Blackstone Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blackstone Bundle

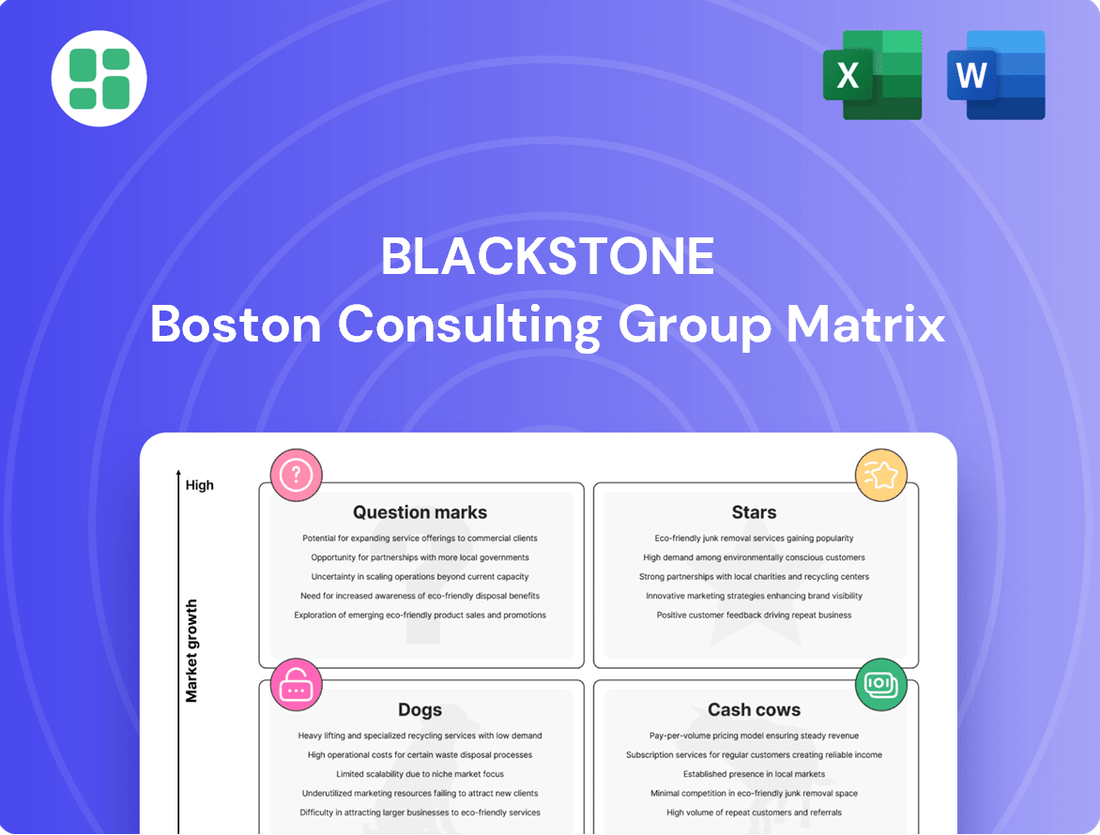

Unlock the strategic potential of the Blackstone BCG Matrix, revealing how its diverse portfolio is positioned for growth and profitability. Understand which ventures are market leaders (Stars), which are reliable income generators (Cash Cows), which require careful consideration (Question Marks), and which may need divestment (Dogs).

This insightful overview is just the tip of the iceberg. Dive into the full Blackstone BCG Matrix for a comprehensive analysis, including data-driven insights and actionable strategies to optimize your investment decisions and product lifecycle management.

Don't miss out on the complete picture; purchase the full report to gain a clear roadmap for resource allocation and future business development, ensuring Blackstone's continued success in dynamic markets.

Stars

Blackstone's private credit business is a clear Star within the BCG Matrix, showcasing remarkable expansion and market leadership. As of recent reporting, its Assets Under Management (AUM) have surged to an impressive $465 billion, with inflows surpassing $113 billion in the last year alone. This represents a substantial 35% year-over-year growth specifically in its investment-grade private credit segment.

This segment, exemplified by vehicles like the Blackstone Private Credit Fund (BCRED), has solidified its position as a global frontrunner. The increasing demand from corporations for alternative, non-bank financing solutions continues to fuel this rapid ascent. Its robust performance and significant market share in the expanding alternative credit landscape firmly cement its Star status.

Blackstone's infrastructure strategy, especially in digital and energy transition, has seen impressive growth. Their dedicated infrastructure fund, BIP, generated $1.2 billion in fee revenues and delivered 17% annual net returns, showcasing strong performance.

The firm is heavily investing over $25 billion in digital and energy infrastructure, with a keen eye on AI expansion. This significant capital allocation underscores their leadership in a rapidly expanding and vital sector for the future economy.

These infrastructure investments are strategically positioned to capitalize on the increasing demand for digital connectivity and sustainable energy solutions, driving substantial value and future growth.

Blackstone's life sciences investments shone brightly in 2024, achieving a remarkable 33% appreciation rate for the entire year. This performance highlights the sector's robust growth and Blackstone's successful strategy within it.

The firm's commitment is further evidenced by its active fundraising for a new multi-billion-dollar life sciences fund, aiming for at least $5 billion. This substantial capital allocation underscores Blackstone's confidence and expanding footprint in this dynamic and innovative industry.

Private Wealth Channel Expansion

Blackstone's private wealth channel is a clear Star in its BCG matrix, demonstrating exceptional growth and market leadership. In the first quarter of 2025, capital raised in this segment surged by approximately 40% year-over-year, hitting a nearly three-year high. This impressive performance underscores the channel's strategic importance and Blackstone's ability to capture significant capital from individual investors.

The channel's momentum is further evidenced by its 2024 sales figures, which surpassed $28 billion. This represents a substantial increase, nearly doubling the capital raised from individuals in perpetual strategies compared to the previous year. Blackstone's dominant position in this expanding market solidifies its status as a Star, indicating strong potential for continued success and resource allocation.

- Private Wealth Capital Raised (Q1 2025): Approximately 40% year-over-year increase.

- 2024 Sales in Wealth Channel: Exceeded $28 billion.

- Perpetual Strategies (Individual Investors): Nearly doubled compared to the prior year.

- Market Position: Leading and expanding.

Secondaries (Strategic Partners)

Blackstone’s secondaries business, known as Strategic Partners, stands out as a dominant force in the private equity secondary market. In 2023, the firm successfully closed its ninth flagship fund at an impressive $22.2 billion, surpassing its fundraising goals. This substantial capital raise underscores the significant demand and Blackstone's continued leadership in this specialized area.

Looking ahead, Blackstone intends to launch its next secondaries fund, with expectations that it will be even larger than its predecessor. This strategic move signals a commitment to expanding its already substantial market share and capitalizing on the growing opportunities within the secondaries sector. The consistent success in fundraising and performance solidifies Strategic Partners' position as a Star in the private equity landscape.

- Market Leadership: Blackstone's Strategic Partners is a recognized leader in the private equity secondaries market.

- Record Fundraising: The firm closed its ninth flagship fund in 2023, raising $22.2 billion, exceeding its target.

- Future Growth: Plans for a new, larger secondaries fund indicate continued expansion and market dominance.

- Star Status: Consistent strong fundraising and performance validate its Star rating within the industry.

Blackstone's real estate business is a clear Star, demonstrating resilience and strategic growth. Despite market headwinds, the firm's real estate segment saw significant activity, with approximately $10 billion deployed in new investments during 2024. This strategic deployment highlights their ability to identify and capitalize on opportunities in a dynamic market.

The firm's focus on logistics and rental housing sectors has been particularly strong, with substantial capital allocated to these areas. These sectors are experiencing robust demand, positioning Blackstone's real estate holdings for continued appreciation and income generation. Their proactive approach to portfolio management and opportunistic acquisitions solidifies their Star status.

| Segment | 2024 Deployment (Approx.) | Key Drivers | Status |

| Real Estate | $10 billion | Logistics, Rental Housing, Opportunistic Acquisitions | Star |

| Private Credit | $465 billion AUM (Total) | Corporate Demand for Alternative Financing | Star |

| Infrastructure | $25 billion+ Investment | Digital Connectivity, Energy Transition, AI | Star |

| Life Sciences | 33% Appreciation (2024) | Sector Growth, New Fund Fundraising | Star |

| Private Wealth | 40% YoY Capital Raise (Q1 2025) | Individual Investor Demand, Perpetual Strategies | Star |

| Secondaries (Strategic Partners) | $22.2 billion Fund IX Close (2023) | Market Leadership, Growing Demand | Star |

What is included in the product

The Blackstone BCG Matrix analyzes business units based on market growth and share, guiding investment decisions.

The Blackstone BCG Matrix offers a clear, one-page overview to strategically allocate resources, relieving the pain of uncertain investment decisions.

Cash Cows

Blackstone's core corporate private equity funds are a bedrock of their business, holding a dominant position in a mature market. These funds consistently deliver robust fee-related earnings, acting as a reliable engine for the firm's financial health.

While growth might not be explosive, the stability and predictability of cash flows from these established funds are invaluable. As of the first quarter of 2024, Blackstone reported total assets under management (AUM) of $1.06 trillion, with private equity remaining a significant component, underscoring their Cash Cow status.

Blackstone Real Estate Income Trust (BREIT), a core+ real estate strategy, has demonstrated robust and consistent returns, achieving a cumulative annualized net return of 9.4% since its inception. This strong performance positions BREIT as a prime example of a Cash Cow within the real estate investment landscape.

BREIT concentrates on stabilized real estate assets, characterized by long investment horizons and a focus on generating steady income streams. These assets typically require less ongoing capital for maintenance, contributing to their predictable cash generation.

The consistent and reliable cash flow generated by BREIT's portfolio of stabilized properties underscores its status as a Cash Cow. This segment provides a stable foundation for income generation, requiring minimal new investment to maintain its current level of profitability.

Blackstone's perpetual capital vehicles represent a significant portion of their business, accounting for 46% of their fee-earning Assets Under Management (AUM). This robust segment provides a predictable and expanding revenue stream from management fees, establishing a strong financial foundation for the firm.

These long-duration funds are designed to generate consistent fee income, insulating Blackstone from the volatility of market cycles and reducing the need for constant fundraising. Their enduring nature and reliable fee generation solidify their position as a key Cash Cow for Blackstone.

Liquid Credit Strategies

Blackstone's liquid credit strategies, a key part of its credit and insurance business, are performing well. In 2024, these strategies delivered impressive annual gross returns of 9.5%.

While not experiencing the explosive growth seen in private credit, these liquid credit strategies are crucial for generating consistent income. They represent a stable and dependable element within Blackstone's extensive credit offerings.

The predictable and steady returns from these liquid credit strategies, operating within a well-established market, firmly place them in the Cash Cow category of the BCG Matrix.

- Consistent Performance: Achieved 9.5% annual gross returns in 2024.

- Stable Income Generation: Contributes reliably to Blackstone's overall revenue.

- Diversified Credit Platform: A fundamental component of the firm's broad credit offerings.

- Mature Market Presence: Benefits from steady, predictable returns in an established sector.

Multi-Asset Investing (BXMA)

Blackstone's Multi-Asset Investing (BXMA) segment is a strong performer within the firm's portfolio, consistently generating net realizations and contributing positively to Blackstone's overall business diversification. This segment is a reliable source of cash flow, underpinning the firm's ability to explore a wide array of investment avenues.

BXMA boasts significant assets under management, with $87.8 billion as of the latest reporting. Steady inflows into this segment highlight its appeal to investors seeking diversified exposure, solidifying its position as a dependable Cash Cow for Blackstone.

- BXMA's AUM: $87.8 billion

- Segment Contribution: Consistent net realizations and reliable cash flow

- Investor Appeal: Diversified exposure and steady inflows

- Strategic Value: Supports firm's diverse business mix and investment opportunities

Blackstone's core private equity funds act as reliable Cash Cows, generating consistent fee-related earnings from a dominant position in a mature market. These funds, a significant component of Blackstone's substantial assets under management, provide stability and predictability.

The Blackstone Real Estate Income Trust (BREIT) exemplifies a Cash Cow with its consistent returns, achieving a cumulative annualized net return of 9.4% since inception by focusing on stabilized real estate assets that generate steady income with minimal capital reinvestment.

Blackstone's perpetual capital vehicles, representing 46% of fee-earning AUM, are key Cash Cows due to their long duration and predictable fee generation, insulating the firm from market volatility and reducing fundraising needs.

Liquid credit strategies, delivering 9.5% annual gross returns in 2024, are stable income generators within Blackstone's credit business, firmly establishing them as Cash Cows in a well-established market.

The Multi-Asset Investing (BXMA) segment, with $87.8 billion in AUM, functions as a Cash Cow by consistently generating net realizations and providing reliable cash flow, supporting the firm's diverse investment strategies.

| Segment | Status | Key Metric | 2024 Data/Status |

|---|---|---|---|

| Core Private Equity Funds | Cash Cow | Fee-related earnings | Dominant, mature market position |

| Blackstone Real Estate Income Trust (BREIT) | Cash Cow | Cumulative annualized net return | 9.4% (since inception) |

| Perpetual Capital Vehicles | Cash Cow | Fee-earning AUM percentage | 46% |

| Liquid Credit Strategies | Cash Cow | Annual gross returns | 9.5% (2024) |

| Multi-Asset Investing (BXMA) | Cash Cow | Assets Under Management (AUM) | $87.8 billion |

What You See Is What You Get

Blackstone BCG Matrix

The comprehensive BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks or placeholder content; you'll gain access to a professionally structured analysis tool ready for immediate strategic application. You can confidently expect the same high-quality, data-driven insights and clear visual representations that are crucial for effective business planning and decision-making.

Dogs

Blackstone's opportunistic real estate, specifically traditional office spaces, encountered significant challenges in 2024, posting a -3.7% gross return for the year. This underperformance highlights the sector's current difficulties.

Despite Blackstone's active acquisition strategy, some older office properties and associated debt instruments, such as those held by BXMT dealing with non-performing loans, have demonstrated volatility and weak results. These specific segments within the real estate portfolio are struggling due to limited growth prospects and prevailing market pressures.

Blackstone, like any major investment firm, constantly reviews its vast portfolio. Older, smaller private equity investments that no longer fit with the firm's current strategic focus or show minimal potential for future expansion might be candidates for sale. These are assets that, while perhaps not losing money, could be holding onto capital that could be deployed more effectively elsewhere, fitting the description of a Dog in the BCG matrix.

Blackstone Mortgage Trust (BXMT) has encountered difficulties, especially with non-performing office loans. This has put pressure on its dividend and highlights regulatory concerns regarding less liquid assets. In 2024, the office sector continued to be a challenging area for real estate debt, with vacancy rates remaining elevated in many major cities.

Small, Fully Matured or Winding Down Funds

Blackstone, managing a diverse portfolio, likely holds several smaller, mature funds nearing the end of their lifecycle. These funds, characterized by limited growth prospects and a shrinking market presence as capital is distributed, align with the 'Dog' category in the BCG Matrix. They represent assets that are no longer strategic growth drivers.

These mature funds, while not necessarily loss-making, have reached a point where their ability to generate significant new returns or spearhead new initiatives is minimal. Their contribution to Blackstone's overall growth is therefore limited, fitting the profile of a 'Dog' which typically requires minimal investment but also offers little upside.

- Limited Growth Potential: Funds in this category have exhausted their primary growth phase and are unlikely to capture substantial new market share.

- Diminishing Market Share: As capital is returned to investors, the fund's overall size and influence in its market segment decrease.

- Low Strategic Importance: These funds do not align with new strategic initiatives or significant capital deployment plans within Blackstone's broader investment strategy.

- Capital Distribution Phase: The focus shifts from growth to the orderly return of capital to limited partners, marking the winding-down process.

Highly Illiquid, Non-Core Assets from Older Portfolios

Within Blackstone's vast portfolio, some older, non-core assets might be highly illiquid. These are assets acquired in past market cycles that no longer align with the firm's current strategic focus. They can be challenging to sell profitably in today's environment.

These types of assets often consume valuable resources without contributing significantly to new growth or market expansion. They represent a category of holdings that require careful management to minimize drag on overall portfolio performance.

- Illiquidity Risk: Difficulty in finding buyers or achieving desired valuations for these assets.

- Resource Drain: Management time and capital allocated to assets with limited upside potential.

- Strategic Misfit: Holdings that do not align with Blackstone's current investment themes or growth objectives.

Within Blackstone's diverse portfolio, certain mature funds or older, non-core assets can be categorized as 'Dogs' in the BCG Matrix. These are investments with limited growth prospects and diminishing market share, often nearing the end of their lifecycle.

These 'Dog' assets, while not necessarily generating losses, typically require minimal new investment and offer little potential for significant future returns. Their strategic importance to Blackstone's current growth objectives is low, and the focus is on orderly capital distribution.

For instance, Blackstone's opportunistic real estate sector, particularly traditional office spaces, experienced a -3.7% gross return in 2024, indicating challenges and limited growth in this segment. Similarly, older private equity investments that no longer align with strategic focus might be candidates for divestment.

Blackstone Mortgage Trust (BXMT) has also faced headwinds, especially with non-performing office loans in 2024, highlighting the difficulties in certain real estate debt segments.

| Category | Characteristics | Blackstone Example (Illustrative) | 2024 Performance Indication |

| Dogs | Low market share, low growth potential | Mature, non-core real estate assets; older, smaller private equity funds nearing end of lifecycle | Office real estate (-3.7% gross return); challenges in specific real estate debt segments (BXMT) |

Question Marks

Blackstone's substantial investment of over $25 billion into Pennsylvania's digital and energy infrastructure is a clear signal of their focus on high-growth markets, particularly those supporting AI expansion. This strategic allocation positions them within a robust infrastructure segment but with a specific, emerging emphasis on AI-driven components.

This dedicated focus on AI infrastructure, while part of the broader infrastructure strength, represents a newer, high-potential area where Blackstone is actively building market share. As such, it fits the profile of a Question Mark within the BCG Matrix, demanding significant capital and strategic investment to cultivate its full growth potential.

Blackstone's introduction of new products like the Private Multi-Asset Credit and Income Fund (BMAX) is a strategic move to tap into the burgeoning private wealth market, offering individual investors a gateway to private credit. This segment is experiencing significant growth, with private credit assets under management projected to reach $2.7 trillion by 2028, up from $1.2 trillion in 2022.

While BMAX represents a high-growth opportunity, it's a relatively new entrant, meaning it currently holds a low market share. This necessitates substantial investment in marketing and driving investor adoption, characteristic of a Question Mark in the BCG matrix. The fund's success hinges on its ability to attract and retain capital in a competitive landscape.

Blackstone's late 2024 launch of a European infrastructure perpetual vehicle places it in the Question Mark quadrant of the BCG Matrix. This new fund offers investors access to Blackstone's robust global infrastructure expertise but targets a new geographic market, requiring it to establish a presence and build significant market share within Europe.

While Blackstone is a powerhouse in infrastructure globally, this specific European perpetual fund is a novel product. Its success hinges on capturing investor interest and demonstrating competitive returns in a region where it's building its footprint. This strategic move into a high-growth sector, albeit in an unfamiliar market for this particular vehicle, defines its Question Mark status.

Blackstone Capital Partners Asia Fund III

Blackstone is actively raising its third private equity fund focused on Asia, Blackstone Capital Partners Asia Fund III, with an ambitious target of $10 billion. This fund represents Blackstone's continued commitment to the region, aiming to capitalize on its significant growth potential.

Asia presents a compelling landscape for private equity, characterized by dynamic economies and expanding markets. However, this particular fund, being a newer vintage, is still in the crucial stages of fundraising and initial deployment.

Its position can be likened to a Question Mark in the BCG Matrix. While the Asian market offers high growth prospects, the fund's developing market share and the need to establish a proven track record relative to established regional competitors place it in this category. Success will hinge on its ability to effectively deploy capital and generate strong returns in this competitive environment.

- Fundraising Target: $10 billion for Blackstone Capital Partners Asia Fund III.

- Market Context: Asia is identified as a high-growth region for private equity.

- Fund Stage: Currently in fundraising and deployment phase.

- BCG Matrix Classification: Positioned as a Question Mark due to high growth market and developing market share.

Early-Stage Growth Equity in Emerging Technologies

Blackstone Growth (BXG) actively seeks out early-stage companies in emerging technologies, aiming to fuel their expansion with Blackstone's extensive resources. These nascent ventures, while holding significant future potential, currently represent a small fraction of BXG's overall portfolio, mirroring the characteristics of a Question Mark in the BCG Matrix.

These early-stage technology investments, such as their reported participation in funding rounds for AI-driven cybersecurity startups in 2024, demand substantial capital infusion and strategic guidance. The objective is to nurture them into market leaders, akin to Stars, or risk them failing to gain traction and becoming Dogs.

- High-Growth Potential: Investments in areas like quantum computing or advanced biotech are targeted for their disruptive capabilities.

- Low Market Share: These companies are in their infancy, yet to capture significant market share in their respective, often nascent, industries.

- Capital Intensive: Significant funding is required for research, development, and market penetration.

- Strategic Importance: BXG's involvement provides not just capital but also operational expertise and network access to accelerate growth.

Blackstone's ventures into new, high-growth markets with unproven market share exemplify the Question Mark category in the BCG Matrix. These initiatives require significant capital and strategic focus to develop into market leaders or be divested.

The firm's investment in emerging technology sectors, like advanced AI infrastructure and early-stage tech startups, highlights this strategy. These areas offer substantial future potential but currently demand substantial investment to build traction and competitive positioning.

Blackstone's approach with these Question Marks involves careful resource allocation to nurture growth and mitigate risks, aiming to transform them into future Stars or Cash Cows.

| Initiative | Market Growth | Market Share | BCG Classification | Strategic Focus |

| AI Infrastructure (PA) | High | Developing | Question Mark | Capital Intensive, Strategic Build-out |

| Private Multi-Asset Credit (BMAX) | High | Low | Question Mark | Marketing & Investor Adoption |

| European Infrastructure Perpetual | High | Low (New Market) | Question Mark | Market Entry & Share Capture |

| Asia Private Equity Fund III | High | Developing | Question Mark | Fundraising & Deployment |

| Early-Stage Tech (BXG) | Very High | Low | Question Mark | R&D, Market Penetration |

BCG Matrix Data Sources

Our BCG Matrix draws from comprehensive market data, including company financial reports, industry growth rates, and competitive landscape analysis to provide actionable strategic insights.