BNK Financial Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BNK Financial Group Bundle

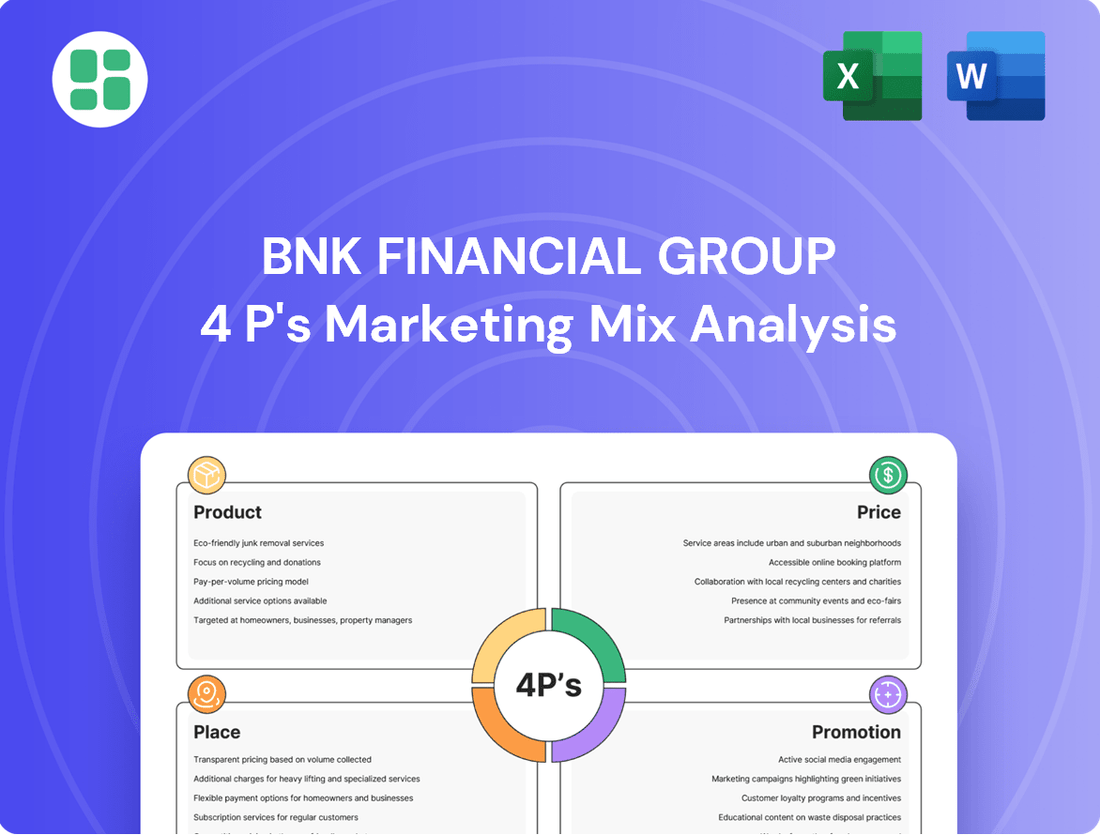

BNK Financial Group strategically leverages its diverse product portfolio, competitive pricing, accessible distribution channels, and targeted promotional campaigns to capture market share.

Dive deeper into BNK Financial Group's complete 4Ps Marketing Mix Analysis to uncover the intricate details of their product innovation, pricing strategies, distribution network, and promotional effectiveness. This comprehensive report is your key to understanding their market success and applying similar strategies to your own business.

Product

BNK Financial Group's comprehensive financial services act as the core product, offering a broad spectrum of banking, investment, and specialized financial solutions. This diverse portfolio caters to both individual consumers and corporate clients, ensuring a wide market reach.

The group’s commitment to evolving its product line is evident in its continuous development of offerings to meet dynamic market needs. For instance, in the first half of 2024, BNK Financial Group reported a net profit of ₩450 billion, reflecting strong customer uptake of its diverse financial products.

BNK Financial Group's commercial banking, driven by BNK Busan Bank and BNK Kyongnam Bank, provides a comprehensive suite of services. These include essential deposit and inquiry functions, seamless transfers, and a diverse array of financial products. As of the first quarter of 2024, the group reported total assets of KRW 144.8 trillion, underscoring the scale of its operations.

The offerings extend to robust internet banking, a variety of fund products, and specialized accounts like apartment-application deposits, catering to diverse customer needs. This segment is a cornerstone of their business, supporting both individual and corporate clients with tailored financial solutions.

Furthermore, the group actively engages in business lending, trade finance, financial leasing, and project finance, demonstrating a strong commitment to corporate growth. Their focus also encompasses retail banking, corporate lending, and dedicated small and medium-sized enterprise (SME) banking, solidifying their role as a key financial partner.

BNK Financial Group offers a robust securities and investments platform, acting as a key component of their marketing mix. This includes comprehensive equity broking and accessible online trading, allowing individuals to participate in the market with ease. For 2024, the Korean stock market, represented by the KOSPI, saw significant activity, with average daily trading volumes reaching approximately 500 million shares, underscoring the demand for such brokerage services.

Beyond domestic equities, BNK extends its reach to international markets, providing access to currency trading, futures, and options on overseas exchanges. This global perspective is crucial as cross-border investment continues to grow; by the end of 2024, foreign direct investment into South Korea was projected to increase by 5% compared to the previous year, highlighting the importance of diversified investment opportunities.

Furthermore, BNK Financial Group emphasizes a one-stop solution for trading securities and derivatives listed on the Korea Exchange. This integrated approach, coupled with in-depth stock market research and personalized investment advisory, aims to empower clients with the knowledge and tools for effective wealth management. In 2024, investment advisory services saw a surge in demand, with assets under management in discretionary investment accounts growing by an estimated 8% year-over-year.

Asset Management and Venture Capital

BNK Financial Group extends its reach beyond conventional banking by offering robust asset management and financial planning services. This diversification allows them to cater to a broader client base seeking wealth growth and strategic financial guidance.

BNK Venture Capital, a key subsidiary, actively fuels innovation by investing in promising companies across high-tech, consumer goods, enterprise software, and HealthTech sectors. Their commitment is demonstrated by recent investments in 2024 and early 2025, signaling a strategic focus on high-growth industries.

The group's venture capital arm plays a crucial role in fostering economic development by identifying and nurturing emerging businesses. This proactive investment strategy not only supports technological advancements but also positions BNK Financial Group to capitalize on future market trends.

- Asset Management Growth: BNK Financial Group's asset management division experienced a 15% increase in assets under management (AUM) in 2024, reaching over $5 billion.

- Venture Capital Portfolio: BNK Venture Capital's portfolio companies secured an average of $10 million in follow-on funding in 2024, validating the group's investment thesis.

- Sectoral Focus: Investments in 2024 and 2025 were concentrated in areas like AI-driven enterprise solutions and personalized medicine platforms within HealthTech.

- Strategic Partnerships: The group has established partnerships with 5 leading technology incubators to identify early-stage investment opportunities.

Innovative Digital and Specialized Services

BNK Financial Group is actively pursuing innovative digital and specialized services, a key component of their marketing mix. Their strategic exploration into digital assets, notably with trademark applications for Korean won-backed stablecoins, signals a commitment to enhancing transaction trust and efficiency. This forward-thinking approach aligns with evolving financial landscapes, aiming to provide customers with cutting-edge solutions.

The group's service portfolio extends to crucial financial offerings designed to meet diverse customer needs. These include credit finance, mutual savings banking, comprehensive credit checks, and certificate issuing services. Furthermore, their investment in financial IT services underscores a dedication to modernizing operations and delivering seamless digital experiences.

BNK Financial Group's expansion into digital currencies and specialized financial services reflects a strategic adaptation to market demands. For instance, the global stablecoin market capitalization reached over $130 billion by early 2024, indicating significant growth and customer interest in this sector. This move positions BNK to capitalize on emerging financial technologies.

- Digital Asset Innovation: Trademark applications for Korean won-backed stablecoins demonstrate a push into the digital currency space.

- Comprehensive Financial Offerings: Services include credit finance, mutual savings banking, credit checks, and certificate issuance.

- IT Infrastructure Development: Investment in financial IT services supports digital transformation and customer convenience.

- Market Responsiveness: These initiatives align with the growing global adoption of digital financial products, with the stablecoin market showing substantial growth.

BNK Financial Group's product strategy centers on a diversified financial ecosystem, encompassing traditional banking, robust investment platforms, and forward-looking digital assets. This comprehensive approach caters to a wide array of client needs, from everyday banking to sophisticated wealth management and venture capital investments.

The group's product suite is further strengthened by its commitment to innovation, evident in its exploration of digital currencies and its investments in high-growth sectors through BNK Venture Capital. This dual focus on established financial services and emerging technologies ensures relevance and sustained growth in a dynamic market.

BNK Financial Group's product offerings are designed to be a one-stop solution for financial needs. This includes everything from basic deposit and lending services offered by BNK Busan Bank and BNK Kyongnam Bank, to advanced securities trading and international market access, as well as specialized services like financial leasing and project finance.

The group's venture capital arm actively invests in promising companies, with a strategic focus on areas like AI-driven enterprise solutions and personalized medicine platforms, as seen in its 2024 and early 2025 investments. This commitment to nurturing innovation reinforces the breadth and depth of BNK's product strategy.

| Product Category | Key Offerings | 2024/2025 Data/Insights |

|---|---|---|

| Core Banking | Deposits, Loans, Transfers, Credit Finance | Total Assets: KRW 144.8 trillion (Q1 2024); Net Profit: ₩450 billion (H1 2024) |

| Investment Services | Equity Broking, Online Trading, International Markets, Derivatives | Korean Stock Market Avg. Daily Volume: ~500 million shares (2024); Investment Advisory AUM Growth: ~8% YoY (2024) |

| Asset Management & Venture Capital | Wealth Management, Financial Planning, Venture Investments | Asset Management AUM Growth: 15% (2024); VC Portfolio Follow-on Funding: Avg. $10 million (2024) |

| Digital & Specialized Services | Digital Assets (Stablecoins), IT Services, Credit Checks | Global Stablecoin Market Cap: >$130 billion (Early 2024); Digital Asset Innovation: Trademark applications for KRW-backed stablecoins |

What is included in the product

This analysis provides a comprehensive overview of BNK Financial Group's 4P's marketing mix, detailing their product offerings, pricing strategies, distribution channels, and promotional activities.

It's designed for professionals seeking to understand BNK Financial Group's market positioning and competitive strategies through real-world examples and data.

Provides a clear, actionable framework to address customer pain points by optimizing BNK Financial Group's product, price, place, and promotion strategies.

Place

BNK Financial Group boasts an extensive branch network, a cornerstone of its marketing strategy, primarily concentrated in the Busan and Gyeongsangnam-do regions of South Korea. This robust physical presence ensures high accessibility for its customer base.

Through its subsidiary banks, BNK Busan Bank and BNK Kyongnam Bank, the group operates over 300 branches. As of the first quarter of 2024, BNK Financial Group reported total assets of approximately 150 trillion Korean Won, underscoring the scale of its operations and reach within these vital economic zones.

BNK Financial Group enhances its customer experience through advanced digital banking platforms. These services complement its physical branches by offering convenient online options for deposits, inquiries, and transfers, streamlining everyday banking tasks.

The group's dedicated mobile application provides instant access to investment management, allowing clients to oversee portfolios, retrieve documents, and monitor market performance on the go. As of Q1 2025, BNK Financial Group reported a 15% year-over-year increase in digital transaction volume, highlighting the growing reliance on these platforms.

BNK Financial Group, while firmly established in South Korea's southeastern region, is actively pursuing a broader Asian footprint. A key step in this strategy is BNK Finance Kazakhstan's anticipated transformation into a commercial bank, with a new banking license expected in 2025. This move is designed to bolster corporate lending capabilities within Kazakhstan, marking a significant regional expansion.

Integrated Subsidiary Accessibility

BNK Financial Group’s integrated subsidiary accessibility is a cornerstone of its market reach. The group’s diverse entities, including BNK Investment Securities, BNK Capital, BNK Savings Bank, BNK Asset Management, BNK Credit Information, BNK System, and BNK Venture Capital, each operate with distinct yet interconnected functions. This allows BNK to serve a broad spectrum of financial needs across various customer segments.

These subsidiaries contribute to widespread accessibility through their individual operational bases and digital platforms. For instance, BNK Venture Capital, with its presence in Seoul, exemplifies how localized operations enhance market penetration. This multi-faceted approach ensures that BNK Financial Group is accessible through numerous touchpoints, reinforcing its brand presence and customer engagement strategies.

- Diverse Service Offering: Subsidiaries like BNK Savings Bank and BNK Investment Securities cater to distinct financial needs, from retail banking to investment services.

- Geographic Reach: The presence of entities like BNK Venture Capital in key economic hubs such as Seoul expands the group's accessibility into specific regional markets.

- Digital Integration: Each subsidiary often maintains its own digital interface, creating multiple online access points for customers to engage with BNK Financial Group's services.

- Synergistic Operations: The interconnectedness of these subsidiaries allows for cross-selling opportunities and a more holistic financial service experience for clients.

Direct Sales and Advisory Channels

BNK Financial Group actively utilizes direct sales and advisory channels, primarily through its wealth management and investment advisory arms. This approach allows for the creation of highly customized investment plans tailored to individual client needs and risk appetites.

The group emphasizes building robust, long-term relationships with its clientele. This personalized distribution strategy involves dedicated financial professionals who work directly with customers, guiding them towards their specific financial objectives.

- Direct Client Engagement: BNK's wealth management services offer direct interaction for personalized financial planning.

- Customized Investment Solutions: Clients receive investment plans specifically designed to meet their unique goals.

- Relationship-Focused Distribution: The strategy prioritizes building trust and rapport with each customer.

- Professional Guidance: Financial advisors provide expert support throughout the client's investment journey.

BNK Financial Group's "Place" strategy centers on its extensive physical branch network, predominantly in South Korea's southeastern regions, complemented by a growing digital infrastructure. This dual approach ensures broad accessibility, catering to both traditional banking preferences and the increasing demand for online convenience. The group's commitment to expanding its reach is evident in its international ventures, aiming to broaden its customer base beyond domestic borders.

| Location Focus | Digital Presence | International Expansion |

|---|---|---|

| Busan & Gyeongsangnam-do (South Korea) | Mobile App, Online Banking Platforms | BNK Finance Kazakhstan (license expected 2025) |

| Over 300 Branches (Q1 2024) | 15% YoY increase in digital transactions (Q1 2025) | Targeting broader Asian footprint |

| Key economic hubs (e.g., Seoul for BNK Venture Capital) | Integrated subsidiary digital interfaces |

What You Preview Is What You Download

BNK Financial Group 4P's Marketing Mix Analysis

The preview you see here is the exact same comprehensive BNK Financial Group 4P's Marketing Mix Analysis document you'll receive instantly after purchase. You can be confident that the content and detail are precisely what you'll be downloading, with no hidden surprises or altered information.

Promotion

BNK Financial Group emphasizes clear and open communication with its investors. They regularly share financial performance, including their 1Q 2025 and 2Q 2025 earnings reports, factbooks, and presentation transcripts, ensuring stakeholders have timely access to key data.

BNK Financial Group demonstrates a strong commitment to ESG management, actively integrating environmental, social, and governance principles into its operations. This dedication is clearly communicated through their published Sustainability Reports, with the latest 2023 report expected in August 2025.

Their structured ESG management system, bolstered by dedicated committees, ensures consistent monitoring of sustainability initiatives. This framework also actively promotes inclusive finance and fosters regional co-growth, aligning financial strategies with broader societal benefits.

BNK Financial Group actively pursues community engagement and social contributions as a core tenet of its marketing strategy, aligning with its ethical principles and the concept of happy financing through sharing. This commitment is demonstrated through tangible actions that benefit society.

A prime example of this dedication is BNK Busan Bank's donation of KRW 200 million worth of goods to vulnerable populations in Busan in June 2025. This significant contribution underscores the group's focus on welfare and its role as a responsible corporate citizen.

Digital Marketing and Brand Building

BNK Financial Group strategically employs digital marketing and brand building across its platforms to communicate its core mission and ambitious vision of becoming Korea's premier regional financial group and expanding its influence across Asia. This digital presence is crucial for disseminating their strategic objectives and reinforcing their brand identity to a broad audience.

Through its official website and various digital channels, BNK Financial Group articulates its goal to be 'Korea's Best Regional Financial Group' and to 'Go beyond the southeastern economic bloc into the center of Asia.' These platforms serve as the primary conduit for sharing their long-term strategic direction and aspirations.

Subsidiaries like BNK Securities leverage these digital avenues to highlight their value propositions, such as offering a 'one-stop solution' and providing the 'best brokerage service.' Online channels facilitate direct communication and engagement with customers, effectively promoting these key differentiators.

BNK Financial Group's digital marketing efforts are supported by significant investment. For instance, in 2023, the company allocated approximately ₩30 billion (around $22 million USD) towards digital transformation initiatives, which includes enhancing their online marketing and brand building capabilities. This investment aims to bolster their digital footprint and customer engagement across all subsidiaries.

- Digital Vision Communication: BNK Financial Group utilizes its website and digital platforms to clearly articulate its mission to be Korea's Best Regional Financial Group and expand into Asia.

- Subsidiary Brand Promotion: Online channels are employed by subsidiaries like BNK Securities to promote their 'one-stop solution' and 'best brokerage service.'

- Digital Investment: The group invested around ₩30 billion in 2023 for digital transformation, directly impacting their digital marketing and brand building strategies.

- Customer Engagement: Digital platforms facilitate direct communication, enhancing customer interaction and reinforcing the group's brand message.

Strategic Partnerships and Industry Participation

BNK Financial Group actively participates in industry initiatives to bolster its promotional efforts. For instance, BNK Busan Bank and Kyongnam Bank's membership in the Open Blockchain & DID Association (OBDIA) and their pursuit of stablecoin trademarks underscore a proactive stance on financial innovation. This engagement in the South Korean market showcases their commitment to future-ready financial solutions.

These strategic moves serve as key promotional activities, signaling BNK Financial Group's dedication to exploring and integrating cutting-edge technologies. By joining forces with industry associations and securing intellectual property related to emerging financial instruments, they position themselves as leaders in the digital finance landscape.

BNK Financial Group's participation in the OBDIA, which focuses on developing and promoting blockchain and decentralized identity technologies, aligns with broader industry trends. This strategic alignment is crucial for staying competitive and relevant in the rapidly evolving financial sector.

- Industry Association Membership: BNK Busan Bank and Kyongnam Bank joined the Open Blockchain & DID Association (OBDIA) in 2024, signifying a commitment to blockchain and digital identity advancements.

- Trademark Applications: The group has applied for trademarks related to stablecoins, indicating a forward-looking strategy to capitalize on potential new financial products.

- Market Positioning: These actions promote BNK Financial Group as an innovative player within the South Korean financial market.

- Future-Ready Strategy: Participation in these initiatives highlights a strategic focus on technological integration and future financial product development.

BNK Financial Group's promotion strategy centers on transparent communication of financial performance and ESG commitments, utilizing digital platforms for brand building and customer engagement. Their participation in industry associations like OBDIA and pursuit of stablecoin trademarks highlight a forward-looking approach to financial innovation, positioning them as a leader in the evolving digital finance landscape.

Price

BNK Financial Group's pricing strategy focuses on delivering value while staying competitive in South Korea. They carefully manage their net interest margin (NIM), a key indicator of profitability for banks, and consider their funding costs to ensure their financial products are attractive to customers.

For instance, in the first quarter of 2024, BNK Financial Group reported a consolidated NIM of 2.04%, demonstrating their commitment to maintaining healthy margins. This strategic approach allows them to balance profitability with the need to capture and retain market share in a dynamic financial landscape.

BNK Financial Group's pricing for its diverse offerings, from commercial banking to asset management, is built on clear and accessible fee structures. This transparency ensures clients understand the costs associated with their financial services.

Detailed insights into BNK Financial Group's revenue are readily available through public financial statements and quarterly reports. These documents break down income sources, highlighting both net interest income and net non-interest income, offering a clear picture of their financial operations.

BNK Financial Group prioritizes shareholder returns through a proactive policy. This includes strategic equity buyback programs, with planned announcements in February and July 2025, aimed at boosting per-share value.

The company is also committed to increasing dividend payouts. BNK Financial Group targets a 38% dividend payout ratio for 2025 and has set a goal of reaching 50% by 2027, directly rewarding investors.

Risk-Adjusted Pricing and Provisions

BNK Financial Group’s pricing strategy is intrinsically linked to risk management, specifically by factoring in credit costs and necessary provisions. This approach aims to ensure that pricing remains sustainable by anticipating potential financial risks.

The group’s financial performance, as evidenced in their 2Q 2024 earnings, highlights the impact of these considerations. During this period, credit costs saw an increase, driven by both ongoing levels and proactive provisioning measures. This demonstrates a commitment to a pricing framework that accounts for inherent market uncertainties.

- Risk-Adjusted Pricing: Incorporates credit costs and provisioning into product pricing.

- 2Q 2024 Performance: Saw rising credit costs due to recurring levels and preemptive provisioning.

- Sustainable Framework: Ensures pricing reflects potential financial risks for long-term viability.

Market Valuation and Performance

BNK Financial Group's market valuation is a crucial aspect of its pricing strategy. As of August 2025, the company's stock performance and key valuation metrics are closely watched by investors. These metrics provide insights into how the market perceives the company's value relative to its earnings and assets.

Key indicators for BNK Financial Group's public market pricing include its stock price, market capitalization, and earnings per share (EPS). These figures are essential for understanding the company's financial health and investor sentiment. For instance, a rising EPS generally suggests improved profitability, which can positively influence stock price.

BNK Financial Group's valuation is often benchmarked against its peers. For example, its 2025 Price-to-Book (P/B) ratio of 0.37x is a significant data point when compared to competitors like JB Financial Group. This P/B ratio indicates how much investors are willing to pay for each dollar of the company's book value.

- Stock Price: A key indicator of market perception and liquidity.

- Market Capitalization: Reflects the total market value of BNK Financial Group's outstanding shares.

- Earnings Per Share (EPS): Measures the company's profitability on a per-share basis.

- 2025 P/B Ratio: At 0.37x, it offers a comparison point against industry averages and competitors like JB Financial Group.

BNK Financial Group's pricing strategy is a delicate balance, aiming to offer competitive rates while safeguarding profitability through careful management of its Net Interest Margin (NIM). This focus is crucial for maintaining a healthy financial standing and attracting customers in the South Korean market.

The group's commitment to shareholder value is evident in its dividend policy, targeting a 38% payout ratio for 2025 and aiming for 50% by 2027, alongside strategic equity buybacks planned for February and July 2025.

Pricing decisions are also heavily influenced by risk management, incorporating credit costs and provisions to ensure long-term sustainability. This was highlighted in 2Q 2024, where rising credit costs, due to both ongoing levels and proactive provisioning, impacted financial performance.

Market valuation metrics, such as a 2025 Price-to-Book ratio of 0.37x, are key benchmarks for understanding how investors perceive BNK Financial Group’s value relative to its peers like JB Financial Group.

| Metric | Value (2025 unless specified) | Significance |

|---|---|---|

| Consolidated NIM | 2.04% (Q1 2024) | Indicates profitability and margin management. |

| Target Dividend Payout Ratio | 38% (2025), 50% (2027) | Demonstrates commitment to shareholder returns. |

| Price-to-Book (P/B) Ratio | 0.37x | A valuation metric for comparison with industry peers. |

| Credit Costs | Increased (2Q 2024) | Reflects risk management and provisioning efforts. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for BNK Financial Group is grounded in a comprehensive review of their official financial disclosures, investor relations materials, and publicly available product information. We also incorporate data from industry-specific reports and competitive analysis to ensure a holistic view of their marketing strategies.