Block SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Block Bundle

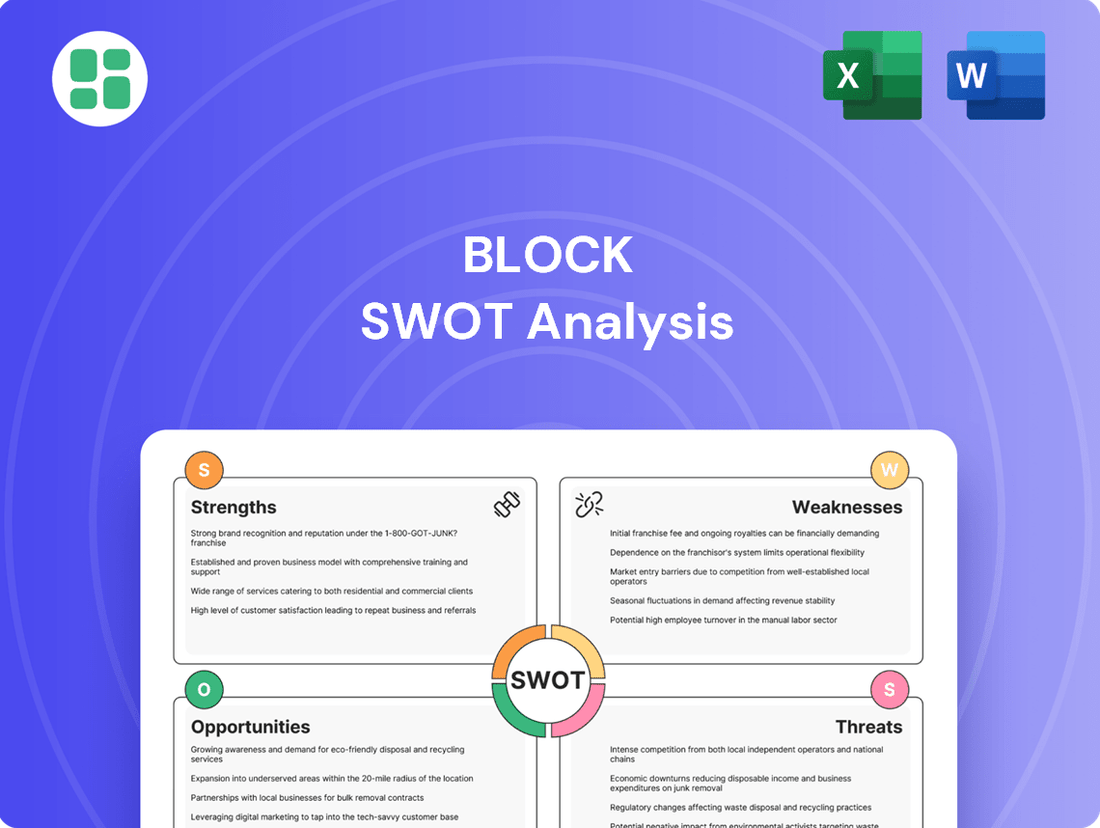

This powerful Block SWOT analysis reveals the core strengths, potential weaknesses, exciting opportunities, and critical threats facing the company. Understand the foundational elements that shape its current market position and future trajectory.

Ready to move beyond the basics and unlock actionable strategies? Purchase the full SWOT analysis to gain access to a comprehensive, professionally written report complete with expert commentary and editable tools, perfect for informed decision-making.

Strengths

Block, Inc. boasts a powerful, integrated ecosystem, connecting its Square business solutions with the Cash App for consumers. This synergy fosters significant cross-selling opportunities, making it easier to retain customers by offering a comprehensive suite of financial tools for everyone from sole proprietors to everyday users.

Block, through its Square and Cash App ecosystems, boasts formidable brand recognition. Square is a trusted name for small and medium-sized businesses seeking seamless payment processing solutions, a segment it has deeply penetrated.

Cash App, on the other hand, has captured the younger demographic with its intuitive peer-to-peer payment functionality and has expanded into banking and investing services. This dual brand strength allows Block to cater to a broad customer base, from entrepreneurs to everyday consumers.

Block's dedication to pioneering new technologies via TBD and Spiral firmly places it as a leader in the dynamic blockchain and Bitcoin landscape. This forward-thinking approach, exemplified by their work on Bitcoin mining chips and systems, is poised to create significant future growth opportunities and set Block apart from conventional financial players.

Scalable Technology Infrastructure

Block's technology infrastructure is a significant strength, built for scalability to manage substantial transaction volumes and an expanding user base across its Square and Cash App ecosystems. This robust foundation allows for efficient growth into new markets and service offerings without requiring major re-engineering.

This inherent scalability is crucial for Block's continued expansion. For instance, in Q1 2024, Block reported a 25% year-over-year increase in Cash App’s total net revenue, reaching $4.2 billion, demonstrating the platform's ability to handle significant user engagement and transaction growth. The underlying technology’s capacity to adapt and grow alongside user adoption is a key differentiator.

- Scalable Architecture: Supports millions of concurrent users and transactions.

- Efficient Expansion: Enables seamless entry into new geographic markets and service verticals.

- Cost-Effective Growth: Minimizes the need for costly infrastructure upgrades as the user base expands.

- Product Innovation: Facilitates rapid deployment of new features and services to meet evolving customer needs.

Large and Engaged User Base

Block's Cash App has cultivated a massive and actively engaged user base, reaching 57 million monthly active users in the first quarter of 2025. This extensive network is a significant asset, fostering a powerful network effect for its peer-to-peer payment services and offering a prime opportunity to roll out new financial products.

This strong user engagement translates directly into market presence for Square's business solutions. The widespread adoption by merchants ensures a consistent flow of revenue and reinforces Block's position in the market.

- 57 million monthly active users for Cash App in Q1 2025.

- Network effect benefits from a large, engaged user base.

- Cross-selling opportunities for new financial services.

- Merchant adoption drives continuous revenue for Square.

Block's integrated ecosystem, linking Square and Cash App, is a major strength, enabling significant cross-selling and customer retention. This synergy allows Block to serve a wide range of users, from small businesses to individuals, with a comprehensive suite of financial tools.

The company benefits from strong brand recognition across both Square and Cash App. Square is a trusted provider for businesses needing payment processing, while Cash App has successfully attracted a younger demographic and expanded into banking and investing.

Block's commitment to innovation through TBD and Spiral positions it as a leader in blockchain and Bitcoin technology. This forward-looking strategy, including work on Bitcoin mining, promises future growth and differentiation from traditional financial firms.

The company's technology infrastructure is built for scalability, efficiently handling high transaction volumes and user growth across its platforms. This robust foundation supports expansion into new markets and services cost-effectively.

| Platform | Key Strength | User Base (Q1 2025) | Revenue Growth (YoY Q1 2024) |

|---|---|---|---|

| Square | Merchant payment solutions, brand trust | Millions of merchants | N/A (Segmented reporting) |

| Cash App | Peer-to-peer payments, banking, investing, young demographic | 57 million monthly active users | 25% total net revenue growth |

| TBD/Spiral | Blockchain and Bitcoin innovation | N/A (Development focus) | N/A (Investment phase) |

What is included in the product

Delivers a strategic overview of Block’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT data into a clear, actionable framework for immediate problem-solving.

Weaknesses

Block faces formidable competition in every sector it operates in. Traditional banks, established payment networks like Visa and Mastercard, and a growing number of fintech disruptors are all vying for market share. This crowded landscape means Block must constantly innovate and spend heavily on marketing to stand out, impacting profitability.

For instance, in the digital payments space, Block's Cash App competes directly with PayPal's Venmo and Zelle, which is integrated into many major banks. In the cryptocurrency sector, it contends with numerous exchanges and decentralized finance platforms. This intense rivalry can compress margins and make acquiring new customers a costly endeavor, as evidenced by rising customer acquisition costs reported in the fintech industry throughout 2024.

Block, as a financial technology company operating in payments, banking, and cryptocurrency, faces significant regulatory scrutiny. This oversight is particularly intense given the sensitive nature of its services, requiring constant adaptation to evolving compliance landscapes.

Recent allegations concerning widespread compliance failures and insufficient user due diligence within Cash App have intensified this scrutiny. Such issues can lead to substantial financial penalties and damage Block's reputation, impacting its operational stability and investor confidence.

For instance, in 2023, Block agreed to pay a $25 million settlement to resolve a consumer protection lawsuit related to its Cash App services, highlighting the tangible costs of compliance lapses.

Block's newer initiatives, such as TBD, Spiral, and Tidal, while showcasing innovation, are not yet substantial profit drivers and demand significant capital. This investment phase means these ventures may weigh on overall profitability for the foreseeable future.

Block's Q1 2025 earnings report highlighted a noticeable slowdown in growth for both its Square and Cash App segments. This trend underscores the ongoing difficulty in achieving consistent profitability across its diverse portfolio of businesses, especially as it continues to nurture emerging projects.

Reliance on Specific Segments and User Demographics

Block's revenue is significantly tied to specific market segments, posing a vulnerability. The Square ecosystem primarily serves small and medium-sized businesses, a group often more susceptible to economic contractions. For instance, in Q1 2024, while Block reported a 21% year-over-year increase in Gross Payment Volume (GPV) for its Seller segment, the health of SMBs remains a critical factor.

Cash App's reliance on a younger demographic, particularly Millennials and Gen Z, also presents a risk. While these groups are digitally native and have high adoption rates for financial apps, shifts in their spending habits, economic pressures affecting younger workers, or evolving preferences for financial tools could impact Cash App's growth trajectory. In 2023, Cash App continued to see strong user engagement, but future growth will depend on retaining and expanding its appeal within these core demographics.

- Dependence on SMBs: Economic downturns can disproportionately affect small and medium-sized businesses, directly impacting Square's transaction volumes.

- Demographic Concentration: Cash App's strong user base among Millennials and Gen Z makes it vulnerable to shifts in younger consumer behavior or economic conditions impacting these age groups.

- Market Saturation: As digital payment solutions become more widespread, Block faces increased competition for these key user segments.

Operational Complexity and Integration Challenges

Block's diverse offerings, spanning payment processing via Square, banking services, investing through Cash App Investing, and even entertainment ventures, create significant operational complexities. Managing these distinct business units effectively requires robust systems and processes.

Integrating these varied services into a cohesive and efficient ecosystem is an ongoing hurdle. For instance, ensuring seamless data flow and a unified user experience across Square's merchant services and Cash App's consumer platform demands constant attention and investment in technology. In Q1 2024, Block reported a gross profit of $2.04 billion, highlighting the scale of operations they manage.

- Operational Silos: Different business units may operate with distinct technologies and workflows, hindering cross-platform synergy.

- Scalability Issues: Rapid growth in one segment can strain resources and integration capabilities in others.

- User Experience Fragmentation: Inconsistent experiences across services can confuse customers and dilute brand loyalty.

Block's reliance on small and medium-sized businesses (SMBs) for its Square segment makes it susceptible to economic downturns. For example, while Block's Seller segment saw a 21% year-over-year increase in Gross Payment Volume (GPV) in Q1 2024, the overall health of SMBs remains a critical factor. Similarly, Cash App's concentration among Millennials and Gen Z presents a risk if these demographics experience shifts in spending habits or economic pressures. The fintech market is also increasingly saturated, intensifying competition for these key user groups.

Block's diverse operations, from payments to cryptocurrency, lead to significant complexities in management and integration. Ensuring seamless data flow and a unified user experience across its various platforms, like Square and Cash App, requires continuous technological investment and attention. This can result in operational silos, potential scalability issues as one segment grows, and a fragmented user experience that could dilute brand loyalty. In Q1 2024, Block reported a gross profit of $2.04 billion, underscoring the scale of these integrated operations.

| Weakness | Description | Impact | Example/Data |

| Dependence on SMBs | Square's revenue is heavily tied to the performance of small and medium-sized businesses. | Economic contractions can disproportionately affect SMBs, directly impacting Square's transaction volumes and revenue. | Q1 2024: Square's Seller segment GPV increased 21% YoY, but SMB health remains a key vulnerability. |

| Demographic Concentration | Cash App's user base is heavily concentrated among Millennials and Gen Z. | Shifts in younger consumer behavior, economic conditions impacting these age groups, or evolving preferences for financial tools could hinder Cash App's growth. | 2023: Cash App continued strong user engagement, but future growth hinges on retaining and expanding appeal within these core demographics. |

| Market Saturation | The digital payments and fintech landscape is highly competitive. | Increased competition can compress margins and make customer acquisition more expensive, impacting profitability. | Rising customer acquisition costs reported in the fintech industry throughout 2024. |

| Operational Complexity | Managing diverse business units (Square, Cash App, TBD, etc.) creates significant operational challenges. | Potential for operational silos, scalability issues, and a fragmented user experience across services, hindering synergy and brand loyalty. | Q1 2024: Block reported $2.04 billion in gross profit, indicating the scale of operations requiring complex management. |

Same Document Delivered

Block SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Block has a substantial runway for global expansion, targeting regions with large unbanked populations and growing small business sectors. This presents a significant opportunity to replicate the success of its Square and Cash App ecosystems internationally.

The company's international gross payment volume saw a robust 25% increase in 2024, underscoring the strong demand and potential for further penetration into new markets. This growth trajectory signals Block's capability to capture new customer segments and revenue streams beyond its current core markets.

Block's TBD and Spiral initiatives position it for deeper integration of blockchain and Bitcoin. Imagine Square merchants accepting Bitcoin payments more easily, or Cash App users having even more ways to invest in crypto. This moves beyond simple trading to embedding digital assets into everyday transactions.

In 2024, the digital asset landscape is rapidly evolving. Block's ability to leverage its existing user base within Square and Cash App for crypto adoption could be a significant differentiator. For instance, if Cash App's reported 56 million monthly active users in Q1 2024 engage more with crypto features, it represents a massive on-ramp for mainstream digital currency use.

Block has a significant opportunity to deepen its relationship with its existing user base by offering a broader suite of financial services. Leveraging the trust built through Cash App and Square, the company can move into areas like lending, insurance, and advanced wealth management.

For instance, Cash App Borrow had already garnered 5 million monthly active users by the close of 2024, clearly indicating a strong market appetite for credit facilities directly integrated into the app. This success provides a solid foundation for expanding lending capabilities to a wider audience and exploring other financial products.

Cross-Selling and Ecosystem Synergies

Block, Inc. (Square) has significant opportunities to leverage its distinct platforms, Square and Cash App, for cross-selling. As Square continues its transformation into a full-service commerce solution, and Cash App deepens its banking capabilities, the potential for synergistic growth becomes increasingly apparent. This integration fosters stronger network effects, driving greater engagement across the entire Block ecosystem.

Consider the following opportunities:

- Enhanced Cash App Integration for Square Sellers: Offering Cash App as a payment option for Square merchants can simplify transactions and potentially attract a younger demographic to seller platforms. In Q1 2024, Cash App reported 57 million monthly active users, a substantial base to tap into for merchant transactions.

- Square Services for Cash App Users: Providing Square's business management tools, like point-of-sale systems or payroll services, to Cash App's growing user base who may also be small business owners or freelancers presents a clear cross-selling avenue.

- Ecosystem Loyalty Programs: Developing integrated loyalty programs that reward users for engaging with both Square and Cash App services could significantly boost retention and increase the lifetime value of customers.

Leveraging Data for Personalized Services

Block's extensive user and transaction data from both Square and Cash App presents a significant opportunity to craft deeply personalized financial services. This includes tailoring product offerings, refining marketing strategies, and enhancing risk assessment models with unique user profiles. For instance, by analyzing spending habits, Block can offer more relevant credit products or investment opportunities to specific user segments.

Leveraging this data can significantly boost user experience and operational efficiency. Insights derived from data analytics can streamline onboarding processes, reduce fraud, and optimize customer support. This data-driven approach is crucial for staying competitive in the rapidly evolving fintech landscape, where personalization is a key differentiator.

- Personalized Product Development: Block can create bespoke financial tools, such as tailored savings plans or investment portfolios, based on individual user transaction histories and financial goals.

- Targeted Marketing Campaigns: Data allows for highly specific marketing efforts, ensuring that promotions and new product announcements reach the users most likely to be interested.

- Advanced Risk Assessment: Utilizing granular transaction data can lead to more accurate credit scoring and fraud detection, reducing losses and expanding access to financial services for underserved populations.

- New Revenue Streams: The insights gained from data analysis can be monetized through premium features, data-driven partnerships, or by offering enhanced analytics to small businesses on the Square platform.

Block is well-positioned to capitalize on the growing demand for digital assets and blockchain technology. By integrating Bitcoin and other cryptocurrencies more seamlessly into its Cash App and Square ecosystems, Block can attract new users and offer innovative financial solutions. This strategy aligns with the increasing mainstream adoption of digital currencies, potentially driving significant transaction volume and user engagement.

The company's focus on international expansion presents a substantial growth avenue, particularly in emerging markets with large unbanked populations. Block's proven model of providing accessible financial tools through Cash App and payment processing through Square can be replicated globally. Evidence of this potential is seen in the 25% international gross payment volume increase in 2024, signaling strong market receptiveness.

Block's ability to leverage its vast user data from both Square and Cash App offers a powerful opportunity for personalized financial services. By understanding user behavior, Block can develop tailored products, enhance marketing efforts, and improve risk management. This data-driven approach can lead to increased customer loyalty and the creation of new revenue streams through premium offerings and strategic partnerships.

The cross-selling potential between Square and Cash App is immense. Enabling Cash App as a payment method for Square merchants, and offering Square's business tools to Cash App users who are also entrepreneurs, creates synergistic growth. Developing integrated loyalty programs further strengthens this ecosystem, driving higher customer lifetime value and reinforcing network effects.

Threats

The financial services landscape is fiercely competitive. Traditional banks are pouring billions into digital upgrades, aiming to retain customers, while nimble fintech startups are rapidly capturing market share with innovative offerings. This intense rivalry puts pressure on Block’s market standing and can drive up the cost of acquiring new customers.

For instance, in 2024, major banks like JPMorgan Chase announced significant investments in AI and cloud technology to enhance their digital platforms, directly challenging Block's ecosystem. Similarly, the surge of neobanks and payment processors in 2024 and early 2025 means Block faces constant pressure to differentiate its services and maintain competitive pricing, potentially impacting its profit margins.

Evolving financial regulations, especially around digital assets and data handling, present a substantial challenge for Block. For instance, the ongoing discussions and potential implementation of new rules by bodies like the SEC or global financial regulators could significantly alter the operational landscape. These shifts can lead to increased compliance burdens, potentially impacting Block's ability to innovate and expand its services.

Stricter compliance requirements often translate directly into higher operational costs. Block may need to invest more in legal teams, compliance software, and reporting infrastructure to adhere to new mandates. This could affect profitability, especially if new regulations limit revenue streams or impose significant penalties for non-compliance, as seen with past fines levied on financial technology firms for regulatory breaches.

Block's revenue streams are highly susceptible to economic fluctuations. A significant economic downturn, characterized by reduced consumer spending, could directly impact Cash App's transaction volumes. For instance, during periods of economic stress, individuals tend to cut back on discretionary spending, which translates to fewer transactions on the platform.

Furthermore, small businesses, a core segment for Square's seller ecosystem, are particularly vulnerable during recessions. A slowdown in economic activity often leads to decreased sales for these businesses, consequently reducing their reliance on payment processing services and impacting Square's transaction-based revenue and subscription growth. For example, if inflation remains elevated throughout 2024, it could further squeeze small business margins, making them more price-sensitive and potentially delaying investments in new payment technologies.

Cybersecurity Breaches and Data Privacy Concerns

Block, as a custodian of sensitive financial and personal data, is a constant target for sophisticated cyberattacks. A successful breach could result in substantial financial penalties, severe reputational damage, and a significant erosion of customer trust, directly impacting its core operations and future growth.

The financial services industry, including companies like Block, has seen a significant rise in the cost of data breaches. In 2023, the average cost of a data breach reached $4.45 million globally, a 15% increase over three years, according to IBM's Cost of a Data Breach Report. For Block, this translates to potential losses from regulatory fines, legal settlements, and the cost of remediation.

- Regulatory Scrutiny: Increased data privacy regulations globally, such as GDPR and CCPA, impose hefty fines for non-compliance and data breaches, with penalties potentially reaching millions of dollars.

- Reputational Damage: A major cybersecurity incident can severely damage Block's brand image, leading to customer attrition and making it harder to attract new users.

- Operational Disruption: Cyberattacks can disrupt Block's services, leading to downtime, lost revenue, and increased operational costs for recovery and security enhancements.

- Financial Losses: Beyond fines, breaches incur costs related to investigation, notification, credit monitoring for affected customers, and potential lawsuits.

Technological Obsolescence and Rapid Innovation

Block faces a significant threat from technological obsolescence driven by the relentless pace of innovation in fintech. The rapid evolution of technologies like artificial intelligence and embedded finance means that if Block doesn't continuously update its platforms and services, its current offerings could quickly become outdated. For instance, the global AI market is projected to reach $1.8 trillion by 2030, highlighting the immense investment and progress in this area, which competitors are actively leveraging.

Failure to adapt to these emerging technologies and shifting consumer expectations poses a direct risk to Block's market position. Competitors who are more agile in adopting new tech, such as blockchain or advanced data analytics for personalized financial services, could rapidly capture market share. In 2024, the adoption rate of embedded finance solutions is expected to continue its upward trajectory, with a significant portion of consumers now expecting financial services to be seamlessly integrated into non-financial platforms.

- Rapid AI Advancements: The continuous development of AI in areas like fraud detection and personalized customer service requires ongoing investment to remain competitive.

- Embedded Finance Growth: Competitors integrating financial services into e-commerce or social media platforms could divert users from Block's traditional ecosystem.

- Shifting Consumer Preferences: Younger demographics, in particular, expect digital-native, intuitive financial tools, making platform modernization crucial.

- Competitive Landscape: New fintech entrants, often with leaner structures, can pivot more quickly to adopt disruptive technologies than established players.

Block faces significant threats from intense competition, evolving regulations, economic downturns, cybersecurity risks, and technological obsolescence.

The rapid pace of innovation in fintech, particularly in areas like AI and embedded finance, demands continuous investment and adaptation from Block to avoid becoming outdated. For instance, the global AI market is projected to reach $1.8 trillion by 2030, with competitors actively leveraging these advancements.

Economic instability, marked by inflation and reduced consumer spending, directly impacts Block's transaction volumes and the revenue from its seller ecosystem. Elevated inflation in 2024, for example, could further pressure small business margins, making them more price-sensitive.

Cybersecurity threats are a constant concern, with the average cost of a data breach increasing significantly. In 2023, this cost reached $4.45 million globally, a 15% rise over three years, posing substantial financial and reputational risks to Block.

| Threat Category | Specific Risk | Impact on Block | Example/Data Point (2024/2025 Focus) |

|---|---|---|---|

| Competition | Fintech Disruption | Loss of market share, pressure on pricing | Major banks investing billions in digital upgrades; neobanks gaining traction. |

| Regulatory Environment | Compliance Burden | Increased operational costs, potential service limitations | Evolving digital asset and data handling rules by SEC and global regulators. |

| Economic Factors | Recessionary Impact | Reduced transaction volumes, lower small business revenue | Elevated inflation in 2024 impacting small business margins and spending. |

| Cybersecurity | Data Breaches | Financial penalties, reputational damage, loss of trust | Average data breach cost $4.45M globally in 2023 (IBM), a 15% increase in 3 years. |

| Technology | Obsolescence | Outdated offerings, loss of competitive edge | AI market projected to reach $1.8T by 2030; embedded finance growth. |

SWOT Analysis Data Sources

This analysis draws from robust data sources including official financial filings, comprehensive market intelligence reports, and validated industry expert opinions, ensuring a thorough and accurate strategic assessment.