Bravura Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bravura Solutions Bundle

Bravura Solutions operates within a dynamic financial technology landscape, where understanding the competitive forces at play is crucial for strategic success. This analysis highlights the intense rivalry among existing players and the significant bargaining power buyers wield, impacting pricing and service offerings.

The full Porter's Five Forces report reveals the real forces shaping Bravura Solutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bravura Solutions' dependence on highly specialized technology, like proprietary database systems and cloud infrastructure, grants significant leverage to its suppliers. These providers, often offering unique or complex integrated software components, can command higher prices due to the substantial costs and technical hurdles Bravura would face if it attempted to switch vendors. For instance, in 2024, companies relying on specialized SaaS solutions often reported switching costs equivalent to 10-20% of their annual software expenditure, highlighting the potential impact on Bravura.

The financial software sector thrives on specialized expertise, demanding professionals in software development, financial compliance, and niche consulting. The limited availability of these highly skilled individuals significantly bolsters the bargaining power of both employees and the recruitment firms that source them.

This concentrated power often translates into amplified wage expectations and protracted recruitment cycles, directly influencing Bravura Solutions' operational expenditures and its capacity to meet project deadlines. For instance, in 2024, the demand for experienced cloud engineers in fintech outstripped supply by an estimated 30%, driving up average salaries in the sector.

Bravura Solutions' increasing focus on data and AI automation means it depends more on providers of advanced analytics tools and AI frameworks. If these suppliers offer specialized or top-tier functionalities, they can leverage this to influence pricing and contract conditions. For example, the global AI market was valued at approximately $150 billion in 2023 and is projected to grow significantly, indicating a strong and potentially concentrated supplier base for critical AI components.

The capacity of Bravura to effectively integrate these advanced technologies into its software platforms is vital for sustaining its competitive edge. Suppliers with proprietary algorithms or unique data processing capabilities can command higher prices or dictate terms, directly impacting Bravura's cost structure and product development timelines. This reliance underscores the strategic importance of managing these supplier relationships.

Infrastructure and Hosting Services

Bravura Solutions' reliance on infrastructure and hosting services, encompassing on-premise, managed hosted, and cloud solutions, highlights a significant dependency on external providers. This creates a dynamic where the bargaining power of these suppliers can directly influence Bravura's operational costs and service delivery capabilities.

The cloud computing market, a key area for Bravura's scalable solutions, is notably concentrated. Major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform dominate this space. For instance, in the first quarter of 2024, AWS held an estimated 31% of the cloud infrastructure market, followed by Azure with 25% and Google Cloud with 11%. This concentration allows these providers substantial leverage in negotiating pricing and terms, potentially increasing Bravura's hosting expenses and impacting its profitability.

This supplier concentration can lead to several challenges for Bravura:

- Increased Costs: Limited competition among top-tier cloud providers can result in higher infrastructure and hosting fees, directly impacting Bravura's cost of goods sold.

- Service Level Agreement (SLA) Constraints: Dominant providers may dictate terms in SLAs, potentially limiting Bravura's flexibility in service customization or demanding premium pricing for enhanced support.

- Vendor Lock-in: Migrating between major cloud providers can be complex and costly, potentially reducing Bravura's negotiating power over time.

- Impact on Global Scalability: While cloud services enable global reach, reliance on a few key providers means Bravura's ability to scale rapidly and cost-effectively is subject to the pricing and capacity decisions of these suppliers.

Consulting and Implementation Partners

Bravura Solutions may leverage external consulting and implementation partners for specialized skills or to scale operations for major client engagements. The strength of these partners, particularly their availability and the quality of their offerings, directly impacts Bravura's project execution capabilities and efficiency. For instance, if demand for specialized financial software implementation partners surges, as seen in the broader IT services sector where growth in cloud consulting reached an estimated 15% year-over-year in early 2024, these partners could increase their pricing or impose stricter contract terms, thereby increasing Bravura's costs and potentially limiting its flexibility.

The bargaining power of these consulting and implementation partners hinges on several factors. A limited pool of highly skilled firms specializing in Bravura's core technologies, such as wealth management or superannuation platforms, would grant them significant leverage. Conversely, a robust ecosystem of readily available and competent partners would diminish their power. For example, if Bravura needs partners with deep expertise in specific regulatory compliance frameworks, and few firms possess this, those firms will have higher bargaining power.

- Limited Specialized Expertise: If few partners possess the niche technical or industry knowledge required for Bravura's projects, their bargaining power increases.

- High Demand for Partner Services: A general increase in demand for IT consulting and implementation services, as observed in the market, can empower partners to negotiate better terms.

- Quality and Reputation: Partners with a strong track record and reputation can command higher rates and dictate more favorable contract conditions.

- Scalability and Capacity: The ability of partners to quickly scale their resources to meet Bravura's project demands influences their negotiating position.

Bravura Solutions faces considerable supplier bargaining power due to its reliance on specialized technology, particularly in cloud infrastructure and proprietary software. The concentrated nature of the cloud market, with AWS, Azure, and Google Cloud holding significant market share, allows these providers to influence pricing and terms, potentially increasing Bravura's operational costs. For instance, in Q1 2024, AWS commanded an estimated 31% of the cloud infrastructure market, highlighting the leverage these major players possess.

Furthermore, the demand for specialized IT talent and consulting services, critical for Bravura's project execution, amplifies the bargaining power of recruitment firms and implementation partners. In 2024, the shortage of skilled cloud engineers in fintech, estimated at 30% above demand, drove up salaries and empowered recruitment agencies. This situation can lead to increased project costs and extended timelines for Bravura.

| Supplier Category | Key Dependencies for Bravura | Supplier Bargaining Power Factors | 2024 Market Data/Impact |

|---|---|---|---|

| Cloud Infrastructure Providers | Scalable hosting, data storage, computing power | Market concentration (AWS, Azure, GCP), switching costs, proprietary technology | AWS market share Q1 2024: 31%. Increased hosting fees impact cost of goods sold. |

| Specialized Software/AI Vendors | Proprietary algorithms, advanced analytics tools, AI frameworks | Unique functionalities, limited availability of expertise, integration complexity | Global AI market valued ~$150B in 2023, with strong growth. Suppliers of top-tier AI can command higher prices. |

| IT Consulting & Implementation Partners | Niche technical expertise, project scaling, regulatory compliance knowledge | Limited pool of specialized firms, high demand for services, partner reputation | Cloud consulting growth ~15% YoY early 2024. High demand empowers partners to negotiate better terms. |

What is included in the product

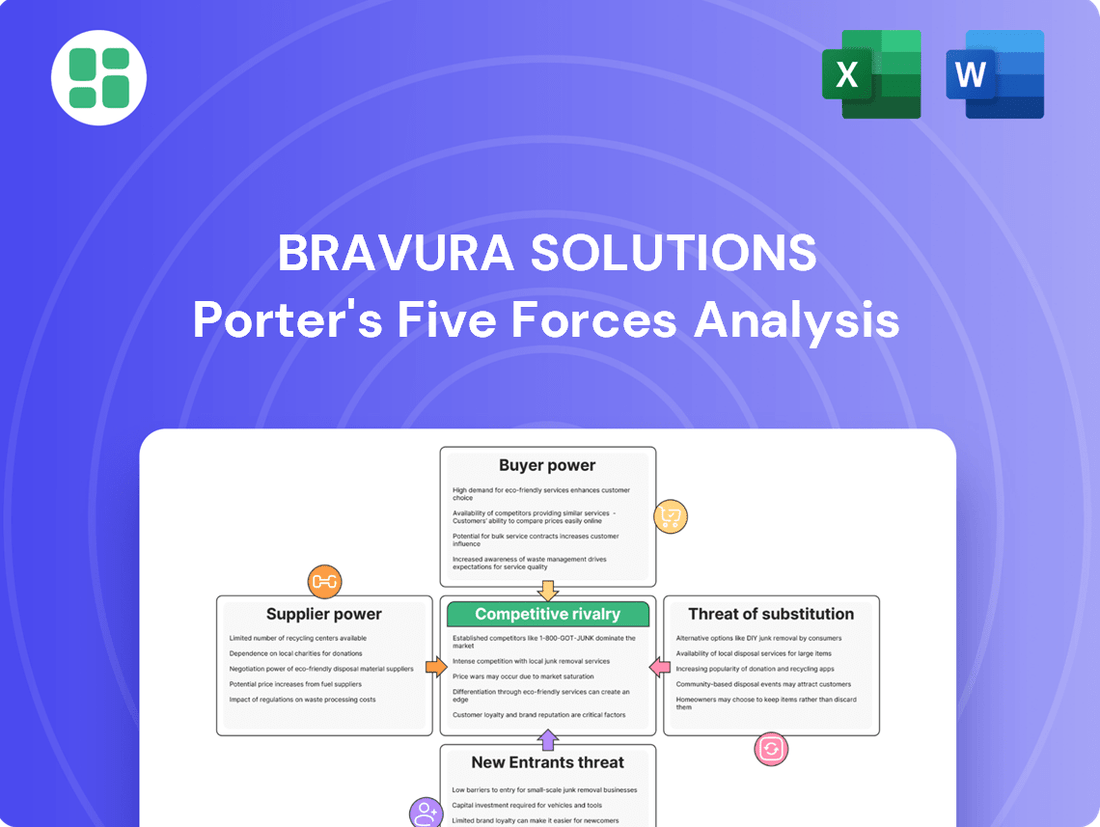

This analysis of Bravura Solutions examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes to understand its competitive environment.

Instantly identify and mitigate competitive threats with a dynamic, visual representation of each force.

Customers Bargaining Power

Bravura Solutions' core clientele consists of major financial institutions, such as wealth management firms, life insurance companies, and fund administrators. These organizations manage trillions of dollars in assets, making them pivotal to Bravura's operations.

The sheer scale of these clients, managing vast sums of money, grants them significant leverage. Their substantial purchasing power and intricate procurement procedures allow them to negotiate advantageous terms and pricing, directly impacting Bravura's revenue streams.

The strategic importance of these large clients cannot be overstated. The loss of even a single major customer can have a considerable detrimental effect on Bravura's overall financial performance, highlighting the substantial bargaining power they wield.

While Bravura Solutions serves large clients, the mission-critical nature of its software, such as the Sonata platform, deeply embeds it within their core financial administration. This integration means that switching to a competitor involves substantial expense, considerable time, and significant operational risks, effectively raising the barrier for customers to change providers.

Financial institutions often demand highly customized solutions, meaning Bravura must adapt its offerings to meet specific client needs. This customization, coupled with the necessity for seamless integration into existing legacy systems and other third-party applications, significantly amplifies customer bargaining power. Clients seek precise functionalities and bespoke development, making Bravura's adaptability a key factor in their satisfaction and retention.

Long-Term Contracts and Service Agreements

Bravura Solutions typically secures its revenue through long-term contracts for software licensing and essential maintenance and support services. These agreements, often spanning several years, create a predictable revenue stream. However, they also grant customers significant leverage during renewal discussions. If customers experience service quality issues or if the competitive landscape changes, they can use the upcoming renewal as an opportunity to negotiate more favorable terms.

For instance, in the competitive wealth management software market, customers might have options from competitors like Temenos or FIS. This competitive pressure intensifies during contract renewals, allowing clients to demand better pricing or service levels. Bravura's strategic focus on rebuilding client trust is a direct response to the power customers wield in these long-term relationship negotiations.

The bargaining power of customers is amplified by:

- Long-term commitments: Customers are locked into multi-year contracts for core financial software.

- Switching costs: While high, customers will explore alternatives if dissatisfaction is significant, particularly during renewal periods.

- Market dynamics: The presence of strong competitors provides customers with viable alternatives, increasing their negotiation leverage.

Client Focus on Operational Efficiency and Digitalization

Bravura's clients are prioritizing operational efficiency and digital transformation. This means they're looking for solutions that streamline processes, enhance customer interactions, and leverage technologies like AI and automation. The pressure is on Bravura to deliver tangible value and a clear return on investment for these strategic initiatives.

This client focus directly impacts Bravura's bargaining power. As clients demand more sophisticated and integrated digital solutions, they gain leverage. They can more easily switch providers if Bravura cannot meet these evolving needs, especially as competitors emerge with advanced capabilities. For instance, the 2024 trend shows a significant increase in demand for cloud-based, AI-driven customer service platforms within the financial sector, a space Bravura operates in.

- Client Demand for Efficiency: Financial institutions are investing heavily in digital advice platforms and automation to reduce costs and improve customer engagement.

- Digitalization as a Differentiator: Companies that successfully integrate AI and data analytics into their operations gain a competitive edge, influencing their vendor choices.

- ROI Pressure: Clients expect demonstrable financial benefits from technology investments, making it crucial for vendors like Bravura to prove their solutions' effectiveness.

- Partnership Example: Bravura's collaboration with AMP on digital advice solutions exemplifies the industry's move towards more integrated and client-centric digital offerings.

Bravura Solutions' customers, primarily large financial institutions, possess significant bargaining power due to their substantial asset management and long-term contracts. This leverage is amplified by the high switching costs associated with Bravura's deeply integrated software, like the Sonata platform, and the demand for customized solutions. The competitive landscape further empowers clients, especially during contract renewals, as they can leverage alternative providers such as Temenos or FIS to negotiate better terms.

The push for digital transformation and operational efficiency in 2024, particularly the demand for AI-driven platforms, grants clients more leverage. If Bravura cannot meet these evolving needs, clients can explore competitors offering advanced capabilities, thereby increasing their negotiation power.

| Factor | Impact on Bravura | Customer Leverage |

|---|---|---|

| Client Size & Asset Management | High dependence on major clients | Significant purchasing power |

| Contract Length & Renewal | Predictable revenue, but negotiation points | Opportunity to renegotiate terms |

| Switching Costs & Customization | High integration, but client-specific needs | Clients demand tailored solutions, potential for leverage if needs aren't met |

| Competitive Landscape | Need to stay competitive | Access to alternatives like Temenos, FIS |

| Digital Transformation Demands (2024+) | Pressure to innovate with AI/automation | Clients can switch to vendors with advanced capabilities |

Preview the Actual Deliverable

Bravura Solutions Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Bravura Solutions, detailing the competitive landscape and strategic implications within the financial technology sector. The document you see here is precisely what you'll receive immediately after purchase, offering an in-depth examination of industry rivalry, buyer and supplier power, the threat of new entrants, and the threat of substitute products. This is the complete, ready-to-use analysis file, ensuring you get exactly what you need to understand Bravura Solutions' market position.

Rivalry Among Competitors

The financial software sector is a crowded space, with many established companies providing services in wealth management, life insurance, and funds administration. Key rivals include eMoney, Morningstar Direct, Pershing Financial Services, Carta Fund Management, Backstop Solutions Group, and Nelito Systems, all vying for market dominance.

Bravura Solutions encounters significant competition from firms that offer very similar core products, intensifying the battle for market share. For instance, in the wealth management segment, the market is highly fragmented with numerous providers, making it challenging to differentiate and capture new clients.

Competitive rivalry in the financial technology sector is intense, fueled by a constant stream of product innovation. Companies are heavily investing in features that leverage data analytics, artificial intelligence, automation, and digital advice capabilities to attract and retain clients. This dynamic environment means that staying ahead requires continuous development and adaptation.

The battle for market share is fought on multiple fronts, including the comprehensiveness of platform offerings, the seamlessness of integration with existing systems, robust regulatory compliance, and an intuitive user experience. Bravura Solutions' strategic focus on its 'Energise, Build and Grow' approach, with a particular emphasis on enhancing digital advice services, directly addresses these competitive pressures.

Competitive rivalry in the software sector, particularly for offerings like Bravura's, often translates into significant pricing pressure, especially for more commoditized or less distinct solutions. Firms must constantly reinforce their unique selling points, which for Bravura includes advanced technology, reliable customer support, and a history of successful deployments with major clients.

Bravura's ability to maintain its market position hinges on its capacity to consistently demonstrate superior value. This is achieved not just through product features but also through the reliability and effectiveness of its services, backed by a strong client roster. The company's recent financial performance, marked by a return to profitability and an upward revision of its financial outlook, suggests it is successfully navigating these competitive pressures and solidifying its standing.

Global and Regional Competition

Bravura Solutions navigates a complex competitive arena across EMEA and APAC, contending with both established global software titans and formidable regional competitors. The intensity and nature of this rivalry shift significantly depending on the specific geography, influenced by diverse regulatory frameworks and distinct client preferences. For instance, in the APAC region, Bravura faces competition from local players who may have deeper inroads into specific national markets.

The competitive landscape is characterized by a mix of large, diversified technology providers and specialized financial software vendors. These competitors often vie for market share through product innovation, pricing strategies, and the ability to offer integrated solutions. Bravura's efforts to regain client confidence in these markets are crucial for its competitive positioning.

Key competitive dynamics include:

- Global Software Giants: Large multinational technology companies with broad product portfolios often compete with Bravura, leveraging their scale and extensive resources.

- Regional Specialists: Local or regional software providers possess in-depth understanding of specific market needs and regulatory nuances, posing a significant challenge.

- Client Trust and Relationships: In markets where Bravura has faced challenges, rebuilding trust is a primary competitive differentiator.

- Regulatory Influence: Varying regulatory environments across EMEA and APAC create distinct competitive pressures and opportunities for tailored solutions.

Market Growth and Consolidation

The life insurance software market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of 8.5% through 2028, reaching an estimated $15.2 billion. This expansion naturally fuels more intense competition as new entrants and existing players vie for market share.

This dynamic environment also points towards a trend of consolidation. As financial institutions increasingly demand integrated and comprehensive software solutions, larger, established providers are likely to acquire smaller, specialized firms. This strategy allows them to broaden their product portfolios and gain access to new technologies or customer segments, thereby intensifying the competitive rivalry among all market participants.

- Projected growth in the life insurance software market is significant.

- Increased competition is a direct result of market expansion.

- Consolidation through acquisitions is a key trend.

- Larger players are expanding offerings by acquiring niche providers.

Bravura Solutions operates in a highly competitive financial software market, facing pressure from both global technology giants and specialized regional players. The need for continuous innovation, particularly in areas like AI and digital advice, is paramount to retaining clients and market share. Pricing strategies and the ability to offer integrated, user-friendly solutions are key battlegrounds.

The intense rivalry is evident in the life insurance software sector, projected to grow significantly. This expansion attracts more competition, driving a trend towards consolidation as larger firms acquire smaller, specialized companies to broaden their offerings. Bravura's focus on digital services and client trust is crucial for navigating this dynamic environment.

| Competitor Type | Key Characteristics | Impact on Bravura |

| Global Software Giants | Broad portfolios, extensive resources, scale | Intensified competition on features and pricing |

| Regional Specialists | Deep market understanding, regulatory nuance | Challenge in specific geographies, need for localized solutions |

| Niche Software Providers | Specialized capabilities, innovation focus | Potential for acquisition or direct competition on specific product lines |

SSubstitutes Threaten

Large financial institutions, who are Bravura's primary customers, often have substantial IT departments and the resources to develop their own software. For instance, in 2024, major banks globally continued to invest heavily in digital transformation, with IT spending in the financial services sector projected to reach over $600 billion.

While building proprietary solutions can be more expensive and take longer, it grants clients complete control and the ability to tailor the software precisely to their unique needs. This means they can bypass third-party vendors entirely for certain functions.

This presents a potential threat, especially for less critical or specialized features within Bravura's offerings. If a client identifies a specific functionality as a core differentiator, the temptation to develop it internally rather than rely on a vendor like Bravura could increase.

The threat of substitutes for Bravura Solutions' specialized financial software comes from generic enterprise software like ERP or CRM systems. These platforms can be customized to handle some financial processes, offering a perceived lower-cost alternative, particularly for less complex or regulated functions. For instance, many mid-sized businesses in 2024 are adopting cloud-based ERP solutions from vendors like SAP or Oracle, which offer broad functionality that can be adapted for financial management, potentially reducing the need for highly specialized software.

Manual processes or outsourcing can act as a substitute for Bravura Solutions' offerings, especially for smaller entities or specific tasks where the cost of sophisticated software is a barrier. For instance, a small financial advisory firm might opt for manual data entry and reporting rather than investing in a full-suite platform. However, the broader industry push towards digital transformation and automation, driven by the need for efficiency and scalability, limits the long-term viability of purely manual approaches. In 2024, the global IT outsourcing market was valued at over $450 billion, indicating a significant demand for external services, but this often involves leveraging technology, not replacing it entirely.

Consulting Services without Software Licensing

The threat of substitutes for Bravura Solutions, particularly within the consulting services landscape, arises when financial institutions choose process re-engineering and advisory services over outright software licensing. This strategy focuses on optimizing existing workflows and leveraging internal expertise, effectively bypassing the need for new software platforms. For instance, a bank might engage a specialized consultancy to streamline its compliance reporting processes, thereby reducing the perceived necessity for a new regulatory reporting software solution.

Bravura's own offering of professional consulting services acts as a direct countermeasure to this threat. By providing integrated solutions that combine software with expert guidance, Bravura can retain clients who might otherwise seek standalone consulting. This dual approach allows Bravura to address clients' needs for both technological advancement and operational improvement.

The market for IT consulting in the financial services sector is substantial. In 2023, the global financial services IT spending was projected to reach over $200 billion, with a significant portion allocated to consulting and implementation services. This highlights the considerable demand for advisory services that could potentially substitute for software purchases.

- Process Optimization Focus: Financial institutions may prioritize consulting to improve existing systems and workflows, reducing the immediate need for new software licenses.

- Advisory Services as Alternative: Pure consulting engagements focused on strategy and operational efficiency can serve as a substitute for acquiring new technology platforms.

- Bravura's Integrated Offering: Bravura's provision of professional consulting services alongside its software solutions mitigates this threat by offering a comprehensive package.

- Market Context: The significant global spending on financial services IT, including consulting, underscores the potential for substitute solutions to emerge.

Disruptive Fintech Solutions for Specific Functions

The emergence of specialized fintech firms presents a significant threat of substitution for traditional software providers like Bravura Solutions. These agile companies often focus on cloud-native solutions for very specific financial functions, such as digital wealth management or particular aspects of fund administration.

While these niche offerings might not replace Bravura's entire platform, they can erode market share by providing superior agility and cost-effectiveness in targeted areas. For instance, a fintech specializing in automated compliance reporting could attract clients seeking a more streamlined and less expensive solution than a module within a broader legacy system. In 2024, the fintech sector continued its rapid expansion, with venture capital funding flowing into solutions aimed at optimizing specific financial workflows.

This trend forces established players to either adapt by integrating similar capabilities or risk losing business to these more focused disruptors. The ability of these fintechs to quickly iterate and respond to market demands often outpaces larger, more complex organizations.

- Niche Fintech Focus: Specialized solutions for specific financial processes like digital advice or fund administration tasks.

- Substitution Threat: These targeted solutions can chip away at Bravura's market share.

- Key Advantages: Superior agility and cost-effectiveness compared to broader platforms.

- Market Impact: Forces established providers to innovate or risk losing business to focused disruptors.

The threat of substitutes for Bravura Solutions stems from clients developing in-house software or utilizing generic enterprise solutions. Large financial institutions, with significant IT budgets—projected to exceed $600 billion globally in 2024 for financial services IT—can build proprietary systems. Alternatively, customizable ERP or CRM platforms from vendors like SAP or Oracle offer a lower-cost substitute for certain financial processes, especially for mid-sized businesses adopting these solutions in 2024.

Manual processes or outsourcing to specialized firms also pose a threat, particularly for smaller entities or specific tasks. While the global IT outsourcing market was over $450 billion in 2024, indicating a demand for external services, these often leverage technology rather than replace it entirely. Furthermore, specialized fintech companies offering agile, cloud-native solutions for niche financial functions can erode market share by providing superior agility and cost-effectiveness in targeted areas, a trend supported by continued venture capital investment in fintech solutions in 2024.

| Substitute Type | Description | Client Motivation | Example (2024/2025 Data) | Impact on Bravura |

|---|---|---|---|---|

| In-house Development | Clients build their own software solutions. | Control, customization, perceived long-term cost savings. | Major banks investing heavily in digital transformation; IT spending in financial services exceeded $600 billion. | Reduced demand for Bravura's platform for specific functionalities. |

| Generic Enterprise Software | Utilizing customizable ERP/CRM systems for financial processes. | Lower perceived cost, broad functionality, integration with existing systems. | Mid-sized businesses adopting cloud-based ERPs from SAP or Oracle. | Substitution for less specialized or complex financial modules. |

| Manual Processes/Outsourcing | Performing tasks manually or outsourcing to service providers. | Cost-effectiveness for smaller firms or specific tasks, focus on core competencies. | Small advisory firms using manual data entry; global IT outsourcing market >$450 billion. | Limited threat for core, complex functions; viable for non-critical tasks. |

| Specialized Fintechs | Agile, cloud-native solutions for niche financial functions. | Superior agility, cost-effectiveness, specialized features. | Fintechs focusing on digital wealth management or automated compliance reporting. | Erosion of market share in specific segments. |

Entrants Threaten

Entering the financial software market, particularly for sophisticated platforms like those provided by Bravura Solutions, demands significant upfront capital. This includes substantial investments in research and development, building robust IT infrastructure, and establishing sales and support networks. For instance, the global financial software market was valued at approximately $45 billion in 2023 and is projected to grow, indicating the scale of investment needed to compete.

The creation of advanced, reliable, and secure financial software is a complex, multi-year undertaking. These platforms must handle intricate financial operations, comply with diverse regulatory frameworks, and integrate with various systems. This lengthy development cycle, coupled with high operational costs, naturally erects a formidable barrier for potential new competitors aiming to challenge established players like Bravura.

The wealth management, life insurance, and funds administration industries are subject to stringent regulatory oversight, requiring significant investment in expertise to navigate complex national and international financial laws. For instance, the European Union's MiFID II regulations impose extensive reporting and conduct requirements, significantly increasing operational complexity and cost for firms.

New companies entering these markets must contend with substantial upfront costs and extended timelines to secure the necessary certifications and develop compliant technological solutions. This regulatory hurdle acts as a significant barrier, making it difficult for new players to establish a foothold and compete effectively with established entities that have already invested in compliance infrastructure.

The financial services technology sector, where Bravura Solutions operates, demands a profound understanding of complex financial products, intricate market behaviors, and the specific operational workflows of clients. Newcomers struggle to acquire this specialized knowledge and build the essential trust that comes with proven reliability and robust security, which are paramount in handling sensitive financial data.

Bravura Solutions, with its three decades of experience, has solidified its position by serving prominent financial institutions, cultivating significant client trust. This deep-seated confidence and accumulated expertise present a formidable barrier for any new entrant aiming to disrupt the established market.

Established Client Relationships and Switching Costs

Established players like Bravura Solutions often boast deep, long-standing relationships with major financial institutions. These 'blue-chip' clients are less likely to risk disruption by switching to new, unproven providers for their critical systems.

The high cost and complexity associated with migrating away from deeply integrated, mission-critical software create significant barriers for new entrants. Financial firms face substantial expenses and operational risks when attempting to switch core platforms.

- Incumbent Advantage: Bravura's existing client base provides a stable revenue stream and a strong reference point, making it harder for newcomers to gain traction.

- Switching Costs: For a financial institution, replacing a core system like those provided by Bravura can involve millions in data migration, retraining, and integration costs, often spanning several years. For example, a large bank might spend upwards of $50 million on such a transition.

- Integration Complexity: Bravura's solutions are often deeply embedded within a client's existing IT infrastructure, making a clean break and seamless integration with a new system a daunting technical challenge.

Access to Distribution Channels and Data

Newcomers face significant hurdles in securing access to the critical sales channels and established client networks needed to engage with major financial institutions. This gatekeeping by incumbents limits reach and revenue potential for emerging players.

Established firms often possess extensive proprietary data sets, a valuable asset for developing advanced AI and analytics capabilities. This data advantage allows them to offer more sophisticated and personalized solutions, creating a steep climb for new entrants lacking comparable information resources.

- Distribution Channel Barriers: In 2024, many financial technology markets saw continued consolidation of distribution partnerships, making it harder for new entrants to secure shelf space or integration with major platforms. For example, a new wealth management software might struggle to get listed on the preferred vendor lists of large banks without existing relationships.

- Data Moats: The increasing reliance on AI in financial services means that firms with decades of transactional and client data have a significant competitive edge. In 2024, firms leveraging AI for personalized investment advice or risk management, powered by vast historical data, demonstrated superior performance and client retention compared to those with limited datasets.

- Client Network Lock-in: Long-standing relationships between established financial institutions and their clients are difficult to disrupt. New entrants must offer a compelling value proposition that not only matches but significantly exceeds the perceived benefits of staying with a trusted, familiar provider.

The threat of new entrants into the sophisticated financial software market, where Bravura Solutions operates, is considerably low. This is primarily due to the immense capital required for research, development, and building robust IT infrastructure, estimated to be in the billions for comprehensive platforms. The lengthy development cycles, coupled with high operational costs and the need for specialized financial and regulatory expertise, create substantial barriers.

Furthermore, stringent regulatory compliance, as seen with MiFID II in Europe, necessitates significant investment in legal and operational frameworks, making it difficult for newcomers to navigate. Bravura's decades of experience, established client trust, and deep integration within existing financial institutions create formidable switching costs for clients, often in the tens of millions of dollars for major system overhauls, further deterring new market entrants.

The competitive landscape is further shaped by incumbent advantages like established client networks and data moats, particularly with the rise of AI in financial services. In 2024, firms leveraging extensive historical data for AI-driven insights showed marked improvements in client retention and performance, a capability new entrants struggle to replicate.

| Barrier Type | Description | Estimated Cost/Impact |

|---|---|---|

| Capital Requirements | R&D, IT infrastructure, sales & support | Billions for comprehensive platforms |

| Product Differentiation & Loyalty | Complex financial software, regulatory compliance | Years of development, significant legal investment |

| Switching Costs | Data migration, retraining, integration | Tens of millions for large financial institutions |

| Access to Distribution Channels | Securing partnerships with major financial institutions | Limited access without established relationships |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bravura Solutions leverages data from industry-specific market research reports, financial filings of key competitors, and expert interviews with industry professionals to provide a comprehensive view of the competitive landscape.