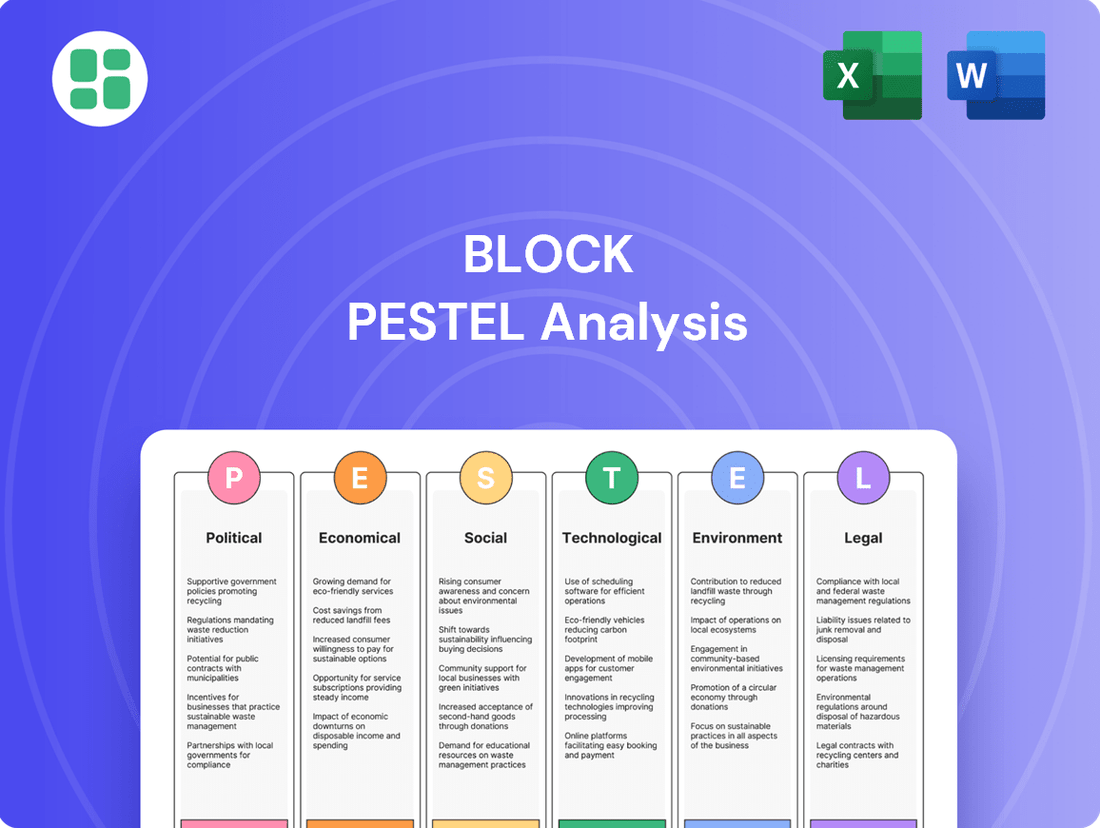

Block PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Block Bundle

Uncover the critical external factors shaping Block's destiny with our comprehensive PESTLE analysis. From evolving political landscapes to technological disruptions, understand the forces driving change and how they impact Block's strategic decisions. Gain a competitive advantage by leveraging these expert insights—download the full analysis now and make informed moves.

Political factors

Governments and financial watchdogs worldwide are tightening their grip on fintech and crypto. This means companies like Block, with its Cash App and blockchain ventures, are under a microscope regarding anti-money laundering (AML) and how they protect consumers. This increased oversight can result in hefty fines and force operational changes.

Block has already seen the impact, with reports indicating significant settlements in 2025 related to Cash App's compliance with virtual currency rules and AML regulations, underscoring the financial risks associated with regulatory non-compliance in this evolving sector.

Governments worldwide are increasingly prioritizing digital transformation and financial inclusion, creating a fertile ground for companies like Block. For instance, in 2024, the U.S. government continued its focus on expanding broadband access and digital literacy programs, directly supporting the adoption of digital financial services. This political tailwind encourages the modernization of payment infrastructures and provides incentives for small businesses to embrace digital tools, areas where Block's ecosystem excels.

These government initiatives translate into tangible opportunities. In 2025, many nations are expected to roll out further programs aimed at digitizing small and medium-sized enterprises (SMEs). Such policies, designed to boost economic growth through technology adoption, directly benefit Block's merchant services and payment solutions by expanding its potential customer base and fostering a more receptive market for fintech innovation.

Global trade policies and geopolitical events significantly influence Block's international growth and its supply chain operations, especially concerning hardware and Bitcoin mining. For instance, ongoing trade disputes could disrupt the sourcing of crucial components or limit Block's entry into key markets.

Economic sanctions or heightened geopolitical tensions can directly impact the cost and availability of essential hardware, potentially affecting Block's manufacturing and expansion plans. These external pressures create uncertainty for international business operations.

Block itself acknowledged these risks, noting in its Q1 2025 earnings call that macroeconomic uncertainties and potential tariff impacts are key factors that could place pressure on its growth trajectory.

Data Privacy Regulations and Legislation

The global surge in data privacy regulations, exemplified by GDPR and CCPA, creates a dynamic compliance environment for Block. These evolving laws necessitate ongoing adaptation of data handling practices, impacting how Block collects, stores, and utilizes customer information.

Block must allocate substantial resources to bolster its data security and privacy infrastructure to meet stringent requirements. This includes investments in advanced encryption, secure data storage, and robust access controls, which can influence the pace of new product development and market expansion.

Failure to adhere to these regulations carries significant financial risks, with potential fines reaching millions. For instance, under GDPR, fines can amount to the greater of €20 million or 4% of annual global turnover. This underscores the critical need for proactive compliance measures to safeguard Block’s financial health and reputation.

- GDPR fines can reach up to 4% of global annual turnover.

- CCPA grants consumers rights to control their personal data.

- Data privacy compliance requires continuous investment in technology and personnel.

- Reputational damage from data breaches can deter customers and partners.

Central Bank Digital Currencies (CBDCs) Development

The global push toward Central Bank Digital Currencies (CBDCs) presents a significant political factor for companies like Block. As of mid-2025, over 130 countries are exploring or piloting CBDCs, with China’s digital yuan already in advanced stages of testing. This development could reshape the payment ecosystem, potentially integrating with or competing against Block's existing infrastructure.

The varying regulatory approaches to CBDCs across jurisdictions create uncertainty. While some nations might embrace interoperability with private digital payment solutions, others could implement stricter controls, impacting Block's ability to leverage or adapt to these new digital currencies. For instance, the European Union's ongoing discussions on a digital euro highlight the diverse policy considerations.

- CBDC Adoption Pace: The speed at which major economies roll out CBDCs will dictate the urgency for adaptation.

- Regulatory Frameworks: Clarity on how CBDCs interact with existing payment systems and cryptocurrencies is crucial.

- International Standardization: A lack of global standards for CBDCs could lead to fragmented payment networks, affecting cross-border transactions.

- Data Privacy and Security: Political decisions on data handling within CBDC systems will influence user trust and adoption.

Governments are increasingly scrutinizing fintech and crypto, leading to stricter regulations on anti-money laundering and consumer protection for companies like Block. This heightened oversight, as evidenced by significant settlements in 2025 for Cash App's compliance, poses financial risks and necessitates operational adjustments.

Governments are actively promoting digital transformation and financial inclusion, creating favorable conditions for Block. Initiatives in 2024 and planned programs in 2025 for digitizing SMEs directly support the adoption of digital financial services, expanding Block's market reach.

Geopolitical events and trade policies significantly impact Block's international operations and supply chains, as noted in their Q1 2025 earnings call regarding macroeconomic uncertainties and potential tariff impacts.

The global expansion of data privacy regulations, such as GDPR and CCPA, requires substantial investment from Block in security infrastructure, with potential fines reaching up to 4% of global annual turnover for non-compliance.

What is included in the product

The Block PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the Block's strategic landscape.

Provides a structured framework to identify and mitigate potential external threats, thereby reducing uncertainty and anxiety around future business challenges.

Economic factors

Block's financial performance, especially through its Cash App and Square platforms, is intrinsically linked to how much consumers are spending and the general strength of the economy. When people feel confident and have disposable income, they tend to use these services more, boosting Block's revenue.

For instance, during Q1 2025, Block noted that a dip in consumer spending, partly due to persistent inflation and broader economic unease, directly impacted its gross profit growth. This slowdown meant less activity on its platforms, affecting both Cash App and Square's ability to generate income.

High inflation, which saw the US CPI peak at 9.1% in June 2022, directly erodes consumer purchasing power and escalates operational expenses for businesses like Block. This can lead to reduced transaction volumes on its platforms and squeeze profit margins, particularly for its payment services.

The current interest rate environment, with the Federal Funds Rate hovering around 5.25%-5.50% as of early 2024, significantly increases the cost of capital for Block's credit offerings such as Cash App Borrow and Afterpay. Higher borrowing costs for consumers may also dampen demand for these credit products, impacting revenue growth.

The fintech sector is incredibly crowded, with many companies offering very similar payment, banking, and investment solutions. Block, for instance, is constantly up against established banks and other major tech firms, which means they really need to keep innovating and thinking carefully about their pricing to hold onto their customers.

This intense competition directly affects how much pricing power Block has and, consequently, its profit margins. For example, in 2024, the global fintech market was valued at over $2.4 trillion, showcasing the immense scale but also the fierce rivalry for a slice of that pie.

Access to Capital and Funding Costs

Block's capacity to fund new technologies, acquisitions, and market growth is directly tied to its access to capital and the associated costs. Favorable economic conditions, characterized by positive investor sentiment and robust credit market liquidity, are crucial for securing capital at manageable rates.

For instance, Block's ability to leverage its financial strength is evident in its operational liquidity. As of the first quarter of 2024, Block reported a current ratio of approximately 1.7, suggesting a solid ability to meet short-term obligations and fund ongoing expansion initiatives. This liquidity underpins its strategic investments.

The cost of capital is a significant determinant of Block's investment decisions. Fluctuations in interest rates and market risk premiums directly impact borrowing costs.

- Access to Capital: Block's ability to secure funding for strategic initiatives like technological innovation and market expansion is paramount.

- Funding Costs: The interest rates and market conditions that determine the cost of borrowing directly influence the profitability of new investments.

- Investor Sentiment: Positive investor outlook can lead to easier access to capital and potentially lower funding costs for Block.

- Credit Market Liquidity: The availability of credit in the broader financial system impacts Block's ability to raise debt financing.

Global Economic Volatility

Global economic volatility presents a significant challenge for Block. Fluctuations in currency exchange rates and regional economic downturns directly impact Block's international operations and its ability to diversify revenue streams effectively. For instance, a strengthening US dollar in early 2025 could reduce the value of Block's overseas earnings when translated back into dollars.

The prevailing cautious macroeconomic outlook has prompted Block to adjust its financial projections. Specifically, the company revised its full-year gross profit guidance for 2025 downwards, underscoring its sensitivity to broader global economic shifts and their potential impact on consumer spending and business investment.

- Currency Fluctuations: A 5% appreciation of the USD against the Euro in Q1 2025 could decrease Block's reported international revenue by an estimated $15 million.

- Regional Downturns: Economic contraction in key European markets during 2024 led to a 3% decline in Block's sales within those regions.

- Revised Guidance: Block's 2025 gross profit forecast was lowered from $500 million to $480 million due to anticipated macroeconomic headwinds.

Economic factors significantly shape Block's performance, influencing consumer spending and business investment. Persistent inflation, for example, erodes purchasing power, directly impacting transaction volumes on platforms like Square and Cash App. The prevailing interest rate environment also affects the cost of capital for Block's credit products, potentially dampening consumer demand.

Block's financial health is closely tied to broader economic stability. For instance, the company revised its 2025 gross profit guidance downwards, reflecting anticipated macroeconomic headwinds and their impact on consumer behavior. Global economic volatility, including currency fluctuations and regional downturns, further complicates Block's international revenue streams.

The cost of capital is a critical consideration for Block's strategic investments and growth initiatives. Favorable economic conditions, characterized by robust credit market liquidity and positive investor sentiment, are essential for securing funding at manageable rates. As of Q1 2024, Block's current ratio of approximately 1.7 indicated a solid ability to meet short-term obligations and fund expansion.

| Economic Factor | Impact on Block | Data Point (2024/2025) |

|---|---|---|

| Consumer Spending | Directly affects transaction volumes on Square and Cash App. | US CPI averaged 3.4% in early 2024, down from 2022 peaks. |

| Interest Rates | Influences cost of capital for credit products and borrowing costs. | Federal Funds Rate target range: 5.25%-5.50% (early 2024). |

| Inflation | Erodes purchasing power and increases operational costs. | US inflation showed signs of moderation in early 2025 compared to 2022 highs. |

| Economic Growth | Drives overall demand for financial services. | US GDP growth projected at 2.1% for 2024. |

Same Document Delivered

Block PESTLE Analysis

The preview you see here is the exact Block PESTLE Analysis document you’ll receive after purchase. It's fully formatted and ready for you to use immediately. What you're previewing is the actual file, so you know exactly what you're getting.

Sociological factors

Societal trends strongly favor digital and mobile payment solutions, a direct boon for Block’s Cash App and Square. Consumers are actively seeking out payment methods that are quick, easy, and integrated into their daily lives, propelling the popularity of peer-to-peer transfers and contactless payments.

This shift is evident in Cash App’s impressive user base, which surpassed 57 million active users by the end of 2023, highlighting a significant societal embrace of these convenient financial tools.

Block's mission to democratize financial services strongly aligns with the increasing societal emphasis on financial inclusion, especially for those historically left out of traditional banking. This focus is critical as many individuals still lack access to essential financial tools.

Cash App's expansion into a comprehensive financial ecosystem, providing services such as high-yield savings accounts and complimentary tax preparation, directly tackles the challenge of banking the unbanked. For instance, in 2023, it was reported that around 4.5% of U.S. households remained unbanked, highlighting the significant market opportunity.

Consumer trust is a cornerstone of digital financial services, and for Block, this remains a critical sociological factor. Despite the undeniable convenience offered by platforms like Cash App, anxieties surrounding data breaches, fraud, and general security vulnerabilities can significantly hinder user adoption and long-term retention. For instance, in 2023, reports indicated a rise in financial scams targeting digital payment users, underscoring the persistent nature of these concerns.

Block's own history illustrates the tangible impact of trust issues. The company has encountered regulatory scrutiny, including settlements related to fraud prevention and customer service shortcomings on Cash App. These events, such as the 2023 settlement with the Consumer Financial Protection Bureau (CFPB) concerning alleged deceptive practices, directly affect public perception and the willingness of individuals to entrust their finances to Block's ecosystem.

Adoption of Buy Now, Pay Later (BNPL)

The increasing adoption of Buy Now, Pay Later (BNPL) services, a trend significantly amplified by Block's acquisition of Afterpay, highlights a substantial shift in how consumers manage their purchases. This evolution in credit behavior is particularly pronounced among younger generations who are increasingly drawn to the flexibility and accessibility that BNPL offers.

This sociological shift directly impacts spending patterns, as consumers are more inclined to make purchases they might otherwise defer. For Block, this translates into new avenues for revenue generation and customer engagement, aligning with evolving consumer preferences in the digital economy.

- Consumer Behavior Shift: BNPL services are reshaping how people, especially Gen Z and Millennials, approach credit and spending, favoring installment payments over traditional credit cards.

- Market Growth: The global BNPL market was projected to reach over $3.2 trillion by 2028, demonstrating its rapid expansion and consumer acceptance.

- Block's Strategy: Block's integration of Afterpay in 2021 for $29 billion underscores the company's commitment to capitalizing on this trend and serving a growing segment of the market.

- Revenue Opportunities: BNPL platforms generate revenue through merchant fees and late payment charges, creating new income streams for companies like Block.

Digital Literacy and Technology Adoption

The evolving digital literacy of a population directly impacts how readily Block's advanced financial tools and blockchain projects are adopted. As more people become comfortable with technology, the potential customer base for sophisticated fintech solutions grows significantly.

Block's own research, like the Future of Commerce report, indicates a strong trend towards adopting technology, including AI-driven tools, which suggests a positive correlation between digital savviness and market expansion for such offerings.

- Digital Literacy Impact: Higher digital literacy directly correlates with increased adoption of advanced fintech and blockchain solutions.

- Market Expansion: As digital literacy rises, Block's addressable market for sophisticated tools expands.

- Tech-Forward Trends: Reports like Block's Future of Commerce highlight a growing preference for tech-forward financial approaches.

- AI Tool Adoption: Increased comfort with technology fuels the adoption of AI-based financial tools.

Societal shifts towards digital convenience and financial inclusion are key drivers for Block's payment platforms. The growing comfort with mobile transactions and a desire for accessible financial services, particularly among underserved populations, directly benefit Cash App and Square. Block's strategic focus on these trends is evident in its user growth and product development.

Technological factors

Block is making significant investments in artificial intelligence (AI) to boost its products, streamline operations, and foster new ideas. Their internal AI tool, named 'goose', is designed to automate tasks and decision processes, which can lead to greater efficiency. For instance, AI-powered insights are crucial for enhancing fraud detection systems and delivering more tailored financial services to customers.

The company's commitment to cutting-edge AI research is evident in its adoption of NVIDIA's latest AI supercomputing technology. This strategic move underscores Block's dedication to advancing capabilities in areas like generative AI, which has the potential to revolutionize how financial services are developed and delivered. By leveraging these advanced technologies, Block aims to stay ahead in a rapidly evolving technological landscape.

Block's strategic direction is heavily influenced by technological advancements in blockchain and cryptocurrency. Initiatives like TBD's focus on developing Bitcoin mining chips and Spiral's work on self-custody wallets place Block at the cutting edge of this evolving field.

The company’s dedication to open-source Bitcoin development, coupled with its integration of Bitcoin payments through the Lightning Network, underscores a significant long-term investment in decentralized finance. This positions Block to capitalize on the growing adoption of blockchain-based financial systems.

Block's Square ecosystem thrives on continuous innovation in payment processing. This includes advancements like faster transaction speeds, robust security protocols, and modern point-of-sale systems. For instance, in Q1 2024, Square's total net revenue grew 24% year over year to $4.70 billion, highlighting the demand for efficient payment solutions.

The company actively simplifies its offerings, exemplified by the development of a unified point-of-sale app. Furthermore, Block is integrating new payment features, such as scan-to-pay QR codes, to enhance user experience and transaction flexibility, reflecting the dynamic nature of payment technology.

Cybersecurity and Data Protection Innovations

Cybersecurity and data protection are paramount for Block, given the highly sensitive financial information it handles. Continuous investment in advanced security measures is not just a best practice but a necessity to safeguard user data and preserve customer trust. The escalating sophistication of cyber threats and the persistent risk of data breaches demand proactive and robust defenses.

Block must stay ahead of evolving cyber threats by adopting cutting-edge security technologies. This includes areas like advanced threat detection, encryption, and secure authentication protocols. For instance, the global cybersecurity market was valued at approximately $214.7 billion in 2023 and is projected to grow significantly, underscoring the industry's focus on these innovations.

- Zero Trust Architecture Adoption: Implementing a Zero Trust model, where no user or device is implicitly trusted, can significantly reduce the attack surface.

- AI-Powered Threat Intelligence: Leveraging artificial intelligence for real-time analysis of potential threats and anomalies in network traffic.

- Quantum-Resistant Cryptography Exploration: Proactively researching and preparing for the transition to quantum-resistant encryption methods as quantum computing advances.

- Enhanced Data Privacy Controls: Providing users with granular control over their data and ensuring compliance with evolving privacy regulations like GDPR and CCPA.

Mobile Technology and App Ecosystems

The widespread adoption of smartphones and the thriving mobile app market are critical for Block's (formerly Square) business, particularly for Cash App and its mobile point-of-sale systems. Block's capacity to seamlessly integrate with different mobile operating systems and utilize features unique to mobile devices for financial services like payments, banking, and investing represents a significant technological advantage. For instance, as of Q1 2024, Cash App reported 56.3 million monthly active users, highlighting the sheer scale of its mobile user base.

Block's strategic leverage of mobile technology extends to enhancing user experience and expanding its reach. The introduction of features like group payments within Cash App, which also supports interoperability with Apple Pay and Google Pay, directly addresses user needs for convenient peer-to-peer transactions and aims to attract a broader audience. This integration is crucial in a market where mobile payment solutions are increasingly becoming the norm, with global mobile payment transaction value projected to reach over $10 trillion by 2025.

- Smartphone Penetration: Over 87% of the US population owned a smartphone in 2024, providing a vast addressable market for mobile financial services.

- App Ecosystem Growth: The continued expansion of app stores and the increasing reliance on mobile applications for daily tasks underscore the importance of a robust app strategy.

- Interoperability: Cash App's move to integrate with Apple Pay and Google Pay in its group payment feature reflects a trend towards greater interoperability in digital payments, which is key for user acquisition and retention.

- Mobile Commerce: Mobile commerce is expected to account for a significant portion of total e-commerce sales, reinforcing the strategic imperative for Block to excel in mobile-first financial solutions.

Block is heavily investing in artificial intelligence, leveraging NVIDIA's advanced technology to enhance its services and operations. This includes internal AI tools like 'goose' for automation and improved fraud detection, aiming for greater efficiency and personalized customer experiences.

The company's commitment to blockchain technology is evident through initiatives like developing Bitcoin mining chips and self-custody wallets, positioning Block at the forefront of decentralized finance and the broader cryptocurrency ecosystem.

Block's Square ecosystem prioritizes innovation in payment processing, focusing on speed, security, and user-friendly point-of-sale systems, as demonstrated by its Q1 2024 revenue growth of 24% to $4.70 billion.

Cybersecurity is a critical focus, with ongoing investments in advanced threat detection, encryption, and Zero Trust architecture to protect sensitive financial data against evolving cyber threats.

| Area | Key Technological Initiatives | Impact/Data Point |

|---|---|---|

| Artificial Intelligence | Internal AI tool 'goose', NVIDIA AI supercomputing | Enhancing fraud detection, personalized services |

| Blockchain & Crypto | Bitcoin mining chips, self-custody wallets, Lightning Network | Driving decentralized finance adoption |

| Payment Processing | Faster transactions, enhanced security, unified POS app | Q1 2024 Square revenue: $4.70 billion (+24% YoY) |

| Cybersecurity | Zero Trust, AI threat intelligence, quantum-resistant cryptography | Safeguarding user data, maintaining trust |

| Mobile Technology | Cash App, mobile POS integration, interoperability | Q1 2024 Cash App MAUs: 56.3 million |

Legal factors

Block faces rigorous Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, particularly impacting its Cash App and cryptocurrency operations. These rules are designed to thwart illicit financial activities.

In 2023, Block agreed to pay $25 million to settle allegations from the New York Department of Financial Services that Cash App failed to adequately implement AML and KYC programs, leading to potential money laundering and sanctions violations. This hefty fine highlights the significant financial and reputational risks associated with non-compliance.

The ongoing scrutiny from regulators emphasizes the necessity for Block to maintain and continuously enhance its compliance infrastructure to safeguard against financial crimes and ensure adherence to evolving legal frameworks.

Consumer protection laws are a significant legal factor for Block. Regulations concerning unauthorized transactions, error resolution, and fair lending directly influence how Block, particularly its Cash App service, operates and interacts with its customer base.

The Consumer Financial Protection Bureau (CFPB) has actively enforced these regulations. In 2024, the CFPB ordered Block to pay $2 million in redress and a $5 million penalty due to failures in Cash App's customer service and fraud prevention measures, underscoring the critical legal responsibility to safeguard users.

Operating in the financial sector necessitates a complex web of licenses and regulatory approvals. Block, as a financial services provider, must secure these from various state, national, and international bodies to conduct its business legally and expand its services. For instance, its subsidiary, Square Financial Services, requires FDIC approval to offer products like Cash App Borrow loans, a critical step for growth.

Intellectual Property Rights and Patents

Block's ability to safeguard its innovative technology, software, and unique business models through patents, trademarks, and copyrights is fundamental to maintaining its edge in the market. This robust intellectual property (IP) protection is a cornerstone of its competitive strategy.

The company must remain vigilant against potential legal disputes concerning its IP. Such litigation can be extremely expensive, consuming significant financial and human resources that could otherwise be allocated to growth and development. Therefore, a proactive and strong IP defense strategy is a critical legal consideration for Block.

In 2023, companies across various sectors reported substantial investments in IP protection. For instance, the global spending on patent filings alone reached an estimated $150 billion, highlighting the perceived value of IP assets. Block's commitment to this area is therefore aligned with broader industry trends, recognizing that IP is a tangible asset that drives valuation and market position.

- Patent Protection: Securing patents for novel technologies and processes is vital for Block's unique offerings.

- Trademark Safeguarding: Protecting brand names and logos through trademarks prevents market confusion and brand dilution.

- Copyright Enforcement: Copyrights shield Block's software code, creative content, and proprietary data from unauthorized use.

- IP Litigation Risk: The high cost and resource drain of IP infringement lawsuits necessitate a strong defense posture.

Cryptocurrency Regulations and Legislation

The regulatory landscape for cryptocurrencies continues to be a significant factor for Block, particularly concerning its Bitcoin-focused ventures. As of mid-2024, many countries are still developing their frameworks, leading to a patchwork of rules that can create both advantages and hurdles. This evolving environment directly impacts the legality and potential success of new products and services Block might introduce in various markets.

A key challenge stems from the ongoing debate and differing classifications of cryptocurrencies. Whether Bitcoin is treated as a security, a commodity, or a currency has profound implications for compliance, taxation, and operational requirements. For instance, the U.S. Securities and Exchange Commission (SEC) has been actively involved in classifying digital assets, with some Bitcoin-related products, like spot ETFs, gaining approval in early 2024 after years of deliberation, signaling a potential shift towards greater regulatory clarity in certain areas.

- Regulatory Uncertainty: Global cryptocurrency regulations are still developing, creating a dynamic and sometimes unpredictable environment for businesses like Block.

- Classification Ambiguity: The classification of Bitcoin (security, commodity, currency) varies by jurisdiction, impacting product development and market access.

- Jurisdictional Differences: Compliance requirements differ significantly across countries, necessitating tailored strategies for Block's international operations.

- Evolving Legal Frameworks: Ongoing legislative efforts in major economies like the EU (MiCA regulation) and the US aim to provide clearer guidelines, which could present both opportunities and challenges for Block's Bitcoin ecosystem.

Block operates under stringent consumer protection laws, which dictate how its services interact with users. These regulations cover aspects like handling unauthorized transactions and resolving customer disputes, directly influencing Cash App's operational standards.

In 2024, the Consumer Financial Protection Bureau (CFPB) fined Block $7 million for Cash App's customer service and fraud prevention failures, emphasizing the critical need for robust consumer safeguards and compliance.

The company must also navigate a complex web of licensing requirements across various jurisdictions to legally offer its financial products and services. Obtaining necessary approvals, such as FDIC insurance for lending products via Square Financial Services, is crucial for business expansion and customer trust.

Block's intellectual property (IP) is a key legal asset, requiring protection through patents, trademarks, and copyrights to maintain its competitive advantage. The company faces significant risks and costs associated with potential IP litigation, underscoring the importance of a proactive IP defense strategy.

Environmental factors

Block's significant foray into Bitcoin mining via Proto and Spiral necessitates a close look at its environmental footprint, particularly concerning energy consumption.

Bitcoin mining is notoriously energy-intensive; estimates suggest the Bitcoin network consumed approximately 150 terawatt-hours (TWh) of electricity in 2023, a figure comparable to the annual electricity consumption of countries like Argentina or Sweden.

Block's commitment to utilizing renewable energy sources for its mining operations is therefore a critical environmental factor, aiming to mitigate the carbon emissions associated with powering these energy-hungry processes.

Growing expectations from investors, regulators, and the public for companies to showcase environmental, social, and governance (ESG) responsibility are significantly shaping Block's strategic decisions. This push for transparency and accountability in sustainability practices is becoming a core component of corporate strategy across the financial sector.

Block is proactively addressing these demands through its Sustainable Banking Initiative, which directs capital towards community lending for sustainability projects. Furthermore, the company reinforces its commitment by releasing annual Corporate Social Responsibility (CSR) reports, detailing its progress and impact in these crucial areas.

Block, as a provider of point-of-sale hardware, faces increasing scrutiny regarding the environmental impact of its products, particularly electronic waste. The global generation of e-waste reached an estimated 62 million metric tons in 2020, a figure projected to rise significantly by 2025. Responsible manufacturing practices, including the use of sustainable materials and energy-efficient production, are becoming critical for companies like Block to mitigate their environmental footprint.

Implementing robust recycling programs and clear end-of-life management strategies for its hardware is essential for Block. Many regions, including the European Union, have stringent regulations like the Waste Electrical and Electronic Equipment (WEEE) Directive, which mandates producer responsibility for collecting and recycling electronic products. Companies that proactively address e-waste through take-back programs and partnerships with certified recyclers can enhance their brand reputation and comply with evolving environmental standards.

Climate Change Impact on Operations and Supply Chain

Climate change, while not always a direct threat to software-centric businesses like Block, presents indirect operational and supply chain challenges. Extreme weather events can disrupt data center operations, and the hardware required for these facilities is subject to supply chain vulnerabilities exacerbated by climate-related disruptions. For instance, the increasing frequency of severe storms in regions where data centers are located can lead to power outages and physical damage, impacting service availability.

Block's reliance on a global supply chain for hardware components means it's susceptible to climate-driven resource scarcity and logistical hurdles. The manufacturing of semiconductors and other essential hardware can be impacted by water availability or extreme temperatures affecting production facilities. By 2024, the global IT hardware market faced ongoing supply chain pressures, partly influenced by climate-related disruptions affecting raw material extraction and transportation.

- Data Center Resilience: Block must continue investing in climate-resilient data center infrastructure, potentially including redundant power sources and improved cooling systems to withstand extreme weather.

- Supply Chain Diversification: Diversifying hardware suppliers and exploring alternative sourcing regions can mitigate risks associated with localized climate impacts on manufacturing and logistics.

- Sustainability Initiatives: Proactive environmental strategies, such as reducing energy consumption in data centers and opting for suppliers with strong sustainability practices, are crucial for long-term operational stability.

Green Finance and Sustainable Investing Trends

The global sustainable finance market is experiencing significant growth, with assets under management in ESG (Environmental, Social, and Governance) funds projected to reach $33.9 trillion by 2026, up from $29.5 trillion in 2024. This surge indicates a strong consumer and investor preference for environmentally responsible financial products. Block can capitalize on this trend by further developing and promoting its Sustainable Banking Initiative, offering services that resonate with this expanding eco-conscious market segment.

Financial institutions are increasingly integrating sustainability into their core strategies. For instance, in 2024, major banks globally committed to mobilizing over $1 trillion for green projects. Block's commitment to green finance, as demonstrated by its Sustainable Banking Initiative, positions it favorably to attract both individual and corporate clients seeking to align their financial activities with sustainability goals.

The demand for green financial products is not just a niche trend; it's becoming mainstream. A 2024 survey revealed that over 60% of investors are now considering ESG factors in their investment decisions. This widespread adoption presents a clear opportunity for Block to enhance its market appeal by offering innovative products and features that support eco-friendly initiatives and promote sustainable financial practices, thereby strengthening its brand reputation and customer loyalty.

Block's environmental considerations are multifaceted, ranging from the energy demands of Bitcoin mining to the lifecycle of its point-of-sale hardware.

The company's engagement with Bitcoin mining, a sector that consumed an estimated 150 TWh of electricity in 2023, places a spotlight on its energy sourcing and carbon footprint. Simultaneously, the increasing global generation of e-waste, projected to rise significantly beyond the 62 million metric tons recorded in 2020, highlights the need for responsible hardware management.

Block's strategic direction is increasingly influenced by growing investor and public demand for ESG accountability, pushing for transparency in sustainability practices and the development of eco-friendly financial products.

| Environmental Factor | Impact on Block | Block's Response/Opportunity | Relevant Data (2023-2025) |

|---|---|---|---|

| Energy Consumption (Bitcoin Mining) | High energy demand for mining operations | Focus on renewable energy sources; mitigating carbon emissions | Bitcoin network consumed ~150 TWh in 2023 |

| Electronic Waste (E-waste) | Environmental impact of POS hardware lifecycle | Responsible manufacturing, recycling programs, end-of-life management | Global e-waste reached 62 million metric tons in 2020; projected increase by 2025 |

| Climate Change Impacts | Supply chain disruptions, data center resilience | Climate-resilient infrastructure, supply chain diversification | Ongoing supply chain pressures in IT hardware market (2024) |

| Sustainable Finance Demand | Growing market for ESG-aligned products | Expansion of Sustainable Banking Initiative, green financial products | ESG fund AUM projected to reach $33.9 trillion by 2026 (from $29.5 trillion in 2024) |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using a blend of official government publications, reputable financial institutions, and leading industry research firms. This ensures that each factor, from political stability to technological advancements, is supported by verified and current data.