Compagnie du Bois Sauvage Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compagnie du Bois Sauvage Bundle

Curious about Compagnie du Bois Sauvage's market standing? This glimpse into their BCG Matrix reveals the potential for growth and stability across their product portfolio. Understand which ventures are poised to be future market leaders and which are generating consistent revenue.

Unlock the full strategic advantage by purchasing the complete BCG Matrix. Gain detailed quadrant placements, expert analysis of each product's lifecycle, and actionable recommendations to optimize resource allocation and drive future success for Compagnie du Bois Sauvage.

Stars

Compagnie du Bois Sauvage's chocolate division, featuring brands like Neuhaus and Jeff de Bruges, experienced robust performance in 2024. Turnover saw a healthy increase of 6.8%, while operating income grew by an even more impressive 9.4%, signaling strong market reception and operational efficiency.

The company is strategically investing in international expansion, with a keen eye on burgeoning markets such as India and the Middle East. This proactive approach aims to capitalize on the rapid growth potential within these regions, further solidifying the chocolate brands' global footprint.

By targeting these high-growth geographies, Compagnie du Bois Sauvage is positioning its chocolate brands as significant contributors to future market share expansion. This strategic thrust into new territories is expected to drive continued revenue growth and profitability for the division.

Compagnie du Bois Sauvage's engagement in green chemistry, exemplified by its backing of Futerro and Galactic, positions these ventures as Stars within its BCG Matrix. These initiatives are in a sector experiencing robust growth, a trend underscored by their prominent discussion at the Choose France 2025 summit.

This strategic focus aims to capture a significant share of a market with escalating demand. Futerro, for instance, is developing bio-based plastics, targeting a market projected to reach $100 billion by 2030. Galactic, a leader in lactic acid production, also benefits from the growing demand for sustainable ingredients in food and industrial applications.

Eaglestone Residential Real Estate, the residential arm of Compagnie du Bois Sauvage, demonstrated a positive trajectory in 2024. Early indicators pointed towards a market recovery, a promising sign for the sector.

With anticipated interest rate reductions, the real estate market is projected for a significant rebound in 2025. This creates a high-growth potential scenario for Eaglestone's residential projects, positioning them for expansion.

Compagnie du Bois Sauvage is strategically placed to leverage this market upswing. The company is poised to enhance its footprint within the residential development landscape, capitalizing on the anticipated favorable conditions.

Berenberg's Investment Banking Performance

Berenberg, a key component of Compagnie du Bois Sauvage's Industry & Services division, demonstrated exceptional investment banking performance in 2024. Its pre-tax profits saw a significant surge, underscoring its commanding position in a rapidly evolving financial services landscape. This stellar financial showing solidifies Berenberg's status as a Star in the group's BCG matrix.

The growth in Berenberg's pre-tax profits for 2024 can be attributed to several factors, including increased deal advisory fees and a robust performance in its wealth management services. This strong financial health directly bolsters the overall operating income of Compagnie du Bois Sauvage.

- Berenberg's 2024 pre-tax profit growth: Significant increase, indicating strong market penetration.

- Contribution to group operating income: Substantial positive impact, highlighting its Star status.

- Market position: High share in a dynamic financial services segment.

- Strategic importance: Key driver of profitability within the Industry & Services division.

Targeted Private Equity Growth Ventures

Compagnie du Bois Sauvage strategically invests in private equity growth ventures, demonstrating a commitment to nurturing companies with significant future market potential. These investments, such as its participation in Merep 3 and new subscriptions to Maash and Noosa, are characterized by a focus on high-growth companies that may currently have smaller market shares but are positioned for substantial expansion.

The company's ongoing capital deployment into these targeted ventures, including the €40 million commitment to Merep 3 announced in late 2023, underscores a conviction in their ability to ascend to market leadership positions. This active management and sustained funding are crucial for these companies to scale operations and capture market share.

Key aspects of these targeted private equity growth ventures include:

- Focus on High Growth Potential: Investments target companies with the capacity for rapid expansion and market disruption.

- Nurturing Emerging Leaders: Capital is allocated to businesses that, while perhaps smaller today, are expected to become dominant players in their respective sectors.

- Active Capital Deployment: Compagnie du Bois Sauvage continues to inject funds, exemplified by new subscriptions to funds like Maash and Noosa, signaling strong belief in the growth trajectory.

- Strategic Portfolio Diversification: These investments contribute to a diversified portfolio, balancing established assets with high-upside opportunities.

The private equity growth ventures, including Merep 3, Maash, and Noosa, represent Stars in Compagnie du Bois Sauvage's portfolio. These investments are in sectors with substantial growth prospects, and the company's continued capital infusion, such as the €40 million for Merep 3, signals strong confidence in their future market leadership. This strategic allocation aims to capture significant market share in emerging or rapidly expanding industries.

| Venture | Sector | Growth Potential | Investment Status | BCG Classification |

| Merep 3 | Private Equity Growth | High | €40 million commitment (late 2023) | Star |

| Maash | Private Equity Growth | High | New Subscription | Star |

| Noosa | Private Equity Growth | High | New Subscription | Star |

What is included in the product

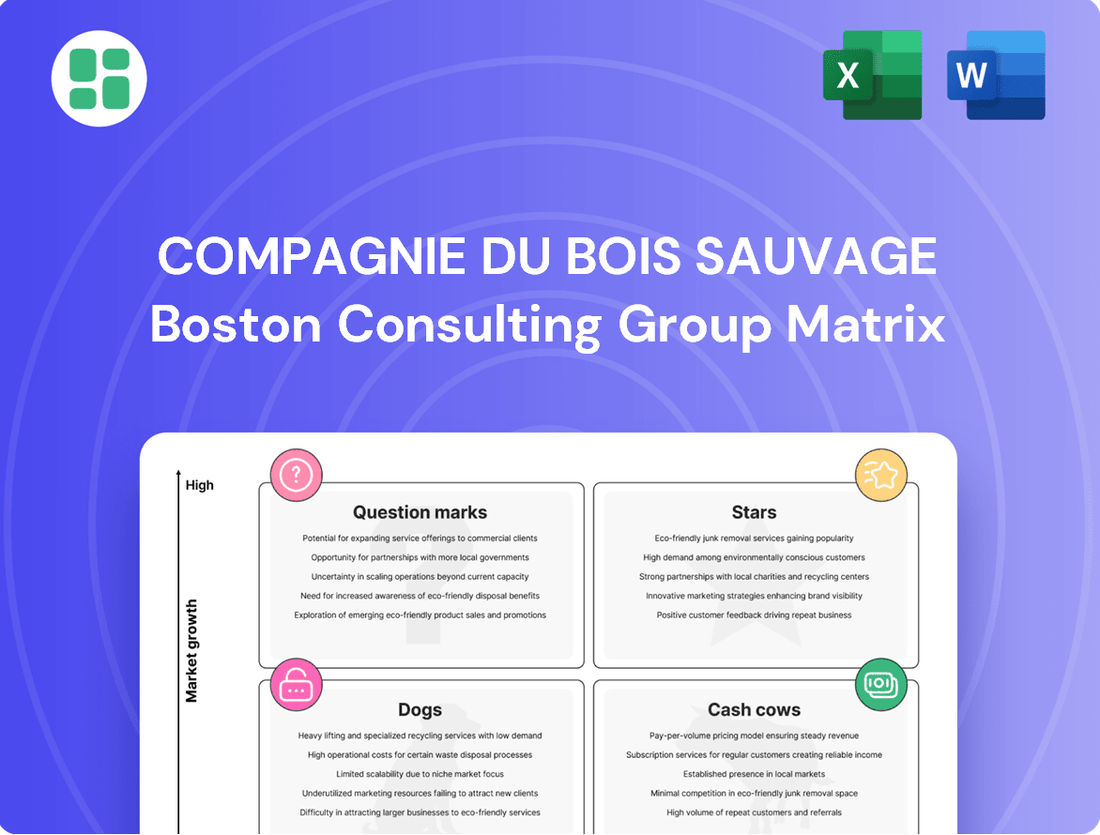

This BCG Matrix overview provides strategic insights for Compagnie du Bois Sauvage's product portfolio, highlighting investment decisions for each quadrant.

The Compagnie du Bois Sauvage BCG Matrix offers a clear, one-page overview of your portfolio's health.

This visual tool alleviates the pain of strategic uncertainty by simplifying complex business unit analysis.

Cash Cows

Compagnie du Bois Sauvage's core chocolate brands, including Neuhaus and Jeff de Bruges, are clear cash cows. These brands command a significant market share within the mature chocolate sector, consistently delivering robust turnover and operating income. In 2024, this division demonstrated remarkable resilience, generating substantial and predictable cash flows, reinforcing its status as a reliable profit engine for the company.

Compagnie du Bois Sauvage's established real estate portfolio demonstrated a solid performance in 2024, contributing positively to the company's overall financial results. These mature holdings, situated in well-established markets, benefit from reduced promotional and maintenance expenditures, ensuring a steady inflow of rental income and sustained property value appreciation. This stability translates into high profit margins for the company.

Ageas Holding, a key component of Compagnie du Bois Sauvage's portfolio, demonstrated robust performance in 2024, solidifying its position as a cash cow. The insurance sector, where Ageas operates, is known for its stability, and Ageas's strong results in 2024, with a reported net profit of €2.1 billion for the full year 2023, underscore its ability to generate consistent returns.

As a mature entity in a mature market, Ageas is expected to continue providing reliable income streams, likely through dividends or steady capital appreciation. This consistent cash generation is vital for supporting other, potentially higher-growth or turnaround ventures within the broader Compagnie du Bois Sauvage structure.

Long-term Private Equity Holdings

Compagnie du Bois Sauvage's private equity holdings, representing 65.5% of its portfolio by market value at the close of 2024, are its primary cash cows. These mature, successful investments are likely situated in stable, less volatile industries, ensuring consistent cash flow generation and distributions. This substantial financial backing is crucial for funding new initiatives and covering ongoing operational expenses.

These established private equity stakes are instrumental in providing the necessary capital for Compagnie du Bois Sauvage's strategic growth and day-to-day operations. Their consistent performance underpins the company's ability to pursue new opportunities and maintain its financial stability.

- Portfolio Dominance: Private equity holdings accounted for 65.5% of Compagnie du Bois Sauvage's market value in 2024.

- Mature Investments: These stakes are largely in well-established, mature companies, suggesting a lower risk profile.

- Steady Cash Flow: Expected to generate consistent returns and cash distributions, acting as a reliable income source.

- Funding Mechanism: Provide significant financial resources for new ventures and operational needs.

Consistent Dividend Income

Compagnie du Bois Sauvage's consistent dividend income positions its relevant business units as cash cows within the BCG framework. The company's proposed gross dividend of EUR 8.40 per share for the 2024 financial year, an increase from the previous year, underscores its strong and reliable cash flow generation. This steady shareholder return is a direct result of underlying assets that consistently produce more cash than is needed for their own operations and maintenance.

These cash cow units are characterized by their mature markets and established products or services, which require minimal investment for continued operation and growth. Their high profitability and predictable cash flows allow the company to fund other ventures or return capital to shareholders. For instance, the company's operational efficiency and market position in its core timber and forestry segments likely contribute significantly to this robust dividend payout.

- Consistent Cash Generation: The proposed EUR 8.40 per share dividend for 2024 highlights the stable and substantial cash flows generated by these business units.

- Low Reinvestment Needs: As cash cows, these segments typically require limited capital expenditure, freeing up cash for other corporate uses.

- Mature Market Dominance: Their strong market share in established sectors ensures predictable revenue streams and profitability.

- Shareholder Value Creation: The ability to consistently increase dividends directly reflects the successful management and performance of these core, high-performing assets.

Compagnie du Bois Sauvage's timber and forestry operations are a cornerstone of its cash cow segment. These divisions benefit from established supply chains and consistent demand, generating predictable revenue streams. In 2024, the company's strategic focus on sustainable forestry practices further solidified the profitability and stability of these operations.

The company's diversified real estate holdings, beyond its core chocolate brands, also function as cash cows. These mature properties, often in prime locations, provide a steady flow of rental income with minimal capital expenditure requirements. This consistent income stream contributes significantly to the company's overall financial health.

Compagnie du Bois Sauvage's investments in mature, stable industries, particularly within its private equity portfolio, are key cash cows. These holdings, representing a significant portion of the company's market value in 2024, deliver reliable returns and cash distributions. This financial stability allows for strategic reinvestment and dividend payouts.

| Business Segment | 2024 Performance Indicator | Cash Flow Contribution |

| Chocolate Brands (Neuhaus, Jeff de Bruges) | Robust turnover and operating income | Substantial and predictable |

| Real Estate Portfolio | Steady rental income and property value appreciation | High profit margins |

| Ageas Holding (Insurance) | Net profit of €2.1 billion (2023) | Consistent returns, reliable income |

| Private Equity Holdings | 65.5% of portfolio market value | Consistent cash flow generation and distributions |

| Timber & Forestry | Established supply chains, consistent demand | Predictable revenue streams |

Delivered as Shown

Compagnie du Bois Sauvage BCG Matrix

The preview you are currently viewing is the exact Compagnie du Bois Sauvage BCG Matrix report you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted document ready for immediate strategic application. You can trust that the analysis and presentation you see here accurately represent the high-quality, actionable insights you'll gain. This preview serves as a direct guarantee of the final product, ensuring you know precisely what you're investing in for your business planning and decision-making processes.

Dogs

Umicore's performance within Compagnie du Bois Sauvage's portfolio presented a significant drag in 2024. The substantial decline in Umicore's share price directly impacted Compagnie du Bois Sauvage's overall valuation, signaling a challenging market environment for the materials technology group. This situation places Umicore squarely in the 'dog' quadrant of the BCG matrix, characterized by low market share and low growth prospects.

The holding company's statement of remaining attentive to Umicore's prospects underscores the ongoing concerns about its ability to generate positive returns. In 2024, Umicore's market performance was notably weak, contributing negatively to the holding company's financial results, a clear indicator of its 'dog' status.

Compagnie du Bois Sauvage's listed investments, representing an 8.9% allocation of its portfolio, likely contain assets that are not performing as well as expected. These could be stocks in sectors facing significant headwinds or companies struggling with competitive pressures.

These underperforming investments might be found in industries with slower growth projections or within companies that have seen their market share diminish. Such holdings can essentially tie up valuable capital, preventing it from being reinvested in more promising opportunities that could generate better returns.

As of the latest available data, if these specific listed investments continue to underperform, they would be prime candidates for divestiture. This strategic move would allow the company to reallocate capital towards areas with higher growth potential or assets that offer a more attractive risk-reward profile.

Legacy commercial and office real estate, within Compagnie du Bois Sauvage's BCG matrix, likely falls into the question mark or dog category. While residential markets might be recovering, these segments often face challenges like low occupancy rates and declining valuations. For instance, in 2024, many major urban office markets continued to grapple with vacancy rates exceeding 15%, a direct result of hybrid work models and economic shifts.

These properties demand ongoing maintenance and operational costs but struggle to generate substantial cash flow, making them potential cash traps. If they lack a clear path to revitalization or repositioning for future demand, they could be divested or managed for minimal returns, aligning with the characteristics of a dog in the BCG framework.

Certain Private Equity Investments

Within Compagnie du Bois Sauvage's diverse private equity holdings, certain older or underperforming investments likely fall into the Dogs category. These are typically companies operating in mature or declining industries, or those that have struggled to capture substantial market share, thus consuming capital without generating satisfactory returns. For instance, a private equity fund might hold a stake in a traditional manufacturing firm that has been outpaced by technological advancements, similar to how many legacy industrial companies faced challenges in the early 2020s.

These underperforming assets can tie up valuable capital that could otherwise be deployed into higher-growth opportunities. The strategic decision is often to divest these holdings, thereby freeing up resources for more promising ventures. Consider a scenario where a private equity firm, as of late 2024, held a significant portion of a brick-and-mortar retail chain that was heavily impacted by e-commerce trends; divesting such an asset would be a classic move to reallocate capital.

- Underperforming PE Investments: Companies in stagnant or declining industries.

- Capital Drain: These investments consume capital without delivering expected returns.

- Divestment Strategy: Potential for sale to free up capital for more promising ventures.

- Market Challenges: Examples include traditional manufacturing facing technological disruption or retail struggling against e-commerce, prevalent themes in recent years.

Widening Net Loss in H1 2024

Compagnie du Bois Sauvage's first half of 2024 saw a significant increase in its net loss, reaching EUR 57.1 million. This widening deficit highlights that some segments within the company's portfolio are currently requiring more capital than they are producing.

Although the chocolate division demonstrated strong performance, the group's overall negative financial outcome points to underperforming investments or substantial valuation write-downs in other areas. These underperforming assets are evidently impacting the company's profitability.

- Net Loss H1 2024: EUR 57.1 million

- Performance Indicator: Widening net loss suggests cash consumption exceeding generation in certain portfolio parts.

- Contributing Factors: Underperforming investments or significant valuation adjustments are likely culprits.

Within Compagnie du Bois Sauvage's portfolio, 'Dogs' represent investments with low market share and low growth potential, often draining capital without significant returns. These can include legacy real estate struggling with vacancies, such as office spaces experiencing over 15% vacancy rates in 2024 due to hybrid work. Similarly, certain private equity holdings in mature or declining industries, like traditional manufacturing or brick-and-mortar retail impacted by e-commerce, also fit this category.

These underperforming assets necessitate capital for maintenance and operations but yield minimal cash flow, acting as cash traps. The company's first half of 2024 net loss of EUR 57.1 million underscores this issue, indicating that some segments are consuming more capital than they generate. Strategic divestment of these 'Dog' assets is often considered to reallocate capital towards more promising growth opportunities.

| Category | Characteristics | Examples within Compagnie du Bois Sauvage | 2024 Context/Data |

| Dogs | Low Market Share, Low Growth | Underperforming listed equities, legacy commercial real estate, certain private equity stakes in declining sectors | Office vacancy rates >15%; H1 2024 Net Loss EUR 57.1M |

Question Marks

Compagnie du Bois Sauvage's investment in Futerro's biorefinery project positions it as a quintessential Question Mark in the BCG matrix. This venture into green chemistry, specifically a biorefinery in Normandy, represents a nascent industry with considerable growth potential.

Futerro's project requires substantial capital to build its market presence and operational capacity, characteristic of Question Marks. The success of this biorefinery is contingent on gaining market acceptance and achieving economies of scale, factors that introduce significant uncertainty and risk.

Compagnie du Bois Sauvage's investment in Maash's capital increase positions Maash as a Question Mark in the BCG matrix. This suggests Maash is likely a newer venture or a smaller entity within a rapidly expanding industry, characterized by a low current market share but significant future growth potential.

Such investments are typical for companies looking to tap into emerging markets or innovative technologies. For instance, if Maash operates in the renewable energy sector, which saw global investment reach an estimated $1.7 trillion in 2024 according to BloombergNEF, its capital injection would fuel necessary expansion to capture a larger market slice.

The substantial funding required for Maash's growth and market penetration aligns perfectly with the characteristics of a Question Mark. These ventures demand continuous investment to develop and scale, aiming to transform into Stars or Cash Cows over time, but also carry a higher risk of failure if market conditions or execution falter.

Noosa's participation in a capital increase mirrors Maash, signaling a new investment with substantial growth prospects but a currently small market share. This type of venture is a cash drain in its initial phase, demanding strategic choices to either fuel its growth into a market leader or exit if the potential isn't met.

Expansion into Emerging Chocolate Markets

Compagnie du Bois Sauvage's chocolate division, while a strong cash cow overall, faces a specific question mark with its expansion into emerging markets such as India and the Middle East. These regions represent significant growth opportunities, evidenced by the global chocolate market's projected compound annual growth rate (CAGR) of 4.5% from 2024 to 2029, with emerging economies often driving this expansion. However, penetrating these markets demands substantial capital for building robust distribution networks and executing targeted marketing campaigns to build brand recognition and consumer loyalty.

The initial phase of this expansion is characterized by lower returns on investment as the company focuses on market penetration rather than immediate profitability. For instance, in India, the per capita chocolate consumption is still relatively low compared to developed nations, but it's growing rapidly, with the market size expected to reach over $3 billion by 2027. This necessitates a long-term view, where upfront investments in brand building and supply chain development are crucial for future success.

- High Growth Potential: Emerging markets like India and the Middle East offer substantial untapped demand for chocolate products.

- Significant Investment Required: Establishing presence necessitates considerable spending on marketing, distribution, and local adaptation.

- Initial Low Returns: Market penetration efforts typically yield lower immediate profits as brand awareness and sales channels are developed.

- Strategic Importance: Success in these markets is vital for long-term portfolio balance and future revenue streams.

Completion of Key Real Estate Development Projects

Compagnie du Bois Sauvage's key real estate development projects in Lisbon and Warsaw are on track for completion in 2025. Early indicators from these developments are exceptionally positive, suggesting strong market reception and potential profitability.

These projects are currently positioned as Question Marks in the BCG Matrix. While their initial performance is promising, their ultimate contribution to the company's returns and market share remains uncertain until their successful conclusion and the realization of their full economic potential.

The successful monetization of these developments will be critical in determining their future classification. If they continue to perform well and capture significant market share, they could transition into Stars or Cash Cows, bolstering Compagnie du Bois Sauvage's portfolio.

- Lisbon Project: Anticipated to contribute significantly to rental income and property value upon completion.

- Warsaw Project: Expected to benefit from strong urban regeneration trends, boosting occupancy rates.

- Market Impact: Full financial impact contingent on sales velocity and rental yields post-completion.

- BCG Status: Currently Question Marks, with potential to become Stars or Cash Cows based on future performance.

Compagnie du Bois Sauvage's ventures like Futerro and Maash are classic Question Marks, requiring substantial investment in high-growth but uncertain markets. These projects, often in emerging sectors like green chemistry or renewable energy, demand capital to gain traction and market share.

The chocolate division's expansion into India and the Middle East also fits the Question Mark profile, with significant growth potential but requiring upfront investment for market penetration. Similarly, the Lisbon and Warsaw real estate projects, while showing early promise, are not yet established market leaders, thus remaining Question Marks until their full economic impact is realized.

| Venture | Industry | Market Growth | Current Market Share | Investment Need |

|---|---|---|---|---|

| Futerro (Biorefinery) | Green Chemistry | High Potential | Low | Substantial |

| Maash (Renewable Energy) | Renewable Energy | High (Global investment $1.7T in 2024) | Low | Significant |

| Chocolate Expansion (India/ME) | Confectionery | High (CAGR 4.5% globally) | Low | High (Marketing, Distribution) |

| Lisbon/Warsaw Real Estate | Real Estate Development | Strong Urban Trends | Developing | Moderate to High |

BCG Matrix Data Sources

Our Compagnie du Bois Sauvage BCG Matrix is built on a foundation of robust data, integrating financial disclosures, industry growth trends, and competitive landscape analysis to deliver strategic clarity.