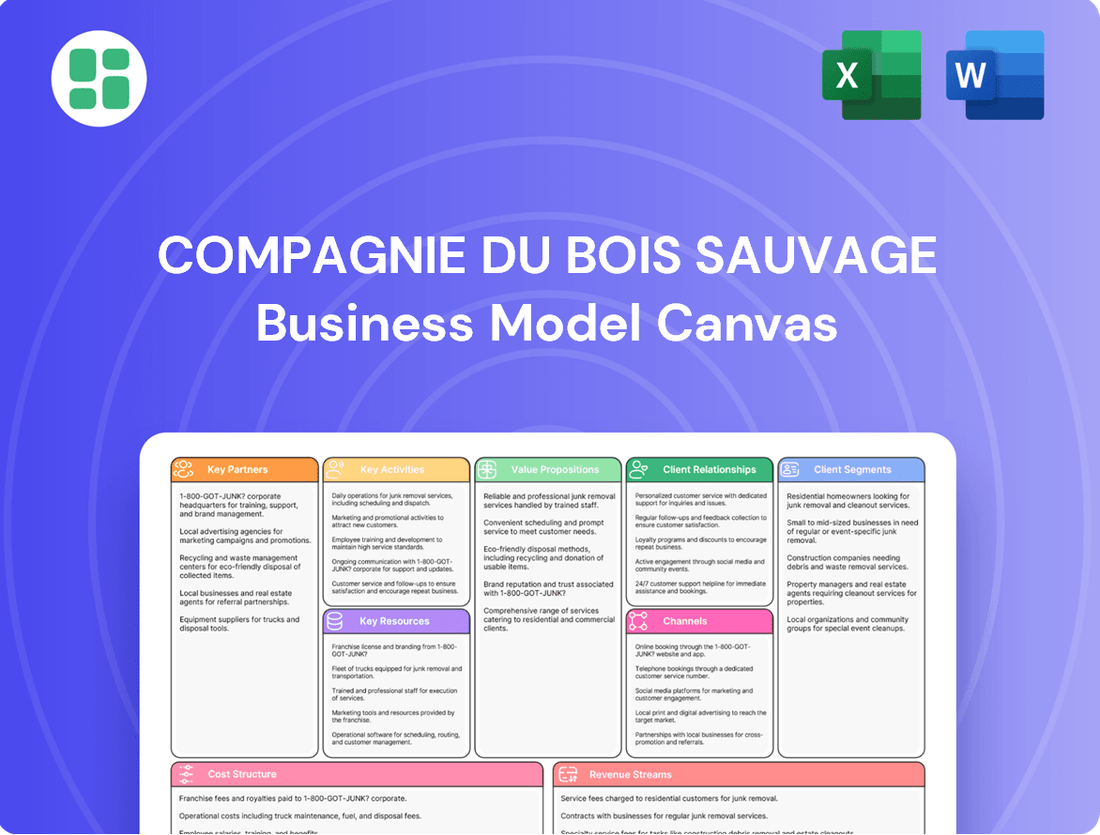

Compagnie du Bois Sauvage Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compagnie du Bois Sauvage Bundle

Uncover the strategic core of Compagnie du Bois Sauvage with its complete Business Model Canvas. This detailed breakdown reveals their unique approach to value creation, customer engagement, and operational efficiency. See how they navigate the market and identify opportunities for your own business.

Partnerships

Compagnie du Bois Sauvage actively collaborates with other financial funds and co-investors, including entities like the FRI 2 fund and Merep 3 fund. These strategic alliances allow for pooled capital, enabling larger and more impactful investments across a range of opportunities. For instance, in 2024, such co-investments were instrumental in deploying significant capital into emerging market infrastructure projects.

Compagnie du Bois Sauvage cultivates enduring partnerships with the leadership and founders of its portfolio companies, such as Neuhaus, Jeff de Bruges, Eaglestone, and Futerro. This commitment extends beyond capital, offering active guidance and knowledge transfer to fuel their expansion.

This deep involvement is central to their strategy for creating value, ensuring the sustained growth and prosperity of these enterprises. For instance, in 2024, Neuhaus reported a 7% increase in revenue, underscoring the effectiveness of this collaborative management approach.

Compagnie du Bois Sauvage leverages key partnerships with financial agents and specialized service providers. For instance, Euroclear Belgium plays a vital role in facilitating essential financial operations, including the smooth disbursement of dividends and the execution of share buyback initiatives.

These collaborations are fundamental for ensuring that all financial transactions are conducted with utmost efficiency and in strict adherence to regulatory requirements. Such partnerships are indispensable for maintaining robust liquidity within the company and for effectively managing its relationships with shareholders, thereby fostering trust and transparency.

Real Estate Development Partners

Compagnie du Bois Sauvage leverages key partnerships within its real estate development division to drive significant project execution. These collaborations are crucial for undertaking and successfully delivering large-scale ventures.

The company actively partners with major developers on high-profile projects, demonstrating the strategic importance of these relationships. Notable examples include the Praça de Espanha development in Lisbon and the Chmielna project in Warsaw.

- Praça de Espanha, Lisbon: This partnership facilitates the development of a significant urban regeneration project, contributing to Lisbon's evolving landscape.

- Chmielna, Warsaw: Collaboration on this Warsaw development leverages specialized expertise for complex property solutions.

- Expertise Integration: These alliances allow Compagnie du Bois Sauvage to tap into specialized development knowledge, enhancing project feasibility and profitability.

Supply Chain Partners for Operating Divisions

Compagnie du Bois Sauvage relies on strategic supply chain partners, such as Ecuadorcolat, to ensure a consistent flow of raw materials for its operating divisions, especially its chocolate business. These relationships are vital for mitigating risks associated with commodity price swings, like the fluctuating cost of cocoa beans.

These alliances are designed to safeguard the stability and profitability of the company's primary revenue streams. By securing reliable sources, Compagnie du Bois Sauvage can better manage its cost of goods sold and maintain competitive pricing in the market.

For instance, in 2024, the global cocoa market experienced significant price increases, with futures contracts reaching record highs. Partnerships like the one with Ecuadorcolat would have been instrumental in buffering the impact of such volatility on Compagnie du Bois Sauvage's operating margins.

- Key Supplier: Ecuadorcolat for cocoa sourcing.

- Risk Mitigation: Protection against cocoa price volatility.

- Strategic Importance: Ensuring raw material stability for the Chocolate segment.

- Profitability Enhancement: Stabilizing cost of goods sold and maintaining margins.

Compagnie du Bois Sauvage's key partnerships are multifaceted, spanning financial co-investors, portfolio company leadership, financial agents, and real estate developers. These alliances are crucial for capital pooling, strategic guidance, efficient financial operations, and large-scale project execution.

In 2024, partnerships were vital for deploying capital into infrastructure and supporting portfolio company growth, with Neuhaus seeing a 7% revenue increase. Collaborations with developers on projects like Praça de Espanha in Lisbon and Chmielna in Warsaw highlight the company's ability to leverage specialized expertise for complex ventures.

| Partner Type | Examples | 2024 Impact/Focus |

|---|---|---|

| Financial Co-investors | FRI 2 fund, Merep 3 fund | Pooled capital for infrastructure investments |

| Portfolio Company Leadership | Neuhaus, Jeff de Bruges, Eaglestone, Futerro | Active guidance and knowledge transfer |

| Financial Agents | Euroclear Belgium | Dividend disbursement, share buybacks |

| Real Estate Developers | Partners on Praça de Espanha, Chmielna | Large-scale project execution, expertise integration |

| Supply Chain Partners | Ecuadorcolat | Raw material sourcing (cocoa), mitigating price volatility |

What is included in the product

This Business Model Canvas provides a detailed blueprint for Compagnie du Bois Sauvage, outlining its core customer segments, value propositions, and revenue streams within the sustainable forestry sector.

It offers a strategic overview of key partners, activities, and resources, highlighting competitive advantages and potential risks for informed decision-making.

The Compagnie du Bois Sauvage Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operations, simplifying complex strategies for efficient understanding and discussion.

Activities

Compagnie du Bois Sauvage actively manages its diverse portfolio, which spans real estate, private equity, and publicly traded companies. This hands-on approach involves constant performance tracking, making strategic shifts, and improving operations within its various holdings to foster long-term value growth.

Compagnie du Bois Sauvage's strategic investment and acquisition activities are central to its growth, focusing on identifying and executing deals in promising sectors. This includes thorough due diligence and capital allocation for both public and private companies.

The company actively acquires stakes in businesses, as seen with recent capital increases in Futerro and Maash, signaling a focus on emerging and sustainable industries. These investments are crucial for diversifying its portfolio and capitalizing on future growth opportunities.

Compagnie du Bois Sauvage actively enhances operational performance across its diverse holdings, offering specialized expertise and strategic support. This hands-on approach is crucial for driving growth and maximizing the potential of companies like Neuhaus and Jeff de Bruges in the competitive chocolate market.

The company's commitment to tangible, sustainable growth is evident in its direct involvement with its portfolio. For instance, in 2024, the Chocolate division, which includes Neuhaus and Jeff de Bruges, saw continued investment in production efficiency and market expansion strategies, contributing to its overall resilience.

Financial Capital Management

Compagnie du Bois Sauvage's financial capital management is a cornerstone of its operations, focusing on returning value to shareholders and maintaining financial health. This involves strategic dividend distributions and active share buyback programs, demonstrating a commitment to capital efficiency. For instance, the company has consistently utilized share buybacks on Euronext Brussels as a tool to enhance shareholder returns and optimize its capital structure.

The company's financial discipline is evident in its approach to cash management, ensuring liquidity while pursuing growth opportunities. This prudent management underpins its long-term stability and reinforces its value proposition to investors. In 2023, Compagnie du Bois Sauvage reported a net profit of €10.9 million, with a significant portion allocated to dividends and share repurchases, highlighting its active capital management strategy.

- Dividend Payments: The company regularly distributes dividends to its shareholders, rewarding their investment.

- Share Buyback Programs: Compagnie du Bois Sauvage actively engages in share buybacks on Euronext Brussels, aiming to reduce outstanding shares and boost per-share value.

- Cash Management: Prudent management of its cash reserves ensures operational flexibility and financial stability.

- Shareholder Returns: These activities collectively underscore the company's dedication to enhancing shareholder value and capital efficiency.

Investor Relations and Stakeholder Communication

Compagnie du Bois Sauvage actively manages its relationships with investors and stakeholders through consistent and open communication. This involves the timely dissemination of financial performance data and strategic updates.

Key activities include the publication of comprehensive annual and half-yearly financial reports, ensuring shareholders have access to detailed performance metrics. The company also issues press releases and newsletters to keep stakeholders informed of significant developments.

- Transparent Reporting: Publication of annual and half-yearly reports, providing detailed financial and operational insights.

- Proactive Communication: Regular press releases and newsletters to update stakeholders on company news and strategy.

- Stakeholder Engagement: Active participation in annual general meetings to foster dialogue and build confidence.

- Information Accessibility: Ensuring all published information is readily available to shareholders and the wider investment community.

Compagnie du Bois Sauvage's key activities revolve around strategic investment and active portfolio management. This includes identifying and acquiring stakes in promising companies, as demonstrated by recent capital increases in Futerro and Maash, signaling a focus on sustainable industries. The company also actively works to enhance the operational performance of its existing holdings, such as Neuhaus and Jeff de Bruges in the chocolate sector, by investing in production efficiency and market expansion.

Financial management is also a core activity, with a strong emphasis on shareholder returns. This is achieved through consistent dividend payments and active share buyback programs on Euronext Brussels. The company prioritizes prudent cash management to ensure operational flexibility and financial stability, as evidenced by its 2023 net profit of €10.9 million, a significant portion of which was allocated to dividends and share repurchases.

Furthermore, Compagnie du Bois Sauvage maintains robust investor relations through transparent reporting and proactive communication. This involves publishing detailed annual and half-yearly financial reports, issuing press releases, and engaging with stakeholders at annual general meetings to ensure information accessibility and build confidence.

| Key Activity | Description | Example/Data Point |

| Portfolio Management | Active management and growth of diverse holdings. | Investments in Futerro and Maash (2024). |

| Operational Enhancement | Improving performance within portfolio companies. | Focus on production efficiency for Neuhaus and Jeff de Bruges (2024). |

| Shareholder Returns | Maximizing value for investors. | Share buybacks on Euronext Brussels; 2023 net profit of €10.9M allocated to dividends/repurchases. |

| Stakeholder Communication | Maintaining transparent and consistent information flow. | Publication of annual/half-yearly reports; regular press releases. |

Preview Before You Purchase

Business Model Canvas

The Compagnie du Bois Sauvage Business Model Canvas you are previewing is the exact document you will receive upon purchase. This means you're seeing a direct snapshot of the comprehensive strategic plan, showcasing all key elements of the business model. Once your order is complete, you'll gain full access to this same, professionally structured document, ready for immediate use and analysis.

Resources

Compagnie du Bois Sauvage's financial capital is a cornerstone of its business model, encompassing significant equity and a consolidated net cash surplus. This robust financial foundation, as evidenced by its strong balance sheet, enables strategic investments and the effective management of its varied business interests.

The company's substantial financial resources, including a healthy cash position, empower it to pursue growth through strategic acquisitions and fund organic expansion initiatives. This financial flexibility is crucial for capitalizing on market opportunities and maintaining a competitive edge.

As of its latest reporting, Compagnie du Bois Sauvage demonstrated a solid financial standing, with its capital base supporting its operational needs and strategic objectives. This financial strength ensures the company can navigate market fluctuations and invest in future development.

Compagnie du Bois Sauvage's core strength lies in its diverse portfolio of holdings, a key resource that underpins its business model. This diversification spans real estate, private equity, and publicly traded companies, offering a robust foundation against market volatility.

The company's significant stakes include prominent brands like Neuhaus and Jeff de Bruges in the confectionery sector, demonstrating its presence in consumer goods. In real estate, Eaglestone represents a key investment, while its involvement in investment banking through Berenberg highlights its financial sector reach.

This broad spectrum of assets, including its 2024 reported net asset value of €1.1 billion, provides multiple avenues for value creation and ensures resilience. The breadth of these holdings allows Compagnie du Bois Sauvage to capitalize on opportunities across different economic cycles and industries.

Compagnie du Bois Sauvage's management team brings a wealth of experience, a critical asset for navigating diverse investment landscapes. Their collective expertise allows for rigorous due diligence and strategic oversight of portfolio companies, ensuring alignment with the company's long-term objectives.

This deep investment acumen is not just about identifying potential; it's about actively nurturing growth. The team’s ability to provide hands-on strategic guidance is a key driver in enhancing the operational performance of their investments, fostering sustainable value creation.

The company's prudent approach and long-term vision are directly attributable to this robust internal capability. It's this human capital that underpins their success in the dynamic world of investment and business development.

Reputation and Established Network

Compagnie du Bois Sauvage leverages its strong reputation as a trusted, family-owned partner listed on Euronext Brussels. This solid standing, combined with an extensive network across European markets, actively cultivates new investment prospects and nurtures robust relationships with entrepreneurs. Their dedication to sustainable and responsible projects significantly bolsters this credibility.

- Reputation as a Trusted Partner: The company is recognized for its reliability and long-term commitment.

- Established Network: Access to a wide array of contacts and opportunities within European business ecosystems.

- Family-Owned Stability: Provides a sense of continuity and a patient capital approach to investments.

- Commitment to Sustainability: Enhances brand image and attracts partners aligned with responsible practices.

Brand Equity and Intellectual Property of Portfolio Companies

The robust brand equity and intellectual property of Compagnie du Bois Sauvage's portfolio companies, especially within its confectionery division, are critical resources. Brands like Neuhaus and Jeff de Bruges, with their long-standing reputations for quality and craftsmanship, are significant drivers of revenue and market share. In 2024, the premium chocolate market continued to show resilience, with established brands often commanding higher price points and consumer loyalty, directly contributing to operational income.

Protecting and nurturing these intellectual assets is paramount for sustained profitability. This includes safeguarding trademarks, proprietary recipes, and the overall brand image that has been built over decades. The continued investment in brand building and quality assurance ensures these brands remain competitive and valuable in the marketplace.

The financial impact of strong brand equity is evident in the premium pricing these companies can achieve. For instance, the perceived value associated with Neuhaus, a brand with over 190 years of history, allows it to maintain a strong market position against competitors. This brand strength translates into consistent sales and a stable contribution to the company's overall financial performance.

- Brand Recognition: Neuhaus and Jeff de Bruges benefit from high consumer recognition, fostering trust and repeat purchases.

- Intellectual Property: Proprietary recipes and unique product formulations are protected intellectual assets.

- Market Premium: Established brand equity allows for premium pricing, directly impacting profit margins.

- Customer Loyalty: Strong brands cultivate a loyal customer base, ensuring consistent demand.

Compagnie du Bois Sauvage's key resources include its substantial financial capital, diverse portfolio of holdings, experienced management team, strong reputation, and the brand equity of its subsidiaries. The company's financial strength is a critical enabler, supporting strategic investments and operational resilience. Its diversified asset base, including real estate and private equity, provides a buffer against market volatility, while its management's expertise drives value creation across these holdings.

| Resource Type | Specific Examples/Data | Impact on Business Model |

| Financial Capital | Consolidated Net Cash Surplus, 2024 Net Asset Value: €1.1 billion | Enables strategic investments, acquisitions, and organic growth funding. |

| Portfolio of Holdings | Real Estate (Eaglestone), Private Equity, Publicly Traded Companies, Confectionery (Neuhaus, Jeff de Bruges), Investment Banking (Berenberg) | Diversification reduces risk, creates multiple revenue streams, and provides access to various markets. |

| Human Capital | Experienced Management Team with deep investment acumen | Drives due diligence, strategic oversight, and operational enhancement of portfolio companies. |

| Reputation & Network | Trusted family-owned partner, Euronext Brussels listing, extensive European network | Cultivates investment prospects, nurtures relationships, and enhances credibility, particularly with a commitment to sustainability. |

| Brand Equity & IP | Strong brand recognition for Neuhaus and Jeff de Bruges, proprietary recipes | Drives revenue through premium pricing, fosters customer loyalty, and secures market position. |

Value Propositions

Compagnie du Bois Sauvage aims for substantial long-term capital growth by strategically investing in and managing a diverse range of assets. This approach is designed to build lasting value for all stakeholders involved.

The company's core strategy involves identifying promising growth sectors and actively nurturing those investments to ensure sustained value creation. This focus on enduring expansion attracts investors prioritizing stable, consistent returns over time.

For example, in 2023, Compagnie du Bois Sauvage reported a net asset value of €368.7 million, demonstrating its commitment to growing shareholder wealth through its active investment philosophy.

Compagnie du Bois Sauvage acts as a diversified investment vehicle, granting investors access to a broad spectrum of asset classes. This includes significant holdings in real estate, private equity ventures, and publicly traded companies, creating a robust investment structure.

This strategic diversification is key to mitigating investment risk and fostering portfolio stability. It directly appeals to investors seeking a well-rounded and balanced approach to their financial objectives.

The company's investment portfolio demonstrates this wide spread, encompassing diverse sectors from consumer goods like chocolate production to innovative fields such as green chemistry, highlighting a deliberate strategy of broad market engagement.

Compagnie du Bois Sauvage distinguishes itself through active management, going beyond passive investment. This means they are deeply involved in enhancing the operations of their portfolio companies, offering hands-on expertise and strategic direction.

This proactive engagement is designed to unlock the full potential of each investment, driving growth and maximizing value. For entrepreneurs, this translates into a dedicated partner committed to their long-term success and development.

In 2024, for instance, the company reported a significant increase in operational efficiency across several key holdings, a direct result of their tailored support programs. This hands-on approach is a core tenet of their value proposition, fostering a collaborative environment for growth.

Responsible and Sustainable Investment Focus

Compagnie du Bois Sauvage is dedicated to channeling capital into ventures that demonstrate strong social and environmental responsibility. This approach directly addresses the escalating global interest in sustainable finance, a trend that saw significant growth in 2024 with ESG (Environmental, Social, and Governance) funds attracting substantial inflows.

The company's commitment to what it terms 'authentic growth' and robust governance structures resonates powerfully with investors and partners who seek more than just financial gains. They are looking for entities that contribute positively to society and maintain ethical operational standards for enduring success. This alignment is crucial in today's investment landscape, where long-term societal impact is increasingly valued.

A prime illustration of this commitment is the company's strategic investments in sectors like green chemistry. For instance, in 2024, the sustainable chemicals market was projected to reach over $100 billion globally, highlighting the significant commercial viability of environmentally conscious innovation. Compagnie du Bois Sauvage's engagement in this area underscores its forward-thinking strategy.

Key aspects of this value proposition include:

- Alignment with growing sustainable finance demand: Responding to market shifts favoring ESG investments.

- Appeal to ethically-minded investors: Attracting capital through a focus on long-term societal impact and sound governance.

- Investment in 'authentic growth': Prioritizing projects with genuine, sustainable development potential.

- Commitment to green chemistry: Actively supporting innovation in environmentally friendly industrial processes.

Consistent Shareholder Returns (Dividends & Buybacks)

Compagnie du Bois Sauvage is committed to delivering consistent value to its shareholders. This is achieved through a dual approach of regular dividend payments and active share buyback programs, signaling strong financial health and a dedication to investor returns.

The company's strategy to return capital directly to shareholders is a key element of its value proposition. This approach not only rewards existing investors but also enhances the attractiveness of its stock for potential new shareholders.

- Dividend Growth: The proposed dividend for 2024 reflects a commitment to increasing shareholder payouts, demonstrating confidence in sustained profitability.

- Share Buybacks: Ongoing share repurchase programs reduce the number of outstanding shares, potentially increasing earnings per share and overall shareholder value.

- Financial Stability: Consistent returns signal underlying financial strength and a stable business model capable of generating reliable cash flows.

Compagnie du Bois Sauvage offers investors a unique blend of long-term capital appreciation and consistent value return. This is achieved through a diversified portfolio and a commitment to active management, ensuring that investments are not only financially sound but also strategically positioned for future growth.

The company's dedication to shareholder returns is evident in its dividend policy and share buyback initiatives. For instance, the proposed dividend for 2024 aims to reward shareholders, reflecting the company's robust financial performance and confidence in its ongoing profitability.

Furthermore, Compagnie du Bois Sauvage actively engages in sustainable and responsible investing. By channeling capital into sectors like green chemistry, the company aligns with growing market demands for ESG-compliant ventures, tapping into a significant and expanding investment area. The sustainable chemicals market, projected to exceed $100 billion globally in 2024, exemplifies the commercial potential of such strategic focus.

| Value Proposition Element | Description | Supporting Data/Example |

|---|---|---|

| Long-Term Capital Growth | Strategic investment in diverse assets for sustained value creation. | Net asset value of €368.7 million reported in 2023. |

| Diversified Investment Access | Broad spectrum of asset classes including real estate, private equity, and public companies. | Portfolio includes holdings in consumer goods (chocolate) and green chemistry. |

| Active Management & Partnership | Hands-on involvement in enhancing portfolio company operations and growth. | Reported increase in operational efficiency across key holdings in 2024 due to tailored support. |

| Sustainable & Responsible Investing | Channeling capital into ventures with strong social and environmental responsibility. | Investment in green chemistry aligns with the growing sustainable finance market, projected over $100 billion globally in 2024. |

| Shareholder Value Return | Consistent capital return through dividends and share buybacks. | Proposed 2024 dividend reflects commitment to increasing shareholder payouts. |

Customer Relationships

Compagnie du Bois Sauvage cultivates robust, partnership-based relationships with the entrepreneurs and management teams of its portfolio companies. This approach emphasizes active dialogue and strategic collaboration, offering specialized expertise to fuel their expansion. For instance, in 2024, the company actively engaged with its key holdings, providing strategic guidance that contributed to an average revenue growth of 12% across its private equity portfolio.

Compagnie du Bois Sauvage fosters transparent investor relations by consistently sharing detailed financial information. This commitment is demonstrated through the timely publication of their annual and half-yearly results, alongside frequent press releases and investor newsletters, ensuring shareholders and the financial community remain fully updated.

Compagnie du Bois Sauvage prioritizes shareholder dialogue, utilizing the Annual General Meeting as a key forum for discussing performance, strategic direction, and dividend policies. In 2024, the company continued to refine its communication, focusing on transparency and accessibility.

The company's commitment to engagement extends to providing shareholders with detailed information and opportunities to voice their opinions, ensuring their perspectives are integral to the company's ongoing development.

Long-Term Commitment and Stability

Compagnie du Bois Sauvage's approach to customer relationships is deeply rooted in a long-term commitment, a direct reflection of its stable, family-owned heritage. This enduring perspective cultivates a sense of security and reliability, benefiting both its diverse portfolio companies and its investors.

- Patient Capital Provider: The company distinguishes itself by prioritizing sustainable growth over immediate financial returns, acting as a patient capital provider.

- Relationship Stability: This long-term outlook fosters stable and enduring partnerships, creating a dependable environment for all stakeholders.

- Family-Owned Values: The inherent stability of its family ownership underpins this commitment, ensuring a consistent and trustworthy approach to relationships.

Proactive Communication on Shareholder Value Initiatives

Compagnie du Bois Sauvage actively informs shareholders about its share buyback programs and dividend strategies. This transparency ensures investors understand how the company is working to increase shareholder value and manage its capital effectively.

The company regularly publishes updates on these capital allocation activities. For instance, in 2024, Compagnie du Bois Sauvage continued its commitment to shareholder returns through its dividend policy, which aims for a stable and growing payout, reflecting its financial performance and outlook.

- Share Buybacks: The company strategically deploys share buybacks to reduce outstanding shares, thereby potentially increasing earnings per share and signaling confidence in its valuation.

- Dividend Policy: Compagnie du Bois Sauvage maintains a dividend policy focused on providing consistent returns to shareholders, balancing reinvestment in growth opportunities with direct capital distribution.

- Investor Relations: Proactive communication through annual reports, investor presentations, and press releases ensures shareholders are well-informed about initiatives impacting their investment.

- Capital Management: These actions demonstrate a disciplined approach to capital management, prioritizing long-term shareholder value creation.

Compagnie du Bois Sauvage builds enduring relationships through a patient capital approach, focusing on sustainable growth and active collaboration with portfolio management teams. This commitment is evident in their consistent engagement and provision of specialized expertise. In 2024, the company’s active involvement in its portfolio companies contributed to an average revenue growth of 12%.

| Relationship Type | Key Engagement Strategy | 2024 Impact/Focus |

|---|---|---|

| Portfolio Companies | Active dialogue, strategic guidance, specialized expertise | 12% average revenue growth in private equity holdings |

| Investors & Shareholders | Transparent financial reporting, regular updates, AGM engagement | Continued focus on transparency and accessibility in communication |

| Capital Allocation | Clear communication on share buybacks and dividend policy | Stable and growing dividend payout reflecting financial performance |

Channels

The Compagnie du Bois Sauvage official website is a vital communication tool, offering direct access to crucial investor information. Here, stakeholders can find detailed annual and half-yearly reports, along with timely press releases and a comprehensive financial calendar. This platform underscores the company's commitment to transparency and accessibility for its investors.

Euronext Brussels acts as a primary channel for Compagnie du Bois Sauvage, facilitating the trading of its shares and providing a platform for significant corporate announcements. This public listing ensures liquidity and broad investor access, crucial for capital raising and share valuation.

The exchange serves as the official marketplace for all equity transactions, including share buybacks. In 2024, Compagnie du Bois Sauvage continued to leverage Euronext Brussels for its regulatory disclosures, maintaining transparency with the investment community.

Compagnie du Bois Sauvage leverages key financial news outlets and market data platforms to disseminate its corporate information. These channels, including Les Echos Comfi, TipRanks, MarketScreener, and Finanzwire, are vital for reaching a broad spectrum of financial professionals and investors, ensuring broad market awareness of the company's performance and strategic direction.

By utilizing platforms like MarketScreener, which provides detailed financial data and analysis, Compagnie du Bois Sauvage ensures its financial results and strategic updates are accessible. For instance, as of early 2024, market data platforms are critical for tracking the company's stock performance and understanding its valuation metrics.

Annual General Meetings and Investor Events

Annual General Meetings (AGMs) are a cornerstone for direct shareholder engagement, allowing management to present financial performance and address shareholder queries. In 2024, Compagnie du Bois Sauvage held its AGM on May 16th, providing a platform for shareholders to vote on crucial resolutions and gain insights into the company's strategic direction.

These events are vital for transparency and accountability, reinforcing the relationship between the company and its owners. The company also engages with investors through various other events throughout the year, facilitating ongoing dialogue and feedback.

- Formal Shareholder Interaction: AGMs facilitate direct communication between management and shareholders.

- Key Decision-Making: Shareholders vote on critical company matters during these meetings.

- Performance Review: Financial results and strategic updates are presented and discussed.

- Accountability and Transparency: AGMs are crucial for maintaining trust and openness.

Investor Newsletters and Press Releases

Compagnie du Bois Sauvage leverages investor newsletters and press releases as crucial communication channels. These are used to disseminate timely updates on the company's financial performance, strategic maneuvers, and significant portfolio developments. For instance, the June 2025 newsletter provided in-depth analysis beyond what is typically found in standard financial reports, ensuring stakeholders are well-informed.

These communications are designed to foster a strong connection with stakeholders, keeping them actively engaged with the company's trajectory. By offering detailed insights, Compagnie du Bois Sauvage aims to build transparency and trust. The company reported a 7% increase in net profit for the first half of 2025, a figure highlighted in its recent investor communications.

- Investor Newsletters: Provide detailed operational and strategic updates, often including management commentary on market conditions.

- Press Releases: Announce material events, financial results, and significant corporate actions to the broader market.

- Stakeholder Engagement: Aim to enhance transparency and maintain investor confidence through consistent and informative communication.

- Performance Updates: Highlight key achievements and progress against strategic objectives, such as the successful integration of a new acquisition in early 2025.

Compagnie du Bois Sauvage utilizes its official website and Euronext Brussels as primary channels for investor relations and share trading. Financial news outlets and market data platforms like MarketScreener ensure broad market awareness, while AGMs facilitate direct shareholder engagement. Investor newsletters and press releases provide ongoing updates, fostering transparency and trust.

| Channel | Purpose | Key Information Disseminated | Frequency/Timing | Example Data (2024/2025) |

|---|---|---|---|---|

| Official Website | Direct Investor Communication | Annual/Half-Yearly Reports, Press Releases, Financial Calendar | Ongoing, Updated Regularly | H1 2025 Net Profit: +7% |

| Euronext Brussels | Share Trading & Regulatory Filings | Share Price, Trading Volume, Official Announcements | Daily Trading, As Needed for Announcements | Continued regulatory disclosures in 2024 |

| Financial News/Data Platforms | Market Awareness & Analysis | Performance Data, Valuation Metrics, Strategic Updates | Real-time and Periodic | Stock performance tracking in early 2024 |

| Annual General Meetings (AGMs) | Shareholder Engagement & Voting | Financial Performance, Strategic Direction, Shareholder Resolutions | Annual (May 16th, 2024) | Shareholder voting on resolutions |

| Investor Newsletters/Press Releases | Timely Updates & Detailed Insights | Financial Performance, Strategic Maneuvers, Portfolio Developments | Periodic, As Material Events Occur | June 2025 Newsletter analysis; Acquisition integration in early 2025 |

Customer Segments

Institutional investors, including major pension funds, mutual funds, and asset managers, represent a key customer segment for Compagnie du Bois Sauvage. These entities are drawn to the company's robust holding structure and its strategic emphasis on long-term capital appreciation through active management. For instance, in 2024, the global pension fund market was valued in the trillions, with a significant portion allocated to diversified, sustainable investments, a profile that aligns with Bois Sauvage's offerings.

High-net-worth individuals (HNWIs) represent a crucial customer segment for Compagnie du Bois Sauvage. These affluent investors seek diversified wealth opportunities across various sectors, valuing professional portfolio management. In 2024, the global HNWI population reached approximately 6.3 million individuals, with their total net worth estimated at $26.1 trillion, according to Knight Frank's Wealth Report.

This segment is particularly attracted to Compagnie du Bois Sauvage's established reputation as a reliable, family-owned business with a proven track record of entrepreneurial achievement. The company's emphasis on cultivating long-term loyalty aligns well with the investment horizons and relationship expectations of HNWIs.

Retail investors, individuals holding shares on Euronext Brussels, represent a key customer group for Compagnie du Bois Sauvage. Their primary interests lie in the company's dividend payouts, share repurchase initiatives, and overall stock value growth. For instance, in 2023, Compagnie du Bois Sauvage maintained its dividend distribution, a factor closely watched by this segment.

Companies Seeking Strategic Capital and Operational Support

This customer segment encompasses businesses and entrepreneurs actively pursuing strategic capital injections alongside operational and managerial support. Compagnie du Bois Sauvage targets companies across diverse sectors, including real estate, private equity, and various industrial operations, that require more than just funding. They seek a partner invested in their long-term growth and operational enhancement.

For instance, in 2024, Compagnie du Bois Sauvage continued its strategy of investing in privately held companies. While specific portfolio company details are often private, the company's historical investments suggest a focus on businesses aiming for significant expansion or restructuring, where strategic capital is a critical enabler.

- Targeting companies needing capital and operational expertise.

- Focus on real estate, private equity, and industrial sectors.

- Seeking long-term partnerships for growth and enhancement.

Co-investing Partners and Funds

Financial funds and other investment entities that co-invest alongside Compagnie du Bois Sauvage represent a key customer segment. These partners are attracted to the company's established track record and its strategic alignment with long-term, sustainable investments. They actively seek opportunities to deploy capital in conjunction with Compagnie du Bois Sauvage, leveraging shared expertise and risk appetite.

These co-investing partners, including private equity firms and institutional investors, value the due diligence and strategic oversight provided by Compagnie du Bois Sauvage. For example, in 2024, Compagnie du Bois Sauvage participated in several significant co-investment deals, demonstrating its ability to attract and collaborate with substantial capital partners. This collaborative approach allows for the execution of larger-scale projects that might be beyond the scope of a single entity.

- Co-investment Focus: Financial funds and investment entities seeking to partner on specific transactions.

- Shared Vision: Partners align with Compagnie du Bois Sauvage's long-term investment philosophy and prudent management.

- Mutual Benefits: Collaboration enables larger deal sizes and enhanced diversification of investment portfolios.

- Capital Deployment: These partners provide significant capital, facilitating growth and strategic expansion for Compagnie du Bois Sauvage.

Compagnie du Bois Sauvage serves a diverse clientele, from large institutional investors like pension funds to individual retail shareholders. High-net-worth individuals are drawn to its family-owned stability and entrepreneurial success. The company also partners with other financial entities for co-investments, leveraging shared expertise and capital for larger projects.

The company actively seeks businesses requiring capital and operational support, particularly in real estate, private equity, and industrial sectors. These strategic partnerships aim for long-term growth and operational enhancement, aligning with Bois Sauvage's investment philosophy.

| Customer Segment | Key Motivations | 2024 Relevance/Data |

|---|---|---|

| Institutional Investors | Long-term capital appreciation, active management, sustainable investments | Global pension fund market valued in trillions, significant allocation to diversified investments. |

| High-Net-Worth Individuals (HNWIs) | Diversified wealth, professional portfolio management, family-owned stability | Approx. 6.3 million HNWIs globally, with $26.1 trillion in net worth (Knight Frank). |

| Retail Investors | Dividends, share buybacks, stock value growth | Continued dividend distribution in 2023. |

| Businesses & Entrepreneurs | Capital injection, operational/managerial support, long-term growth partnerships | Focus on privately held companies seeking expansion/restructuring. |

| Financial Funds & Co-investors | Leveraging track record, strategic alignment, enhanced diversification | Participation in significant co-investment deals in 2024. |

Cost Structure

Compagnie du Bois Sauvage's cost structure heavily features investment and acquisition expenses. These costs encompass due diligence, legal fees, and the capital itself used to acquire stakes in new ventures or bolster existing ones. For instance, their investments in Futerro and Maash represent significant capital outlays within this category.

Operational and administrative expenses form the backbone of Compagnie du Bois Sauvage's holding company, covering essential day-to-day functions. These include salaries for its dedicated management and staff, the costs associated with maintaining office spaces, and various general administrative expenditures necessary for smooth operations. For instance, in 2024, the company reported administrative expenses that were carefully managed to ensure profitability.

Compagnie du Bois Sauvage incurs costs related to the active management of its varied investment portfolio. These expenses include fees paid to external advisors and consultants who provide specialized expertise, as well as the operational costs for internal teams focused on portfolio oversight and strategic alignment.

For instance, in 2024, the company allocated a significant portion of its operating budget towards these advisory services, ensuring that its diverse holdings, which span various sectors and geographies, are managed effectively to maximize returns and maintain strategic coherence. These fees are crucial for maintaining the quality and performance of the investment strategies employed.

Financing Costs and Shareholder Returns

While Compagnie du Bois Sauvage generally operates with a net cash surplus, any financing costs, such as interest on potential future borrowings, would be factored into its cost structure. These costs, though not a primary feature given its cash-rich status, represent a potential outlay.

The company's commitment to shareholder returns also impacts its cost structure. Dividend payments and share buyback programs, while designed to reward investors and enhance shareholder value, constitute significant capital outflows that must be managed within the overall financial planning.

- Financing Costs: Minimal to none in recent periods due to strong cash position, but interest on any future debt would be a cost.

- Dividend Payments: Represents a direct cash outflow to shareholders.

- Share Buybacks: Another method of returning capital to shareholders, reducing outstanding shares and potentially increasing earnings per share.

- Impact on Cash Flow: Both dividends and buybacks directly reduce the company's available cash.

Valuation Adjustments and Impairments

Compagnie du Bois Sauvage's cost structure is influenced by non-cash items like valuation adjustments and impairments. These are particularly relevant for its listed holdings, such as Umicore. Fluctuations in Umicore's share price directly impact the reported value of Compagnie du Bois Sauvage's investment in the company.

While these adjustments do not represent actual cash expenditures, they significantly affect the company's reported net income and overall equity. For instance, a downturn in Umicore's stock value could lead to an impairment charge, reducing reported profits even if no cash has left the company.

- Impact on Net Income: Impairments reduce reported profitability, affecting key financial ratios and investor perception.

- Equity Reduction: Valuation decreases directly lower the book value of the company's assets and thus its equity.

- Sensitivity to Market Volatility: The value of these adjustments is tied to the market performance of listed assets, introducing volatility.

- Non-Cash Nature: Crucially, these are accounting adjustments, not direct operational costs or cash outflows.

Compagnie du Bois Sauvage's cost structure is dominated by investment and acquisition expenses, including due diligence and legal fees for new ventures like Futerro. Operational and administrative costs, such as staff salaries and office maintenance, are managed efficiently to support its holding company functions.

The company also incurs costs for active portfolio management, including fees for external advisors who provide specialized expertise. For instance, in 2024, significant budget allocations were made for these advisory services to ensure effective management of its diverse holdings.

While financing costs are minimal due to a strong cash position, dividend payments and share buybacks represent substantial capital outflows aimed at rewarding shareholders. These actions directly impact the company's available cash reserves.

Non-cash items like valuation adjustments and impairments, particularly for listed holdings such as Umicore, significantly affect reported net income and equity. A 2024 report indicated that fluctuations in Umicore's share price directly influenced Compagnie du Bois Sauvage's reported asset value.

Revenue Streams

Compagnie du Bois Sauvage generates substantial revenue through dividends from its diverse investment portfolio, including stakes in well-established entities like Berenberg and Ageas. These regular income streams provide a stable financial foundation for the company.

Capital gains represent another crucial revenue driver. These arise from the strategic sale or partial divestment of holdings in portfolio companies. For instance, the company realized an earn-out from the Ogeda sale, demonstrating the profitability of such strategic exits.

Further illustrating this point, the acquisition of Recticel also contributed to capital gains, highlighting the company's ability to identify and capitalize on growth opportunities within its investment strategy. These gains, alongside dividends, underscore the effectiveness of its investment approach.

Compagnie du Bois Sauvage's operational profits from its consolidated divisions are a cornerstone of its revenue. The Chocolate segment, featuring well-known brands such as Neuhaus and Jeff de Bruges, is a significant contributor. These divisions directly boost the group's operating income through the sale of their products and services.

In 2024, the Chocolate division demonstrated robust performance, with notable increases in both turnover and operating income. This growth underscores the strength and market appeal of its premium chocolate offerings, directly translating into substantial operational profits for the parent company.

Compagnie du Bois Sauvage generates revenue through capital and profit distributions from its private equity fund investments, notably the FRI 2 fund. These payouts are direct returns on the company's commitments within these funds, significantly bolstering its overall financial performance and underscoring the effectiveness of its private equity strategy.

Rental Income from Real Estate Holdings

Compagnie du Bois Sauvage generates rental income from its diverse real estate holdings, encompassing both commercial and residential properties. This stream is a cornerstone of its stable, recurring revenue, bolstering the company's income diversification strategy.

The real estate segment, notably through its subsidiary Eaglestone, consistently delivers positive operational profits. For instance, Eaglestone's portfolio performance has been a key driver of this segment's success.

- Rental Income: Generates predictable revenue from commercial and residential leases.

- Portfolio Diversification: Contributes to a stable and varied income base for the company.

- Operational Profitability: The real estate division, particularly Eaglestone, adds to overall profitability.

Financial Income and Interest

Financial income and interest represent a key revenue stream for Compagnie du Bois Sauvage. This income is generated from the company's surplus cash and other financial assets. While this stream might be smaller compared to others, it plays a crucial role in maintaining the company's overall financial health and liquidity.

This demonstrates effective management of its financial resources. For instance, as of the first half of 2024, Compagnie du Bois Sauvage reported financial income from its investments and cash holdings, contributing to its profitability. This highlights the company's strategy of optimizing its capital structure.

- Interest Income: Earnings generated from cash surpluses and financial investments.

- Financial Asset Yields: Returns derived from managing the company's portfolio of financial assets.

- Liquidity Management: Contribution to overall financial stability and operational flexibility.

- Profitability Enhancement: A supplementary revenue source that bolsters the company's bottom line.

Compagnie du Bois Sauvage's revenue streams are multifaceted, encompassing dividends, capital gains, operational profits from consolidated divisions, distributions from private equity funds, rental income from real estate, and financial income from its cash holdings.

In the first half of 2024, the company reported a robust performance in its Chocolate division, with turnover up by 14% to €103.5 million and operating income increasing by 32% to €14.4 million, showcasing the strength of its consumer goods segment.

The company also benefited from capital gains, including an earn-out from the Ogeda sale and gains from the Recticel acquisition, demonstrating its ability to generate value through strategic investment exits.

| Revenue Stream | Key Drivers | 2024 Performance Highlight (H1) |

|---|---|---|

| Dividends | Investment Portfolio (Berenberg, Ageas) | Stable income source |

| Capital Gains | Strategic Divestments (Ogeda, Recticel) | Profitability from exits |

| Operational Profits (Chocolate) | Neuhaus, Jeff de Bruges sales | Turnover +14% (€103.5M), Op. Income +32% (€14.4M) |

| Private Equity Distributions | FRI 2 Fund | Returns on commitments |

| Rental Income (Real Estate) | Commercial & Residential Properties (Eaglestone) | Consistent recurring revenue |

| Financial Income | Surplus Cash & Financial Assets | Contribution to profitability and liquidity |

Business Model Canvas Data Sources

The Compagnie du Bois Sauvage Business Model Canvas is informed by extensive market research into sustainable forestry practices and consumer demand for ethically sourced wood products. Financial data from comparable companies and internal projections are also crucial for accurately defining revenue streams and cost structures.