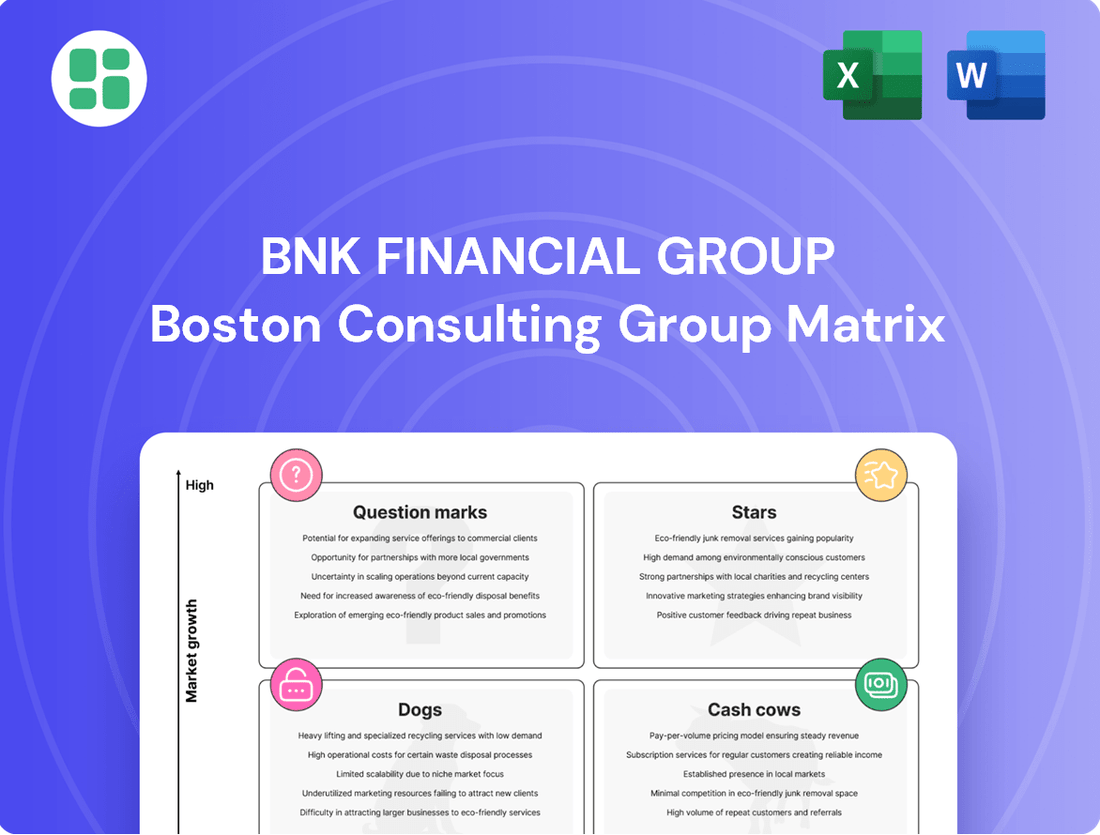

BNK Financial Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BNK Financial Group Bundle

Curious about BNK Financial Group's strategic positioning? Our BCG Matrix preview highlights key product categories, but the real power lies in the full report. Understand which products are driving growth, which are generating steady income, and which require careful consideration.

Unlock the complete picture of BNK Financial Group's portfolio by purchasing the full BCG Matrix. Gain detailed quadrant placements, actionable insights, and a clear roadmap for optimizing investments and product development. Don't miss out on this essential strategic tool.

Stars

BNK Financial Group is strategically investing in digital transformation by forming a future strategy team and restructuring its Customer Value Innovation Division. This focus on digital customer experiences and emerging channels, including the creation of an AI Business Team, positions them to capitalize on the high-growth fintech and digital banking sectors.

The group's commitment to digital capabilities is a key driver for its potential growth. For instance, in 2023, the global fintech market was valued at over $1.1 trillion and is projected to grow significantly. By enhancing its digital offerings, BNK Financial Group aims to capture a larger share of this expanding market.

BNK Financial Group is strategically positioning its AI and Data-Driven Services as a Star within its BCG Matrix. The establishment of a dedicated AI Business Team signals a strong commitment to integrating cutting-edge AI technologies, recognizing the explosive growth and substantial investment in AI across the global financial landscape, including a notable surge in South Korea.

This focus on AI aligns with a market trend where financial institutions are increasingly leveraging data analytics and artificial intelligence for everything from customer service to risk management. For instance, in 2023, financial services firms globally saw a significant increase in AI adoption, with many reporting improved operational efficiency and enhanced customer engagement.

While BNK's AI services are still in their developmental phase, their potential is immense. Successful execution in creating unique, AI-powered offerings could very well propel BNK Financial Group to a dominant market position in this high-growth sector, much like other financial innovators who have already seen substantial returns from their AI investments.

BNK Financial Group's 2024-2026 Mid-to Long-term ESG Strategy heavily emphasizes 'Green Finance,' aiming to bolster environmental protection and expand sustainable financing. This strategic pivot aligns with a significant global surge in ESG and sustainable investing, signaling a robust growth trajectory for this market segment.

The expansion of green finance products represents a potential star in BNK Financial Group's BCG matrix. The global sustainable finance market is projected to reach $50 trillion by 2025, according to Bloomberg Intelligence. Successfully introducing and gaining traction for innovative green financial products and services could allow BNK to capture a substantial portion of this expanding market, driving significant revenue and growth.

Non-Face-to-Face Customer Division

BNK Financial Group's Non-Face-to-Face Customer Division, particularly within Busan Bank and Gyeongnam Bank, is strategically positioned to capture the burgeoning digital banking market. This division focuses on enhancing digital capabilities to serve customers who prefer remote interactions, aiming to mirror the success of 'Stars' in the BCG matrix by achieving both high growth and high market share in digital channels.

The establishment of this division is a direct response to evolving customer behavior, with a significant portion of the banking population increasingly opting for digital platforms. For instance, in 2024, the digital banking sector saw continued expansion, with many banks reporting substantial increases in mobile and online transactions. This trend suggests that a strong performance in the Non-Face-to-Face Customer Division could indeed represent a 'Star' segment for BNK Financial Group, indicating a high-potential area for future investment and growth.

- Digital Adoption Growth: In 2024, many financial institutions observed a year-over-year increase of over 15% in active digital users, highlighting the rapid shift towards non-face-to-face banking.

- Customer Preference Shift: Surveys in early 2025 indicated that over 60% of new account openings were initiated through digital channels, underscoring the importance of this segment.

- Investment in Digital Infrastructure: BNK Financial Group's continued investment in its digital platforms and non-face-to-face service capabilities is crucial for solidifying its position in this 'Star' quadrant.

- Competitive Landscape: The success of this division is vital as competitors also aggressively expand their digital offerings, making market share in these channels a key differentiator.

Strategic Fintech Collaborations

Strategic fintech collaborations are crucial for BNK Financial Group's growth. South Korea's banking sector saw fintech investment reach approximately ₩4.5 trillion (around $3.3 billion USD) in 2023, highlighting the competitive landscape. By partnering with innovative fintech firms, BNK can enhance its service offerings and operational agility, positioning itself for significant market share gains.

These partnerships can unlock new revenue streams and customer segments. For instance, collaborations focused on digital lending platforms or personalized wealth management solutions could tap into unmet market needs. Success in these ventures would place BNK's fintech initiatives in the Stars quadrant of the BCG Matrix, signifying high growth and high market share.

- Enhanced Personalization: Fintech partnerships enable tailored financial advice and product recommendations, increasing customer engagement.

- Operational Efficiency: Automating processes through fintech solutions can reduce costs and improve service delivery speed.

- Market Expansion: Collaborations can open doors to new customer demographics and geographical markets.

- Innovation Pipeline: Staying ahead of market trends by integrating cutting-edge fintech capabilities ensures long-term competitiveness.

BNK Financial Group is strategically positioning its AI and Data-Driven Services as a Star within its BCG Matrix. The establishment of a dedicated AI Business Team signals a strong commitment to integrating cutting-edge AI technologies, recognizing the explosive growth and substantial investment in AI across the global financial landscape, including a notable surge in South Korea.

This focus on AI aligns with a market trend where financial institutions are increasingly leveraging data analytics and artificial intelligence for everything from customer service to risk management. For instance, in 2023, financial services firms globally saw a significant increase in AI adoption, with many reporting improved operational efficiency and enhanced customer engagement.

While BNK's AI services are still in their developmental phase, their potential is immense. Successful execution in creating unique, AI-powered offerings could well propel BNK Financial Group to a dominant market position in this high-growth sector, much like other financial innovators who have already seen substantial returns from their AI investments.

BNK Financial Group's Non-Face-to-Face Customer Division, particularly within Busan Bank and Gyeongnam Bank, is strategically positioned to capture the burgeoning digital banking market. This division focuses on enhancing digital capabilities to serve customers who prefer remote interactions, aiming to mirror the success of 'Stars' in the BCG matrix by achieving both high growth and high market share in digital channels.

The establishment of this division is a direct response to evolving customer behavior, with a significant portion of the banking population increasingly opting for digital platforms. For instance, in 2024, the digital banking sector saw continued expansion, with many banks reporting substantial increases in mobile and online transactions. This trend suggests that a strong performance in the Non-Face-to-Face Customer Division could indeed represent a 'Star' segment for BNK Financial Group, indicating a high-potential area for future investment and growth.

Strategic fintech collaborations are crucial for BNK Financial Group's growth. South Korea's banking sector saw fintech investment reach approximately ₩4.5 trillion (around $3.3 billion USD) in 2023, highlighting the competitive landscape. By partnering with innovative fintech firms, BNK can enhance its service offerings and operational agility, positioning itself for significant market share gains.

These partnerships can unlock new revenue streams and customer segments. For instance, collaborations focused on digital lending platforms or personalized wealth management solutions could tap into unmet market needs. Success in these ventures would place BNK's fintech initiatives in the Stars quadrant of the BCG Matrix, signifying high growth and high market share.

| BNK Financial Group Stars (BCG Matrix) | Description | Market Growth | Market Share | Strategic Focus |

| AI and Data-Driven Services | Leveraging AI for enhanced customer service, risk management, and operational efficiency. | High | High (Potential) | Investment in AI Business Team, digital transformation. |

| Non-Face-to-Face Customer Division | Expanding digital banking capabilities to cater to remote customer interactions. | High | High (Potential) | Enhancing digital platforms, mobile and online transaction growth. |

| Strategic Fintech Collaborations | Partnering with fintech firms to innovate service offerings and expand market reach. | High | High (Potential) | Digital lending, personalized wealth management, operational agility. |

What is included in the product

Highlights which BNK Financial Group units to invest in, hold, or divest based on market share and growth.

The BCG Matrix provides a clear, visual snapshot of BNK Financial Group's portfolio, alleviating the pain of strategic uncertainty.

Cash Cows

Busan Bank, a cornerstone of BNK Financial Group, commands a strong position in its primary markets of Busan and Gyeongsangnam-do.

Despite a slight dip in the banking sector's net income in Q1 2025, Busan Bank continues to be a mature, cash-generating entity, holding a substantial market share in traditional banking services.

Its consistent generation of significant interest income makes it the primary profit driver for the entire BNK Financial Group.

Kyongnam Bank, acquired by BNK Financial Group in 2014, is a prime example of a Cash Cow within the group's BCG Matrix. Its operation in the mature commercial banking sector, particularly in its established regional market, mirrors the characteristics of a well-entrenched entity.

This segment benefits from a high market share, ensuring consistent and reliable cash generation. In 2023, BNK Financial Group reported that its banking subsidiaries, including Kyongnam Bank, contributed significantly to its net interest income, a testament to the stable revenue streams these mature operations provide.

Deposit-taking and loan provision are the bedrock of BNK Financial Group's banking subsidiaries, forming its core operational activities. These essential banking services have secured a substantial market share in their primary operating regions, consistently contributing significant interest revenue to the group.

These established segments are characterized by their stability and operate within low-growth markets, a profile that makes them reliable sources of consistent cash flow for BNK Financial Group. For instance, in 2024, BNK's net interest income from these activities remained a primary driver of profitability, reflecting the steady demand for these fundamental financial services.

Established Regional Branch Network

BNK Financial Group's established regional branch network, boasting 260 locations with a significant presence in Busan and Gyeongsangnam-do, positions it as a strong Cash Cow within the BCG framework. This extensive physical footprint has cultivated a deep and loyal customer base, ensuring consistent revenue streams from traditional banking services. Despite operating in a mature, low-growth market, the network's stability is a key asset.

The group's substantial investment in its physical infrastructure translates into a reliable channel for customer interaction and service delivery. This established network is crucial for maintaining market share and generating predictable cash flows, even as the banking landscape evolves. For instance, as of the first quarter of 2024, BNK Financial Group reported total assets of approximately ₩40 trillion, underscoring the scale and stability of its operations, largely supported by this branch network.

- Established Customer Base: The 260-branch network, particularly in Busan and Gyeongsangnam-do, supports a large and engaged customer segment.

- Stable Revenue Generation: This physical infrastructure provides a consistent channel for traditional banking services, ensuring predictable cash flow.

- Market Stability: While the market is low-growth, the established network helps BNK maintain its position and fend off new entrants.

- Operational Efficiency: Leveraging existing branches for core services minimizes the need for significant new investment in these mature markets.

Capital Adequacy and Shareholder Returns

BNK Financial Group is strategically leveraging its established businesses, often referred to as cash cows, to enhance shareholder value. The group's commitment to increasing its payout ratio to 50% by 2027 underscores this focus on returning capital to investors from its stable, cash-generating segments.

This strategy is supported by a robust capital position. For instance, BNK Financial Group reported an increase in its common equity capital ratio in the first quarter of 2025, demonstrating its financial strength and capacity to distribute earnings.

- Capital Strength: BNK Financial Group's common equity capital ratio saw an upward trend in Q1 2025.

- Shareholder Returns: The group aims to raise its payout ratio to 50% by 2027.

- Strategic Focus: This move signals a clear intention to extract and return value from mature, cash-rich business lines.

Busan Bank and Kyongnam Bank represent BNK Financial Group's core Cash Cows. These entities operate in mature markets with high market share, generating consistent and substantial cash flows. Their established regional presence and customer loyalty ensure stable revenue streams, primarily from traditional banking services like deposit-taking and lending.

These segments are crucial for funding other ventures and returning value to shareholders. For example, BNK Financial Group's net interest income, largely driven by these subsidiaries, remained a primary profit driver in 2024. The group's strategy includes increasing its payout ratio to 50% by 2027, directly benefiting from the reliable earnings of these cash cows.

The group's extensive branch network, totaling 260 locations, further solidifies its Cash Cow status. This infrastructure supports a deep customer base and provides a stable platform for revenue generation, even in low-growth environments. As of Q1 2025, BNK Financial Group's total assets were around ₩40 trillion, reflecting the scale and stability of these operations.

| Entity | Market Position | Cash Flow Generation | Growth Potential | Strategic Role |

|---|---|---|---|---|

| Busan Bank | High Market Share (Busan & Gyeongnam) | High & Stable | Low | Core Profit Driver |

| Kyongnam Bank | Established Regional Presence | High & Stable | Low | Consistent Revenue Stream |

| Branch Network (260 locations) | Dominant Regional Footprint | Predictable & Reliable | Low | Customer Access & Service |

Preview = Final Product

BNK Financial Group BCG Matrix

The BNK Financial Group BCG Matrix preview you're examining is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a comprehensive strategic tool ready for immediate application in your business planning and analysis.

Dogs

The investment securities arm of BNK Financial Group saw its net income dip in the first quarter of 2025, signaling a struggle in a crowded marketplace. This underperformance suggests a potentially small slice of the market and a limited contribution to the company's bottom line.

This segment might be acting as a cash trap, where profits are shrinking even as expenses remain, making it difficult to generate meaningful returns. For instance, if this division’s revenue fell by 5% in Q1 2025 while its operating costs stayed flat, it would directly impact its profitability negatively.

The capital sector within BNK Financial Group experienced a notable decline in net income during the first quarter of 2025, mirroring trends seen in other investment securities. This downturn signals challenges in expanding its market footprint or achieving robust growth within its specialized operations.

This segment may be operating at a break-even point or even consuming capital without yielding significant returns, prompting a critical review of its strategic direction or potential divestment.

BNK Financial Group experienced substantial financial strain from problematic project finance loans, leading to significant losses and heightened provisioning. These issues were particularly acute in late 2024 and the first quarter of 2025, stemming from exposures to regional construction and manufacturing sectors facing downturns.

These high-risk assets are characterized by their low growth and low return potential. They actively deplete capital reserves due to the increasing need for loan loss provisions, impacting the group's overall financial health and capital allocation efficiency.

Credit Information and Debt Collection Business

Within BNK Financial Group's broader portfolio, credit information and debt collection services often reside in a mature, low-growth market. If BNK's operations in this specific segment do not command a leading market share or exhibit robust profitability, they might be categorized as Dogs in the BCG matrix. These services may primarily support internal group functions rather than acting as substantial external revenue drivers.

- Market Maturity: The credit information and debt collection sector is generally considered mature, with growth rates often mirroring overall economic expansion rather than exhibiting rapid acceleration.

- Competitive Landscape: Dominance in this sector typically requires significant scale and established infrastructure, making it challenging for smaller players to gain substantial market share.

- Potential Classification: Without a clear competitive advantage or strong revenue contribution, BNK's credit information and debt collection business could be classified as a Dog, requiring careful management or divestment considerations.

Legacy Systems and Outdated Channels

Legacy IT systems and traditional service channels at BNK Financial Group, if not fully integrated into the digital transformation, could be categorized as Dogs in the BCG Matrix. These systems often come with substantial maintenance expenses while experiencing declining customer interaction and a shrinking market share against newer, more agile competitors.

For instance, a significant portion of older banking infrastructure might still rely on mainframe technology, which, while reliable, can be costly to update and integrate with modern APIs. In 2024, it's estimated that maintaining such legacy systems can represent 70-80% of an IT budget for some financial institutions, diverting resources from innovation.

- High Maintenance Costs: Continued expenditure on outdated hardware and software.

- Diminishing Customer Engagement: Lack of modern features leads to customer attrition.

- Low Market Share: Inability to compete effectively with digitally native financial services.

- Limited ROI Potential: Significant investment required for minimal expected returns.

BNK Financial Group's credit information and debt collection services may be classified as Dogs. This sector is mature, with growth rates closely tied to the broader economy, and BNK's operations might not hold a leading market share or exhibit strong profitability. Consequently, these services could be more beneficial for internal support than substantial external revenue generation.

Legacy IT systems, particularly those not fully integrated into digital transformation efforts, also fit the Dog category. These systems incur significant maintenance costs while facing declining customer engagement and market share due to competition from newer, more agile platforms. For example, maintaining mainframe technology, common in older banking infrastructure, can consume a large portion of IT budgets, diverting funds from innovation.

These "Dog" segments within BNK Financial Group represent areas with low market share and low growth potential. They often require substantial investment for upkeep but offer minimal returns, potentially draining capital from more promising ventures. Strategic decisions regarding these units might involve careful management or consideration for divestment to reallocate resources effectively.

Question Marks

BNK Financial Group's venture investment business aligns with the characteristics of Question Marks in the BCG Matrix. These ventures are high-growth potential but currently hold low market share, demanding significant capital for development and market penetration. For instance, in 2024, the venture capital industry saw substantial activity, with global VC funding reaching hundreds of billions, reflecting the appetite for these high-risk, high-reward opportunities.

The inherent speculative nature of these investments means they are not yet established revenue generators. BNK Financial Group is essentially betting on future market leaders, understanding that many will fail, but a successful few could become lucrative Stars. This strategy requires careful selection and substantial ongoing funding to nurture these nascent businesses.

BNK Financial Group's new digital banking products and platforms represent a significant investment in the future, positioning them as Stars in the BCG Matrix. These initiatives, including digital sales centers and innovative customer experiences, are in their early stages, reflecting low current market penetration but targeting the high-growth digital finance sector. The group's commitment to this area is underscored by projected digital banking growth, with estimates suggesting the global digital banking market could reach over $30 trillion by 2026, requiring substantial capital for user acquisition and market share expansion.

BNK Financial Group's AI-driven financial solutions, developed by its nascent AI Business Team, are currently positioned as Question Marks within the BCG Matrix. While the broader AI initiatives are recognized as Stars, these specific applications are in their nascent stages, indicating high growth potential in the rapidly expanding AI finance sector.

These new offerings face the challenge of low current market share, necessitating significant investment to achieve scalability and market penetration. For instance, the global AI in financial services market was valued at approximately $10.6 billion in 2023 and is projected to reach $40.8 billion by 2028, growing at a CAGR of 31.1% during this period, according to MarketsandMarkets. This robust market growth highlights the inherent potential for BNK's new solutions.

The success of these early-phase AI financial solutions hinges on their ability to capture market share and demonstrate a clear return on investment. If they can effectively leverage the market's growth and carve out a significant niche, they have the potential to evolve into Stars, mirroring the success of BNK's overall AI strategy.

Emerging International Market Presence

BNK Financial Group's international market presence, while not its core focus, is an area with emerging potential. These ventures into less established markets, though currently holding a low market share, represent significant growth opportunities. For instance, in 2024, BNK Financial Group continued its strategic exploration of Southeast Asian markets, particularly focusing on Vietnam and Cambodia, aiming to build a foundational presence.

- Emerging Markets: BNK Financial Group's international strategy is characterized by a cautious yet forward-looking approach to new territories.

- High Growth Potential: These nascent international operations are positioned to capitalize on the rapid economic development in emerging economies.

- Strategic Investment: Establishing a foothold in these markets requires substantial capital allocation for market research, regulatory compliance, and building local partnerships.

- Risk-Reward Profile: While offering substantial long-term rewards, these ventures inherently carry higher risks due to market volatility and competitive landscapes.

Innovative ESG-focused Financial Instruments

BNK Financial Group is exploring innovative ESG-focused financial instruments, recognizing the burgeoning demand for investments that align with environmental, social, and governance principles. These new offerings, while currently in early adoption phases, are designed to capture a rapidly expanding market segment.

These instruments, such as sustainability-linked bonds and ESG-themed exchange-traded funds (ETFs), target a market that saw global sustainable fund flows reach $107 billion in the first quarter of 2024, according to Morningstar data. Despite this growth, these specific instruments represent a small fraction of the overall investment landscape, necessitating significant marketing and strategic investment to establish market leadership.

- Sustainability-Linked Bonds: These debt instruments tie financial characteristics, like coupon rates, to the issuer achieving predefined ESG performance targets. For instance, a company might issue a bond where the interest rate decreases if it meets its carbon emission reduction goals.

- ESG Themed ETFs: These are exchange-traded funds that specifically track indices composed of companies demonstrating strong ESG performance, offering diversified exposure to sustainable businesses. The global ETF market reached over $11 trillion in assets under management by the end of 2023.

- Green Loans: Loans where the proceeds are exclusively used for projects with environmental benefits, such as renewable energy or energy efficiency initiatives. The green loan market is projected to grow significantly, with demand driven by corporate net-zero commitments.

- Impact Investing Funds: Funds that aim to generate both positive, measurable social and environmental impact alongside a financial return. These funds are attracting increasing interest from institutional investors seeking to align their capital with their values.

BNK Financial Group's new digital banking platforms and AI-driven financial solutions are prime examples of Question Marks. These ventures operate in high-growth sectors but currently hold minimal market share, demanding substantial capital investment for development and market penetration. For instance, the global AI in financial services market was valued at approximately $10.6 billion in 2023 and is projected to reach $40.8 billion by 2028, highlighting the growth potential for BNK's AI initiatives.

These investments are speculative, with the expectation that a few successful ventures will eventually become Stars, generating significant returns. This strategy requires careful selection and sustained funding to nurture these nascent businesses into market leaders. The success of BNK's AI solutions, for example, hinges on their ability to capture market share within this expanding sector.

BNK's exploration of emerging international markets, such as Vietnam and Cambodia, also fits the Question Mark profile. While these markets offer high growth potential, BNK's presence is nascent, requiring strategic investment to build a foundation. Similarly, new ESG-focused financial instruments, despite growing market interest with $107 billion in sustainable fund flows in Q1 2024, represent early-stage ventures for BNK needing capital to gain traction.

| Business Area | BCG Category | Market Growth | Current Market Share | Capital Needs |

|---|---|---|---|---|

| Digital Banking Platforms | Question Mark | High (Global digital banking market > $30T by 2026) | Low | High |

| AI-driven Financial Solutions | Question Mark | Very High (AI in Finance: $10.6B in 2023 to $40.8B by 2028) | Low | High |

| Emerging International Markets (e.g., Vietnam, Cambodia) | Question Mark | High (Regional economic development) | Low | Moderate to High |

| ESG-focused Financial Instruments | Question Mark | High ($107B sustainable fund flows in Q1 2024) | Low | Moderate |

BCG Matrix Data Sources

Our BNK Financial Group BCG Matrix is constructed using a blend of internal financial statements, comprehensive market research reports, and publicly available competitor data to provide a robust strategic overview.