BP Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BP Bundle

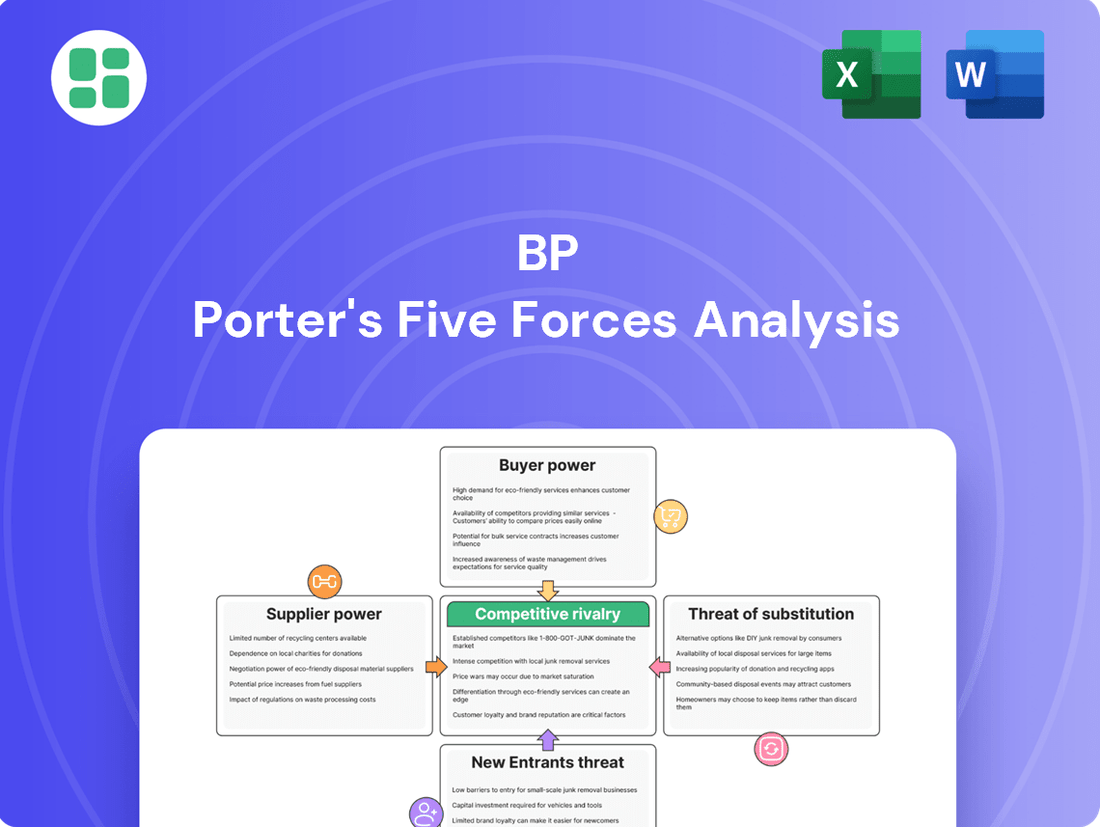

Porter's Five Forces Analysis reveals the intense competition BP faces, from the bargaining power of its customers to the threat of new companies entering the oil and gas market. Understanding these dynamics is crucial for navigating the industry's complexities.

The complete report reveals the real forces shaping BP’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

BP's reliance on highly specialized equipment and technology for its oil and gas operations, from exploration to refining, means that suppliers of these advanced tools hold considerable sway. Companies providing proprietary drilling technology, sophisticated seismic imaging, and intricate processing units can exert significant bargaining power due to the unique nature and substantial investment required for their products.

The growing emphasis on digital transformation within the upstream oil and gas sector, particularly the integration of Internet of Things (IoT) sensors, further amplifies the leverage of specialized technology manufacturers. For instance, the global market for oil and gas IoT is projected to reach approximately $32.9 billion by 2026, indicating a strong demand for these advanced solutions and, consequently, enhanced supplier power.

The global energy sector, including giants like BP, relies heavily on a specialized and skilled workforce. Think of deep-sea drilling or complex petrochemical operations; these require very specific expertise. When there's a scarcity of these highly experienced individuals or specialized technical services, their bargaining power naturally increases, driving up labor costs for companies like BP. This is especially evident for niche engineering and environmental consulting firms, which are vital for maintaining compliance and operational smoothness.

Governments and National Oil Companies (NOCs) in resource-rich nations act as significant suppliers of crude oil and natural gas. Their authority over licensing and concession agreements for these finite resources grants them substantial bargaining power. This influence allows them to dictate production quotas, taxation structures, and the very terms of resource extraction, directly impacting companies like BP.

BP's global operations mean it must contend with a spectrum of geopolitical environments and regulatory regimes. For example, in 2024, Saudi Arabia, through its NOC Saudi Aramco, continued to be a dominant force in global oil supply, with production levels significantly influencing market dynamics and pricing, underscoring the immense supplier power wielded by national entities.

Raw Material and Commodity Suppliers

BP procures substantial quantities of raw materials and commodities, such as chemicals for refining and steel for infrastructure. While BP is vertically integrated, these external dependencies mean that price volatility or supply disruptions for these essential inputs can directly impact its operational expenses. For example, crude oil prices, a primary feedstock for BP's refining operations, experienced significant fluctuations throughout 2024, with Brent crude averaging around $83 per barrel in the first half of the year, impacting refining margins.

The company's strategic shift towards lower carbon energy sources introduces new supply chain considerations. This includes reliance on critical minerals for battery production and rare earth elements vital for wind turbine technology. Ensuring stable and cost-effective access to these materials is crucial for BP's growth in these emerging sectors.

- Crude Oil and Natural Gas: BP's refining segment is heavily reliant on the global supply and pricing of crude oil and natural gas.

- Steel and Construction Materials: Significant volumes of steel and other construction materials are required for building and maintaining pipelines, refineries, and renewable energy infrastructure.

- Specialized Components for Renewables: The expansion into wind and solar energy necessitates sourcing specialized components like turbine blades, solar panels, and associated electrical equipment.

- Chemical Feedstocks: Various chemicals are used in BP's refining processes and petrochemical operations, creating dependencies on chemical suppliers.

Shift to Renewable Energy Supply Chains

As BP pivots towards renewable energy, the bargaining power of suppliers in these new sectors is growing. Companies providing components for wind turbines, solar panels, and electric vehicle charging stations are becoming critical partners.

The supply chains for these technologies are still maturing. For instance, in the offshore wind sector, a few key manufacturers dominate the production of large-scale turbines, potentially giving them leverage. In 2023, the global offshore wind market saw significant investment, with project pipelines expanding, increasing demand for these specialized suppliers.

- Emerging Supplier Concentration: Key players in solar panel manufacturing, particularly those with advanced photovoltaic technologies, can exert considerable influence due to market consolidation.

- Technological Dependence: BP's reliance on cutting-edge battery technology for its EV charging infrastructure means suppliers of these advanced components hold significant bargaining power.

- Supply Chain Bottlenecks: Disruptions or limited capacity in the supply of rare earth minerals essential for wind turbine magnets can empower those suppliers.

Suppliers of specialized technology and equipment for the oil and gas industry, including proprietary drilling tools and seismic imaging systems, hold significant bargaining power due to the unique nature and high investment costs of their products. This leverage is amplified by the increasing demand for digital transformation solutions like IoT sensors in the upstream sector, with the oil and gas IoT market projected to reach approximately $32.9 billion by 2026.

Governments and national oil companies in resource-rich regions also wield substantial power by controlling resource extraction licenses and dictating terms, directly impacting companies like BP. For example, Saudi Aramco's production decisions in 2024 continued to significantly influence global oil market dynamics, highlighting the immense power of national suppliers.

BP's reliance on raw materials such as crude oil, a key feedstock for its refining operations, exposes it to price volatility. Brent crude averaged around $83 per barrel in the first half of 2024, impacting refining margins and demonstrating the supplier power inherent in commodity markets.

As BP expands into renewable energy, suppliers of critical components like large-scale wind turbine blades and advanced battery technology for EV charging infrastructure are gaining influence due to market consolidation and technological dependence. The offshore wind market's significant investment in 2023 further increased demand for these specialized suppliers.

| Supplier Category | Key Products/Services | Impact on BP | Example Data/Trend | Supplier Bargaining Power Factor |

|---|---|---|---|---|

| Technology & Equipment | Proprietary drilling tech, seismic imaging | High operational costs, dependence on innovation | Oil & Gas IoT market ~$32.9B by 2026 | High (specialization, R&D costs) |

| National Oil Companies | Crude oil, natural gas | Supply security, pricing volatility | Brent crude ~$83/bbl (H1 2024) | Very High (resource control, government backing) |

| Renewable Components | Wind turbine blades, solar panels, batteries | Supply chain development, cost of transition | Offshore wind market investment growth (2023) | Growing (market concentration, tech dependence) |

What is included in the product

Analyzes the five competitive forces shaping BP's industry: threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and rivalry among existing competitors.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

BP's industrial and commercial customers, such as airlines and large manufacturers, often buy in massive quantities. This scale gives them considerable leverage to negotiate better prices and terms. For instance, a major airline might secure preferential fuel rates due to its substantial annual consumption, directly impacting BP's pricing power.

These high-volume clients, including shipping conglomerates and extensive manufacturing operations, wield significant bargaining power. Their ability to commit to long-term contracts, often involving millions of barrels of oil or equivalent petrochemicals, allows them to demand competitive pricing. This can put downward pressure on BP's profit margins as they strive to retain these key accounts.

The potential for these large customers to switch suppliers if terms are not met is a constant factor. BP's reliance on these substantial orders means they must remain competitive. In 2024, the global energy market experienced fluctuating demand, further empowering large buyers to seek the most advantageous deals from energy providers like BP.

For individual consumers buying fuel at BP's retail stations, their bargaining power is typically quite low. This is mainly because gasoline is a pretty standard product, and in many areas, there aren't many different fuel brands to choose from nearby. However, these consumers are very sensitive to price. They can easily drive a little further to a competitor if the price is better, or if a rival station offers more convenience or a better loyalty program. For instance, in 2024, average gasoline prices fluctuated significantly, making price a constant consideration for drivers.

A significant and evolving segment of BP's customer base is increasingly demanding lower carbon energy solutions, including EV charging, biofuels, and hydrogen. This shift empowers customers who prioritize sustainability, as they can choose providers aligned with their environmental values.

BP's strategic pivot towards these areas is a response to this growing customer preference and a means to retain and attract future clients. For instance, BP aims to grow its convenience and mobility businesses, which include EV charging, by investing £1 billion in the UK by 2030, indicating a direct response to consumer demand for greener options.

Commodity Buyers (Refineries, Traders)

Major buyers of crude oil and natural gas, like independent refineries and large trading houses, navigate a global marketplace where prices are primarily set by benchmarks such as Brent and West Texas Intermediate (WTI). While they can't dictate global price levels, their substantial purchase volumes and keen market awareness enable them to negotiate favorable terms regarding delivery, quality, and contract specifics.

These commodity buyers possess moderate bargaining power, particularly when engaging in spot market transactions. For instance, in 2024, the average spot price for WTI crude oil fluctuated significantly, impacting the leverage buyers had in immediate purchases. Major trading houses often secure better terms due to their ability to aggregate demand and their sophisticated understanding of supply chain logistics.

- Global Price Benchmarks: Buyers are heavily influenced by established benchmarks like Brent and WTI, limiting direct price control.

- Volume and Market Intelligence: Large purchasing volumes and access to market data grant buyers leverage in negotiating contract terms.

- Spot Market Influence: Bargaining power is more pronounced in the spot market where immediate needs can be met.

- Negotiation Levers: Key negotiation points include delivery schedules, product quality specifications, and payment terms.

Integrated Business Model Impact

BP's integrated business model, encompassing exploration, production, refining, and marketing, significantly influences the bargaining power of its customers. This vertical integration allows BP to manage costs and supply across different stages, thereby mitigating some of the pressure from its varied customer segments.

By controlling the value chain, BP can offer more competitive pricing and a more stable supply, which can reduce the leverage individual customers or groups of customers might otherwise have. For instance, in 2024, BP's refining segment contributed to its overall financial performance, demonstrating the synergy of its integrated operations.

However, the diverse nature of BP's customer base, ranging from individual consumers at retail stations to large industrial clients purchasing refined products, means that bargaining power varies considerably. Each segment presents unique demands and competitive pressures that BP must address.

- Integrated Operations: BP's control over exploration, production, refining, and marketing creates internal efficiencies that can buffer against external customer demands.

- Customer Segmentation: Despite integration, distinct customer groups (e.g., retail vs. industrial) possess different bargaining power due to market structure and volume.

- 2024 Performance: BP's financial reports for 2024 would likely show how its integrated model impacted profitability across different customer-facing segments.

The bargaining power of customers is a key factor in Porter's Five Forces analysis, influencing a company's profitability. For BP, this power varies significantly across its diverse customer base.

Large industrial clients, such as airlines and manufacturers, wield considerable power due to their high-volume purchases, enabling them to negotiate favorable pricing and terms. In 2024, fluctuating global energy demand amplified this leverage, as these buyers sought the most advantageous deals.

Conversely, individual retail customers have minimal bargaining power, as gasoline is largely a commoditized product with limited brand differentiation at the pump. However, their price sensitivity means they can easily switch to competitors based on minor price differences or convenience, a dynamic evident in 2024's volatile fuel prices.

| Customer Segment | Bargaining Power | Key Drivers | 2024 Context |

|---|---|---|---|

| Large Industrial Buyers (Airlines, Manufacturers) | High | Volume, Long-term Contracts, Switching Costs | Fluctuating demand empowered buyers seeking better terms. |

| Commodity Traders/Refineries | Moderate | Volume, Market Intelligence, Spot Market Access | Price volatility in WTI/Brent influenced negotiation leverage. |

| Individual Retail Consumers | Low | Price Sensitivity, Product Homogeneity, Convenience | Price sensitivity was high due to fluctuating gasoline prices. |

Preview Before You Purchase

BP Porter's Five Forces Analysis

This preview showcases the complete BP Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises or placeholder content. You can confidently download and utilize this comprehensive report to understand the strategic landscape and competitive intensity facing BP.

Rivalry Among Competitors

The global oil and gas arena is a battleground for giants like Shell, ExxonMobil, Chevron, and TotalEnergies, who slug it out across the entire value chain, from drilling for oil to selling gasoline. Their competition is fierce, fueled by the constant pursuit of market share, securing new reserves, and staying ahead with new technologies in this established, money-heavy industry.

Competitive rivalry within the oil and gas sector, including for BP, is significantly shaped by the volatile nature of global energy prices. These prices are highly susceptible to geopolitical shifts, economic trends, and decisions made by organizations like OPEC+. For instance, BP's reported profit decline in 2024, influenced by these market dynamics, underscores the constant challenge of managing fluctuating revenues against substantial fixed costs.

This inherent price volatility forces companies like BP into aggressive competition, not only on pricing but also on operational efficiency to maintain profitability. The constant need to adapt to these unpredictable market conditions intensifies rivalry as firms strive to secure market share and manage their cost structures effectively amidst fluctuating demand and supply.

The global shift towards cleaner energy sources intensifies competition. Traditional energy giants like BP are now vying with specialized renewable energy firms and even new entrants for dominance in emerging low-carbon markets. This dynamic is evident as major oil and gas companies, including Shell and ExxonMobil, also increase their investments in areas like hydrogen and carbon capture, creating a multi-front battle for future energy leadership.

Geographical and Regulatory Competition

Competition in the energy sector is intensely geographical, with companies like BP actively seeking exploration rights, market access, and crucial regulatory approvals across various nations. This global pursuit creates a dynamic landscape where success hinges on navigating diverse national interests and policy frameworks.

The varying regulatory environments, including environmental standards, tax regimes, and local content requirements, significantly shape the competitive arena. These differences can create advantages or disadvantages for companies entering or expanding in specific markets, directly impacting BP's operational strategies and its ability to compete effectively in regions like the North Sea versus the Gulf of Mexico.

- Geographical Competition: Companies vie for access to resources and markets globally, influencing strategic investment decisions.

- Regulatory Impact: Differing environmental regulations and tax policies create uneven playing fields, affecting market entry and expansion costs.

- National Interests: Government policies and national priorities can favor local players or impose restrictions, intensifying rivalry.

- BP's Global Presence: BP faces a complex web of competitive pressures that vary significantly across its diverse international operating regions.

Technological Innovation and Efficiency

The energy sector is intensely competitive, with companies constantly vying to outdo each other through technological innovation. This drive for better technology is all about making operations more efficient, cutting down costs, and ensuring safety. For example, advancements in areas like digital oilfield technology and carbon capture are becoming key ways companies set themselves apart.

BP, in particular, is heavily invested in this race. Their strategy emphasizes not only maintaining operational discipline and reducing structural costs but also making strategic investments in cutting-edge technologies. This approach directly addresses the fierce rivalry driven by the need for technological superiority.

- 2024 Investments: BP announced in early 2024 a significant increase in its planned investment in low-carbon energy, signaling a commitment to technological advancement in this area.

- Efficiency Gains: Companies adopting advanced digital twin technology for their refineries have reported efficiency improvements of up to 15% in 2024, directly impacting cost reduction.

- Carbon Capture: The global market for carbon capture, utilization, and storage (CCUS) is projected to grow substantially, with many energy majors, including BP, actively participating in pilot projects and large-scale developments throughout 2024.

Competitive rivalry in the oil and gas industry is characterized by intense competition among established global players and emerging energy companies. This rivalry is amplified by the sector's capital-intensive nature and the constant drive for efficiency and technological advancement, as seen in BP's strategic focus on digital oilfield technologies and carbon capture initiatives throughout 2024.

The volatility of energy prices, influenced by geopolitical events and OPEC+ decisions, forces companies like BP to engage in aggressive competition on both pricing and operational efficiency. This dynamic is underscored by BP's profit fluctuations in 2024, highlighting the challenge of managing revenue against significant fixed costs.

The global energy transition further intensifies rivalry, with traditional energy giants like BP now competing with specialized renewable energy firms and new entrants in low-carbon markets. This multi-front battle for future energy leadership is evident in the increased investments by major oil and gas companies in areas like hydrogen and carbon capture.

Geographical and regulatory differences also play a crucial role, with companies like BP navigating diverse national interests and policy frameworks. Varying environmental standards, tax regimes, and local content requirements create distinct competitive landscapes across regions such as the North Sea and the Gulf of Mexico.

| Metric | BP (2024 Estimate/Target) | Industry Trend |

|---|---|---|

| Low-Carbon Investment Increase | Significant increase announced early 2024 | Growing investment across majors |

| Digital Twin Efficiency Gains | Up to 15% reported for refineries using technology | Key driver for cost reduction |

| Carbon Capture, Utilization, and Storage (CCUS) Market | Active participation in pilot projects | Projected substantial growth |

SSubstitutes Threaten

The most significant threat of substitution for BP's traditional fossil fuel business stems from the rapid advancement and increasing competitiveness of renewable energy sources like solar and wind power. Technological improvements, coupled with declining costs and favorable government incentives, are making these alternatives more attractive to consumers and businesses alike.

In 2024, the global installed capacity for solar power alone was projected to reach over 1,300 gigawatts, a testament to its growing market share. This surge in renewable deployment directly challenges the long-term demand for oil and gas, even as BP itself invests in these cleaner alternatives.

The accelerating adoption of electric vehicles (EVs) presents a significant threat to BP's traditional refined fuels business. As consumer preference shifts towards EVs, the demand for gasoline and diesel, a core revenue stream for BP's retail segment, is expected to decline. For instance, by the end of 2023, global EV sales surpassed 13.6 million units, a substantial increase from previous years, indicating a growing market share away from internal combustion engine vehicles.

BP is actively mitigating this threat by investing in and expanding its EV charging infrastructure. This strategic pivot aims to capture a share of the burgeoning EV market and diversify its energy offerings. However, the pace at which this transition occurs, influenced by factors like charging availability, battery technology advancements, and government incentives, will critically determine the impact of substitution on BP's fuel sales.

Biofuels and hydrogen are emerging as significant substitutes for traditional fossil fuels, especially in sectors that are difficult to decarbonize, such as aviation, shipping, and heavy industry. BP's strategic investments reflect this trend, with substantial development in green hydrogen projects and sustainable aviation fuel (SAF). For instance, BP aims to produce up to 10 million tonnes of green hydrogen annually by 2030, signaling a major commitment to this alternative energy source.

While currently operating at a smaller scale compared to conventional fuels, these alternatives possess considerable growth potential. As technology advances and economies of scale are achieved, biofuels and hydrogen are poised to increasingly capture market share in specific segments, thereby posing a growing threat to traditional fuel markets. The International Energy Agency (IEA) projects that hydrogen could supply 13% of the world's energy needs by 2050 under net-zero emissions scenarios, highlighting the long-term substitution threat.

Energy Efficiency and Conservation

Improvements in energy efficiency and a growing emphasis on conservation present a significant, albeit indirect, threat of substitution for traditional energy sources like those provided by BP. As industries and consumers adopt technologies that reduce energy consumption, the overall demand for energy products can decrease.

For instance, advancements in building insulation, more efficient appliances, and hybrid or electric vehicles directly lessen the need for fossil fuels. This trend means that even if energy production capacity remains the same, the market size for BP's core products could shrink. In 2024, the global push for sustainability continues to drive innovation in energy-saving technologies, making this a persistent competitive force.

- Reduced Demand: Increased energy efficiency directly lowers the volume of energy products needed.

- Technological Innovation: New technologies in sectors like transportation and housing are key drivers of conservation.

- Consumer Behavior: A shift towards more conscious energy use amplifies the impact of efficiency gains.

- Market Impact: These factors collectively create a substitute threat by diminishing the market share for traditional energy.

Government Policy and Regulatory Support

Government policy plays a significant role in shaping the threat of substitutes for BP. For instance, in 2024, many nations continued to implement or strengthen carbon pricing mechanisms, such as carbon taxes or emissions trading schemes. These policies directly increase the cost of fossil fuels, making cleaner energy alternatives more economically attractive. The European Union’s Emissions Trading System (EU ETS) saw an average price of around €65 per tonne of CO2 in early 2024, a substantial increase from previous years, which incentivizes the adoption of lower-carbon solutions.

Regulatory support for renewable energy sources further amplifies this threat. Initiatives like tax credits, subsidies, and renewable portfolio standards encourage investment and deployment of solar, wind, and other green technologies. In the United States, the Inflation Reduction Act of 2022, with its extended tax credits for renewable energy, continued to drive significant investment throughout 2024, with projections indicating billions of dollars in new clean energy projects. This regulatory landscape directly challenges BP's traditional oil and gas business by making substitutes more competitive.

While BP has articulated net-zero ambitions, these policies can accelerate the transition and intensify competitive pressure. For example, mandates for electric vehicle (EV) sales or phase-out dates for internal combustion engine vehicles, such as those being implemented by the UK and California, directly reduce demand for refined petroleum products. By 2024, many countries had set targets for significant EV adoption, with some aiming for 50% or more of new car sales to be electric by 2030, thereby increasing the threat of substitutes for BP's core products.

- Carbon Pricing Impact: Increased carbon taxes and emissions trading schemes in 2024 made fossil fuels more expensive, boosting the competitiveness of renewable energy substitutes.

- Renewable Energy Incentives: Government subsidies and tax credits, like those extended by the US Inflation Reduction Act, fueled investment in clean energy, directly challenging BP's traditional markets.

- EV Mandates: Policies setting targets for electric vehicle adoption in 2024 and beyond are projected to reduce demand for refined petroleum products, a key revenue stream for BP.

- Policy Acceleration: Government regulations and support for net-zero initiatives can hasten the shift away from fossil fuels, intensifying the threat of substitutes for BP's legacy business.

The threat of substitutes for BP is substantial, driven by the growing viability and adoption of renewable energy sources like solar and wind power, alongside electric vehicles (EVs). These alternatives are becoming increasingly cost-competitive due to technological advancements and supportive government policies.

In 2024, the global installed solar capacity was projected to exceed 1,300 gigawatts, demonstrating a significant market shift. Simultaneously, global EV sales surpassed 13.6 million units by the end of 2023, signaling a direct challenge to BP's traditional refined fuels business. Furthermore, BP's commitment to producing 10 million tonnes of green hydrogen annually by 2030 highlights the company's own recognition of these evolving energy landscapes.

| Substitute | 2024 Projection/Data | Impact on BP |

|---|---|---|

| Solar Power | >1,300 GW installed capacity | Reduces demand for fossil fuels in electricity generation. |

| Electric Vehicles (EVs) | >13.6 million units sold (2023) | Decreases demand for gasoline and diesel. |

| Green Hydrogen | BP target: 10 million tonnes/year by 2030 | Potential to displace fossil fuels in heavy industry and transport. |

Entrants Threaten

The oil and gas sector, including BP's operations, demands massive upfront investments for exploration, drilling, and refining facilities. These substantial capital requirements present a significant hurdle for any new company looking to enter the market, effectively limiting the threat of new entrants.

BP's extensive global infrastructure, from offshore platforms to refineries, represents billions in existing assets. Competing with such established, capital-intensive operations requires immense financial backing, making it exceptionally difficult for newcomers to achieve the scale necessary to challenge established players like BP.

New entrants in the oil and gas sector, like BP, encounter significant barriers due to extensive regulatory hurdles and licensing complexities. Obtaining environmental permits, adhering to stringent safety standards, and securing exploration and production licenses are time-consuming and financially demanding processes. For instance, in 2024, the average time to secure initial exploration permits in many OECD countries exceeded 18 months, with associated costs often running into millions of dollars.

These regulatory landscapes are often managed by governments, which frequently prioritize established players when granting access to valuable reserves. This governmental control creates a substantial deterrent for new companies, as they must not only compete with existing operators but also navigate a system that may favor incumbents. In 2023, only 15% of new exploration licenses awarded globally went to companies with less than five years of operational history in the sector.

Established companies like BP have a significant advantage due to their extensive infrastructure. Think of their vast network of refineries, pipelines, and thousands of retail stations. This isn't something a new player can easily replicate.

The sheer capital and time needed to build a comparable supply chain are immense, presenting a formidable barrier. For instance, the cost to construct a single new refinery can easily run into billions of dollars, a hurdle most newcomers cannot overcome.

Brand Recognition and Customer Loyalty

BP benefits from significant brand recognition and deeply entrenched customer loyalty, especially within its retail and industrial divisions. For instance, in 2024, BP's global retail network served millions of customers daily, a testament to its established presence.

Newcomers face a formidable barrier as they require considerable marketing expenditure and extended periods to cultivate the trust and market share that BP already commands. This loyalty is particularly pronounced in the convenience and mobility sectors, presenting a substantial hurdle for any new competitor seeking to enter the market.

- Brand Strength: BP's brand equity is a critical defense against new entrants.

- Customer Loyalty: Established customer relationships are difficult for new players to replicate.

- Marketing Investment: Significant capital is needed to challenge BP's brand awareness.

- Market Share: Entrenched market share makes it hard for newcomers to gain traction.

Emerging Opportunities in New Energy Sectors

While the traditional oil and gas industry presents formidable entry barriers due to high capital requirements and established infrastructure, emerging lower-carbon energy sectors offer a different landscape. For instance, the electric vehicle (EV) charging market and small-scale renewable energy projects, such as distributed solar or battery storage, may have comparatively lower initial capital outlays for new players. This can attract a wider range of entrants looking to capitalize on the energy transition.

However, achieving meaningful scale and long-term profitability in these nascent markets still demands substantial investment, advanced technological know-how, and strategic alliances. BP is actively investing in these areas, aiming to build its capabilities and secure market position. For example, BP aims to significantly expand its EV charging network, targeting over 100,000 charge points by 2030 globally, demonstrating the ongoing need for capital even in these seemingly more accessible sectors.

- Lower Capital Barriers in New Energy: Sectors like EV charging and small-scale renewables may have less prohibitive entry costs compared to traditional oil and gas.

- Scale and Profitability Challenges: Despite lower initial barriers, achieving significant market presence and profitability requires substantial investment and expertise.

- BP's Strategic Investments: BP is actively pursuing investments and partnerships to build scale and competitive advantage in these evolving energy markets.

- 2030 EV Charging Target: BP plans to have over 100,000 public EV charge points worldwide by 2030, illustrating the scale of investment required.

The threat of new entrants into the oil and gas sector is generally low due to immense capital requirements, established infrastructure, and significant regulatory hurdles. However, the evolving energy landscape, particularly in areas like electric vehicle charging and distributed renewables, presents a more accessible entry point for new players, though achieving scale still demands considerable investment.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | Massive upfront investment for exploration, drilling, and refining. | Prohibitive for most newcomers. | New refinery construction costs can exceed $10 billion. |

| Infrastructure & Scale | Extensive global networks of pipelines, refineries, and retail stations. | Difficult and costly to replicate. | BP's retail network serves millions daily. |

| Regulatory & Licensing | Complex and time-consuming processes for permits and licenses. | Adds significant cost and delay. | Average of 18+ months for initial exploration permits in OECD countries. |

| Brand Loyalty & Marketing | Established brand recognition and customer loyalty. | Requires substantial marketing spend to overcome. | New entrants need years to build trust comparable to incumbents. |

| Emerging Energy Sectors | Lower initial capital in EV charging, small-scale renewables. | Opens avenues for new competition. | BP targets 100,000+ EV charge points by 2030. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including proprietary market research reports, company financial statements, and industry expert interviews. This multi-faceted approach ensures a comprehensive understanding of competitive intensity.