Block Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Block Bundle

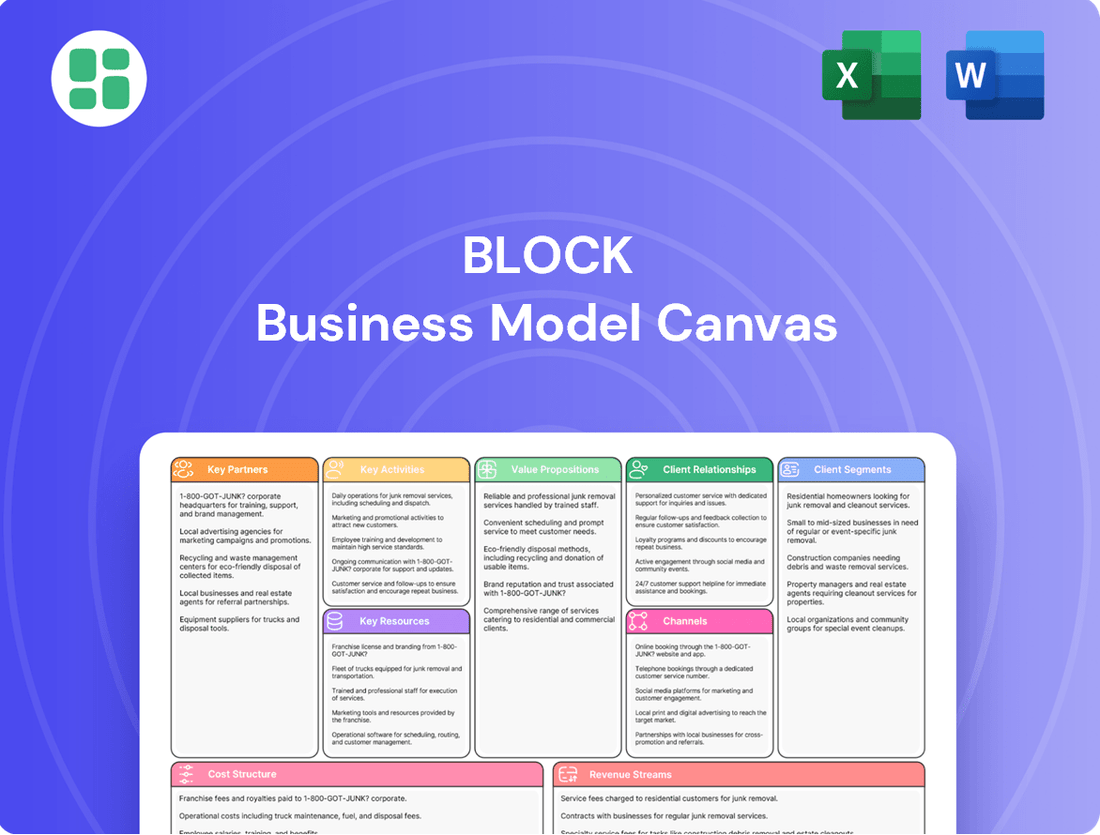

Discover the intricate workings of Block's innovative business model. This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Perfect for anyone aiming to understand or replicate disruptive strategies.

Partnerships

Block collaborates with banks and financial institutions to power its payment processing, direct deposit capabilities, and lending initiatives. A prime example is Square Financial Services obtaining FDIC approval to offer Cash App Borrow consumer loans across the nation, broadening its financial product suite.

These relationships are essential for ensuring regulatory adherence and extending the availability of Block's financial services. For instance, in 2023, Block's Cash App ecosystem saw significant growth, with Cash App Card spending reaching $10.7 billion, underscoring the importance of its banking partnerships in facilitating these transactions.

Block partners with technology and software integrators to expand the capabilities of its Square ecosystem. These collaborations are crucial for offering businesses a connected suite of tools. For instance, the Square App Marketplace allows seamless integration with popular restaurant management systems and accounting software, enhancing operational efficiency for merchants.

Block actively fosters third-party innovation by providing robust developer tools. The Mobile Payments SDK, for example, is designed to simplify the process for developers building new integrations. This open approach encourages a vibrant ecosystem, with over 400 apps available in the Square App Marketplace as of early 2024, demonstrating the breadth of these partnerships.

Block, through its Square ecosystem, strategically partners with numerous e-commerce platforms to broaden its market presence beyond traditional brick-and-mortar sales. These alliances enable Square to function as a deeply integrated payment solution for online merchants, ensuring a smooth transaction process for sellers operating across various sales channels.

These collaborations are crucial for Square's strategy, allowing it to offer a unified payment experience for businesses selling both online and in person. For instance, Square's integration with platforms like Shopify and BigCommerce allows merchants to easily accept payments through Square's terminals and online checkout, simplifying operations.

In 2023, Square reported that its seller ecosystem facilitated billions of dollars in gross payment volume for its merchants, with a significant portion of this growth attributed to online sales and e-commerce integrations. This highlights the critical role these platform partnerships play in driving revenue and expanding Square's reach within the digital commerce landscape.

Music Labels and Artists (for Tidal)

Tidal's core business model hinges on robust partnerships with major music labels, independent labels, and a wide array of artists. These collaborations are fundamental for licensing the extensive music library that attracts subscribers. For instance, in 2024, Tidal continued its efforts to secure diverse content, understanding that a comprehensive catalog is a primary driver of user acquisition and retention.

These key partnerships are not just about access to music; they are also crucial for fostering an environment that advocates for artist compensation. Tidal's commitment to higher royalty payouts, a differentiating factor, requires ongoing negotiation and agreement with these content creators and rights holders. This focus on artist-centric value aims to attract exclusive content and build stronger artist relationships.

- Music Licensing Agreements: Tidal's ability to offer millions of tracks depends on licensing deals with major labels like Universal Music Group, Sony Music Entertainment, and Warner Music Group, as well as numerous independent labels.

- Artist Exclusives: Securing exclusive releases or early access from popular artists is a key strategy to attract and retain subscribers, a practice that requires direct artist and label buy-in.

- Royalty Structures: Partnerships involve complex agreements on royalty payments, with Tidal emphasizing its commitment to more favorable terms for artists compared to some competitors.

Blockchain and Bitcoin Development Collaborators

Block actively collaborates with a diverse range of partners within the blockchain and Bitcoin ecosystem. These include other technology companies and a broad spectrum of open-source contributors who are vital to the ongoing innovation and security of these decentralized systems.

A significant aspect of Block's partnership strategy involves direct support for Bitcoin development. Initiatives like Spiral are instrumental in funding and fostering advancements in the Bitcoin protocol. This commitment extends to practical applications, as seen in their collaboration with firms like Core Scientific to enhance their Bitcoin mining operations.

Despite the winding down of certain internal projects, Block's dedication to the open-source Bitcoin development community remains unwavering. This ongoing engagement ensures continued contributions to the foundational technology that underpins their services.

- Technology Companies: Collaborations with firms developing complementary blockchain solutions and infrastructure.

- Open-Source Contributors: Partnerships with developers and researchers contributing to Bitcoin's core protocol and related projects.

- Mining Operations: Strategic alliances with entities like Core Scientific to bolster Bitcoin mining capabilities and efficiency.

- Development Initiatives: Support for organizations such as Spiral, which directly fund and advance Bitcoin development.

Block's Key Partnerships are crucial for expanding its financial services and technological capabilities. These include collaborations with banks for payment processing and lending, and with technology integrators to enhance its Square ecosystem. Furthermore, partnerships with e-commerce platforms are vital for Square's online sales strategy, while alliances within the blockchain space support Bitcoin development.

What is included in the product

A structured framework for visualizing and analyzing a business model, organized into nine interconnected building blocks.

It provides a holistic view of how a company creates, delivers, and captures value.

The Block Business Model Canvas streamlines complex business planning, offering a clear, visual framework that alleviates the pain of scattered ideas and unstructured strategy by consolidating all essential elements onto a single, manageable page.

Activities

Block's core activities center on the relentless development and refinement of its diverse product ecosystem, encompassing Square's payment solutions, Cash App's financial services, Tidal's music streaming, and its forward-thinking blockchain ventures.

This crucial work involves crafting intuitive user interfaces, engineering resilient backend infrastructure, and rigorously ensuring the security and scalability of all its platforms. For instance, in 2023, Block reported significant investments in research and development, with R&D expenses totaling $1.49 billion, underscoring their commitment to innovation.

Key areas of focus for innovation include advancements in AI automation to streamline operations and enhance user experiences, alongside substantial investment in building and securing robust Bitcoin infrastructure, reflecting a strategic push into decentralized technologies.

Block's core activities revolve around the robust processing of payments for a vast network of businesses via its Square ecosystem. This includes handling millions of transactions daily, ensuring regulatory compliance, and managing the flow of funds securely.

Simultaneously, Block facilitates peer-to-peer transactions and banking services through Cash App, further expanding its financial operations. In 2023, Square processed $204.7 billion in total payment volume, demonstrating the sheer scale of its payment processing capabilities.

These operations are critical for Block's business model, as they underpin the accessibility of commerce and financial services offered through its integrated platforms.

Block focuses on acquiring new users for its Square and Cash App platforms while fostering deeper engagement. This involves strategic marketing, innovative feature releases, and personalized incentives like Cash App Card offers.

Cash App's expansion is significantly fueled by enhanced customer interaction and the introduction of new functionalities. For instance, in the first quarter of 2024, Cash App's total net revenue reached $4.2 billion, demonstrating the impact of these engagement strategies.

Research and Development in Decentralized Technologies

Block heavily invests in pioneering decentralized technologies, particularly within the blockchain and Bitcoin ecosystems through its dedicated Spiral initiatives. This research and development is geared towards enhancing decentralized financial systems, improving Bitcoin mining efficiency, and bolstering self-custody solutions for users.

The company's commitment to open-source innovation is central to its strategy of broadening global financial access. For instance, in 2024, Block continued to allocate substantial resources to projects like the Bitcoin hardware wallet, aiming to make secure Bitcoin storage more accessible to a wider audience.

- Focus on Decentralized Finance: Block's R&D actively contributes to building more robust and accessible decentralized financial (DeFi) infrastructure.

- Advancements in Bitcoin Mining: Significant efforts are directed towards optimizing Bitcoin mining hardware and software, reflecting the company's deep involvement in the Bitcoin network.

- Self-Custody Solutions: Development of user-friendly and secure self-custody tools is a priority, empowering individuals to control their digital assets.

- Open-Source Contribution: Block's commitment to open-source principles ensures that its technological advancements benefit the broader decentralized technology community.

Content Licensing and Curation (for Tidal)

For Tidal, a core activity involves securing content licenses from major record labels and independent artists. This is crucial for building and maintaining a comprehensive music and video library. In 2024, the music industry continued to see significant growth in streaming revenue, with global revenues reaching an estimated $28.6 billion in 2023, a trend expected to persist.

Another key activity is the meticulous curation of high-quality audio and video content. This includes ensuring lossless audio formats and offering exclusive content, which differentiates Tidal in a competitive market. The platform's commitment to high-fidelity sound is a significant draw for audiophiles.

Managing the subscription platform efficiently is also a vital activity. This encompasses user acquisition, retention, and the seamless delivery of services. As of early 2024, the global music streaming market continued its expansion, with subscription services forming the backbone of this growth.

- Content Licensing: Negotiating agreements with record labels and artists to access their music and video catalogs.

- Content Curation: Selecting and organizing high-quality audio and video content, including exclusive releases and high-fidelity options.

- Platform Management: Overseeing the operational aspects of the streaming service, including user experience, subscription management, and technical infrastructure.

Block's key activities are multifaceted, spanning financial technology, digital music, and decentralized systems. These include developing and maintaining payment processing infrastructure for businesses via Square, managing peer-to-peer financial services through Cash App, and curating content for the Tidal streaming platform.

A significant focus is placed on innovation within the blockchain space, particularly in areas like Bitcoin mining efficiency and self-custody solutions. For instance, Block's R&D spending reached $1.49 billion in 2023, highlighting its commitment to technological advancement.

The company also actively engages in user acquisition and retention strategies across its platforms, exemplified by Cash App's total net revenue of $4.2 billion in Q1 2024, driven by enhanced customer interaction and new features.

| Activity | Description | Key Metric/Data Point |

| Payment Processing (Square) | Handling business transactions and ensuring regulatory compliance. | Processed $204.7 billion in total payment volume in 2023. |

| Financial Services (Cash App) | Facilitating peer-to-peer payments and banking services. | Achieved $4.2 billion in total net revenue in Q1 2024. |

| Content Curation (Tidal) | Securing licenses and curating high-quality music and video. | Global music streaming revenue reached an estimated $28.6 billion in 2023. |

| Blockchain Development | Advancing Bitcoin mining efficiency and self-custody solutions. | Invested $1.49 billion in R&D in 2023, with a focus on decentralized tech. |

Preview Before You Purchase

Business Model Canvas

The Block Business Model Canvas preview you're seeing is the actual document you will receive upon purchase. This means the structure, content, and design are identical to the final deliverable, ensuring no surprises. You'll gain full access to this comprehensive tool, ready for immediate use and customization.

Resources

Block's proprietary technology is a cornerstone of its business model, encompassing a vast array of software, algorithms, and patents. This intellectual property fuels its diverse offerings, from Square's point-of-sale systems to the financial services within Cash App and its forward-looking blockchain initiatives.

A key technological asset is Square's new order-based infrastructure, designed to enhance efficiency and scalability across its ecosystem. Block's commitment to innovation is evident in its continuous development and protection of these core technological assets.

Block's powerhouse brands, Square and Cash App, are critical assets, cultivating user trust and driving customer acquisition. This strong brand recognition is a cornerstone of their business model, making them go-to platforms for financial transactions.

Block's reputation as a fintech innovator further enhances its appeal, attracting both consumers and businesses seeking cutting-edge financial solutions. This perception of innovation is a key differentiator in a competitive market.

The company's portfolio extends to include Afterpay and Tidal, broadening its reach and diversifying its brand equity. These acquisitions in 2021 and 2021 respectively, for $29 billion and an undisclosed amount, bolster Block's ecosystem and market presence.

Block's success hinges on its substantial human capital, boasting over 10,000 employees worldwide as of early 2024. This extensive team includes highly skilled engineers, innovative product developers, sharp data scientists, crucial cybersecurity experts, and dedicated customer support professionals. These individuals are the engine driving Block's diverse product ecosystems, from Square's merchant services to Cash App's financial tools.

The collective expertise of these professionals is fundamental to Block's continuous innovation and operational efficiency. For instance, their deep understanding of financial technology, user experience design, and data analytics allows Block to develop and refine complex platforms that serve millions of users and businesses globally. This human capital is not just a headcount; it's the core intellectual property that fuels the company's competitive advantage.

Customer Network and Data

Square's extensive network, encompassing millions of businesses, and Cash App's user base, reaching tens of millions, form a significant asset. This vast ecosystem generates a wealth of transaction and user data.

The data collected from these platforms offers deep insights crucial for enhancing products, tailoring user experiences, and strengthening risk management strategies. In 2024, Cash App alone boasted 57 million monthly active users, highlighting the scale of this data resource.

- Vast User Base: Millions of businesses on Square and tens of millions of individuals on Cash App.

- Data Generation: Extensive transaction and user data is continuously collected.

- Strategic Value: Insights drive product development, personalization, and risk management.

- 2024 Metric: Cash App reported 57 million monthly active users.

Financial Capital

Financial capital is absolutely crucial for a company like Block, enabling everything from daily operations to ambitious growth plans. It's the fuel that powers significant research and development, allowing them to innovate and stay ahead in the fast-paced fintech industry. Think of it as the engine for their expansion, whether that's acquiring new businesses or extending their reach into new markets worldwide.

Block actively manages its financial resources to support these growth initiatives. For instance, in May 2024, the company announced a significant offering of senior notes. This demonstrates a strategic approach to securing the necessary funds to execute their long-term vision and maintain operational momentum.

- Access to substantial financial capital supports ongoing operations, R&D, acquisitions, and global scaling.

- Strategic capital raising through instruments like senior notes offerings is a key method for funding growth.

- Investment in growth initiatives signifies a commitment to future expansion and market leadership.

Block's key resources are a blend of proprietary technology, powerful brands, skilled human capital, vast user networks, and robust financial backing. These elements collectively enable Block to deliver innovative financial solutions across its ecosystem.

The company's intellectual property, including software and patents, forms the technological backbone. This is complemented by the strong market presence of its brands, Square and Cash App, which have cultivated significant user trust and loyalty. Block also leverages its extensive employee base, comprising over 10,000 individuals as of early 2024, to drive innovation and operational excellence.

The vast networks of businesses on Square and users on Cash App are critical, generating substantial data that informs product development and personalization. For example, Cash App reported 57 million monthly active users in 2024. This data-driven approach, supported by strategic financial management, including recent senior notes offerings, underpins Block's competitive advantage and growth trajectory.

| Resource Category | Key Assets | Significance |

|---|---|---|

| Intellectual Property | Proprietary software, algorithms, patents | Drives innovation across all Block products and services. |

| Brands | Square, Cash App, Afterpay, Tidal | Builds user trust, drives customer acquisition, and enhances market presence. |

| Human Capital | Over 10,000 employees (early 2024) including engineers, data scientists, etc. | Fuels innovation, operational efficiency, and complex platform development. |

| User Networks & Data | Millions of businesses (Square), Tens of millions of users (Cash App) | Provides valuable insights for product enhancement, personalization, and risk management. |

| Financial Capital | Access to capital, senior notes offerings | Enables R&D, acquisitions, global scaling, and operational funding. |

Value Propositions

Square's value proposition centers on providing a unified platform that simplifies complex business operations for sellers. This integrated ecosystem combines payment processing with point-of-sale (POS) systems and broader management tools, making it easier for businesses to handle day-to-day tasks.

By streamlining everything from sales to staff management and even offering access to financial services, Square frees up valuable time for business owners. This efficiency allows them to focus more on growing their ventures rather than getting bogged down in administrative details.

In 2023, Square's seller ecosystem processed $203.7 billion in gross payment volume, demonstrating the scale of its impact. This integration empowers businesses to run and expand more effectively by providing a cohesive suite of commerce solutions.

Cash App offers a remarkably simple interface for sending money, managing bank accounts, and even dabbling in investments, breaking down barriers to financial services for many. This accessibility extends to more complex features like Bitcoin trading and obtaining quick loans, truly making sophisticated financial tools available to a wider audience.

Block's leadership views Cash App as a foundational 'financial operating system for the next generation,' highlighting its role in providing a comprehensive suite of financial tools. In the first quarter of 2024, Cash App reported a substantial increase in its customer base, with over 56 million monthly active customers, demonstrating its widespread adoption and appeal.

Tidal provides a superior music experience, focusing on high-fidelity audio and exclusive content for discerning listeners. This commitment to quality, coupled with a dedication to artist compensation, resonates with users who seek both exceptional sound and ethical support for creators.

In 2024, Tidal streamlined its offerings, merging its HiFi and HiFi Plus tiers into a single subscription. This move simplifies access to its premium features, including high-resolution audio and curated content, making the artist-centric, high-quality experience more accessible to a broader audience.

Innovation in Decentralized Financial Solutions

Block's commitment to decentralized finance is evident through its Spiral and Bitcoin initiatives, positioning it as a pioneer in this evolving space. This focus appeals to a growing segment of users and developers seeking innovative financial technologies and enhanced financial autonomy. By investing in Bitcoin mining and developing its self-custody wallet, Bitkey, Block is actively building the infrastructure for a more accessible and user-controlled financial future.

Key aspects of this value proposition include:

- Pioneering Decentralized Finance: Block's Spiral initiative actively explores and develops new decentralized financial solutions, aiming to reshape traditional financial systems.

- Expanding Bitcoin Access: Through strategic investments in Bitcoin mining and the development of user-friendly tools like Bitkey, Block is working to make Bitcoin more accessible and manageable for a wider audience.

- Empowering Users and Developers: This approach directly addresses the demand for greater financial freedom and control, attracting individuals and creators interested in the cutting edge of financial technology.

- Strategic Investment in Bitcoin Infrastructure: Block's increasing investment in Bitcoin mining operations and its self-custody wallet, Bitkey, underscores a long-term vision for Bitcoin's role in decentralized finance.

Seamless Ecosystem Connectivity

Block fosters a powerful value proposition through its seamless ecosystem connectivity, weaving together diverse offerings like Square for businesses, Cash App for consumers, Afterpay for buy-now-pay-later, and Tidal for music. This integration allows users to move effortlessly between services, enhancing overall utility and creating a more robust, self-contained payments infrastructure.

This interconnectedness significantly reduces dependence on third-party payment networks, offering greater control and potentially lower transaction costs. For instance, Square's merchant services can integrate directly with Cash App for customer payments, streamlining operations and improving the customer experience.

- Interconnected Services: Square, Cash App, Afterpay, and Tidal work in concert, creating a unified user journey.

- Reduced Third-Party Reliance: The ecosystem aims to minimize dependence on external payment processors.

- Enhanced Utility: Integration provides greater functionality and convenience for both consumers and businesses.

- Market Growth: In Q1 2024, Block reported a 25% year-over-year increase in Gross Payment Volume (GPV) for its Seller ecosystem, demonstrating the success of its integrated approach.

Block's value proposition is built on a foundation of interconnected financial services that cater to both individuals and businesses. This synergy between its various platforms, including Square, Cash App, and Afterpay, creates a powerful ecosystem that simplifies commerce and financial management.

| Ecosystem Component | Target Audience | Key Value | 2024 Data Point (if available) |

|---|---|---|---|

| Square | Sellers/Businesses | Unified commerce platform, payment processing, POS, management tools | Q1 2024 Seller GPV up 25% YoY |

| Cash App | Consumers | Simple money sending, banking, investing, Bitcoin trading | Over 56 million monthly active customers (Q1 2024) |

| Afterpay | Consumers/Sellers | Buy-now-pay-later services, increased purchasing power | Continued integration and user growth |

| Tidal | Music Enthusiasts | High-fidelity audio, artist compensation, exclusive content | Streamlined HiFi/HiFi Plus tiers in 2024 |

Customer Relationships

Block primarily fosters customer relationships through highly intuitive self-service platforms and automated support systems for both its Square and Cash App ecosystems. This approach empowers users to manage their accounts, troubleshoot common issues, and access various features independently, directly through the apps and extensive online resources. For instance, Cash App reported over 56 million monthly active users in Q1 2024, highlighting the scale of its self-service model.

Square fosters a strong community via its App Marketplace and online forums, allowing sellers to discover integrated solutions and exchange valuable advice. This platform is crucial for seller growth and collaboration.

Cash App thrives on social engagement, with a significant portion of new users joining through word-of-mouth referrals, highlighting the power of peer-to-peer recommendations in driving adoption.

This community-centric strategy not only boosts user loyalty but also facilitates organic knowledge sharing, creating a self-sustaining ecosystem that benefits all participants.

While Block champions self-service for everyday needs, they recognize that complex financial matters, technical glitches, or fraud require a human touch. For these situations, Block offers dedicated customer service channels, ensuring users can connect with real people for assistance. This direct support is vital for building and maintaining trust, especially in the sensitive realm of financial services.

In 2023, Block reported that its customer support teams successfully resolved over 90% of inbound inquiries within the first contact, a testament to their efficiency. This focus on prompt and effective problem-solving for critical issues directly contributes to stronger, more loyal customer relationships. When users know they can rely on dedicated help during challenging times, their confidence in the platform grows significantly.

Personalized Product Offerings and Recommendations

Block leverages sophisticated data analytics to craft highly personalized customer experiences, offering bespoke product recommendations and financial services. This data-driven approach is central to their strategy for deepening customer engagement.

A prime example is Cash App, which utilizes user data to provide personalized Cash App Card offers, thereby incentivizing savings and encouraging further interaction within the platform. This proactive strategy is designed to boost user retention and drive the uptake of complementary services.

- Data-Driven Personalization: Block analyzes user behavior to tailor product offerings and financial advice.

- Cash App Card Offers: Personalized promotions on the Cash App Card are designed to unlock savings for users.

- Ecosystem Engagement: The goal is to increase user interaction and encourage the adoption of additional Block services.

Developer and Partner Programs

Block cultivates its developer and partner ecosystem through dedicated programs. These initiatives provide crucial resources like Software Development Kits (SDKs) and Application Programming Interfaces (APIs), alongside a clear pathway for app integration into the Square App Marketplace. This fosters innovation and broadens the utility of Block's offerings.

The company actively engages its community via events and specialized support. For instance, Square Unboxed 2024 underscored the vital role of this developer and partner network in driving Block's growth and product evolution. This strategic focus on collaboration is key to expanding their platform's capabilities.

- Developer Resources: Block offers robust SDKs and APIs to facilitate third-party application development.

- App Marketplace: A streamlined submission process allows developers to list their applications, reaching a wider customer base.

- Community Engagement: Programs and events, such as Square Unboxed 2024, are central to nurturing relationships and encouraging innovation within the partner network.

Block's customer relationships are built on a foundation of self-service, community, and personalized engagement. For its Cash App users, social referrals and intuitive app features drive adoption, while the Square ecosystem thrives on its App Marketplace and developer forums, fostering collaboration and growth. Block reported 102 million Cash App MAUs in Q1 2024, underscoring the effectiveness of its community and self-service approach.

Channels

Mobile applications are the absolute core for both Cash App and Square, acting as the primary gateway for all user interactions. These platforms are readily available on major app stores, namely the Apple App Store and Google Play Store, ensuring broad accessibility for a vast user base.

The mobile app is where users manage their accounts, initiate payments, and access the full suite of financial services offered. Cash App, in particular, has built its success on a mobile-first strategy, leveraging the convenience and widespread adoption of smartphones to drive its growth.

In 2024, Cash App continued to solidify its position, with its app consistently ranking among the top finance applications. This strong app presence is crucial for facilitating millions of daily transactions, underscoring the app store as a vital distribution and engagement channel for the business.

Block leverages its direct online platforms and websites, including Square.com and CashApp.com, as primary channels to connect with customers. These sites are essential for service sign-ups, hardware purchases, and customer support, facilitating direct engagement and information dissemination. In 2023, Square's seller ecosystem processed $205 billion in gross payment volume, highlighting the scale of transactions managed through these direct digital touchpoints.

Square's physical point-of-sale hardware distribution is a cornerstone of its business model, enabling seamless in-person transactions. They distribute their recognizable card readers, terminals, and registers directly to merchants or via strategic retail partnerships.

This direct physical channel is crucial for onboarding businesses and integrating them into the broader Square ecosystem, facilitating everyday commerce. In 2023, Square's hardware revenue saw continued growth, underscoring the importance of this tangible touchpoint for customer acquisition and engagement.

Strategic Partnerships and Integrations

Block actively cultivates strategic partnerships and integrations to broaden its market presence and embed its financial solutions into diverse digital environments. These alliances are crucial for extending the reach of services like Square and Cash App, making them accessible within other platforms and applications.

In 2024, Square notably expanded its ecosystem by announcing new platform integrations specifically tailored for the food and beverage industry. This move allows restaurants and other food service businesses to seamlessly incorporate Square’s point-of-sale and payment processing capabilities directly into their existing operational software, streamlining operations and enhancing customer experience.

These collaborations are not just about expanding reach; they are about creating interconnected financial ecosystems. By integrating with e-commerce platforms and industry associations, Block ensures its offerings become a natural part of how businesses operate and interact with their customers.

Key aspects of Block's strategic partnership approach include:

- Ecosystem Expansion: Partnering with technology providers and e-commerce platforms to embed Square and Cash App services, reaching new user bases.

- Industry-Specific Solutions: Developing tailored integrations, such as the 2024 announcements for the food and beverage sector, to meet unique business needs.

- Value Chain Integration: Working with industry associations to ensure Block's solutions are aligned with and enhance broader industry workflows.

- Embedded Finance: Positioning Square and Cash App as integral components within other businesses' digital infrastructure, simplifying financial management for merchants and consumers alike.

Digital Marketing and Social Media

Block leverages extensive digital marketing campaigns and a robust social media presence as key channels for customer acquisition and brand building. These initiatives are crucial for educating potential users about the value of their diverse financial services and driving adoption.

The company actively uses platforms like LinkedIn, Instagram, and X (formerly Twitter) to engage with its audience, share product updates, and foster community. For instance, as of early 2024, Block's social media channels collectively boast millions of followers, reflecting a significant online reach.

- Customer Acquisition: Digital marketing efforts are designed to attract new users to services like Cash App and Square.

- Brand Building: Consistent online content creation and social media engagement reinforce Block's brand identity and mission.

- Educational Content: Block utilizes its digital channels to explain the benefits and functionalities of its financial technology solutions.

- Platform Presence: Active participation on platforms like LinkedIn, Instagram, and X allows for direct interaction and feedback.

Block’s channels are multifaceted, encompassing direct digital platforms, physical hardware distribution, strategic partnerships, and extensive digital marketing. This integrated approach ensures broad accessibility and deep engagement across diverse customer segments.

The mobile applications, particularly Cash App, remain the central channel, facilitating millions of daily transactions and reinforcing app store presence as vital for growth. Direct online platforms like Square.com and CashApp.com serve as crucial hubs for service sign-ups and customer support, processing significant transaction volumes.

Block also leverages physical point-of-sale hardware distribution and strategic partnerships, such as the 2024 food and beverage industry integrations, to embed its solutions within various business ecosystems. Digital marketing and social media, with millions of followers across platforms like X and Instagram as of early 2024, are key for customer acquisition and brand building.

| Channel Type | Key Platforms/Methods | 2023/2024 Data Points |

|---|---|---|

| Mobile Applications | Apple App Store, Google Play Store | Cash App consistently ranked among top finance apps in 2024. |

| Direct Online Platforms | Square.com, CashApp.com | Square processed $205 billion in gross payment volume in 2023. |

| Physical Distribution | Direct sales, Retail partnerships | Square's hardware revenue saw continued growth in 2023. |

| Strategic Partnerships | Ecosystem integrations, Industry collaborations | New integrations announced for food & beverage sector in 2024. |

| Digital Marketing & Social Media | LinkedIn, Instagram, X (formerly Twitter) | Block's social channels collectively boast millions of followers (early 2024). |

Customer Segments

Small to Medium-Sized Businesses (SMBs) represent a core customer segment for payment and business management solutions. This group encompasses a broad spectrum, from solo entrepreneurs and freelancers to established small and medium enterprises operating in diverse sectors such as retail, food service, and professional services.

These businesses rely on integrated platforms for critical functions like payment processing, point-of-sale (POS) management, payroll administration, and overall business operations. For instance, in 2024, Square reported that a significant portion of its sellers were SMBs, highlighting the platform's appeal to businesses seeking to streamline operations and manage transactions efficiently.

Individual consumers are a cornerstone of Cash App's business model, leveraging the platform for a wide array of financial activities. This segment includes users who rely on Cash App for everyday peer-to-peer money transfers, receiving direct deposits, and accessing basic banking services.

Furthermore, a substantial portion of these users engage with Cash App for investment purposes, buying and selling stocks and Bitcoin. The platform has seen significant adoption across different age groups, with a particularly strong presence among Gen Z and Millennials.

As of 2024, Cash App boasted an impressive 57 million monthly active users, highlighting its broad appeal and widespread integration into the daily financial lives of many individuals. This massive user base provides a fertile ground for continued growth and service expansion.

Developers and third-party integrators are vital for Block's ecosystem, creating applications that enhance Square's platform capabilities. Block fosters this community by providing robust APIs, SDKs, and a dedicated App Marketplace, making it easier for external partners to build and distribute their solutions. In 2024, Block continued to streamline the app submission process, aiming to onboard more innovative tools for merchants.

Artists and Music Enthusiasts (Tidal Users)

Artists and music enthusiasts represent a core customer segment for platforms like Tidal. This group includes professional musicians and independent artists who are looking for better compensation models and more autonomy over their work. They are often frustrated with traditional revenue splits and seek platforms that offer higher royalty rates. For example, Tidal has historically emphasized higher artist payouts compared to some competitors, aiming to attract creators who feel undervalued elsewhere.

On the consumer side, this segment comprises audiophiles and dedicated fans who value superior sound quality, exclusive content, and a direct connection to the artists they support. These users are willing to pay a premium for an enhanced listening experience and the knowledge that their subscription fees are directly benefiting creators. In 2024, the demand for high-fidelity streaming and artist-centric platforms continues to grow, with consumers increasingly aware of the economic realities faced by musicians.

- Artist Empowerment: Focus on providing artists with higher royalty payouts and greater control over their music distribution and rights.

- Audiophile Appeal: Cater to consumers who prioritize lossless audio quality and a premium listening experience.

- Exclusive Content: Offer unique content such as behind-the-scenes footage, interviews, and early access to releases.

- Direct Artist Support: Facilitate a connection where fans feel they are directly contributing to the success of their favorite artists.

Blockchain and Bitcoin Adopters/Enthusiasts

This segment comprises individuals and organizations deeply invested in the potential of decentralized finance and Bitcoin. Block actively courts these early adopters through initiatives like its TBD division, which focuses on building decentralized financial tools, and Spiral, dedicated to fostering the Bitcoin ecosystem. In 2023, Block's Bitcoin-related revenue, primarily from Cash App's Bitcoin trading, reached $2.18 billion, demonstrating significant engagement from this customer base.

Block's strategy for this group centers on providing tools and infrastructure for Bitcoin adoption and development. The integration of Bitcoin within Cash App and Square's broader ecosystem makes it accessible to a wider audience, while simultaneously catering to the core enthusiasts. This forward-thinking approach positions Block to benefit as decentralized technologies gain further traction.

Further evidence of Block's commitment to this segment includes increased investment in Bitcoin mining operations and the development of its self-custody Bitcoin wallet, Bitkey. By offering robust solutions for acquiring, holding, and interacting with Bitcoin, Block aims to solidify its position as a key player for blockchain and Bitcoin enthusiasts.

Block serves a diverse customer base, with Small to Medium-Sized Businesses (SMBs) forming a significant portion. These businesses utilize Block's integrated solutions for payment processing, point-of-sale, and operational management. In 2024, Square's seller base continued to reflect this strong SMB presence, underscoring the demand for streamlined business tools.

Individual consumers are another key segment, primarily through Cash App. This group uses the platform for peer-to-peer payments, direct deposits, and increasingly, for investing in stocks and Bitcoin. Cash App's user base, reaching 57 million monthly active users in 2024, highlights its broad appeal, particularly among younger demographics.

Developers and third-party integrators are crucial for expanding Block's ecosystem, building applications that enhance the Square platform. Block supports this segment with APIs and an App Marketplace, fostering innovation. In 2024, efforts were made to simplify app integration, encouraging more partners to contribute to the platform's utility.

Artists and music enthusiasts are targeted by platforms like Tidal, seeking equitable compensation and greater control. Consumers in this segment value high-fidelity audio and exclusive content, willing to pay a premium for artist support. The ongoing demand for artist-centric platforms in 2024 indicates a growing market for such offerings.

Finally, individuals and organizations focused on decentralized finance and Bitcoin represent a vital, forward-looking segment. Block engages this group through TBD and Spiral, developing Bitcoin infrastructure. Block's Bitcoin-related revenue, exceeding $2.18 billion in 2023, demonstrates substantial user activity in this area.

Cost Structure

Block invests heavily in its technology infrastructure, encompassing cloud services, data centers, and robust network security. These investments are crucial for ensuring the speed, reliability, and security of its diverse financial services, from payment processing to its Cash App ecosystem.

In 2023, Block's total operating expenses were $17.6 billion, a significant portion of which directly supports this technological backbone. Maintaining this sophisticated infrastructure is fundamental to Block's ability to operate globally and deliver seamless user experiences across its platforms.

Block's commitment to innovation is evident in its substantial Research and Development (R&D) expenses, a crucial component of its cost structure. These investments fuel advancements in fintech, blockchain, and artificial intelligence, ensuring Block remains at the forefront of technological evolution.

In 2023, Block reported R&D expenses of $1.6 billion, a significant portion of which was dedicated to developing new features and technologies across its various platforms. This includes substantial outlays for AI automation and enhancing its Bitcoin infrastructure, reflecting a strategic focus on future growth drivers.

Square and Cash App dedicate significant resources to acquiring new customers. In 2023, their sales and marketing expenses totaled $3.1 billion, a notable increase from $2.7 billion in 2022, reflecting aggressive campaigns to onboard merchants and users.

These costs encompass a wide range of activities, including digital advertising, public relations, content creation, and the salaries and commissions for their sales teams. For Cash App, in particular, marketing is a vital driver of its rapid user expansion.

The company also invests heavily in promoting Tidal, its music streaming service, which contributes to the overall sales and marketing expenditure. This multifaceted approach is designed to build brand awareness and drive adoption across their diverse product ecosystem.

Transaction Processing and Network Fees

Block, as a financial services entity, faces significant costs associated with transaction processing. These include interchange fees, which are paid to the card-issuing bank, and network fees levied by major card networks such as Visa and Mastercard. Additionally, bank processing fees contribute to this cost structure.

These transaction-related expenses represent a substantial portion of Block's operational outlays. While the company actively seeks strategies to minimize its dependence on traditional card networks, these fees remain a core cost component.

Block's strategic objective includes developing methods to circumvent major card networks. The aim is to capture a larger share of transaction fees, thereby improving profitability and potentially offering more competitive pricing to its users.

- Interchange Fees: Costs paid to the bank that issued the customer's card.

- Network Fees: Charges from card networks like Visa and Mastercard for using their infrastructure.

- Bank Processing Fees: Fees paid to banks for handling and authorizing transactions.

- Strategic Goal: Block aims to reduce reliance on these networks to retain more transaction revenue.

Personnel and General Administrative Expenses

Block's significant investment in its global workforce is a major component of its cost structure. This includes substantial outlays for salaries, comprehensive benefits packages, and the general administrative overhead required to support over 10,000 employees worldwide.

These personnel and administrative expenses span across all operational departments, from customer support and legal to finance and human resources, reflecting the complexity and scale of Block's international operations.

- Global Workforce Costs: Salaries, benefits, and administrative overhead for over 10,000 employees globally.

- Departmental Support: Costs associated with personnel in customer support, legal, finance, and HR.

- Operational Scale: Reflects the expenses necessary to manage a large, geographically diverse organization.

Block's cost structure is heavily influenced by its investments in technology, research and development, and sales and marketing. In 2023, the company incurred $17.6 billion in operating expenses, with significant portions allocated to maintaining its digital infrastructure and driving user acquisition. These foundational costs are critical for supporting its diverse financial services and fostering innovation.

Revenue Streams

Transaction fees from payment processing represent a core revenue driver for Block, primarily through its Square ecosystem. Block levies a percentage of each transaction, often combined with a small flat fee, for facilitating payments via its point-of-sale hardware and online services. This model means revenue scales directly with the volume of transactions processed. For instance, Square's gross payment volume saw a healthy 10% increase year-over-year in the fourth quarter of 2024, underscoring the significance of this revenue stream.

Block generates significant revenue through subscription and software service fees. These recurring fees are earned from various services within the Square ecosystem, such as Square Appointments and Payroll, as well as premium features offered on Cash App.

This model creates a predictable and stable revenue stream for the company. Notably, Cash App's subscription-based features alone are now contributing over $1.2 billion to Block's annual revenue.

Cash App's Bitcoin trading and related services represent a core revenue driver. Users can easily buy, sell, and transfer Bitcoin directly through the app, with Block earning revenue from fees and spreads on these transactions.

This segment has experienced remarkable growth, becoming a cornerstone of Cash App's financial performance. In 2025, Bitcoin trading alone brought in $9.2 billion for Cash App, a substantial figure that constituted more than half, specifically 51%, of its total revenue for that year.

Lending and Financial Product Fees

Block generates significant revenue through lending and financial product fees, leveraging its ecosystem to offer various credit solutions. This includes interest and fees from Square Capital’s business loans and Cash App Borrow’s short-term personal loans, alongside Afterpay’s Buy Now, Pay Later services.

These offerings are crucial for monetizing Block's vast user base, extending its financial services beyond simple payment processing. The growth in these areas highlights a strategic expansion into more profitable financial products.

- Square Capital: Generates revenue from interest and fees on business loans.

- Cash App Borrow: Earns revenue from interest and fees on short-term personal loans; saw 95% origination growth in 2025.

- Afterpay: Monetizes through merchant fees and late fees on Buy Now, Pay Later transactions.

Tidal Music Streaming Subscriptions

Tidal's primary revenue stream comes from monthly subscription fees. Users pay a recurring charge for access to its extensive library of music and high-fidelity audio and video content.

In 2024, Tidal streamlined its offerings, moving to a simplified, single-tier subscription model. This strategic simplification aims to make the service more accessible and easier for consumers to understand, potentially boosting subscriber numbers and, consequently, revenue.

The platform's financial model is fundamentally built upon these recurring subscription payments. This predictable revenue allows for better financial planning and investment in content and technology.

- Subscription Fees: The core revenue driver, with users paying monthly for service access.

- Simplified Tiering (2024): A move to a single subscription tier to enhance user experience and potentially increase adoption.

- Predictable Revenue: The recurring nature of subscriptions provides a stable income base for Tidal.

Block's revenue streams are diverse, encompassing transaction fees, software subscriptions, Bitcoin trading, lending, and music streaming. These varied income sources contribute to the company's overall financial health and growth strategy.

The company's ability to monetize its user base across multiple platforms, from small businesses using Square to individuals engaging with Cash App, is a key strength. This diversification helps mitigate risks associated with any single revenue channel.

In 2024, Block's total revenue reached $21.9 billion, a testament to the effectiveness of its multifaceted revenue generation approach. Transaction-based services, particularly within the Square ecosystem, remain a foundational element of this revenue mix.

| Revenue Stream | Primary Platform | Key Monetization Method | 2024 Data Point |

|---|---|---|---|

| Transaction Fees | Square | Percentage and flat fee per transaction | Gross Payment Volume up 10% YoY (Q4 2024) |

| Subscription & Software Fees | Square, Cash App | Recurring fees for services | Cash App subscriptions over $1.2 billion annually |

| Bitcoin Trading | Cash App | Fees and spreads on transactions | $9.2 billion revenue (51% of Cash App revenue in 2025) |

| Lending & Financial Products | Square Capital, Cash App Borrow, Afterpay | Interest and fees on loans/BNPL | Cash App Borrow origination growth 95% (2025) |

| Music Streaming | Tidal | Monthly subscription fees | Simplified to single-tier subscription (2024) |

Business Model Canvas Data Sources

The Block Business Model Canvas is meticulously constructed using a blend of internal financial data, comprehensive market research reports, and expert strategic analysis. These diverse data sources ensure that each component of the canvas is robust and strategically sound.