Bravura Solutions Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bravura Solutions Bundle

Discover how Bravura Solutions leverages its product innovation, strategic pricing, targeted distribution, and impactful promotion to dominate the financial technology landscape. This analysis goes beyond the surface, revealing the core components of their marketing success.

Unlock the full potential of your own marketing strategies by understanding Bravura Solutions' proven 4Ps. Get instant access to a comprehensive, editable report filled with actionable insights and real-world examples.

Product

Bravura Solutions' comprehensive software platforms are central to their product strategy, offering specialized solutions for wealth management, life insurance, and funds administration. These platforms, including offerings for superannuation, pensions, and private wealth, provide end-to-end processing, addressing complex operational demands within these financial sectors.

The company's software suite, such as their Sonata and Garrard's Eagle solutions, are designed to handle high volumes and intricate rules, crucial for sectors like Australian superannuation where assets under administration reached an estimated AUD 3.8 trillion by the end of 2023. This robust technological backbone is key to Bravura's market position.

Bravura Solutions' specialized offerings cater to diverse financial sectors. Sonata is a robust asset management system, while Rufus specifically addresses pension insurance needs. Garradin is designed for smaller asset managers, demonstrating a tiered approach to market segmentation.

Further enhancing its portfolio, Bravura offers Babel for seamless funds network connectivity, crucial for efficient financial operations. ePASS is tailored for the unique demands of Asian life insurance markets, highlighting geographic customization.

The company also provides Sonata Alta, a reimagined solution for superannuation administration. This suite of specialized products underscores Bravura's commitment to providing targeted, high-value solutions across various financial landscapes, aiming to improve efficiency and market reach for its clients.

Bravura's product strategy for 2024-2025 is heavily geared towards digital and automation. This includes developing advanced digital advice solutions and leveraging artificial intelligence to automate intricate processes.

The core aim is to streamline operations and boost efficiency for their clients through comprehensive digitization. This focus is evident in products like Midwinter Advice and Orchestrator, which are designed to drive digital transformation and automate complex workflows.

Integrated Microservices and Connectivity

Bravura Solutions' integrated microservices and connectivity, exemplified by offerings like Dashboards Connect, are pivotal to their Product strategy. This modular approach is designed for open architecture, enabling seamless integration with existing financial institution systems and crucial connections to fund transaction networks. This adaptability is key in a rapidly changing financial landscape.

The company's focus on microservices allows for greater flexibility, enabling clients to adopt specific functionalities rather than entire monolithic systems. This modularity directly supports financial institutions in navigating evolving market demands and regulatory shifts. For instance, the increasing trend towards open banking and data sharing necessitates robust and adaptable connectivity solutions, a core strength of Bravura's platform.

- Enhanced Integration: Bravura's microservices architecture facilitates smoother integration with a wider array of third-party applications and legacy systems, reducing implementation friction for financial institutions.

- Adaptability to Regulations: The modular design allows for quicker updates and modifications to comply with new financial regulations, such as those impacting data privacy or transaction reporting, a critical need in 2024 and beyond.

- Future-Proofing Investments: By offering granular, connectable services, Bravura enables clients to invest in specific capabilities as needed, rather than undertaking costly overhauls, supporting long-term strategic planning.

Value-Enhancing Features

Bravura Solutions' products are engineered to significantly accelerate client time-to-market, a critical factor in the fast-paced financial services industry. For instance, their digital platforms are built to streamline the onboarding process, reducing the time it takes for new customers to access services. This focus on speed directly translates to competitive advantage for their clients.

The company prioritizes the delivery of seamless digital experiences, recognizing that customer interaction is increasingly online. Bravura's solutions are designed to be intuitive and user-friendly, ensuring that clients can navigate complex financial products and services with ease. This enhances customer satisfaction and loyalty.

Compliance with evolving financial services regulations is a core value-enhancer. Bravura's offerings are built with regulatory adherence in mind, automating processes to minimize errors and reduce the risk of non-compliance. This proactive approach helps clients avoid costly penalties and maintain operational integrity.

Bravura's solutions simplify complexity and automate operations, leading to significant efficiency gains. By reducing manual tasks and streamlining workflows, clients can lower operational costs and reallocate resources to more strategic initiatives. This drive for efficiency ultimately maximizes the value delivered to both Bravura's clients and their end-customers.

- Accelerated Time-to-Market: Bravura's platforms reduce deployment times, enabling clients to launch new products and services faster.

- Enhanced Digital Experience: Intuitive interfaces and seamless digital journeys improve customer engagement and satisfaction.

- Regulatory Compliance: Solutions are designed to automate compliance processes, mitigating risk and ensuring adherence to financial regulations.

- Operational Efficiency: Automation and simplification of complex processes lead to cost savings and improved operational performance.

Bravura Solutions' product strategy centers on delivering specialized, end-to-end software platforms for wealth management, life insurance, and funds administration. Their offerings, such as Sonata and Rufus, are designed to handle complex operations and high volumes, crucial for sectors like Australian superannuation, which managed approximately AUD 3.8 trillion in assets by late 2023. The company is also focusing on digital transformation and automation for 2024-2025, enhancing efficiency through solutions like Midwinter Advice.

Bravura's product suite leverages microservices and open architecture for enhanced integration and adaptability, allowing clients to adopt specific functionalities. This modular approach supports clients in navigating evolving market demands and regulatory shifts, such as the increasing need for open banking connectivity. This strategy aims to accelerate client time-to-market, improve digital experiences, ensure regulatory compliance, and boost operational efficiency.

| Product Area | Key Solutions | Target Sector | 2023/2024 Relevance | 2024/2025 Focus |

|---|---|---|---|---|

| Wealth Management | Sonata | Asset Management | Handles complex rules for large AUM | Digital advice, AI automation |

| Life Insurance | ePASS | Asian Life Insurance | Tailored for specific market demands | Streamlining digital customer journeys |

| Funds Administration | Garrard's Eagle, Rufus | Superannuation, Pensions | End-to-end processing, high volume capacity | Microservices for enhanced integration, regulatory adaptability |

What is included in the product

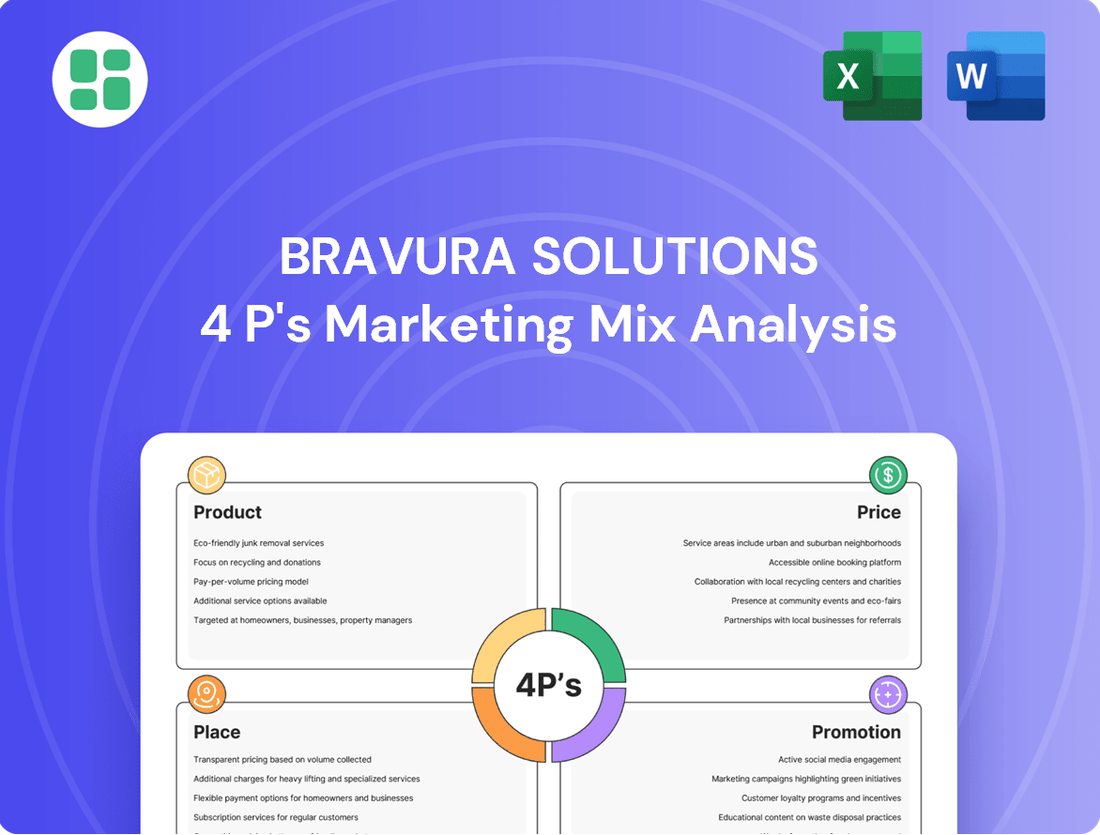

This analysis offers a comprehensive deep dive into Bravura Solutions' Product, Price, Place, and Promotion strategies, providing actionable insights for marketing professionals.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of information overload for busy executives.

Provides a clear, concise framework for evaluating product, price, place, and promotion, resolving the challenge of fragmented marketing planning.

Place

Bravura Solutions boasts a robust global market presence, with offices strategically positioned across Australia, New Zealand, the United Kingdom, Europe, Africa, and Asia. This expansive network enables them to effectively serve a diverse international clientele, managing assets valued in the trillions of dollars.

Bravura Solutions champions a direct client engagement model, primarily interacting with financial institutions through its own sales force and strategic partnerships. This direct approach, evident in their consistent client retention rates, allows for a deep understanding of client needs, facilitating the co-creation of bespoke software solutions.

By bypassing extensive third-party intermediaries, Bravura cultivates robust, long-term relationships. For instance, their significant contract wins in 2024, such as the multi-year agreement with a major Australian superannuation fund, underscore the effectiveness of this direct engagement in delivering complex, integrated financial technology services.

Bravura Solutions provides its software through diverse delivery methods, catering to varied client needs. Options include traditional on-premise installations, where clients manage their own infrastructure, and managed hosting, which offers a middle ground.

Furthermore, Bravura leverages cloud-based services, a growing trend in the financial technology sector. This flexibility allows businesses to align their IT strategy with their operational requirements, ensuring optimal performance and scalability.

For instance, in 2024, the global cloud computing market, which underpins many of these delivery models, was projected to reach over $1.3 trillion, highlighting the significant shift towards flexible, accessible software solutions. This trend is expected to continue growing through 2025, with cloud adoption remaining a key differentiator for service providers like Bravura.

Strategic Regional Focus

Bravura Solutions is strategically concentrating its efforts on specific geographic markets, notably the Asia-Pacific region, to establish a strong foothold for its digital advice solutions. This focused approach allows them to cultivate deep relationships with key industry players.

By prioritizing markets with significant growth potential, Bravura aims to solidify its position as a leading provider in these critical areas. For instance, the Asia-Pacific wealth management market is projected to reach $3.7 trillion in assets under management by 2027, presenting a substantial opportunity.

- Targeted Market Penetration: Focusing on regions like Asia-Pacific for digital advice solutions.

- Relationship Building: Cultivating partnerships with key players in these chosen markets.

- Growth Area Leadership: Aiming to become a dominant provider in high-potential segments.

- Market Opportunity: Leveraging the significant growth anticipated in the Asia-Pacific wealth management sector.

Extensive Client Network

Bravura Solutions boasts an extensive client network, a significant asset in its marketing mix. This network is built on trust and proven delivery, serving over 50 'blue chip' clients. These clients represent a broad spectrum of the financial services industry, underscoring Bravura's versatility and deep market penetration.

The company's client base includes prominent asset managers, custodian banks, pension funds, super funds, and wealth platforms. This diverse clientele highlights Bravura's ability to cater to the complex needs of various financial institutions, solidifying its reputation as a go-to provider.

- Client Diversity: Serves over 50 'blue chip' clients across asset management, custody banking, pensions, superannuation, and wealth management sectors.

- Industry Trust: The established network signifies deep trust and a strong, reliable presence within the financial services industry.

- Market Reach: Demonstrates significant reach and influence, indicating a broad adoption of Bravura's solutions.

- Proven Track Record: The sheer number and caliber of clients point to a history of successful implementations and client satisfaction.

Bravura Solutions' strategic placement involves a global network of offices and a direct client engagement model. This approach prioritizes building strong, long-term relationships by delivering tailored software solutions directly to financial institutions, bypassing intermediaries.

The company offers flexible delivery methods, including on-premise, managed hosting, and cloud-based services, aligning with the growing trend of cloud adoption in the FinTech sector. This adaptability ensures clients can choose the IT strategy that best suits their operational needs.

Bravura's market presence is further defined by its focused penetration into high-growth regions like Asia-Pacific, aiming to lead in emerging digital advice solutions. This geographic strategy is supported by a robust client base of over 50 'blue chip' firms across various financial sectors.

| Aspect | Description | 2024/2025 Data/Projection |

|---|---|---|

| Global Presence | Strategically located offices across key financial hubs. | Serving clients in Australia, New Zealand, UK, Europe, Africa, and Asia. |

| Client Engagement | Direct interaction via sales force and partnerships. | Focus on co-creation and deep understanding of client needs. |

| Delivery Models | On-premise, managed hosting, and cloud-based services. | Leveraging cloud services amidst a global market projected to exceed $1.3 trillion in 2024. |

| Market Focus | Targeting high-potential regions like Asia-Pacific. | Asia-Pacific wealth management market projected to reach $3.7 trillion by 2027. |

| Client Portfolio | Serving over 50 'blue chip' financial institutions. | Includes asset managers, custodian banks, pension funds, and wealth platforms. |

What You Preview Is What You Download

Bravura Solutions 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Bravura Solutions 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Bravura Solutions prioritizes strategic media and investor communications as a core element of its marketing mix. The company actively manages its public image by regularly issuing media releases that detail significant company announcements, financial performance updates, and key strategic advancements.

To foster transparency and keep stakeholders informed, Bravura conducts dedicated investor presentations and publishes comprehensive half-yearly and annual reports. For instance, in its 2024 fiscal year, Bravura reported a revenue of AUD 340 million, underscoring the importance of clear communication regarding its financial health and operational progress to its investor base.

Bravura Solutions leverages thought leadership and content marketing to solidify its position as a fintech expert. By disseminating market insights, regulatory updates, and technology trends via whitepapers, articles, and case studies, the company actively educates its audience. This strategic approach aims to build credibility and establish Bravura as a go-to resource in the financial technology space.

Bravura Solutions actively cultivates industry partnerships, a key element of its marketing strategy. These collaborations, like those with Colonial First State and AMP, are crucial for expanding their digital solution offerings. In 2024, such strategic alliances are vital for staying competitive in the rapidly evolving fintech landscape.

Awards and Accreditations

Bravura Solutions leverages its prestigious awards and accreditations as a key element in its marketing mix. This strategy aims to build credibility and showcase industry leadership. For instance, their recognition at the 2024 Australasian Investor Relations Association Awards underscores their commitment to excellence in client engagement and communication.

Further solidifying their standing, Bravura Solutions' role as a Platinum partner for significant industry events, such as the Super Fund of the Year Awards 2025, amplifies their brand visibility. This partnership directly targets key decision-makers within the financial services sector, reinforcing their position as a trusted provider.

These acknowledgments and strategic partnerships translate into tangible benefits:

- Enhanced Brand Reputation: Industry awards validate Bravura's service quality and innovation.

- Increased Market Visibility: Platinum partnerships at major events ensure prominent brand placement.

- Credibility Boost: Accolades from respected organizations like the Australasian Investor Relations Association build trust with potential clients.

- Competitive Differentiation: Demonstrating industry recognition sets Bravura apart from competitors in a crowded market.

'Energise, Build and Grow' Strategy Communication

Bravura Solutions actively communicates its 'Energise, Build and Grow' strategy, a core component of its marketing efforts. This strategy emphasizes three key pillars: business improvement, a sharp focus on client needs, and enhanced profitability. The company uses consistent messaging across multiple channels to reinforce its dedication to rebuilding trust and driving performance.

This strategic communication aims to galvanize stakeholders and clearly articulate the company's direction. For instance, during the first half of FY24, Bravura reported a statutory net loss after tax of $12.6 million, highlighting the ongoing transformation efforts. The 'Energise, Build and Grow' narrative is designed to demonstrate progress towards overcoming these challenges and achieving sustainable growth.

- Business Improvement: Focus on operational efficiency and streamlining processes.

- Client Focus: Prioritizing client relationships and service delivery.

- Profitability: Driving financial performance and shareholder value.

- Trust and Performance: Rebuilding confidence and accelerating business acceleration.

Bravura Solutions employs a multi-faceted promotional strategy, emphasizing thought leadership, strategic partnerships, and clear financial communication. By actively sharing market insights through whitepapers and articles, they position themselves as industry experts. Their collaboration with entities like Colonial First State and AMP in 2024 highlights their commitment to expanding digital solutions, reinforcing their market presence.

The company also leverages industry accolades, such as their recognition at the 2024 Australasian Investor Relations Association Awards, to build credibility. Furthermore, their role as a Platinum partner for events like the Super Fund of the Year Awards 2025 directly targets key financial sector decision-makers, amplifying brand visibility and reinforcing their trusted provider status.

Bravura's consistent communication of its 'Energise, Build and Grow' strategy, focusing on business improvement, client needs, and profitability, aims to rebuild stakeholder trust. Despite a statutory net loss after tax of $12.6 million in the first half of FY24, this narrative underscores their commitment to overcoming challenges and achieving sustainable growth.

| Promotional Tactic | Objective | Example (2024/2025) | Impact |

|---|---|---|---|

| Thought Leadership | Establish industry expertise | Whitepapers, market insights articles | Builds credibility, educates audience |

| Strategic Partnerships | Expand service offerings, market reach | Colonial First State, AMP collaborations | Enhances competitive positioning |

| Financial Communications | Transparency, investor confidence | Investor presentations, H1 FY24 reports (AUD 340M revenue FY24) | Informs stakeholders, demonstrates progress |

| Awards & Accreditations | Validate service quality, leadership | Australasian Investor Relations Association Awards 2024 | Boosts brand reputation |

| Event Sponsorships | Increase brand visibility, target audience | Platinum partner, Super Fund of the Year Awards 2025 | Direct engagement with decision-makers |

Price

Bravura Solutions' pricing strategy is implicitly value-based, aligning with the substantial operational efficiencies, risk mitigation, and improved customer experiences its software provides to major financial institutions. The investment in their solutions is validated by the enduring value and competitive edge they offer clients, a crucial factor in the highly regulated financial sector.

For instance, in their 2024 fiscal year, Bravura reported revenue growth, underscoring the market's willingness to pay a premium for solutions that demonstrably enhance client operations and compliance, often saving institutions millions in potential fines or inefficiencies.

Bravura Solutions likely structures its pricing around enterprise licensing for its sophisticated software, complemented by subscription-based fees for continuous support, maintenance, and software updates. This approach aligns with the typical revenue models for complex B2B software providers.

While exact figures are proprietary, Bravura's financial reports indicate a significant portion of revenue derived from software licenses and related professional services, underscoring the importance of these components in their go-to-market strategy.

Bravura Solutions' revenue mix significantly shapes its financial guidance. For FY2025, initial guidance was set between $235 million and $240 million.

This range was later revised upwards to $248 million to $252 million, demonstrating how shifts in revenue streams, such as the phasing out of one-off license fees and fluctuations in professional services revenue, directly impact the company's outlook.

Profitability and Shareholder Returns

Bravura Solutions' return to profitability in FY2025, alongside the recommencement of dividend payments, signals a robust financial health. This stability allows for competitive pricing strategies while ensuring strong shareholder value. The company's financial performance directly underpins its market positioning and pricing decisions.

The company's financial resurgence is a key factor in its pricing strategy, enabling it to offer competitive terms. This financial strength translates into tangible shareholder benefits, reinforcing investor confidence. For instance, the resumption of dividends in FY2025 demonstrates a commitment to returning capital to shareholders.

- FY2025 Profitability: Bravura Solutions achieved profitability in the fiscal year 2025, a significant turnaround.

- Dividend Resumption: The company recommenced dividend payments, rewarding shareholders for their investment.

- Competitive Pricing: Financial stability supports Bravura's ability to maintain competitive pricing in the market.

- Shareholder Value: The focus on profitability and dividends directly contributes to enhancing shareholder returns.

Competitive and Market-Driven Considerations

Bravura Solutions' pricing strategy is deeply intertwined with the competitive dynamics of the financial technology market. The company positions its digital advice solutions as a premium offering, aiming for the 'top of the tree' in the industry.

This premium positioning suggests that Bravura's pricing likely reflects the advanced features, robust functionality, and comprehensive support that accompany their solutions. While exact pricing figures are proprietary, industry benchmarks for similar enterprise-level wealth management software in 2024 and early 2025 often range from tens of thousands to several hundred thousand dollars annually, depending on the scale of deployment and specific modules utilized.

Key considerations influencing Bravura's pricing include:

- Competitive Benchmarking: Analyzing pricing models of direct competitors in the digital wealth and financial advice software space.

- Value-Based Pricing: Aligning costs with the perceived and quantifiable benefits clients receive, such as increased efficiency, improved client engagement, and regulatory compliance.

- Market Demand: Adjusting pricing based on the current demand for sophisticated digital advice platforms within the financial services sector.

- Feature Differentiation: Pricing premium features and advanced analytics that set Bravura apart from lower-tier offerings.

Bravura Solutions' pricing strategy is premium, reflecting the advanced capabilities and value proposition of its digital advice solutions. This approach is supported by the company's strong financial performance, including its return to profitability in FY2025 and the recommencement of dividend payments, which bolster investor confidence and enable competitive market positioning.

The company's FY2025 revenue guidance, initially between $235 million and $240 million, was later revised upwards to $248 million to $252 million, indicating robust market demand and successful sales execution. This upward revision highlights the market's acceptance of Bravura's value-based pricing for its sophisticated software, which offers significant operational efficiencies and competitive advantages to financial institutions.

Bravura's pricing is influenced by competitive benchmarking, value-based considerations, market demand, and feature differentiation. For instance, enterprise-level wealth management software in 2024-2025 typically commands annual fees ranging from tens of thousands to hundreds of thousands of dollars, depending on deployment scale and modules.

| Metric | FY2024 (Approx.) | FY2025 Guidance (Revised) | Key Pricing Implication |

|---|---|---|---|

| Revenue | [Data not explicitly stated for FY2024, but growth reported] | $248M - $252M | Demonstrates market acceptance of premium pricing. |

| Profitability | [Not profitable in FY2024] | Achieved Profitability | Supports competitive pricing and investment in R&D. |

| Dividends | Not Paid | Resumed Payments | Signals financial stability, enabling premium pricing. |

4P's Marketing Mix Analysis Data Sources

Our Bravura Solutions 4P's Marketing Mix Analysis draws from a comprehensive suite of data sources, including official company financial reports, investor relations materials, and product development announcements. We also leverage industry-specific market research, competitor analysis, and public domain information to ensure a robust and accurate representation of the company's strategies.