BP SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BP Bundle

BP faces significant challenges in its transition to renewable energy, a key weakness in its current market position. However, its established global infrastructure and strong brand recognition present considerable strengths. Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

BP's strength lies in its deeply integrated and diversified energy operations. The company actively participates in the entire value chain, from exploring and producing oil and gas to refining, marketing, and even venturing into petrochemicals. This broad operational scope, which includes segments like lubricants and aviation fuel, provides a robust buffer against market fluctuations in any single sector.

Further bolstering its position, BP's strategic acquisitions and subsidiaries, such as Amoco and Arco, have significantly expanded its reach and capabilities. This integrated model, coupled with a substantial global footprint in over 70 countries, allows BP to leverage synergies and manage risks effectively across a wide array of energy markets.

BP has shown strong financial performance, with a commitment to rewarding shareholders. Despite some profit shifts in 2024, the company generated substantial operating cash flow and actively pursued share buybacks and dividend increases.

Looking ahead, BP is targeting impressive growth, aiming for a compound annual growth rate of over 20% in adjusted free cash flow between 2024 and 2027. Furthermore, the company has set an ambitious goal to achieve a return on average capital employed (ROACE) exceeding 16% by 2027, underscoring its focus on profitability and shareholder value.

BP is demonstrating a strong commitment to the energy transition by significantly investing in areas like biofuels, hydrogen, EV charging, and renewable power generation. This strategic shift aims to align the company with a lower-carbon future.

The company has set an ambitious target of achieving net-zero emissions for its operational Scope 1 and 2 emissions by 2050, or potentially sooner. This goal underscores their dedication to reducing their environmental footprint.

As of the fourth quarter of 2024, BP reported a substantial renewables pipeline totaling 60.6 gigawatts (GW). This figure highlights their ongoing, yet carefully managed, investment in expanding their renewable energy portfolio.

Extensive Global Network and Market Leadership

BP's extensive global network is a cornerstone of its strength, with operations spanning over 70 countries and serving millions of customers daily. This vast operational footprint, particularly evident in its leading position in the UK oil and gas sector and as a major gasoline retailer in the US, grants significant competitive advantages in distribution and customer engagement.

In 2023, BP reported a significant global presence, operating approximately 18,700 retail sites worldwide. The company's integrated energy system allows for efficient product delivery and access to diverse markets, reinforcing its market leadership.

- Global Reach: Operations in over 70 countries.

- Customer Base: Serves millions of customers daily.

- Market Position: Leading oil and gas business in the UK.

- Retail Dominance: Prominent gasoline retailer in the United States.

Focus on Operational Efficiency and Safety

BP's dedication to operational efficiency is a significant strength, driving cost reductions and improved performance. The company is actively pursuing structural cost savings, targeting at least $2 billion in reductions by the end of 2026 when compared to 2023 figures. This focus not only bolsters financial health but also enhances competitiveness in a dynamic energy market.

Safety remains a paramount concern, with tangible improvements demonstrated in BP's operational record. The company achieved a reduction in combined Tier 1 and Tier 2 process safety events for the second year running in 2024. This consistent progress underscores a strong safety culture and effective risk management practices.

Key aspects of BP's focus on operational efficiency and safety include:

- Commitment to structural cost reductions: Aiming for at least $2 billion in savings by the end of 2026 relative to 2023.

- Improved safety metrics: A reduction in combined Tier 1 and Tier 2 process safety events for two consecutive years (2023 and 2024).

- Enhanced operational performance: Driving efficiency across all business segments.

BP's integrated business model, spanning from upstream exploration to downstream marketing, provides significant resilience against sector-specific downturns. This diversification, coupled with a substantial global presence in over 70 countries, allows for efficient resource allocation and risk management.

The company's financial health is robust, with a stated aim to grow adjusted free cash flow by over 20% annually between 2024 and 2027, targeting a return on average capital employed (ROACE) exceeding 16% by 2027. This financial discipline supports shareholder returns through dividends and buybacks.

BP's strategic investments in low-carbon energy, including biofuels, hydrogen, and renewable power, are expanding its portfolio. By the fourth quarter of 2024, BP had a significant renewables pipeline of 60.6 gigawatts (GW), signaling a commitment to the energy transition.

Operational efficiency is a key strength, with BP targeting at least $2 billion in structural cost savings by the end of 2026 compared to 2023. This focus is complemented by a strong safety record, evidenced by a reduction in process safety events for two consecutive years (2023 and 2024).

| Metric | 2024 Target/Status | 2027 Target |

|---|---|---|

| Adjusted Free Cash Flow Growth (CAGR) | >20% (2024-2027) | |

| Return on Average Capital Employed (ROACE) | >16% | |

| Structural Cost Savings | Target of $2 billion by end of 2026 (vs. 2023) | |

| Renewables Pipeline | 60.6 GW (Q4 2024) |

What is included in the product

Delivers a strategic overview of BP’s internal and external business factors, examining its strengths in integrated energy operations and weaknesses in transition progress, alongside opportunities in renewables and threats from volatile energy markets.

Offers a clear, actionable framework for identifying and addressing strategic vulnerabilities.

Weaknesses

BP's significant reliance on its legacy oil and gas operations exposes it directly to the inherent volatility of global energy markets. Fluctuations in crude oil and natural gas prices can drastically impact revenue streams and profitability, creating uncertainty for the company. For example, BP's reported profit saw a 30% decline in the third quarter of 2024, largely attributed to these price swings.

BP's considerable debt burden, standing at $42.3 billion as of the third quarter of 2023, alongside environmental liability provisions estimated at $21.5 billion, presents a significant weakness. These substantial financial obligations can limit the company's ability to invest in new projects and respond flexibly to market changes.

The high levels of debt and liabilities may also attract scrutiny from activist investors who are advocating for improved operational efficiency to mitigate these financial risks.

BP faces significant challenges in achieving its climate goals, with emissions under its operational control and from product use increasing in 2024. This trend highlights the difficulty in translating ambition into tangible reductions.

Recent strategic adjustments, such as scaling back earlier 2030 targets for oil and gas production cuts and moderating renewable energy investments, have attracted criticism. These decisions signal a potential shift in the company's energy transition trajectory.

The recalibration of its strategy could negatively influence public perception, potentially fueling skepticism about BP's long-term commitment to decarbonization and the transition to cleaner energy sources.

History of Operational Risks and Environmental Incidents

BP has a significant history of operational risks and environmental incidents, most notably the 2010 Deepwater Horizon disaster. This event alone resulted in billions of dollars in fines and cleanup costs, and its repercussions continue to impact BP's financial standing and public perception. The ongoing legal and environmental remediation efforts stemming from such incidents represent a substantial and persistent weakness for the company.

These past failures highlight the inherent operational dangers within the oil and gas sector, which BP, as a major player, is particularly exposed to. The financial implications of these risks are not theoretical; they manifest as:

- Significant legal liabilities and settlements: The Deepwater Horizon incident led to over $65 billion in costs for BP.

- Substantial environmental cleanup expenses: Ongoing monitoring and remediation efforts can span decades.

- Damage to brand reputation and stakeholder trust: Negative publicity can affect customer loyalty and investor confidence.

Efficiency Gap Compared to Peers

BP faces a notable efficiency gap when stacked against its industry peers. This is evident in its higher operating costs, including distribution, administration, production, and manufacturing, as a proportion of its revenue. For instance, during the first half of 2025, BP reported distribution and administration expenses at 9.1% of its income, a figure significantly higher than Shell's 4.3% for the same period.

This disparity in operational efficiency is a key concern, particularly for activist investors like Elliott Investment Management. They are actively advocating for BP to implement measures to streamline its operations and reduce these overheads. The goal is to unlock greater free cash flow, which in turn can enhance shareholder value and provide more capital for strategic investments or returns.

- Higher Operating Costs: BP's distribution and administration expenses were 9.1% of income in H1 2025, compared to Shell's 4.3%.

- Investor Pressure: Elliott Investment Management is pushing for improved efficiency to boost free cash flow.

- Strategic Imperative: Enhancing operational efficiency is crucial for BP to remain competitive and maximize financial performance.

BP's financial structure is burdened by substantial debt and environmental liabilities, totaling $42.3 billion in debt and $21.5 billion in environmental provisions as of late 2023. This significant financial leverage can constrain investment capacity and strategic flexibility.

The company's progress on climate goals is lagging, with emissions from its operations and product use increasing in 2024. This underperformance raises concerns about the feasibility of its decarbonization strategy and could impact its reputation among environmentally conscious stakeholders.

BP's operational efficiency appears weaker compared to peers, with distribution and administration costs representing 9.1% of income in H1 2025, notably higher than Shell's 4.3%. This inefficiency is a focal point for activist investors seeking improved financial performance.

A history of significant operational risks, exemplified by the $65 billion cost of the Deepwater Horizon incident, continues to pose a weakness. These past events underscore the inherent dangers in the oil and gas sector, leading to ongoing legal, cleanup, and reputational challenges.

What You See Is What You Get

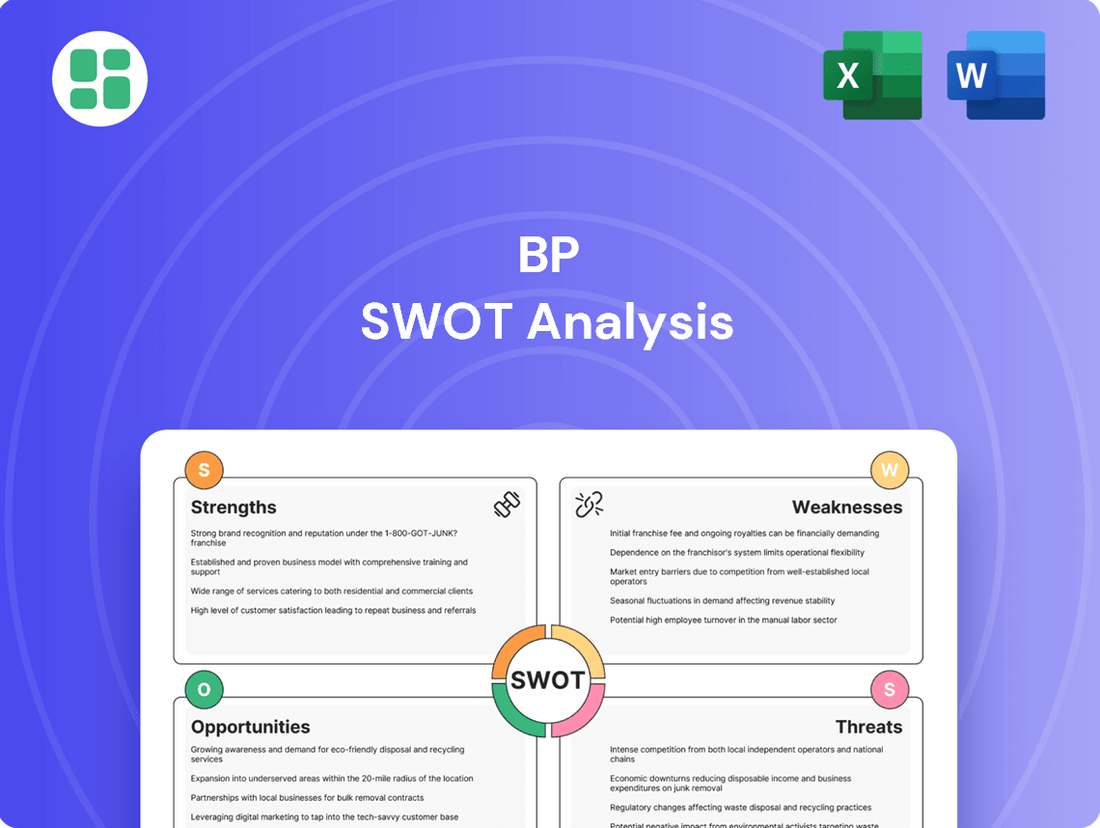

BP SWOT Analysis

The preview you see is the actual BP SWOT analysis document you'll receive upon purchase. This ensures you know exactly what you're getting—a professional, comprehensive report. Unlock the full, detailed analysis with your purchase.

Opportunities

The global pivot towards decarbonization offers BP a substantial avenue for growth, particularly in renewable energy and low-carbon solutions. The company is well-positioned to capitalize on this trend by increasing its investments across various sustainable sectors, including wind, solar, biofuels, and hydrogen production.

BP's strategic expansion into electric vehicle (EV) charging infrastructure further diversifies its portfolio and taps into a rapidly growing market. This focus directly addresses the escalating global demand for cleaner energy alternatives, allowing BP to leverage its established operational scale and expertise.

In 2023, BP reported significant progress, with its renewables pipeline reaching approximately 38 GW, demonstrating a tangible commitment to this opportunity. The company’s strategic investments, such as the acquisition of Archaea Energy in late 2022 for $4.1 billion, underscore its intent to become a major player in the burgeoning bioenergy market.

The global push for decarbonization fuels significant demand for energy storage and carbon capture technologies, creating substantial growth opportunities. BP's strategic investments in these areas, such as its involvement in major UK CCS projects, position it to capitalize on this expanding market and become a leader in the transition to a lower-carbon economy.

BP can significantly accelerate its energy transition and unlock new growth avenues by forging strategic partnerships and joint ventures. These collaborations are particularly valuable for entering new markets and advancing cutting-edge technological development. For instance, its joint venture JERA Nex bp in offshore wind and its efforts to find partners for Lightsource bp, its solar and battery storage business, exemplify this strategy.

These alliances enable BP to share crucial capabilities and access external financing, thereby de-risking investments and expanding its reach. In 2024, BP continued to actively seek such collaborations, aiming to leverage the expertise and capital of its partners to achieve its ambitious net-zero targets and capitalize on emerging clean energy opportunities.

Leveraging Global Presence in Emerging Markets

BP can capitalize on the anticipated surge in natural gas and overall energy demand within emerging economies, especially in Asia and Africa. These regions represent significant avenues for market expansion.

The company's strategic focus on these growth markets is underscored by its projection of a 30% increase in natural gas demand by 2040. This forward-looking approach aims to secure a substantial share in these expanding energy landscapes.

BP has already committed substantial capital to these opportunities, with current investments exceeding $3.5 billion. This financial commitment signals confidence in the long-term potential of these emerging markets.

- Projected Growth: Anticipated 30% rise in natural gas demand in Asia and Africa by 2040.

- Current Investment: Over $3.5 billion already invested in emerging market energy projects.

- Market Focus: Strategic emphasis on Asia and Africa for future energy demand.

Technological Innovation and Digital Transformation

BP's commitment to technological innovation, particularly in deep-water exploration and digital transformation, presents significant opportunities. The company's continued investment in these areas, as evidenced by its substantial capital expenditure plans for 2024-2025, is expected to drive operational efficiencies and unlock new revenue potential.

This digital push is crucial for optimizing resource extraction and improving overall performance. BP is focusing on areas like advanced analytics and AI to enhance decision-making across its operations, aiming to reduce costs and increase output from its existing and future projects.

The increasing digitalization of the energy sector also creates demand for specialized talent. Roles in data science, software development, and IT are becoming paramount as BP integrates advanced digital tools and platforms into its core business functions. For instance, BP's investment in digital twin technology for its offshore assets aims to improve predictive maintenance and operational uptime.

Key opportunities include:

- Enhanced Operational Efficiency: Leveraging advanced technologies like AI and machine learning to optimize drilling, production, and logistics, potentially leading to significant cost reductions.

- New Revenue Streams: Developing data-driven services or insights for partners and customers, capitalizing on the vast amounts of data generated from its operations.

- Talent Acquisition and Development: Attracting and retaining skilled professionals in data analytics, cybersecurity, and software engineering to support its digital transformation agenda.

- Improved Safety and Environmental Performance: Utilizing digital tools for real-time monitoring and predictive analytics to enhance safety protocols and minimize environmental impact.

BP is strongly positioned to benefit from the global shift towards decarbonization, with significant opportunities in renewable energy sources like solar and wind, and emerging areas such as hydrogen and biofuels. The company's strategic acquisitions, like Archaea Energy for $4.1 billion in late 2022, highlight its commitment to building a substantial presence in bioenergy, aiming to capitalize on the growing demand for cleaner alternatives.

The expansion of electric vehicle (EV) charging infrastructure presents another key growth avenue, tapping into a market expected to see substantial expansion in the coming years. BP's renewables pipeline stood at approximately 38 GW in 2023, showcasing tangible progress in this transition.

The increasing demand for energy storage and carbon capture technologies also offers considerable potential. BP's involvement in major UK carbon capture and storage (CCS) projects demonstrates its proactive approach to these critical low-carbon solutions.

Strategic partnerships and joint ventures are vital for BP's energy transition, enabling access to new markets and advanced technologies. For example, the JERA Nex bp joint venture in offshore wind and efforts to find partners for Lightsource bp exemplify this collaborative strategy, which is crucial for sharing expertise and de-risking investments in 2024 and beyond.

| Opportunity Area | Key Initiatives/Investments | Projected Impact/Data |

|---|---|---|

| Renewable Energy & Biofuels | Acquisition of Archaea Energy ($4.1B, late 2022), JERA Nex bp (offshore wind JV) | Renewables pipeline ~38 GW (2023); significant growth in bioenergy market |

| EV Charging Infrastructure | Portfolio expansion | Capitalizing on rapidly growing global EV market |

| Energy Storage & CCS | Investment in UK CCS projects | Addressing demand for critical low-carbon solutions |

| Strategic Partnerships | Seeking partners for Lightsource bp | De-risking investments, expanding reach, accelerating transition |

Threats

BP's profitability is significantly exposed to the unpredictable swings in global oil and gas prices. These price fluctuations are often driven by geopolitical events, shifts in supply and demand, and the overall health of the global economy. Such volatility directly impacts BP's revenue streams, creating a need for sophisticated risk mitigation strategies to navigate this uncertainty.

The global energy market has experienced considerable disruption, with an estimated economic impact reaching $2.1 trillion. This broad instability underscores the challenge BP faces in maintaining consistent financial performance amidst a backdrop of unpredictable energy market dynamics and ongoing geopolitical tensions.

BP operates in a fiercely competitive energy landscape. Major integrated oil and gas companies like Shell and ExxonMobil, along with a growing number of renewable energy providers, present significant rivalry. This intense competition can exert downward pressure on prices, potentially eroding BP's market share and profitability across its various business lines.

Increasingly stringent environmental regulations and government policies aimed at accelerating decarbonization present a significant threat to BP. For instance, the European Union's "Fit for 55" package, aiming to reduce greenhouse gas emissions by at least 55% by 2030, could lead to higher operating costs and impact the profitability of BP's traditional oil and gas businesses.

The implementation of carbon pricing mechanisms, such as carbon taxes or emissions trading schemes, could further increase compliance costs for BP. In 2023, the average carbon price across major economies was around $30 per tonne, a figure expected to rise, directly affecting the cost of producing and selling fossil fuels and potentially devaluing hydrocarbon assets.

Reputational Damage and Shareholder Activism

BP's history, particularly the 2010 Deepwater Horizon oil spill, continues to be a significant factor in its public image. This past event can resurface, influencing how stakeholders perceive current operations and future strategies.

Any perceived faltering in BP's commitment to its energy transition goals or a slower-than-expected shift away from fossil fuels could ignite public backlash. This can manifest as negative media coverage, reduced consumer loyalty, and increased scrutiny from environmental groups.

Activist investors are increasingly focused on environmental, social, and governance (ESG) performance. For instance, in early 2024, several shareholder resolutions were filed at BP's annual general meeting, calling for more aggressive climate targets and greater transparency in emissions reporting. Such actions can directly impact investor confidence and, consequently, BP's stock valuation, as seen in periods of heightened ESG-related shareholder pressure.

- Reputational Shadow: The Deepwater Horizon incident remains a benchmark for environmental failures, influencing public perception of BP's operational integrity.

- Climate Commitment Scrutiny: Any perceived deviation from stated climate targets or a slower pace in renewable energy investments can lead to boycotts and negative sentiment.

- Shareholder Activism: In 2024, BP faced renewed pressure from activist investors regarding its climate strategy, with resolutions filed at its AGM demanding more ambitious emissions reduction goals.

- Market Impact: Heightened ESG concerns and activist campaigns can negatively affect investor confidence, potentially leading to downward pressure on BP's share price.

Disruptive Technologies and Energy Transition Pace

Rapid advancements in alternative energy technologies, like enhanced battery storage and more efficient solar and wind power generation, pose a significant threat. For instance, by the end of 2023, global renewable energy capacity additions reached a record 510 gigawatts (GW), a 50% increase from 2022, according to the International Energy Agency (IEA). This accelerating pace of innovation could make BP's existing fossil fuel assets less valuable more quickly than anticipated.

A faster-than-expected global energy transition presents a direct challenge to BP's traditional business model. If demand for oil and gas declines at an accelerated rate, it could render a significant portion of BP's reserves and infrastructure obsolete before their expected economic lifespan. BP's 2023 financial results showed a significant portion of its upstream assets still tied to hydrocarbon production, highlighting this vulnerability.

The increasing efficiency and decreasing costs of renewable energy solutions directly impact BP's competitive landscape. For example, the levelized cost of electricity (LCOE) for onshore wind and utility-scale solar PV continued to fall in 2023, making them increasingly competitive against traditional energy sources. This trend could erode BP's market share and profitability in the energy sector.

- Technological Leapfrogs: Breakthroughs in areas like green hydrogen production or advanced geothermal energy could rapidly shift market dynamics.

- Accelerated Policy Support: Governments worldwide are increasingly implementing policies favoring renewables, potentially speeding up the decline of fossil fuel demand.

- Shifting Consumer Preferences: Growing consumer demand for sustainable energy solutions may pressure companies like BP to adapt more rapidly than planned.

- Stranded Asset Risk: The rapid pace of transition increases the risk that BP's substantial investments in oil and gas reserves could become stranded assets.

The escalating cost of compliance with evolving environmental regulations and the potential for carbon pricing mechanisms to increase operating expenses pose a significant threat. For instance, the average carbon price in major economies in 2023 was around $30 per tonne, a figure anticipated to rise, directly impacting the cost of fossil fuel production and potentially devaluing hydrocarbon assets.

BP faces intensified shareholder activism, particularly concerning its environmental, social, and governance (ESG) performance. In early 2024, several shareholder resolutions were filed at BP's annual general meeting, urging more ambitious climate targets and greater transparency in emissions reporting, which can impact investor confidence and stock valuation.

Rapid advancements in alternative energy technologies, such as battery storage and solar power, are a threat as they can make BP's existing fossil fuel assets less valuable more quickly than anticipated. Global renewable energy capacity additions reached a record 510 GW in 2023, a 50% increase from 2022.

| Threat Category | Specific Threat | Impact on BP | Relevant Data/Example |

|---|---|---|---|

| Regulatory & Policy | Stricter Environmental Regulations & Carbon Pricing | Increased operating costs, potential asset devaluation | Average carbon price ~$30/tonne (2023), EU 'Fit for 55' |

| Market & Competition | Rapid Advancements in Alternative Energy | Reduced value of fossil fuel assets, market share erosion | Global renewable capacity up 50% YoY to 510 GW (2023) |

| Stakeholder & Reputation | Shareholder Activism on ESG | Impact on investor confidence and stock valuation | Shareholder resolutions at 2024 AGM on climate targets |

| Operational & Strategic | Accelerated Global Energy Transition | Risk of stranded assets, obsolescence of infrastructure | BP's upstream assets heavily tied to hydrocarbon production |

SWOT Analysis Data Sources

This BP SWOT analysis is built upon a foundation of robust data, drawing from official financial reports, comprehensive market intelligence, and expert industry analysis to provide a well-rounded strategic perspective.