Compagnie du Bois Sauvage SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compagnie du Bois Sauvage Bundle

The Compagnie du Bois Sauvage possesses unique strengths in its sustainable forestry practices and strong community relationships, but faces external threats from fluctuating market demands and evolving environmental regulations.

Want to understand the full strategic landscape? Purchase the complete SWOT analysis to uncover actionable insights, identify growth opportunities, and mitigate potential risks for Compagnie du Bois Sauvage.

Strengths

Compagnie du Bois Sauvage's diversified investment portfolio is a significant strength, encompassing real estate, private equity, and listed companies. This broad spread across asset classes significantly reduces the risk of being overly exposed to any single market sector, fostering greater stability in its revenue generation and enhancing its ability to withstand market downturns in specific industries.

As of 2024, the company's strategic asset allocation clearly demonstrates this diversification. Private equity investments represent a substantial 65.5% of the portfolio, complemented by 25.6% in real estate and 8.9% in listed investments. This balanced approach provides a robust foundation for long-term growth and resilience.

Compagnie du Bois Sauvage's Chocolate division, encompassing brands like Neuhaus and Jeff de Bruges, delivered a strong performance in 2024. This segment achieved a 6.8% sales increase and a notable 9.4% rise in operating income compared to the previous year, showcasing its market resilience and consumer appeal.

Furthermore, the company's real estate arm, Eaglestone, marked a significant turnaround by generating positive operational profits in 2024. This recovery in the real estate market underscores the company's ability to navigate challenging economic conditions and capitalize on emerging opportunities within its diverse portfolio.

Compagnie du Bois Sauvage's commitment to long-term value creation is a significant strength, as evidenced by its strategic approach to portfolio management. This isn't about quick wins; it's about fostering sustainable growth within its holdings.

The company actively supports its portfolio companies through strategic investments and operational improvements, a stark contrast to a focus on short-term trading. This hands-on approach aims to build tangible, lasting value.

Furthermore, Compagnie du Bois Sauvage's emphasis on socially and environmentally responsible projects aligns with evolving investor preferences. For instance, in 2024, the company continued to prioritize investments in sustainable forestry and renewable energy initiatives, demonstrating a forward-thinking strategy.

Stable and Experienced Shareholding/Management

Compagnie du Bois Sauvage's position as a family-owned entity listed on Euronext Brussels grants it a notably stable principal shareholder structure. This continuity fosters a sense of trust and predictability, crucial for long-term strategic planning and investor confidence.

The company actively cultivates its image as a reliable ally for entrepreneurs, offering not just capital but also valuable expertise and guidance to facilitate business expansion. This approach inherently points to an experienced management team with a clear, consistent vision for supporting growth.

- Stable Shareholding: Family ownership provides a long-term perspective, reducing the risk of sudden shifts in control or strategy.

- Experienced Management: The company's commitment to supporting entrepreneurs suggests a deep well of operational and strategic experience within its leadership.

- Trust as a Partner: This focus on partnership implies a management philosophy centered on collaboration and shared success, rather than purely transactional relationships.

Active Capital Management

Compagnie du Bois Sauvage demonstrates a proactive approach to capital management. This includes a commitment to returning value to shareholders through share buyback programs, signaling management's belief in the company's underlying worth.

The company actively repurchased shares throughout 2024 and into early 2025. Specifically, from November 2024 through June 2025, Compagnie du Bois Sauvage repurchased a total of 13,512 shares. This strategy aims to boost earnings per share and enhance overall shareholder returns.

- Active Capital Allocation: Company actively manages its capital structure.

- Shareholder Value Focus: Ongoing share buybacks indicate confidence in intrinsic value.

- Recent Buyback Activity: 13,512 shares repurchased between November 2024 and June 2025.

- Strategic Goal: Aim to enhance shareholder returns and earnings per share.

Compagnie du Bois Sauvage benefits from a strong, diversified portfolio, minimizing sector-specific risks and ensuring revenue stability. Its strategic asset allocation in 2024, with 65.5% in private equity, 25.6% in real estate, and 8.9% in listed companies, highlights this resilience.

The company's Chocolate division showed robust performance in 2024, with a 6.8% sales increase and a 9.4% rise in operating income, demonstrating strong market appeal. Additionally, the Eaglestone real estate arm achieved positive operational profits in 2024, showcasing effective navigation of market challenges.

Compagnie du Bois Sauvage's commitment to long-term value creation and socially responsible projects, such as sustainable forestry and renewable energy, aligns with modern investment trends and investor preferences.

The family-owned structure, listed on Euronext Brussels, provides a stable shareholder base, fostering predictability and investor confidence for strategic planning.

Management's active capital allocation, including share buybacks, signals confidence in the company's intrinsic value. Between November 2024 and June 2025, 13,512 shares were repurchased, aiming to boost EPS and shareholder returns.

| Asset Class | 2024 Allocation (%) | 2024 Performance Indicator |

|---|---|---|

| Private Equity | 65.5 | Substantial portfolio component |

| Real Estate (Eaglestone) | 25.6 | Turnaround to positive operational profits |

| Listed Investments | 8.9 | Diversifying component |

| Chocolate Division | N/A | 6.8% sales increase, 9.4% operating income rise |

What is included in the product

Offers a full breakdown of Compagnie du Bois Sauvage’s strategic business environment, detailing its internal capabilities and external market forces.

Provides a clear, actionable SWOT analysis for Compagnie du Bois Sauvage, highlighting key opportunities and mitigating potential threats to relieve strategic planning pain points.

Weaknesses

While Compagnie du Bois Sauvage benefits from diversification, its substantial holdings in listed companies, especially those prone to market swings, pose a significant risk. This exposure means that downturns in the stock market can directly and negatively impact the company's overall asset valuation.

A prime example of this vulnerability was seen in the company's 2024 performance. A considerable decline in the share price of Umicore, a key listed investment, resulted in a material negative effect on Compagnie du Bois Sauvage's total asset valuation, highlighting the direct link between its listed portfolio and its financial standing.

Compagnie du Bois Sauvage's significant reliance on the European market presents a notable weakness. In 2023, approximately 75% of its revenue was generated from European operations, leaving it vulnerable to regional economic slowdowns or shifts in consumer spending. This concentration means that any adverse developments within the EU, such as increased trade barriers or recessions, could disproportionately impact the company's financial performance.

Compagnie du Bois Sauvage faced a notable challenge in 2024, reporting a net loss attributable to the Group despite a positive operating profit. This divergence stemmed from significant fluctuations in the fair value of its investment portfolio, highlighting the impact of external market conditions on its bottom line.

The company's 2024 financial results illustrate this weakness, where changes in investment valuations led to a net loss. For instance, a substantial negative adjustment in the fair value of certain assets, amounting to €20.5 million in 2024, directly offset operating earnings, demonstrating how non-operational market movements can overshadow core business performance.

Sensitivity to Raw Material Price Fluctuations

Compagnie du Bois Sauvage's significant reliance on its Chocolate division exposes it to the volatility of cocoa prices. For instance, in early 2024, cocoa futures reached record highs, exceeding $10,000 per metric ton, a stark increase from previous years. This surge, driven by supply chain disruptions in West Africa, directly impacts the cost of goods sold for the company's confectionery products.

While the company aims to mitigate these effects through brand strength and pricing strategies, prolonged periods of extreme price volatility can still erode profit margins. The ability to fully pass on these increased costs to consumers is not guaranteed, especially in competitive markets. This sensitivity remains a key weakness for the company's financial performance.

- Cocoa Price Volatility: Cocoa prices have experienced significant upward pressure, with futures surpassing $10,000 per metric ton in early 2024, impacting raw material costs.

- Margin Pressure: Sustained or extreme price fluctuations in cocoa can directly pressure the profitability of the Chocolate division, even with brand protection efforts.

- Competitive Market Impact: The ability to fully absorb rising raw material costs through price increases is limited by market competition, potentially affecting overall profitability.

Complexity in Portfolio Management and Valuation

Managing Compagnie du Bois Sauvage's diverse holdings, which span private equity, real estate, and publicly traded securities, presents significant challenges. This diversification necessitates a broad range of specialized knowledge, making consistent and accurate valuation across these varied asset classes a complex undertaking.

The company's intrinsic value per share experienced a decrease from 2023 to 2024, reflecting these valuation difficulties. This decline underscores the inherent complexities in accurately assessing the worth of a portfolio composed of both liquid and illiquid assets, impacting overall financial reporting and strategic decision-making.

- Diverse Asset Classes: Portfolio includes private equity, real estate, and listed companies, requiring varied expertise.

- Valuation Challenges: Difficulty in consistently valuing illiquid and diverse holdings.

- Declining Intrinsic Value: Intrinsic value per share fell from 2023 to 2024, indicating valuation hurdles.

- Expertise Requirement: Need for specialized knowledge to manage and value different investment types effectively.

Compagnie du Bois Sauvage's significant exposure to listed companies, particularly Umicore, proved to be a vulnerability in 2024, as a decline in Umicore's share price negatively impacted the company's asset valuation. This reliance on a few key listed investments makes the company susceptible to market volatility.

The company's heavy concentration in the European market, which accounted for approximately 75% of its revenue in 2023, presents a significant weakness. Economic downturns or unfavorable policy changes within the EU could disproportionately affect its financial performance.

Compagnie du Bois Sauvage experienced a net loss attributable to the Group in 2024, despite a positive operating profit, due to substantial fluctuations in the fair value of its investment portfolio, including a €20.5 million negative adjustment in asset valuations.

The company's Chocolate division faces pressure from the volatility of cocoa prices, which reached record highs exceeding $10,000 per metric ton in early 2024, impacting raw material costs and potentially eroding profit margins due to competitive market pressures limiting price pass-through.

Managing its diverse asset classes, including private equity and real estate alongside listed securities, presents valuation challenges, as evidenced by a decline in its intrinsic value per share from 2023 to 2024.

What You See Is What You Get

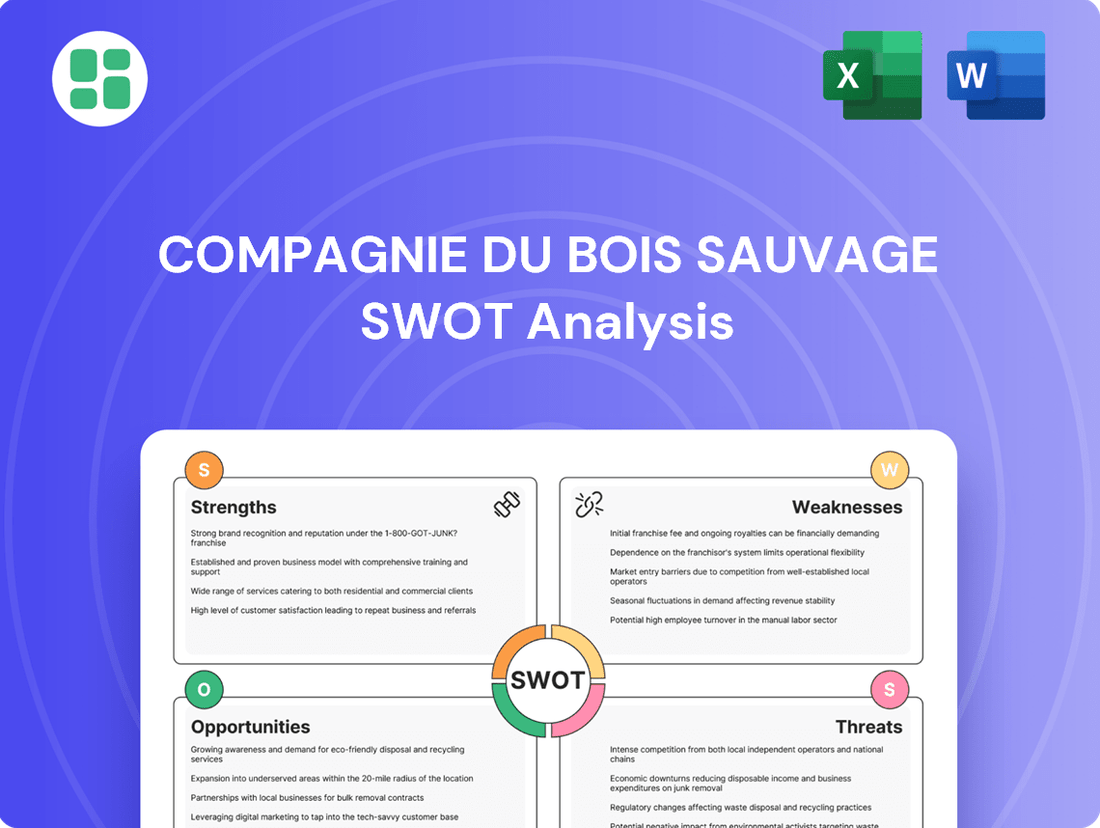

Compagnie du Bois Sauvage SWOT Analysis

This preview reflects the real Compagnie du Bois Sauvage SWOT analysis document you'll receive. You're seeing the actual content, ensuring no surprises, only professional quality for your strategic planning needs.

Opportunities

Compagnie du Bois Sauvage is well-positioned to capitalize on opportunities through strategic acquisitions in high-growth sectors, aligning with its commitment to long-term value creation and active portfolio management. This approach allows for diversification beyond traditional assets into promising 'industries of the future'.

For instance, the company's reported strategy to invest in sectors like renewable energy or advanced materials could yield significant returns. As of early 2025, many of these emerging sectors are experiencing robust growth, with some projected to expand by over 15% annually, offering substantial upside potential for well-timed acquisitions.

The real estate market showed promising signs of recovery in 2024, with Eaglestone's performance indicating a positive trend. This presents a significant opportunity for Compagnie du Bois Sauvage to leverage this upturn.

The company's diversified real estate portfolio, spanning both residential and commercial properties across various geographies, is well-positioned to benefit from this renewed market activity and increasing demand.

The Chocolate division, notably through Jeff de Bruges' expansion of its boutique network, is showing robust performance, presenting a clear avenue for further geographic reach or intensifying penetration in existing markets.

Investments in automation and digitalization within this division are poised to significantly boost operational efficiency and cost management, thereby fueling additional growth trajectories.

Capitalizing on Share Buyback Programs

Compagnie du Bois Sauvage's ongoing share buyback programs, observed in late 2024 and continuing into early 2025, present a significant opportunity. These actions often signal management's belief that the company's stock is undervalued, thereby creating a pathway to enhance shareholder value through a reduced share count. This strategic capital allocation can also optimize the company's financial structure and improve key per-share performance indicators.

The buyback strategy can directly impact financial metrics, potentially leading to:

- Increased Earnings Per Share (EPS): By reducing the total number of outstanding shares, the company's net income is divided among fewer shares, thus boosting EPS.

- Enhanced Shareholder Returns: A lower share count can lead to a higher stock price, benefiting existing shareholders.

- Signal of Confidence: Management initiating buybacks often conveys a strong vote of confidence in the company's future prospects.

- Capital Structure Optimization: Buybacks can be a tool to rebalance the company's debt and equity mix, potentially improving financial flexibility.

Enhanced ESG Reporting and Sustainable Investments

Compagnie du Bois Sauvage's upcoming 2025 ESG report, mandated by the Corporate Sustainability Reporting Directive (CSRD), offers a significant opportunity to attract a growing segment of socially responsible investors. This proactive reporting aligns with increasing global demand for transparency in environmental, social, and governance practices, a trend that saw sustainable investment funds reach an estimated $3.7 trillion in the US alone by the end of 2023.

By deeply embedding ESG factors into its investment strategy, the company can bolster its reputation and unlock access to new pools of capital. This strategic integration is crucial as many institutional investors now screen portfolios for ESG compliance, with over 70% of investors surveyed in a 2024 industry report indicating that ESG performance influences their allocation decisions.

- CSRD Compliance: The 2025 ESG report fulfills regulatory requirements, enhancing transparency and trust.

- Investor Attraction: A strong ESG profile appeals to the expanding market of socially responsible investors.

- Reputation Enhancement: Deeper ESG integration improves brand image and stakeholder perception.

- Capital Access: Meeting ESG criteria can broaden access to diverse funding sources and potentially lower the cost of capital.

Compagnie du Bois Sauvage is strategically positioned to benefit from emerging market trends, particularly in high-growth sectors like renewable energy and advanced materials, where annual expansion could exceed 15% as of early 2025. The company can also leverage the recovering real estate market, as evidenced by Eaglestone's positive performance in 2024, to enhance its diversified property portfolio. Furthermore, ongoing share buyback programs initiated in late 2024 signal management's confidence and offer a pathway to increased shareholder value.

The company's commitment to ESG, highlighted by its upcoming 2025 CSRD-mandated report, presents a significant opportunity to attract socially responsible investors, a market segment estimated to manage $3.7 trillion in the US by the end of 2023, with over 70% of investors considering ESG performance in their decisions.

| Opportunity Area | Key Driver | 2024/2025 Data Point |

|---|---|---|

| Emerging Sector Investments | High-growth potential | Projected annual expansion > 15% in select sectors |

| Real Estate Market Recovery | Positive market trends | Eaglestone's performance in 2024 |

| Share Buyback Programs | Enhanced shareholder value | Initiated late 2024, continuing into early 2025 |

| ESG Reporting & Integration | Attracting socially responsible investors | Sustainable investment funds: ~$3.7 trillion (US, end 2023) |

Threats

Economic downturns in Europe pose a significant threat to Compagnie du Bois Sauvage. A prolonged period of high inflation and rising interest rates, as seen in various European economies throughout 2023 and projected into 2024, directly impacts consumer spending and real estate demand, key drivers for many of the company's investments.

Furthermore, market volatility can depress private equity valuations, a crucial segment for the company. For instance, the European Central Bank's interest rate hikes in 2023, reaching 4.5% by September, aimed to curb inflation but simultaneously increased borrowing costs and dampened investment appetite across the continent.

Compagnie du Bois Sauvage faces a significant threat from the fluctuating valuations of its key listed holdings. For instance, a substantial decline in Umicore's share price negatively impacted Compagnie du Bois Sauvage's valuation in 2024, underscoring the inherent risk in its investment portfolio. Any future downturns in its other major listed assets could similarly diminish its net asset value and overall financial health.

Compagnie du Bois Sauvage faces heightened competition across its diverse investment portfolio, from private equity and real estate funds to other holding companies, all vying for prime opportunities. This intensified rivalry can inflate asset valuations and restrict access to desirable investments, potentially hindering the company's future profitability.

Regulatory Changes and Compliance Costs

Evolving regulatory landscapes, especially concerning real estate and private equity, pose a significant threat. New requirements such as the Corporate Sustainability Reporting Directive (CSRD) could lead to increased compliance costs and potentially restrict certain investment activities for Compagnie du Bois Sauvage.

The implementation of CSRD, while an opportunity for transparency, also presents a threat through a substantial increase in administrative burden and associated costs. For instance, companies in scope for the initial phase of CSRD reporting in 2024 are facing significant investments in data collection and assurance processes.

- Increased Compliance Costs: New regulations can necessitate significant expenditure on legal counsel, reporting software, and personnel training.

- Operational Restrictions: Stricter rules might limit the types of investments Compagnie du Bois Sauvage can pursue or require modifications to existing operations.

- Administrative Burden: The effort required to comply with new reporting standards, like CSRD, diverts resources from core business activities.

Challenges in Specific Portfolio Segments

Despite generally positive performance, Compagnie du Bois Sauvage faces headwinds in specific areas. The Industry & Services division, for instance, encountered difficulties in 2024, partly attributed to a slowdown in the electric vehicle market that affected key holdings like Umicore. This segment's performance, excluding the impact of Berenberg, highlights the vulnerability to sector-specific downturns.

The persistent underperformance of certain portfolio companies, or the emergence of unforeseen operational issues, presents a tangible threat. Such challenges can disproportionately impact overall group results, even when other segments are thriving. For example, if a significant investment within the Industry & Services division fails to meet expectations, it could dilute the positive contributions from other, more robust business units.

- Sectoral Slowdowns: The electric vehicle market slowdown in 2024 impacted Umicore, a key player within Compagnie du Bois Sauvage's Industry & Services segment, demonstrating the risk of sector-specific downturns.

- Portfolio Concentration Risk: Underperformance or unforeseen issues in individual portfolio companies, particularly within specialized divisions, can negatively affect the consolidated financial results.

- Operational Volatility: The reliance on specific industrial sectors means that shifts in demand or operational disruptions within those sectors pose a direct threat to the company's overall financial stability.

Compagnie du Bois Sauvage is susceptible to economic downturns, particularly in Europe, where inflation and rising interest rates, as seen in 2023 and projected into 2024, dampen consumer spending and real estate demand. Market volatility also threatens private equity valuations, with European Central Bank rate hikes in 2023 impacting investment appetite. The company's financial health is directly tied to the performance of its listed holdings, as evidenced by the negative impact of Umicore's share price decline in 2024 on its net asset value.

Intensified competition across all investment areas, from private equity to real estate, can inflate asset prices and limit access to lucrative opportunities. Furthermore, evolving regulatory landscapes, such as the Corporate Sustainability Reporting Directive (CSRD), introduce increased compliance costs and potential operational restrictions. The administrative burden of new reporting standards, like CSRD, which began impacting companies in 2024, diverts valuable resources from core business activities.

Sector-specific slowdowns, like the 2024 impact on the electric vehicle market affecting Umicore, pose a risk to the Industry & Services division. This highlights the vulnerability of the company to downturns in key industrial sectors. Portfolio concentration risk is also a concern, as underperformance or operational issues in individual companies can disproportionately affect overall group results, even if other segments are performing well.

| Threat Category | Specific Example/Impact | Relevant Data Point (2023-2025) |

| Economic Headwinds | European economic slowdown, inflation, interest rate hikes | ECB interest rates reached 4.5% by September 2023. |

| Market Volatility | Depressed private equity valuations | Broad market declines in European equities during 2023. |

| Portfolio Performance | Decline in Umicore share price | Umicore's share price experienced significant volatility in 2024. |

| Competition | Increased rivalry for prime investment opportunities | Rising deal multiples observed in European private equity in 2023. |

| Regulatory Changes | CSRD implementation and compliance costs | Companies faced increased costs for CSRD reporting in 2024. |

| Sectoral Slowdowns | Electric vehicle market slowdown | Impact on Umicore's performance in 2024. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Compagnie du Bois Sauvage's official financial filings, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate assessment.