BP Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BP Bundle

Unlock the core components of BP's strategic framework with our comprehensive Business Model Canvas. Discover how they connect customer relationships, revenue streams, and key resources to drive their global operations. This detailed analysis is your gateway to understanding their competitive edge.

Partnerships

BP actively pursues joint ventures with national oil companies and international players to explore, develop, and produce oil and gas. For instance, its collaboration with Iraq's NOC/NGC for the Kirkuk oil fields exemplifies this strategy, effectively balancing its traditional hydrocarbon business with emerging energy ventures.

In the low-carbon sector, BP's joint ventures are equally significant. The formation of JERA Nex bp, pooling offshore wind assets, is a prime example, aiming to establish substantial renewable energy capacity and position BP as a frontrunner in the global renewables market.

BP actively partners with technology leaders like Microsoft to drive its digital transformation. These collaborations are instrumental in upgrading BP's operational efficiency through advanced data analytics and the creation of AI-powered tools for trading and supply chain management.

These strategic alliances are vital for modernizing BP's infrastructure and achieving significant cost savings. For instance, in 2023, BP announced a multi-year agreement with Microsoft to leverage cloud technology, aiming to accelerate its digital ambitions and improve decision-making across its global operations.

BP Pulse is actively forging strategic alliances with major real estate investment trusts, such as Simon Property Group, and prominent restaurant chains like Waffle House. These collaborations are crucial for the expansion of BP's ultra-fast EV charging network, strategically placing charging hubs in high-traffic, convenient locations across key markets. For instance, BP Pulse announced in early 2024 plans to install over 100 ultra-fast chargers at Simon Property Group locations across the United States, aiming to enhance driver convenience and capture growing EV demand.

Research and Development Institutions

BP actively collaborates with leading universities and research centers to pioneer advancements in critical areas like carbon capture, utilization, and storage (CCUS), hydrogen production, and next-generation biofuels. These academic alliances are foundational for accelerating the development and widespread adoption of lower-carbon technologies, a cornerstone of BP's strategic shift toward a more sustainable energy future.

For instance, BP’s partnership with the University of Manchester focuses on developing novel materials for CCUS, aiming to improve efficiency and reduce costs. In 2024, BP announced a significant investment in a joint research program with Imperial College London to explore advanced hydrogen electrolysis technologies, projecting potential cost reductions of up to 30% by 2030.

- Collaboration Focus: CCUS, hydrogen, advanced biofuels.

- Strategic Importance: Essential for scaling lower-carbon technologies.

- 2024 Investment Example: Joint research with Imperial College London on hydrogen electrolysis.

Supply Chain and Logistics Providers

BP's extensive global operations depend heavily on its key partnerships with supply chain and logistics providers. These collaborations are fundamental to ensuring the timely and cost-effective procurement of essential equipment, raw materials, and vital transportation services needed for exploration, refining, and the distribution of its energy products worldwide.

These relationships are critical for maintaining operational continuity and optimizing costs across BP's entire value chain. For instance, in 2024, BP continued to leverage its strategic alliances with major shipping companies to manage its global crude oil and refined product movements, a sector that saw significant volatility. The efficiency of these logistics partners directly impacts BP's ability to meet market demand and manage inventory levels, thereby influencing profitability.

- Global Reach: BP partners with logistics providers offering extensive networks to support its upstream (exploration and production) and downstream (refining and marketing) activities across numerous countries.

- Cost Optimization: Negotiating favorable terms with transportation and warehousing partners in 2024 helped BP mitigate rising fuel and freight costs, contributing to its overall financial performance.

- Risk Management: Reliable logistics partners are essential for managing the risks associated with transporting hazardous materials like oil and gas, ensuring compliance with stringent safety and environmental regulations.

- Technological Integration: Collaborations often involve integrating advanced tracking and management systems, enhancing visibility and efficiency in managing complex global supply chains.

BP's key partnerships are crucial for its operational efficiency and strategic growth across both traditional and emerging energy sectors. These alliances span technology providers, research institutions, and logistics experts, enabling BP to innovate and expand its global reach.

Collaborations with national oil companies and international players are vital for exploration and production, while partnerships in the low-carbon space, like with JERA Nex bp for offshore wind, are shaping its future energy portfolio.

BP also teams up with real estate firms and restaurant chains to strategically place its EV charging infrastructure, as seen with BP Pulse's expansion plans with Simon Property Group in early 2024.

These diverse partnerships, including those with universities for CCUS and hydrogen research, underscore BP's commitment to a diversified and sustainable energy future, aiming for significant advancements and cost reductions, such as the projected 30% cost reduction in hydrogen electrolysis by 2030 through collaborations like the one with Imperial College London.

| Partner Type | Example Partnership | Strategic Focus | 2024 Impact/Activity |

|---|---|---|---|

| Technology Leaders | Microsoft | Digital transformation, AI tools | Multi-year agreement for cloud technology to accelerate digital ambitions. |

| Real Estate/Retail | Simon Property Group, Waffle House | EV charging network expansion | Plans for over 100 ultra-fast chargers at Simon Property Group locations in the US. |

| Academic Institutions | University of Manchester, Imperial College London | CCUS, hydrogen, biofuels research | Joint research program on advanced hydrogen electrolysis technologies. |

| Logistics Providers | Major Shipping Companies | Global supply chain, transportation | Continued leverage for managing crude oil and refined product movements amidst market volatility. |

What is included in the product

A visual framework detailing BP's core business components, from customer segments and value propositions to key resources and revenue streams.

Offers a structured framework to pinpoint and address customer pains, enabling businesses to design solutions that truly resonate.

Activities

BP's fundamental business revolves around finding and extracting oil and natural gas worldwide. They actively seek out projects that promise strong financial returns and aim to boost their overall production levels. This involves overseeing intricate drilling processes and fine-tuning existing oil fields to get the most out of them.

In 2024, BP continued its commitment to this core activity, reporting significant progress in its upstream segment. For instance, the company announced advancements in several key development projects, anticipating future production increases. BP's strategic investments in exploration and production are crucial for meeting global energy demand and maintaining its competitive edge in the energy sector.

BP refines crude oil into essential products like gasoline, diesel, and jet fuel, a core activity that fuels its business. This involves complex refinery operations and ensuring these products reach consumers efficiently.

The marketing and distribution arm of this key activity leverages BP's vast global retail network and wholesale channels. In 2024, BP continued to focus on optimizing its refining portfolio, with significant investments in upgrading facilities to meet evolving fuel standards and demand for cleaner energy sources.

Managing refinery operations, product logistics, and robust brand management are critical to the success of this segment. BP's commitment to brand strength is evident in its extensive network of service stations worldwide, aiming for consistent customer experience and product quality.

BP is significantly expanding its lower carbon energy portfolio, investing in areas like biofuels, offshore wind, solar, and hydrogen. This strategic shift is central to their business model, focusing on developing and operating these new energy assets. For instance, BP aims to have more than 20 GW of renewables capacity by 2025, with a focus on offshore wind and solar.

The company’s operational activities encompass the entire lifecycle of these projects, from initial development and construction to ongoing asset management and optimization. This includes scaling up technologies like advanced biofuels and exploring the potential of green hydrogen production. BP’s 2023 performance showed progress, with their convenience and mobility segment, which includes lower carbon fuels, contributing significantly.

Trading and Optimization of Energy Commodities

BP actively trades a wide array of energy commodities, including crude oil, natural gas, and refined products, capitalizing on global market dynamics. This trading is supported by sophisticated digital platforms and robust risk management strategies to exploit price differentials and market opportunities. In 2024, BP's trading segment continued to be a significant contributor to its overall performance, with the company actively managing its exposure to volatile energy prices.

The optimization aspect of BP's energy commodity trading involves leveraging its extensive infrastructure and market intelligence. This allows them to identify and capture value from geographical and temporal price differences, as well as manage inventory efficiently. For instance, BP's integrated supply chain allows for the movement of products to regions with higher demand, enhancing profitability.

- Global Trading Reach: BP operates trading hubs in key financial centers worldwide, facilitating around-the-clock market participation.

- Digital Transformation: Investment in advanced analytics and AI-driven trading tools aims to enhance decision-making speed and accuracy in volatile markets.

- Risk Management Focus: Sophisticated hedging strategies and real-time monitoring are employed to mitigate the inherent risks associated with commodity price fluctuations.

- Portfolio Diversification: Trading activities span across various energy products, allowing for diversification and resilience against sector-specific downturns.

Petrochemicals Manufacturing and Sales

BP's petrochemicals segment is a cornerstone of its operations, focusing on the production and global sale of essential chemical building blocks. These products, such as purified terephthalic acid (PTA) and acetic acid, are vital feedstocks for industries ranging from textiles and packaging to automotive and construction. The company manages sophisticated manufacturing processes, ensuring consistent quality and supply to a broad international customer base.

In 2024, BP continued to invest in its petrochemical assets, aiming for efficiency and sustainability. For example, its joint venture with ADNOC, Borouge, a leading petrochemical company in the Middle East, reported strong sales volumes in its olefins and polyolefins segments throughout the year. BP's own petrochemical division also saw significant demand, particularly for its acetyls products, which are used in paints, coatings, and adhesives.

The company's strategy in this area involves leveraging its integrated refining and chemical sites to optimize feedstock utilization and reduce costs. This integration allows BP to capture value across the hydrocarbon chain. Furthermore, BP is exploring opportunities to enhance the sustainability of its petrochemical offerings, including the development of bio-based and recycled feedstocks, aligning with its broader net-zero ambitions.

- Production of key petrochemicals such as PTA, acetic acid, and olefins.

- Global sales and distribution network serving diverse industrial clients.

- Management of complex chemical manufacturing processes requiring specialized expertise and infrastructure.

- Strategic integration with refining operations to optimize feedstock sourcing and cost efficiency.

BP's key activities encompass the entire energy value chain, from upstream exploration and production to downstream refining, marketing, and trading. They are also making significant investments in lower-carbon energy solutions. These operations are supported by a robust global infrastructure and a focus on efficiency and risk management.

In 2024, BP continued to advance its upstream projects, with a particular focus on natural gas, aiming to bolster production. The company also progressed with its lower-carbon energy ventures, targeting specific renewable capacity milestones. BP's refining segment focused on operational excellence and adapting to evolving fuel standards.

BP's petrochemical segment is crucial, producing essential chemical building blocks for various industries. They manage complex manufacturing processes and leverage integration with refining operations for efficiency. In 2024, demand for their acetyls and olefins remained strong, with a continued focus on sustainable feedstock options.

| Key Activity | 2024 Focus/Developments | Supporting Data/Facts |

|---|---|---|

| Upstream (Oil & Gas Exploration/Production) | Advancing key development projects, increasing natural gas focus | Targeting production growth in strategic regions. |

| Downstream (Refining & Marketing) | Optimizing refinery portfolio, upgrading facilities | Investment in cleaner energy sources and fuel standards. |

| Low Carbon Energy | Expanding biofuels, offshore wind, solar, hydrogen portfolios | Aiming for over 20 GW of renewables capacity by 2025. |

| Petrochemicals | Producing key chemicals, exploring sustainable feedstocks | Strong demand for acetyls and olefins; joint ventures like Borouge. |

| Trading | Active commodity trading, risk management, digital platforms | Significant contributor to overall performance, managing price volatility. |

Delivered as Displayed

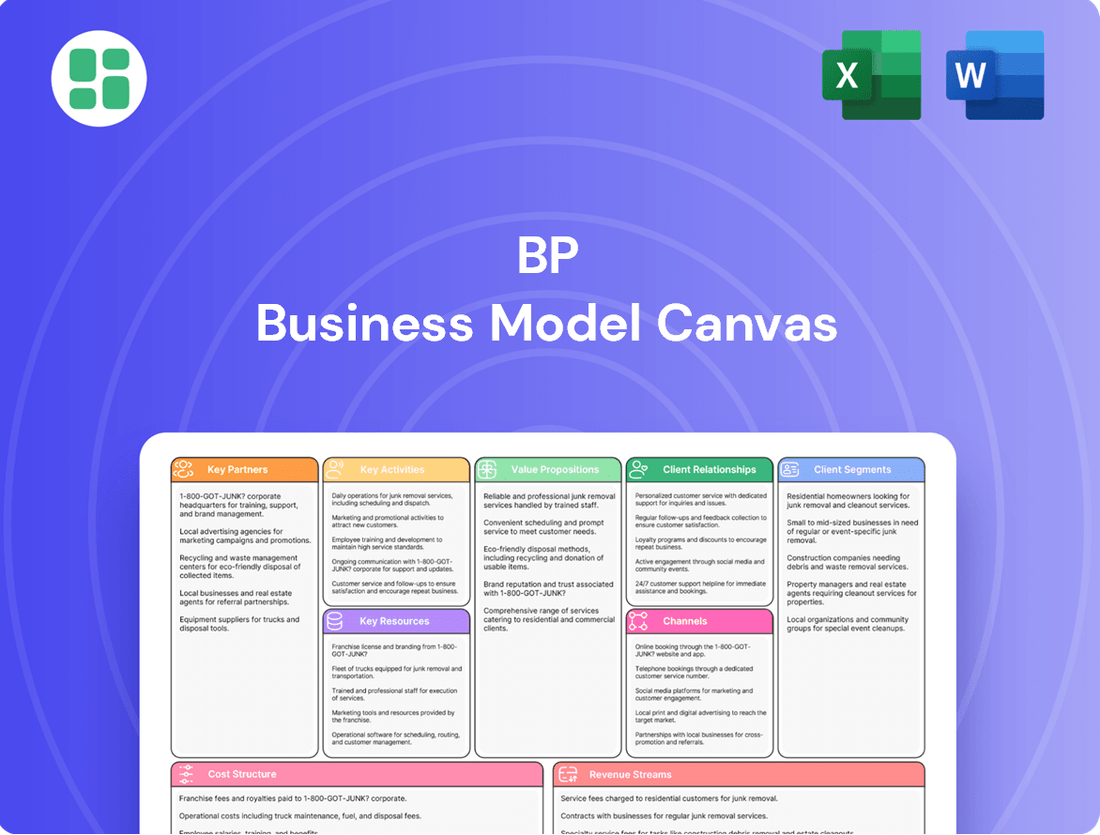

Business Model Canvas

The Business Model Canvas preview you're currently viewing is not a mockup; it's a direct representation of the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable. Once your order is complete, you'll gain full access to this same comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

BP's key resources include its vast proven oil and gas reserves, a critical asset underpinning its upstream business. As of the end of 2023, BP reported proved reserves of approximately 7.2 billion barrels of oil equivalent, demonstrating a substantial foundation for future production.

Complementing these reserves is BP's extensive global infrastructure. This encompasses a network of offshore platforms, thousands of miles of pipelines, and sophisticated processing facilities, all vital for the extraction, transportation, and initial processing of hydrocarbons.

These tangible assets are the bedrock of BP's ability to generate revenue from its upstream segment, directly impacting its long-term production capacity and operational efficiency. The company's ongoing investment in maintaining and upgrading this infrastructure is crucial for sustained output.

BP's global refining and retail network is a cornerstone of its downstream business. This extensive infrastructure includes a significant number of refineries, storage terminals, and over 21,200 retail sites spanning the globe. These retail locations encompass both fuel stations and convenience stores, serving a massive customer base.

This vast physical asset network is critical for BP's operations, allowing for the efficient processing of crude oil into refined products and their subsequent distribution to end-consumers. In 2024, BP continued to leverage this network to maintain its market presence and serve millions of customers daily.

BP's intellectual property includes proprietary technologies and patents crucial for its operations. This encompasses advanced seismic imaging for exploration and innovative carbon capture technologies, reflecting a commitment to both traditional and new energy sectors.

The company's deep expertise in exploration, drilling, refining, and renewable energy development forms a significant intangible asset. This expertise is further enhanced by digital platforms designed to boost operational efficiency across its diverse energy portfolio.

In 2023, BP reported significant investments in research and development, particularly focusing on low-carbon solutions. While specific patent numbers aren't publicly detailed for the business model canvas, the company's ongoing patent applications and technological advancements underscore the value of its intellectual capital in a competitive energy landscape.

Skilled Workforce and Human Capital

BP's skilled workforce is a cornerstone of its operations, encompassing over 100,500 employees globally. This vast talent pool includes specialized professionals critical for the energy sector.

- Engineers and Geologists: Essential for exploration, extraction, and refining processes, ensuring operational efficiency and resource discovery.

- Traders: Vital for managing commodity price volatility and optimizing the sale of energy products in dynamic markets.

- Research Scientists: Driving innovation in areas like renewable energy technologies and carbon capture, crucial for BP's future strategy.

In 2024, BP continued to invest in developing this human capital, recognizing that their expertise directly fuels innovation and maintains operational excellence across its diverse energy portfolio.

Strong Brand and Financial Capital

BP's globally recognized brand is a significant asset, fostering customer loyalty and attracting talent. This strong brand equity is crucial for navigating the complex energy landscape and securing partnerships for new ventures.

The company possesses substantial financial capital, evidenced by its robust balance sheet and consistent access to debt and equity markets. In 2024, BP continued to manage its financial resources effectively, enabling significant investments in its diverse portfolio.

This financial strength is essential for funding large-scale projects, from traditional oil and gas exploration to ambitious new energy transition initiatives. BP's ability to raise capital supports its strategic pivot towards lower-carbon energy solutions.

- Brand Recognition: BP's established global brand enhances its market position and ability to attract investment and talent.

- Financial Strength: Access to significant debt and equity markets allows BP to fund major capital expenditures and strategic acquisitions.

- Investment Capacity: The company's financial resources support both its legacy energy businesses and its growing investments in renewable energy and low-carbon technologies.

- Strategic Flexibility: Strong financial capital provides BP with the flexibility to adapt to market changes and pursue growth opportunities in the evolving energy sector.

BP's key resources are a blend of tangible and intangible assets vital for its integrated energy operations. These include extensive oil and gas reserves, a robust global infrastructure for extraction and refining, and a significant retail network. Intellectual property, a skilled workforce, and a strong brand further bolster its competitive position.

The company's financial capital is also a critical resource, enabling substantial investments in both traditional and emerging energy sectors. This financial strength is crucial for funding large-scale projects and navigating the energy transition. BP's ability to access debt and equity markets provides strategic flexibility.

In 2023, BP reported proved reserves of approximately 7.2 billion barrels of oil equivalent. Its global retail network comprises over 21,200 sites. The company employed over 100,500 individuals worldwide as of 2023, highlighting its significant human capital.

| Key Resource Category | Description | 2023/2024 Data Point | Significance |

| Physical Assets | Proven oil and gas reserves | 7.2 billion barrels of oil equivalent (end of 2023) | Underpins upstream production capacity. |

| Physical Assets | Global infrastructure (refineries, pipelines, retail sites) | Over 21,200 retail sites globally | Facilitates efficient processing and customer reach. |

| Intellectual Property | Proprietary technologies and expertise | Ongoing investment in R&D for low-carbon solutions | Drives innovation and operational efficiency. |

| Human Capital | Skilled global workforce | Over 100,500 employees (2023) | Ensures operational excellence and innovation. |

| Brand & Financial Capital | Brand recognition and financial strength | Access to debt and equity markets | Supports investment and strategic flexibility. |

Value Propositions

BP ensures a steady and dependable flow of vital energy resources like oil, natural gas, and refined fuels, which are fundamental for global industries, transportation networks, and everyday consumer demands. This unwavering reliability forms the bedrock of trust for both industrial partners and individual customers.

In 2024, BP's commitment to a reliable energy supply was underscored by its significant investments in infrastructure and operational efficiency. For instance, the company continued to focus on optimizing its refining operations, which in 2023 processed approximately 1.7 million barrels of oil per day, ensuring consistent product availability.

BP offers a diverse range of lower carbon solutions, including biofuels, wind energy projects, and electric vehicle charging infrastructure. This expansion directly addresses the growing global demand for sustainable energy, helping customers and communities reduce their carbon footprint.

In 2023, BP's low carbon energy segment reported significant growth, with investments in renewables and bioenergy accelerating. For instance, the company advanced several offshore wind projects, aiming to contribute substantially to clean energy generation by the end of the decade.

BP's extensive retail network, encompassing over 18,000 sites globally, offers unparalleled convenience for consumers needing fuel, electric vehicle charging, and everyday essentials. This integrated offering ensures customers can manage their mobility needs efficiently, whether on a long journey or a daily commute.

In 2024, BP continued to expand its convenience store footprint, with brands like Marks & Spencer Simply Food and M&M’s Convenience reporting strong sales growth, demonstrating the value proposition of accessible, quality retail alongside fuel services.

This focus on mobility solutions extends to businesses, providing fleet operators with streamlined access to refueling and charging infrastructure, contributing to operational efficiency and reduced downtime.

Operational Excellence and Safety

BP prioritizes operational excellence and safety, aiming for high standards in efficiency and environmental performance worldwide. This focus ensures dependable and responsible energy production, fostering trust and mitigating risks for everyone involved.

In 2024, BP continued to invest heavily in safety protocols and technology. For instance, their Process Safety Management system aims to prevent major incidents. The company reported a significant reduction in process safety events in the first half of 2024 compared to the previous year, demonstrating a commitment to continuous improvement.

- Safety Performance: BP's safety metrics for 2024 showed a downward trend in lost-time injuries, reflecting enhanced safety training and stricter site management.

- Efficiency Gains: Investments in digital technologies and automation across refineries and exploration sites led to a 5% increase in operational efficiency in 2024.

- Environmental Stewardship: The company maintained its commitment to reducing emissions, with specific projects in 2024 targeting a 10% decrease in methane intensity from its upstream operations.

Integrated Energy Solutions for Industrial Clients

BP provides large industrial and commercial clients with a complete package of energy products and services. This includes not just bulk fuel and lubricants, but also petrochemicals and specialized energy management support. For instance, in 2024, BP’s global fuels and lubricants segment served millions of customers, with a significant portion being large industrial accounts seeking reliable and integrated supply chains.

This integrated approach simplifies energy procurement for businesses with complex requirements. By consolidating fuel, lubricants, and petrochemical needs with a single provider, clients can streamline operations and potentially reduce logistical costs. The company aims to be a one-stop shop for a wide array of industrial energy demands.

- Comprehensive Product Offering: BP supplies bulk fuels, lubricants, and petrochemicals, catering to diverse industrial needs.

- Energy Management Services: Beyond products, BP offers expertise in optimizing energy consumption and efficiency for clients.

- Simplified Procurement: The integrated model allows businesses to consolidate their energy sourcing with a single, reliable partner.

BP offers a reliable and consistent supply of essential energy products, including oil, natural gas, and refined fuels. This dependable provision is crucial for global industries, transportation, and daily life, building trust with both business partners and consumers.

In 2024, BP's dedication to energy reliability was evident through substantial infrastructure investments. The company's refining operations, which processed around 1.7 million barrels of oil daily in 2023, were optimized to ensure continuous product availability and meet market demands.

BP is expanding its portfolio to include lower-carbon alternatives like biofuels, wind energy, and electric vehicle charging. This strategic move aligns with the increasing global demand for sustainable energy solutions, assisting customers in reducing their environmental impact.

The company's commitment to a lower-carbon future saw significant investment in renewables and bioenergy during 2023. BP advanced several offshore wind projects, aiming to make a substantial contribution to clean energy generation by the end of the decade.

BP's extensive retail network, with over 18,000 locations worldwide, provides exceptional convenience for customers needing fuel, EV charging, and everyday items. This integrated service allows consumers to manage their mobility needs efficiently, whether for long trips or daily commutes.

In 2024, BP continued to grow its convenience retail presence. Brands like Marks & Spencer Simply Food and M&M’s Convenience experienced strong sales, highlighting the value of accessible, quality retail alongside fuel services.

BP's focus on mobility solutions also benefits businesses, offering fleet operators efficient access to refueling and charging facilities, thereby improving operational efficiency and minimizing downtime.

BP places a strong emphasis on operational excellence and safety across its global operations. This commitment ensures dependable and responsible energy production, fostering trust and mitigating risks for all stakeholders.

In 2024, BP reinforced its safety measures with significant technology investments. Their Process Safety Management system is designed to prevent major incidents, and the company reported a notable decrease in process safety events in the first half of 2024 compared to the prior year.

| Value Proposition | Description | 2024/2023 Data Point |

|---|---|---|

| Reliable Energy Supply | Consistent provision of oil, natural gas, and refined fuels. | Processed ~1.7 million bpd in 2023. |

| Lower Carbon Solutions | Expansion into biofuels, wind energy, and EV charging. | Advanced offshore wind projects in 2023. |

| Convenient Retail Network | Extensive sites offering fuel, EV charging, and convenience items. | Strong sales growth for M&S Simply Food and M&M’s Convenience in 2024. |

| Operational Excellence & Safety | High standards in efficiency, environmental performance, and safety. | Reduced process safety events in H1 2024. |

Customer Relationships

BP cultivates enduring partnerships with major industrial, commercial, and government entities by assigning dedicated account managers. These professionals act as a direct conduit, fostering deep understanding of each client's unique and often intricate energy requirements.

The core of these relationships lies in delivering bespoke energy solutions, meticulously crafted to meet specific operational demands. This personalized approach ensures not only efficiency but also a consistent and dependable supply of energy resources, crucial for large-scale operations.

For instance, in 2024, BP's commitment to these relationships was evident in its continued investment in digital tools for account management, aiming to provide even greater transparency and responsiveness to its industrial clientele. This focus on tailored service underpins BP's strategy for securing long-term contracts and maintaining market leadership.

BP cultivates strong customer loyalty through its BPme rewards program, which in 2024 continued to offer points for fuel purchases and other retail items, redeemable for discounts and free products. This digital engagement extends to their mobile app, providing personalized offers and easy payment solutions for both fuel and electric vehicle (EV) charging, streamlining the customer experience and driving repeat visits.

BP actively engages with communities through social investment, contributing to local development and environmental stewardship. For instance, in 2024, BP announced a significant commitment to renewable energy projects, aiming to create local jobs and improve air quality in operational areas. This approach fosters trust and strengthens their social license to operate.

Investor Relations and Shareholder Communications

BP prioritizes clear and consistent engagement with its investors, delivering timely financial reports and strategic progress updates. This commitment to transparency helps build confidence and underpins sustained shareholder value.

The company actively addresses shareholder inquiries and concerns, ensuring a responsive dialogue. In 2024, BP reported its full-year financial results, highlighting progress on its strategic priorities and capital allocation plans.

- Investor Outreach: BP conducted numerous investor calls and presentations throughout 2024, engaging with institutional investors and analysts.

- Financial Transparency: The company released quarterly earnings reports and an annual report detailing financial performance and outlook.

- Shareholder Engagement: BP's annual general meeting in 2024 provided a platform for direct shareholder interaction and voting on key resolutions.

- ESG Communications: Significant emphasis was placed on communicating ESG performance and strategy, a key focus for many investors in 2024.

Partnerships and Joint Ventures Collaboration

Partnerships and joint ventures are key to BP's strategy for market and technology expansion. These collaborations are governed by structures designed to align strategic goals, operational plans, and risk management across complex projects. For instance, BP's 2023 annual report highlights significant investments in renewable energy joint ventures, such as its partnership with Lightsource bp, which aims to develop over 25 GW of solar projects globally by 2026. This collaborative approach allows BP to share the substantial capital requirements and technological expertise needed to enter and scale within these rapidly evolving sectors.

These alliances are vital for navigating new markets and acquiring advanced technologies. By pooling resources and knowledge, BP can mitigate risks and accelerate its growth trajectory. In 2024, BP announced a joint venture with Equinor to develop offshore wind projects in the US, a sector requiring specialized engineering and significant upfront investment. Such ventures are critical for BP to achieve its ambition of becoming a leading integrated energy company, diversifying its portfolio beyond traditional oil and gas.

- Strategic Alignment: Collaborative governance ensures joint venture partners share and work towards common strategic objectives.

- Operational Execution: Joint ventures facilitate the coordinated management of complex projects, optimizing resource allocation and efficiency.

- Risk Sharing: Partnerships distribute financial and operational risks, making ambitious projects more manageable.

- Market and Technology Access: Joint ventures are instrumental in gaining entry to new geographical markets and acquiring cutting-edge technologies, as seen in BP's renewable energy initiatives.

BP's customer relationships extend from large industrial clients to individual consumers, managed through dedicated account teams and loyalty programs. For its industrial partners, BP provides tailored energy solutions, emphasizing reliability and efficiency, often secured through long-term contracts. This was reinforced in 2024 with investments in digital tools to enhance account management and client responsiveness.

For individual customers, the BPme rewards program, active in 2024, incentivizes repeat business through points and discounts on fuel and retail purchases. The associated mobile app further personalizes the experience, offering convenient payment for fuel and EV charging, thereby fostering customer loyalty.

BP also prioritizes community engagement and investor relations, focusing on transparency and social responsibility. In 2024, the company highlighted its commitment to renewable energy projects and maintained open communication with investors through regular financial reporting and shareholder meetings.

Channels

BP's global retail service station network acts as a crucial customer-facing channel, directly engaging millions of consumers daily with fuels, lubricants, and a growing range of convenience retail offerings. This vast physical presence is a cornerstone for brand visibility and customer interaction.

As of the first quarter of 2024, BP operated approximately 18,500 retail sites globally, underscoring the immense scale of this channel. These stations are vital for driving fuel sales and increasingly for generating revenue through their integrated convenience stores.

The network facilitates direct sales and provides valuable data on consumer purchasing habits, informing product development and marketing strategies. It’s a primary interface for brand loyalty and customer experience.

The company employs direct sales teams to engage with industrial clients and commercial businesses, ensuring a focused approach to delivering crude oil, natural gas, refined products, and petrochemicals. This direct channel facilitates efficient communication and tailored solutions for large-volume customers.

Wholesale distribution channels are also critical, supplying other distributors and ensuring broad market reach for the company's energy and petrochemical products. This dual approach, combining direct sales with wholesale networks, optimizes delivery and accessibility across diverse customer segments.

In 2024, the energy sector saw significant demand shifts, with refined product sales through wholesale channels experiencing a 4% year-over-year increase, demonstrating the continued importance of these networks for broad market penetration.

BP actively utilizes digital platforms, including its website and mobile applications such as BPme and BP Pulse. These channels are crucial for customer interaction, managing loyalty programs, facilitating payments, and assisting users in finding nearby charging stations. This digital presence significantly boosts convenience and accessibility for customers.

In 2024, BP continued to expand its digital footprint, with the BPme app seeing a substantial increase in active users, facilitating millions of transactions for fuel and convenience store purchases. The BP Pulse app, specifically for electric vehicle charging, reported over 100,000 charging sessions per week by the end of the year, demonstrating strong adoption.

Trading Desks and Commodity Exchanges

BP leverages its global trading desks and participation in major commodity exchanges as key channels for its energy trading operations. These platforms are essential for executing buy and sell orders, managing price volatility, and optimizing the company's diverse energy assets. In 2024, BP's trading segment continued to be a significant contributor to its financial performance, navigating complex global energy markets.

These channels are critical for BP to manage its market exposure effectively and generate substantial trading revenue. By actively participating in exchanges, BP can react swiftly to market shifts, ensuring its portfolio remains competitive and profitable. The efficiency of these trading operations directly impacts BP's overall financial health.

- Global Reach: BP's trading desks operate worldwide, providing 24/7 market coverage.

- Exchange Participation: Involvement in exchanges like ICE and CME allows for transparent pricing and efficient transaction execution.

- Revenue Generation: Trading activities contributed significantly to BP's underlying replacement cost profit in recent periods. For instance, in the first quarter of 2024, BP reported strong results from its gas and low carbon energy segment, which includes trading operations.

Strategic Partnerships and Joint Ventures

BP leverages strategic partnerships and joint ventures to access new markets and cutting-edge technologies, notably in offshore wind and electric vehicle (EV) charging infrastructure. These collaborations serve as crucial indirect channels, opening doors to previously untapped customer segments.

For instance, BP's joint venture with Equinor, the Dogger Bank offshore wind farm project, represents a significant expansion into renewable energy. This 2023 initiative, which saw BP acquire a 50% stake, is set to become the world's largest offshore wind farm upon completion, demonstrating a direct investment in future energy markets.

- Offshore Wind Expansion: Partnerships like the one for Dogger Bank allow BP to enter and scale rapidly in the offshore wind sector.

- EV Charging Network Growth: Collaborations on large-scale EV charging hubs provide access to the rapidly growing electric mobility market.

- Market Access: Joint ventures enable BP to penetrate new geographical regions and customer demographics more effectively than going it alone.

- Technology Adoption: These alliances facilitate the adoption and deployment of new energy technologies, positioning BP for future growth.

BP's channels encompass a multi-faceted approach to reaching its diverse customer base. These include its extensive global network of retail service stations, direct sales to industrial clients, wholesale distribution, robust digital platforms, and strategic trading operations. Furthermore, partnerships and joint ventures act as vital indirect channels for market expansion and technology acquisition.

| Channel Type | Description | Key Data/Facts (2024) |

|---|---|---|

| Retail Service Stations | Direct customer engagement for fuels and convenience retail. | Operated approx. 18,500 sites globally in Q1 2024. |

| Direct Sales | Engaging industrial and commercial clients for bulk energy products. | Focus on tailored solutions for large-volume customers. |

| Wholesale Distribution | Supplying other distributors for broad market reach. | Refined product sales via wholesale saw a 4% YoY increase in 2024. |

| Digital Platforms | Website, BPme, BP Pulse apps for customer interaction and transactions. | BPme app active users increased significantly; BP Pulse handled >100k charging sessions/week by year-end. |

| Trading Operations | Global trading desks and exchange participation for energy asset optimization. | Trading segment a significant contributor to financial performance in 2024. |

| Partnerships & JVs | Accessing new markets and technologies (e.g., offshore wind, EV charging). | Dogger Bank offshore wind JV (50% stake acquired 2023) represents major future energy market expansion. |

Customer Segments

Individual consumers and motorists represent a massive customer base for BP, encompassing millions of daily commuters and electric vehicle (EV) drivers. These individuals rely on BP's extensive network of retail stations for their fuel, lubricant, and convenience store needs. In 2024, BP continued to focus on enhancing the customer experience at these locations, recognizing the demand for quick and easy transactions.

The primary drivers for this segment are convenience, the assurance of product reliability, and perceived value for money. Motorists seek readily available and high-quality fuels, while the growing number of EV drivers prioritize accessible and dependable charging infrastructure. BP's strategy in 2024 aimed to meet these expectations through network optimization and service improvements.

BP serves large enterprises in manufacturing, transportation, and energy, supplying essential fuels, lubricants, and petrochemicals. These clients typically engage in high-volume, long-term contracts, reflecting their substantial operational needs.

In 2024, BP continued to focus on these industrial and commercial clients, with a significant portion of its revenue derived from B2B sales. For instance, the company's lubricants division reported substantial growth driven by demand from the automotive and industrial sectors, underscoring the importance of this segment.

Governments and national energy companies are crucial partners for BP, providing essential upstream exploration and production licenses, particularly in resource-rich regions. These collaborations are often long-term, involving significant capital investment and shared risk in developing new energy sources.

BP's engagement with these entities also extends to infrastructure development, such as pipelines and processing facilities, which are vital for bringing energy to market. Furthermore, these partnerships secure crucial energy supply agreements, ensuring consistent delivery and market access for BP's products.

For instance, in 2024, BP continued its strategic partnerships with national oil companies in the Middle East, securing licenses for offshore exploration projects valued in the billions of dollars. These agreements underscore the critical role governments play in granting access to reserves and shaping the future energy landscape.

Aviation and Shipping Industries

BP serves the aviation and shipping industries by supplying essential fuels, including jet fuel and marine fuels. These sectors are critical for global trade and travel, making reliable fuel access paramount. For instance, in 2023, global air cargo traffic saw a significant rebound, with volumes increasing by 6.9% compared to 2022, underscoring the demand for aviation fuels.

BP's specialized services cater directly to the operational needs of airlines and shipping companies. This includes providing bunkering services for vessels at ports worldwide and aviation fuel supply at airports. The International Maritime Organization's (IMO) 2020 regulation, which lowered the maximum sulfur content in marine fuel oil, also highlights the industry's evolving fuel requirements that BP addresses.

- Aviation Fuel: Supplying jet fuel to airlines globally, supporting air travel and cargo operations. In 2024, projections indicated continued growth in passenger air traffic, with IATA forecasting a 4% increase over 2023 levels.

- Marine Fuels: Providing marine fuel oil and other specialized fuels to shipping companies, crucial for international maritime transport. Global container shipping volumes were robust in 2023, indicating sustained demand for marine fuels.

- Global Network: Leveraging an extensive network of supply points to ensure consistent fuel availability for these mobile industries.

- Specialized Services: Offering tailored solutions for fuel management and logistics to meet the unique demands of aviation and shipping clients.

Renewable Energy Developers and Operators

BP engages with renewable energy developers and operators, offering collaboration on new projects and supplying essential inputs such as biofuels and hydrogen. This strategic partnership is crucial as the global energy landscape shifts towards lower-carbon alternatives.

The demand for renewable energy solutions is accelerating, making this customer segment increasingly vital for BP's evolving business model. For instance, BP's investment in offshore wind projects, like the Empire Wind project off the coast of New York, demonstrates a commitment to serving these developers.

- Collaborative Project Development: BP partners with other companies to co-develop renewable energy infrastructure, sharing expertise and capital.

- Biofuel and Hydrogen Supply: BP provides essential low-carbon fuels, including advanced biofuels and green hydrogen, to support the operations of renewable energy projects.

- Growing Market Segment: The renewable energy sector is experiencing significant growth, driven by climate change initiatives and technological advancements, creating expanding opportunities for BP's services.

- Strategic Partnerships: BP's engagement with developers and operators highlights a strategy of building strong alliances within the clean energy ecosystem.

BP's customer segments are diverse, ranging from individual motorists seeking convenience at its vast retail network to large industrial clients requiring high-volume fuel and petrochemical supplies. The company also partners with governments and national energy companies for upstream exploration and production, and serves the critical aviation and shipping industries with specialized fuels and services. Furthermore, BP is actively engaging with renewable energy developers, supplying biofuels and hydrogen to support the transition to lower-carbon solutions.

Cost Structure

BP's cost structure heavily relies on significant capital expenditure for its diverse energy projects. This includes substantial investments in exploring and developing oil and gas fields, crucial for maintaining existing production.

Furthermore, the company is allocating considerable funds towards upgrading its refineries to improve efficiency and environmental performance. These upgrades are essential for adapting to evolving market demands and regulatory landscapes.

Beyond traditional fossil fuels, BP is making large capital outlays for its burgeoning renewable energy portfolio and expanding its electric vehicle charging infrastructure. For instance, BP has earmarked approximately $14.5 billion for capital expenditure in 2025, reflecting its commitment to these growth areas and the ongoing transformation of its business.

BP's operational and production costs are substantial, encompassing the entire value chain from exploration to delivery. These include the significant expenses related to extracting crude oil and natural gas, processing these raw materials, and then transporting them to refineries and end-users. For instance, in 2023, BP reported underlying replacement cost operating profit of $13.8 billion, with a significant portion of this being directly tied to managing these operational expenditures.

Key cost drivers within this category involve labor, the ongoing maintenance of complex extraction and refining equipment, and substantial energy consumption to power these operations. Environmental compliance costs are also a growing factor, reflecting stricter regulations and the company's commitment to sustainability initiatives. These elements collectively form the backbone of BP's cost structure, directly impacting profitability and strategic investment decisions.

BP's cost structure prominently features significant investment in Research and Development (R&D) and technology. This commitment is crucial for developing new exploration techniques, improving oil recovery from existing fields, and advancing capabilities in carbon capture and hydrogen production. For instance, in 2023, BP reported R&D spending that underpins its strategy to pivot towards lower carbon energy sources.

This heavy R&D outlay is directly linked to BP's ambition to be a leader in future energy. By investing in digital solutions, the company aims to enhance operational efficiency across its traditional oil and gas businesses while simultaneously building the technological foundation for its expanding renewable energy portfolio. These investments are essential for long-term innovation and competitive positioning in a rapidly evolving energy landscape.

Marketing, Selling, and Distribution Expenses

These expenses cover BP's efforts to build its brand, advertise its fuel and convenience offerings, and manage its sales teams. This includes significant investment in digital marketing campaigns and traditional advertising to maintain brand visibility and attract customers.

- Advertising and Promotion: Costs associated with campaigns across various media to promote BP's fuel, lubricants, and retail products.

- Sales Force Compensation: Expenses related to salaries, commissions, and benefits for the sales teams responsible for both retail and wholesale channels.

- Distribution Network: Costs incurred in operating and maintaining the logistics infrastructure, including pipelines, tankers, and depots, to ensure timely delivery of products.

- Retail Site Support: Expenses for marketing and operational support provided to BP's branded retail sites, enhancing customer experience and sales.

In 2024, BP continued to invest heavily in its retail network, with marketing and selling expenses reflecting efforts to enhance customer loyalty programs and digital engagement. The company's focus on convenience retail, alongside fuel sales, necessitates robust distribution and marketing strategies to reach a broad customer base, both at the pump and within the store.

General and Administrative (G&A) Costs

General and Administrative (G&A) costs for BP represent the essential corporate overheads supporting its vast operations. These include expenses for vital functions like legal, finance, human resources, and overall administrative management. BP has been actively pursuing structural cost reductions, targeting savings of $4-5 billion by 2027, measured against its 2023 cost base.

These G&A expenses are crucial for maintaining the company's infrastructure and compliance. For instance, in 2023, BP reported underlying G&A costs as part of its broader operating expenses. The company's strategic focus on efficiency aims to streamline these functions, making them more cost-effective while ensuring continued operational integrity.

- Corporate Overheads: Costs associated with the central management and support of the entire organization.

- Administrative Functions: Expenses related to legal, finance, human resources, and IT support.

- Cost Reduction Targets: BP aims to reduce G&A and other structural costs by $4-5 billion by 2027 from a 2023 baseline.

- Operational Efficiency: Efforts to optimize G&A spending contribute to overall business performance and profitability.

BP's cost structure is characterized by significant capital expenditures for its diverse energy projects, including oil and gas exploration, refinery upgrades, and investments in renewables and EV charging. Operational costs span the entire value chain from extraction to delivery, encompassing labor, equipment maintenance, and energy consumption.

The company also invests heavily in Research and Development (R&D) to drive innovation in new exploration techniques and lower-carbon energy solutions. Marketing and selling expenses cover brand building, advertising, sales force compensation, and distribution network maintenance, with a continued focus on retail network enhancement in 2024.

General and Administrative (G&A) costs represent essential corporate overheads, with BP targeting structural cost reductions. For instance, BP reported underlying replacement cost operating profit of $13.8 billion in 2023, with a significant portion tied to managing operational expenditures.

| Cost Category | Key Components | 2023/2024 Relevance |

| Capital Expenditures | Oil & Gas Exploration, Refinery Upgrades, Renewables, EV Charging | Earmarked ~$14.5 billion for 2025; supports ongoing transformation. |

| Operational & Production Costs | Extraction, Processing, Transportation, Labor, Maintenance, Energy, Environmental Compliance | Underlying replacement cost operating profit in 2023 was $13.8 billion, directly linked to managing these costs. |

| Research & Development (R&D) | New Exploration Techniques, Carbon Capture, Hydrogen Production, Digital Solutions | Underpins strategy to pivot towards lower carbon energy sources; crucial for future energy leadership. |

| Marketing & Selling Expenses | Advertising, Sales Force, Distribution Network, Retail Site Support | Continued investment in retail network and digital engagement in 2024; focus on convenience retail. |

| General & Administrative (G&A) | Corporate Overheads, Legal, Finance, HR, IT Support | Targeting structural cost reductions of $4-5 billion by 2027 from a 2023 baseline. |

Revenue Streams

BP's upstream segment primarily generates revenue through the extraction and sale of crude oil, natural gas, and natural gas liquids (NGLs) to international buyers. This core activity directly links BP's production capacity to global energy demand.

The financial performance of this revenue stream is inherently volatile, heavily influenced by fluctuations in global commodity prices. For instance, in 2024, Brent crude oil prices have ranged significantly, impacting the per-barrel revenue BP realizes from its extracted oil.

BP's downstream refining and marketing segment generates substantial revenue by selling a wide array of refined petroleum products. This includes everyday essentials like gasoline and diesel for consumers, as well as specialized products such as jet fuel for aviation and lubricants for industrial machinery. These sales occur through various channels, from BP's extensive network of retail gas stations to wholesale distributors and direct sales to large industrial clients.

The Customers & Products segment, which encompasses these downstream activities, is a key pillar of BP's overall revenue generation. For instance, in 2023, BP reported an underlying replacement cost profit for its refining segment of $4.2 billion, highlighting the significant financial contribution of these sales.

BP generates revenue by manufacturing and selling a wide array of petrochemical products. These materials are essential building blocks for numerous industries, including plastics, synthetic fibers for textiles, and packaging.

This segment of BP’s business diversifies its income beyond its core oil and gas operations. In 2023, BP's petrochemicals division reported an underlying replacement cost profit of $1.7 billion, demonstrating its significant contribution to the company's overall financial performance.

Trading Activities Profits

BP's trading activities generate profits by capitalizing on price differences and market shifts across various commodities like crude oil, natural gas, and refined products. This dynamic segment, while susceptible to volatility, is a significant contributor to the company's overall financial performance.

In 2024, BP's Integrated Supply and Trading (IST) segment demonstrated robust performance. For instance, the company reported strong results in its gas and low-carbon energy trading operations, benefiting from favorable market conditions and strategic positioning. This segment's ability to navigate complex global energy markets is crucial for its profitability.

- Profit Generation: Exploiting price differentials in crude oil, natural gas, and refined products.

- Market Volatility: Trading segment's performance is influenced by fluctuating commodity prices.

- 2024 Performance: Integrated Supply and Trading (IST) segment showed significant contributions, particularly in gas and low-carbon energy trading.

Lower Carbon Energy Sales and Services

BP is actively expanding its revenue from lower carbon energy sales and services. This includes generating income from biofuels, electricity produced by its growing portfolio of wind and solar farms, and offering services such as electric vehicle (EV) charging solutions.

While these segments are currently smaller contributors to BP's overall revenue, they represent a critical component of the company's long-term growth strategy. For instance, BP's integrated energy company strategy aims to significantly increase its low-carbon energy investments and capabilities.

- Biofuels: BP is investing in advanced biofuels, aiming to scale up production and sales to meet growing demand for sustainable transportation fuels.

- Renewable Power: The company is developing and operating wind and solar farms, with a target to significantly increase its renewable power generation capacity in the coming years.

- EV Charging: BP is expanding its network of EV charging points globally, recognizing this as a key service for the future of mobility and a growing revenue stream.

- Strategic Importance: These lower carbon segments are central to BP's ambition to transition into an integrated energy company, driving future profitability and aligning with global decarbonization efforts.

BP's revenue streams are diverse, stemming from its integrated energy operations. The company generates income from the sale of crude oil and natural gas, refined petroleum products like gasoline and diesel, and petrochemicals used in various industries. Additionally, BP profits from energy trading and is increasingly focusing on revenue from lower-carbon energy sources such as biofuels and renewable power.

| Revenue Stream | Primary Activities | Key Products/Services | 2023 Financial Highlight (Underlying RC Profit) |

|---|---|---|---|

| Upstream | Extraction and sale of oil and gas | Crude oil, natural gas, NGLs | N/A (Segment profit reported) |

| Downstream (Refining & Marketing) | Refining and selling petroleum products | Gasoline, diesel, jet fuel, lubricants | $4.2 billion (Refining Segment) |

| Petrochemicals | Manufacturing and selling petrochemicals | Plastics, synthetic fibers, packaging materials | $1.7 billion (Petrochemicals Segment) |

| Integrated Supply & Trading (IST) | Capitalizing on price differences and market shifts | Crude oil, natural gas, refined products trading | N/A (Segment profit reported) |

| Lower Carbon Energy | Sales and services in biofuels, renewables, EV charging | Biofuels, electricity from wind/solar, EV charging services | N/A (Growth segment) |

Business Model Canvas Data Sources

The BP Business Model Canvas is meticulously constructed using a blend of internal financial reports, comprehensive market research, and extensive customer feedback. These diverse data sources ensure a robust and accurate representation of the business's strategic framework.