BNK Financial Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BNK Financial Group Bundle

BNK Financial Group's strengths lie in its robust digital banking platform and expanding customer base, but it faces challenges from intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for strategic planning.

Want the full story behind BNK Financial Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BNK Financial Group commands significant regional market dominance, particularly in Busan and Gyeongsangnam-do. This deep-rooted presence fosters a loyal customer base and provides invaluable local market intelligence, enabling the group to offer highly relevant financial solutions.

The group's strategic focus on these key areas allows for the development of specialized financial products and services precisely tailored to the unique needs of both individual and corporate clients within these regions. This localized approach is a cornerstone of their competitive advantage.

Subsidiaries like Busan Bank and Gyeongnam Bank are instrumental in solidifying this regional strength. As of Q1 2024, Busan Bank reported total assets of approximately KRW 75 trillion, underscoring its substantial footprint and influence within its primary operating territories.

BNK Financial Group boasts a robust and diversified financial services portfolio, encompassing commercial banking via subsidiaries like Busan Bank and Kyongnam Bank, alongside securities brokerage, asset management, and venture capital operations. This broad spectrum of services allows the group to cater to a wide array of client needs within the South Korean financial landscape, from individual banking to corporate investment strategies.

This strategic diversification is a key strength, effectively mitigating risks by reducing dependence on any single business line. For instance, in 2023, BNK Financial Group reported total assets exceeding 140 trillion Korean Won, with its banking segment forming the core, but its non-banking affiliates contributing significantly to overall profitability and stability, demonstrating the resilience provided by its varied offerings.

BNK Financial Group boasts a strong domestic credit rating, consistently achieving 'AAA' from major agencies such as NICE, KIS, and KR. This top-tier rating underscores the group's exceptional financial stability, high-quality assets, and effective risk management. Such a strong credit profile significantly boosts investor confidence and provides easier access to capital markets, a crucial advantage in the competitive financial landscape.

Proactive Digital and AI Strategy

BNK Financial Group is aggressively advancing its digital and AI strategy, evident in the formation of dedicated teams like the Future Strategy Team and the Artificial Intelligence (AI) Business Team. This proactive approach is designed to foster innovation in digital customer experiences and optimize internal operations, thereby boosting their competitive edge in the evolving financial sector. By reorganizing to prioritize digital customer value and establishing divisions focused on non-face-to-face interactions, BNK is clearly positioning itself for sustained growth.

Key initiatives underscore BNK's commitment to digital transformation:

- Future Strategy Team: Established to spearhead long-term digital and AI planning.

- AI Business Team: Focused on integrating artificial intelligence for operational efficiency and new service development.

- Digital Customer Experience Innovation: Reorganization efforts are centered on enhancing customer interactions through digital channels.

- Non-Face-to-Face Divisions: Created to expand service accessibility and cater to the growing demand for remote banking solutions.

Commitment to Shareholder Returns

BNK Financial Group is actively prioritizing shareholder returns, signaling a strong commitment to its investors. This dedication is evident in their strategic financial policies designed to boost shareholder value.

Key initiatives include a forward-looking plan to raise the payout ratio to 50% by 2027, a significant increase that directly benefits shareholders. Furthermore, the group has implemented interim dividends, providing more frequent returns to investors.

BNK Financial Group's approach to risk-weighted asset management is also geared towards enhancing earnings visibility, making the company more attractive to investors. The cancellation of previously repurchased shares further underscores this commitment to maximizing shareholder value.

- Target Payout Ratio: Aiming for 50% by 2027.

- Dividend Policy: Introduction of interim dividends.

- Shareholder Value Focus: Cancellation of repurchased shares.

- Investor Appeal: Enhanced earnings visibility through asset management.

BNK Financial Group's strong regional presence, particularly in Busan and Gyeongsangnam-do, fosters deep customer loyalty and provides unique local market insights. This allows for tailored financial solutions that resonate with regional needs.

The group's diversified financial services, spanning banking, securities, asset management, and venture capital, create a resilient business model. This breadth reduces reliance on any single sector, as seen in 2023 where total assets exceeded KRW 140 trillion, with non-banking affiliates contributing significantly to stability.

BNK Financial Group maintains a robust domestic credit rating, consistently achieving AAA from major agencies. This reflects exceptional financial stability and effective risk management, bolstering investor confidence and capital access.

The group's aggressive digital and AI strategy, including dedicated teams and reorganized divisions for non-face-to-face interactions, positions it for future growth and enhanced customer experiences.

BNK Financial Group demonstrates a strong commitment to shareholder returns, evidenced by its goal of a 50% payout ratio by 2027 and the introduction of interim dividends.

| Metric | Value (Q1 2024/2023) | Significance |

|---|---|---|

| Busan Bank Total Assets | ~KRW 75 Trillion (Q1 2024) | Demonstrates significant regional banking strength. |

| BNK Financial Group Total Assets | > KRW 140 Trillion (2023) | Highlights overall scale and diversification. |

| Credit Rating | AAA (NICE, KIS, KR) | Indicates high financial stability and investor appeal. |

| Target Payout Ratio | 50% by 2027 | Shows a commitment to increasing shareholder returns. |

What is included in the product

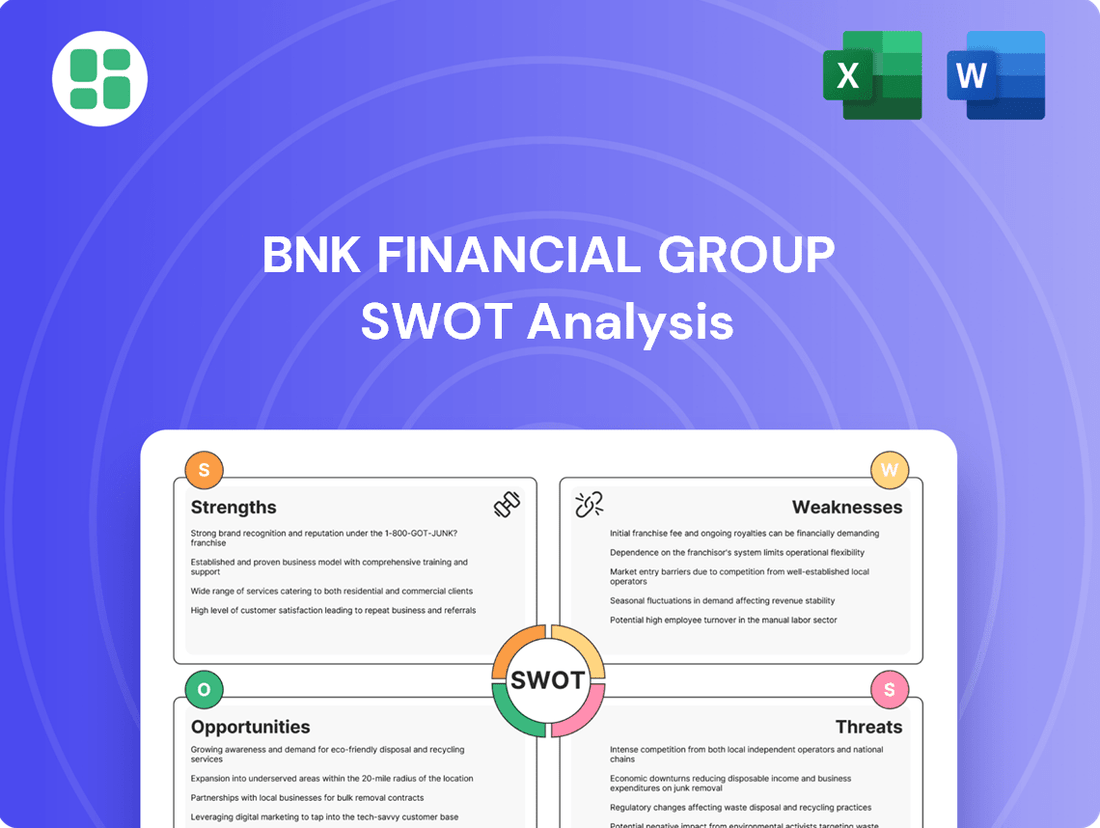

Delivers a strategic overview of BNK Financial Group’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, structured breakdown of BNK Financial Group's strategic landscape, simplifying complex internal and external factors for better decision-making.

Weaknesses

BNK Financial Group's significant presence in the Busan and Gyeongsangnam-do regions, while a historical strength, presents a notable concentration risk. This geographic focus makes the group particularly vulnerable to localized economic downturns or sector-specific challenges impacting these areas. For instance, a slowdown in the shipbuilding or automotive industries, key to the Gyeongsangnam-do economy, could disproportionately affect BNK's loan portfolio and overall financial performance.

BNK Financial Group's significant involvement in real estate project financing, especially with regional builders and manufacturers, presents a notable weakness. This concentration exposes the group to the inherent risks within the construction sector, which can directly impact earnings and necessitate higher credit provisions.

The increasing delinquency rates observed across the Korean banking landscape, particularly among small and medium-sized enterprises, amplify BNK Financial Group's vulnerability in this area. For instance, as of Q1 2024, the Financial Supervisory Service reported a rise in non-performing loans for SMEs, a trend that could disproportionately affect institutions with substantial project financing exposure.

BNK Financial Group experiences lower earnings visibility compared to its larger national competitors. This is largely due to the inherent volatility in its net interest margin (NIM) and a reliance on non-interest income sources that can fluctuate significantly. For instance, in the first quarter of 2024, BNK’s NIM saw a slight compression, impacting predictable income streams.

This lack of consistent earnings predictability makes it more challenging for investors to reliably forecast BNK's future financial performance. While the company actively seeks to smooth out its earnings, external economic factors and shifts in the financial markets can still introduce considerable uncertainty into its revenue streams, as seen in the second half of 2023 when fee income was lower than anticipated.

Increasing Delinquency Rates

BNK Financial Group, like many in the South Korean banking sector, is grappling with increasing delinquency rates. This is particularly evident in loans extended to small and medium-sized enterprises (SMEs) and in the household credit segment. For instance, by the end of 2023, delinquency rates for Korean banks generally saw an uptick, signaling a broader economic pressure affecting borrowers.

This rise in overdue payments points to a potential weakening in the quality of BNK's loan portfolio. Such deterioration directly translates into a higher likelihood of loan losses, which in turn can significantly dent the group's profitability. The necessity for proactive provisioning by BNK underscores these underlying asset quality concerns, as the bank anticipates potential future defaults.

- Rising SME Delinquencies: Reflecting broader economic headwinds impacting smaller businesses in South Korea.

- Household Credit Strain: Indicating increased pressure on individual borrowers, potentially due to inflation or interest rate hikes.

- Impact on Profitability: Higher delinquency rates necessitate increased loan loss provisions, directly reducing net income.

Intense Competition in the Broader Market

BNK Financial Group operates within South Korea's fiercely competitive financial landscape. Rivalry comes from established large domestic banks, agile internet-only banks, and influential global financial players. This intense competition puts pressure on BNK's profit margins and can hinder its ability to grow market share beyond its current regional strongholds.

The need for BNK to diversify its revenue streams, particularly moving beyond its reliance on household lending, underscores the significant competitive pressures it faces. Staying relevant requires ongoing, substantial investment in technological innovation and customer-centric product development to attract and retain clients in this dynamic market.

- Market Share Pressure: Intense competition limits BNK's potential to expand its market share, especially outside its core regional markets.

- Margin Compression: The need to compete on price and service can lead to reduced profit margins on financial products.

- Innovation Imperative: Continuous investment in new technologies and digital services is essential to keep pace with competitors and customer expectations.

- Diversification Need: Competitive pressures highlight the strategic necessity for BNK to reduce its dependence on traditional household lending.

BNK Financial Group's concentrated regional focus in Busan and Gyeongsangnam-do creates significant vulnerability to localized economic downturns. For instance, a slowdown in the region's key industries like shipbuilding could disproportionately impact BNK's loan portfolio. Furthermore, its substantial exposure to real estate project financing, particularly with regional builders, exposes it to sector-specific risks that can affect earnings and necessitate higher credit provisions.

The group faces challenges with earnings visibility due to fluctuations in its net interest margin and reliance on volatile non-interest income. For example, BNK's net interest margin experienced slight compression in Q1 2024, impacting predictable income streams. This makes future financial performance harder for investors to forecast accurately, as seen in the second half of 2023 when fee income fell short of expectations.

BNK is susceptible to rising delinquency rates across South Korea, particularly within the SME and household credit segments. By the end of 2023, delinquency rates for Korean banks generally saw an uptick, signaling broader economic pressures on borrowers. This trend directly impacts BNK's asset quality, leading to higher potential loan losses and necessitating increased provisioning, as evidenced by a rise in non-performing loans for SMEs reported by the Financial Supervisory Service in Q1 2024.

Intense competition from large domestic banks, internet-only banks, and global financial players pressures BNK's profit margins and hinders market share growth beyond its core regions. The need to diversify revenue streams, especially reducing reliance on household lending, is critical. Continuous investment in technological innovation and digital services is essential to remain competitive and meet evolving customer expectations, as market pressures necessitate competitive pricing and service offerings.

| Weakness | Description | Impact | Example Data (as of Q1 2024/End 2023) |

|---|---|---|---|

| Regional Concentration | Heavy reliance on Busan and Gyeongsangnam-do economies. | Vulnerability to localized economic shocks. | Key industries in Gyeongsangnam-do include shipbuilding and automotive. |

| Real Estate Project Financing Exposure | Significant involvement with regional builders. | Increased risk from construction sector volatility. | Higher credit provisions may be required due to sector risks. |

| Rising Delinquencies (SME & Household) | Increased overdue payments in loan portfolio. | Potential for higher loan losses and reduced profitability. | Q1 2024: Rise in non-performing loans for SMEs reported by Financial Supervisory Service. End 2023: General uptick in delinquency rates for Korean banks. |

| Lower Earnings Visibility | Volatility in Net Interest Margin (NIM) and non-interest income. | Difficulty in forecasting future financial performance. | Q1 2024: Slight compression in BNK's NIM. H2 2023: Lower than anticipated fee income. |

| Intense Competition | Rivalry from established banks, internet banks, and global players. | Pressure on profit margins, limited market share growth. | Necessity for continuous investment in technology and digital services. |

Preview Before You Purchase

BNK Financial Group SWOT Analysis

This is a real excerpt from the complete BNK Financial Group SWOT analysis. Once purchased, you’ll receive the full, editable version, offering a comprehensive understanding of their Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full BNK Financial Group SWOT report you'll get. Purchase unlocks the entire in-depth version, providing actionable insights for strategic planning.

You’re viewing a live preview of the actual BNK Financial Group SWOT analysis file. The complete version becomes available after checkout, ensuring you have all the necessary data.

Opportunities

The South Korean open banking market is set for impressive expansion, with forecasts indicating a 31.1% compound annual growth rate between 2025 and 2030. This robust growth trajectory offers BNK Financial Group a prime opportunity to forge deeper connections with fintech innovators, refine its data-driven customer solutions, and broaden its digital reach.

By capitalizing on this open banking surge, BNK Financial Group can tap into new revenue streams and attract a more diverse customer base, particularly within the lucrative banking and capital markets sector, which represents a significant portion of the overall market's revenue generation.

BNK Financial Group's commitment to digital transformation and the establishment of an AI Business Team presents a significant opportunity to pioneer new digital and AI-driven services. This strategic direction allows for the creation of innovative products that cater to evolving customer needs and market demands.

The group can leverage AI to enhance non-face-to-face banking experiences and optimize digital sales centers, thereby improving customer engagement and operational efficiency. This aligns with the increasing digital maturity observed across the banking sector, with many institutions reporting substantial growth in digital channel usage.

For instance, by mid-2024, the financial services industry saw a notable uptick in digital transactions, with some banks reporting over 70% of customer interactions occurring through digital platforms. BNK Financial Group can capitalize on this trend by diversifying its revenue streams through these advanced digital channels, offering personalized financial solutions powered by AI.

BNK Financial Group's 2024-2026 Mid-to Long-term ESG Strategy, with its focus on Green Finance, Co-prosperity Finance, and Righteous Finance, presents a substantial growth avenue. This strategic direction is particularly timely given the increasing global demand for sustainable investments.

By prioritizing sustainable finance, BNK Financial Group can attract a growing segment of socially conscious investors and enhance its corporate reputation. This focus also allows the group to capitalize on the expanding market for green loans and investments, a trend supported by a projected 15% annual growth rate for the global green bond market through 2027.

Potential for Institutional Crypto Trading

South Korea's financial watchdogs are set to unveil guidelines for institutional crypto investment by Q3 2025. This move will permit professional investors and public firms to trade cryptocurrencies within a regulated environment. This developing market presents fresh opportunities for BNK's securities brokerage and asset management divisions, contingent on the establishment of suitable regulatory and risk management protocols.

This regulatory evolution is anticipated to foster market stability and draw significant capital inflows. For instance, the global digital asset market capitalization reached approximately $2.5 trillion in early 2024, indicating substantial untapped potential for regulated institutional participation.

- Regulatory Clarity: South Korea's upcoming institutional crypto guidelines by Q3 2025 offer a clear path for adoption.

- Market Growth: The global digital asset market's growth, exceeding $2.5 trillion in early 2024, signals substantial opportunities.

- BNK's Advantage: BNK's existing securities brokerage and asset management arms are well-positioned to capitalize on this shift.

- Risk Mitigation: Successful entry hinges on developing robust regulatory compliance and risk management frameworks.

Diversification of Revenue Sources

BNK Financial Group is actively diversifying its revenue by establishing a dedicated Pension Division and a Senior Finance Team. This strategic initiative aims to broaden income generation beyond conventional banking services.

By focusing on specific demographic segments such as seniors and expanding into the pension services market, BNK Financial Group is tapping into growing demand. This move is designed to lessen dependence on its core banking operations and cultivate stable, long-term revenue channels. For instance, the global pension fund market was valued at approximately $50 trillion in 2023 and is projected to grow significantly in the coming years, presenting a substantial opportunity.

- Pension Division Establishment: Directly addresses the growing need for retirement planning and management services.

- Senior Finance Team: Focuses on a demographic with increasing financial needs and wealth.

- Market Penetration: Aims to capture market share in the expanding senior and pension sectors.

- Reduced Reliance on Core Banking: Creates a more resilient business model by adding non-traditional revenue streams.

The South Korean open banking market's projected 31.1% CAGR through 2030 offers BNK Financial Group a chance to deepen fintech partnerships and expand digital services. This growth, particularly in banking and capital markets, presents clear avenues for new revenue and customer acquisition.

BNK's AI focus allows for pioneering new digital services, enhancing non-face-to-face interactions, and optimizing digital sales. This aligns with the trend of over 70% of customer interactions occurring digitally by mid-2024 for many banks.

The group's ESG strategy, emphasizing Green, Co-prosperity, and Righteous Finance, taps into the growing demand for sustainable investments, supported by a projected 15% annual growth in the global green bond market through 2027.

South Korea's upcoming Q3 2025 crypto investment guidelines for institutions, allowing professional investors and firms to trade within a regulated environment, present a significant opportunity for BNK's securities and asset management divisions, given the global digital asset market's early 2024 valuation of $2.5 trillion.

| Opportunity Area | Key Driver | BNK's Position | Market Potential (Example) |

|---|---|---|---|

| Open Banking Expansion | 31.1% CAGR (2025-2030) | Fintech partnerships, digital service enhancement | Banking & Capital Markets Revenue |

| AI & Digital Transformation | Increased digital interaction (70%+) | New AI-driven services, improved customer experience | Enhanced operational efficiency |

| ESG & Sustainable Finance | Growing investor demand | Green Finance focus, enhanced reputation | 15% annual growth in green bonds (through 2027) |

| Digital Asset Regulation | Institutional crypto trading guidelines (Q3 2025) | Leveraging securities/asset management arms | $2.5 trillion global digital asset market (early 2024) |

Threats

BNK Financial Group faces considerable threats from a potential economic slowdown in South Korea, exacerbated by global uncertainties. The nation's export-dependent economy is particularly vulnerable to trade tariffs and domestic political instability, which could dampen overall economic activity.

The risk of a recession in 2024-2025 could significantly impact BNK. Lowered GDP growth forecasts, such as those from the Bank of Korea which revised its 2024 growth forecast down to 2.1% in February 2024, signal a challenging environment. This slowdown typically leads to reduced consumer and corporate spending, directly affecting loan demand and increasing the likelihood of credit defaults for the group.

The Bank of Korea's inclination towards potential interest rate cuts in 2025 to stimulate economic activity presents a significant threat to BNK Financial Group. This anticipated monetary policy shift, combined with a persistent narrowing of the loan-deposit interest rate spread, directly pressures BNK's Net Interest Margin (NIM).

A declining NIM directly translates to reduced interest income for BNK, potentially impacting overall profitability. This is particularly concerning if the group faces elevated funding costs or experiences a slowdown in loan origination. For instance, in the first quarter of 2024, the average NIM for Korean banks hovered around 1.5%, a figure that could face further pressure with rate cuts.

The South Korean financial sector is navigating a dynamic regulatory environment, with significant shifts impacting institutions like BNK Financial Group. Recent and anticipated changes include updated short selling rules, new frameworks for virtual assets, and potential enhancements to capital adequacy requirements. These developments necessitate ongoing adaptation of BNK's operational strategies and compliance protocols.

Adapting to these evolving regulations could involve increased operational expenses for BNK Financial Group, potentially impacting profitability. Furthermore, new guidelines might introduce limitations on specific business activities or product offerings, requiring strategic adjustments. For instance, the Financial Services Commission (FSC) has been actively discussing advancements in digital finance regulation throughout 2024 and into 2025, which could directly influence BNK's fintech initiatives.

Failure to adhere to these changing regulatory mandates poses a substantial risk, potentially resulting in significant financial penalties and reputational damage. BNK Financial Group must maintain robust compliance systems to mitigate these threats effectively, ensuring alignment with directives from bodies like the Bank of Korea and the FSC.

Increased Credit Risk from At-Risk Loans

The increasing volume of Stage 2 and Stage 3 loans across South Korea's major banks, including BNK Financial Group, signals a heightened credit risk environment. This trend suggests a greater likelihood of loan defaults and necessitates increased provisioning by financial institutions, which can negatively impact earnings and the overall health of their balance sheets.

For BNK Financial Group, this translates directly into a higher potential for non-performing loans (NPLs) and the need for more robust loan loss provisions. The economic headwinds further amplify these concerns, making proactive risk management crucial.

- Rising NPL Ratios: South Korea's banking sector saw an uptick in NPLs in late 2023 and early 2024, with some reports indicating a climb above 0.5% for aggregate Stage 3 loans.

- Provisioning Impact: Increased provisioning directly reduces a bank's net income, as these funds are set aside to cover potential loan losses.

- Economic Sensitivity: A challenging economic outlook, marked by slower growth or potential downturns, increases the probability of borrowers defaulting on their obligations.

Intensified Competition from Fintech and Digital Banks

The financial landscape is rapidly evolving with the surge of fintech and digital-only banks, creating a more competitive environment for established institutions like BNK Financial Group. These new entrants often leverage advanced technology to offer streamlined customer experiences and potentially more competitive pricing, directly challenging traditional banking models.

BNK must actively invest in its own technological infrastructure and digital capabilities to counter this trend. For instance, the global fintech market size was projected to reach $325 billion in 2024, highlighting the significant investment and growth in this sector. Staying ahead requires continuous innovation to match the agility and digital-native advantages of competitors.

Failure to adapt could result in customer churn, as consumers increasingly seek convenient and digitally-integrated banking solutions. BNK's ability to offer comparable or superior digital services will be crucial in retaining its customer base and attracting new ones in this intensified competitive arena.

- Digital Transformation Pace: Fintech companies are known for their rapid deployment of new digital services, often outpacing traditional banks in innovation cycles.

- Cost Structure Advantage: Internet-only banks can operate with lower overheads compared to brick-and-mortar institutions, potentially allowing them to offer more attractive rates or fees.

- Customer Experience Focus: New digital players prioritize user-friendly interfaces and seamless online/mobile experiences, setting higher customer expectations.

- Market Share Erosion: Without a strong digital offering, BNK risks losing market share to more agile and digitally-focused competitors.

BNK Financial Group faces significant threats from increasing non-performing loan (NPL) ratios across South Korea's banking sector, with Stage 3 loans showing an upward trend. This necessitates higher loan loss provisions, directly impacting profitability and requiring proactive risk management amidst economic headwinds.

The competitive landscape is intensifying due to the rapid growth of fintech and digital-only banks, which often possess lower cost structures and a focus on superior digital customer experiences. BNK must accelerate its digital transformation to retain customers and market share against these agile competitors.

Evolving regulatory frameworks, including changes in short selling rules and capital adequacy requirements, demand continuous adaptation and could increase operational expenses for BNK. Failure to comply with directives from bodies like the Financial Services Commission (FSC) risks penalties and reputational damage.

Potential interest rate cuts by the Bank of Korea in 2025, coupled with a narrowing loan-deposit interest rate spread, directly pressure BNK's Net Interest Margin (NIM), potentially reducing interest income. For instance, the average NIM for Korean banks in Q1 2024 was around 1.5%, a figure vulnerable to further compression.

SWOT Analysis Data Sources

This BNK Financial Group SWOT analysis is built upon a foundation of credible data, including official financial filings, comprehensive market research reports, and expert industry commentary to provide a robust and insightful assessment.