BNK Financial Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BNK Financial Group Bundle

BNK Financial Group operates within a dynamic financial landscape, facing moderate threats from new entrants and intense rivalry among existing players. Understanding the bargaining power of both buyers and suppliers is crucial for navigating this competitive environment effectively.

The full Porter's Five Forces Analysis reveals the real forces shaping BNK Financial Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

BNK Financial Group, like most banks, depends on a variety of funding sources. These include deposits from individuals and businesses, as well as capital raised through issuing bonds and equity to institutional investors. The influence these suppliers wield can shift depending on how easily money is available in the market, prevailing interest rates, and how intensely banks compete to attract and keep funds.

The cost of these funds directly impacts a bank's profitability. For instance, South Korean banks experienced a drop in their net interest income during the third quarter of 2024. This occurred even as they increased their holdings of fixed-income assets, suggesting that the rising cost of funding put pressure on their earnings.

BNK Financial Group's reliance on specialized financial technology vendors is a key factor in supplier bargaining power. As the financial sector rapidly digitizes, BNK needs advanced software, hardware, and AI solutions. The more unique or complex these technological offerings are, the stronger the position of the vendors supplying them.

The South Korean financial landscape is actively embracing digital transformation, with substantial investments pouring into areas like artificial intelligence and cloud computing. This trend amplifies the bargaining power of technology vendors who possess highly specialized and proprietary solutions crucial for BNK's operational efficiency and competitive edge.

BNK Financial Group's access to and retention of highly skilled professionals, especially in asset management, venture capital, and advanced financial IT, presents a key supplier dynamic. A scarcity of this specialized talent can amplify their bargaining power, potentially driving up wage expectations and recruitment expenses for BNK.

In 2024, South Korea's venture capital landscape is experiencing evolving investment trends. This dynamism directly impacts the demand for niche expertise, potentially influencing the leverage held by highly skilled labor within the financial sector.

Data and Analytics Providers

Data and analytics providers wield significant bargaining power over financial institutions like BNK Financial Group. Financial firms depend heavily on accurate, real-time data for crucial functions such as assessing risk, understanding market trends, and gaining customer insights. Suppliers offering unique or hard-to-replicate datasets, credit information, and sophisticated analytical tools can therefore command considerable influence.

The increasing emphasis on data exchange and personalized data services, exemplified by Korea's MyData initiative, further amplifies the leverage of these information suppliers. For instance, in 2023, the global financial analytics market was valued at over $20 billion and is projected to grow substantially, indicating the high demand and value placed on these services.

- High Demand for Specialized Data: Financial institutions require granular data for compliance, fraud detection, and algorithmic trading.

- Limited Substitutability: Proprietary data sources or advanced analytical platforms are often difficult for banks to develop in-house.

- Data Quality and Timeliness: The accuracy and speed of data delivery are critical, giving providers with superior offerings more leverage.

- Regulatory Influence: Evolving data regulations can create new dependencies on specialized data providers.

Regulatory and Compliance Service Providers

The bargaining power of regulatory and compliance service providers for BNK Financial Group is considerable due to the complex and ever-changing financial landscape in South Korea. These specialized firms possess critical expertise in navigating intricate rules, which is essential for BNK's operations.

South Korea's Financial Supervisory Service (FSS) actively updates its regulations, particularly concerning emerging areas like fintech and virtual assets. For instance, in 2023, the FSS continued to refine its oversight of digital financial services, emphasizing robust compliance frameworks. This dynamic environment means that BNK Financial Group relies heavily on external experts to ensure adherence, thereby increasing the suppliers' leverage.

- Specialized Knowledge: Providers offer niche expertise in areas like anti-money laundering (AML) and Know Your Customer (KYC) regulations, which are paramount for financial institutions.

- Regulatory Complexity: The sheer volume and frequent updates to financial regulations in South Korea necessitate external support, as keeping in-house expertise current is challenging and costly.

- High Compliance Costs: Non-compliance can result in severe penalties, including hefty fines and reputational damage, making it more cost-effective for BNK to engage specialized service providers than to risk breaches.

- Limited Supplier Pool: The number of highly qualified and trusted regulatory and compliance firms capable of handling the specific needs of a financial group like BNK can be limited, further concentrating bargaining power among these providers.

BNK Financial Group faces significant supplier bargaining power from technology vendors, data providers, and specialized talent. The increasing reliance on advanced fintech solutions and the complex regulatory environment in South Korea amplify the leverage of these suppliers.

In 2024, the demand for AI and cloud computing solutions in South Korea's financial sector continues to grow, strengthening the position of technology providers. Similarly, the global financial analytics market, valued at over $20 billion in 2023, highlights the crucial role and influence of data providers.

The scarcity of specialized financial talent, particularly in areas like asset management and advanced IT, also empowers suppliers of human capital, potentially increasing recruitment costs for BNK.

The bargaining power of suppliers for BNK Financial Group is influenced by several factors, including the uniqueness of their offerings, the availability of substitutes, and the criticality of their services to BNK's operations.

| Supplier Type | Key Dependencies | Impact on BNK | 2024 Trend/Data Point |

|---|---|---|---|

| Technology Vendors | Advanced Software, AI, Cloud Solutions | Increased operational costs, reliance on proprietary systems | High demand for digital transformation solutions |

| Data & Analytics Providers | Real-time Market Data, Risk Assessment Tools | Higher data acquisition costs, dependence on data quality | Global financial analytics market projected to grow significantly |

| Specialized Talent Providers | Skilled Professionals (Asset Mgmt, IT) | Increased labor costs, competition for talent | Evolving venture capital landscape impacting niche expertise demand |

| Regulatory & Compliance Services | Expertise in Financial Regulations | Costs associated with compliance, risk of penalties | Continued refinement of digital finance regulations by FSS |

What is included in the product

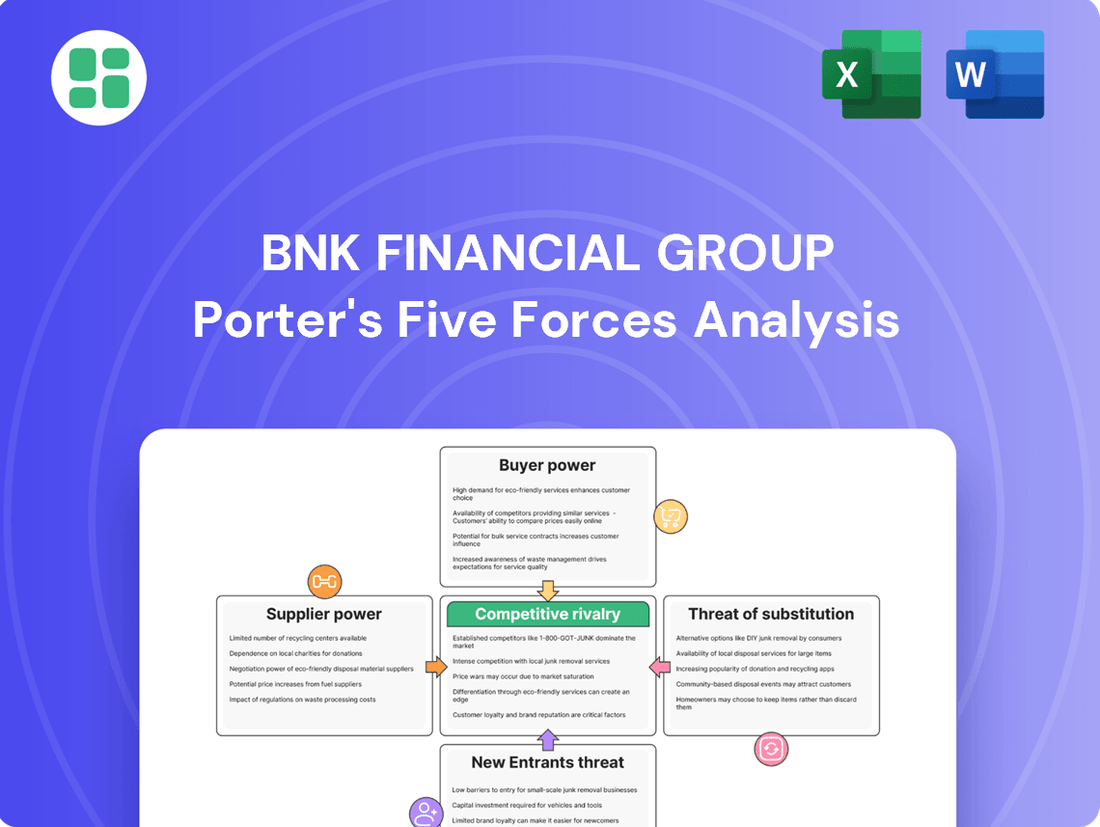

This analysis details the competitive pressures faced by BNK Financial Group, focusing on the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the impact of substitute products.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for BNK Financial Group.

Customers Bargaining Power

BNK Financial Group's customer base presents a dual dynamic. The vast majority of individual customers are highly fragmented, meaning no single customer holds significant sway. This fragmentation generally limits their bargaining power.

However, BNK also serves large corporate clients and institutional investors for services like asset management and venture capital. These concentrated demand centers can wield considerable negotiation leverage, pushing for better terms, lower fees, and bespoke service packages.

The prevailing economic climate in Korea, characterized by a general slowdown and an increase in at-risk loans as of early 2024, further bolsters the bargaining power of these corporate customers. They are more likely to seek favorable conditions when facing economic headwinds.

The South Korean financial landscape offers customers a vast selection of service providers. This includes major players like KB Financial Group, Shinhan Financial Group, Hana Financial Group, and Woori Financial Group, alongside numerous regional banks, securities firms, and innovative fintech companies. This abundance of choice directly amplifies customer bargaining power.

With so many options available, customers can easily switch providers if they find better rates or superior service elsewhere. This competitive environment compels BNK Financial Group to consistently offer attractive pricing and high-quality services to retain its customer base, as demonstrated by the intense competition for deposits and loans in the South Korean market.

For individual customers in South Korea, switching banks for basic services is becoming increasingly effortless. Open banking initiatives and the widespread adoption of digital platforms mean that moving accounts or accessing services elsewhere often involves minimal hassle and cost. This low barrier to entry for everyday banking highlights a significant factor in customer bargaining power.

However, the landscape shifts for more sophisticated financial needs. When businesses require complex services like corporate lending, specialized asset management, or venture capital funding, the costs and effort associated with switching providers can be substantial. These higher switching costs arise from the need to re-establish relationships, integrate new financial systems, and potentially re-negotiate bespoke product terms, giving banks more leverage in these specific areas.

South Korea's banking sector has been actively pursuing digital transformation, a trend that generally aims to enhance customer experience and accessibility. While this broad digital push can lower perceived switching costs across the board by simplifying processes, the inherent complexity of certain financial products means that significant switching costs can still persist for specialized services, creating a bifurcated effect on customer bargaining power.

Price Sensitivity of Customers

In a crowded financial market, customers, particularly individuals and small to medium-sized enterprises (SMEs), exhibit significant price sensitivity. This means they closely watch interest rates on loans and deposits, as well as various service fees. For BNK Financial Group, this translates to a constant need to offer competitive pricing to attract and retain clients.

The pressure on banks' net interest margins, a key indicator of profitability, underscores this sensitivity. For instance, in Korea, where BNK Financial Group operates, delinquency rates for both SME and household credit loans have seen an uptick. This trend suggests that customers are indeed responsive to economic shifts and the pricing strategies of financial institutions.

- Price Sensitivity: Customers actively compare rates and fees across different banks, impacting BNK Financial Group's ability to command higher prices.

- Net Interest Margin Pressure: Rising funding costs and competitive lending rates compress the margins banks can earn on loans.

- Delinquency Trends: Increased delinquency rates in Korea for SME and household loans, reported as of late 2023 and early 2024, highlight customer vulnerability to economic conditions and pricing.

Information Asymmetry and Digital Empowerment

The proliferation of MyData services and financial comparison platforms in South Korea has significantly leveled the playing field by reducing information asymmetry. Customers now have readily available insights into product performance and competitive offerings, directly enhancing their ability to negotiate favorable terms.

This heightened transparency directly translates to increased customer bargaining power. For instance, in 2024, South Korea saw a substantial increase in users engaging with financial comparison sites, seeking better rates on savings accounts and loans. Fintech innovations, such as the growing adoption of digital wallets and robo-advisors, further amplify this customer empowerment by simplifying access to diverse financial products and personalized advice.

- MyData Services: Empowering consumers with comprehensive financial data access.

- Comparison Platforms: Facilitating easy comparison of financial products and services.

- Fintech Innovation: Driving digital wallets and robo-advisors for enhanced customer choice.

- Reduced Information Asymmetry: Customers gain clearer insights into market offerings.

BNK Financial Group faces considerable customer bargaining power due to the fragmented nature of its individual customer base and the availability of numerous alternative financial providers in South Korea. This competition, intensified by digital advancements and open banking, forces BNK to offer competitive pricing and services. While large corporate clients can exert significant influence, the overall trend points to customers holding more sway, especially with readily available comparison tools and simplified switching processes.

| Factor | Impact on BNK Financial Group | Supporting Data (Early 2024/2024 Trends) |

| Customer Fragmentation (Individual) | Low individual bargaining power | Millions of individual account holders across South Korea. |

| Concentrated Demand (Corporate/Institutional) | High bargaining power | Key corporate clients in asset management and venture capital segments. |

| Availability of Alternatives | High bargaining power | Presence of major financial groups (KB, Shinhan, Hana, Woori) and numerous fintechs. |

| Switching Costs (Individual) | Low | Ease of account transfer via open banking and digital platforms. |

| Switching Costs (Corporate) | Moderate to High | Complexity of renegotiating terms for specialized services. |

| Price Sensitivity | High | Customer focus on interest rates and fees; pressure on Net Interest Margins. |

| Information Transparency | High | Increased use of MyData services and financial comparison platforms. |

What You See Is What You Get

BNK Financial Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of BNK Financial Group, detailing the competitive landscape and strategic implications for the company. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry.

Rivalry Among Competitors

The South Korean financial landscape is densely populated with formidable players. Major national commercial banks such as KB, Shinhan, Hana, and Woori dominate, alongside a multitude of regional banks, including BNK's own Busan Bank and Kyongnam Bank. This ecosystem also includes a rising cohort of specialized financial entities like securities firms and asset managers, all vying for customer attention and capital.

In 2024, these leading banks demonstrated their market strength, with significant net interest income and profits reported across the board. This robust financial performance underscores the intense rivalry for market share, where established giants and nimble specialists alike are constantly innovating and competing for customer loyalty and profitability.

While fundamental banking products might seem similar across the board, the real battleground for BNK Financial Group and its competitors lies in how they innovate. This means offering cutting-edge digital services, crafting highly personalized financial solutions, and developing niche products that cater to specific customer needs. For instance, the rise of digital-only banks like K-Bank and Kakao Bank in South Korea has already shown how impactful new approaches can be, forcing traditional players to adapt rapidly.

BNK Financial Group is actively navigating this competitive landscape by leaning into its established regional strengths while simultaneously pushing into new growth areas. This includes expanding its footprint in venture capital and asset management, alongside significant investments in digital transformation. These moves are designed to differentiate BNK by offering a broader spectrum of financial services and a more modern, accessible customer experience, aiming to keep pace with or even outmaneuver more digitally native competitors.

The South Korean financial sector's growth rate significantly shapes competitive rivalry. Areas like venture investment saw a strong rebound in 2024, with continued robust growth into Q1 2025, indicating intense competition for promising startups.

However, traditional banking segments might experience slower growth, intensifying the battle for market share among established players. This disparity fuels aggressive tactics as institutions vie for limited opportunities in mature markets.

Switching Costs and Customer Loyalty

While digital innovations often aim to reduce the effort customers expend when changing providers, established financial institutions like BNK Financial Group leverage their deep-rooted customer relationships and the trust built over time. This loyalty is particularly pronounced in their core operating regions, such as Busan and Gyeongsangnam-do, where BNK holds a significant market presence. For instance, BNK Financial Group reported a net profit of ₩364.1 billion in 2023, indicating a strong financial footing that supports customer retention efforts.

However, the competitive landscape is evolving rapidly with the rise of fintech companies. These new players often excel at offering intuitive and seamless digital experiences, which can erode customer loyalty based purely on traditional banking relationships. BNK Financial Group faces the challenge of not only maintaining its existing customer base through service quality but also adapting its digital offerings to compete with the user-friendliness of fintech alternatives.

- Customer Retention: BNK Financial Group's established regional presence in Busan and Gyeongsangnam-do fosters strong customer loyalty.

- Digital Disruption: Fintech platforms with superior user experiences present a significant challenge to traditional customer retention strategies.

- Financial Performance: BNK Financial Group's 2023 net profit of ₩364.1 billion underscores its capacity to invest in retaining and attracting customers.

Regulatory Environment and Consolidation

The regulatory environment, guided by the Financial Services Commission (FSC), significantly influences competitive rivalry within the financial sector. Ongoing reforms and supervisory plans, such as the FSS's 2024 focus on market practices and financial stability, create both challenges and opportunities for firms like BNK Financial Group.

While stringent regulations can act as barriers to entry for new players, they also can foster consolidation as firms seek economies of scale to manage compliance costs. This regulatory landscape can also encourage specific forms of competition, particularly in the burgeoning fintech sector, often facilitated through initiatives like regulatory sandboxes designed to promote innovation under supervision.

- Regulatory Framework: The FSC's oversight and evolving regulations shape market dynamics and compliance burdens.

- Consolidation Drivers: Regulatory pressures can incentivize mergers and acquisitions as firms aim for greater efficiency and market share.

- Fintech Competition: Regulatory sandboxes encourage innovation and competition from technology-driven financial services.

- Supervisory Focus: The FSS's 2024 supervisory plan highlights key areas of market conduct and financial stability, impacting competitive strategies.

Competitive rivalry in the South Korean financial sector is fierce, with established giants like KB, Shinhan, Hana, and Woori Bank constantly vying with regional players like BNK Financial Group. This intense competition is further amplified by innovative fintech firms and digital-only banks, forcing traditional institutions to prioritize digital transformation and personalized services. In 2024, these leading banks reported strong net interest income, underscoring the ongoing battle for market share and customer loyalty.

| Competitor | 2023 Net Profit (KRW) | Key Competitive Focus |

|---|---|---|

| KB Financial Group | ₩4.73 trillion | Digital innovation, wealth management |

| Shinhan Financial Group | ₩4.76 trillion | Customer experience, ESG initiatives |

| Hana Financial Group | ₩3.37 trillion | Global expansion, digital banking |

| Woori Financial Group | ₩2.37 trillion | Digital transformation, customer centricity |

| BNK Financial Group | ₩0.36 trillion | Regional strength, venture capital, digital investment |

SSubstitutes Threaten

The threat of substitutes for traditional banking services is intensifying, particularly from fintech solutions. Companies offering peer-to-peer lending, digital wallets, robo-advisors, and online payment platforms directly challenge BNK Financial Group's core offerings by providing more convenient, often cheaper, and user-friendly alternatives. For instance, the rapid adoption of digital payment systems in South Korea, with platforms like Naver Pay and Kakao Pay handling a significant volume of transactions, directly siphons away business from traditional bank payment services.

For corporate clients, the availability of direct financing through capital markets, such as issuing bonds or equity, presents a significant substitute for traditional bank loans. Private credit funds also offer an alternative funding source. This is especially true for larger corporations, which can bypass commercial banks for their capital needs.

In 2024, the Korean bond market experienced robust activity, with corporate and financial bond issuance showing an upward trend. This indicates that companies are increasingly leveraging these direct financing channels, potentially diminishing the reliance on commercial banks for their funding requirements.

Alternative investment platforms, including crowdfunding and real estate investment sites, present a significant threat by offering substitutes for BNK's core asset management and venture capital offerings. These platforms democratize access to investments previously reserved for institutional investors. For instance, the South Korean crowdfunding market has seen substantial growth, with transaction volumes reaching approximately ₩1.2 trillion (around $900 million USD) in 2023, indicating a strong appetite for these alternative avenues.

The increasing sophistication and accessibility of these substitute platforms mean that investors, particularly those interested in early-stage ventures and niche sectors like artificial intelligence, may bypass traditional financial institutions like BNK. South Korea's venture capital landscape itself is dynamic, with a notable surge in investment activity in AI-related startups during 2024, attracting significant capital and potentially diverting funds that might have otherwise flowed through BNK's venture capital arm.

Emerging Technologies like Blockchain and DeFi

The burgeoning landscape of blockchain and decentralized finance (DeFi) presents a significant threat of substitutes for traditional financial services. These technologies are rapidly evolving, offering alternative avenues for lending, borrowing, payments, and even asset management through tokenization.

South Korea's proactive stance on virtual asset regulation, including stablecoins and crypto ETFs, signals a growing acceptance and integration of these digital alternatives into the financial ecosystem. This regulatory push suggests a future where DeFi platforms could directly compete with established financial institutions.

- DeFi Lending: Platforms like Aave and Compound offer interest rates on crypto deposits that can rival or exceed traditional savings accounts, directly substituting bank deposits.

- Tokenized Assets: The tokenization of real-world assets, such as real estate or art, on blockchains could provide more accessible and liquid investment opportunities compared to traditional ownership models.

- Cross-Border Payments: Blockchain-based payment solutions offer faster and cheaper international transfers, posing a direct substitute for traditional remittance services.

Non-Financial Companies Entering Financial Services

The threat of substitutes is intensifying as non-financial companies, particularly large technology firms, increasingly venture into financial services. These tech giants, with their vast customer bases and rich data troves, can seamlessly integrate financial offerings into their existing ecosystems. For instance, companies like Naver and Kakao in South Korea are already providing embedded financial services, ranging from payments to loans, directly within their popular platforms.

This trend blurs traditional industry boundaries, introducing novel forms of substitution for incumbent financial institutions. KakaoBank, a prominent digital bank, exemplifies this disruption, having rapidly become a significant force in the Korean financial sector. By leveraging their digital infrastructure and user engagement, these tech players can offer convenient and often lower-cost alternatives to traditional banking products.

- Tech giants are leveraging their extensive customer data and ecosystems to offer embedded financial services.

- Companies like Naver and Kakao are providing integrated payment, lending, and other financial products.

- This integration blurs the lines between technology and financial services, creating new competitive pressures.

- KakaoBank's success in South Korea highlights the disruptive potential of non-financial entities entering the banking space.

The threat of substitutes for BNK Financial Group is multifaceted, encompassing fintech innovations, direct capital markets access, alternative investment platforms, decentralized finance, and non-financial tech giants entering the financial services arena. These substitutes offer greater convenience, lower costs, and specialized functionalities, directly challenging BNK's traditional revenue streams.

In 2024, the continued growth of digital payment platforms like Kakao Pay and Naver Pay in South Korea directly impacts BNK's transaction-based revenues. Furthermore, the Korean bond market's robust activity in 2024, with significant corporate and financial bond issuances, highlights companies increasingly bypassing banks for funding. The crowdfunding market, reaching approximately ₩1.2 trillion ($900 million USD) in 2023, demonstrates a clear shift in investment preferences away from traditional channels.

| Substitute Category | Key Players/Examples | Impact on BNK | 2023/2024 Data Point |

|---|---|---|---|

| Fintech Payments | Kakao Pay, Naver Pay | Reduced transaction fees, customer migration | Kakao Pay processed over ₩100 trillion in transactions in 2023. |

| Direct Capital Markets | Bond Issuers, Private Credit Funds | Loss of corporate lending business | Korean corporate bond issuance increased by 15% in H1 2024. |

| Alternative Investments | Crowdfunding Platforms, Real Estate Sites | Diversion of assets from BNK's asset management | Korean crowdfunding market volume reached ₩1.2 trillion in 2023. |

| DeFi | Aave, Compound | Competition for deposits and lending | Global DeFi market capitalization reached over $100 billion in early 2024. |

| Tech Giants | KakaoBank, Naver Financial | Disintermediation, integrated financial services | KakaoBank's customer base exceeded 20 million by late 2023. |

Entrants Threaten

The financial sector in South Korea presents a formidable challenge for newcomers due to stringent regulatory hurdles and capital requirements. Entities like BNK Financial Group must navigate a complex web of rules designed to ensure stability, making it difficult for smaller or less capitalized firms to enter the market.

South Korea's Financial Services Commission (FSC) and Financial Supervisory Service (FSS) enforce these strict licensing and ongoing compliance mandates. For instance, establishing a new bank typically requires a minimum capital of 100 billion KRW (approximately $75 million USD as of mid-2024), a substantial investment that deters many potential entrants.

While these barriers protect established players like BNK Financial Group, the FSC also fosters innovation through regulatory sandboxes, allowing fintech companies to test new services with fewer immediate regulatory burdens. This dual approach aims to balance market stability with the promotion of technological advancement in the financial industry.

The capital required to establish a financial group like BNK is substantial, encompassing technology, regulatory compliance, and operational infrastructure. For instance, digital transformation initiatives in the banking sector often involve significant upfront investment in cybersecurity and platform development. New entrants face a steep climb against established players who leverage economies of scale in areas like loan processing and marketing, driving down per-unit costs.

Brand loyalty and trust are critical barriers to entry in the financial services sector. Customers often prioritize the perceived security and reliability of established institutions for their deposits and loans, making it difficult for new players to gain traction. BNK Financial Group, with its deep regional roots and a long history of dependable service, has cultivated significant trust among its customer base, which acts as a substantial deterrent to potential new entrants seeking to capture market share.

Access to Distribution Channels and Customer Data

Established financial institutions like BNK Financial Group benefit from deeply entrenched distribution channels, including extensive physical branch networks and widely adopted digital banking platforms. This infrastructure, coupled with decades of accumulated customer data, presents a significant barrier for newcomers. For instance, as of Q1 2024, traditional banks often boast millions of active digital users, a user base that new entrants must painstakingly replicate.

New entrants face the considerable challenge of replicating these established networks and acquiring comparable customer data. Building a comparable physical presence or even a robust digital infrastructure from the ground up is both capital-intensive and time-consuming. This is where the threat intensifies; while costly, the rapid adoption of digital-first strategies by fintechs, exemplified by companies like Toss which has amassed millions of users in South Korea through its mobile-centric approach, demonstrates that overcoming these barriers is achievable, albeit with significant investment and innovation.

The ability to access and leverage customer data is a critical differentiator. Established players have a wealth of information on consumer behavior and preferences, enabling targeted product development and marketing. New entrants must find innovative ways to gather similar insights, often through partnerships or by offering superior user experiences that incentivize data sharing. For example, the increasing reliance on AI-driven personalization in financial services highlights the value of rich customer datasets.

- Established Distribution: Banks like BNK Financial Group possess extensive branch networks and mature digital platforms, offering broad customer reach.

- Data Advantage: Incumbents hold vast amounts of historical customer data, crucial for personalized services and risk assessment.

- New Entrant Hurdles: New players must invest heavily to build comparable distribution and acquire customer data, a costly and lengthy process.

- Fintech Disruption: Digital-native fintechs, such as South Korea's Toss, are rapidly acquiring users through innovative, mobile-first strategies, bypassing traditional infrastructure requirements.

Technological Innovation and Niche Market Entry

While traditional banking faces high capital and regulatory hurdles, technological innovation significantly lowers entry barriers for nimble fintech firms targeting specific market niches. These new entrants can leverage specialized technology to offer innovative solutions, bypassing the need for a full, costly banking license. For instance, internet-only banks and specialized payment processors have demonstrated success by disrupting particular financial service areas.

This trend is evident globally, with countries like South Korea actively fostering venture investment in areas like AI and biotech, creating fertile ground for new, technology-driven companies to emerge and challenge established players. These tech-focused entrants often gain traction by offering superior user experiences or more efficient processes within a defined segment of the financial market.

- Fintech Niche Disruption: Technology enables new entrants to target specific financial services, like payments or lending, rather than requiring broad operational scope.

- Lowered Entry Barriers: Innovations in digital platforms and cloud computing reduce the capital and infrastructure needed to launch specialized financial services.

- South Korea Example: Significant venture investment in AI and biotech indicates a readiness for tech-driven innovation to enter and potentially disrupt various sectors, including finance.

- Regulatory Arbitrage: Some fintechs operate under lighter regulatory frameworks initially, allowing them to scale rapidly before facing full banking oversight.

The threat of new entrants for BNK Financial Group is moderately high, primarily driven by technological advancements that lower capital requirements for specialized financial services. While traditional banking entry remains heavily regulated and capital-intensive, fintech companies can leverage digital platforms to offer specific services, bypassing some of the established infrastructure costs. For example, the rise of digital-only banks and payment processors in South Korea demonstrates this trend, with some amassing millions of users rapidly.

Established players like BNK benefit from significant brand loyalty and extensive distribution networks, including millions of active digital users as of early 2024. However, agile fintechs can disrupt specific niches by offering superior user experiences and innovative solutions, often with lower overheads. This necessitates that BNK continues to invest in digital transformation and customer-centric strategies to maintain its competitive edge against these emerging threats.

| Barrier Type | Impact on New Entrants | BNK Financial Group's Advantage |

|---|---|---|

| Regulatory Hurdles | High (Capital, Licensing) | Established compliance infrastructure |

| Capital Requirements | Very High (e.g., 100B KRW for banks) | Significant financial resources |

| Distribution Channels | Challenging to replicate (Branches, Digital) | Extensive physical and digital presence |

| Brand Loyalty & Trust | Difficult to build | Long-standing regional presence and reputation |

| Technology & Data | Requires substantial investment | Existing customer data and digital platforms |

| Fintech Innovation | Moderate (Niche disruption) | Potential for partnership or competitive response |

Porter's Five Forces Analysis Data Sources

Our BNK Financial Group Porter's Five Forces analysis is built upon a robust foundation of data, drawing from BNK Financial Group's official annual reports, investor presentations, and regulatory filings. We supplement this with industry-specific market research reports from reputable firms and macroeconomic data from national statistical agencies to provide a comprehensive view of the competitive landscape.