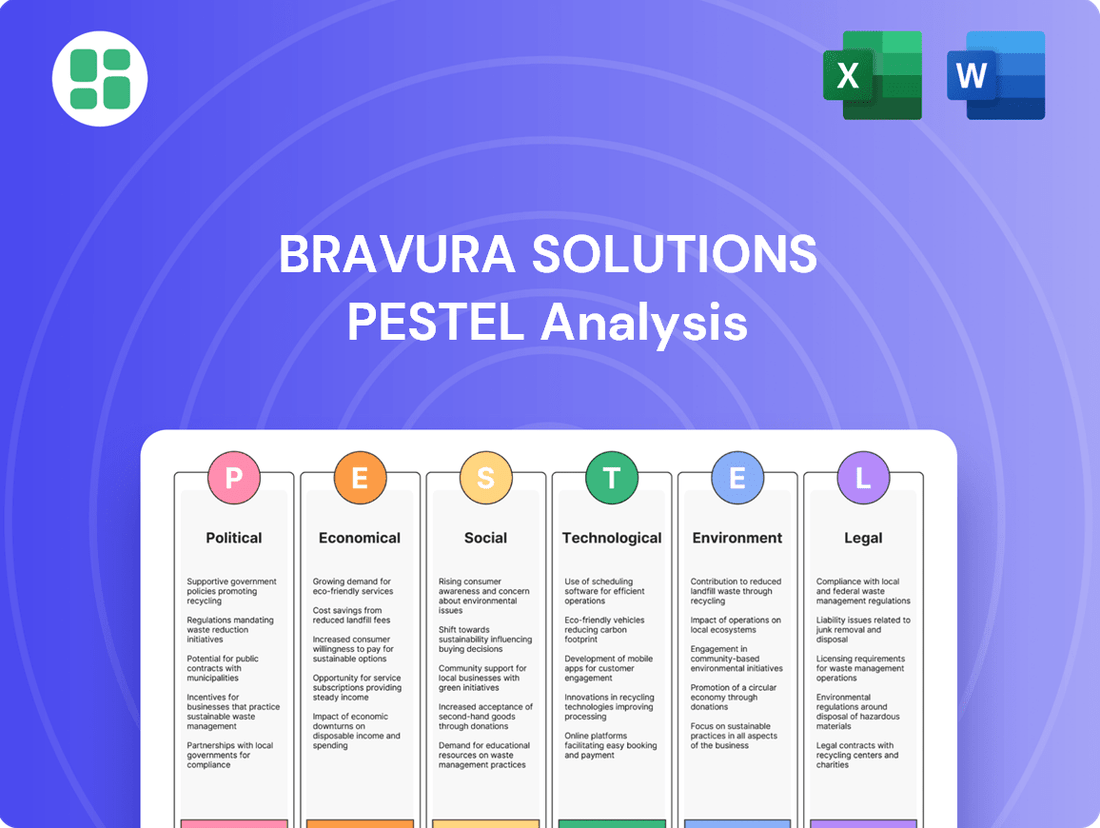

Bravura Solutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bravura Solutions Bundle

Navigate the complex external environment impacting Bravura Solutions with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its future. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now and gain the strategic foresight you need.

Political factors

Political stability across Bravura Solutions' core markets, including Australia, the UK, Europe, and Asia, is a critical determinant of its operating landscape. For instance, Australia's federal government, led by Prime Minister Anthony Albanese as of mid-2025, has emphasized digital economy growth, potentially benefiting Bravura's technology offerings. Conversely, shifts in regulatory frameworks, such as proposed changes to data privacy laws in the UK or the EU's ongoing digital services regulations, could necessitate strategic adjustments.

Financial services regulatory reforms are a constant challenge for companies like Bravura Solutions. Governments worldwide are updating laws concerning consumer protection, market behavior, and overall financial stability. For instance, the UK's Financial Conduct Authority (FCA) has been actively implementing new consumer duty rules, impacting how firms interact with their clients, effective from July 2023, with further expectations for 2024 and beyond.

Bravura Solutions must ensure its software offerings, particularly in wealth management, life insurance, and funds administration, remain compliant with these ever-changing regulations. This adaptability requires ongoing investment and can be a significant drain on resources. The European Union's MiFID II directive, for example, continues to shape market conduct and transparency requirements across member states, necessitating continuous software updates.

Bravura Solutions' global footprint means its operations are directly impacted by international trade policies. For instance, the European Union's continued focus on digital single market initiatives and data localization requirements can influence how Bravura delivers its software and services across member states, potentially increasing compliance costs.

Shifts in trade agreements, such as potential renegotiations of existing pacts or the introduction of new tariffs on digital services, could affect Bravura's pricing strategies and market accessibility in key regions like North America or Asia-Pacific. The World Trade Organization’s discussions on e-commerce, aiming to establish rules for digital trade, will be crucial for Bravura’s cross-border activities.

Geopolitical tensions, like those observed in Eastern Europe or the South China Sea, can disrupt supply chains and create uncertainty for companies operating internationally. This could lead to increased operational complexities or even temporary barriers to service provision for Bravura in affected markets, impacting its ability to serve a diverse client base.

Data Sovereignty and Cross-Border Data Flows

Governments worldwide are intensifying their focus on data sovereignty, enacting laws that mandate the local storage and processing of sensitive financial information. This trend directly affects companies like Bravura Solutions, whose cloud-based offerings and international service delivery are predicated on the free movement of data. For instance, the European Union's General Data Protection Regulation (GDPR) has set a precedent for stringent data localization requirements, impacting how companies handle personal data of EU citizens.

These evolving regulations on cross-border data flows present significant operational challenges. Bravura may need to invest in establishing regional data centers or implement complex, country-specific compliance protocols. This could lead to increased operational expenses and a more fragmented service delivery model, potentially impacting efficiency and scalability. For example, Australia's data retention laws require telecommunications companies to store customer metadata for two years, illustrating the type of localized data management that could become more prevalent.

- Data Localization Mandates: Increasing number of countries are implementing laws requiring financial data to be stored and processed within their borders.

- Impact on Cloud Services: This can disrupt the operational model of cloud-dependent financial technology providers like Bravura, necessitating localized infrastructure.

- Compliance Costs: Adhering to diverse data sovereignty laws across different jurisdictions will likely increase operational complexity and expenditure for global firms.

- Cross-Border Data Flow Restrictions: Limitations on transferring data internationally can hinder seamless global service delivery and require tailored solutions for each market.

Government Support for Digital Transformation

Governments globally are actively promoting digital transformation in financial services. For instance, the Australian government's Digital Economy Strategy aims to boost digital adoption, potentially benefiting companies like Bravura Solutions by encouraging their clients to invest in modern software. This support often materializes through grants and incentives for technology upgrades.

Such initiatives can directly stimulate demand for Bravura's offerings. In the UK, the Financial Conduct Authority’s Project Innovate has fostered a more receptive environment for technological advancements, indirectly supporting the modernization efforts of financial institutions that rely on Bravura's platforms. Conversely, a government's hesitance to invest in or regulate digital infrastructure could hinder the pace of adoption.

- Government digital strategies can accelerate client modernization.

- Incentives for technology adoption boost demand for financial software.

- Regulatory environments favoring innovation are advantageous.

- Lack of digital infrastructure investment can slow market growth.

Government policies significantly shape the financial technology landscape for Bravura Solutions. Initiatives promoting digital transformation, like Australia's Digital Economy Strategy, encourage clients to adopt modern software, directly benefiting Bravura. Conversely, evolving regulations, such as the UK's FCA consumer duty rules impacting client interactions, necessitate continuous adaptation and investment from the company.

What is included in the product

This Bravura Solutions PESTLE analysis examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic direction.

A concise, actionable summary of Bravura Solutions' PESTLE analysis, providing clear insights into external factors impacting the business to inform strategic decision-making.

Economic factors

The global economy's trajectory significantly influences the financial services sector, and by extension, companies like Bravura Solutions. In 2024, while some regions are experiencing moderate growth, others face persistent inflationary pressures and the lingering effects of geopolitical instability, which can dampen investment activity. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% for 2024, a slight slowdown from previous years, indicating a cautious economic environment.

Periods of robust economic expansion typically fuel demand for Bravura's software solutions, as financial institutions see increased investment and wealth management volumes. Conversely, a global recession or even a significant slowdown can lead to reduced IT spending by these institutions. This means that tighter budgets might delay or scale back new software projects or upgrades, directly impacting Bravura's revenue streams and growth prospects.

Looking ahead to 2025, forecasts suggest a gradual but uneven recovery in global economic growth, with emerging markets potentially outperforming developed economies. However, recessionary risks remain, particularly in certain advanced economies grappling with high interest rates and potential credit crunches. This economic duality presents both opportunities for Bravura in faster-growing markets and challenges in regions experiencing prolonged downturns.

Interest rate fluctuations directly impact financial institutions' profitability and their willingness to invest in new technologies. For instance, in the first half of FY25, Bravura Solutions reported improved profitability, demonstrating an ability to navigate varied economic climates. This financial health is crucial as higher rates can dampen overall investment volumes, potentially altering the demand for specific financial product support within Bravura's software offerings.

Inflationary pressures directly impact Bravura Solutions by increasing operational costs. For instance, rising energy prices and higher wages, a trend seen globally through 2024 and projected into 2025, can significantly inflate expenses related to data centers, office utilities, and employee compensation. Software development, a core function, also becomes more costly as skilled labor demands higher salaries in an inflationary environment.

While Bravura has demonstrated a commitment to cost optimization, sustained high inflation, potentially exceeding 3-4% in key markets throughout 2024-2025, could challenge profit margins. This is particularly true if the company cannot fully pass these increased costs onto its clients through price adjustments, especially in competitive segments of the financial technology market.

For Bravura's clients, the economic climate of 2024-2025, marked by persistent inflation, can constrain their own budgets for new technology investments. This could lead to a cautious approach, potentially delaying purchasing decisions for new software solutions or upgrades as businesses prioritize essential spending and manage tighter financial resources.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant economic factor for Bravura Solutions, a global entity with operations spanning Australia, the UK, Europe, and Asia. Fluctuations in these currency markets directly affect the company's reported financial performance, as earnings from foreign subsidiaries are translated back into Bravura's primary reporting currency. This exposure means that even strong operational performance can be masked or amplified by currency movements.

For instance, in the first half of fiscal year 2025 (H1 FY25), foreign exchange movements contributed to Bravura's revenue uplift. This highlights the tangible impact these economic shifts have on the company's top line. Understanding and managing this volatility is therefore crucial for accurate financial forecasting and investor communication.

Key impacts of currency exchange rate volatility include:

- Impact on Reported Earnings: Adverse currency movements can decrease the value of foreign revenues when converted, potentially reducing reported profits.

- Revenue Fluctuations: Favorable exchange rate shifts can boost reported revenues, as seen in Bravura's H1 FY25 results, creating a variable component in top-line growth.

- Competitive Pricing: Significant currency swings can affect the competitiveness of Bravura's offerings in different international markets.

- Hedging Strategies: The need for and effectiveness of currency hedging strategies become paramount to mitigate financial risks associated with exchange rate volatility.

Financial Market Volatility and Investor Confidence

Periods of heightened financial market volatility, such as those seen in early 2024 with fluctuating interest rates and geopolitical uncertainties, can significantly dampen investor confidence. This often translates into a more cautious approach, leading to reduced transaction volumes on trading platforms, which directly impacts the demand for the processing systems Bravura Solutions provides.

Conversely, a sustained period of stable or growing markets, as experienced in parts of late 2023 and projected for certain sectors in 2024, tends to bolster investor sentiment. This increased confidence fuels greater participation in wealth management and investment activities, thereby driving demand for Bravura's software and services from their extensive client base.

- Market Volatility Impact: In Q1 2024, the S&P 500 experienced daily swings averaging 1.2%, a notable increase from previous periods, potentially slowing transaction processing demand.

- Investor Confidence Indicator: The AAII Investor Sentiment Survey in April 2024 showed bullish sentiment at 45%, a healthy level suggesting continued interest in investment products.

- Sectoral Trends: While overall market volatility can be a concern, specific sectors like technology and renewable energy showed strong investor interest throughout 2023 and into early 2024, potentially creating niche growth opportunities for Bravura's clients.

- Bravura's Position: As a key provider of wealth management technology, Bravura is positioned to benefit from increased assets under management driven by sustained positive investor sentiment.

The economic landscape of 2024-2025 presents a mixed bag for Bravura Solutions. Global growth, projected around 3.2% for 2024 by the IMF, indicates moderate expansion but also highlights persistent inflationary pressures in many regions. This economic climate directly influences financial institutions' IT spending, potentially impacting demand for Bravura's software solutions.

Interest rate volatility and ongoing inflation are key economic factors. Higher rates can curb investment volumes, while rising operational costs due to inflation, potentially exceeding 3-4% in key markets through 2024-2025, could challenge profit margins if not fully passed on to clients. Currency exchange rate fluctuations also play a significant role, as seen in Bravura's H1 FY25 results where foreign exchange movements contributed to revenue uplift.

Financial market volatility, evident in early 2024 with daily S&P 500 swings averaging 1.2%, can dampen investor confidence and transaction volumes, affecting demand for processing systems. Conversely, sustained positive investor sentiment, with bullish sentiment at 45% in April 2024, can boost wealth management activities, benefiting Bravura's position as a key technology provider.

| Economic Factor | 2024 Projection/Observation | 2025 Outlook | Impact on Bravura Solutions |

|---|---|---|---|

| Global GDP Growth | IMF projects 3.2% for 2024 | Gradual but uneven recovery expected | Influences IT spending by financial institutions |

| Inflation Rate | Persistent pressures, potentially >3-4% in key markets | Likely to remain a concern | Increases operational costs, may impact margins |

| Interest Rates | Fluctuating, impacting profitability | Continued volatility expected | Affects investment volumes and client willingness to invest in new tech |

| Currency Exchange Rates | Volatile, positively impacted H1 FY25 revenue | Continued volatility expected | Affects reported earnings and revenue competitiveness |

| Market Volatility | High in early 2024 (e.g., S&P 500 daily swings ~1.2%) | Potential for continued fluctuations | Impacts transaction volumes and investor sentiment |

Preview Before You Purchase

Bravura Solutions PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Bravura Solutions covers political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Bravura Solutions' strategic landscape.

Sociological factors

Aging populations in key markets like Europe and Australia are fueling a greater need for superannuation, pension, and retirement planning services. This trend is a significant tailwind for companies like Bravura Solutions, as financial institutions increasingly rely on sophisticated software to navigate the complexities of managing retirement assets and wealth transfers for an expanding elderly demographic.

For instance, the proportion of the population aged 65 and over in the OECD countries is projected to reach 26.1% by 2050, up from 17.5% in 2020. This growing segment requires specialized financial management tools, directly benefiting software providers that can streamline these intricate processes.

Modern consumers, particularly younger demographics, increasingly demand intuitive and fully digital interactions with their financial service providers. This expectation is a significant driver for Bravura's clients, pushing them towards substantial investments in digital transformation initiatives. They require platforms that offer superior online portals, robust mobile accessibility, and highly personalized service offerings.

This shift means financial institutions are prioritizing digital channels. For instance, a 2024 report indicated that 75% of banking customers now prefer digital channels for routine transactions. Consequently, Bravura's clients are actively seeking solutions that can power these enhanced digital experiences, ensuring a seamless and engaging journey for end-users.

Societies worldwide are placing a greater emphasis on financial literacy and inclusion. This trend means more people are becoming aware of and engaging with financial services, creating a larger potential customer base for Bravura's clients.

For instance, in 2024, initiatives aimed at improving financial education saw significant uptake, with reports indicating a 15% increase in participation in online financial planning courses compared to the previous year. This heightened awareness directly benefits Bravura's software offerings, especially those supporting digital advice and user-friendly investment platforms.

As more individuals gain financial knowledge, they are more likely to seek out and utilize sophisticated financial products and services. This expansion of the market is a positive indicator for Bravura, as it translates to increased demand for the technology solutions that enable financial institutions to serve a broader and more informed clientele.

Workforce Demographics and Talent Availability

The availability of skilled talent, especially in areas like software development, cybersecurity, and financial technology, is a crucial sociological element. Bravura Solutions, operating with a global workforce, needs to stay attuned to shifting workforce demographics and actively compete for top talent. For instance, in 2024, the demand for cybersecurity professionals is projected to outstrip supply significantly, creating a competitive hiring landscape.

Initiatives focused on diversity, equity, and inclusion (DEI) are increasingly vital for attracting and retaining a skilled workforce. Companies that foster inclusive environments often see higher employee engagement and innovation. By 2025, it's anticipated that a substantial portion of the global workforce will prioritize working for organizations with strong DEI commitments.

- Talent Shortage: Projections indicate a widening gap in skilled IT professionals, impacting recruitment for roles in software engineering and fintech development.

- Global Workforce Dynamics: Bravura Solutions must navigate varying labor laws, cultural expectations, and skill availability across its international operations.

- DEI Imperative: A strong DEI strategy is not just socially responsible but a business necessity for attracting and retaining a diverse, high-performing team.

- Future of Work: Adapting to remote work trends and flexible arrangements is key to accessing a broader talent pool and meeting employee expectations in 2024-2025.

Ethical Investing and ESG Awareness

Societal awareness around Environmental, Social, and Governance (ESG) principles is rapidly reshaping investment landscapes. This growing demand from consumers and institutional investors alike is compelling financial institutions to prioritize sustainability in their strategies and product offerings. For instance, global sustainable investment assets reached an estimated $37.8 trillion in 2024, demonstrating a significant shift in capital allocation.

Bravura Solutions, as a key player in financial software, is directly impacted by this trend. Its clients, including asset managers and wealth management firms, are increasingly seeking robust software solutions to facilitate ESG screening, manage sustainable investment products, and generate comprehensive ESG reporting. This necessitates Bravura's continuous development and integration of ESG-centric functionalities into its core platforms.

Bravura's own commitment to ESG is underscored by its achievement of a 'Prime' ESG rating, reflecting strong performance across environmental, social, and governance metrics. This rating is often awarded by specialized ESG assessment firms, indicating a high level of adherence to sustainable practices.

- Growing ESG Investment: Global sustainable investment assets are projected to exceed $50 trillion by 2025, driven by increasing investor and regulatory pressure.

- Client Demand for ESG Tools: Financial institutions are actively seeking technology that supports ESG data aggregation, analysis, and client-facing ESG reporting features.

- Bravura's ESG Positioning: Achieving a 'Prime' ESG rating validates Bravura's internal commitment to sustainability and enhances its appeal to ESG-conscious clients.

- Regulatory Tailwinds: Evolving regulations, such as the EU's Sustainable Finance Disclosure Regulation (SFDR), are mandating greater transparency and ESG integration, further amplifying demand for supporting technologies.

The increasing emphasis on financial literacy and inclusion globally is expanding the potential customer base for Bravura's clients, as more individuals engage with financial services. For example, in 2024, participation in online financial planning courses saw a 15% rise, directly benefiting software providers like Bravura that support digital advice platforms.

Societal expectations for digital-first interactions are driving financial institutions to invest heavily in technology that enhances online portals and mobile accessibility. A 2024 report highlighted that 75% of banking customers prefer digital channels for routine transactions, underscoring the need for Bravura's solutions to power these improved client experiences.

The growing demand for ESG-focused investments, with global sustainable assets estimated at $37.8 trillion in 2024, is compelling financial firms to integrate sustainability. This trend necessitates Bravura's development of software that supports ESG screening and reporting, a need further amplified by regulations like the EU's SFDR.

The availability of skilled talent, particularly in fintech and cybersecurity, is a critical factor, with demand for cybersecurity professionals significantly outstripping supply in 2024. Bravura must also navigate evolving workforce dynamics and prioritize DEI to attract and retain top talent, as a substantial portion of the workforce will favor companies with strong DEI commitments by 2025.

Technological factors

The financial services sector is experiencing a significant shift driven by rapid advancements in Artificial Intelligence (AI) and Machine Learning (ML). These technologies are revolutionizing operations, from sophisticated fraud detection systems to highly personalized client advisory services and the automation of routine tasks. For instance, by the end of 2024, it's projected that AI adoption in financial services will reach over 80% for specific use cases like risk management and customer service.

Bravura Solutions needs to proactively embed AI and ML into its core platforms. This integration is crucial for delivering cutting-edge analytics, predictive capabilities, and enhanced operational efficiencies. Clients in wealth management and funds administration are increasingly demanding these advanced features to gain a competitive edge and improve their service offerings, with a significant portion of wealth management firms planning to increase their AI investments by 15-20% in 2025.

The financial technology sector is increasingly embracing cloud computing and Software-as-a-Service (SaaS) models, a trend that directly benefits companies like Bravura Solutions. Financial institutions are actively migrating to these flexible, scalable, and cost-effective solutions. For instance, a significant portion of financial services workloads are expected to be in the cloud by 2025, with many firms prioritizing SaaS for its agility.

As financial services increasingly move online, the risk of cyberattacks is growing. In 2024, the financial sector experienced a significant rise in sophisticated threats, with ransomware attacks alone costing the industry billions globally. Bravura Solutions must prioritize advanced cybersecurity solutions, including robust identity and access management and strong data encryption protocols, to safeguard sensitive information and maintain client confidence.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are poised to reshape financial services, offering enhanced transparency and efficiency in areas like payments and asset management. Bravura Solutions must actively monitor and consider integrating DLT into its platforms to maintain its edge in financial technology, especially concerning funds administration and the burgeoning digital assets sector.

The adoption of DLT is accelerating. For instance, the global blockchain market size was valued at approximately USD 12.76 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 43.7% from 2024 to 2030, according to Grand View Research. This growth underscores the increasing relevance and potential impact of these technologies.

Specifically for Bravura, the implications are significant:

- Streamlined Operations: DLT can automate and expedite processes like trade settlements and reconciliation, reducing operational costs and risks.

- Enhanced Security and Transparency: The immutable nature of blockchain provides a secure and transparent audit trail for transactions, crucial for regulatory compliance and investor trust.

- New Product Development: Integration of DLT could enable Bravura to offer innovative services related to digital securities, tokenized assets, and faster cross-border payments.

- Competitive Advantage: Early adoption and effective implementation of DLT can differentiate Bravura from competitors and attract clients seeking cutting-edge solutions.

Automation and Digital Process Orchestration

The relentless pursuit of operational efficiency and cost reduction within financial institutions is a significant driver for automation. This trend directly fuels the demand for sophisticated solutions that can streamline complex workflows.

Bravura Solutions is positioned to capitalize on this by offering platforms designed to simplify and automate critical processes. Think about tasks like order routing and trade settlements; automating these reduces manual effort, minimizes errors, and ultimately boosts overall efficiency for their clients.

Key to realizing these benefits is robust workflow orchestration and enhanced system connectivity. For instance, in 2024, the global financial automation market was valued at approximately $15.2 billion, with projections indicating substantial growth driven by these very factors.

- Increased adoption of Robotic Process Automation (RPA) in back-office functions.

- Growing investment in AI-powered solutions for fraud detection and compliance.

- Demand for cloud-based automation platforms to enhance scalability and flexibility.

- Focus on end-to-end digital process orchestration to improve client onboarding and service delivery.

Technological advancements are reshaping the financial services landscape at an unprecedented pace. AI and ML are becoming integral, with over 80% of financial services firms expected to adopt them for specific functions like risk management by the end of 2024, driving demand for sophisticated analytics and automation. Cloud computing and SaaS models are also seeing increased adoption, with a significant portion of financial services workloads migrating to the cloud by 2025, offering scalability and cost-effectiveness.

The rise of blockchain and DLT presents opportunities for enhanced transparency and efficiency, with the global blockchain market projected for substantial growth. Furthermore, automation, particularly RPA and AI-powered solutions, is a key focus for financial institutions seeking to streamline operations and reduce costs, evidenced by the approximately $15.2 billion valuation of the global financial automation market in 2024.

| Technology | Adoption Trend (2024/2025) | Impact on Bravura Solutions |

|---|---|---|

| AI/ML | Over 80% adoption for specific use cases by end of 2024; 15-20% planned investment increase by wealth management firms in 2025 | Enhance analytics, predictive capabilities, and operational efficiency; meet client demand for advanced features |

| Cloud/SaaS | Significant migration of financial services workloads by 2025 | Leverage flexible, scalable, and cost-effective solutions; improve agility |

| Blockchain/DLT | Global market projected for significant CAGR (43.7% from 2024-2030) | Streamline operations, enhance security, develop new digital asset services |

| Automation (RPA/AI) | Global market valued at ~$15.2 billion in 2024; focus on end-to-end process orchestration | Automate complex workflows, reduce operational costs, minimize errors |

Legal factors

Bravura Solutions operates in the heavily regulated financial services sector, where compliance with diverse national and international rules is critical. This includes adherence to frameworks governing superannuation, pensions, life insurance, and investment products, impacting everything from product creation to client communication.

The evolving nature of these regulations, such as updated data privacy laws and capital adequacy requirements, necessitates continuous investment in compliance infrastructure. For instance, the Australian Prudential Regulation Authority (APRA) in 2024 continued to emphasize robust data management and security for superannuation funds, a key market for Bravura.

Strict data privacy laws, like GDPR and CCPA, significantly influence how Bravura Solutions handles sensitive financial information. Compliance necessitates robust data protection measures within their software, impacting data collection, processing, and storage practices for both Bravura and its clients.

Bravura's platforms must actively support adherence to these regulations, which include provisions for data residency, obtaining explicit consent, and managing data breaches effectively. Failure to comply can result in substantial penalties, as seen with GDPR fines that can reach up to 4% of global annual turnover.

Financial institutions are under immense pressure to comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are designed to thwart illegal financial activities, and failure to adhere can result in hefty penalties. For example, in 2023, fines related to AML/KYC non-compliance exceeded $2 billion globally, highlighting the critical nature of these laws.

Bravura Solutions' software must therefore be equipped with advanced functionalities that allow its clients to conduct thorough due diligence, keep a close watch on transactions, and report any suspicious behavior. Staying compliant with these ever-evolving global and local AML/KYC mandates is paramount, as regulatory frameworks are frequently updated to counter new financial crime tactics.

Consumer Protection and Disclosure Laws

Consumer protection and disclosure laws are critical for Bravura Solutions, as they dictate how financial products and services must be presented. Regulations like the EU's General Data Protection Regulation (GDPR) and the UK's Financial Conduct Authority (FCA) Consumer Duty, which came into effect in July 2023, mandate clear communication of fees, risks, and product terms. Bravura's software must enable its clients to comply with these stringent requirements, ensuring transparency and fair customer treatment.

These legal frameworks directly impact the design of wealth management and insurance platforms. For instance, the FCA reported that in 2023, consumer complaints related to clarity of information and fees remained a significant area of concern, highlighting the need for robust disclosure functionalities within financial software. Bravura's solutions are therefore built to support clients in proactively managing these obligations.

- Enhanced Transparency Requirements: Laws increasingly demand clear, understandable disclosures of all costs, charges, and potential risks associated with financial products.

- Customer Centricity Mandates: Regulatory bodies are pushing for a more customer-focused approach, requiring firms to demonstrate they are delivering good outcomes for consumers.

- Data Privacy and Security: Legislation like GDPR (in effect since 2018, with ongoing enforcement and updates) impacts how customer data is handled and protected within financial software.

- Fair Treatment of Vulnerable Customers: Regulators are focusing on ensuring that vulnerable consumers receive appropriate support and clear, accessible information.

Cybersecurity Legislation and Reporting Mandates

Beyond general data privacy, specific cybersecurity legislation mandates how companies must protect their systems and report breaches. For instance, the European Union's NIS2 Directive, which came into effect in January 2023 and will be transposed into national law by October 2024, significantly expands the scope of cybersecurity obligations for critical entities, including those in the financial sector. Financial services are often subject to stricter cybersecurity requirements due to the sensitive nature of the data they handle, with regulations like the Gramm-Leach-Bliley Act (GLBA) in the US continuing to set a high bar.

Bravura's commitment to security and its identity management solutions help clients navigate these evolving legal landscapes. The company's offerings are designed to align with these stringent requirements, ensuring that financial institutions can meet their compliance obligations. This proactive approach is crucial as regulatory bodies worldwide continue to enhance cybersecurity oversight. For example, in 2024, many jurisdictions are focusing on strengthening incident reporting timelines and the scope of entities covered by cybersecurity laws.

Key aspects of cybersecurity legislation relevant to Bravura's clients include:

- Mandatory Breach Notification: Laws often dictate specific timeframes and procedures for reporting cybersecurity incidents to authorities and affected individuals.

- Data Protection Standards: Regulations specify technical and organizational measures companies must implement to safeguard sensitive data.

- Third-Party Risk Management: Increasing scrutiny is placed on how companies manage the cybersecurity risks associated with their vendors and service providers.

- Cyber Resilience Requirements: Regulators are pushing for greater resilience, requiring organizations to demonstrate their ability to withstand and recover from cyberattacks.

Legal factors profoundly shape Bravura Solutions' operational landscape, demanding strict adherence to evolving regulations in financial services. These include stringent data privacy laws like GDPR, impacting how sensitive client information is managed, with non-compliance carrying significant financial penalties, potentially up to 4% of global annual turnover.

Furthermore, Anti-Money Laundering (AML) and Know Your Customer (KYC) mandates necessitate robust functionalities within Bravura's platforms to facilitate thorough due diligence and transaction monitoring, as global AML fines exceeded $2 billion in 2023.

Consumer protection laws, such as the UK's FCA Consumer Duty implemented in July 2023, require enhanced transparency in product disclosures and a customer-centric approach, directly influencing software design to ensure fair treatment and clear communication of fees and risks.

Cybersecurity legislation, including the EU's NIS2 Directive effective from January 2023, imposes stricter data protection standards and breach notification requirements, pushing for greater cyber resilience within financial institutions.

| Regulation Area | Key Requirement | Impact on Bravura | Example Legislation/Data |

|---|---|---|---|

| Data Privacy | Secure handling and protection of sensitive customer data | Requires robust data security features in software; compliance with GDPR fines (up to 4% global turnover) | GDPR (effective 2018), CCPA |

| Financial Crime | Preventing money laundering and illegal financial activities | Needs advanced AML/KYC functionalities for clients; global AML fines exceeded $2 billion in 2023 | AML/KYC regulations |

| Consumer Protection | Ensuring transparent product information and fair customer outcomes | Software must facilitate clear disclosure of fees, risks; FCA Consumer Duty (July 2023) | FCA Consumer Duty |

| Cybersecurity | Protecting systems and data from cyber threats, mandatory breach reporting | Mandates strong security measures and incident response capabilities; NIS2 Directive (Jan 2023) | NIS2 Directive, GLBA |

Environmental factors

Financial institutions are under increasing scrutiny regarding their environmental, social, and governance (ESG) performance. This trend is driving new reporting requirements, with regulators worldwide mandating greater transparency. For instance, the European Union’s Sustainable Finance Disclosure Regulation (SFDR) has significantly impacted how financial products are classified and reported, with a substantial portion of assets now falling under Article 8 or Article 9, emphasizing sustainability characteristics or sustainable investment objectives.

Bravura Solutions can leverage this shift by providing advanced software solutions designed to help clients navigate these complex ESG reporting landscapes. These capabilities enable financial firms to efficiently track, analyze, and report on ESG metrics embedded within their investment portfolios, ensuring compliance and meeting stakeholder expectations. The demand for such tools is growing, as evidenced by the projected expansion of the ESG investing market, which analysts anticipate will reach trillions of dollars globally in the coming years.

Investors are increasingly seeking financial products that reflect their environmental and social values, a trend that directly influences Bravura's client base. This rising demand necessitates that Bravura's clients expand their offerings to include a broader spectrum of sustainable investment options, such as green bonds and ethical funds.

Consequently, Bravura's platforms must be equipped to handle the administration and detailed reporting requirements associated with these specialized financial instruments. For instance, the global sustainable investment market reached an estimated $35.3 trillion in assets under management by the end of 2022, according to the Global Sustainable Investment Alliance, highlighting the significant scale of this client demand.

Bravura Solutions, as a global technology provider with data centers and offices, directly contributes to environmental concerns through its energy consumption. The company's operational footprint, while not as direct as heavy manufacturing, is significant given its reliance on digital infrastructure and widespread physical presence.

In 2023, the tech sector continued to see a rise in corporate sustainability goals. Companies like Bravura are increasingly investing in renewable energy sources for their facilities. For instance, many tech firms are aiming for 100% renewable energy procurement for their data centers, a trend likely to continue and be a focus for Bravura in 2024 and 2025.

Reducing its carbon footprint through energy efficiency and renewable energy adoption is crucial for Bravura's reputation. This commitment can attract environmentally conscious clients and investors, especially as Environmental, Social, and Governance (ESG) factors become more integrated into investment decisions. By 2025, we expect to see more transparent reporting on these initiatives from technology companies.

Climate Change Risk Management in Finance

Financial institutions are facing growing pressure to actively manage climate-related financial risks. This includes assessing the impact of climate change on their investments and operations, with a particular focus on physical risks like extreme weather events and transition risks associated with shifting to a low-carbon economy. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) has seen widespread adoption, with over 4,000 organizations globally supporting its recommendations as of early 2024, indicating a significant shift in reporting expectations.

This evolving landscape creates a strong demand for sophisticated software solutions. Bravura's technology can empower clients to effectively model these climate risks, conduct stress tests on their portfolios under various environmental scenarios, and seamlessly integrate crucial climate data into their investment decision-making processes. This capability is becoming essential as regulatory bodies worldwide, such as the European Central Bank, continue to emphasize climate risk management in their supervisory frameworks, with stress tests in 2024 and 2025 specifically targeting climate resilience.

- Demand for Climate Risk Modeling: Financial firms need tools to quantify the potential financial impact of climate events on their assets.

- Portfolio Stress Testing: Software is required to simulate how portfolios would perform under different climate change scenarios, such as a 2-degree Celsius warming pathway.

- Data Integration: The ability to incorporate climate-related data, like carbon emissions or physical risk assessments, into existing investment platforms is critical.

- Regulatory Compliance: Solutions that help meet evolving disclosure requirements, like those influenced by the TCFD, are highly valued.

Supply Chain Environmental Standards

Bravura Solutions operates with a complex global supply chain, making its environmental footprint intrinsically linked to its suppliers' practices. Adherence to standards like responsible sourcing and effective waste management by these partners directly influences Bravura's own environmental performance and public image. For instance, a significant portion of the technology sector, where Bravura operates, faces increasing scrutiny regarding e-waste and the carbon intensity of manufacturing processes. In 2024, reports indicated that over 60% of global consumers consider a company's environmental impact when making purchasing decisions, highlighting the reputational risk associated with a non-compliant supply chain.

The pursuit of supply chain environmental certifications, such as ISO 14001, signals a deeper commitment to sustainability for Bravura Solutions. These certifications often involve rigorous audits of supplier operations, ensuring compliance with environmental regulations and best practices. As of early 2025, the demand for transparent and sustainable supply chains has intensified, with many large enterprise clients, including major financial institutions, incorporating environmental performance into their vendor selection criteria. This trend is expected to drive greater adoption of green procurement policies across the industry.

Key considerations for Bravura Solutions regarding its supply chain environmental standards include:

- Supplier Audits: Implementing robust auditing processes to verify environmental compliance among key suppliers.

- Sustainable Sourcing: Prioritizing suppliers who demonstrate responsible resource extraction and manufacturing.

- Waste Reduction Initiatives: Collaborating with suppliers to minimize waste generation and promote circular economy principles.

- Carbon Footprint Tracking: Working towards measuring and reducing the Scope 3 emissions associated with its supply chain operations.

Environmental factors are increasingly shaping the financial services industry, pushing companies like Bravura Solutions to adapt. Growing investor and consumer demand for sustainable options means Bravura's clients need robust solutions for managing ESG data and reporting on green financial products. For instance, the global sustainable investment market reached an estimated $35.3 trillion in assets under management by the end of 2022, underscoring this significant market shift.

Bravura's own operational footprint, including energy consumption in its data centers and offices, is also under environmental scrutiny. Many tech companies, including those in Bravura's sector, are setting ambitious goals for renewable energy procurement, with a strong push towards 100% by 2025 to enhance their sustainability credentials.

Climate-related financial risks are a major concern for financial institutions, driving a need for advanced modeling and stress-testing capabilities. The widespread adoption of frameworks like the Task Force on Climate-related Financial Disclosures (TCFD), supported by over 4,000 organizations globally as of early 2024, highlights the urgency in addressing these risks.

Bravura's supply chain also presents environmental challenges, with increasing focus on e-waste and manufacturing carbon intensity. By early 2025, a significant portion of enterprise clients are integrating environmental performance into their vendor selection, pushing for greater supply chain transparency and sustainability.

| Environmental Factor | Impact on Bravura's Clients | Bravura's Opportunity/Challenge | Relevant Data/Trend |

|---|---|---|---|

| ESG Reporting Demand | Increased need for transparent reporting on environmental impact and sustainable investments. | Develop and enhance software for ESG data aggregation and reporting. | Global sustainable investment market: $35.3 trillion (end of 2022). |

| Climate Risk Management | Requirement to assess and manage physical and transition risks related to climate change. | Provide tools for climate risk modeling, scenario analysis, and TCFD-aligned disclosures. | TCFD support: Over 4,000 organizations globally (early 2024). |

| Operational Footprint | Pressure to reduce energy consumption and carbon emissions from technology infrastructure. | Invest in renewable energy for facilities and improve energy efficiency. | Tech sector push for 100% renewable energy for data centers by 2025. |

| Supply Chain Sustainability | Scrutiny on suppliers' environmental practices, including e-waste and manufacturing emissions. | Implement supplier audits and promote sustainable sourcing and waste reduction. | Over 60% of consumers consider environmental impact in purchasing decisions (2024). |

PESTLE Analysis Data Sources

Our Bravura Solutions PESTLE Analysis is meticulously constructed using a robust blend of official government publications, reputable financial institutions, and leading industry research firms. This ensures that every aspect of the macro-environment, from political stability to technological advancements, is informed by credible and current data.