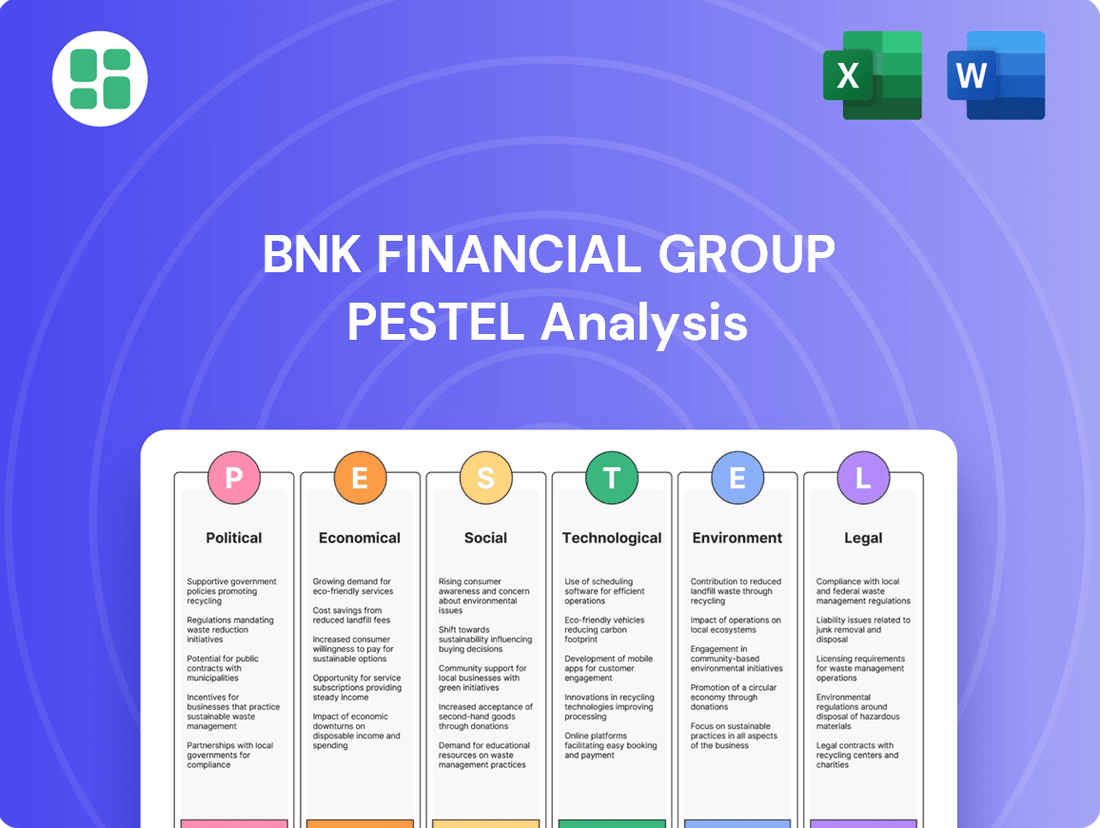

BNK Financial Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BNK Financial Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting BNK Financial Group's strategic direction. Our expertly crafted PESTLE analysis provides a clear roadmap to navigate these external forces, empowering you to make informed decisions. Don't get left behind; download the full version now for actionable intelligence.

Political factors

The South Korean government, via the Financial Services Commission (FSC) and the Bank of Korea (BOK), is a key architect of financial stability. Their policies, which involve managing liquidity and capital adequacy, directly shape the operating landscape for institutions like BNK Financial Group. For instance, the BOK's benchmark interest rate, which stood at 3.50% as of early 2024, influences lending costs and investment returns, a critical consideration for BNK's business model.

South Korea's financial sector is undergoing significant regulatory shifts, with the Financial Services Commission (FSC) actively promoting fintech innovation. For instance, the expanded regulatory sandbox program, which saw a 20% increase in approved projects in 2023, allows companies like BNK to test new digital financial services with reduced regulatory hurdles.

The government's consideration of allowing cryptocurrency exchanges to connect with multiple banking institutions, a move being discussed throughout 2024, could open up new revenue streams for BNK by facilitating digital asset transactions.

However, these evolving regulations also present compliance challenges; for example, new data privacy laws effective from early 2025 will require substantial investment in IT infrastructure and security protocols for BNK to maintain adherence.

Geopolitical tensions, especially in the Middle East, and evolving global trade policies, such as ongoing US tariffs on specific sectors, present significant downside risks to the Korean economy. These external pressures can indirectly impact BNK Financial Group by affecting the export performance of its corporate clients, overall economic expansion, and consequently, the credit quality of its loan portfolio. For instance, disruptions in energy supply chains due to Middle East conflicts could increase operational costs for businesses, potentially leading to slower growth and higher default probabilities.

Political Stability and Policy Continuity

Political stability and consistent economic policies are bedrock for investor confidence and BNK Financial Group's strategic planning. Uncertainty stemming from recent political shifts, such as potential changes in fiscal or monetary policy, directly impacts consumer and investor sentiment, which in turn can affect demand for financial products and services.

For instance, the South Korean political landscape in late 2024 and early 2025 will be closely watched for its impact on regulatory frameworks affecting the financial sector. Any perceived instability or abrupt policy changes could lead to a more cautious approach from both domestic and international investors, potentially slowing down market growth and BNK Financial Group's expansion initiatives.

- Domestic Political Stability: Continued political stability in South Korea is vital for maintaining a predictable business environment.

- Policy Continuity: The consistency of economic and financial policies, particularly regarding interest rates and capital markets, directly influences BNK Financial Group's operational landscape.

- Investor Confidence: Shifts in government priorities or unexpected policy reversals can erode investor confidence, impacting capital availability and market valuations.

- Consumer Sentiment: Political developments often have a ripple effect on consumer confidence, affecting spending habits and the demand for financial services like loans and investments.

Regional Development Initiatives

BNK Financial Group's strategic focus on the Busan and Gyeongsangnam-do regions means that government-led regional development initiatives directly bolster its operations. For instance, South Korea's 2024 budget allocated significant funds towards enhancing infrastructure in the southeastern region, a key area for BNK. This can translate into increased demand for the group's commercial lending and investment banking services as local businesses expand.

Government policies designed to stimulate economic growth in these specific areas are particularly beneficial. These can include tax incentives for businesses operating in designated development zones or funding for new industrial complexes. Such measures are projected to drive economic activity, creating more opportunities for BNK Financial Group to engage with a growing client base.

- Increased Local Business Activity: Government investment in regional infrastructure and development projects, such as the expansion of the Busan New Port, directly stimulates economic activity, creating more potential clients for BNK's banking services.

- Demand for Financial Services: As regional economies grow, there's a corresponding rise in demand for commercial banking, corporate finance, and venture capital services, areas where BNK Financial Group has a strong presence.

- Favorable Regulatory Environment: Policies supporting regional development can also include favorable regulatory frameworks for financial institutions operating within those zones, potentially reducing operational costs or opening new avenues for business.

South Korea's political landscape significantly influences BNK Financial Group through regulatory frameworks and economic policy. Government initiatives aimed at regional development, such as infrastructure investment in the Busan and Gyeongsangnam-do regions, directly benefit BNK's core markets. For example, the 2024 budget's focus on southeastern regional enhancement is projected to boost local business activity and demand for financial services.

Regulatory changes, particularly those promoting fintech, offer opportunities for BNK to innovate. The expanded regulatory sandbox, which saw a 20% increase in approved projects in 2023, allows for testing new digital services. Discussions around cryptocurrency exchange banking in 2024 could also unlock new revenue streams.

However, evolving regulations, like new data privacy laws effective early 2025, necessitate significant IT investment. Geopolitical risks, such as Middle East tensions, can indirectly impact BNK by affecting corporate clients' performance and credit quality.

Political stability is crucial for investor confidence and strategic planning. Uncertainty regarding fiscal or monetary policy shifts in late 2024 and early 2025 could dampen consumer and investor sentiment, impacting demand for BNK's offerings.

| Factor | Impact on BNK Financial Group | Data/Trend (2024-2025) |

|---|---|---|

| Domestic Political Stability | Predictable business environment, investor confidence | Key focus for policy continuity; any shifts monitored closely. |

| Regulatory Frameworks | Opportunities for fintech innovation, compliance challenges | 20% increase in regulatory sandbox projects (2023); new data privacy laws (early 2025). |

| Regional Development Policies | Increased local business activity, demand for services | 2024 budget allocation for southeastern region infrastructure; Busan New Port expansion. |

| Geopolitical Factors | Indirect impact on corporate clients, credit quality | Ongoing Middle East tensions and global trade policy shifts noted. |

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting BNK Financial Group, offering a comprehensive view of its operating landscape.

A clear, actionable PESTLE analysis for BNK Financial Group that highlights key external factors, offering relief by simplifying complex market dynamics for strategic decision-making.

Economic factors

The Bank of Korea's (BOK) monetary policy, especially its benchmark interest rate decisions, directly influences BNK Financial Group's profitability by affecting its net interest margin. As of late 2024, the BOK has been navigating a complex economic landscape, with signals pointing towards potential rate adjustments to balance inflation control and economic growth support.

For instance, if the BOK were to implement rate cuts in early 2025, this would likely lead to lower lending and deposit rates for BNK. This shift would impact the bank's core operations, potentially narrowing the spread between the interest earned on loans and paid on deposits, a key driver of banking profitability.

South Korea's economic growth is expected to be around 2.2% in 2024, primarily fueled by exports, but this is projected to slow slightly to 2.1% in 2025 as domestic demand gains momentum. This shift directly impacts BNK Financial Group's potential business volume. A pickup in domestic demand, particularly in private consumption and construction, would likely translate to increased loan demand and a healthier asset quality for BNK.

However, if private consumption and construction investment remain subdued, BNK could face challenges with loan origination and potentially see a deterioration in the quality of its existing loan portfolio, especially for household and small business clients. For instance, a slowdown in construction could lead to increased non-performing loans in that sector.

Inflation significantly impacts consumer purchasing power, directly affecting demand for BNK Financial Group's products. Higher inflation erodes the value of savings and can lead to increased borrowing costs, potentially slowing loan demand. For example, South Korea's consumer price index (CPI) saw a notable increase in 2023, impacting household budgets.

Corporate operating costs are also sensitive to inflation, influencing profitability and the ability of businesses to service debt. While the Bank of Korea (BOK) aims to stabilize inflation around its target in 2025, any resurgence in price pressures, perhaps driven by volatile international oil prices, could hinder economic recovery and affect loan repayment capabilities.

Household Debt Levels and Credit Risk

High household debt in South Korea continues to pose a substantial financial risk, directly impacting the credit quality of loan portfolios held by institutions such as BNK Financial Group. This persistent issue can lead to increased non-performing loans, straining the financial health of banks.

Despite efforts through macroprudential policies, delinquency rates are showing an upward trend, especially for household and individual business loans. This signals ongoing solvency challenges for certain financial entities within the sector.

- Household debt to disposable income ratio: As of Q4 2024, this stood at an elevated 205%, a slight increase from the previous year, indicating continued borrower strain.

- Delinquency rate on household loans: By early 2025, this rate had reached approximately 0.55%, up from 0.48% in early 2024, highlighting growing repayment difficulties.

- Individual business loan delinquency: This segment saw a rise to around 0.70% by early 2025, exacerbating concerns for banks with significant exposure.

Global Economic Conditions and Trade

The global economic outlook, particularly concerning trade disputes and the performance of critical export sectors like semiconductors, directly influences South Korea's economic trajectory and, by extension, BNK Financial Group. A robust export environment typically strengthens BNK's corporate clientele, fostering increased demand for financial services.

Conversely, escalating trade protectionism or a slowdown in the semiconductor industry cycle presents headwinds, potentially dampening economic growth and reducing the need for banking and financial products. For instance, South Korea's semiconductor exports, a significant driver of its economy, experienced a notable contraction in early 2023, with shipments falling by 37.2% year-on-year in the first quarter, highlighting the sensitivity to global demand shifts.

- Global Growth Forecasts: The IMF's April 2024 World Economic Outlook projected global growth at 3.2% for 2024, a slight upgrade from 2023, but noted persistent risks from geopolitical tensions and trade fragmentation.

- Semiconductor Market Trends: The semiconductor industry, crucial for South Korea, is expected to see a rebound in 2024, with industry analysts forecasting a significant increase in chip demand driven by AI and data center growth, though supply chain vulnerabilities remain.

- Trade Balance Impact: South Korea's trade balance is closely tied to global demand. A widening trade deficit, as seen in parts of 2023, can signal weaker external demand and impact corporate profitability, affecting the financial sector.

- Geopolitical Risks: Ongoing geopolitical tensions, including those affecting major trading partners, can disrupt supply chains and create uncertainty, leading to reduced investment and a more cautious approach to lending by financial institutions like BNK.

The Bank of Korea's (BOK) monetary policy, particularly its benchmark interest rate, directly shapes BNK Financial Group's profitability by influencing its net interest margin. As of late 2024, the BOK is carefully managing inflation and economic growth, with potential adjustments to the benchmark rate expected in early 2025.

South Korea's economic growth, projected at 2.2% for 2024 and a slightly slower 2.1% in 2025, is heavily reliant on exports but is seeing a gradual increase in domestic demand. This shift, favoring private consumption and construction, could boost BNK's loan origination and asset quality.

Inflation continues to impact consumer spending and corporate costs, affecting loan demand and repayment capabilities for BNK. While the BOK aims for price stability in 2025, external factors like oil prices could reignite inflationary pressures.

High household debt remains a significant risk for BNK, with the household debt to disposable income ratio at 205% in Q4 2024 and delinquency rates on household loans rising to 0.55% by early 2025.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on BNK Financial Group |

|---|---|---|---|

| GDP Growth | 2.2% | 2.1% | Influences loan demand and corporate client health. |

| Inflation (CPI) | Moderate increase in 2023, target stabilization | Target stabilization, potential volatility | Affects consumer purchasing power and corporate costs. |

| Benchmark Interest Rate (BOK) | Navigating policy | Potential adjustments | Directly impacts net interest margin. |

| Household Debt to Disposable Income | 205% (Q4 2024) | Continued concern | Increases risk of non-performing loans. |

| Household Loan Delinquency Rate | 0.48% (early 2024) | 0.55% (early 2025) | Indicates growing repayment difficulties. |

Preview Before You Purchase

BNK Financial Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of BNK Financial Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic planning. Understand the external forces shaping the financial sector and BNK's position within it.

Sociological factors

South Korea's demographic landscape presents a significant challenge for BNK Financial Group, marked by a rapidly aging population and a persistently low fertility rate. As of recent projections for 2024, the country's total fertility rate hovers around 0.7 children per woman, a stark figure that points to a shrinking future workforce and a growing dependency ratio. This demographic shift directly influences the demand for financial services, necessitating a strategic pivot towards products catering to retirement planning, wealth preservation, and the increasing need for long-term care solutions.

The aging demographic, with the proportion of those aged 65 and over expected to reach over 20% by 2025, means a larger segment of the population will require specialized financial advice and products focused on income generation in retirement and estate planning. Concurrently, a declining birth rate impacts the growth potential of traditional savings and investment products aimed at younger generations, pushing BNK to innovate and adapt its service portfolio to meet the evolving needs of an older, and potentially smaller, customer base.

South Korea boasts a highly connected population, with smartphone penetration reaching 95% in 2024. This digital fluency translates into a strong demand for convenient online and mobile banking solutions. BNK Financial Group must prioritize innovation in its digital offerings to keep pace with consumer expectations.

The rise of digital-only banks like Kakao Bank and Toss Bank, which have rapidly gained market share since their launches, underscores this shift. Kakao Bank, for instance, reported over 25 million users by early 2025, highlighting the significant customer appetite for digital-first financial services. BNK needs to enhance its digital channels and services to remain competitive.

Financial literacy is a key driver of investment trends, impacting how individuals engage with financial products. As more people move away from traditional savings and towards capital markets, BNK's asset management and securities brokerage arms must adapt to more complex investment needs. For instance, in 2024, a significant portion of younger investors, particularly Gen Z and Millennials, showed a marked increase in their engagement with stock markets, often through digital platforms, highlighting a demand for accessible education and user-friendly interfaces.

Regional Identity and Community Engagement

BNK Financial Group's deep roots in Busan and Gyeongsangnam-do highlight the critical importance of regional identity and community engagement. This focus directly influences customer loyalty and market penetration for its various subsidiaries.

Understanding and actively participating in local community life, including supporting regional initiatives and fostering strong local business networks, is paramount. The group's success is intrinsically linked to the trust and goodwill it cultivates within these specific geographic areas.

- Regional Focus: BNK Financial Group's primary operating regions are Busan and Gyeongsangnam-do, where it holds significant market share.

- Community Investment: In 2023, BNK Financial Group reportedly invested over ₩10 billion in various social contribution activities, many of which were concentrated in its core regional markets.

- Customer Loyalty: Surveys indicate that customers in these regions often cite community involvement and local understanding as key factors in their banking relationships.

- Local Economic Impact: The group's subsidiaries are major employers and financiers of local small and medium-sized enterprises, reinforcing their embeddedness in the regional economy.

Wealth Distribution and Social Disparities

Governmental efforts to foster sustainable economic growth often involve addressing wealth distribution and social disparities, which directly impacts BNK Financial Group. These initiatives may steer the group towards adjusting its lending strategies and developing financial products that cater to a broader economic spectrum.

Expect a heightened focus on financial inclusion and programs designed to support lower-income households. This necessitates BNK tailoring its services to meet the unique needs of a diverse clientele, potentially through accessible digital platforms or community-based financial literacy programs.

For instance, in 2024, many developed nations are exploring or implementing policies aimed at reducing income inequality. In the United States, discussions around progressive taxation and expanded social safety nets continue, influencing the economic landscape for financial institutions. Similarly, the European Union is prioritizing initiatives for social cohesion and economic convergence among member states, potentially impacting cross-border financial services and investment strategies.

- Policy Alignment: BNK must align its strategic objectives with government mandates promoting equitable wealth distribution.

- Product Innovation: Development of inclusive financial products, such as micro-loans or affordable housing finance, will be crucial.

- Market Reach: Expanding services to underserved communities can unlock new customer segments and revenue streams.

- Reputational Impact: Demonstrating commitment to social responsibility can enhance brand loyalty and public perception.

South Korea's societal fabric is undergoing significant shifts, with a rapidly aging population and a low birth rate presenting unique challenges and opportunities for BNK Financial Group. The increasing proportion of elderly citizens necessitates a greater emphasis on retirement planning, wealth management, and healthcare-related financial products.

Digital adoption is a defining characteristic, with high smartphone penetration driving demand for seamless online and mobile banking experiences. BNK must continue to invest in its digital infrastructure to meet evolving customer expectations and compete with agile digital-native players.

Financial literacy levels are on the rise, particularly among younger demographics, leading to increased engagement with capital markets. This trend requires BNK to enhance its advisory services and investment product offerings to cater to more sophisticated investment needs.

BNK's strong regional identity in Busan and Gyeongsangnam-do fosters deep community ties and customer loyalty. Maintaining this connection through local investment and engagement is crucial for sustained growth and market presence.

Technological factors

BNK Financial Group faces a critical need to invest heavily in its digital banking and mobile platform capabilities, mirroring South Korea's rapid adoption of these technologies. By the end of 2024, it's projected that over 70% of all banking transactions in South Korea will be conducted digitally, highlighting the urgency for BNK to maintain a competitive edge.

To stay relevant, BNK must actively counter innovations from agile fintech firms and emerging digital-only banks, ensuring its mobile apps offer intuitive account management, streamlined payment solutions, and accessible lending options. This commitment to user experience is paramount, as a study in early 2025 revealed that over 60% of Korean consumers consider a bank's mobile app functionality a primary factor in their banking relationship.

South Korea's fintech sector is rapidly expanding, with mobile payments, blockchain, and robo-advisory services gaining significant traction. This growth presents a dual challenge and opportunity for BNK Financial Group. For instance, the digital payment market saw a 15% year-on-year increase in transaction value in 2024, highlighting the shift away from traditional banking methods.

To remain competitive, BNK must strategically adopt and integrate these fintech innovations. This could involve developing proprietary solutions or forging partnerships with agile fintech startups, mirroring trends seen with other major financial institutions that have invested in or acquired fintech capabilities to broaden their digital offerings and customer reach.

Artificial intelligence and big data analytics are revolutionizing the financial sector, allowing for hyper-personalized customer experiences, robust risk management, and streamlined operational efficiencies. BNK Financial Group can harness these advancements for sophisticated credit scoring models, proactive fraud detection, customized investment recommendations, and optimizing all customer touchpoints.

By integrating AI and data analytics, BNK can gain a competitive edge. For instance, in 2024, financial institutions leveraging AI for fraud detection saw a reduction in fraudulent transactions by an average of 15-20%, according to industry reports. This technology also aids in predicting market trends and personalizing financial advice, potentially increasing customer retention by up to 25%.

Cybersecurity and Data Protection

As financial services increasingly move online, strong cybersecurity and data protection are absolutely critical for BNK Financial Group. The company needs to pour resources into safeguarding customer information and transactions to avoid costly breaches and keep public confidence, especially with tough data privacy rules like GDPR and CCPA. For instance, in 2024, the average cost of a data breach for financial institutions globally was reported to be around $5.90 million, highlighting the significant financial risk.

BNK's commitment to cybersecurity directly impacts its reputation and ability to operate. Failing to protect sensitive data can lead to severe regulatory penalties and a loss of customer loyalty, which is especially damaging in a competitive market. Reports from 2024 indicate that over 70% of consumers consider data security a top factor when choosing a financial provider.

Key areas of focus for BNK's technological strategy regarding cybersecurity should include:

- Advanced threat detection and prevention systems

- Regular security audits and vulnerability assessments

- Employee training on data protection best practices

- Compliance with evolving data privacy regulations

Blockchain and Digital Asset Developments

South Korea is at the forefront of blockchain innovation, actively exploring central bank digital currencies (CBDCs) and refining stablecoin regulations. BNK Financial Group must closely track these advancements, as they have the potential to fundamentally alter payment infrastructures and asset management paradigms.

These technological shifts could unlock novel opportunities for BNK in the burgeoning digital asset services sector. For instance, the Bank of Korea's ongoing research into a CBDC, alongside evolving regulatory frameworks for stablecoins, signals a significant upcoming transformation in financial transactions and digital asset custody.

- South Korea's Blockchain Leadership: The nation is actively engaged in pilot programs and policy discussions surrounding CBDCs and digital asset regulation.

- Impact on Payment Systems: CBDC developments could streamline cross-border payments and introduce new forms of digital transactions.

- Asset Management Evolution: Regulatory clarity on stablecoins may pave the way for more sophisticated digital asset-backed financial products.

BNK Financial Group must prioritize its digital infrastructure to align with South Korea's rapid digital banking adoption, where over 70% of transactions are projected to be digital by the end of 2024. Staying competitive requires a focus on user-friendly mobile platforms that offer seamless account management and payment solutions, as a 2025 study indicated that over 60% of Korean consumers consider app functionality a key factor in their banking choice.

Legal factors

BNK Financial Group navigates a stringent regulatory landscape in South Korea, encompassing capital adequacy, liquidity, and consumer protection. For instance, the Bank for International Settlements (BIS) capital adequacy ratio for major banks in South Korea was generally maintained above 15% in early 2024, a key metric BNK must adhere to.

Recent policy shifts, such as the Financial Services Commission (FSC) reintroducing stricter liquidity coverage ratio (LCR) requirements for banks in early 2024, following a temporary easing during the pandemic, directly influence BNK's balance sheet management and strategic planning. This means BNK needs to hold more high-quality liquid assets, potentially impacting lending capacity.

BNK Financial Group operates within South Korea's stringent anti-money laundering (AML) and Know Your Customer (KYC) regulatory framework. These rules are paramount for financial institutions to combat financial crimes and maintain market integrity.

Compliance necessitates robust internal controls, including thorough transaction monitoring and accurate reporting to authorities. Failure to adhere can result in significant penalties and reputational damage.

In 2023, South Korean financial institutions reported over 4,000 suspicious transaction cases to the Financial Intelligence Unit (FIU), highlighting the active enforcement of AML/KYC measures.

South Korea's robust data privacy landscape, epitomized by the Personal Information Protection Act (PIPA), imposes strict obligations on financial institutions like BNK Financial Group. BNK must meticulously manage customer data, ensuring compliance with regulations concerning collection, storage, and processing to safeguard privacy. Failure to comply can result in significant penalties, impacting customer trust and potentially leading to legal repercussions, underscoring the critical importance of data security in the financial sector.

Corporate Governance and Disclosure Requirements

BNK Financial Group, like all listed entities, must navigate evolving corporate governance and disclosure requirements. These mandates, including the submission of mandatory corporate governance reports by listed companies, directly influence BNK's operational transparency and accountability. For instance, the Korea Exchange's corporate governance index, which BNK Financial Group is a part of, emphasizes adherence to best practices, impacting how the company communicates its structure and decision-making processes to stakeholders.

Adherence to these rigorous standards is not merely a compliance exercise; it's vital for fostering robust investor relations and upholding market integrity. In 2024, for example, financial regulators globally have continued to scrutinize disclosure practices, pushing for greater clarity on executive compensation and risk management, areas where BNK must demonstrate strong governance to maintain investor confidence.

- Enhanced Disclosure: Companies are increasingly expected to provide detailed information on board diversity, audit committee effectiveness, and shareholder rights.

- Regulatory Scrutiny: Financial authorities are intensifying oversight of corporate governance, with non-compliance leading to fines and reputational damage.

- Investor Expectations: Institutional investors, managing trillions in assets, prioritize strong governance as a key factor in their investment decisions.

- Market Confidence: Transparent and accountable governance practices are crucial for building and maintaining trust in the financial markets.

Digital Asset and Cryptocurrency Legislation

South Korea's digital asset and cryptocurrency legislation is a dynamic area, with ongoing efforts to establish clear regulatory frameworks. Recent discussions and drafting of new laws aim to govern stablecoin issuance and crypto custody services, directly impacting financial institutions like BNK Financial Group.

These evolving legal requirements necessitate BNK's proactive adaptation. Failure to comply could hinder potential collaborations and the development of new crypto-related financial products and services. The Financial Services Commission (FSC) has been actively involved in shaping these regulations, with a focus on investor protection and market stability.

- Evolving Regulations: South Korea is actively developing legislation for stablecoins and crypto custody.

- Impact on BNK: BNK must adapt to new rules affecting crypto partnerships and services.

- FSC's Role: The Financial Services Commission is a key player in shaping these legal frameworks.

BNK Financial Group operates under South Korea's robust legal framework, which includes stringent capital adequacy rules, like the BIS ratio which remained above 15% for major banks in early 2024, and evolving digital asset regulations. The Financial Services Commission's (FSC) proactive approach to areas like crypto custody and stablecoins directly influences BNK's strategic planning and product development, demanding continuous adaptation to ensure compliance and mitigate risks.

| Legal Area | Key Regulation/Trend | Impact on BNK | Relevant Data/Observation (2024) |

|---|---|---|---|

| Capital Adequacy | BIS Capital Adequacy Ratio | Maintains financial stability and lending capacity | Maintained above 15% for major banks |

| Liquidity | Liquidity Coverage Ratio (LCR) | Requires holding high-quality liquid assets | Stricter requirements reintroduced in early 2024 |

| Financial Crime | AML/KYC Regulations | Mandates robust internal controls and reporting | Over 4,000 suspicious transaction cases reported by institutions in 2023 |

| Data Privacy | Personal Information Protection Act (PIPA) | Strict obligations for customer data management | Emphasis on data security and potential penalties for non-compliance |

| Corporate Governance | Disclosure and Governance Standards | Requires transparency and accountability | Increased scrutiny on executive compensation and risk management globally |

| Digital Assets | Evolving Crypto Legislation | Influences partnerships and service offerings | Ongoing development of rules for stablecoins and crypto custody |

Environmental factors

South Korea is actively enhancing its environmental, social, and governance (ESG) reporting framework, moving towards alignment with global benchmarks such as the IFRS S1 and S2 sustainability disclosure standards. This evolution includes the anticipated implementation of mandatory climate-related disclosures by 2026.

BNK Financial Group will likely encounter escalating demands for greater transparency regarding its environmental footprint. This will necessitate comprehensive reporting on its environmental impact, specifically covering Scope 1 and Scope 2 emissions, with a growing possibility of requiring Scope 3 emissions reporting as well.

The Korean government is actively pushing for green finance, evidenced by initiatives like the Korean Green Classification System (K-Taxonomy). This system sets clear standards for what qualifies as an environmentally beneficial economic activity, guiding investment and lending practices. BNK Financial Group can capitalize on this by growing its sustainable lending and investment offerings, directly supporting national environmental goals and potentially attracting environmentally conscious investors.

BNK Financial Group faces growing pressure to manage climate-related risks. This includes assessing physical risks, like how extreme weather events might impact properties securing loans, and transition risks, such as policy shifts affecting industries with high carbon emissions within their investment portfolios. For instance, the European Central Bank's 2024 climate stress test revealed that banks could face significant losses from physical climate risks by 2050, highlighting the urgency for institutions like BNK to integrate these assessments.

Corporate Social Responsibility (CSR) and Public Perception

BNK Financial Group's commitment to environmental, social, and governance (ESG) principles is increasingly crucial. Public awareness of corporate social responsibility is high, with a 2024 survey indicating that 72% of consumers consider a company's environmental impact when making purchasing decisions. This means BNK's sustainability efforts directly influence its brand image and how it's perceived by the public.

Demonstrating strong environmental stewardship can translate into tangible benefits. For instance, companies with robust sustainability reports often see higher customer loyalty and attract a greater share of socially conscious investment capital. In 2025, ESG-focused funds are projected to manage over $50 trillion globally, highlighting the financial incentive for BNK to prioritize these areas.

- Growing public demand for CSR: 72% of consumers consider environmental impact in purchasing decisions (2024).

- Impact on brand reputation: Strong environmental practices enhance public perception and trust.

- Attracting socially conscious investors: ESG funds are expected to reach over $50 trillion by 2025.

- Enhancing customer loyalty: Commitment to sustainability can foster stronger customer relationships.

Environmental Regulations and Compliance

BNK Financial Group navigates a landscape of evolving environmental regulations impacting its operations. Compliance with directives on energy efficiency, waste reduction, and emissions control is paramount to avoid significant penalties and legal challenges. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR), which came into full effect in 2023, requires financial institutions to disclose sustainability-related information about their investment products, influencing how BNK reports on its environmental impact.

Failure to adhere to these environmental mandates can result in substantial fines, as seen with other financial institutions facing penalties for non-compliance with climate-related disclosures. BNK's commitment to environmental stewardship is therefore not just a matter of corporate responsibility but a critical element of risk management and maintaining public trust. In 2024, many financial regulators worldwide are increasing scrutiny on greenwashing claims, making transparent and accurate reporting on environmental initiatives essential for BNK.

Key areas of regulatory focus for BNK include:

- Energy Consumption: Implementing energy-saving measures in all facilities to reduce operational carbon footprint.

- Waste Management: Developing robust recycling and waste disposal programs to minimize landfill contributions.

- Pollution Prevention: Ensuring all operational activities, including digital infrastructure, adhere to pollution control standards.

- Sustainable Finance Disclosure: Transparently reporting on the environmental impact of investment portfolios and lending practices.

BNK Financial Group operates within an evolving environmental regulatory landscape. South Korea is aligning with global standards like IFRS S1 and S2, with mandatory climate disclosures expected by 2026. This shift necessitates BNK to enhance its reporting on emissions, potentially including Scope 3, and to navigate green finance initiatives like the K-Taxonomy.

Climate-related risks, both physical and transitional, are becoming critical considerations for financial institutions. The European Central Bank's 2024 climate stress test indicated potential significant losses from physical risks by 2050, underscoring the need for BNK to integrate robust risk assessments into its operations and investment strategies.

Public and investor expectations regarding environmental stewardship are rising. A 2024 survey revealed 72% of consumers consider environmental impact in purchasing decisions, directly affecting brand perception. Furthermore, ESG-focused funds are projected to manage over $50 trillion globally by 2025, presenting a financial incentive for BNK to prioritize sustainability.

| Environmental Factor | Impact on BNK Financial Group | Key Initiatives/Considerations |

|---|---|---|

| Regulatory Alignment | Increased reporting requirements, potential penalties for non-compliance. | Adherence to IFRS S1/S2, mandatory climate disclosures (by 2026), K-Taxonomy compliance. |

| Climate Risk Management | Exposure to physical and transitional risks impacting loan portfolios and investments. | Integrating climate stress testing, assessing physical asset vulnerability, managing transition risk in high-emission sectors. |

| Stakeholder Expectations | Pressure for transparency, impact on brand reputation and investor attraction. | Enhancing ESG reporting, developing green finance products, fostering customer loyalty through sustainability. |

PESTLE Analysis Data Sources

Our BNK Financial Group PESTLE Analysis is informed by a comprehensive review of official government publications, reputable financial news outlets, and leading industry research firms. This ensures that our understanding of political, economic, social, technological, legal, and environmental factors is grounded in timely and authoritative information.