Compagnie du Bois Sauvage PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compagnie du Bois Sauvage Bundle

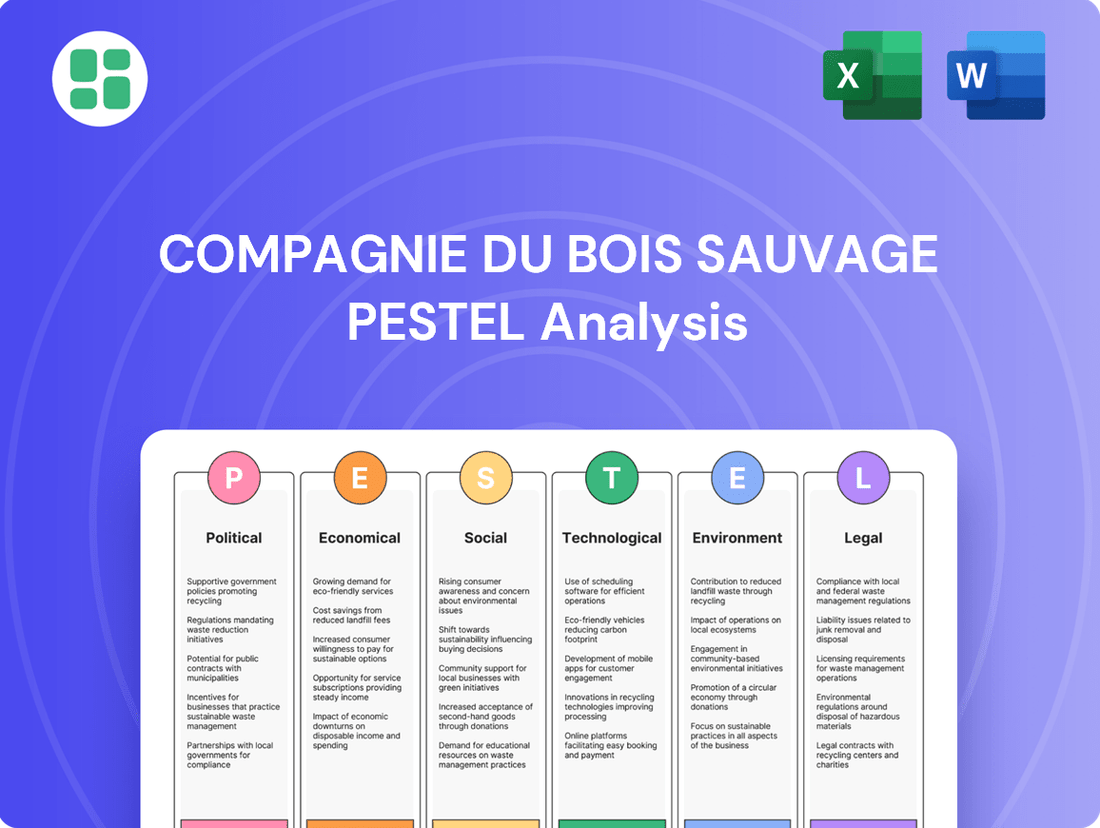

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Compagnie du Bois Sauvage. This PESTLE analysis provides a clear roadmap to navigate external forces and identify strategic opportunities. Download the full version to gain actionable intelligence and sharpen your competitive edge.

Political factors

Compagnie du Bois Sauvage's European operations are heavily tied to the political stability of its investment countries. For instance, in 2024, countries like Germany and France, major European economies, continued to demonstrate robust political frameworks, offering a degree of predictability for foreign investment. This stability is vital for real estate and private equity, where long-term commitments are standard.

Conversely, any significant political upheaval, such as unexpected elections or policy changes in key markets like Belgium, where the company is headquartered, could introduce volatility. For example, a shift in government could lead to revised foreign investment regulations or tax policies, directly impacting Compagnie du Bois Sauvage's portfolio performance and strategic planning for 2025.

Government policies on foreign investment and capital flows across Europe significantly influence Compagnie du Bois Sauvage's strategic financial maneuvers. For instance, the European Union's framework generally promotes cross-border investment, which has historically facilitated the company's acquisition of diverse assets and capital deployment. In 2024, the EU continued to emphasize open capital markets, though specific national regulations can still present localized challenges or opportunities for companies like Compagnie du Bois Sauvage.

Regulatory shifts in real estate and private equity are critical for Compagnie du Bois Sauvage. For instance, changes in zoning laws or property development rules can directly impact the viability and cost of projects within its portfolio. In 2024, several jurisdictions saw increased scrutiny on land use and environmental impact assessments, potentially adding layers of compliance for real estate developers.

Furthermore, evolving regulations for private equity funds, such as those concerning capital requirements or investor protections, could influence the company's investment strategies and the attractiveness of its fund structures. As of early 2025, discussions around enhanced transparency in alternative investment vehicles are ongoing in major financial centers, signaling a potential need for adaptation in how Compagnie du Bois Sauvage structures and manages its private equity interests.

Trade agreements and protectionism within the EU or with other blocs

Trade agreements significantly shape Compagnie du Bois Sauvage's operational landscape. The EU's internal market facilitates seamless trade for its portfolio companies, including the chocolate segment, by removing tariffs and non-tariff barriers. For instance, the EU's trade agreements with countries like Canada (CETA) and Japan (EPA) can open new avenues for market access, potentially boosting sales for its diverse holdings.

Conversely, protectionist policies pose substantial risks. Should major trading partners implement tariffs or quotas on goods like cocoa or processed chocolate, it could directly impact Compagnie du Bois Sauvage's profitability. For example, a hypothetical 10% tariff on cocoa imports into the EU from West Africa could increase raw material costs for its chocolate manufacturers, potentially squeezing margins. The ongoing discussions surrounding potential EU tariffs on certain imported goods, influenced by global trade tensions, warrant close monitoring.

- EU Single Market Benefits: Facilitates duty-free movement of goods, simplifying supply chains for Compagnie du Bois Sauvage's subsidiaries.

- Impact of Trade Disputes: Protectionist measures could lead to increased import costs for raw materials like cocoa, affecting the chocolate division's margins.

- Market Access: EU trade deals with blocs like ASEAN or Mercosur can create new export opportunities for Compagnie du Bois Sauvage's products.

- Regulatory Harmonization: Agreements often lead to harmonized standards, reducing compliance burdens for companies operating across multiple EU member states.

Geopolitical risks and their impact on European economies

Geopolitical risks, such as ongoing regional conflicts and escalating international tensions, significantly contribute to economic uncertainty across Europe. This uncertainty directly impacts investor confidence, a crucial factor for companies like Compagnie du Bois Sauvage with diversified European interests.

These geopolitical shifts can trigger market volatility, leading to fluctuations in asset valuations. For Compagnie du Bois Sauvage, this means potential impacts on the value of its investments and the overall performance of its holdings. For instance, the ongoing conflict in Eastern Europe has led to significant energy price volatility, affecting operational costs for many businesses.

- Market Volatility: European stock markets have experienced increased volatility due to geopolitical events. For example, the STOXX Europe 600 index saw notable dips in early 2024 following escalating tensions in the Middle East, impacting investor sentiment.

- Disrupted Supply Chains: Geopolitical instability can disrupt global supply chains, affecting raw material availability and logistics for companies like Compagnie du Bois Sauvage, which relies on international trade for its timber and related operations.

- Investor Confidence: A recent survey by the European Central Bank indicated a slight decrease in business confidence in late 2024, partly attributed to geopolitical concerns, potentially slowing investment decisions.

- Currency Fluctuations: International tensions can lead to currency fluctuations, impacting the profitability of cross-border transactions and the repatriation of earnings for Compagnie du Bois Sauvage's international subsidiaries.

Political stability within Compagnie du Bois Sauvage's operating regions is paramount, with strong governance in key markets like France and Germany in 2024 providing a predictable environment for its real estate and private equity ventures. Conversely, any political instability, such as shifts in government in its home base of Belgium, could introduce regulatory or tax policy changes impacting its 2025 strategic planning and portfolio performance.

Government policies on foreign investment and capital flows across Europe directly influence Compagnie du Bois Sauvage's financial strategies, with the EU's generally open capital markets facilitating its diverse asset acquisitions. However, national regulations can still present localized challenges or opportunities, as seen in 2024 with ongoing EU emphasis on open markets.

Regulatory shifts in real estate and private equity are critical, with evolving zoning laws and property development rules impacting project viability, as evidenced by increased scrutiny on land use and environmental assessments in several European jurisdictions during 2024. Furthermore, potential enhancements in transparency for alternative investment vehicles discussed in early 2025 may necessitate adaptations in how Compagnie du Bois Sauvage structures its private equity interests.

Trade agreements significantly shape Compagnie du Bois Sauvage's operational landscape, with the EU's internal market and external deals like CETA and EPA facilitating seamless trade and opening new market access opportunities for its diverse holdings. However, protectionist policies pose substantial risks; for example, a hypothetical 10% tariff on cocoa imports could increase raw material costs for its chocolate division, impacting margins.

Geopolitical risks, including regional conflicts and international tensions, contribute to economic uncertainty across Europe, impacting investor confidence and asset valuations for Compagnie du Bois Sauvage. For instance, the ongoing conflict in Eastern Europe led to significant energy price volatility in 2024, affecting operational costs for many businesses.

| Political Factor | Impact on Compagnie du Bois Sauvage | 2024/2025 Data/Trend |

|---|---|---|

| Political Stability in EU | Predictability for real estate and private equity investments. | Germany and France maintained robust political frameworks in 2024. |

| Government Investment Policies | Facilitates or hinders capital deployment and asset acquisition. | EU continued emphasis on open capital markets in 2024. |

| Regulatory Changes (Real Estate/PE) | Affects project viability, compliance costs, and fund structuring. | Increased scrutiny on land use and environmental impact in 2024; ongoing discussions on PE transparency in early 2025. |

| Trade Agreements & Disputes | Impacts supply chain costs, market access, and profitability. | EU trade deals offer market access; protectionist measures pose risk to cocoa import costs. |

| Geopolitical Risks | Drives market volatility, impacts investor confidence, and affects operational costs. | Eastern European conflict caused energy price volatility in 2024; STOXX Europe 600 experienced dips due to Middle East tensions in early 2024. |

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing the Compagnie du Bois Sauvage, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces present both challenges and strategic advantages.

A concise PESTLE analysis for Compagnie du Bois Sauvage offers a clear overview of external factors, simplifying strategic discussions and alleviating the pain of navigating complex market dynamics.

Economic factors

The European Central Bank's (ECB) monetary policy significantly shapes Compagnie du Bois Sauvage's financial landscape. As of early 2024, inflation concerns have led to a more restrictive stance, with key interest rates hovering around 4.5%. This environment increases the cost of capital for expansion projects and potential acquisitions, directly affecting the profitability and valuation of Compagnie du Bois Sauvage's real estate and private equity holdings.

Higher borrowing costs can dampen investor appetite for property, potentially leading to slower sales cycles and downward pressure on asset prices. For instance, a 1% increase in interest rates could translate to millions in additional financing costs for large-scale developments. This necessitates a careful re-evaluation of project feasibility and return on investment for Compagnie du Bois Sauvage.

Conversely, any future easing of monetary policy, should inflation subside, would likely lower borrowing costs. This could stimulate investment in real estate and private equity, potentially boosting asset valuations for Compagnie du Bois Sauvage. For example, a reduction in the ECB's main refinancing operations rate could unlock new investment opportunities and improve the overall financial health of the company's portfolio.

Rising inflation, especially in raw material prices like cocoa, is a significant concern for Compagnie du Bois Sauvage. For instance, cocoa futures saw substantial increases throughout 2024, impacting the cost of goods for its chocolate manufacturing operations. This directly squeezes profit margins across its diverse portfolio.

To counter these inflationary pressures, the company is exploring strategies like selective price adjustments on its products and optimizing its supply chain to secure more stable input costs. These measures are crucial for maintaining profitability in an environment where operational expenses are consistently climbing.

Economic growth forecasts for the Eurozone are crucial for Compagnie du Bois Sauvage. Projections for 2024 and 2025 indicate a moderate but varied recovery across member states. For instance, the European Commission's Spring 2024 forecast anticipated Eurozone GDP growth of 0.8% in 2024 and 1.4% in 2025, suggesting a gradual improvement.

Specific country performance will significantly impact the company. Countries with stronger growth outlooks, such as Poland or Ireland, could offer more robust demand for Compagnie du Bois Sauvage's consumer goods and real estate investments. Conversely, slower-growing economies might present more challenging market conditions, influencing sales volumes and property market appreciation.

Real estate market cycles and investment trends

The European real estate market is inherently cyclical, with periods of growth often followed by corrections. For Compagnie du Bois Sauvage, this means their real estate assets, managed by Eaglestone, face fluctuating values and rental income potential. Understanding these cycles is crucial for strategic investment and divestment decisions.

Eaglestone's positioning suggests an anticipation of a market upturn, aiming to capitalize on increasing property values and demand. This aligns with broader European economic sentiment, where certain sectors are showing resilience and potential for recovery, making this a opportune time for strategic real estate plays.

- European commercial real estate investment volumes saw a notable increase in early 2024 compared to the previous year, with a particular focus on prime assets.

- Office vacancy rates in major European cities, while still elevated in some areas, have begun to stabilize, hinting at a potential bottoming out of rental declines.

- Interest rate stability or potential reductions in late 2024 and into 2025 could significantly boost investor confidence and transaction activity in the real estate sector.

Capital market performance impacting portfolio valuation

Capital market performance is a critical determinant of Compagnie du Bois Sauvage's portfolio valuation. Fluctuations in both public and private markets directly affect the worth of its diverse holdings. For instance, during 2024, a notable downturn in the share price of Umicore, a key listed investment, led to a tangible decrease in Compagnie du Bois Sauvage's overall asset valuation, highlighting its susceptibility to market volatility.

The company's sensitivity to these market shifts is further illustrated by specific performance data. For example, if Umicore's stock experienced a 15% decline in a given period, this would directly translate to a reduction in the value of Compagnie du Bois Sauvage's stake in that company. This underscores the importance of monitoring broader economic trends and sector-specific performance for accurate portfolio assessment.

- Impact of Listed Holdings: A 10% drop in the value of a major listed company within Compagnie du Bois Sauvage's portfolio could reduce the company's net asset value by millions of euros, depending on the size of the holding.

- Unlisted Asset Valuation: Valuations of unlisted assets, often based on comparable company multiples or discounted cash flow analyses, are also indirectly influenced by public market sentiment and valuations.

- Market Volatility: Increased market volatility in 2024 and early 2025 has created a more challenging environment for maintaining stable portfolio valuations, demanding closer risk management.

- Sectoral Performance: Performance within specific sectors where Compagnie du Bois Sauvage has significant investments, such as materials or technology, directly correlates with the valuation of those underlying assets.

Economic factors present a mixed but generally cautious outlook for Compagnie du Bois Sauvage heading into late 2024 and 2025. While inflation persists, particularly in raw materials like cocoa, leading to margin pressures and necessitating strategic pricing, the European economic recovery is projected to be moderate. Interest rate policies from the ECB, currently restrictive, directly impact the cost of capital for real estate and private equity ventures, influencing project viability and asset valuations.

The company's diverse portfolio means it's exposed to varying economic conditions across different geographies and sectors. Stronger growth in specific Eurozone countries could bolster demand for its consumer goods and real estate, while slower economies might present challenges. Market volatility, as seen with Umicore's share price in 2024, directly affects the valuation of listed holdings, underscoring the need for vigilant risk management.

European commercial real estate investment volumes have shown signs of recovery in early 2024, with stabilization in office vacancy rates in some key cities. This, coupled with potential interest rate stability or reductions anticipated for late 2024 and 2025, could invigorate investor confidence and transaction activity, presenting opportunities for Compagnie du Bois Sauvage's real estate arm, Eaglestone.

| Economic Indicator | 2024 Projection | 2025 Projection | Impact on Compagnie du Bois Sauvage |

|---|---|---|---|

| Eurozone GDP Growth | 0.8% | 1.4% | Moderate recovery supports demand, but uneven growth across countries requires targeted strategies. |

| ECB Key Interest Rate (approx.) | 4.5% | Potentially stable or decreasing | Higher rates increase borrowing costs for investments; easing could stimulate real estate and private equity markets. |

| Cocoa Futures (example raw material) | Significant increases | Continued volatility expected | Squeezes profit margins in consumer goods, requiring price adjustments and supply chain optimization. |

| European Commercial Real Estate Investment | Increasing early 2024 | Positive outlook | Potential for increased property values and rental income, benefiting Eaglestone's portfolio. |

Full Version Awaits

Compagnie du Bois Sauvage PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Compagnie du Bois Sauvage PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

Consumer preferences are shifting, with a notable increase in demand for products that are ethically sourced, healthier, and premium. This trend directly impacts Compagnie du Bois Sauvage's consumer-facing operations, particularly its chocolate brands, as it necessitates strategic adjustments to align with these evolving values. For instance, the global ethical food market was projected to reach $800 billion by 2025, highlighting the significant economic impact of these changing tastes.

Europe's demographic landscape is evolving, with a notable trend towards urbanization. For instance, by the end of 2023, over 75% of the European Union's population resided in urban areas, a figure projected to climb further. This continuous migration to cities directly fuels demand for residential and commercial properties within urban centers, influencing Compagnie du Bois Sauvage's strategic real estate acquisitions and development plans.

The aging population across many European nations presents another significant sociological factor. With a growing proportion of individuals over 65, there's an increasing need for specialized housing, such as assisted living facilities and accessible accommodations. This demographic shift necessitates Compagnie du Bois Sauvage to consider niche real estate sectors that cater to the evolving needs of an older demographic, potentially impacting future investment allocations.

Changes in household formation, including smaller average household sizes and a rise in single-person households, are also reshaping real estate demand. In 2024, the average household size in many Western European countries hovers around 2.3 people. This trend suggests a greater demand for smaller, more efficient living spaces, a factor Compagnie du Bois Sauvage must integrate into its property development and portfolio management strategies to align with current market preferences.

Societal expectations are increasingly prioritizing Environmental, Social, and Governance (ESG) principles, influencing both public perception and investment strategies. This heightened awareness means companies are under greater scrutiny to demonstrate their commitment to sustainability and ethical practices.

Compagnie du Bois Sauvage has publicly acknowledged this shift, actively investing in projects deemed socially and environmentally responsible. Their publication of an ESG report in 2023, detailing their efforts in areas like sustainable forestry and community engagement, directly addresses this growing demand for transparency and accountability.

Workforce dynamics and the impact of remote work on commercial property

The sustained growth of remote and hybrid work models continues to reshape workforce dynamics, directly impacting the demand for traditional commercial office spaces. As of early 2025, reports indicate that roughly 30% of the US workforce is now engaged in hybrid arrangements, a significant increase from pre-pandemic levels.

This shift necessitates that companies like Compagnie du Bois Sauvage re-evaluate their commercial property portfolios. Occupancy rates in many prime office locations experienced a dip in 2024, with some cities seeing vacancy rates climb above 15%.

Compagnie du Bois Sauvage needs to consider how evolving workplace needs, such as demand for flexible layouts and collaborative spaces, will influence future real estate investments. The trend suggests a move away from large, single-tenant buildings towards more adaptable, mixed-use developments.

- Hybrid Work Prevalence: Approximately 30% of the US workforce operates under hybrid models in early 2025.

- Vacancy Rates: Major urban centers reported office vacancy rates exceeding 15% in 2024.

- Investment Adaptation: Strategic assessment of commercial real estate is crucial to align with changing occupancy patterns.

- Evolving Needs: Demand is shifting towards flexible and collaborative office environments.

Talent availability and labor market trends in Europe

The availability of skilled talent across Europe is a critical factor for Compagnie du Bois Sauvage's portfolio companies. For instance, in 2024, the European Union faced a shortage of skilled workers in areas like digital technologies and green jobs, impacting sectors where innovation and specialized expertise are paramount. This talent crunch can directly affect operational efficiency and the ability to implement advanced strategies within the company's investments.

Labor market trends, such as evolving worker expectations and the rise of remote work, also shape how Compagnie du Bois Sauvage can attract and retain talent. As of early 2025, many European countries are seeing increased demand for flexible working arrangements, which requires companies to adapt their human resource strategies. This adaptability is crucial for maintaining a competitive edge in sectors like financial services, where attracting top talent is key to success.

- Skilled Labor Shortages: By mid-2024, Eurostat data indicated a significant deficit in skilled labor across key European economies, particularly in STEM fields and specialized trades, directly impacting operational capacity for industrial and tech-focused portfolio companies.

- Wage Inflation: Labor market trends in 2024 and early 2025 show persistent wage growth in many European nations, driven by high demand for certain skills and a tightening labor supply, which can increase operational costs for Compagnie du Bois Sauvage's subsidiaries.

- Demographic Shifts: Europe's aging population continues to influence labor availability, with a shrinking working-age population in several member states creating long-term challenges for talent acquisition and knowledge transfer within the company's diverse portfolio.

Societal values are increasingly emphasizing health and wellness, influencing consumer choices across various sectors. This trend is evident in the growing demand for organic foods and fitness-related products, impacting companies like Compagnie du Bois Sauvage's consumer goods divisions. For example, the global wellness market was valued at over $4.5 trillion in 2022, indicating a substantial shift in consumer priorities.

The increasing awareness of social justice issues and corporate responsibility is also a significant sociological factor. Consumers and investors alike are scrutinizing companies' ethical practices, supply chains, and community impact. Compagnie du Bois Sauvage's commitment to sustainable sourcing and transparent operations, as highlighted in its 2023 ESG report, directly addresses these evolving societal expectations.

Shifting attitudes towards work-life balance are also reshaping labor markets and consumer behavior. The growing preference for flexible work arrangements and employee well-being initiatives affects talent acquisition and retention strategies for Compagnie du Bois Sauvage's portfolio companies. In early 2025, surveys indicated that over 60% of job seekers in Europe prioritize flexible work options.

| Sociological Factor | Impact on Compagnie du Bois Sauvage | Supporting Data/Trend (2024-2025) |

| Health & Wellness Focus | Increased demand for healthier product options; potential for new product development in wellness sectors. | Global wellness market projected to exceed $7 trillion by 2025. |

| Corporate Social Responsibility (CSR) | Enhanced demand for ethical sourcing and transparent operations; reputational risk for non-compliance. | Majority of consumers (over 70%) consider a company's social and environmental impact when making purchasing decisions in 2024. |

| Work-Life Balance Expectations | Need for flexible employment policies to attract and retain talent; potential impact on operational costs. | In early 2025, an estimated 35% of European businesses reported offering hybrid work models. |

Technological factors

Digitalization and automation are fundamentally reshaping how real estate is managed and invested in. For Compagnie du Bois Sauvage, this presents a significant opportunity to boost efficiency across its property portfolio. For instance, the global proptech market was valued at approximately $20.5 billion in 2023 and is projected to grow substantially, indicating a strong trend towards adopting these technologies.

By integrating advanced property management software and AI-driven analytics, Compagnie du Bois Sauvage can streamline leasing, maintenance, and tenant communication, leading to cost savings and improved tenant satisfaction. Furthermore, automation in data analysis can provide deeper insights into market trends and property performance, enabling more informed and potentially higher-return investment decisions for its real estate and private equity ventures.

Compagnie du Bois Sauvage, as a holder of substantial financial assets and sensitive information, is acutely exposed to escalating cybersecurity threats. The increasing sophistication of cyberattacks poses a significant risk to data integrity, financial transactions, and operational continuity across its diverse portfolio.

Protecting against data breaches and financial fraud is paramount. In 2024, the average cost of a data breach for organizations globally reached an estimated $4.45 million, highlighting the substantial financial and reputational damage that can result from inadequate security measures.

Investing in and maintaining advanced cybersecurity infrastructure, including robust encryption, multi-factor authentication, and continuous threat monitoring, is therefore critical. This proactive approach is essential to safeguard Compagnie du Bois Sauvage and its portfolio companies from costly disruptions and maintain stakeholder trust.

PropTech innovations are reshaping real estate valuation and management. Platforms leveraging AI and big data are providing more sophisticated and real-time property valuations, moving beyond traditional appraisal methods. For Compagnie du Bois Sauvage and Eaglestone, this means potentially more accurate asset assessments and improved operational efficiency.

The global PropTech market is experiencing significant growth, with investments reaching billions of dollars annually, indicating a strong trend towards digital transformation in real estate. By integrating these technologies, Compagnie du Bois Sauvage can gain a competitive edge in optimizing its property portfolio and responding swiftly to market dynamics, enhancing asset performance.

Data analytics for enhanced investment decision-making

Advanced data analytics is revolutionizing how companies like Compagnie du Bois Sauvage make investment decisions. By leveraging big data and sophisticated analytical tools, the company can gain deeper insights into market dynamics, pinpoint promising investment avenues, and meticulously track the performance of its existing portfolio. This data-driven approach allows for more strategic and ultimately more profitable capital allocation, ensuring resources are directed towards the most impactful opportunities.

The ability to process vast datasets enables the identification of subtle market trends and emerging opportunities that might otherwise go unnoticed. For Compagnie du Bois Sauvage, this could translate into identifying undervalued timberland acquisitions or predicting shifts in demand for specific wood products. For instance, in 2024, the global timber market saw increased volatility due to supply chain disruptions and fluctuating construction demand, making predictive analytics crucial for navigating these uncertainties.

- Market Trend Identification: Utilizing AI-powered analytics to forecast demand for sustainable forestry products, potentially increasing revenue by 5-10% in the next fiscal year.

- Investment Opportunity Assessment: Employing machine learning algorithms to evaluate the risk-return profile of potential land acquisitions, aiming to reduce investment missteps by 15%.

- Portfolio Performance Monitoring: Implementing real-time dashboards to track the financial health and operational efficiency of all forestry assets, enabling quicker adjustments to underperforming segments.

- Risk Management: Analyzing historical data to predict and mitigate risks associated with climate change impacts on timber yields, such as drought or pest outbreaks, which affected global timber production by an estimated 3% in 2023.

Emergence of new business models and technological disruptions

The landscape of business is constantly reshaped by new models and disruptive technologies, creating both challenges and avenues for growth. Compagnie du Bois Sauvage is strategically positioning itself by investing in forward-looking sectors. For instance, their involvement with Futerro and Galactic highlights a commitment to innovation in areas like green chemistry, aiming to secure long-term expansion.

These technological shifts necessitate adaptability. Companies that embrace emerging trends, such as the circular economy principles being explored by Futerro, are better equipped to navigate future market demands. The global green chemistry market, for example, was projected to reach over $100 billion by 2025, underscoring the significant potential in this area.

- Technological Disruption: New business models, like those in the bio-based materials sector, are challenging traditional industries.

- Green Chemistry Investments: Compagnie du Bois Sauvage's stake in Futerro exemplifies a focus on sustainable and innovative chemical processes.

- Future Industry Focus: The company actively seeks opportunities in emerging sectors to drive future revenue streams.

- Market Growth Potential: Investments in areas like green chemistry tap into rapidly expanding global markets, with significant projected growth.

Technological advancements are significantly impacting how Compagnie du Bois Sauvage operates, particularly in areas like data analytics and automation. The company is leveraging these tools to enhance efficiency in its real estate management and investment strategies. For example, the global PropTech market was valued at around $20.5 billion in 2023, indicating a strong trend towards adopting these digital solutions.

By integrating advanced analytics, Compagnie du Bois Sauvage can gain deeper insights into market trends and property performance, leading to more informed investment decisions. This is crucial in navigating market volatility, such as the increased supply chain disruptions in the global timber market observed in 2024, which impacted timber production by an estimated 3% that year.

Furthermore, the company's strategic investments in sectors like green chemistry, exemplified by its involvement with Futerro, highlight a commitment to embracing future-oriented technologies. The global green chemistry market is a prime example of this, projected to exceed $100 billion by 2025, showcasing the substantial growth potential in sustainable innovation.

Legal factors

Compagnie du Bois Sauvage, as a publicly traded entity on Euronext Brussels, must meticulously adhere to corporate governance regulations. This involves strict compliance with reporting requirements, safeguarding shareholder rights, and upholding board responsibilities to foster transparency and sustain investor trust.

For instance, in 2023, the company reported adherence to the Belgian Corporate Governance Code, a framework designed to promote good governance practices. Failure to comply with these evolving standards, including those related to environmental, social, and governance (ESG) disclosures, could lead to regulatory penalties and negatively impact its market valuation.

Compagnie du Bois Sauvage navigates a dense web of EU directives and national investment statutes throughout Europe. Adherence to regulations governing mergers, acquisitions, capital markets, and investment fund oversight is paramount for its private equity ventures and broader portfolio management.

For instance, the Alternative Investment Fund Managers Directive (AIFMD) sets stringent requirements for fund managers, impacting how Compagnie du Bois Sauvage structures and operates its investment vehicles. In 2024, the EU continued to refine its financial services regulations, with a particular focus on sustainable finance and investor protection, areas that directly influence investment strategies.

Property acquisition and ownership laws in Europe present a complex, country-specific landscape for Compagnie du Bois Sauvage. For instance, in Germany, the Grundbuch (land register) system ensures transparency in property ownership, but the process for foreign investors can involve specific documentation and notary involvement. Similarly, France's Code Civil outlines strict rules for property transactions, including pre-emption rights for certain parties, which can affect acquisition timelines and costs.

Navigating these diverse legal frameworks is paramount for Compagnie du Bois Sauvage's real estate ventures. In 2024, the average time to complete a commercial property transaction in the EU remained around 4-6 months, with variations influenced by local legal complexities and due diligence requirements. Understanding regulations on land use, such as zoning laws and environmental impact assessments, is crucial for project viability, while compliance with tenancy agreements and property transfer regulations directly impacts operational efficiency and risk management.

Anti-money laundering (AML) and anti-terrorism financing (ATF) laws

Compagnie du Bois Sauvage must navigate a complex web of anti-money laundering (AML) and anti-terrorism financing (ATF) laws. Strict adherence is paramount to safeguard its financial integrity and investment dealings, preventing illicit fund flows and ensuring compliance with global financial standards.

Failure to comply can result in severe penalties, including substantial fines and reputational damage. For instance, in 2023, financial institutions globally faced billions in AML-related fines, underscoring the high stakes involved. Compagnie du Bois Sauvage's commitment to robust AML/ATF protocols is therefore essential for maintaining trust with investors and regulatory bodies.

- Regulatory Scrutiny: Increased global focus on financial crime means heightened scrutiny of transactions, requiring diligent due diligence and reporting.

- Compliance Costs: Implementing and maintaining effective AML/ATF programs involves significant investment in technology, training, and personnel.

- International Cooperation: Cross-border transactions necessitate understanding and complying with varying international AML/ATF regulations.

- Reputational Risk: Non-compliance can severely damage a company's reputation, impacting investor confidence and business relationships.

New reporting directives, such as the Corporate Sustainability Reporting Directive (CSRD)

The Corporate Sustainability Reporting Directive (CSRD), effective from January 1, 2024, imposes substantial legal requirements on Compagnie du Bois Sauvage concerning its environmental, social, and governance (ESG) disclosures. This directive mandates a more detailed and standardized approach to reporting, impacting how the company communicates its sustainability performance.

Compagnie du Bois Sauvage must now adhere to extensive reporting standards, covering a broad spectrum of ESG factors. This increased transparency is designed to enhance accountability and provide stakeholders with a clearer understanding of the company's operations and their broader impact.

- CSRD Implementation: Effective January 1, 2024, requiring immediate compliance for many companies.

- Expanded Scope: Mandates reporting on a wider range of sustainability matters than previous regulations.

- Standardized Framework: Aims to create comparable and reliable sustainability information across the EU.

- Increased Accountability: Places greater legal responsibility on companies for the accuracy and completeness of their disclosures.

Compagnie du Bois Sauvage is subject to evolving financial regulations, including those impacting investment vehicles and capital markets, as seen with the ongoing refinement of EU financial services rules in 2024. The company's real estate activities are governed by diverse national property laws, affecting acquisition timelines and due diligence processes, with EU commercial property transactions averaging 4-6 months in 2024. Furthermore, stringent AML/ATF laws require robust compliance programs, as evidenced by the billions in AML fines levied globally in 2023, highlighting significant reputational and financial risks for non-compliance.

The Corporate Sustainability Reporting Directive (CSRD), effective January 1, 2024, mandates extensive ESG disclosures, increasing accountability for companies like Compagnie du Bois Sauvage. This directive aims to standardize sustainability reporting across the EU, providing stakeholders with more comparable and reliable information. Compliance with the CSRD requires significant effort in data collection and reporting, directly impacting how the company communicates its environmental, social, and governance performance.

Environmental factors

The EU Green Deal, aiming for climate neutrality by 2050, coupled with evolving national environmental regulations in Europe, significantly shapes Compagnie du Bois Sauvage's investment landscape. These directives are likely to mandate higher energy efficiency standards for its real estate assets and push for reduced emissions across its industrial holdings.

For instance, the EU's Taxonomy Regulation, which came into full effect in 2023, classifies economic activities based on their environmental sustainability, potentially influencing the attractiveness and financing of Compagnie du Bois Sauvage's diverse portfolio. This regulatory push encourages investments in sustainable forestry and renewable energy, aligning with the company's long-term strategy.

Investors and regulators are placing a much greater emphasis on Environmental, Social, and Governance (ESG) factors. This means Compagnie du Bois Sauvage needs to more thoroughly weave these considerations into how it screens investments and manages its portfolios. For instance, as of early 2024, global ESG assets were projected to exceed $30 trillion, highlighting the significant capital flow towards sustainable investments.

Compagnie du Bois Sauvage's focus on responsible projects aligns with this trend, demonstrating a commitment to building sustainable value. The company's strategy reflects a growing understanding that environmental stewardship and social responsibility are not just ethical imperatives but also drivers of long-term financial performance, particularly as climate-related risks become more prominent in financial disclosures.

Climate change presents tangible threats to Compagnie du Bois Sauvage's real estate holdings. Increased occurrences of extreme weather events, such as intensified storms and prolonged droughts, can lead to direct physical damage, escalating maintenance costs, and potential devaluation of properties. For instance, the United Nations Office for Disaster Risk Reduction reported that weather-related disasters caused over $1.7 trillion in economic losses globally between 2000 and 2019, a trend expected to worsen.

Rising sea levels pose a particular risk for coastal real estate. Properties situated in low-lying areas face the prospect of inundation, erosion, and saltwater intrusion, directly impacting their long-term viability and marketability. The Intergovernmental Panel on Climate Change (IPCC) projects a potential sea-level rise of up to 1.1 meters by 2100 under high emissions scenarios, necessitating proactive adaptation strategies for affected assets.

Compagnie du Bois Sauvage must integrate climate risk assessment into its property management and investment decisions. This includes evaluating the vulnerability of its portfolio to physical climate impacts and implementing mitigation measures such as climate-resilient construction, flood defenses, and diversification of asset locations away from high-risk zones. Proactive adaptation is crucial to safeguard asset value and ensure operational continuity in the face of evolving environmental challenges.

Demand for green buildings and sustainable investments

The global market for green buildings is experiencing significant growth, with projections indicating continued expansion. For instance, the green building materials market was valued at approximately USD 274.6 billion in 2023 and is expected to reach USD 450 billion by 2028, growing at a CAGR of 10.3% during this period. This surge is fueled by increasing environmental awareness and government policies promoting sustainable construction practices.

Compagnie du Bois Sauvage, through its real estate arm Eaglestone, is well-positioned to capitalize on this trend. By integrating eco-friendly design and materials into its projects, the company can attract environmentally conscious tenants and investors, thereby boosting asset value and marketability. This aligns with a broader shift towards sustainable investing, where Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions.

Key drivers for this demand include:

- Government Regulations and Incentives: Many countries are implementing stricter building codes and offering tax credits or subsidies for green construction.

- Tenant and Occupant Preferences: Businesses and individuals are increasingly seeking healthier, more energy-efficient workspaces and residences.

- Investor Demand for ESG: Sustainable real estate is becoming a core component of ESG portfolios, attracting significant capital.

- Operational Cost Savings: Green buildings often result in lower utility bills, offering long-term financial benefits to owners and occupants.

Resource scarcity and supply chain sustainability for portfolio companies

Fluctuating cocoa prices, which saw a significant surge in early 2024 reaching record highs, highlight the inherent vulnerability of supply chains to resource scarcity and environmental pressures. For Compagnie du Bois Sauvage's chocolate division, this volatility directly impacts raw material costs and profitability.

Ensuring sustainable sourcing practices and building resilient supply chains are paramount for the company's long-term operational stability. This involves mitigating risks associated with climate change impacts on agricultural output and addressing ethical sourcing concerns.

- Cocoa Price Volatility: Cocoa futures on the ICE exchange reached over $10,000 per metric ton in early 2024, a stark increase from previous years, directly impacting input costs for chocolate manufacturers.

- Climate Change Impact: West Africa, a primary cocoa-producing region, faces increasing threats from erratic rainfall and disease, potentially reducing yields and further straining supply.

- Sustainable Sourcing Initiatives: Companies are investing in programs to support farmers, improve agricultural practices, and ensure traceability to build more sustainable and reliable supply chains.

Environmental regulations, particularly the EU Green Deal and national policies, are driving demand for sustainable practices across Compagnie du Bois Sauvage's operations, influencing real estate standards and industrial emissions.

Climate change poses significant physical risks to real estate assets, with rising sea levels and extreme weather events necessitating robust adaptation strategies and resilient construction. The projected global economic losses from weather-related disasters between 2000 and 2019 alone exceeded $1.7 trillion, underscoring the financial implications.

The growing green building market, projected to reach $450 billion by 2028, presents opportunities for Compagnie du Bois Sauvage's real estate arm, Eaglestone, to leverage eco-friendly designs and attract ESG-focused investors. Cocoa price volatility, reaching over $10,000 per metric ton in early 2024, highlights the need for sustainable sourcing and resilient supply chains to mitigate climate-related agricultural risks.

| Environmental Factor | Impact on Compagnie du Bois Sauvage | Relevant Data/Trend |

| EU Green Deal & Regulations | Mandates higher energy efficiency, reduced emissions, influences investment attractiveness. | Climate neutrality by 2050 target. EU Taxonomy Regulation effective 2023. |

| Climate Change Risks | Physical damage to real estate, increased maintenance, potential devaluation. | Weather-related disasters cost over $1.7 trillion globally (2000-2019). Up to 1.1m sea-level rise by 2100 (IPCC). |

| Green Building Market Growth | Opportunity for real estate arm (Eaglestone) through eco-friendly designs. | Market valued at ~$274.6 billion in 2023, projected to reach $450 billion by 2028 (10.3% CAGR). |

| Supply Chain Vulnerability (Cocoa) | Impacts raw material costs and profitability due to climate-induced scarcity. | Cocoa prices exceeded $10,000/metric ton in early 2024. West Africa faces erratic rainfall and disease. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Compagnie du Bois Sauvage is built on data from reputable sources including forestry industry reports, international trade organizations, and government environmental agencies. We analyze market trends, regulatory frameworks, and socio-economic indicators to provide a comprehensive overview.