Block Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Block Bundle

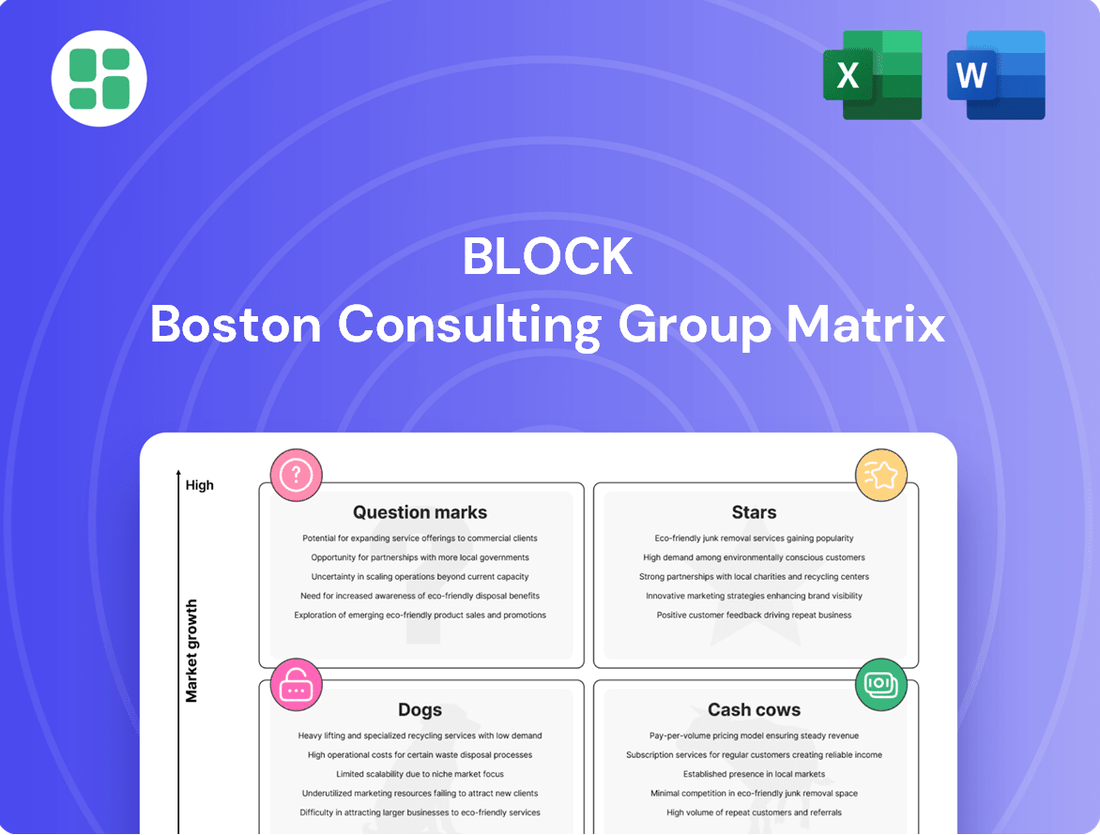

The BCG Matrix is a powerful tool that helps businesses categorize their products or business units based on market share and market growth rate. Understanding where your offerings fall – as Stars, Cash Cows, Dogs, or Question Marks – is crucial for effective resource allocation and strategic planning. This preview offers a glimpse into this vital framework.

Unlock the full potential of the BCG Matrix by purchasing the complete report. Gain detailed quadrant analysis, actionable insights for each product category, and a clear roadmap to optimize your portfolio for sustained growth and profitability.

Stars

Cash App, a key component of Block's portfolio, is positioned as a Star in the BCG Matrix due to its robust growth and expanding market presence. In the first quarter of 2025, its gross profit climbed to $1.39 billion, a solid 10% increase compared to the previous year.

With 57 million monthly active users in 2024, Cash App is projected to reach 60 million by 2025, underscoring its strong user acquisition and retention capabilities. This growth trajectory is further bolstered by the platform's continuous innovation, including the introduction of services like Cash App Borrow and deeper integration with Afterpay.

The Cash App Card is a significant player within Block's portfolio, demonstrating strong growth and user adoption. In 2024, it boasted 24 million users, with projections indicating a rise to 27 million by 2025. This expansion is particularly notable among younger demographics like Millennials and Gen Z.

This strong user base, concentrated in key spending age groups, presents a prime opportunity for Block to drive increased transaction volume and deeper customer engagement through the Cash App Card. The strategic integration of Afterpay further enhances its utility and appeal.

Cash App Borrow, a lending feature within Block's Cash App, is a key player in the company's growth strategy. By the close of 2024, it's projected to serve 5 million monthly active users, highlighting its significant adoption and utility.

Block is actively enhancing Cash App Borrow by broadening eligibility criteria and increasing lending limits. This expansion is supported by advancements in their underwriting processes and a strategic rollout across more states, indicating a robust demand for accessible micro-lending solutions.

The strong user engagement with Cash App Borrow signals a clear market need for convenient, small-scale lending. Block is well-positioned for substantial growth in this segment, with the feature expected to see pronounced acceleration in the coming periods.

Afterpay Integration with Cash App

The integration of Afterpay into Cash App represents a significant strategic maneuver, positioning it as a potential star within Block's BCG Matrix. This move aims to capture a larger share of consumer spending by offering flexible payment options directly through a widely adopted financial platform.

Initial performance indicators are highly encouraging. For example, early tests revealed nearly $150 million in loan originations, demonstrating a robust user appetite for Afterpay's buy now, pay later (BNPL) services within the Cash App ecosystem. This suggests a strong alignment with current consumer spending behaviors and a clear path toward increased monetization for Block.

- Growth Potential: Afterpay's integration is expected to fuel substantial revenue growth for Cash App by catering to user spending habits.

- Monetization: The BNPL service offers a new avenue for generating income, enhancing Cash App's overall financial performance.

- User Engagement: By embedding Afterpay, Cash App deepens its relationship with users, providing a more comprehensive financial toolkit.

- Market Position: This strategic integration strengthens Cash App's competitive standing in the digital payments and financial services landscape.

Bitcoin Trading on Cash App

Bitcoin trading on Cash App represents a significant growth area for Block, fitting the profile of a Star in the BCG Matrix. In 2024, Bitcoin revenue through Cash App surged to $10.1 billion, indicating robust user engagement with cryptocurrency. This upward trend is expected to continue, with projections suggesting $11.5 billion in Bitcoin revenue for 2025, underscoring sustained demand.

Cash App's role in facilitating Bitcoin transactions is substantial. By 2025, the platform processed over 12 million Bitcoin transactions, solidifying its position as a key player in the crypto ecosystem. Block's strategic investment in Bitcoin, including its own Bitcoin acquisition program, further reinforces this segment's status as a high-growth, high-market-share initiative.

- Bitcoin Revenue Growth: $10.1 billion in 2024, projected $11.5 billion in 2025.

- Transaction Volume: Over 12 million Bitcoin transactions processed via Cash App in 2025.

- Strategic Importance: Block's investment program supports Bitcoin's growth.

- Market Position: Dominant presence in the crypto trading space for Cash App users.

Stars in the BCG Matrix represent business units with high growth and high market share, demanding significant investment to maintain their position. Block's Cash App, with its expanding user base and increasing transaction volumes, clearly embodies this category.

The platform's successful integration of services like Afterpay and its prominent role in facilitating Bitcoin trading further solidify its Star status. These elements contribute to both its rapid growth and its dominant market presence within Block's overall portfolio.

Cash App's financial performance, with gross profit climbing and user numbers projected to rise, reinforces its position as a key growth driver for Block. The company's strategic focus on enhancing these offerings ensures their continued success.

The Cash App Card, with its strong user adoption, particularly among younger demographics, also fits the Star profile. Its increasing utility, amplified by Afterpay integration, positions it for continued expansion and revenue generation.

| Business Unit | BCG Category | Key Metrics (2024-2025 Projections) | Strategic Importance |

|---|---|---|---|

| Cash App (Overall) | Star | Gross Profit: $1.39B (Q1 2025, +10% YoY) Monthly Active Users: 57M (2024) to 60M (2025) |

Core growth driver, expanding ecosystem |

| Cash App Card | Star | Users: 24M (2024) to 27M (2025) Demographics: Strong adoption among Millennials & Gen Z |

Enhances user engagement and transaction volume |

| Cash App Borrow | Star | Monthly Active Users: Projected 5M (2024) Expansion: Broadening eligibility, increasing limits |

Addresses demand for micro-lending, drives utility |

| Afterpay Integration | Star | Loan Originations: ~$150M (early tests) Monetization: New revenue stream via BNPL |

Captures consumer spending, strengthens competitive position |

| Bitcoin Trading (Cash App) | Star | Bitcoin Revenue: $10.1B (2024) to $11.5B (2025) Transactions: >12M (2025) |

Significant revenue generator, key crypto facilitator |

What is included in the product

Strategic guidance on allocating resources by categorizing products into Stars, Cash Cows, Question Marks, and Dogs.

Visualize your portfolio's strengths and weaknesses instantly, easing strategic decision-making.

Cash Cows

Square's point-of-sale ecosystem is a prime example of a cash cow within the Block BCG Matrix. In the first quarter of 2025, this merchant-focused segment achieved a substantial $898 million in gross profit, marking a solid 9% increase compared to the previous year. This growth underscores its established strength and consistent performance in the market.

The company continues to hold a commanding market share in payment processing and point-of-sale systems, particularly among small and medium-sized businesses. This dominance is a key indicator of its cash cow status, as it benefits from established customer bases and economies of scale.

Ongoing investments in crucial supporting infrastructure and relentless product innovation, such as the continually evolving Square Point of Sale app, are designed to further enhance operational efficiency and boost cash flow for its users. These strategic moves reinforce the ecosystem's ability to generate predictable and substantial revenue streams.

Square's business management software, encompassing retail, restaurant, appointment, and invoicing tools, acts as a significant cash cow within Block's BCG Matrix. These integrated solutions boost seller flexibility and operational efficiency, fostering robust customer loyalty and consistent revenue. In 2023, Square's seller ecosystem saw continued growth, with gross payment volume reaching $220.4 billion, demonstrating the underlying strength of its integrated offerings.

Square Banking Services, encompassing lending, instant transfers, and checking/savings accounts for businesses, acts as a significant Cash Cow for Block. These offerings deepen seller relationships and generate stable, recurring revenue by capitalizing on Square's vast existing merchant network.

The company's FDIC approval to issue Cash App Borrow loans nationwide is a key driver, allowing Square to expand its financial services reach and solidify its position as a financial hub for small businesses. This strategic move is expected to further enhance revenue stability and profitability.

Managed Payment Services

Square's managed payment services act as a significant Cash Cow within Block's BCG Matrix. These services streamline the often-complex process of payment acceptance for businesses, allowing them to focus on their core operations.

The high profit margins associated with these managed payment services are a key driver of their Cash Cow status. Businesses rely on the consistency and reliability that Block provides through these offerings, creating a stable and predictable revenue stream.

Block's overall gross profit margins are robust, a direct reflection of the strong returns generated by these essential payment processing solutions. For instance, in the first quarter of 2024, Block reported a gross profit of $2.07 billion, with payment services being a substantial contributor.

- High Profitability: Managed payment services generate substantial profit margins for Block.

- Essential Business Function: These services are critical for businesses, ensuring smooth transactions.

- Consistent Revenue: They provide a reliable and predictable income source for Block.

- Strong Financial Performance: High gross profit margins underscore the success of these offerings.

Afterpay BNPL (Standalone)

Afterpay, operating as a standalone Buy Now, Pay Later (BNPL) service, demonstrates strong performance within the Block BCG Matrix. Its Gross Merchandise Value reached $10.3 billion in Q1 2025, marking a 13% year-over-year increase, with gross profit seeing a 14% rise.

Despite its integration with Cash App, Afterpay continues to generate substantial cash flow from its established user base in a market that is both expanding and maturing. This standalone operation is a key contributor to Block's overall financial health.

- Market Position: Afterpay operates in a growing BNPL market, which is projected to reach $3.2 trillion globally by 2028, according to some estimates.

- Financial Performance: Q1 2025 saw a 13% year-over-year growth in Gross Merchandise Value to $10.3 billion, alongside a 14% increase in gross profit.

- Strategic Reach: Its availability on platforms like Google Pay broadens its customer access and reinforces its position as a significant standalone BNPL provider.

Cash cows are business units or products that have a high market share in a slow-growing industry. They generate more cash than they consume, providing a stable source of funding for other business ventures. These operations typically have low operating costs and high profit margins due to their established market position.

Block's point-of-sale systems and integrated business management software exemplify cash cows. These offerings benefit from a loyal customer base and economies of scale, consistently generating significant revenue. For instance, Square's seller ecosystem saw its gross payment volume reach $220.4 billion in 2023, highlighting the stability and strength of these mature products.

Managed payment services also fall into this category, characterized by high profit margins and essential functionality for businesses. Block's overall robust gross profit margins, with $2.07 billion reported in Q1 2024, are substantially supported by these reliable payment processing solutions.

Afterpay, while in a growing market, also functions as a cash cow due to its significant market share and established revenue streams. Its Q1 2025 performance, with $10.3 billion in Gross Merchandise Value and a 14% rise in gross profit, demonstrates its capacity to generate consistent returns.

| Business Unit | Market Share | Industry Growth | Cash Generation |

| Point-of-Sale Systems | High | Slow | High |

| Business Management Software | High | Slow | High |

| Managed Payment Services | High | Slow | High |

| Afterpay (BNPL) | Significant | Growing | High |

Preview = Final Product

Block BCG Matrix

The BCG Matrix document you are currently previewing is the precise, fully formatted report you will receive immediately after your purchase. This comprehensive tool, designed for strategic clarity, will be delivered without any watermarks or demo content, ensuring you get a professional and ready-to-use analysis. You can confidently expect the exact same content and layout for your business planning needs. This is your direct gateway to actionable strategic insights, delivered instantly.

Dogs

Tidal Music Streaming Service, within Block's BCG matrix, is a classic example of a question mark, potentially moving towards a dog. With only about 721,400 US users in 2024, it holds a mere 0.5% of the crowded music streaming market. This low market share in a high-growth industry suggests limited traction.

Block's strategic shift, prioritizing Bitcoin mining over Tidal, further solidifies its position as a potential dog. The company has signaled a reduction in investment, hinting at a possible divestiture. This lack of commitment and declining revenue in its segment, marked by a $132 million goodwill impairment charge in late 2023, points to poor future prospects.

While Square's hardware, like their iconic registers and terminals, forms a crucial part of their business, some older models might operate on thinner profit margins. This is especially true when compared to the higher-margin software and payment processing services they offer.

As Square rolls out advanced, integrated hardware such as the Square Handheld, older, less efficient devices can become less of a strategic focus. These legacy products may also demand significant customer support, potentially outweighing the revenue they bring in.

For instance, in early 2024, Square (now Block) continued to sell a range of hardware, but the company's strategic emphasis and investment were clearly shifting towards newer, more feature-rich solutions, indicating a potential de-prioritization of older, lower-margin hardware sales.

Within Block's extensive software suite, there exist minor, non-core specialized programs. These are designed for very specific user groups or have yet to gain widespread traction among sellers.

These niche offerings typically command a small market share and contribute little to Block's overall revenue growth or profitability. For instance, if a specialized analytics tool serves only 0.5% of Block's seller base, its impact on the company's top line would be negligible.

Reallocating the resources, both financial and human, currently dedicated to these low-adoption products to more promising, high-growth segments of Block's business would be a strategic move. This ensures capital is deployed where it can generate the most significant returns.

Underperforming International Square Markets

While Square's global reach is a significant asset, some international markets may not be meeting performance benchmarks. These areas, characterized by a low market share and sluggish growth even after initial investment, could be consuming valuable resources without generating adequate returns.

Such underperforming regions may require a strategic re-evaluation, potentially leading to scaled-back operations or divestment. The company could benefit from reallocating resources towards international markets that demonstrate stronger potential for growth and market penetration.

- Underperforming International Markets: Identified regions with low market share and slow growth.

- Resource Drain: These markets may be consuming capital without sufficient return on investment.

- Strategic Re-evaluation: Potential for scaling back or exiting underperforming international ventures.

- Focus on Promising Regions: Prioritizing investment in international markets with higher growth prospects.

Early-Stage, Non-Bitcoin Focused Blockchain Projects

Block's early-stage, non-Bitcoin focused blockchain initiatives, previously housed under its TBD division, have largely been reclassified as 'dogs' within the BCG matrix. This strategic pivot, which occurred in late 2024, saw Block scale back its broader open and decentralized technology focus to concentrate more intently on Bitcoin mining operations. Consequently, projects within TBD that failed to gain significant market traction or did not align with this sharpened strategic direction are now considered underperforming assets.

These 'dog' category projects, by definition, possess low market share and exhibit minimal growth potential. They continue to consume valuable resources, including capital and personnel, without contributing meaningfully to Block's overarching cryptocurrency strategy, which is now heavily weighted towards Bitcoin. For instance, while specific financial figures for these discontinued TBD projects are not publicly detailed, the shift in focus implies a reallocation of substantial R&D and operational budgets away from these less successful ventures.

- Low Market Share: Non-Bitcoin blockchain projects within TBD struggled to capture significant user adoption or developer engagement compared to established ecosystems.

- Lack of Growth: These ventures did not demonstrate a clear path to scalable growth or a compelling value proposition that resonated with the market.

- Resource Drain: Continued investment in these projects diverted resources from Block's core Bitcoin mining and related growth areas.

- Strategic Misalignment: The late 2024 strategic recalibration to prioritize Bitcoin mining rendered many of these diversified blockchain projects redundant.

Dogs represent business units or products with low market share and low growth prospects. These are often cash traps, consuming resources without generating significant returns, prompting companies to consider divestment or discontinuation.

Block's early-stage, non-Bitcoin focused blockchain initiatives, previously under its TBD division, have largely been reclassified as dogs. This strategic pivot in late 2024 saw Block scale back its broader decentralized technology focus to concentrate on Bitcoin mining. Projects within TBD that failed to gain traction or align with this sharpened direction are now considered underperforming assets.

These 'dog' category projects possess low market share and minimal growth potential, consuming valuable resources without contributing meaningfully to Block's cryptocurrency strategy, now heavily weighted towards Bitcoin. The shift implies a reallocation of substantial R&D and operational budgets away from these less successful ventures.

Tidal Music Streaming Service, with only about 721,400 US users in 2024 and a mere 0.5% market share, exemplifies a dog. Block's strategic shift, prioritizing Bitcoin mining over Tidal and signaling reduced investment, further solidifies its dog status, marked by a $132 million goodwill impairment charge in late 2023.

| Business Unit/Product | Market Share | Growth Rate | Strategic Implication |

| Tidal Music Streaming | 0.5% (US, 2024) | Low | Potential divestment due to low traction and strategic shift away from the service. |

| Legacy Square Hardware Models | Low (relative to newer models) | Low | De-prioritization in favor of advanced, higher-margin solutions; potential for reduced support. |

| Niche Software Offerings | Negligible (e.g., 0.5% of seller base for some tools) | Low | Resource reallocation to higher-growth segments; minimal contribution to overall revenue. |

| Underperforming International Markets | Low | Sluggish | Strategic re-evaluation, potential scaling back or exit to focus on stronger regions. |

| Early-stage TBD Blockchain Initiatives (Non-Bitcoin) | Low | Minimal | Reclassified as dogs due to lack of traction and strategic focus on Bitcoin mining. |

Question Marks

Block's Bitcoin mining initiative, though still in its nascent stages, is positioned as a potential star within its business portfolio, reflecting Block's strategic pivot towards strengthening Bitcoin infrastructure. This segment is actively investing in research and development for mining chips and systems, signaling a commitment to a high-growth sector.

Currently, this area is a cash consumer, typical of early-stage ventures, as Block aims to carve out a significant presence in the estimated $3-6 billion annual revenue Bitcoin mining hardware market. The company's ambition is to capture a substantial portion of this industry by leveraging its technological advancements.

Spiral, a subsidiary of Block, is dedicated to expanding Bitcoin's global adoption through its open-source development. This segment operates within the rapidly evolving cryptocurrency market, a sector projected to see significant growth in the coming years. For instance, the global blockchain market, which underpins such developments, was valued at approximately $11.1 billion in 2023 and is expected to reach over $120 billion by 2028, showcasing the high-growth potential.

However, as an entity focused on building foundational, open-source technology, Spiral's direct revenue generation and market share are not its primary metrics. It functions more like a research and development arm, investing resources into creating tools and infrastructure that could have substantial long-term influence on the Bitcoin ecosystem. This strategic positioning places it in a category where immediate financial returns are secondary to the potential for future impact and widespread adoption.

Proto, Block's Bitcoin mining chip and system brand, is positioned as a Star within the BCG Matrix. Its projected contribution of 12% to Block's revenue in 2025, coupled with the high growth potential of the Bitcoin mining hardware market, strongly indicates a Star.

The significant investment required to compete against established players and the fact that the first chips are only slated for delivery in late 2025 highlight its nascent stage and the need for continued capital infusion to maintain its growth trajectory.

Cash App Pay

Cash App Pay, a feature enabling payments via Cash App balance or linked debit cards, achieved 6 million monthly active users by the close of 2024. This indicates growing user engagement in a highly competitive digital payments sector.

While its user base is expanding, Cash App Pay is still in its early stages and requires significant investment to capture a larger market share.

- Adoption Rate: Reached 6 million monthly active users by the end of 2024.

- Market Position: Competes in a crowded digital payment landscape.

- Growth Potential: Needs substantial investment to become a major revenue driver.

AI Automation Initiatives

Block is actively pursuing AI automation initiatives to enhance creativity and operational efficiency. A key internal tool, 'codename goose', is designed to significantly boost employee productivity.

While AI represents a high-growth sector with substantial transformative potential, these specific internal developments are still in their early stages. Their direct impact on market share and cash flow generation is not yet fully quantifiable, making them strategic investments for future growth.

- AI Automation Focus: Block is investing in AI to drive creativity and efficiency across its business.

- Productivity Tools: Internal initiatives like 'codename goose' aim to increase productivity.

- Development Stage: These AI efforts are currently in development, with their market share and cash generation impact yet to be fully realized.

- Strategic Investment: They represent strategic bets with the potential to enhance existing products or spawn new ones.

Question Marks in Block's BCG Matrix represent business units with low market share in high-growth industries. These ventures require significant investment to grow, and their future is uncertain, making them potential future Stars or Dogs.

Block's AI automation initiatives, including the internal tool 'codename goose', are currently Question Marks. While the AI sector is experiencing rapid growth, these specific projects are in early development stages with unproven market impact.

The company is investing heavily in these areas to foster innovation and potentially capture future market share. However, their ability to generate substantial revenue or achieve significant market penetration remains to be seen, necessitating careful monitoring and strategic resource allocation.

| Business Unit | Market Growth | Market Share | Cash Flow | BCG Category |

|---|---|---|---|---|

| AI Automation Initiatives (e.g., 'codename goose') | High | Low | Negative (Investment Phase) | Question Mark |

| Spiral (Open-source Bitcoin development) | High | Low (Focus on adoption, not market share) | Negative (Investment Phase) | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial statements, market research reports, and industry expert opinions to provide a comprehensive strategic overview.