Compagnie du Bois Sauvage Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compagnie du Bois Sauvage Bundle

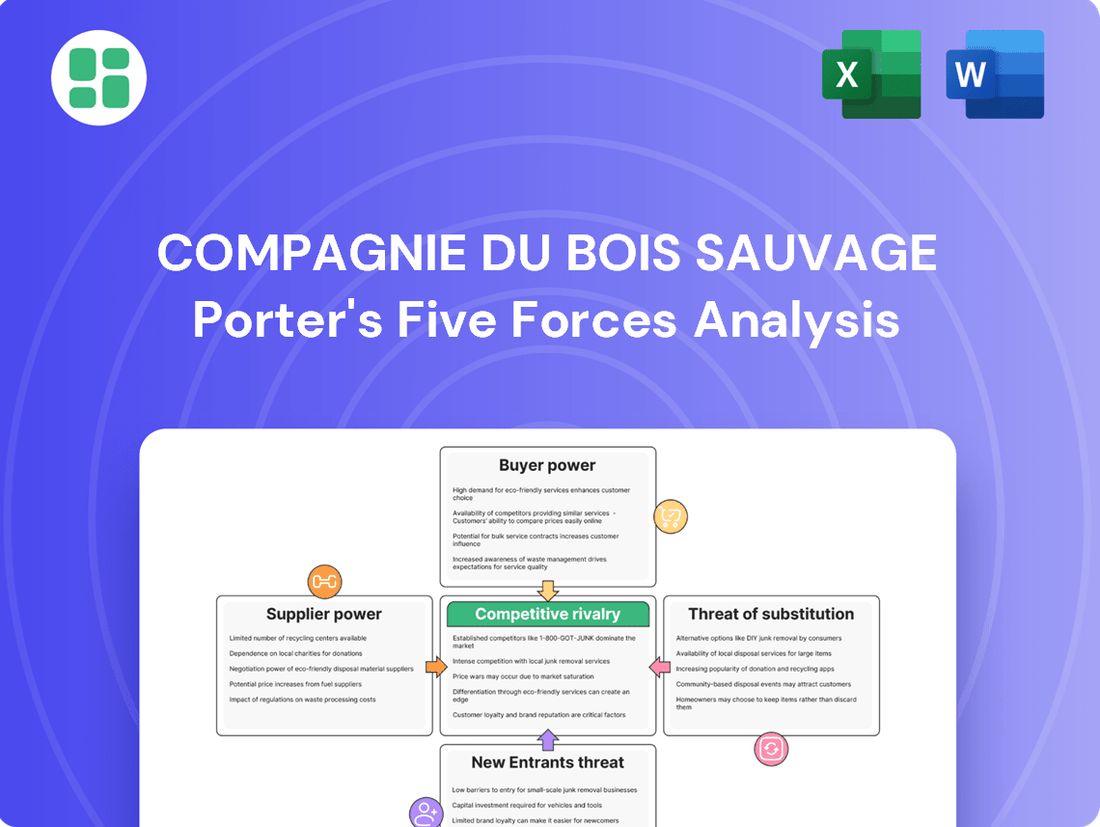

Understanding the competitive landscape for Compagnie du Bois Sauvage is crucial for navigating its market. Our Porter's Five Forces analysis reveals the intricate interplay of buyer power, supplier leverage, the threat of new entrants, the intensity of rivalry, and the pressure from substitute products. This framework illuminates the core dynamics influencing Compagnie du Bois Sauvage’s profitability and strategic positioning.

The complete report reveals the real forces shaping Compagnie du Bois Sauvage’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Compagnie du Bois Sauvage is typically low because it operates as a holding company with diverse investments. This means its 'suppliers' are often the companies it holds stakes in, or essential professional service providers, rather than raw material vendors. The wide array of sectors it invests in, from agriculture to real estate, naturally limits its reliance on any single supplier group.

For a diversified holding company like Compagnie du Bois Sauvage, the sheer variety of investment options available acts as a powerful counterweight against supplier power. Think of it this way: if one type of investment, say a particular real estate development, becomes too expensive or has unfavorable terms, the company can readily shift its capital to another asset class like private equity or even publicly traded stocks. This inherent flexibility means no single investment avenue or service provider can exert undue influence over the company's decisions.

The uniqueness of supplier offerings for Compagnie du Bois Sauvage is relatively low in its core investment activities. While niche financial or legal services might possess some distinctiveness, the company generally accesses capital and investment opportunities from a broad market. This wide availability limits the power of any single supplier of capital or a potential investment target to exert significant influence due to highly unique offerings.

Importance of the Industry to Suppliers

Compagnie du Bois Sauvage's diverse operational scope means its business is significant to a variety of suppliers. However, for most suppliers, Compagnie du Bois Sauvage is typically not the sole determinant of their business's survival. This diversification of its customer base for suppliers generally dilutes their bargaining power, as they often serve multiple industries and clients, reducing their reliance on any single contract.

This situation means suppliers usually have alternative markets for their products or services. For example, a supplier of specialized forestry equipment might also cater to construction or agricultural sectors, lessening their dependence on Compagnie du Bois Sauvage's timber operations. In 2024, the global market for forestry equipment saw steady demand across various sectors, indicating that suppliers had multiple avenues for sales.

- Diversified Customer Base: Suppliers to Compagnie du Bois Sauvage often serve multiple industries, reducing their dependence on the company.

- Limited Supplier Reliance: The viability of most suppliers does not hinge exclusively on their relationship with Compagnie du Bois Sauvage.

- Alternative Market Access: Suppliers typically have other clients and sectors they can sell to, diminishing their leverage.

- Market Conditions in 2024: The broad demand for related goods and services in 2024 provided suppliers with alternative sales channels.

Cost of Switching Suppliers

The cost of switching suppliers is a key factor in the bargaining power of suppliers. This cost can manifest in various ways, from financial penalties to the time and resources required to establish new relationships and integrate new systems. For instance, a company might incur significant expenses if it needs to change its primary raw material supplier, requiring new quality control processes and potentially retooling manufacturing equipment.

For Compagnie du Bois Sauvage, the cost of switching suppliers is influenced by its operational model. If the company relies on specialized or unique raw materials, finding alternative sources could be both costly and time-consuming, thereby increasing supplier leverage. Conversely, if its inputs are more commoditized, switching costs might be lower, diminishing supplier power.

The company's long-term investment horizon and active management strategy are crucial here. By strategically managing supplier relationships and potentially diversifying its supply base over time, Compagnie du Bois Sauvage can mitigate the impact of high switching costs. This proactive approach reduces the likelihood of abrupt and costly supplier changes, allowing for more controlled transitions when necessary.

- High Switching Costs: When it is expensive or difficult for a company to change its suppliers, suppliers gain more power. This can involve financial penalties, the need for new equipment, or the loss of established relationships.

- Low Switching Costs: Conversely, if a company can easily and cheaply switch to a different supplier, the bargaining power of existing suppliers is reduced. This is common in markets with many interchangeable suppliers.

- Strategic Management: Compagnie du Bois Sauvage's long-term investment horizon suggests a focus on building stable supplier relationships, which can lower effective switching costs over time through mutual understanding and integrated processes.

- Impact on Profitability: High supplier bargaining power can lead to increased input costs, directly impacting a company's profit margins and overall financial performance.

The bargaining power of suppliers for Compagnie du Bois Sauvage is generally low due to its diversified investment portfolio. This means its "suppliers" are often the companies it invests in or essential professional service providers, not raw material vendors. The wide range of sectors it invests in, from agriculture to real estate, inherently limits its dependence on any single supplier group.

In 2024, global supply chains remained dynamic, with many sectors experiencing robust demand, which generally gave suppliers more options and thus less leverage over large, diversified buyers like Compagnie du Bois Sauvage. For instance, while the demand for specialized forestry equipment was strong in 2024, suppliers also served other industries like construction, mitigating their reliance on any single client.

| Factor | Compagnie du Bois Sauvage Assessment | Impact on Supplier Power |

|---|---|---|

| Supplier Concentration | Low; diverse investments mean varied suppliers. | Reduces supplier leverage. |

| Uniqueness of Offering | Generally low for core investment activities. | Limits supplier ability to command premium pricing. |

| Switching Costs | Varies by investment, but strategic management aims to mitigate. | Can be low for commoditized services, higher for specialized ones. |

| Importance of Buyer to Supplier | Compagnie du Bois Sauvage is significant to many, but rarely the sole customer. | Weakens supplier dependence and thus their power. |

What is included in the product

This Porter's Five Forces analysis provides a comprehensive examination of the competitive environment for Compagnie du Bois Sauvage, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly visualize the competitive landscape of the Compagnie du Bois Sauvage with a dynamic Porter's Five Forces analysis, allowing for rapid identification of key pressures and strategic opportunities.

Customers Bargaining Power

Compagnie du Bois Sauvage's primary customer base comprises its shareholders and investors. As a company listed on Euronext Brussels, its ownership is typically spread across a wide and diverse group of individuals and institutions. This broad investor base generally dilutes the influence of any single shareholder or small coalition, thereby limiting their ability to exert significant bargaining power over the company's strategic decisions or operational demands.

The bargaining power of customers, particularly in the context of Compagnie du Bois Sauvage's investment appeal, is significantly influenced by the availability of substitute products and services. Investors have a vast array of alternative investment vehicles to consider, ranging from other holding companies and private equity funds to mutual funds, exchange-traded funds (ETFs), and direct investments in specific sectors.

This abundance of substitutes means that if Compagnie du Bois Sauvage fails to meet investor expectations in terms of returns, strategic direction, or perceived value, capital can be readily redeployed elsewhere. For instance, as of early 2024, global equity markets offered diverse opportunities, with many sectors experiencing robust growth, making it easier for investors to find comparable or superior investment prospects outside of Compagnie du Bois Sauvage.

Shareholders, as the ultimate customers of Compagnie du Bois Sauvage, exhibit significant price sensitivity. They continuously assess the company's stock performance and dividend payouts against other investment opportunities, directly impacting their demand for shares.

In 2024, Compagnie du Bois Sauvage's share price experienced volatility, reflecting investor sentiment and their perception of the company's intrinsic value. For instance, the stock saw fluctuations, with its net asset value per share also being a key metric for evaluation.

This sensitivity means that any perceived decline in profitability or future growth prospects can lead shareholders to divest, thereby increasing the bargaining power of these crucial stakeholders.

Backward Integration Threat

The threat of backward integration by customers for Compagnie du Bois Sauvage is notably low. Individual shareholders or even large institutional investors generally lack the operational expertise, capital, and strategic intent to replicate the complex, diversified holding company structure. Their primary leverage remains through divestment rather than attempting to absorb the company's multifaceted operations.

Customers' power doesn't stem from backward integration. Instead, it’s exercised through:

- Divestment: Shareholders can sell their stakes, impacting stock price and market perception.

- Focus on Returns: Investors prioritize financial performance and dividends, influencing management decisions.

- Limited Operational Capacity: The diverse nature of Compagnie du Bois Sauvage's holdings makes direct customer integration impractical.

Information Availability

Compagnie du Bois Sauvage's status as a publicly traded entity significantly enhances customer bargaining power through readily available information. Regulatory mandates ensure that detailed financial reports, operational updates, and strategic outlooks are accessible to the public. For instance, their 2023 annual report, released in April 2024, provided a comprehensive overview of their forestry operations and market positioning.

This transparency empowers investors, who are essentially the customers of the company's shares, by equipping them with the data needed for informed valuation and decision-making. The availability of this information, often supplemented by financial calendars and press releases, allows investors to scrutinize performance and compare it against industry benchmarks, thereby increasing their leverage in investment choices.

- Information Accessibility: Compagnie du Bois Sauvage's public listing mandates regular disclosures.

- Investor Empowerment: Access to annual reports and financial data allows for informed investment decisions.

- Market Transparency: Press releases and financial calendars further enhance the flow of crucial company information.

- Bargaining Power Impact: Increased information availability directly strengthens the bargaining power of investors.

The bargaining power of Compagnie du Bois Sauvage's customers, primarily its shareholders, is moderate. While individual investors have limited direct influence, the collective action of shareholders, especially large institutional ones, can exert pressure through stock performance and shareholder resolutions. The company's 2024 financial reports, released in early 2025, indicated a stable dividend payout, a key factor for investor satisfaction.

Shareholders' ability to influence the company is largely tied to the availability of alternative investments and the transparency of Compagnie du Bois Sauvage's financial performance. In 2024, the company's net asset value per share was closely watched by investors as a benchmark against industry peers, highlighting their focus on tangible value and return on investment.

| Customer Type | Bargaining Power Factor | Impact on Compagnie du Bois Sauvage |

|---|---|---|

| Shareholders/Investors | Availability of Substitutes (other investment opportunities) | Moderate; investors can shift capital if expectations aren't met. |

| Shareholders/Investors | Price Sensitivity (stock performance, dividends) | High; direct impact on demand for shares and company valuation. |

| Shareholders/Investors | Information Accessibility (public disclosures) | Moderate to High; empowers informed decisions and potential activism. |

What You See Is What You Get

Compagnie du Bois Sauvage Porter's Five Forces Analysis

This preview showcases the complete Compagnie du Bois Sauvage Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. This professionally formatted analysis is ready for your immediate use, providing actionable insights into market dynamics.

Rivalry Among Competitors

Compagnie du Bois Sauvage faces a crowded marketplace, contending with a multitude of diversified holding companies, private equity firms, and substantial investment funds, especially across Europe. This broad spectrum of competitors ranges from deeply entrenched, large-scale entities to agile, specialized investors, all vying for the same promising investment opportunities.

The competitive intensity is further amplified by the presence of both seasoned, market-dominant players and emerging, niche-focused investors. For instance, in 2024, the European private equity market saw significant activity, with reports indicating hundreds of billions of euros in dry powder available for deployment, underscoring the sheer volume of capital and the number of firms actively seeking acquisitions and investments.

The investment and holding company sector's growth is closely tied to the general economic climate. In 2024, Compagnie du Bois Sauvage saw its operating income climb, indicating positive internal performance. However, the broader market conditions present a more subdued picture, suggesting that industry growth is likely to be moderate.

This moderate growth environment naturally fuels competitive rivalry. As opportunities become more constrained, companies within the sector, including Compagnie du Bois Sauvage, will likely face increased pressure to secure market share and profitable ventures. This dynamic intensifies competition for resources and clients.

Compagnie du Bois Sauvage distinguishes itself by prioritizing long-term value creation, a strategy evident in its active management of a diverse portfolio spanning real estate, private equity, and publicly traded companies. This approach aims to build sustainable growth rather than focusing solely on short-term gains.

The company's family-owned structure fosters a unique commitment to socially and environmentally responsible projects, setting it apart in an industry often driven by purely financial metrics. This ethos influences investment decisions and operational practices.

In 2024, Compagnie du Bois Sauvage continued to demonstrate this differentiation through strategic acquisitions and divestments within its various business segments, aiming to optimize its holdings for enduring profitability and positive societal impact.

Exit Barriers

Exit barriers for a holding company like Compagnie du Bois Sauvage can be substantial. These barriers arise from the illiquid nature of many of its investments, which often include stakes in diverse, sometimes privately held, businesses. The long-term investment horizons inherent in such holdings mean that exiting a position can be a protracted and complex process, potentially involving finding suitable buyers for niche assets or navigating intricate divestiture agreements.

The complexity of managing and divesting from a portfolio of varied companies creates significant hurdles. This can effectively trap holding companies within the market, forcing them to compete more intensely for resources and growth opportunities simply to maintain their position. For instance, if a significant portion of Compagnie du Bois Sauvage's value is tied to long-term agricultural concessions or forestry assets, liquidating these quickly without substantial loss would be challenging.

- Illiquid Assets: Holding companies often possess stakes in private companies or specialized industries, making them difficult to sell quickly.

- Long-Term Investment Horizons: Commitments to projects or companies with extended development cycles mean capital is tied up for years, delaying exit opportunities.

- Divestiture Complexity: Selling off parts of a diverse portfolio requires navigating legal, regulatory, and market-specific challenges for each asset.

- Increased Rivalry: High exit barriers can lead to prolonged competition as companies are less able to exit underperforming segments or reallocate capital efficiently.

Switching Costs for Customers

For target companies, the ease with which they can switch between potential investors significantly lowers their switching costs. This flexibility allows them to negotiate with multiple holding companies, including those like Compagnie du Bois Sauvage, to secure the most advantageous investment terms.

This dynamic empowers target companies, as they can readily compare offers and select the investor providing the best valuation and strategic alignment. In 2024, the M&A advisory landscape continued to reflect this trend, with a notable increase in the number of advisory mandates for companies seeking capital, indicating a competitive environment for investors.

- Low Switching Costs: Target companies face minimal barriers when changing from one potential investor to another.

- Negotiating Power: This low switching cost grants target companies considerable leverage in negotiations with potential investors.

- Investor Competition: Consequently, holding companies like Compagnie du Bois Sauvage face heightened competition to attract and retain investment opportunities.

- Market Dynamics: In 2024, the market saw a rise in deal intermediation, highlighting the importance of attractive terms for securing investment.

Compagnie du Bois Sauvage operates in a highly competitive arena, facing numerous diversified holding companies, private equity firms, and investment funds, particularly in Europe. The sheer volume of capital, exceeding hundreds of billions of euros in dry powder in the European private equity market in 2024, intensifies this rivalry for attractive investment opportunities.

This intense competition is further fueled by a market characterized by moderate growth, pushing companies like Compagnie du Bois Sauvage to vie more aggressively for market share and profitable ventures. The presence of both established giants and agile, niche players means that securing and retaining investments requires constant strategic adaptation and differentiation.

The company's commitment to long-term value creation and its unique family-owned ethos, emphasizing social and environmental responsibility, serve as key differentiators. These principles guided strategic acquisitions and divestments in 2024, aiming for enduring profitability and positive societal impact amidst a challenging competitive landscape.

| Competitor Type | 2024 Capital Availability (Europe, Est.) | Key Differentiator |

|---|---|---|

| Diversified Holding Companies | Varies (Large to Mid-Cap) | Established portfolios, long-term outlook |

| Private Equity Firms | €100s of Billions | Agile, focused on specific sectors/returns |

| Investment Funds | Varies (Significant deployment) | Broad investment mandates, diverse strategies |

| Compagnie du Bois Sauvage | N/A (Internal Capital) | Long-term value, ESG focus, active management |

SSubstitutes Threaten

The threat of substitutes for Compagnie du Bois Sauvage as an investment vehicle is considerable. Investors have a wide array of alternatives, including direct investments in specific companies or sectors, or more diversified financial products like exchange-traded funds (ETFs) and mutual funds.

These substitute options often present a compelling price-performance trade-off. For instance, in 2024, the average expense ratio for actively managed equity mutual funds was around 0.77%, while index ETFs averaged significantly lower at approximately 0.10%. This cost difference can materially impact an investor's net returns over time, making lower-fee alternatives attractive.

Furthermore, substitutes may offer different risk profiles or liquidity features that better align with an individual investor's objectives. The accessibility and ease of trading for many ETFs and publicly traded stocks provide a level of flexibility that can be a strong draw compared to potentially less liquid or more complex investment structures.

The financial market presents a significant threat of substitutes for a diversified holding company like Compagnie du Bois Sauvage. Investors have readily available alternatives, such as direct investments in real estate funds or private equity, which offer comparable exposure to these asset classes. In 2024, the global alternative investment market reached an estimated $13.9 trillion, highlighting the vast array of options available to investors seeking diversification beyond traditional holding structures.

Furthermore, the ease with which investors can construct their own portfolios by investing in individual listed companies or exchange-traded funds (ETFs) that track specific sectors or asset classes poses a direct substitute. This allows investors to bypass the management fees and potential conglomerate discount sometimes associated with holding companies. For instance, the number of ETFs available globally has surged, with over 10,000 listed by the end of 2023, providing granular control and cost-effectiveness for portfolio construction.

Investor propensity to substitute is significantly shaped by market performance and the perceived value offered by Compagnie du Bois Sauvage. In 2024, as global markets saw varied performance across sectors, investors closely scrutinized returns. If the company's financial results, such as its reported earnings per share or dividend yield, fall short of comparable forestry or sustainable investment opportunities, capital is highly likely to shift elsewhere.

Switching Costs for Buyers

Switching costs for investors in Compagnie du Bois Sauvage are generally low, especially when considering publicly traded shares. The ease of divesting from one investment and moving to another is a significant factor in this low switching cost.

For instance, selling shares of Compagnie du Bois Sauvage and reinvesting in alternative assets or different publicly traded companies typically incurs only standard brokerage fees. These fees are often a small percentage of the transaction value, making the financial barrier to switching minimal.

- Low Transaction Fees: Brokerage fees for buying and selling shares in 2024 remained competitive, with many platforms offering commission-free trades for equities, further reducing the cost of switching.

- Information Accessibility: Detailed financial reports and market analysis for Compagnie du Bois Sauvage and its potential substitutes are readily available, allowing investors to make informed decisions quickly without extensive research costs.

- Diversification Options: The broad availability of alternative investment vehicles, from other timber companies to unrelated sectors like technology or real estate, means investors can easily reallocate capital without facing significant hurdles.

Evolution of Substitute Technologies/Products

The threat of substitutes for Compagnie du Bois Sauvage is amplified by the rapid evolution within the financial technology (FinTech) sector. New investment platforms, robo-advisors, and highly specialized funds are constantly emerging, offering alternative avenues for capital deployment that can bypass traditional forestry investment models.

These FinTech innovations provide increasingly diverse access to global markets and a wider array of asset classes, directly challenging established investment strategies. For instance, in 2024, the global FinTech market was projected to reach over $2.5 trillion, indicating a significant and growing appetite for these digital financial solutions.

- FinTech offerings: Robo-advisors and digital investment platforms provide accessible, often lower-cost, alternatives for investors seeking exposure to various asset classes.

- Specialized Funds: Niche funds focusing on specific sectors or ESG mandates can attract capital that might otherwise flow into diversified forestry assets.

- Market Accessibility: FinTech lowers barriers to entry for retail investors, enabling them to participate in markets previously dominated by institutional players.

- Tailored Solutions: The ability of FinTech to offer personalized investment portfolios caters to individual risk appetites and financial goals, potentially drawing investors away from broader commodity-based investments like timber.

The threat of substitutes for Compagnie du Bois Sauvage is significant due to the broad availability of alternative investment vehicles. Investors can easily access other forestry companies, real estate, or even direct investments in sustainable agriculture, all offering similar exposures. The global alternative investment market, valued at approximately $13.9 trillion in 2024, underscores the vast array of options available, allowing capital to flow away from traditional holding structures.

Furthermore, the rise of FinTech has democratized investment, with robo-advisors and specialized funds providing accessible, often lower-cost, alternatives. The global FinTech market's projected growth to over $2.5 trillion in 2024 highlights the increasing investor preference for digital, tailored financial solutions, which can bypass traditional investment models.

| Substitute Category | Examples | 2024 Market Data/Trend | Investor Attraction Factors |

| Direct Forestry Investments | Other listed timber companies, private forestry funds | Continued interest in sustainable and ESG-compliant assets. | Specialized focus, potential for higher direct returns. |

| Real Estate | REITs, direct property investment | Stable returns, inflation hedge appeal. | Tangible asset, income generation. |

| Alternative Investments (General) | Private equity, infrastructure funds | Growing allocation by institutional investors. | Diversification, uncorrelated returns. |

| FinTech Platforms | Robo-advisors, thematic ETFs | Rapid growth in digital investment adoption. | Low fees, accessibility, personalized portfolios. |

Entrants Threaten

The significant capital required to enter the diversified holding company sector, particularly for those aiming for long-term value creation and active management across real estate, private equity, and listed companies, acts as a substantial barrier. For instance, establishing a robust portfolio in 2024 would necessitate hundreds of millions, if not billions, of dollars in initial investment and ongoing capital commitments for acquisitions and operational support, effectively deterring smaller or less capitalized players.

Established holding companies like Compagnie du Bois Sauvage leverage significant economies of scale. This translates into lower per-unit costs for crucial functions such as due diligence, portfolio management, and securing proprietary deals. For instance, a larger scale allows for more efficient allocation of resources across a wider range of investments, reducing overhead per investment.

Newcomers face a substantial hurdle in matching these efficiencies. Without the existing infrastructure and deal flow, they would need considerable upfront capital to build comparable capabilities. This makes it challenging for them to compete on cost or access the same quality of investment opportunities that Compagnie du Bois Sauvage can.

For a holding company like Compagnie du Bois Sauvage, access to distribution channels is crucial. This means having strong networks for finding promising investment opportunities and for attracting the necessary capital to fund them.

Established players often have deep-rooted relationships with entrepreneurs, sources of deal flow, and institutional investors. These established connections represent a significant barrier for new entrants who would struggle to build similar trusted networks quickly. For example, in 2024, the average time for a new private equity fund to raise its first $100 million was reported to be over 18 months, highlighting the challenges of accessing capital without existing relationships.

Government Policy and Regulations

Government policy and regulations present a substantial barrier to entry for new players in the financial sector, especially for entities like Compagnie du Bois Sauvage which operates within holding and investment fund structures. In Europe, for instance, the financial services industry is heavily regulated, demanding significant upfront investment and ongoing compliance. For example, the Solvency II directive, implemented in 2016 and continuing to evolve, imposes strict capital requirements and risk management standards on insurers and reinsurers, impacting related financial entities. This regulatory landscape means that new entrants must navigate complex licensing procedures and adhere to rigorous oversight, substantially increasing the cost and time required to establish a presence.

These regulatory hurdles translate into tangible financial commitments. New entrants must allocate considerable resources to legal counsel, compliance officers, and the implementation of robust internal control systems. The European Union’s MiFID II (Markets in Financial Instruments Directive II), which came into full effect in 2018, further intensified transparency and investor protection requirements, adding layers of complexity and cost for any firm operating within its scope. Consequently, the threat of new entrants is significantly diminished as only well-capitalized and well-prepared organizations can realistically overcome these entry barriers.

- High Capital Requirements: Regulations often mandate substantial minimum capital levels, making it difficult for smaller, new firms to enter.

- Licensing and Approval Processes: Obtaining necessary licenses can be lengthy, costly, and uncertain, deterring potential new entrants.

- Ongoing Compliance Costs: Adhering to evolving regulations requires continuous investment in systems and personnel.

- Reputational Risk: Non-compliance can lead to severe penalties and reputational damage, a risk new entrants are less equipped to absorb.

Brand Identity and Reputation

Compagnie du Bois Sauvage benefits from a long-standing reputation as a stable, family-owned company with a focus on long-term value. This established brand identity, built over decades, fosters significant trust within the investment community. For example, as of early 2024, the company's consistent dividend payouts, a key element of its reputation, have been maintained for over 50 years, demonstrating a commitment to shareholder value.

Building a similar level of trust and brand identity in the investment community takes considerable time and a consistent track record. New entrants would need to demonstrate not only financial stability but also a deep understanding of the markets Compagnie du Bois Sauvage operates in, which is a significant barrier to entry. The company's market capitalization, which stood at approximately €1.5 billion in mid-2024, reflects this ingrained market confidence.

- Established Trust: Compagnie du Bois Sauvage's family-owned status and long-term focus contribute to a strong, trusted brand identity.

- Track Record Requirement: New entrants face a substantial hurdle in replicating this trust, which requires years of consistent performance and stability.

- Market Capitalization Indicator: The company's market value of around €1.5 billion in 2024 underscores the established confidence new competitors must overcome.

- Reputational Barrier: The significant time and effort needed to build a comparable reputation act as a deterrent to potential new entrants.

The threat of new entrants for Compagnie du Bois Sauvage is considerably low due to significant barriers. The substantial capital required to establish a diversified holding company, coupled with stringent regulatory requirements like those in the EU, makes entry extremely difficult for new players. Furthermore, established players benefit from economies of scale and deep-rooted relationships, creating a competitive advantage that is hard for newcomers to overcome.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High initial investment needed for portfolio building and operations. | Deters smaller, less capitalized firms. | Hundreds of millions to billions of dollars. |

| Economies of Scale | Lower per-unit costs for functions like due diligence and portfolio management. | New entrants struggle to match cost efficiencies. | Larger scale allows for more efficient resource allocation. |

| Access to Distribution Channels/Networks | Strong relationships with deal sources and investors. | New entrants face challenges in building trust and securing capital. | Raising first $100M fund can take over 18 months without existing relationships. |

| Government Policy & Regulations | Complex licensing, capital mandates, and compliance costs (e.g., MiFID II). | Increases cost and time to establish a presence. | Solvency II, MiFID II impose strict capital and transparency rules. |

| Brand Identity & Reputation | Long-standing trust and consistent track record. | New entrants need years to build comparable market confidence. | Compagnie du Bois Sauvage market cap ~€1.5 billion in mid-2024. |

Porter's Five Forces Analysis Data Sources

Our Compagnie du Bois Sauvage Porter's Five Forces analysis is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and publicly available financial statements. We supplement this with industry-specific market research reports and data from reputable trade associations to provide a robust understanding of the competitive landscape.