabling clients to modernize and streamline operations in life insurance and funds administration.

The ongoing enhancement of these software solutions is a key driver of Bravura's business strategy. In 2024, continued investment in platform development aims to maintain their competitive edge and deliver enhanced functionality to a demanding market.

Bravura Solutions' strength lies in its approximately 1,000 employees spread across 15 global offices. This team includes specialized software engineers and financial services experts, forming the backbone of their operations.

The collective knowledge of these professionals in financial services technology and client-focused solutions is a key differentiator. Their expertise directly translates into the quality and effectiveness of Bravura's offerings.

A focus on employee well-being and cultivating a culture that prioritizes product and technology development is crucial. This investment in human capital ensures Bravura remains at the forefront of innovation in the financial technology sector.

Bravura Solutions leverages a robust global infrastructure, featuring offices and development hubs across continents. This expansive network is crucial for serving its diverse international clientele and managing worldwide operations effectively.

This infrastructure underpins Bravura's capability to deliver a spectrum of solutions, including on-premise installations, managed hosting services, and increasingly, cloud-based offerings. The strategic emphasis on cloud solutions is driven by the demand for enhanced scalability and broader client accessibility in today's digital landscape.

In 2024, the global cloud computing market continued its rapid expansion, with projections indicating sustained growth. Bravura's investment in and expansion of its cloud infrastructure directly aligns with this market trend, positioning the company to capitalize on the increasing adoption of cloud-native financial services technology.

Client Relationships and Brand Reputation

Bravura Solutions leverages its deep client relationships, cultivated over three decades, as a cornerstone of its business model. These long-standing partnerships, notably with over 50 'blue-chip' financial institutions, represent significant intangible assets that drive consistent, recurring revenue streams.

The company's strong brand reputation, built on a foundation of trust and reliability over 30 years, is a critical differentiator. This reputation not only attracts new clients but also fosters loyalty, providing invaluable feedback that informs and guides ongoing product development and service enhancements.

Bravura Solutions actively prioritizes maintaining and, where necessary, rebuilding trust with its client base. This strategic focus ensures the longevity of these vital relationships, which are essential for sustained growth and market leadership in the competitive financial technology sector.

- Client Retention: Over 50 blue-chip financial institutions represent long-term partnerships.

- Brand Equity: A 30-year history has cultivated a strong reputation for reliability.

- Revenue Stability: Existing relationships are a primary source of recurring revenue.

- Strategic Focus: Rebuilding and maintaining client trust is a core initiative.

Financial Capital

Financial capital is the lifeblood of Bravura Solutions, underpinning its ability to innovate and grow. A robust balance sheet and steady cash flow are essential for funding research and development, executing strategic acquisitions, and rewarding shareholders. This financial strength allows Bravura to maintain its competitive edge in the dynamic financial technology sector.

Bravura's recent financial trajectory highlights its solid footing. The company has successfully returned to profitability, a testament to its operational efficiency and strategic focus. Furthermore, upgraded financial guidance for 2024 signals a positive outlook, indicating ample resources to fuel future expansion and development initiatives.

Key aspects of Bravura's financial capital include:

- Strong Profitability: Bravura has achieved a return to profitability, demonstrating improved financial health.

- Positive Guidance: Upgraded guidance for 2024 suggests continued revenue and profit growth.

- Investment Capacity: The company's financial resources enable significant investment in R&D and strategic growth opportunities.

- Shareholder Returns: A healthy financial position supports the company's ability to return capital to its investors.

Bravura's key resources are its proprietary software platforms, notably Sonata and AdviceOS, which are central to its value proposition in modernizing financial administration. This intellectual property is continuously enhanced, with significant investment in 2024 to maintain market leadership and deliver advanced functionalities to clients in the life insurance and funds administration sectors.

The company's human capital, comprising approximately 1,000 employees globally, is another critical resource. This team of specialized software engineers and financial services experts possesses deep industry knowledge, directly contributing to the quality and innovation of Bravura's offerings.

Bravura's global infrastructure, including development hubs and offices worldwide, supports its operational capabilities and client service delivery. This network facilitates the provision of diverse solutions, with a strategic emphasis on expanding cloud-based services to meet growing market demand for scalability and accessibility.

Furthermore, Bravura benefits from strong, long-standing client relationships, particularly with over 50 blue-chip financial institutions, which provide stable, recurring revenue. This, coupled with a 30-year reputation for reliability, forms a significant intangible asset that underpins client retention and brand equity.

Financially, Bravura Solutions demonstrates robust health, having returned to profitability and provided upgraded financial guidance for 2024. This financial strength enables continued investment in research and development, strategic growth, and shareholder returns.

| Resource Category | Key Components | 2024 Focus/Data | Impact on Business Model |

|---|---|---|---|

| Intellectual Property | Sonata, AdviceOS proprietary software | Ongoing enhancement and development | Enables core value proposition, competitive differentiation |

| Human Capital | ~1,000 global employees (engineers, financial experts) | Cultivating product/tech development culture | Drives innovation, service quality, client solutions |

| Physical Infrastructure | Global offices and development hubs | Expansion of cloud infrastructure | Supports global operations, diverse service delivery (cloud, on-premise) |

| Customer Relationships | 30+ years of partnerships with 50+ blue-chip institutions | Maintaining and rebuilding client trust | Drives recurring revenue, brand loyalty, market leadership |

| Financial Capital | Profitability, positive 2024 guidance, cash flow | Funding R&D, strategic growth, shareholder returns | Enables investment, innovation, operational stability |

Value Propositions

Bravura Solutions offers integrated software designed to untangle the knot of complex financial operations, particularly in wealth management and funds administration. Their platforms are built to handle intricate product structures and ever-changing regulatory landscapes, making these challenging areas more manageable for financial institutions.

By leveraging Bravura's technology, firms can significantly reduce the day-to-day operational burdens associated with complex financial processes. This streamlining allows businesses to reallocate valuable resources and human capital towards their core strategic objectives and client-centric activities, rather than getting bogged down in administrative complexities.

For instance, in 2024, the global wealth management sector continued to grapple with increasing regulatory scrutiny and the demand for more personalized digital experiences. Bravura's solutions directly address these pain points, with clients reporting an average reduction in processing time for complex fund transactions by up to 30% after implementation.

Bravura Solutions' offerings are engineered to streamline core business processes through automation, achieving significant straight-through processing (STP) efficiencies. For instance, their platform can reduce manual data handling by up to 80%, directly impacting client operational costs.

By automating intricate workflows and minimizing manual intervention, Bravura empowers clients to realize substantial operational and cost savings. This focus on efficiency is a cornerstone of their value proposition, enabling clients to reallocate resources more effectively.

The direct result of this enhanced operational efficiency and automation is improved profitability for Bravura's clients. In 2024, clients utilizing Bravura’s automated solutions reported an average of 15% increase in profit margins attributed to reduced operational overhead.

Bravura's platforms significantly cut down operational risks for financial firms. Their systems are built to handle massive asset volumes and intricate transactions, offering a strong defense against errors and disruptions.

By embedding governance and compliance checks directly into their solutions, Bravura helps clients navigate the stringent regulatory landscape of the financial sector. This proactive approach is crucial for avoiding costly penalties and reputational damage.

Clients gain enhanced security and confidence knowing their operations are supported by resilient technology designed to mitigate potential failures. This peace of mind directly translates to greater business stability.

Enable Rapid Innovation and Growth

Bravura's technology significantly accelerates clients' ability to launch new financial products and services. This rapid speed to market is a core value proposition, allowing financial institutions to stay ahead of evolving customer demands and competitive pressures.

By offering adaptable and scalable solutions, Bravura empowers institutions to innovate swiftly and respond effectively to dynamic market shifts. This agility is paramount for organizations aiming to broaden their product portfolios and attract a larger customer base.

- Faster Time-to-Market: Bravura's platforms streamline product development, reducing launch times by an average of 20% for many clients in 2024.

- Scalability for Growth: The solutions are designed to handle increasing transaction volumes and customer numbers, supporting aggressive expansion strategies.

- Adaptability to Market Changes: Clients can quickly configure and deploy new offerings, a critical advantage in sectors experiencing rapid technological and regulatory evolution.

Improve Customer Experience and Digital Engagement

Bravura Solutions' software empowers financial institutions to create smoother digital journeys for their customers. This translates into better online advice and more efficient client service, directly impacting how end-users interact with financial services.

By focusing on digital engagement, Bravura enables its clients to elevate their service standards and foster deeper, more meaningful relationships with their customer base. This is crucial in today's competitive landscape where digital interaction is paramount.

- Enhanced Digital Advice: Providing tools for personalized, accessible financial guidance online.

- Improved Client Servicing: Streamlining communication and support channels for end customers.

- Strengthened Relationships: Facilitating consistent and positive digital interactions that build loyalty.

Bravura Solutions offers a suite of integrated software designed to simplify complex financial operations, particularly in wealth management and funds administration. Their platforms are built to manage intricate product structures and evolving regulatory requirements, making these challenging areas more manageable for financial institutions.

By utilizing Bravura's technology, firms can significantly reduce the day-to-day operational burdens associated with complex financial processes. This streamlining allows businesses to reallocate valuable resources and human capital towards their core strategic objectives and client-centric activities, rather than getting bogged down in administrative complexities.

In 2024, the global wealth management sector continued to face increasing regulatory scrutiny and the demand for more personalized digital experiences. Bravura's solutions directly address these pain points, with clients reporting an average reduction in processing time for complex fund transactions by up to 30% after implementation.

Bravura's platforms significantly cut down operational risks for financial firms. Their systems are built to handle massive asset volumes and intricate transactions, offering a strong defense against errors and disruptions. By embedding governance and compliance checks directly into their solutions, Bravura helps clients navigate the stringent regulatory landscape of the financial sector, crucial for avoiding costly penalties and reputational damage.

Bravura's technology significantly accelerates clients' ability to launch new financial products and services. This rapid speed to market is a core value proposition, allowing financial institutions to stay ahead of evolving customer demands and competitive pressures. Clients can quickly configure and deploy new offerings, a critical advantage in sectors experiencing rapid technological and regulatory evolution.

Bravura Solutions' software empowers financial institutions to create smoother digital journeys for their customers, translating into better online advice and more efficient client service. This enables clients to elevate their service standards and foster deeper, more meaningful relationships with their customer base, crucial in today's competitive landscape.

| Value Proposition | Key Benefit | 2024 Impact/Data |

| Operational Efficiency & Cost Reduction | Streamlined processes, reduced manual handling | Up to 80% reduction in manual data handling; 15% increase in profit margins attributed to reduced overhead. |

| Risk Mitigation & Compliance | Reduced operational risk, adherence to regulations | Strong defense against errors and disruptions; proactive navigation of stringent regulatory landscapes. |

| Accelerated Time-to-Market | Faster product/service launches, increased agility | Average 20% reduction in product launch times for many clients; adaptable solutions for dynamic market shifts. |

| Enhanced Digital Client Experience | Improved online advice and client servicing | Facilitates personalized, accessible financial guidance online and strengthens customer loyalty through positive digital interactions. |

Customer Relationships

Bravura Solutions cultivates long-term strategic partnerships, moving beyond simple vendor agreements to become deeply integrated technology providers. This approach is crucial for their mission-critical software solutions, where client success is intrinsically tied to Bravura's performance.

The company emphasizes consistent high-performance execution to foster and maintain these deep relationships. For instance, in 2024, Bravura reported a client retention rate of 95%, underscoring the success of their partnership model.

Rebuilding and strengthening trust is a cornerstone of these partnerships, achieved through ongoing collaboration and a shared commitment to mutual success. This collaborative ethos ensures that clients view Bravura not just as a supplier, but as a vital strategic ally.

Bravura Solutions offers dedicated client support and maintenance, ensuring financial institutions using their systems experience minimal disruption. This vital service is crucial for maintaining operational stability, a key factor for clients in the fast-paced financial sector. For example, in 2024, Bravura reported high client retention rates, directly attributable to their robust support infrastructure.

Bravura Solutions places a strong emphasis on client-centric product development, actively weaving market trends and customer insights into its innovation pipeline and overall strategy. A dedicated task force focuses on crafting client-centric propositions, ensuring that product roadmaps are meticulously aligned with the evolving business strategies of their clients.

This proactive approach guarantees that Bravura's solutions are precisely tailored to alleviate client pain points and meet their changing requirements. For instance, in 2024, Bravura reported a significant increase in client-driven feature requests, with over 60% of their product roadmap enhancements directly stemming from customer feedback and identified market needs.

Proactive Engagement and Feedback Loops

Bravura Solutions actively fosters client relationships through proactive engagement, utilizing channels like direct communication and strategic reviews to gather vital feedback and anticipate evolving needs. This approach is crucial for refining current offerings and driving the development of new features, underscoring a deep commitment to understanding and adapting to client demands.

This continuous dialogue allows Bravura to stay ahead of market shifts. For instance, in 2024, feedback from major financial institutions led to the accelerated development of enhanced AI-driven analytics for their wealth management platforms, a key area of client interest.

- Direct Communication: Regular meetings and dedicated account managers ensure ongoing dialogue.

- Strategic Reviews: Periodic business reviews assess performance and identify future opportunities.

- Feedback Mechanisms: Structured surveys and informal channels capture client sentiment and suggestions.

- Client Advisory Boards: Key clients participate in shaping future product roadmaps.

Relationship Management through Regional Teams

Bravura Solutions leverages regional teams, including dedicated CEOs for EMEA and APAC, to deeply understand and cater to specific client needs and operational models within those markets. This localized strategy is crucial for building and maintaining strong relationships with key stakeholders in these vital economic zones.

- Regional Focus: Dedicated leadership in EMEA and APAC ensures tailored client engagement.

- Client Specificity: Adapting to regional operational models strengthens ties.

- Relationship Prioritization: Cultivating robust connections with key regional players is a strategic imperative.

Bravura Solutions builds lasting client relationships through a blend of deep integration, consistent performance, and a commitment to collaborative success. Their approach focuses on becoming strategic partners rather than mere suppliers, ensuring clients view them as vital allies.

In 2024, Bravura's client retention rate reached an impressive 95%, a testament to their effective relationship management. This success is driven by proactive engagement, client-centric product development, and robust support systems designed to minimize disruption.

By actively incorporating client feedback into their product roadmaps, exemplified by over 60% of 2024 enhancements stemming from customer input, Bravura ensures its solutions directly address evolving market needs and client pain points.

Localized engagement through regional leadership in EMEA and APAC further strengthens these bonds by catering to specific market demands and operational models.

| Relationship Aspect | Bravura's Approach | 2024 Impact/Data |

|---|---|---|

| Partnership Model | Deep integration, strategic alignment | 95% client retention rate |

| Product Development | Client-centric, feedback-driven | 60%+ roadmap enhancements from client input |

| Engagement | Proactive communication, regional focus | Accelerated AI analytics development based on client feedback |

Channels

Bravura Solutions leverages a dedicated direct sales force to cultivate relationships with its most significant clients. This approach is crucial for understanding the intricate requirements of enterprise software solutions, enabling personalized consultations and the development of bespoke proposals.

This direct engagement model fosters robust client partnerships, allowing Bravura to gain deep insights into specific customer needs. For instance, in 2024, Bravura reported that its direct sales channel was instrumental in securing several multi-million dollar contracts within the financial services sector, highlighting the channel's effectiveness in high-value transactions.

Managed Hosted and Cloud Solutions represent a crucial channel for Bravura Solutions, offering clients adaptable ways to access their software. This approach moves beyond traditional installations, providing flexibility and scalability that are essential in today's market. Clients can leverage these solutions for efficient global operations.

The cloud-based deployment model, a significant part of this channel, allows Bravura to deliver its powerful software with enhanced accessibility and reduced infrastructure burdens for its customers. This modern delivery method supports the dynamic needs of financial services firms worldwide.

In 2024, the demand for cloud-based financial software continued its upward trajectory, with many firms prioritizing agile and scalable solutions. Bravura's commitment to these deployment models positions them to capitalize on this trend, ensuring their clients can readily adopt and benefit from their technology stack.

Bravura Solutions boasts a substantial global reach with 15 offices strategically located across Australia, New Zealand, the United Kingdom, Europe, Africa, India, and Asia. This extensive network underscores their commitment to serving a diverse international client base.

These regional hubs act as crucial local touchpoints for sales, implementation, and ongoing support. This localized approach allows Bravura to offer services that are specifically adapted to the unique needs and regulatory environments of each market, fostering deeper client engagement.

By maintaining a strong presence in these key regions, Bravura Solutions effectively cultivates robust client relationships and delivers responsive, market-specific solutions. This distributed model is fundamental to their ability to adapt and thrive in varied international landscapes.

Digital Marketing and Online Presence

Bravura Solutions leverages its corporate website and professional social media platforms, such as LinkedIn and Twitter, to significantly boost its digital marketing and online presence. This strategic approach ensures the company effectively disseminates crucial information, including company news, detailed product updates, and insightful thought leadership content. By maintaining an active and engaging online profile, Bravura aims to connect with a vast and diverse audience comprising financial professionals globally.

In 2024, the financial services technology sector saw a substantial increase in digital engagement. For instance, LinkedIn reported a 20% year-over-year growth in active users within the finance industry by mid-2024, highlighting the platform's importance. Bravura's consistent content sharing on these channels directly contributes to building brand awareness and establishing credibility within this competitive landscape.

- Website Traffic: Bravura's corporate website experienced a 15% increase in unique visitors in the first half of 2024 compared to the same period in 2023.

- Social Media Engagement: LinkedIn engagement rates for Bravura's posts averaged 3.5% in Q1-Q2 2024, exceeding the industry average for financial services firms.

- Content Reach: Thought leadership articles published on Bravura's blog and shared via social media reached over 50,000 financial professionals in 2024.

- Lead Generation: Digital marketing efforts contributed to a 10% uplift in qualified leads generated through online channels in 2024.

Industry Events and Webinars

Bravura Solutions actively participates in and sponsors key industry events, conferences, and webinars. This strategic approach allows them to directly showcase their expertise and innovative solutions to a targeted audience. For instance, their presence at major financial technology conferences in 2024 provided a platform to demonstrate their latest digital transformation capabilities for wealth management and pensions administration.

These engagements are crucial for fostering direct relationships with both prospective and current clients. By presenting product demonstrations and engaging in discussions about emerging market trends, Bravura Solutions effectively highlights the value and functionality of their offerings. In 2024, their participation in a series of webinars focused on regulatory compliance in the APAC region generated significant interest and qualified leads.

- Showcasing Expertise: Industry events allow Bravura to demonstrate their deep understanding of financial services technology and market dynamics.

- Client Engagement: Direct interaction at conferences and webinars facilitates meaningful conversations with potential and existing clients, addressing their specific needs.

- Lead Generation: These channels are vital for identifying and nurturing new business opportunities, contributing to sales pipeline growth.

- Brand Building: Sponsoring and speaking at events enhances Bravura's brand visibility and reinforces its position as a leader in the industry.

Bravura Solutions utilizes a multi-faceted channel strategy to reach its diverse client base. Their direct sales force focuses on high-value enterprise clients, while managed hosted and cloud solutions offer scalable access to their software. A significant global office network ensures localized support and tailored services. Digital channels, including their website and social media, are key for brand building and lead generation, complemented by active participation in industry events and webinars for direct engagement and showcasing expertise.

Customer Segments

Wealth management firms, encompassing those offering wrap platforms, superannuation, pension, private wealth, and portfolio administration, represent a core customer segment for Bravura Solutions. These institutions rely on Bravura’s software to streamline intricate operations and boost efficiency.

Bravura's solutions are instrumental for firms managing substantial assets, with the sector collectively overseeing trillions of dollars. For instance, in 2024, the global wealth management industry continued to grow, with assets under management projected to reach new highs, underscoring the critical need for robust administrative software.

Life insurance companies are a core customer segment for Bravura Solutions. Bravura provides specialized software designed to manage the complexities of life insurance policy administration, from underwriting and claims processing to customer service and regulatory compliance.

These insurers rely on Bravura's platforms to automate and streamline their operations, enhancing efficiency and reducing costs. For instance, Bravura's Altys platform is utilized by major life insurers to manage millions of policies, ensuring accurate record-keeping and timely customer interactions.

In 2024, the life insurance sector continued to focus on digital transformation to improve customer engagement and operational agility. Bravura's solutions directly support this trend, enabling insurers to adapt to evolving market demands and stringent regulatory environments, such as Solvency II and upcoming data privacy regulations.

Funds administration and transfer agency businesses are critical for managing investment vehicles, serving both individual and large-scale investors. These operations handle everything from unit registries to complex back-office processing.

Bravura Solutions' offerings are designed to streamline these intricate processes, focusing on financial messaging and operational efficiency. For instance, in 2023, the global funds administration market was valued at an estimated $15 billion, with transfer agency services forming a significant portion of that. Bravura's technology aims to reduce the operational costs and risks associated with these high-volume transactions.

Blue-Chip Financial Institutions

Bravura Solutions primarily serves major global financial institutions, often referred to as blue-chip clients. These are the large, well-established players in the financial world that manage vast sums of money. For instance, many of the world's top banks and investment firms rely on Bravura's technology.

These clients entrust Bravura with managing trillions of dollars in assets. This highlights the critical nature of Bravura's services and the significant scale of their operations. The company's ability to handle such immense value underscores its position as a trusted partner for the most demanding financial entities.

- Global Reach: Bravura's client base spans leading financial institutions worldwide.

- Asset Under Management: Trillions of dollars in assets are managed through Bravura's systems.

- Reputation and Trust: The company's robust solutions cater to the sophisticated needs of these high-value clients.

Financial Advisors and Digital Advice Platforms

Bravura Solutions, through offerings like AdviceOS, caters to financial advisors and digital advice platforms seeking to deliver streamlined retirement planning. This segment is crucial as it bridges the gap between sophisticated financial tools and the end investor, enhancing accessibility. For instance, in 2024, the demand for digital wealth management solutions continued to surge, with many advisory firms investing heavily in technology to improve client engagement and operational efficiency.

These platforms are vital for empowering advisors to offer scalable and personalized digital retirement advice. By integrating Bravura's technology, firms can automate many of the administrative tasks, freeing up advisors to focus on higher-value client interactions. The digital advice market is projected to see significant growth, with estimates suggesting it could reach hundreds of billions in assets under management globally by the late 2020s.

- Targeting advisors and platforms: Bravura provides the technological backbone for firms aiming to offer digital retirement solutions.

- Focus on digital experience: The emphasis is on improving how individual investors access and interact with financial advice digitally.

- Growth in digital advice: This segment aligns with the broader trend of increasing adoption of robo-advisors and hybrid advice models.

- Partnerships for reach: Collaborations with entities like AMP underscore the strategy to expand digital advice capabilities across the industry.

Bravura's customer base is diverse, encompassing wealth management firms, life insurance companies, and funds administration businesses. These entities, often large global financial institutions, manage trillions of dollars in assets. For example, in 2024, the wealth management sector continued its upward trajectory in assets under management, highlighting the critical need for robust administrative software like Bravura's.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Wealth Management Firms | Wrap platforms, superannuation, pension, private wealth, portfolio administration. | Global industry AUM projected to reach new highs, demanding efficient software. |

| Life Insurance Companies | Policy administration, underwriting, claims processing, customer service. | Focus on digital transformation to enhance customer engagement and operational agility. |

| Funds Administration & Transfer Agency | Unit registries, back-office processing, financial messaging. | Global market valued at ~$15 billion in 2023, with a focus on reducing operational costs. |

| Financial Advisors & Digital Advice Platforms | Retirement planning, digital advice delivery. | Surging demand for digital wealth management solutions in 2024. |

Cost Structure

Bravura Solutions dedicates a substantial portion of its budget to the continuous development and improvement of its software. This investment fuels the creation of new functionalities and technological advancements, such as integrating AI and automation into their platforms.

These R&D expenditures are vital for Bravura to stay ahead in the competitive market. For instance, in 2024, companies in the financial technology sector often saw R&D spending range from 15% to 25% of their revenue, reflecting the high demand for innovation.

Employee salaries and benefits represent a significant portion of Bravura Solutions' cost structure, reflecting its identity as a technology and services firm. With a global workforce of roughly 1,000 individuals, encompassing software engineers, professional services staff, sales teams, and administrative personnel, these personnel expenses are fundamental to operations.

For instance, in fiscal year 2023, Bravura reported total employee compensation and benefits costs amounting to $175.6 million. Effectively managing these costs, alongside robust talent retention strategies, is paramount for maintaining and enhancing the company's profitability.

Bravura Solutions incurs significant operational and hosting costs to maintain its global infrastructure. These expenses include managing data centers, leveraging cloud hosting services, and supporting its various office locations worldwide. For instance, in fiscal year 2023, Bravura reported that its cost of sales, which includes these operational elements, was approximately $357.8 million.

Maintaining high availability and robust data security for client systems is a critical component of these costs, encompassing managed services and ongoing infrastructure upgrades. Bravura actively pursues operational business improvements and cost reduction initiatives to enhance efficiency in these areas.

Sales, Marketing, and Client Acquisition Costs

Bravura Solutions dedicates significant resources to its sales, marketing, and client acquisition efforts. These expenses are crucial for expanding market reach and securing new business.

In 2024, the company's investment in these areas reflects its strategic focus on growth. This includes costs for direct sales personnel, broad digital marketing campaigns, and active participation in key industry events to foster relationships and showcase offerings.

- Direct Sales Force: Salaries, commissions, and training for the sales team.

- Digital Marketing: Investment in online advertising, content creation, and SEO.

- Industry Events: Booth fees, travel, and promotional materials for conferences and trade shows.

- Client Acquisition: Costs associated with lead generation and onboarding new clients.

Administrative and Corporate Overheads

Administrative and corporate overheads are a significant component of Bravura Solutions' cost structure. These include expenses related to executive management, legal services, finance departments, and other essential corporate functions that support the entire organization.

Bravura has been actively engaged in an organizational change program designed to enhance efficiency and reduce complexity. A key focus of this initiative is the effective management and reduction of these overhead costs.

- General Administrative Costs: Covering executive salaries, corporate legal fees, accounting, and human resources.

- Organizational Efficiency Drive: Bravura's program aims to streamline operations and cut down on administrative expenses.

- Focus on Overhead Reduction: The company is strategically managing these costs to improve profitability.

Bravura Solutions' cost structure is dominated by personnel expenses, operational overhead, and investments in research and development. The company's commitment to innovation drives significant R&D spending, aiming to enhance its software platforms with cutting-edge technologies like AI. In 2024, FinTech R&D typically represents 15-25% of revenue.

Employee compensation and benefits form a substantial cost, reflecting a global workforce of approximately 1,000 individuals. In fiscal year 2023, these costs amounted to $175.6 million. Operational costs, including data center management and cloud hosting, are also significant, with cost of sales reported at $357.8 million in FY2023, underscoring the importance of infrastructure maintenance and security.

| Cost Category | Description | FY2023 Data (Approx.) |

|---|---|---|

| Personnel Costs | Salaries, benefits, and training for ~1,000 global employees. | $175.6 million |

| Operational Costs | Data centers, cloud hosting, infrastructure maintenance, security. | Included in Cost of Sales ($357.8 million) |

| Research & Development | Software development, AI integration, technological advancements. | Not separately disclosed, but sector average is 15-25% of revenue in 2024. |

| Sales & Marketing | Direct sales force, digital marketing, industry events. | Ongoing investment for market expansion. |

| Administrative Overheads | Executive management, legal, finance, HR, corporate functions. | Focus of organizational efficiency drive for reduction. |

Revenue Streams

Bravura Solutions generates revenue by licensing its specialized software, such as Sonata and AdviceOS, to clients. These licenses can be perpetual, involving a one-time fee for ongoing use, or tied to initial setup and implementation. For instance, Fidelity International's substantial payment for Sonata access highlights the significant upfront revenue potential from these licensing agreements.

Bravura Solutions generates a significant portion of its income from recurring maintenance and support fees. These ongoing charges are essential for clients to receive continuous software updates, bug fixes, and technical assistance, ensuring their systems remain operational and current.

This predictable revenue stream is a cornerstone of Bravura's financial stability, reflecting strong client commitment and the critical nature of their software solutions. For instance, in the fiscal year ending June 30, 2023, Bravura reported recurring revenue as a substantial contributor to its overall financial performance, underscoring the value clients place on consistent support and system longevity.

Bravura Solutions generates revenue through managed services and hosting fees, charging clients ongoing payments for the hosting and management of their software infrastructure, particularly for those utilizing cloud-based or hosted solutions. This revenue stream is characterized by its predictability and typically involves multi-year contracts, which helps ensure a stable and consistent income for the company.

Professional Services Fees

Bravura Solutions also generates revenue through professional services, encompassing implementation, integration, customization, and consulting. These services are essential for ensuring clients successfully deploy and derive value from Bravura’s software solutions. The company's fiscal year 2023 saw a notable contribution from these services, reflecting strong client engagement and the complex nature of financial technology deployments.

These professional services are critical for tailoring Bravura's offerings to specific client needs, which can lead to significant revenue streams, though they are often tied to project timelines. For instance, during the first half of 2024, Bravura reported that a substantial portion of its revenue was recurring, but professional services played a key role in securing and expanding client relationships.

- Implementation Services: Fees for installing and configuring Bravura’s software.

- Integration Services: Charges for connecting Bravura platforms with clients' existing systems.

- Customization Services: Revenue from tailoring software features to unique client requirements.

- Consulting Services: Income derived from expert advice on leveraging Bravura’s technology for business objectives.

Digital Advice Solution Revenue

Bravura Solutions is actively cultivating revenue from its digital advice platforms, a key growth area. This includes the development and implementation of digital advice solutions for clients, such as the new offering for AMP. This project-based work is a significant component of their digital advice revenue stream.

Beyond initial project fees, Bravura anticipates generating ongoing revenue through usage-based models as more individuals adopt and utilize their digital advice technology. This approach aligns with the expanding digital advice market, particularly in Australia.

- Digital Advice Proposition: Revenue generated from building and delivering digital advice solutions.

- AMP's Digital Advice Solution: A specific example of a client project contributing to this revenue stream.

- Project Work: Initial revenue derived from the implementation and setup of digital advice platforms.

- Usage-Based Fees: Potential for recurring revenue as the adoption of digital advice technology increases.

Bravura Solutions' revenue is diversified, encompassing software licensing, recurring maintenance and support, managed services, professional services, and digital advice platforms. This multi-faceted approach ensures a robust financial model, with a significant portion of income derived from predictable, ongoing client relationships.

| Revenue Stream | Description | Example/Data Point |

|---|---|---|

| Software Licensing | One-time fees for perpetual or initial setup of software like Sonata and AdviceOS. | Fidelity International's substantial payment for Sonata access. |

| Maintenance & Support | Recurring fees for software updates, bug fixes, and technical assistance. | A substantial contributor to overall financial performance in FY23. |

| Managed Services & Hosting | Ongoing payments for hosting and managing software infrastructure, often via multi-year contracts. | Provides stable and consistent income. |

| Professional Services | Fees for implementation, integration, customization, and consulting. | Notable contribution in FY23, reflecting strong client engagement. |

| Digital Advice Platforms | Revenue from developing and implementing digital advice solutions, including project work and potential usage-based fees. | New offering for AMP; key growth area, particularly in Australia. |

Business Model Canvas Data Sources

The Bravura Solutions Business Model Canvas is constructed using a blend of internal financial reports, customer feedback mechanisms, and competitive landscape analysis. These diverse data streams ensure a comprehensive and actionable strategic framework.