Blackstone Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blackstone Bundle

Blackstone's competitive landscape is shaped by intense rivalry, the bargaining power of buyers and suppliers, and the constant threat of new entrants and substitutes. Understanding these forces is crucial for navigating the complexities of the investment management industry.

Ready to move beyond the basics? Get a full strategic breakdown of Blackstone’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Blackstone's reliance on a specialized talent pool, encompassing investment professionals, dealmakers, and sector experts, means these individuals hold considerable sway. The scarcity of top-tier talent, especially in alternative asset classes, amplifies their bargaining power.

To attract and retain these crucial 'suppliers' of intellectual capital and deal execution, Blackstone must offer highly competitive compensation, including significant carried interest and bonuses. For instance, in 2024, the demand for experienced private equity professionals remained exceptionally high, with compensation packages often exceeding $1 million annually for senior roles.

Suppliers of proprietary deal flow, including investment banks, brokers, and company founders, wield significant influence by controlling access to distinctive investment opportunities. Blackstone's success hinges on securing prime assets before they hit the broader market.

In 2024, the private equity landscape saw continued demand for unique deal sourcing. For instance, the volume of direct deals, often originating from proprietary networks, remained a key differentiator for top-tier firms, underscoring the importance of these supplier relationships.

To counter this supplier power, Blackstone focuses on cultivating robust relationships and a reputation for swift, effective deal execution. This approach ensures a consistent influx of potential acquisitions, mitigating the risk of being outbid or missing out on attractive opportunities.

In leveraged buyouts, debt providers like banks and institutional investors are critical suppliers of capital, influencing Blackstone's deal execution and returns. Their terms for financing, especially in large transactions, directly impact deal feasibility and profitability.

Blackstone's substantial size does grant it some negotiating power with lenders. However, its reliance on external capital means that changes in credit market conditions, such as the Federal Reserve's interest rate hikes throughout 2023 and into early 2024, can significantly bolster the bargaining power of these financial suppliers.

Third-Party Service Providers

Third-party service providers, including legal counsel, accounting firms, and due diligence specialists, are crucial for Blackstone's extensive global operations. While many services are standard, specialized expertise, especially in intricate cross-border deals or unique investment sectors, can grant these providers leverage. For instance, the demand for specialized ESG (Environmental, Social, and Governance) advisory services has been growing, with firms offering deep expertise in this area potentially commanding higher fees.

Blackstone actively cultivates long-term partnerships with its preferred vendors to guarantee consistent quality and operational efficiency. However, dependence on providers with unique, hard-to-replicate capabilities, such as advanced data analytics platforms for real estate valuation or specialized cybersecurity services, can still present a bargaining challenge. In 2024, the global legal services market was valued at over $700 billion, with a significant portion dedicated to corporate transactions and regulatory compliance, highlighting the scale of these essential services.

- Specialized Expertise: Providers with unique skills in areas like international tax law or complex financial structuring can exert greater influence.

- Long-Term Relationships: Blackstone’s strategy of building preferred vendor networks aims to mitigate supplier power through loyalty and volume.

- Market Dynamics: The increasing complexity of global finance and regulation can elevate the bargaining power of niche service providers.

- Cost of Switching: High switching costs associated with onboarding new, specialized service providers reinforce the position of existing ones.

Proprietary Data and Analytics Vendors

The growing dependence on data for making investment choices in alternative assets elevates the importance of suppliers offering market intelligence, alternative data, and sophisticated analytics. Blackstone, for instance, utilizes these platforms for identifying investment opportunities, overseeing portfolios, and managing risks.

Certain data vendors possess significant bargaining power due to the exclusive insights or technological edge they provide. This can compel firms like Blackstone to forge strategic alliances or invest in developing their own in-house data capabilities. The alternative data market, valued at over $10 billion in 2023 and projected to grow significantly by 2025, underscores this trend.

- Market Intelligence: Essential for identifying trends and opportunities in private equity and real estate.

- Alternative Data: Provides unique insights beyond traditional financial statements, crucial for deal sourcing.

- Advanced Analytics: Enables sophisticated portfolio monitoring and risk assessment.

- Vendor Power: Proprietary technology and unique datasets grant vendors leverage.

Blackstone faces significant supplier power from specialized talent, proprietary deal flow sources, and capital providers, all of whom can command premium terms. The firm's strategy to mitigate this involves building strong relationships and demonstrating superior execution capabilities. This is crucial as the demand for niche skills and unique investment opportunities remained high in 2024, impacting operational costs and deal access.

| Supplier Type | Bargaining Power Factors | Blackstone's Mitigation Strategies | 2024 Context/Data |

|---|---|---|---|

| Talent (Investment Professionals) | Scarcity of top-tier talent, specialized expertise | Competitive compensation, carried interest, retention programs | High demand for PE professionals; senior roles often exceed $1M annually. |

| Deal Flow Sources (Investment Banks, Brokers) | Control over proprietary investment opportunities | Cultivating relationships, reputation for swift execution | Continued demand for direct deals from proprietary networks. |

| Capital Providers (Debt Providers) | Influence over financing terms, credit market conditions | Leveraging firm size for negotiation, diversifying capital sources | Fed rate hikes in 2023-2024 increased lender leverage. |

| Data & Analytics Providers | Exclusive insights, technological edge, proprietary data | Strategic alliances, in-house data development | Alternative data market exceeded $10B in 2023. |

What is included in the product

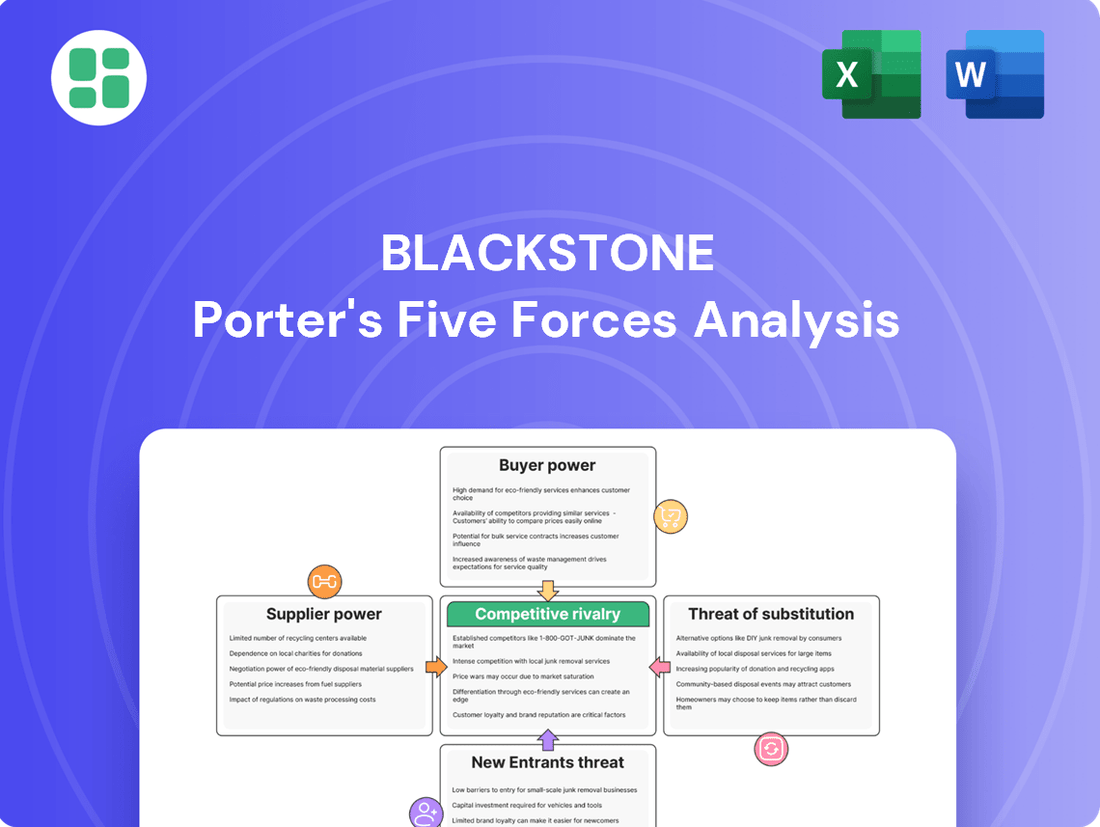

Examines the five competitive forces—threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitutes, and rivalry among existing competitors—to assess Blackstone's industry attractiveness and competitive positioning.

Effortlessly identify and address competitive threats with a dynamic, visual representation of all five forces, allowing for proactive strategy adjustments.

Customers Bargaining Power

Blackstone's primary clients are sophisticated institutional investors, including pension funds, sovereign wealth funds, and endowments. These Limited Partners (LPs) have substantial financial acumen and considerable bargaining leverage due to the large capital commitments they make. For instance, in 2023, Blackstone reported $1.07 trillion in assets under management, with a significant portion coming from these institutional sources.

These LPs conduct rigorous due diligence, expecting not only superior long-term returns but also transparent reporting and favorable terms. Their ability to allocate capital across a global landscape of alternative asset managers means they can exert considerable influence, particularly when assessing fund performance and negotiating management fees.

The bargaining power of customers, particularly Limited Partners (LPs), is significantly shaped by Blackstone's investment performance. Consistently delivering strong returns is crucial for retaining existing capital and attracting new investments. For instance, in 2023, Blackstone reported strong performance across many of its funds, which is a key factor in maintaining LP confidence.

LPs are becoming more discerning, actively seeking out top-performing funds and managers with established track records. This trend intensifies competition among asset managers vying for capital. The ability to demonstrate superior, consistent alpha generation is therefore a critical differentiator in Blackstone's ability to secure and grow its AUM.

Any dip in performance or a prolonged absence of distributions can directly impact Blackstone's future capital allocations, potentially leading to withdrawals. This directly affects the firm's Assets Under Management (AUM) and, consequently, its fee-generating capacity, underscoring the direct link between performance and customer leverage.

Blackstone's investor base is increasingly diverse, moving beyond traditional large institutions to include a growing segment of private wealth clients. This expansion is crucial in managing customer power.

The firm experienced substantial inflows from private wealth channels, reportedly raising billions in both the first and second quarters of 2025. This influx demonstrates a successful broadening of its client reach.

By attracting a wider array of investors, Blackstone lessens its reliance on any single large client or institutional segment. This dilution of dependence effectively diminishes the bargaining power of individual customer groups.

Long-Term Capital Commitments

Blackstone’s management of substantial long-term, illiquid capital, particularly within its private equity and real estate segments, significantly curtails short-term customer power. This structure means that once limited partners (LPs) commit capital to a Blackstone fund, it is typically locked in for a considerable duration, often 10 years or more. This lock-in period severely restricts LPs' ability to demand immediate redemption or exert rapid influence over fund management decisions.

This long-term capital commitment provides Blackstone with a stable and predictable funding base. It grants the firm greater operational flexibility and strategic latitude to pursue its investment strategies, which often require extended timeframes to mature and realize value. For instance, in 2024, Blackstone reported that a significant majority of its assets under management (AUM) were in private markets, underscoring the prevalence of these long-term commitments. This stability allows Blackstone to undertake complex, large-scale transactions that might be unfeasible with more liquid capital structures.

- Long-Term Capital Lock-in: Blackstone’s private equity and real estate funds typically feature capital commitments locked for 10+ years, diminishing immediate customer influence.

- Reduced Short-Term Power: The illiquid nature of committed capital prevents LPs from easily withdrawing funds, thereby limiting their short-term bargaining power.

- Stable Funding Base: Long-term commitments provide Blackstone with predictable capital, enabling strategic deployment over extended investment horizons.

- Strategic Flexibility: This stable funding allows Blackstone to pursue complex, long-duration investments without the pressure of short-term liquidity demands.

Demand for Specific Strategies and Co-investment Opportunities

Customers, particularly large institutional investors, can leverage their capital by demanding access to Blackstone’s specialized strategies like infrastructure or private credit. This demand, coupled with a desire for co-investment opportunities, grants them significant influence over portfolio construction and investment mandates. For instance, in 2024, the demand for ESG-focused investments continued to rise, with many limited partners (LPs) specifically requesting allocations to sustainable infrastructure funds.

Blackstone's ability to cater to these specific demands, such as offering tailored solutions for sovereign wealth funds or providing direct co-investment access in sectors like life sciences, serves as a competitive advantage. However, this also means that these sophisticated investors can effectively negotiate terms and influence the direction of investment strategies, thereby increasing their bargaining power.

- Demand for Niche Strategies: LPs increasingly seek specialized strategies, influencing fund offerings.

- Co-investment Influence: The ability to co-invest gives clients a say in portfolio allocation.

- Evolving LP Priorities: Trends like sustainable and digital infrastructure reflect client-driven shifts.

- Capital as Leverage: Large investors use their capital commitments to negotiate access and terms.

The bargaining power of Blackstone's customers, primarily institutional investors, is moderated by the long-term nature of their capital commitments. While these clients possess significant capital, the illiquid structure of funds, often with 10-year lock-ups, limits their ability to exert immediate pressure or demand rapid redemptions. For example, in 2024, Blackstone's substantial assets in private markets, which are inherently long-term, highlight this structural advantage.

However, sophisticated LPs can still wield influence by demanding access to specialized investment strategies and co-investment opportunities, particularly in areas like ESG-compliant infrastructure, a trend noted in 2024. This selective allocation of capital allows them to negotiate terms and shape portfolio construction, effectively leveraging their investment decisions.

Blackstone's expansion into private wealth channels in 2025, with billions raised, diversifies its client base. This broader investor pool dilutes the power of any single large client group, thereby reducing the overall bargaining leverage of individual customer segments.

| Customer Segment | Capital Lock-in Period | Influence Mechanism | 2024/2025 Trend Impact |

| Institutional Investors (Pension Funds, Sovereign Wealth Funds) | Typically 10+ years | Negotiating terms for specialized strategies, co-investments | Increased demand for ESG, infrastructure |

| Private Wealth Clients | Varies, can be shorter | Growing AUM, potential for diversified leverage | Significant inflows, broadening client base |

Preview the Actual Deliverable

Blackstone Porter's Five Forces Analysis

This preview shows the exact, professionally written Blackstone Porter's Five Forces Analysis you'll receive immediately after purchase, providing a comprehensive overview of the competitive landscape. You're looking at the actual document, detailing each force—threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors—ready for your strategic planning. Once you complete your purchase, you’ll get instant access to this exact file, fully formatted and ready to inform your decision-making.

Rivalry Among Competitors

The alternative asset management industry is a battleground for titans, with firms like Brookfield, Apollo, KKR, and Carlyle constantly vying for the same pools of capital from institutional investors and increasingly, individual investors. This intense rivalry means these giants offer very similar products, making it a fierce competition for securing new mandates, sourcing attractive deals, and attracting top-tier talent.

Blackstone, as the undisputed leader with over $1.2 trillion in assets under management by the second quarter of 2025, possesses significant scale advantages. However, even this immense size doesn't insulate it from the persistent and vigorous competition from its well-established peers who are equally aggressive in pursuing growth and market share.

The competition for prime assets is fierce, with firms holding vast amounts of uninvested capital, often called dry powder, vying for the best deals. This intense rivalry can inflate prices, particularly in sought-after industries like tech and healthcare, potentially squeezing future profits. For instance, in 2023, private equity firms globally raised over $1.2 trillion in new capital, a significant portion of which was aimed at acquiring high-quality assets.

The alternative asset management sector is intensely reliant on human capital, leading to a fierce competition for skilled investment professionals, deal originators, and portfolio managers. This constant battle for talent significantly influences operating costs as firms must offer attractive compensation and performance-based incentives to retain their best people, with poaching being a common strategy among rivals.

Blackstone's robust company culture and extensive global reach are crucial differentiators in this ongoing talent war, helping them to attract and retain top-tier professionals in a highly competitive landscape.

Reputation and Track Record as Key Differentiators

In the intensely competitive landscape of alternative asset management, Blackstone's formidable reputation and proven track record serve as crucial differentiators. Their history of consistently delivering strong returns, even through market cycles, builds significant trust with Limited Partners (LPs), making them a preferred choice for capital allocation.

This established credibility directly impacts their ability to attract and retain capital, a vital component for growth and continued success. For instance, in 2023, Blackstone's real estate funds continued to draw significant investor interest, underscoring the market's confidence in their management capabilities.

- Reputation as a competitive moat: Blackstone's long-standing history of strong performance and ethical business practices provides a significant advantage.

- Investor confidence: A track record of compelling returns is essential for attracting capital from sophisticated LPs.

- Risk of reputational damage: Any perceived failure or underperformance can quickly erode trust and benefit competitors seeking new commitments.

Innovation in Product Offerings and Distribution Channels

Competitive rivalry in the alternative asset management industry is intensely driven by innovation in both product offerings and distribution channels. Firms are continuously developing novel fund structures and investment strategies to attract capital, while also expanding their reach into areas like private wealth management.

Blackstone, for instance, has seen substantial inflows from the private wealth sector and has launched new infrastructure vehicles, demonstrating a commitment to adapting its offerings. This dynamic means that companies failing to innovate risk losing market share to more agile competitors who can better meet evolving investor demands.

- Product Innovation: Development of new fund structures (e.g., credit, real estate, infrastructure) and investment strategies.

- Distribution Channel Expansion: Increased focus on reaching retail and high-net-worth individuals through private wealth channels.

- Blackstone's Activity: Significant inflows from private wealth and launches of new infrastructure vehicles highlight this trend.

- Market Share Risk: Companies that do not innovate risk losing ground to more adaptive competitors.

The competitive rivalry within alternative asset management is fierce, with major players like Brookfield, Apollo, and KKR constantly vying for capital and deals. This intense competition means firms must constantly innovate in product offerings and distribution, as seen with Blackstone's expansion into private wealth and new infrastructure vehicles. Failing to adapt risks losing market share to more agile competitors.

The battle for talent is equally intense, driving up operating costs as firms offer attractive compensation and incentives to secure skilled investment professionals. Blackstone's strong culture and global reach are key advantages in this war for talent, helping them retain top performers.

| Competitor | AUM (Approx. Q2 2025, USD Trillions) | Key Competitive Actions |

|---|---|---|

| Blackstone | $1.2+ | Scale advantage, strong reputation, private wealth expansion, infrastructure vehicles |

| Brookfield | ~$1.0 | Diversified asset classes, significant dry powder |

| Apollo | ~$650 Billion | Focus on credit and hybrid strategies, opportunistic deal-making |

| KKR | ~$570 Billion | Global expansion, sector specialization, growing credit platform |

SSubstitutes Threaten

Large institutional investors, including sovereign wealth funds and pension funds, are increasingly developing in-house expertise to invest directly in private companies and real assets. This trend, evident in the growing direct investment allocations by entities like Norway's Government Pension Fund Global, which manages trillions in assets, allows them to bypass external management fees and potentially enhance returns.

This direct investing capability acts as a significant threat of substitutes for firms like Blackstone, as institutions can internalize functions previously outsourced to alternative asset managers. For instance, a significant portion of the $8.2 trillion managed by US public pension funds in 2024 could be redirected to direct strategies.

Investors have a readily available alternative in publicly traded securities and traditional asset classes like stocks and bonds. These markets offer significant liquidity and typically come with lower management fees than many alternative investments. For instance, the average expense ratio for ETFs in 2024 remained competitive, often below 0.20%, making them an attractive option for cost-conscious investors.

While alternative investments, such as those managed by Blackstone, aim for diversification and potentially higher returns, a strong performance or increased liquidity in public markets can easily pull capital away. For example, if the S&P 500 delivers a robust 15% return in a given year, investors might reallocate funds from less liquid private equity or real estate funds back to equities.

However, the landscape is shifting. In the face of macroeconomic volatility, such as the interest rate hikes and inflation concerns seen in 2023 and continuing into 2024, alternative assets are gaining traction for their perceived portfolio resilience. Many investors are recognizing that while public markets can be more volatile, alternatives may offer a smoother ride and uncorrelated returns, a factor that is increasingly valued.

Large institutional investors, such as pension funds and endowments, are increasingly exploring the development of in-house asset management capabilities. This trend directly substitutes the need for external managers like Blackstone for specific investment strategies, particularly within the alternative asset space. For example, a significant portion of the $8.5 trillion in US pension fund assets could potentially be managed internally, reducing reliance on third-party providers.

While establishing these internal teams requires substantial investment in talent, technology, and infrastructure, it offers institutional investors greater control over their portfolios and a more direct alignment of interests. This strategic shift can lead to reduced management fees and a more tailored approach to asset allocation, posing a competitive threat to external asset managers.

Alternative Investment Products with Lower Barriers to Entry

The threat of substitutes is amplified by the increasing availability of alternative investment products that lower the entry barriers for a wider range of investors. Semi-liquid or evergreen funds, interval funds, and other democratized alternatives now provide accessible substitutes for traditional private equity. These vehicles typically feature reduced investment minimums and offer a degree of liquidity, making them attractive to a broader investor demographic.

Blackstone itself has recognized this trend and launched products like Blackstone Real Estate Income Trust (BREIT) to capture this expanding market. This strategic move by Blackstone highlights the competitive pressure from these more accessible alternative investment structures.

These democratized products directly compete with traditional private equity by offering:

- Lower Investment Minimums: Making private market exposure accessible to a wider investor base, unlike the high minimums of traditional funds.

- Increased Liquidity Options: Providing investors with more frequent redemption opportunities compared to the lock-up periods common in traditional private equity.

- Diversified Access to Alternatives: Allowing retail and smaller institutional investors to gain exposure to asset classes previously dominated by large institutions.

Passive Investment Strategies and Index Funds

Passive investment strategies, particularly index funds, present a significant threat of substitution for traditional active management, including certain alternative investment vehicles. These strategies offer broad market exposure at a substantially lower cost, making them an attractive alternative for investors prioritizing simplicity and expense ratios.

For instance, in 2024, the average expense ratio for passive equity index funds remained remarkably low, often below 0.10%, while actively managed funds typically charged considerably more. This cost differential is a primary driver for investors considering passive options, especially when public markets are performing well and the perceived value of active stock selection diminishes.

- Low Cost: In 2024, the average expense ratio for passive equity index funds was significantly lower than actively managed funds, often under 0.10%.

- Broad Market Exposure: Index funds provide diversification across entire market segments, replicating benchmark indices like the S&P 500.

- Simplicity: The straightforward nature of passive investing appeals to a wide range of investors, reducing the complexity often associated with active management.

- Performance: During periods of strong public market performance, index funds have often outperformed a majority of actively managed funds after fees.

The threat of substitutes for Blackstone arises from institutional investors developing in-house asset management capabilities, allowing them to bypass external managers and potentially reduce fees. For example, a significant portion of the $8.5 trillion in US pension fund assets in 2024 could be managed internally, directly impacting Blackstone's business model.

Publicly traded securities and traditional asset classes like stocks and bonds offer a readily available and often lower-cost substitute. With ETFs in 2024 maintaining competitive expense ratios below 0.20%, these liquid markets become highly attractive, especially when public markets deliver strong returns, potentially drawing capital away from less liquid alternatives.

The rise of democratized alternative investment products, such as semi-liquid or evergreen funds, lowers entry barriers and offers increased liquidity compared to traditional private equity, directly competing with Blackstone's offerings.

Passive investment strategies, with their low costs and broad market exposure, also serve as a significant substitute, particularly when public markets perform well, diminishing the perceived value of active management and alternative investments.

| Substitute Type | Key Characteristics | 2024 Data/Example |

|---|---|---|

| In-house Asset Management | Reduced fees, greater control, direct alignment of interests | Potential for US pension funds ($8.5T AUM) to manage assets internally |

| Publicly Traded Securities (ETFs) | High liquidity, lower expense ratios | Average ETF expense ratios below 0.20% |

| Democratized Alternatives | Lower minimums, increased liquidity, broader access | Accessible structures competing with traditional private equity |

| Passive Investment Strategies | Low cost, broad market exposure, simplicity | Index fund expense ratios often under 0.10% |

Entrants Threaten

The alternative asset management industry, especially for a firm of Blackstone's size, demands vast amounts of capital. This isn't just for setting up and running funds, but also for investing alongside their limited partners. New players find it incredibly difficult to gather this substantial capital, particularly from sophisticated institutional investors who favor managers with a history of success. In 2024, raising funds for standard pooled investment vehicles has proven to be a significant obstacle for emerging funds.

A significant hurdle for new entrants is the requirement for a well-established history of delivering strong returns through different economic conditions. Investors typically seek out firms with a proven ability to generate value and effectively manage risk, making it challenging for newcomers to secure capital.

Established firms like Blackstone benefit immensely from this need for a proven track record. For instance, in 2023, Blackstone reported total assets under management of $1.07 trillion, showcasing the scale and trust built over decades. New entrants simply cannot replicate this level of demonstrated success and investor confidence overnight.

The alternative asset management industry faces significant regulatory hurdles. New entrants must grapple with complex compliance requirements that differ across jurisdictions and asset types, demanding substantial investment in legal expertise and infrastructure. For instance, the Dodd-Frank Act in the United States and similar regulations globally impose stringent reporting and operational standards.

These intricate legal frameworks translate into considerable costs for new players. Navigating rules around investor protection, capital requirements, and operational procedures can easily run into millions of dollars in setup and ongoing compliance expenses. This financial burden acts as a substantial deterrent to potential entrants.

Furthermore, the regulatory landscape is constantly shifting. Anticipated reforms aimed at enhancing transparency and investor safeguards, such as those discussed by the SEC in 2024 regarding private fund disclosures, introduce ongoing uncertainty and necessitate continuous adaptation, further raising the barrier to entry.

Access to Proprietary Deal Flow and Industry Networks

New entrants often struggle with accessing proprietary deal flow, a critical advantage for established firms like Blackstone. Building the deep industry networks and trusted relationships necessary to uncover these exclusive investment opportunities takes considerable time and effort, often spanning decades.

For instance, private equity firms rely heavily on their established connections with investment bankers, lawyers, and corporate executives to gain early access to potential deals. A study by Preqin in 2023 revealed that over 70% of private equity deals are sourced through these proprietary networks, highlighting the significant barrier to entry for newcomers.

Blackstone, with its extensive history and global reach, has cultivated a formidable network that provides a consistent pipeline of high-quality, off-market investment prospects. This inherent advantage makes it exceptionally difficult for new entrants to compete effectively on deal sourcing alone.

- Proprietary Deal Flow: Access to exclusive investment opportunities not available on the open market.

- Industry Networks: Established relationships with management teams, brokers, and advisors.

- Time to Cultivate: Years, often decades, are required to build these crucial connections.

- Competitive Disadvantage: New entrants lack the established networks needed to identify and secure deals.

Talent Acquisition and Retention Challenges

New entrants face significant hurdles in attracting and keeping top investment talent, essential for sourcing deals, conducting due diligence, and managing portfolios effectively. Established players like Blackstone leverage their strong brand, attractive compensation packages, and clear career paths to draw in and hold onto skilled professionals. This makes it tough for newer firms to assemble a competitive team capable of matching the expertise and experience of incumbents.

The competition for talent is fierce, with specialized skills in areas like private equity, real estate, and credit commanding premium salaries and bonuses. For instance, in 2024, average compensation for private equity associates in major financial hubs often exceeded $200,000 annually, with significant performance-based incentives. This high cost of talent acquisition can be a substantial barrier for firms just starting out.

- Talent Drain: Established firms can offer retention bonuses and equity stakes, making it difficult for new entrants to lure away experienced professionals.

- Brand Recognition: Blackstone’s reputation as a leading alternative asset manager provides a significant advantage in attracting candidates who seek prestige and proven success.

- Training and Development: New firms may lack the resources for extensive training programs, which are often a key draw for ambitious junior professionals looking to build their careers.

- Limited Deal Flow: Without a track record of successful deals, new entrants struggle to offer the same level of exciting opportunities that attract high-caliber talent.

The threat of new entrants into the alternative asset management space, particularly for a firm like Blackstone, is considerably low. This is due to the immense capital requirements, the necessity of a proven track record, stringent regulatory hurdles, and the difficulty in replicating established proprietary deal flow and talent acquisition. These factors collectively create substantial barriers, making it exceptionally challenging for newcomers to compete effectively.

| Barrier | Description | Impact on New Entrants | Example Data (2023-2024) |

|---|---|---|---|

| Capital Requirements | Vast sums needed for operations and co-investment. | Difficult to raise sufficient capital from sophisticated investors. | Raising funds for standard vehicles proved a significant obstacle for emerging funds in 2024. |

| Proven Track Record | Demonstrated ability to generate strong returns. | Investors favor established managers with a history of success. | Blackstone's $1.07 trillion AUM in 2023 highlights decades of trust and performance. |

| Regulatory Hurdles | Complex compliance across jurisdictions and asset types. | Requires significant investment in legal expertise and infrastructure. | Dodd-Frank Act and evolving SEC private fund disclosure rules in 2024 add ongoing costs and uncertainty. |

| Proprietary Deal Flow | Access to exclusive investment opportunities through networks. | New entrants lack the deep industry relationships to source deals. | Over 70% of PE deals sourced through proprietary networks (Preqin, 2023). |

| Talent Acquisition | Attracting and retaining top investment professionals. | High compensation demands and competition from established brands. | 2024 PE associate compensation exceeding $200k in major hubs, plus performance incentives. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages proprietary market research, financial statements from public companies, and industry expert interviews to provide a comprehensive view of competitive pressures.