Blackstone SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blackstone Bundle

Blackstone's formidable brand recognition and vast capital reserves are significant strengths, positioning them as a dominant force in private equity. However, navigating evolving regulatory landscapes and managing the inherent risks of large-scale investments are crucial considerations.

Want the full story behind Blackstone's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Blackstone stands as the undisputed global leader in alternative asset management, boasting Assets Under Management (AUM) surpassing $1.2 trillion as of the second quarter of 2025. This immense scale is a powerful differentiator, enabling the firm to deploy substantial capital and maintain a wide-reaching presence across diverse global markets.

The firm's strategic diversification across private equity, real estate, credit and insurance, and multi-asset investing significantly mitigates risk. This broad portfolio structure ensures that Blackstone is not overly dependent on the performance of any single market segment, providing a stable foundation for continued growth and resilience.

Blackstone's robust fundraising prowess is a significant strength, evidenced by a remarkable $62 billion in inflows during Q1 2025, the highest quarterly figure in almost three years. This strong capital generation continued into Q2 2025 with $52.1 billion in inflows, underscoring deep investor confidence in the firm's strategies and ability to deliver attractive returns.

The firm's expanding reach into the private wealth channel is a key driver of this success, with $11 billion raised from this segment in Q1 2025 alone. This diversification of capital sources further solidifies Blackstone's financial foundation and its capacity to deploy capital across its various investment strategies.

Blackstone consistently demonstrates strong investment performance, successfully navigating challenging market conditions across its diverse strategies. This track record instills confidence in its ability to generate returns even when the economic climate is uncertain.

As of the first quarter of 2025, Blackstone held a substantial $177 billion in undrawn capital, commonly referred to as dry powder. This significant financial reserve offers considerable strategic flexibility, allowing the firm to swiftly deploy capital and seize compelling investment opportunities as they emerge in the market.

Strategic Expansion into High-Growth Sectors

Blackstone is actively pursuing strategic expansion into rapidly growing sectors, demonstrating a forward-looking approach to asset management. This includes significant investments in digital infrastructure, such as data centers, which are crucial for the digital economy's expansion. The firm is also channeling capital into the energy transition, supporting the shift towards sustainable energy sources, and the life sciences sector, a field ripe with innovation and long-term growth potential.

These thematic investments are not just about diversification; they are designed to capitalize on major global megatrends. By aligning its investment strategy with these powerful shifts, Blackstone is positioning itself for sustained AUM growth and attractive returns. The firm's focus on private credit and insurance further complements this strategy, providing stable income streams and opportunities for value creation in evolving financial markets.

For instance, Blackstone's real estate division, a significant contributor to its AUM, has seen substantial growth driven by demand for data centers. In 2023, the firm announced plans to invest billions in data center development globally, reflecting confidence in this sector's trajectory. This strategic focus is a key strength, allowing Blackstone to tap into secular growth trends that are reshaping economies worldwide.

- Digital Infrastructure: Blackstone is a major investor in data centers, recognizing their critical role in supporting cloud computing and AI.

- Energy Transition: The firm is actively deploying capital into renewable energy projects and technologies aimed at decarbonization.

- Life Sciences: Blackstone's commitment to life sciences encompasses investments in biopharmaceutical companies and healthcare real estate.

- AUM Growth: These targeted investments have been instrumental in Blackstone's consistent growth in assets under management, reaching over $1 trillion by early 2024.

Innovation in Private Wealth Solutions

Blackstone is significantly broadening access to private markets for individual investors. This is being achieved through innovative perpetual capital vehicles such as Blackstone Real Estate Income Trust (BREIT) and Blackstone Credit & Income Term Fund (BCRED). Newer products like Blackstone Infrastructure Partners (BIP) and Blackstone Managed Account Solutions (BMAX) further expand these offerings across infrastructure and credit. This strategic product development and distribution, often in collaboration with financial advisors, is a primary catalyst for substantial capital inflows and sustained future expansion.

This approach is yielding impressive results, with BREIT, for example, reporting significant growth in net asset value and investor commitments. As of early 2024, BREIT's assets under management have reached tens of billions of dollars, demonstrating strong market demand for accessible private real estate investments. The firm's ability to package complex private market strategies into more liquid, publicly accessible formats is a key competitive advantage.

- Democratization of Private Markets: Blackstone's perpetual capital vehicles provide individual investors with previously unavailable access to private equity, real estate, and credit strategies.

- Product Innovation: The development of offerings like BREIT, BCRED, and BMAX caters to a growing demand for diversified investment opportunities beyond traditional public markets.

- Distribution Prowess: Partnerships with financial advisors are crucial in channeling these innovative products to a wider investor base, driving significant inflows.

- Growth Engine: This focus on product innovation and distribution is a core driver of Blackstone's ongoing asset growth and market leadership in alternative investments.

Blackstone's sheer scale, with over $1.2 trillion in AUM as of Q2 2025, provides unparalleled capital deployment capabilities and global market penetration. Its diversified strategies across private equity, real estate, credit, and multi-asset investing create a robust and resilient business model, insulated from sector-specific downturns.

What is included in the product

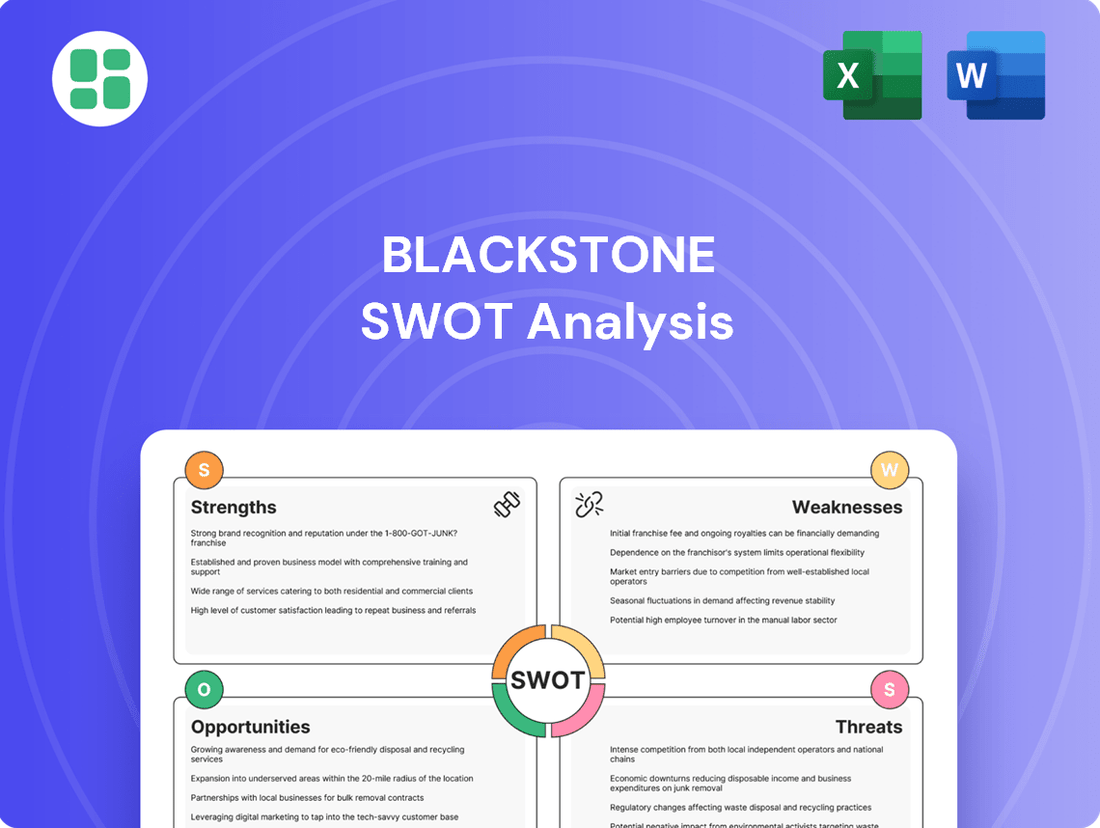

Delivers a strategic overview of Blackstone’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Identifies critical vulnerabilities and untapped opportunities, offering clarity to navigate complex market challenges.

Weaknesses

Blackstone's reliance on performance fees and asset valuations makes it susceptible to market downturns. For instance, during periods of economic contraction, the value of its real estate and private equity holdings can decline, directly impacting the firm's profitability and the amount it earns through carried interest. This cyclicality is a persistent challenge.

Rising interest rates, as seen in 2023 and into 2024, can also dampen deal activity and pressure asset valuations across Blackstone's diverse portfolio. A slowdown in mergers, acquisitions, and real estate transactions directly reduces fee-related income and the potential for capital appreciation, highlighting the firm's vulnerability to macroeconomic shifts.

Blackstone's financial results are significantly tied to its ability to exit investments, known as realization activity. These exits are a primary driver of distributable earnings, meaning the firm's ability to return capital to its investors is directly linked to successful sales of its portfolio companies or assets. A challenging market for large-scale exits, such as initial public offerings or strategic sales, can therefore put a damper on the company's financial performance.

While Blackstone anticipates a more favorable environment for realizations in 2025, any sustained difficulty in divesting its holdings could negatively impact the returns delivered to shareholders. For instance, in the first quarter of 2024, the firm reported a decrease in distributable earnings, partly due to a slower pace of realizations compared to previous periods. This highlights the sensitivity of their business model to market conditions affecting exit opportunities.

Blackstone, as the world's largest alternative asset manager, is subject to heightened regulatory oversight due to its significant market presence and investment strategies. This scrutiny is particularly intense regarding its scale, influence, and the nature of its investment activities. For instance, potential shifts in regulations affecting Business Development Company (BDC) dividend income or evolving Environmental, Social, and Governance (ESG) reporting mandates could necessitate substantial adjustments, leading to increased operational complexity and compliance expenditures.

Potential for Valuation Overlap Risks

Blackstone's aggressive push into high-growth areas like data centers and digital infrastructure, while promising, carries a risk of valuation overlap. This intensified competition from other major players can drive up asset prices, potentially making it more challenging to secure investments at attractive valuations and achieve superior returns. For example, the booming data center market saw significant capital inflows in 2024, with global investment reaching an estimated $200 billion, leading to higher acquisition multiples.

This overlap in investment themes could also lead to margin compression. When multiple large funds target similar assets, the bidding process can become more competitive, driving up purchase prices and subsequently reducing the potential profit margins on those investments. This dynamic was evident in the real estate sector in late 2024, where competition for prime logistics assets pushed cap rates lower.

- Increased competition in high-growth sectors like data centers.

- Risk of inflated valuations due to aggressive pursuit of assets.

- Potential for compressed profit margins from overlapping investment themes.

- Difficulty in finding attractive entry points for investments.

Liquidity Constraints in Certain Funds

Some of Blackstone's alternative investment products, particularly those accessible to individual investors, are subject to redemption limits. This can create liquidity challenges when there's a surge in withdrawal requests or during times of market instability.

While Blackstone Real Estate Income Trust (BREIT) has recently seen a shift towards positive net flows, effectively managing investor expectations regarding liquidity remains a continuous effort for the firm.

- Redemption Limits: Certain alternative funds, especially those for retail investors, have restrictions on when and how much capital can be withdrawn.

- Market Stress Impact: These limits can become a concern during periods of high redemption demand or significant market downturns.

- BREIT's Net Flows: Despite recent improvements, managing investor understanding of liquidity for BREIT is an ongoing process.

Blackstone's performance is heavily influenced by market cycles, impacting its fee income and the value of its assets. For example, a downturn in 2023 and early 2024 saw a slowdown in deal activity and a pressure on valuations, affecting distributable earnings. The firm's reliance on successful exits, such as IPOs or strategic sales, means that market conditions hindering these transactions can directly impact its financial performance, as seen in the first quarter of 2024 when distributable earnings decreased due to slower realizations.

Intense competition in high-growth sectors like data centers, with global investment reaching an estimated $200 billion in 2024, drives up asset prices and can compress profit margins. This aggressive pursuit of similar assets by multiple large funds can lead to less attractive entry points and reduced potential returns, a trend observed in the real estate sector in late 2024 with lower cap rates on prime logistics assets.

Certain alternative investment products, particularly those offered to individual investors, are subject to redemption limits. While Blackstone Real Estate Income Trust (BREIT) has shown positive net flows recently, managing investor expectations around liquidity during market stress remains a continuous challenge.

Preview the Actual Deliverable

Blackstone SWOT Analysis

This is the same Blackstone SWOT analysis document included in your download. The full content is unlocked after payment, providing a comprehensive view of their strategic position.

Opportunities

The private wealth market presents a substantial growth avenue, driven by increasing investor appetite for alternative assets. Trillions of dollars are flowing into private markets, indicating a robust demand that Blackstone is well-positioned to capture.

Blackstone is strategically broadening its product suite and distribution networks, aiming to serve this expanding client base. Anticipated launches of new infrastructure and credit funds by early 2025 are key initiatives to capitalize on this trend.

Blackstone is heavily investing in AI to boost its operations, find better deals, and manage its investments more effectively. This includes using AI for data analysis and improving decision-making processes throughout its vast portfolio.

The firm is also identifying major investment potential in AI infrastructure, particularly data centers. With the rapid growth of AI technologies, the demand for specialized data storage and processing facilities is soaring, presenting a significant opportunity for Blackstone.

Blackstone is well-positioned to capitalize on a burgeoning credit market, often described as a 'Golden Age,' with an addressable market estimated to surpass $30 trillion. This growth is fueled by enduring secular trends and a substantial demand for large-scale financing.

Furthermore, the firm anticipates a cyclical upswing in commercial real estate. Investment activity is projected to gain momentum throughout 2025, with particular strength expected in resilient sub-sectors such as logistics and rental housing.

Increased M&A and IPO Activity

A more favorable environment for mergers and acquisitions (M&A) and a rebound in initial public offerings (IPOs) are anticipated to significantly boost private equity exits in 2025. This presents a substantial opportunity for Blackstone to realize existing investments and generate strong returns.

The improved financing landscape, coupled with the maturation of deals initiated in 2021, creates a prime window for profitable exits. Blackstone is well-positioned to capitalize on this trend.

- Increased M&A and IPO Activity: Projections indicate a surge in deal-making and public market debuts, creating more avenues for private equity firms to divest their holdings.

- Favorable Exit Environment: A more robust economic climate and greater investor appetite for public offerings in 2025 are expected to facilitate higher valuations for exited companies.

- Realization of 2021 Vintage Deals: Investments made during the active 2021 period are now reaching an optimal stage for exit, allowing Blackstone to potentially capture significant capital gains.

- Enhanced Financing Landscape: Easier access to capital for buyers and a more receptive IPO market will likely drive higher transaction multiples for Blackstone's portfolio companies.

Strategic Partnerships and ESG Integration

Blackstone is actively pursuing strategic partnerships to expand its offerings and market penetration. A notable example is its collaboration with Wellington Management and Vanguard, aimed at integrating public and private markets into comprehensive multi-asset solutions. This move is designed to broaden Blackstone's reach and appeal to a wider investor base seeking diversified portfolios.

The firm's commitment to Environmental, Social, and Governance (ESG) integration presents a significant opportunity. Blackstone's Decarbonization Accelerator program, for instance, is a tangible initiative to drive value creation and attract capital from investors prioritizing sustainability. This focus aligns with growing global demand for ESG-compliant investments, potentially opening new avenues for growth and capital raising.

- Strategic Alliances: Collaborations with firms like Wellington Management and Vanguard to blend public and private market investments.

- ESG Focus: Initiatives like the Decarbonization Accelerator to attract sustainability-minded investors and create value.

- Market Reach Enhancement: Partnerships are key to expanding Blackstone's distribution and product offerings.

- Capital Attraction: ESG integration is a strategic lever to draw capital from a growing pool of responsible investors.

Blackstone is poised to benefit from increased M&A and IPO activity in 2025, creating more opportunities for profitable exits. The firm's investments from 2021 are reaching maturity, aligning with a more favorable financing environment that should drive higher valuations for its portfolio companies.

Threats

The alternative asset management landscape is intensely competitive, with many players seeking both investor capital and attractive investment opportunities. This crowded market means firms like Blackstone face constant pressure to perform and differentiate themselves.

Increased competition from other major alternative asset managers, such as KKR and Apollo Global Management, can drive up the cost of acquiring assets. For instance, in 2024, private equity deal volumes remained robust, but valuations in many sectors reflected this heightened competition, potentially impacting future returns.

This competitive environment also puts pressure on fee structures. As more firms offer similar strategies, there's a tendency for fees to compress, impacting the profitability of asset managers. Blackstone's ability to maintain its fee income will depend on its continued ability to generate alpha and attract significant capital commitments.

While the market anticipates interest rate cuts in 2025-2026, sustained volatility or stubborn inflation could hurt Blackstone's asset values. For example, persistent inflation might delay expected rate cuts, increasing borrowing costs for its portfolio companies and dampening investor appetite, especially in sectors like real estate where financing is critical. This could particularly affect Blackstone's credit strategies if default rates rise.

Global geopolitical tensions, such as ongoing conflicts and trade disputes, create significant uncertainty for cross-border investments. These instabilities can disrupt supply chains and dampen investor confidence, directly impacting Blackstone's ability to execute deals and manage its diversified assets, particularly in regions experiencing economic downturns.

For instance, the ongoing geopolitical risks in Eastern Europe and the Middle East, coupled with inflation concerns in major economies throughout 2024 and into 2025, have led to increased volatility in global financial markets. This environment makes it more challenging for Blackstone to accurately assess risk and secure favorable terms for its extensive portfolio of real estate, credit, and private equity investments.

Potential for Regulatory Changes and Increased Scrutiny

Blackstone faces potential headwinds from evolving regulatory landscapes. New legislation or policy shifts, especially concerning private equity, real estate, or environmental, social, and governance (ESG) mandates, could introduce more stringent compliance burdens or curtail existing investment approaches. For instance, proposed changes in capital requirements or investor protection rules in key markets could necessitate adjustments to operational models and potentially impact fee structures or return profiles.

Increased scrutiny from regulators, particularly in light of the firm's substantial assets under management, presents another significant threat. This heightened attention could lead to more frequent audits, investigations, or the imposition of fines for non-compliance. The firm's extensive global operations mean it must navigate a complex web of international regulations, where differing interpretations or enforcement priorities can create compliance challenges.

- Increased Compliance Costs: Adapting to new regulations, such as stricter ESG reporting or data privacy laws, can significantly raise operational expenses.

- Restrictions on Investment Strategies: Policy changes could limit Blackstone's ability to pursue certain high-yield strategies, particularly in sectors like private credit or alternative real estate.

- Reputational Risk: Regulatory breaches or perceived non-compliance can damage Blackstone's reputation, affecting investor confidence and its ability to attract new capital.

- Impact on Fee Income: New regulations might affect the calculation or structure of management and performance fees, potentially reducing revenue streams.

Performance of Key Segments and Sector-Specific Headwinds

While recovery is visible in certain real estate markets, the traditional U.S. office sector continues to grapple with significant headwinds. This persistent weakness poses a threat, particularly for firms with substantial investments in this segment.

Blackstone's performance is susceptible to the underperformance of its key segments, with real estate debt strategies being a notable concern. For instance, as of Q1 2024, commercial real estate debt, especially for office properties, has seen increased distress, impacting valuations and potential returns within Blackstone's real estate debt funds.

- Sectoral Weakness: The ongoing challenges in the U.S. office real estate market, driven by remote work trends and higher interest rates, directly impact Blackstone's real estate portfolio.

- Debt Strategy Exposure: A significant allocation to real estate debt, particularly in sectors facing downturns like traditional office, can lead to increased defaults and reduced profitability for these specific strategies.

- Investor Sentiment: Underperformance in core segments can negatively affect investor confidence and potentially lead to redemption requests or reduced capital inflows into Blackstone's funds.

Intensifying competition from rivals like KKR and Apollo Global Management can inflate asset acquisition costs, as seen with robust private equity deal volumes in 2024 but higher valuations. This pressure also extends to fee compression, potentially impacting Blackstone's profitability if alpha generation falters.

Persistent inflation and geopolitical instability present significant threats. For example, elevated inflation throughout 2024 and into 2025 has increased borrowing costs for portfolio companies and dampened investor appetite, particularly impacting real estate financing and credit strategies due to potential rises in default rates.

Evolving regulatory landscapes and increased scrutiny pose compliance challenges and could restrict investment strategies or impact fee structures. For instance, new ESG reporting mandates or changes in capital requirements necessitate operational adjustments and can heighten reputational risk if breaches occur.

The continued weakness in the U.S. office real estate market, exacerbated by remote work trends and higher interest rates, directly affects Blackstone's substantial real estate portfolio. Furthermore, exposure to real estate debt in distressed sectors can lead to increased defaults and reduced profitability for those specific strategies, potentially impacting overall investor confidence.

SWOT Analysis Data Sources

This Blackstone SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial filings, comprehensive market research reports, and expert commentary from reputable industry analysts to ensure a thorough and insightful assessment.