BP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BP Bundle

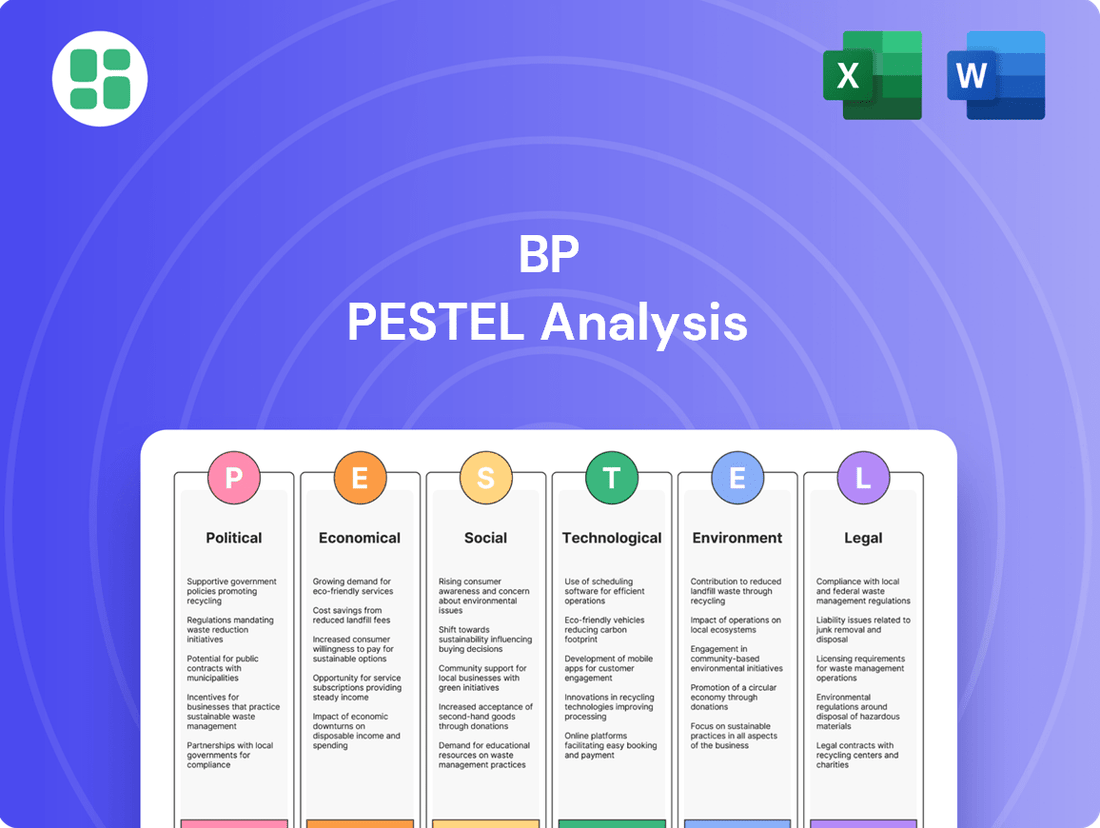

Unlock the critical external factors shaping BP's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play, empowering you to anticipate challenges and seize opportunities. Don't navigate the complex energy landscape blindfolded – gain the strategic advantage by downloading the full analysis today.

Political factors

Government policies worldwide are a major driver for BP's strategy, especially concerning how quickly the energy transition happens. For instance, the European Union's Fit for 55 package, aiming for a 55% emissions reduction by 2030, directly impacts BP's investments in renewable energy and low-carbon solutions in the region.

Supportive government actions, like carbon pricing mechanisms and incentives for decarbonizing energy demand, are vital for BP to meet its net-zero targets. In 2023, BP announced significant investments in offshore wind projects in the US, partly driven by the Inflation Reduction Act's tax credits, demonstrating how policy directly fuels transition efforts.

BP actively engages in policy advocacy, pushing for measures that align with its net-zero ambitions. This includes advocating for clear regulatory frameworks for hydrogen production and carbon capture utilization and storage (CCUS), recognizing that business success in the transition hinges on government and societal collaboration.

Geopolitical tensions, including the ongoing conflict in Ukraine and threats to vital shipping lanes like the Red Sea, significantly disrupt global energy supply chains and contribute to oil price volatility. BP, as a major international energy player, is directly exposed to these risks, which can impact its revenue streams and operational continuity. For instance, the rerouting of vessels around Africa in late 2023 and early 2024 added significant costs and transit times to oil shipments.

BP navigates a dense regulatory landscape, including environmental protection laws and operational safety standards. Compliance with international agreements like the Paris Agreement and national carbon reduction targets is crucial, influencing investment decisions and operational strategies. For instance, the UK's strengthened climate change targets, aiming for a 78% reduction in emissions by 2035 compared to 1990 levels, directly impact BP's transition plans.

International Climate Agreements

BP's net-zero ambition, targeting a 50% reduction in its oil and gas production by 2030 compared to 2019 levels, directly aligns with the Paris Agreement's goal of limiting global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels. This commitment shapes BP's strategic investments, with the company planning to invest up to $2 billion annually in low carbon energy through 2025, and a significant portion of its capital expenditure directed towards new energy ventures. The global push for decarbonization, reinforced by agreements like the Paris Accord, creates both regulatory pressures and market opportunities for companies like BP to transition towards cleaner energy sources and reduce operational emissions.

International climate agreements act as a significant political driver influencing BP's strategic direction and operational planning. These accords set the overarching framework for global decarbonization efforts, directly impacting the energy sector. For instance, the Paris Agreement’s emphasis on transitioning to lower-carbon economies encourages companies to invest in renewable energy and reduce their reliance on fossil fuels. BP's stated ambition to become an integrated energy company, with a focus on growing its low carbon energy businesses, is a direct response to these international commitments and the evolving energy landscape they foster.

- Paris Agreement Alignment: BP's net-zero strategy is designed to be consistent with the Paris Agreement's objectives, aiming to limit global warming.

- Investment in Low Carbon: The company plans to invest significantly in new energy value chains and renewable energy projects, driven by international climate goals.

- Decarbonization Targets: International agreements establish broad decarbonization targets, compelling BP to reduce operational emissions and shift its business model.

National Energy Independence Agendas

Many nations are actively pursuing national energy independence agendas. For instance, the United States' Inflation Reduction Act of 2022 aims to boost domestic clean energy production, potentially creating a more favorable market for renewables. This drive can result in varied national energy policies, some favoring domestic fossil fuel expansion and others prioritizing renewable energy development, directly impacting BP's operational landscape and investment decisions.

These diverse national energy policies create a complex market environment for BP. Countries might implement subsidies for domestic solar and wind projects, while simultaneously offering incentives for continued oil and gas exploration. For example, in 2024, the European Union's REPowerEU plan targets a significant acceleration of renewable energy deployment to reduce reliance on imported fossil fuels, contrasting with nations that may still heavily invest in traditional energy sources to ensure immediate supply security.

BP must skillfully adapt its regional strategies to navigate these evolving national priorities. This means adjusting its portfolio allocation, potentially increasing investments in regions with strong renewable energy support and re-evaluating projects in areas with policies favoring fossil fuel production. The company’s 2024-2025 capital expenditure plans will likely reflect these strategic shifts, aiming to align with governmental objectives for energy security and sustainability.

- National Energy Independence: Over 50 countries have national energy independence as a stated policy goal as of early 2024.

- Renewable Energy Growth: Global renewable energy capacity additions are projected to increase by 10% in 2024 compared to 2023, reaching nearly 500 GW.

- Fossil Fuel Investment Trends: While renewables grow, some nations continue to invest in fossil fuels, with global oil and gas investment expected to remain robust in 2024, albeit with regional variations.

- Policy Impact: National policies can significantly alter the cost and feasibility of energy projects, influencing BP's return on investment and market access.

Government policies play a crucial role in shaping BP's strategic direction, particularly concerning the pace of the energy transition. The European Union's Fit for 55 package, aiming for a 55% emissions reduction by 2030, directly influences BP's investments in renewables within the region.

Supportive government actions, such as carbon pricing and incentives for decarbonization, are vital for BP to achieve its net-zero targets. For instance, BP's 2023 investments in US offshore wind were bolstered by the Inflation Reduction Act's tax credits.

Geopolitical instability, exemplified by the conflict in Ukraine and disruptions in the Red Sea, significantly impacts global energy supply chains and oil price volatility. BP, as an international energy company, faces direct exposure to these risks, which affect its revenue and operations, as seen in the increased costs and transit times for rerouted oil shipments in late 2023 and early 2024.

| Policy Driver | BP's Response/Impact | Relevant Data/Example |

|---|---|---|

| EU Fit for 55 | Investment in EU renewables and low-carbon solutions | Target: 55% emissions reduction by 2030 |

| US Inflation Reduction Act | Investment in US offshore wind projects | Tax credits incentivize clean energy development |

| Geopolitical Tensions (e.g., Red Sea) | Increased operational costs and transit times for oil shipments | Rerouting around Africa added costs in late 2023/early 2024 |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting BP across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive overview of its operating landscape.

Provides a structured framework to identify and mitigate external threats and opportunities, easing the burden of complex market analysis.

Economic factors

Fluctuations in global oil and gas prices are a primary economic factor for BP, directly influencing its profitability and investment capacity. For instance, in the first quarter of 2024, BP reported an underlying replacement cost profit of $2.8 billion, a significant decrease from $3.0 billion in Q1 2023, partly due to lower oil and gas prices compared to the previous year.

Geopolitical events, supply-demand imbalances, and global economic growth forecasts contribute to this volatility. The ongoing conflict in Eastern Europe and OPEC+ production decisions continue to shape supply dynamics, while global economic slowdown fears in late 2023 and early 2024 put downward pressure on demand forecasts.

While BP aims to grow shareholder value, unpredictable commodity prices pose significant revenue risks. The company's strategic focus on transitioning to lower-carbon energy sources is also influenced by these price swings, as they impact the economic viability of both traditional and new energy investments.

BP is strategically balancing substantial ongoing investment in its established oil and gas operations with a growing commitment to lower-carbon energy alternatives. This dual approach aims to leverage existing strengths while preparing for future energy demands.

A significant strategic adjustment in 2025 saw BP reduce its annual renewable energy investments by over US$5 billion, concurrently boosting its allocation to fossil fuels. This recalibration underscores a priority on generating strong returns from hydrocarbon assets to finance the broader energy transition.

The company's capital expenditure plans for 2024 and 2025 illustrate this dynamic, with a substantial portion still earmarked for oil and gas projects, while also signaling continued, albeit adjusted, investment in areas like biofuels and EV charging infrastructure.

BP is aggressively implementing structural cost reduction programs to bolster its financial health and operational efficiency. These efforts are crucial for navigating the complexities of the current energy market.

As of early 2024, BP has successfully realized around $1.7 billion in structural cost savings. The company has set an ambitious target to achieve further reductions by the close of 2027, demonstrating a commitment to sustained efficiency gains.

These strategic initiatives are designed to directly improve BP's profitability and strengthen its free cash flow generation. Such measures are vital for maintaining a competitive edge and ensuring financial resilience in an ever-evolving global economic landscape.

Currency Exchange Rate Fluctuations

As a global energy giant, BP's financial performance is significantly influenced by currency exchange rate fluctuations. With operations and earnings spread across numerous countries, changes in the value of currencies like the US dollar, Euro, and pound sterling directly affect its reported profits and the valuation of its international assets. For instance, a stronger US dollar can reduce the value of earnings generated in weaker currencies when translated back into BP's reporting currency.

Managing this inherent currency risk is a constant focus for BP's treasury operations. The company employs various financial instruments to hedge against adverse movements, aiming to stabilize earnings and protect the value of its overseas investments. These hedging strategies are crucial for providing a more predictable financial outlook to investors and stakeholders.

In 2024, the volatility in major currency pairs presented ongoing challenges. For example, the British pound's performance against the US dollar, a key driver for BP's reporting, saw periods of both strength and weakness, impacting the translation of dollar-denominated earnings. Similarly, fluctuations in the Euro affected results from BP's European operations.

- Impact on Reported Earnings: A strengthening US dollar against currencies where BP generates significant revenue, such as the Euro or Pound Sterling, can lead to lower reported profits when those earnings are translated back into dollars.

- Valuation of International Assets: Fluctuations in exchange rates directly affect the dollar-denominated value of BP's overseas property, plant, and equipment, as well as other international investments.

- Hedging Strategies: BP actively uses financial derivatives, including forward contracts and currency options, to mitigate the impact of currency volatility on its financial results, though perfect hedging is often unachievable.

- 2024 Performance Indicators: Throughout 2024, BP's financial statements reflected the impact of currency movements, with specific notes detailing the gains or losses attributable to foreign exchange rate changes on its various segments.

Inflationary Pressures and Interest Rates

Rising inflationary pressures and shifts in global interest rates directly impact BP's financial landscape. Increased inflation, for instance, can elevate the cost of raw materials and labor, directly affecting operational expenses. For example, the UK's Consumer Price Index (CPI) saw a significant increase, reaching 8.7% in May 2023, highlighting the broad impact of inflation on business costs.

Changes in interest rates, particularly those set by central banks like the US Federal Reserve or the Bank of England, can substantially increase BP's cost of capital. This is crucial for financing large-scale, capital-intensive projects, especially those related to the energy transition. Higher borrowing costs can make new ventures less economically viable, influencing investment decisions. For instance, the US Federal Reserve raised its benchmark interest rate multiple times in 2023, aiming to curb inflation, which consequently increased borrowing costs globally.

- Increased Operational Costs: Inflation drives up expenses for supplies, energy, and wages, impacting BP's profitability.

- Higher Cost of Capital: Rising interest rates make it more expensive for BP to borrow money for new projects and investments.

- Impact on Project Economics: The combined effect of inflation and interest rates can alter the financial viability of long-term projects, particularly in the energy sector.

- Investment Decision Influence: Higher financing costs may lead BP to re-evaluate or delay investments in new technologies or infrastructure.

Economic factors such as fluctuating oil and gas prices, inflation, interest rates, and currency exchange rates significantly impact BP's profitability and strategic decisions. For example, BP's reported profit for the first quarter of 2024 was $2.8 billion, down from $3.0 billion in Q1 2023, partly due to lower commodity prices.

Inflationary pressures in 2023, with the UK's CPI at 8.7% in May, increased BP's operational costs. Simultaneously, rising interest rates, exemplified by the US Federal Reserve's multiple hikes in 2023, increased BP's cost of capital, affecting investment viability.

Currency fluctuations also play a crucial role; for instance, movements in the US dollar against the pound sterling in 2024 directly influenced BP's reported earnings from its global operations.

BP actively manages these economic volatilities through cost reduction programs, aiming for further savings beyond the $1.7 billion realized by early 2024, and employs hedging strategies to mitigate currency risks.

| Economic Factor | Impact on BP | Relevant Data/Example |

|---|---|---|

| Oil & Gas Prices | Profitability, Investment Capacity | Q1 2024 Profit: $2.8 billion (down from $3.0 billion in Q1 2023) |

| Inflation | Increased Operational Costs | UK CPI reached 8.7% in May 2023 |

| Interest Rates | Higher Cost of Capital, Project Viability | US Federal Reserve rate hikes in 2023 |

| Currency Exchange Rates | Reported Earnings, Asset Valuation | USD/GBP fluctuations in 2024 impacting earnings translation |

Preview Before You Purchase

BP PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive BP PESTLE analysis provides a detailed examination of the external factors influencing the company's operations, including Political, Economic, Social, Technological, Legal, and Environmental aspects.

Sociological factors

Public sentiment is increasingly focused on climate change, pushing energy companies like BP to accelerate their transition to cleaner energy sources. Surveys in 2024 indicate a growing majority of consumers expect corporations to prioritize environmental sustainability, directly influencing brand perception and investment decisions.

This societal pressure directly impacts BP's strategic planning, demanding a more robust commitment to net-zero targets and investments in renewable energy. For instance, BP's 2025 sustainability report will likely highlight increased capital allocation towards solar and wind projects, reflecting these evolving stakeholder expectations.

Societal expectations are increasingly prioritizing environmental responsibility, driving a significant global demand for sustainable energy solutions. This shift directly impacts consumer choices and shapes market dynamics, pushing companies like BP to adapt. For instance, a 2024 survey indicated that over 60% of consumers consider a company's sustainability practices when making purchasing decisions.

In response to this growing demand, BP is actively expanding its portfolio beyond traditional fossil fuels. The company has committed to investing billions in areas like biofuels, offshore wind projects, and electric vehicle (EV) charging infrastructure, aiming to capture a larger share of this burgeoning market. By 2025, BP plans to have installed 50,000 EV charging points across the UK alone.

The energy transition demands a significant shift in BP's workforce, requiring new expertise in areas like offshore wind, solar development, hydrogen technologies, and digital analytics. BP's commitment to reskilling is evident in its investments, with the company aiming to equip its employees with the necessary competencies for a net-zero future, fostering a culture that prioritizes both safety and innovation.

Social License to Operate

BP's social license to operate hinges on its ability to demonstrate responsible environmental stewardship and community engagement, especially in light of past environmental challenges and current climate change discussions. The company's sustainability strategy, which includes targets for reducing operational emissions and investing in renewable energy, is central to rebuilding and maintaining public trust. In 2023, BP reported a 10% reduction in Scope 1 and 2 emissions compared to 2019 levels, a step towards its net-zero ambition.

Effective stakeholder engagement is paramount. This includes transparent communication with local communities where BP operates, addressing concerns about safety and environmental impact, and ensuring respect for human rights throughout its supply chain. BP's commitment to community investment programs, which totaled over $100 million globally in 2023, aims to foster positive relationships and contribute to local development.

- Community Investment: BP invested over $100 million in community programs worldwide in 2023.

- Emissions Reduction: Achieved a 10% reduction in Scope 1 and 2 emissions by 2023 compared to 2019.

- Sustainability Framework: Focuses on ethical operations and building stakeholder trust.

- Human Rights: Commitment to upholding human rights across its operations and supply chain.

Health, Safety, and Environmental (HSE) Performance

BP is deeply committed to exceptional Health, Safety, and Environmental (HSE) performance, viewing it as fundamental to its global operations and long-term sustainability. The company actively pursues continuous improvement in safety metrics, with a particular focus on reducing process safety events to safeguard its workforce and the delicate ecosystems it operates within.

Despite rigorous safety protocols, the inherent risks in the energy sector mean that even rare, tragic incidents serve as stark reminders of the perpetual necessity for robust and evolving safety management systems. For instance, BP reported a 13% reduction in Tier 1 process safety events in 2023 compared to 2022, demonstrating a tangible commitment to this critical area.

- Safety Culture: BP invests heavily in fostering a strong safety culture through training and employee engagement programs.

- Environmental Stewardship: Efforts include reducing emissions, managing water resources responsibly, and protecting biodiversity at operational sites.

- Incident Reduction: The company tracks key performance indicators like Lost Time Injury Frequency Rate (LTIFR) and process safety events to drive improvements. In 2023, BP’s LTIFR stood at 0.39 per million hours worked, reflecting ongoing safety focus.

- Regulatory Compliance: Adherence to stringent HSE regulations across all jurisdictions is a non-negotiable aspect of BP's operational framework.

Societal expectations are increasingly prioritizing environmental responsibility, driving a significant global demand for sustainable energy solutions. This shift directly impacts consumer choices and shapes market dynamics, pushing companies like BP to adapt. For instance, a 2024 survey indicated that over 60% of consumers consider a company's sustainability practices when making purchasing decisions.

BP's social license to operate hinges on its ability to demonstrate responsible environmental stewardship and community engagement, especially in light of past environmental challenges and current climate change discussions. The company's sustainability strategy, which includes targets for reducing operational emissions and investing in renewable energy, is central to rebuilding and maintaining public trust. In 2023, BP reported a 10% reduction in Scope 1 and 2 emissions compared to 2019 levels, a step towards its net-zero ambition.

Effective stakeholder engagement is paramount. This includes transparent communication with local communities where BP operates, addressing concerns about safety and environmental impact, and ensuring respect for human rights throughout its supply chain. BP's commitment to community investment programs, which totaled over $100 million globally in 2023, aims to foster positive relationships and contribute to local development.

| Societal Factor | BP's Response/Data (2023-2025) | Impact |

|---|---|---|

| Environmental Awareness | 60% of consumers consider sustainability (2024 survey) | Drives demand for cleaner energy, influencing investment. |

| Community Relations | $100M+ invested in community programs (2023) | Builds social license to operate and stakeholder trust. |

| Emissions Reduction Commitment | 10% reduction in Scope 1 & 2 emissions (vs. 2019, by 2023) | Aligns with net-zero ambitions and public expectations. |

| Workforce Skills | Investing in reskilling for renewable energy expertise | Adapting workforce for the energy transition. |

Technological factors

BP is significantly boosting its investment in Carbon Capture, Utilization, and Storage (CCUS) as a core element of its decarbonization roadmap. This commitment is evident in major projects like the Northern Endurance Partnership in the UK, which aims to capture and store substantial volumes of CO2, and the Tangguh UCC project in Indonesia, further demonstrating BP's dedication to this area.

These technological strides are vital for mitigating emissions originating from industrial operations and natural gas production, with BP targeting the capture of millions of tonnes of CO2 annually through these initiatives. The company's strategic focus on CCUS underscores its role in enabling lower-emission energy solutions.

Hydrogen is a cornerstone of BP's energy transition strategy, with the company actively investing in both blue and green hydrogen production. BP's commitment is underscored by projects like H2 Teesside in the UK, which is designed to supply low-carbon hydrogen to hard-to-abate industrial sectors, contributing to significant emissions reductions.

The successful scaling of these initiatives hinges on continued technological advancements in hydrogen production methods, such as electrolysis and carbon capture, utilization, and storage (CCUS) for blue hydrogen. Furthermore, innovations in hydrogen storage and transportation infrastructure are critical to unlocking its potential as a widespread energy carrier.

BP is heavily investing in digital transformation, with a focus on cloud services and AI to streamline its vast operations. This initiative aims to boost efficiency and inform strategic choices across its global energy portfolio. For instance, BP's commitment to digitalization is evident in its modernization of energy trading platforms and its use of advanced data analytics to refine pricing strategies.

The integration of AI is a core component of BP's strategy to achieve significant cost reductions. By applying AI to areas like predictive maintenance and supply chain optimization, the company expects to unlock substantial savings and improve overall performance. This technological push is crucial for maintaining competitiveness in the rapidly evolving energy sector.

Renewable Energy Technology Innovation

BP's commitment to renewable energy is evident in its ongoing investments in advanced wind and solar power technologies. For instance, by the end of 2023, BP had secured rights to develop significant offshore wind projects, aiming to add gigawatts of capacity to the grid. This focus on innovation is crucial for driving down costs and making renewable sources more competitive.

The accelerating deployment and falling costs of renewable technologies are key enablers of the global energy transition. In 2024, solar photovoltaic (PV) module prices are projected to continue their downward trend, potentially reaching new lows, which further boosts the economic viability of solar projects. This trend directly supports BP's strategy to expand its renewable energy portfolio.

Innovation in energy storage, particularly battery technology, is vital for ensuring the stability and reliability of grids with high renewable energy penetration. By mid-2025, advancements in battery chemistries are expected to deliver higher energy densities and longer lifespans, making grid-scale storage solutions more efficient and cost-effective. This technological progress is essential for integrating intermittent renewable sources like wind and solar into the energy mix, a core objective for BP.

- Investment in Advanced Renewables: BP continues to invest in innovative wind and solar solutions, aiming to increase its renewable energy generation capacity.

- Cost Reductions: The rapid deployment and decreasing costs of solar PV and wind technologies are critical for accelerating the energy transition.

- Energy Storage Advancements: Innovations in battery technology are crucial for grid stability and seamless integration of renewable energy sources.

Methane Emission Measurement and Reduction Technologies

BP is actively deploying cutting-edge methane measurement technologies throughout its oil and gas operations. This initiative is crucial for pinpointing emission sources and implementing effective reduction strategies, aligning with the company's objective of achieving near-zero methane intensity. Methane is a potent greenhouse gas, and its reduction is a key environmental priority.

The company's efforts are supported by real-time data collection and a deeper technical understanding of emission processes. This allows for the implementation of precise mitigation measures, directly addressing identified leaks and inefficiencies. For instance, BP's commitment to reducing methane emissions is a significant part of its broader net-zero ambition, a goal that many energy companies are increasingly prioritizing in their technological roadmaps.

- Advanced Measurement: BP is investing in technologies like infrared cameras and drone-based sensors to detect methane leaks.

- Targeted Mitigation: Real-time data enables rapid response to identified emission points, improving operational efficiency.

- Intensity Goals: The company aims to maintain a methane intensity below 0.1% across its operations, a benchmark set by industry initiatives.

- Technological Integration: Integrating these technologies enhances the overall understanding and management of greenhouse gas footprints.

Technological advancements are central to BP's strategy, particularly in areas like Carbon Capture, Utilization, and Storage (CCUS) and hydrogen production. The company is investing heavily in projects like the Northern Endurance Partnership and H2 Teesside to reduce emissions and develop lower-carbon energy solutions.

Digital transformation, including cloud services and AI, is being leveraged to enhance operational efficiency and inform strategic decisions, with AI expected to drive significant cost reductions through applications like predictive maintenance.

BP's expansion in renewable energy, driven by innovations in solar and wind technologies, is further supported by advancements in energy storage, especially battery technology, which are crucial for grid stability by mid-2025.

The company is also deploying sophisticated methane measurement technologies to pinpoint and reduce emissions, aiming for near-zero methane intensity across its operations.

| Technology Area | BP's Focus | Key Initiatives/Targets | Projected Impact/Data (2024-2025) |

|---|---|---|---|

| CCUS | Decarbonization | Northern Endurance Partnership, Tangguh UCC | Capture millions of tonnes of CO2 annually |

| Hydrogen | Energy Transition | H2 Teesside | Supply low-carbon hydrogen to industrial sectors |

| Digitalization & AI | Efficiency & Cost Reduction | Cloud services, AI for predictive maintenance | Unlock substantial savings, refine pricing strategies |

| Renewables | Capacity Expansion | Offshore wind projects | Add gigawatts of capacity; Solar PV module prices projected to fall |

| Energy Storage | Grid Stability | Battery technology advancements | Higher energy densities, longer lifespans by mid-2025 |

| Methane Reduction | Environmental Performance | Advanced measurement technologies | Target methane intensity below 0.1% |

Legal factors

BP operates under a complex web of environmental regulations worldwide, with particular emphasis on achieving specific emission reduction targets for Scope 1, 2, and 3 emissions. These regulations are not suggestions; they are legally binding requirements that dictate operational limits and necessitate detailed reporting to various regulatory bodies.

Compliance with these mandates directly shapes BP's strategic approach to reducing its carbon footprint. For instance, the company is legally obligated to meet its stated goal of a 20% reduction in operational emissions by 2025, a commitment that is publicly disclosed and subject to scrutiny.

BP's strategic direction is significantly shaped by international climate accords like the Paris Agreement, aiming to limit global warming. The company's net-zero targets are presented as being in harmony with these global aspirations.

However, the dynamic nature of international climate law means that future regulations could mandate more stringent emissions reductions or favor particular decarbonization strategies, potentially impacting BP's operational costs and investment decisions.

BP operates in inherently high-risk environments, necessitating strict adherence to a complex web of national and international health and safety legislation. These regulations, such as the UK's Health and Safety at Work etc. Act 1974, set stringent operational standards, mandate robust emergency preparedness protocols, and outline critical worker protection measures.

Maintaining continuous compliance and demonstrating ongoing improvement in safety performance are not merely best practices but legal imperatives for BP. Failure to meet these obligations can result in substantial penalties, including significant fines and reputational damage, as seen in past incidents where companies faced multi-million dollar settlements for safety breaches.

Anti-Trust and Competition Laws

BP navigates a fiercely competitive global energy landscape, making adherence to anti-trust and competition laws across numerous countries essential. These regulations are designed to curb monopolistic tendencies and foster a level playing field, directly influencing BP's strategies for market engagement, corporate acquisitions, and collaborative ventures.

For instance, in 2024, regulatory bodies continued to scrutinize large energy mergers, with potential implications for market concentration. The European Commission, a key enforcer of competition law, has historically imposed significant fines on energy companies for anti-competitive practices. In 2023, fines related to competition law breaches across various sectors in the EU amounted to billions of euros, underscoring the strict enforcement environment.

- Market Conduct: BP must ensure its pricing strategies and distribution practices do not unfairly disadvantage competitors or consumers.

- Mergers and Acquisitions: Any proposed mergers or acquisitions by BP are subject to rigorous review by competition authorities to prevent undue market power.

- Partnerships and Joint Ventures: Agreements with other energy firms are scrutinized to ensure they do not restrict competition.

- Regulatory Fines: Non-compliance can result in substantial financial penalties, impacting profitability and operational freedom.

Carbon Pricing Mechanisms and Trading Schemes

Carbon pricing mechanisms, like carbon taxes and emissions trading schemes (ETS), are increasingly shaping the energy landscape. For BP, these legal frameworks directly influence operational expenses and strategic investment choices. For instance, the EU Emissions Trading System (EU ETS) saw an average carbon price of €93.74 per tonne of CO2 in 2023, a significant increase from previous years, impacting costs for industries covered by the scheme.

These policies are designed to make emitting carbon more expensive, thereby encouraging a shift towards cleaner energy sources and technologies. This directly affects the economic feasibility of BP's projects, pushing the company to prioritize lower-carbon alternatives. BP's engagement in advocating for effective carbon pricing policies underscores its recognition of their importance in driving the energy transition.

- EU ETS Performance: The EU ETS, a cornerstone of Europe's climate policy, has seen its carbon price fluctuate but generally trend upwards, reaching an average of €93.74/tonne in 2023, reflecting growing stringency.

- Global Adoption: As of 2024, over 70 jurisdictions worldwide have implemented or are planning to implement carbon pricing mechanisms, including ETS and carbon taxes, creating a complex but increasingly unified global approach.

- BP's Stance: BP has publicly supported the implementation of robust carbon pricing, viewing it as a critical tool for decarbonization and a driver for investment in renewable energy and low-carbon solutions.

Legal frameworks significantly influence BP's operational landscape, from environmental compliance to market conduct. Adherence to health and safety legislation is paramount, with breaches potentially leading to substantial fines and reputational damage. Furthermore, competition laws dictate BP's engagement in mergers, acquisitions, and market practices to prevent monopolistic behavior.

Environmental factors

Climate change is a central driver for BP, pushing its strategic shift towards becoming a net-zero company by 2050, or potentially earlier. This commitment encompasses all emission scopes, including Scope 3, with interim reduction targets already established.

The increasing urgency of climate impacts and international agreements to curb global warming directly compel BP to accelerate its transition to lower-carbon energy sources. For instance, BP aims to reduce its absolute upstream oil and gas production by 40% between 2019 and 2030, signaling a tangible move away from traditional fossil fuels.

BP is actively engaged in biodiversity conservation, with a stated goal of achieving a net positive impact on new projects and implementing enhancement plans at its major operational sites. This commitment extends to a firm policy of not undertaking new oil and gas exploration or production within UNESCO World Heritage sites and strict nature reserves, reflecting a strategic approach to environmental stewardship.

The company is investing in ecosystem restoration initiatives, focusing on areas such as seagrass meadows and forests, vital for carbon sequestration and habitat support. For instance, BP's investments in nature-based solutions are projected to contribute to significant carbon removal and biodiversity gains by 2030, aligning with global conservation targets.

BP is prioritizing efficient water use, especially in areas facing water scarcity. The company's goal is to decrease its net freshwater consumption in stressed catchments where it conducts operations.

In 2024, BP focused on detailed water assessments at its sites and put efficiency measures into practice at refineries and other facilities. For instance, during 2023, BP reported a total water withdrawal of 13.3 million cubic meters across its global operations, with a significant portion attributed to water-stressed regions.

Pollution Reduction (Air, Water, Soil)

BP is actively engaged in reducing its environmental footprint, with a particular focus on pollution. The company monitors and works to lower emissions of sulfur oxides and nitrogen oxides, while also managing potential impacts on water and soil quality. This commitment is supported by an operational management system designed to ensure safe, reliable, and compliant operations, thereby minimizing environmental harm.

Evidence of BP's progress in pollution reduction is reflected in its emissions data. In 2024, total air emissions saw a significant decrease, falling by 9% compared to the previous year, 2023. This reduction demonstrates a tangible step towards achieving the company's environmental targets.

- Air Emission Reduction: BP's total air emissions in 2024 were 9% lower than in 2023.

- Pollutant Focus: Efforts are concentrated on reducing sulfur oxides and nitrogen oxides.

- Water and Soil Management: The company actively manages potential impacts on water and soil resources.

- Operational Systems: An operational management system is in place to enhance performance and minimize environmental harm.

Transition to a Lower Carbon Energy System

BP is making substantial investments to shift its energy portfolio towards lower-carbon alternatives. This strategic pivot includes significant capital allocation towards biofuels, wind power generation, and the expansion of electric vehicle (EV) charging networks. For instance, BP announced in 2024 its intention to invest billions in renewable energy projects globally, aiming to significantly bolster its renewable power capacity by 2030.

This transition is driven by the urgent need to address climate change and aligns with global efforts to decarbonize the energy sector. BP's commitment is reflected in its ambitious net-zero targets, which necessitate a fundamental reshaping of its business model and how it allocates resources for future growth. By 2023, BP had already committed over $20 billion to its low-carbon energy strategy, demonstrating a clear direction for its future operations.

- Investment in Renewables: BP's 2024-2030 strategy targets substantial growth in renewable energy capacity, aiming to reach over 50 GW of renewables by 2030.

- Biofuels Expansion: The company is increasing its biofuel production capacity, with a particular focus on sustainable aviation fuel (SAF) and renewable diesel.

- EV Charging Infrastructure: BP aims to have over 100,000 EV charging points globally by 2030, supporting the growing adoption of electric vehicles.

- Resource Allocation: A significant portion of BP's annual capital expenditure is now directed towards these lower-carbon ventures, signaling a long-term commitment to this strategic shift.

Environmental factors are paramount for BP, driving its ambitious net-zero by 2050 strategy and influencing operational decisions. The company is actively reducing its emissions, with total air emissions decreasing by 9% in 2024 compared to 2023, and focusing on pollutants like sulfur and nitrogen oxides.

BP's commitment to biodiversity is evident in its goal for net positive impact on new projects and its policy against exploration in protected areas. Furthermore, significant investments are being made in restoring ecosystems like seagrass meadows, contributing to carbon sequestration and habitat support.

Water management is another key environmental focus, with efforts to decrease freshwater consumption in stressed regions. BP's 2023 water withdrawal was 13.3 million cubic meters, highlighting the importance of efficiency measures implemented across its operations.

The company is also strategically shifting its portfolio towards lower-carbon energy, with billions invested in renewables, biofuels, and EV charging. BP aims for over 50 GW of renewables by 2030 and 100,000 EV charging points globally, backed by over $20 billion committed by 2023.

| Environmental Metric | 2023 Data | 2024 Target/Progress | Commentary |

|---|---|---|---|

| Total Air Emissions Reduction | Baseline | 9% decrease vs. 2023 | Demonstrates progress in pollution control. |

| Renewable Energy Capacity | (Not specified) | Over 50 GW by 2030 | Significant investment in lower-carbon sources. |

| EV Charging Points | (Not specified) | Over 100,000 by 2030 | Supports transition to electric mobility. |

| Water Withdrawal (Global) | 13.3 million m³ | Focus on reduction in stressed areas | Highlights water scarcity management. |

PESTLE Analysis Data Sources

Our BP PESTLE Analysis is informed by a comprehensive mix of public and proprietary data, including official government reports, global economic indicators, and specialized industry research. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting BP's operations.