BP Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BP Bundle

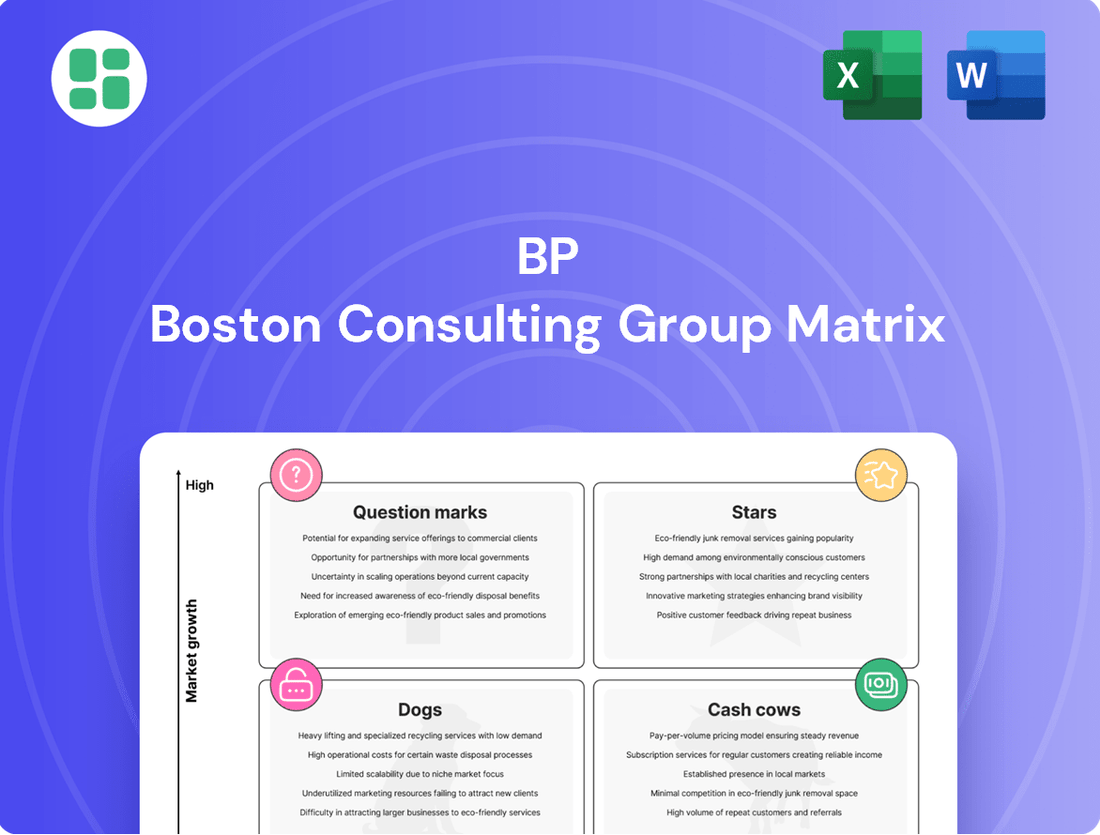

The Boston Consulting Group (BCG) Matrix is a powerful tool for analyzing a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth rate. Understanding these placements is crucial for informed strategic decisions.

This preview offers a glimpse into the BCG Matrix framework, but to truly unlock its strategic potential for your business, you need the full, detailed analysis. Purchase the complete BCG Matrix report to gain actionable insights and a clear roadmap for optimizing your product investments and resource allocation.

Stars

BP's strategic alliance with JERA, forming JERA Nex bp, is a significant move into the burgeoning offshore wind sector. This joint venture targets a substantial 13 gigawatts of net generating capacity, positioning BP as a key contender in the global energy transition.

The venture is designed to attract external investment, enabling aggressive expansion in offshore wind development. This approach allows BP to scale its renewable energy ambitions effectively while maintaining prudent capital management.

EV Charging Infrastructure fits into the Stars category of the BP BCG Matrix. BP's aggressive expansion, reaching over 39,000 charge points globally by the end of 2024, highlights its strong position in a rapidly growing market.

The electric vehicle sector is booming, fueled by rising consumer demand and government mandates pushing for cleaner transportation. This makes EV charging a prime area for investment and growth.

BP's substantial investments are strategically positioned to capitalize on this burgeoning market, aiming to become a leading player in providing essential charging services as the EV revolution accelerates.

While the broader oil and gas industry faces maturity, the global demand for Liquefied Natural Gas (LNG) is experiencing significant expansion. This growth is fueled by a heightened focus on energy security and LNG's positioning as a crucial transition fuel. BP is well-positioned to leverage this trend, possessing considerable assets and robust trading expertise in the LNG market.

BP's Integrated Gas segment is a key driver of growth within its hydrocarbon operations, characterized by strong return generation. In 2024, BP reported that its Gas & Low Carbon Energy segment, which includes LNG, saw its operating cash flow increase, reflecting the segment's positive performance. This segment is considered a star in BP's portfolio due to its high growth potential and profitability.

Bioenergy (Brazilian JV)

BP Bunge Bioenergia, now fully owned by BP, represents a significant move into the bioenergy market. This strategic acquisition allows BP to capitalize on the increasing global demand for sustainable fuels, particularly ethanol derived from sugarcane.

The bioenergy sector is a key growth area, driven by the urgent need for decarbonization across various industries. In 2023, Brazil, a leading producer of sugarcane ethanol, saw its ethanol production reach approximately 33.7 billion liters, with a significant portion being exported, highlighting the market's robust activity and potential.

- Market Growth: The global advanced biofuels market is projected to grow, with ethanol playing a crucial role in meeting renewable energy targets.

- Strategic Control: Full ownership of the Brazilian JV enhances BP's operational efficiency and strategic decision-making in a vital bioenergy hub.

- Sustainability Focus: This investment aligns with BP's broader strategy to transition towards lower-carbon energy sources and reduce its environmental impact.

- Production Capacity: BP Bunge Bioenergia operates multiple facilities across Brazil, contributing significantly to the country's bioenergy output.

Lubricants (Castrol)

Castrol, BP's globally recognized lubricants brand, holds a commanding market share within a mature but steadily expanding sector, particularly in specialized industrial and automotive niches. This strong brand equity and entrenched market leadership position it as a significant contributor, even amidst BP's strategic considerations for potential divestment.

The lubricants market, while mature, demonstrates resilience and growth, with global lubricant demand projected to reach approximately 40.4 million metric tons by 2028, showing a compound annual growth rate (CAGR) of around 1.5% from 2023. Castrol's focus on premium and specialized products, where margins are typically higher, further solidifies its star status.

- Market Dominance: Castrol commands a substantial portion of the global lubricants market, especially in high-value segments.

- Brand Strength: Its established brand recognition and reputation for quality are key competitive advantages.

- Consistent Performance: Despite market maturity, Castrol consistently delivers strong financial results, qualifying it as a star.

- Strategic Importance: Even with potential divestment talks, Castrol remains a vital and profitable business unit for BP.

BP's EV Charging Infrastructure is a prime example of a Star in its portfolio. With over 39,000 charge points globally by the end of 2024, BP is aggressively expanding its footprint in a market experiencing rapid growth due to increasing electric vehicle adoption and supportive government policies. This segment is characterized by high investment and high growth potential, aligning perfectly with the Star quadrant of the BCG matrix.

Integrated Gas, particularly BP's Liquefied Natural Gas (LNG) business, also shines as a Star. Driven by global energy security concerns and LNG's role as a transition fuel, this segment shows strong growth. BP's significant assets and trading expertise in LNG, coupled with a reported increase in operating cash flow for its Gas & Low Carbon Energy segment in 2024, underscore its high growth and profitability.

BP Bunge Bioenergia, now fully owned by BP, represents another Star. The company is capitalizing on the rising demand for sustainable fuels like ethanol, especially in Brazil, a major producer. With Brazil's ethanol production reaching approximately 33.7 billion liters in 2023, BP's strategic control and production capacity in this growing bioenergy market position it strongly.

Castrol, BP's lubricants brand, is a Star due to its strong market share in a resilient sector. While the lubricants market is mature, it's steadily expanding, with global demand projected to reach around 40.4 million metric tons by 2028. Castrol's focus on premium products and its established brand equity ensure consistent performance and profitability.

| Business Segment | BCG Category | Key Growth Driver | 2024 Data/Projection | Strategic Outlook |

|---|---|---|---|---|

| EV Charging Infrastructure | Star | Rising EV adoption, government mandates | 39,000+ charge points globally | Aggressive expansion, market leadership |

| Integrated Gas (LNG) | Star | Energy security, transition fuel demand | Increased operating cash flow (Gas & Low Carbon Energy Segment) | Leveraging assets and trading expertise |

| Bioenergy (BP Bunge Bioenergia) | Star | Demand for sustainable fuels | Brazil ethanol production ~33.7 billion liters (2023) | Full ownership for enhanced strategy and operations |

| Castrol (Lubricants) | Star | Resilient market, specialized niches | Global lubricants demand ~40.4 million metric tons by 2028 | Focus on premium products, brand strength |

What is included in the product

Strategic overview of a company's portfolio, categorizing business units by market share and growth rate.

Visualize strategic positioning, alleviating the pain of resource allocation uncertainty.

Cash Cows

BP's established upstream oil fields, particularly those in mature basins, are a prime example of a cash cow. These mature assets boast a high market share and maintain relatively stable production levels, consistently delivering substantial operating cash flow. This reliable income stream is crucial, requiring lower capital investment for ongoing operations compared to exploration or development of new reserves.

In 2024, BP's upstream segment, driven by these mature fields, continued to be a significant contributor to its financial performance. For instance, the company reported strong underlying replacement cost profit from its Upstream segment in the first quarter of 2024, underscoring the consistent cash generation from these established assets. This financial strength provides the bedrock for BP's investments in other areas, including its strategic shift towards lower-carbon energy sources.

BP's downstream refining operations represent a classic cash cow within its portfolio. These facilities, spread across its global network, are mature assets focused on transforming crude oil into various refined products like gasoline, diesel, and jet fuel.

These operations benefit from strong regional market positions, allowing them to command significant market share. Even in a low-growth industry, their efficiency and ability to capture favorable refining margins, which averaged around $11.70 per barrel in the first quarter of 2024, translate into substantial and consistent cash generation for the company.

BP's global retail and convenience business, a prime example of a Cash Cow in the BCG matrix, consistently generates substantial and steady cash flow. This segment thrives on its extensive network of service stations and convenience stores across the globe, benefiting from high customer traffic and healthy profit margins, especially within the convenience retail sector.

Despite operating in a mature market with relatively low organic growth, the reliable performance of these outlets makes them dependable cash generators. For instance, BP's retail segment has been a significant contributor to its overall financial performance, with convenience sales often showing resilience. In 2024, BP reported strong underlying operational cash flow from its convenience and mobility segment, underscoring its role as a stable income source for the company.

Petrochemicals

BP's petrochemical segment functions as a classic Cash Cow within the BCG framework. This division, which transforms oil and gas into a range of chemical products, operates in a market that has largely matured. Despite modest growth prospects, BP's substantial market share in critical petrochemicals like paraxylene and purified terephthalic acid (PTA) ensures a reliable and substantial inflow of revenue and profits.

The mature nature of the petrochemical market, while limiting rapid expansion, allows BP to leverage its established position for high profit margins. This consistent cash generation is vital for funding other business areas within the company. For instance, in 2024, BP reported that its petrochemicals segment contributed significantly to its underlying replacement cost profit, demonstrating its role as a stable revenue generator.

- Market Maturity: The petrochemical industry is characterized by slow growth but stable demand for essential products.

- Significant Market Share: BP holds leading positions in key petrochemical products, ensuring consistent sales volume.

- High Profit Margins: Operational efficiencies and established market presence allow for strong profitability.

- Cash Generation: The segment reliably generates substantial cash flow, supporting overall corporate financial health.

North Sea Oil & Gas Assets

BP's North Sea oil and gas assets are largely considered Cash Cows within the BCG matrix. These fields, having undergone significant development, are now in a mature production stage, meaning they consistently contribute to BP's overall output and generate steady, reliable cash flows.

The operational focus for these mature assets shifts from extensive exploration to maximizing existing reserves and efficient extraction. This strategy allows BP to effectively 'milk' these established fields for their ongoing production, providing a stable revenue stream.

- Mature Production Phase: Many North Sea fields are past their peak but still yield significant volumes.

- Stable Cash Flows: These assets are crucial for generating consistent revenue for BP.

- Low Exploration Needs: Reduced investment in new exploration means higher profitability from existing infrastructure.

- Contribution to Portfolio: They provide the financial stability needed to fund investments in other business areas, like renewables.

Cash Cows represent business units or products that have a high market share in mature, low-growth industries. These entities generate more cash than they consume, providing a steady stream of income for the company. BP's mature upstream oil fields and downstream refining operations are prime examples, consistently delivering substantial operating cash flow with relatively low capital investment needs.

In 2024, BP's upstream segment, driven by these mature fields, continued to be a significant contributor to its financial performance, with strong underlying replacement cost profit reported in Q1 2024. Similarly, BP's downstream refining operations, benefiting from strong regional market positions and favorable refining margins averaging around $11.70 per barrel in Q1 2024, translate into substantial and consistent cash generation.

| BP Business Segment | BCG Category | Key Characteristics | 2024 Financial Insight |

|---|---|---|---|

| Mature Upstream Oil Fields | Cash Cow | High market share, stable production, low capital investment | Strong underlying replacement cost profit in Q1 2024 |

| Downstream Refining | Cash Cow | Strong regional market positions, efficient operations, favorable margins | Refining margins averaged ~$11.70/barrel in Q1 2024 |

| Global Retail & Convenience | Cash Cow | Extensive network, high customer traffic, healthy profit margins | Strong underlying operational cash flow reported in 2024 |

| Petrochemicals | Cash Cow | Significant market share in key products, high profit margins | Contributed significantly to underlying replacement cost profit in 2024 |

Delivered as Shown

BP BCG Matrix

The BCG Matrix report you are currently previewing is precisely the same comprehensive document you will receive upon purchase. This means no hidden watermarks or demo content, just the fully formatted, analysis-ready file designed to provide clear strategic insights for your business. You can confidently use this preview as an accurate representation of the professional, actionable report that will be delivered directly to you, ready for immediate implementation in your strategic planning or presentations.

Dogs

BP is actively divesting marginal, high-cost oil and gas fields as part of its portfolio optimization strategy. These fields often have low production volumes and high operating expenses, making them less attractive in the current market. For instance, in 2024, BP continued to assess its asset base, aiming to exit fields where the cost of extraction outpaced the market price of oil and gas, thereby improving overall portfolio profitability.

BP's portfolio optimization includes divesting or considering the sale of certain refining assets, like the Gelsenkirchen refinery. These units might be less efficient or have lower utilization rates, impacting their strategic importance.

For instance, as of early 2024, BP's refining segment has faced challenges with fluctuating crack spreads and the need for significant capital investment to meet evolving environmental standards. The Gelsenkirchen refinery, while historically significant, represents a portion of BP's older infrastructure that may no longer align with future strategic growth objectives or market share expansion in core refining operations.

BP's decision to divest its US onshore wind assets, bp Wind Energy, places them in the 'dogs' category of the BCG matrix. While the onshore wind sector itself is expanding, these particular assets haven't secured a significant market position or aligned with BP's evolving energy transition goals.

Niche Legacy Businesses without Scale

Niche legacy businesses without scale represent those smaller, often historical ventures within a company like BP that haven't grown substantially or don't fit the core strategic direction. These operations typically occupy a small slice of their niche markets and have minimal prospects for expansion, suggesting they might be prime candidates for divestment to unlock capital.

For instance, BP’s portfolio might include certain specialized chemical byproducts or historical exploration rights that, while profitable on a small scale, do not align with the company's broader shift towards renewable energy. In 2023, BP reported significant investments in low-carbon energy, signaling a strategic pivot away from traditional, non-scaling assets.

- Low Market Share: These businesses often hold a minimal percentage of their specific market, limiting their ability to leverage economies of scale.

- Limited Growth Potential: The inherent nature of these ventures suggests a constrained ceiling for future revenue and profit generation.

- Capital Reallocation: Divesting or winding down such operations allows companies to redirect resources towards more promising, high-growth strategic areas.

- Strategic Alignment: They often represent a disconnect from the company's current vision and investment priorities.

Divested Mobility & Convenience Businesses in Specific Regions

BP's decision to divest mobility and convenience operations in Austria and the Netherlands, even as the overall segment performs well, signals these specific markets are considered 'dogs' in their BCG matrix. This implies a low market share or a lack of strategic alignment with BP's future growth objectives in these particular regions.

For instance, while BP's global convenience segment saw significant growth, with fuel sales volume in its company-operated retail sites increasing by 3.6% in the first quarter of 2024 compared to the previous year, these specific divestitures point to underperformance or a strategic shift away from these localized markets. The company is likely reallocating resources to areas with higher growth potential.

- Divestment Rationale: Selling Austrian and Dutch mobility and convenience businesses suggests these operations have low market share or strategic relevance.

- BCG Classification: These divested units are categorized as 'dogs' within BP's portfolio, indicating low growth and low market share.

- Strategic Focus: The move aligns with BP's strategy to concentrate on core markets and high-growth opportunities, potentially exiting less competitive or strategically important regional segments.

- Financial Implications: While the broader segment is a cash cow, these specific divestitures aim to improve overall portfolio efficiency and resource allocation.

Dogs in BP's portfolio are business units or assets characterized by low market share and low growth potential. These are typically divested to free up capital for more promising ventures. BP's strategy involves identifying and exiting these underperforming segments to streamline operations and enhance overall profitability.

BP's divestment of US onshore wind assets, for instance, places them in the 'dog' category due to their limited market position within the expanding wind sector and misalignment with BP's evolving energy transition strategy. Similarly, niche legacy businesses without scale, such as specialized chemical byproducts or historical exploration rights, are often considered dogs if they do not contribute significantly to growth or strategic objectives, as evidenced by BP's substantial investments in low-carbon energy in 2023.

The sale of mobility and convenience operations in Austria and the Netherlands exemplifies this approach. Despite the global convenience segment showing growth, these specific regional operations are classified as dogs due to their low market share or lack of strategic alignment with BP's future growth plans in those particular markets.

These 'dog' assets often require significant management attention without yielding commensurate returns, making their divestment a logical step for portfolio optimization. By shedding these low-performing units, BP can reallocate capital and resources towards its strategic growth areas.

| Asset/Business Unit | BCG Category | Rationale | 2024 Action/Status |

|---|---|---|---|

| US Onshore Wind Assets (bp Wind Energy) | Dog | Low market position, not aligned with energy transition goals | Divested |

| Certain Refining Assets (e.g., Gelsenkirchen) | Dog (potential) | Lower efficiency, high capital needs for environmental standards, strategic reassessment | Under assessment/Considered for sale |

| Mobility & Convenience (Austria, Netherlands) | Dog | Low market share or strategic relevance in specific regions | Divested |

| Niche Legacy Businesses (e.g., specialized chemicals) | Dog | Limited scale, low growth prospects, not aligned with core strategy | Potential for divestment |

Question Marks

Green hydrogen production, while currently a nascent market, represents a significant growth opportunity for BP. The company is actively investing in projects like the Lingen Green Hydrogen facility in Germany and a Spanish joint venture, signaling its commitment to this sector. This aligns with the strategic imperative to capture future demand for decarbonization solutions, even though BP's current market share is minimal.

BP's involvement in Carbon Capture, Utilization, and Storage (CCUS) places its projects, such as Net Zero Teesside in the UK and a significant venture in Papua, Indonesia, squarely in the question mark category of the BCG matrix. These initiatives represent high-growth potential as global industries increasingly focus on emission reduction strategies.

The CCUS market is anticipated to experience considerable expansion in the coming years, driven by regulatory pressures and corporate sustainability goals. For instance, the global CCUS market size was valued at approximately $3.5 billion in 2023 and is projected to reach over $15 billion by 2030, indicating a compound annual growth rate of around 23%.

Despite BP's substantial investments in these pioneering CCUS projects, its current market share in this nascent technology remains relatively low. This positions BP's CCUS ventures as high-investment, high-potential opportunities that require further development and market penetration to become stars.

BP is significantly increasing its Sustainable Aviation Fuel (SAF) production, utilizing co-processing at its refineries as a key strategy. This aligns with the aviation industry's urgent need to decarbonize, with SAF demand projected to surge. For instance, by 2025, the global SAF market is expected to reach $17.1 billion, growing at a compound annual growth rate of over 40%.

Despite this strong market tailwind, BP's SAF operations are still in their growth phase. The company is investing heavily to scale up production and capture a larger share of this expanding market. This positions SAF as a potential star in BP's portfolio, but substantial capital expenditure is needed to realize its full market potential.

Emerging Battery Storage Solutions

Emerging battery storage solutions, while not a core, established business for BP currently, represent a significant potential growth area. This sector is experiencing rapid innovation and increasing demand for grid-scale applications, driven by the expansion of renewable energy sources. BP's strategic focus on low-carbon energy naturally aligns with exploring and investing in these nascent technologies.

Within the BP BCG Matrix, these emerging battery storage solutions would likely be categorized as question marks. This is due to their high growth potential but low current market share for BP. For instance, the global battery storage market was valued at approximately $20 billion in 2023 and is projected to reach over $100 billion by 2030, indicating substantial growth. BP's involvement in this space is likely in its early stages, requiring significant investment to capture future market share.

BP's commitment to a low-carbon future suggests potential investments in areas like lithium-ion battery technology, flow batteries, and other advanced storage mechanisms. These could be crucial for stabilizing power grids with intermittent renewables. For example, BP has invested in companies developing advanced battery chemistries, aiming to improve energy density and reduce costs.

- High Growth Potential: The battery storage market is projected for significant expansion, driven by renewable energy integration.

- Low Market Share: BP's current presence in this specific segment is likely minimal, classifying it as a question mark.

- Strategic Alignment: Investment in battery storage aligns with BP's broader low-carbon energy strategy.

- Investment Requirement: Substantial future investment will be necessary for BP to establish a strong market position.

Direct Air Capture (DAC) Technologies

Direct Air Capture (DAC) technologies represent a prime example of a 'question mark' within BP's potential BCG matrix, aligning with their long-term net-zero ambitions. These are highly innovative, early-stage ventures with the potential for significant carbon removal but currently lack market traction.

The high-risk, high-reward nature of DAC means substantial investment in research and development is needed to establish viability and achieve scalability. For instance, while specific BP investments in DAC are not publicly detailed, the broader industry saw significant funding rounds in 2024, with companies like Climeworks raising substantial capital to advance their DAC solutions.

- Technological Immaturity: DAC is still in its nascent stages, requiring extensive R&D to optimize efficiency and reduce costs.

- Market Uncertainty: A significant market for large-scale carbon removal via DAC has yet to fully materialize, creating inherent business risk.

- High Capital Requirements: Scaling DAC operations demands considerable upfront investment in infrastructure and technology development.

- Potential for Disruption: If successful, DAC could become a critical tool in achieving climate goals, offering substantial future rewards.

Question marks in the BCG matrix represent business units or products with low market share in a high-growth industry. For BP, these are areas where significant investment is required to determine if they can become market leaders or if they should be divested. They are characterized by high potential but also high risk, demanding careful strategic evaluation to decide on future resource allocation.

| BP Initiative | Industry Growth Rate | BP Market Share | BCG Category | Strategic Consideration |

|---|---|---|---|---|

| Green Hydrogen | Very High | Low | Question Mark | Invest to gain share or divest if unlikely to succeed. |

| CCUS | High | Low | Question Mark | Requires substantial investment to scale and achieve market leadership. |

| Sustainable Aviation Fuel (SAF) | Very High (projected 40%+ CAGR by 2025) | Low (growing) | Question Mark (potential Star) | Heavy investment needed to capitalize on strong market demand. |

| Battery Storage | High (projected $20B in 2023 to $100B by 2030) | Very Low | Question Mark | Early stage, requires significant R&D and market entry strategy. |

| Direct Air Capture (DAC) | High (emerging) | Negligible | Question Mark | Technologically nascent, high capital needs, market yet to mature. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.