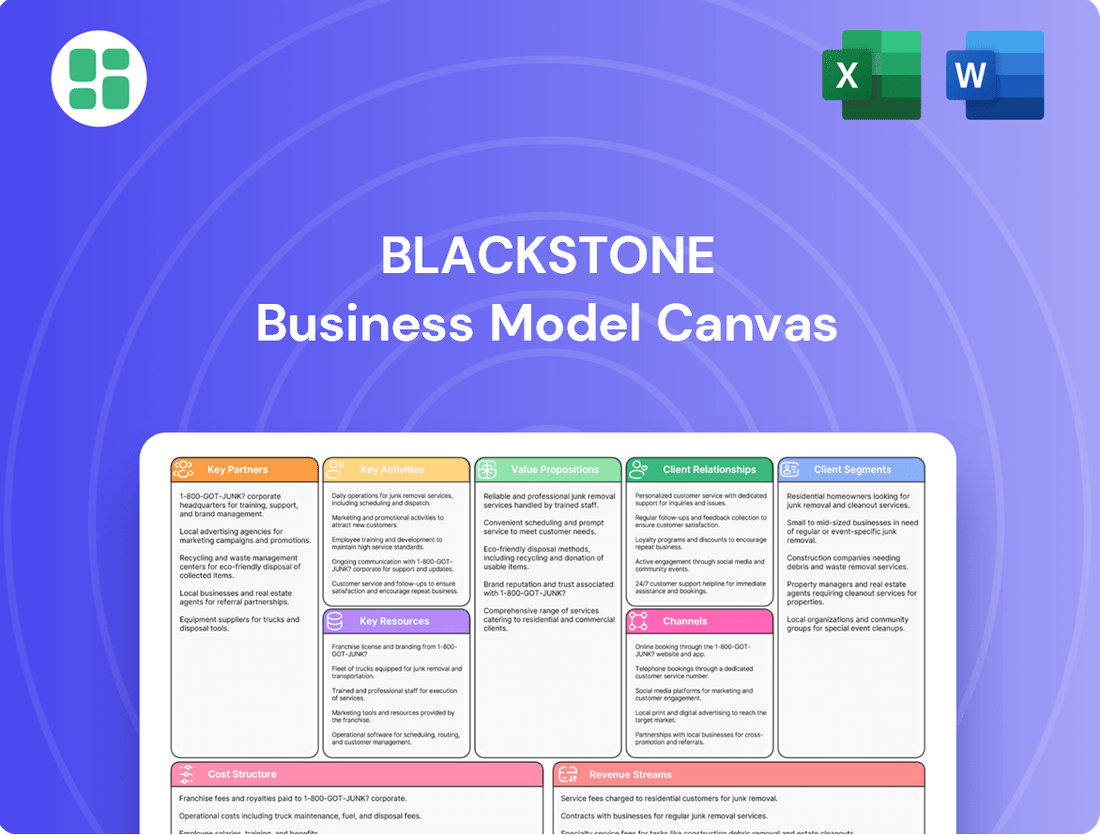

Blackstone Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blackstone Bundle

Curious about the strategic engine driving Blackstone's success? Our comprehensive Business Model Canvas breaks down their key partners, revenue streams, and cost structures, offering a clear roadmap to their market dominance. Discover the actionable insights that fuel their growth and gain a competitive edge by downloading the full, professionally analyzed canvas today.

Partnerships

Blackstone frequently teams up with other institutional investors, sovereign wealth funds, and wealthy individuals for significant deals. This pooling of capital helps manage risk and tap into combined knowledge, enabling larger transactions and shared opportunities across different investment types. For instance, in 2024, Blackstone's real estate funds often brought in co-investors to support major property acquisitions, spreading the investment load.

Blackstone's management teams are instrumental in value creation post-acquisition. These collaborations focus on executing strategic plans and driving operational enhancements within portfolio companies, a core element of Blackstone's investment strategy.

In 2024, Blackstone continued to leverage its extensive network of industry experts and operational specialists to support these management teams. This hands-on approach aims to accelerate growth and improve profitability, as evidenced by the successful turnaround of several key investments.

Blackstone cultivates deep relationships with a wide array of financial institutions and lenders, including major global banks, specialized debt funds, and insurance companies. These partnerships are crucial for Blackstone's ability to secure the significant leverage required to execute its large-scale acquisitions and real estate investments. For instance, in 2024, Blackstone secured substantial debt financing from a syndicate of banks for several major transactions, demonstrating the ongoing importance of these relationships in managing its capital structure and facilitating deal flow.

Advisory Firms and Consultants

Blackstone relies heavily on a network of external advisory firms and consultants to bolster its investment strategies. These partnerships are crucial for in-depth due diligence, ensuring compliance with intricate legal and tax frameworks, and enhancing the operational efficiency of portfolio companies. For instance, in 2023, Blackstone engaged with numerous specialized firms to navigate the complexities of its real estate acquisitions and private equity deals, leveraging their expertise to mitigate risks and identify value-creation opportunities.

These external experts provide specialized knowledge that Blackstone might not possess internally, covering areas such as environmental, social, and governance (ESG) compliance, cybersecurity, and specific industry regulations. This allows Blackstone to make more informed decisions, especially when entering new markets or sectors. The firm’s ability to tap into this broad pool of talent is a significant competitive advantage.

Key partnerships include:

- Legal Counsel: Firms specializing in corporate law, M&A, and regulatory compliance to structure deals and ensure legal soundness.

- Tax Advisors: Experts in international and domestic tax law to optimize tax structures for investments and portfolio companies.

- Financial Auditors: Independent firms to verify financial statements and provide assurance on the financial health of target companies.

- Operational Consultants: Specialists in areas like supply chain management, digital transformation, and human capital to drive performance improvements post-acquisition.

Placement Agents and Distribution Networks

Blackstone strategically utilizes placement agents and its vast global distribution network to facilitate capital raising. These partnerships are crucial for accessing a diverse pool of potential limited partners, ensuring efficient fundraising for new investment vehicles and broadening its investor reach.

In 2024, Blackstone continued to rely on these channels to secure significant capital commitments. For instance, its real estate funds, a major area of fundraising, often benefit from the specialized expertise and established relationships that placement agents provide. These agents help navigate complex investor landscapes and tailor fundraising approaches to specific markets and investor types.

The firm’s extensive network of existing investors, alongside relationships cultivated through placement agents, allows for effective communication and engagement with a wide array of institutional investors, including pension funds, sovereign wealth funds, and endowments. This dual approach is fundamental to Blackstone's ability to consistently deploy capital across its various strategies.

- Placement Agents: Specialized firms that assist in marketing and selling investment funds to institutional investors.

- Distribution Network: Blackstone's internal sales and investor relations teams, along with existing LP relationships, used to market funds.

- Global Reach: Partnerships enable Blackstone to tap into capital sources across North America, Europe, Asia, and other key regions.

- Fundraising Efficiency: These relationships streamline the process of reaching target investors and securing capital commitments for new funds.

Blackstone's key partnerships are vital for sourcing deals, managing risk, and raising capital. These include co-investors like other institutional investors and sovereign wealth funds, which were particularly active in Blackstone's 2024 real estate deals, spreading investment burdens. The firm also relies heavily on financial institutions and lenders for the significant leverage needed for its large-scale transactions, securing substantial debt financing in 2024.

Furthermore, Blackstone collaborates with external advisors and consultants for due diligence, legal, and tax expertise, as seen in its 2023 real estate and private equity dealings. These partnerships provide specialized knowledge, enhancing decision-making in new markets. Placement agents and its distribution network are also crucial for capital raising, effectively tapping into global investor pools for funds launched in 2024.

| Partner Type | Role | 2024 Activity Example |

|---|---|---|

| Institutional Investors/Sovereign Wealth Funds | Co-investment, Capital Raising | Participated in major real estate acquisitions, sharing risk and capital deployment. |

| Financial Institutions/Lenders | Debt Financing | Provided substantial leverage for large-scale acquisitions and investments. |

| Legal & Tax Advisors | Deal Structuring, Compliance | Ensured legal soundness and optimized tax structures for complex transactions. |

| Placement Agents | Fundraising, Investor Relations | Facilitated capital raising for new investment vehicles by accessing diverse investor bases. |

What is included in the product

A comprehensive, pre-written business model tailored to Blackstone's strategy, detailing customer segments, channels, and value propositions.

Organized into 9 classic BMC blocks with full narrative and insights, reflecting real-world operations and plans for informed decision-making.

The Blackstone Business Model Canvas efficiently identifies and addresses key business challenges by offering a structured, visual framework for strategic analysis.

Activities

Blackstone's key activities center on its ability to consistently raise substantial capital from a diverse investor base, including pension funds, sovereign wealth funds, and high-net-worth individuals. This fundraising is crucial for fueling its investment strategies across various asset classes.

The firm then meticulously deploys this raised capital into a wide array of investment opportunities, from real estate and private equity to credit and hedge fund solutions. Managing investor relations and the intricate subscription processes are vital components of this cycle, ensuring smooth capital allocation.

In the first half of 2025, Blackstone reported significant capital inflows, demonstrating continued investor confidence and the effectiveness of its fundraising and deployment machinery. For instance, the firm announced record inflows in Q1 2025, exceeding expectations and setting a strong foundation for capital deployment throughout the year.

Blackstone actively scouts for promising investment opportunities across real estate, private equity, credit, and hedge fund solutions. In 2024, the firm continued to deploy significant capital, with its real estate segment alone seeing substantial activity, including major industrial and logistics portfolio acquisitions.

The core of this activity involves deep dives into potential deals. This rigorous due diligence encompasses detailed financial modeling, legal reviews, operational assessments, and thorough market trend analysis to ensure each investment aligns with Blackstone's risk-return objectives.

Post-acquisition, Blackstone actively manages its portfolio companies and assets, focusing on operational efficiency and growth strategies to boost long-term value. This includes strategic oversight, implementing operational improvements, and making key capital expenditure decisions.

In 2023, Blackstone's real estate segment, a significant part of its portfolio, saw strong performance, with its BREP XI fund reportedly raising over $30 billion, demonstrating continued investor confidence in their value creation capabilities.

Exit Strategy Planning and Execution

Blackstone's key activities include meticulously developing and executing optimal exit strategies for its portfolio companies. This is crucial for realizing substantial returns for its investors.

This involves preparing businesses for sale through strategic repositioning, managing complex Initial Public Offering (IPO) processes, or pursuing other lucrative liquidity events. The private equity industry anticipates a significant surge in exits, with expectations of doubling the number of private equity exits by 2025, underscoring the importance of this activity.

- Strategic Preparation: Companies are groomed for sale by optimizing operations and financial performance.

- IPO Management: Blackstone guides companies through the intricate process of going public.

- Liquidity Event Execution: Pursuing mergers, acquisitions, or secondary buyouts to provide returns.

- Market Timing: Identifying opportune moments in the market to maximize exit valuations.

Risk Management and Compliance

Blackstone’s risk management is central to its operations, focusing on identifying, assessing, and mitigating financial, operational, and regulatory risks across its diverse global portfolios. This proactive approach ensures the stability and integrity of its investments and business practices.

Compliance is non-negotiable in the heavily regulated financial sector. Blackstone adheres to stringent compliance standards to navigate complex legal and regulatory landscapes worldwide, safeguarding its reputation and stakeholder interests.

- Robust Frameworks: Blackstone employs sophisticated risk management frameworks, continually updated to address evolving market dynamics and potential threats.

- Regulatory Adherence: The firm prioritizes strict compliance with all applicable laws and regulations, a critical component of its global operations.

- Mitigation Strategies: Key activities include stress testing portfolios, implementing internal controls, and continuously monitoring for emerging risks, such as those related to cybersecurity and geopolitical instability.

- 2024 Focus: In 2024, a significant emphasis remains on managing inflation-related risks, interest rate volatility, and the ongoing integration of ESG (Environmental, Social, and Governance) factors into risk assessments.

Blackstone's key activities revolve around raising capital, deploying it into diverse investments, and actively managing those assets to generate returns. This includes rigorous due diligence, operational improvements, and strategic exit planning.

The firm's success hinges on its ability to identify and capitalize on market opportunities, execute complex transactions, and maintain strong investor relationships, all while navigating a dynamic global regulatory environment.

In 2024, Blackstone continued its robust deployment of capital, particularly in real estate and private equity, with a focus on sectors poised for growth. The firm's commitment to operational value creation remained a cornerstone of its strategy.

Blackstone's risk management and compliance are paramount, ensuring adherence to global regulations and mitigating potential threats across its vast portfolio. This proactive approach underpins its long-term stability.

What You See Is What You Get

Business Model Canvas

The Business Model Canvas preview you are viewing is not a mockup; it is an exact representation of the document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this complete, ready-to-use Business Model Canvas, allowing you to start strategizing right away.

Resources

Blackstone's vast Assets Under Management (AUM), which surpassed $1.2 trillion by the second quarter of 2025, is its most critical financial resource. This substantial capital base fuels its diverse alternative investment strategies, enabling the firm to execute significant transactions across private equity, real estate, credit, and hedge fund solutions.

Blackstone's human capital is its most vital asset, comprising seasoned investment professionals, operational specialists, and client relationship managers. These individuals possess extensive industry knowledge and proven deal-making capabilities, forming the bedrock of the firm's success.

The firm's competitive edge is significantly bolstered by the deep operational insights and strategic acumen of its experts. This collective expertise allows Blackstone to identify, execute, and enhance value across its diverse portfolio of investments.

As of early 2024, Blackstone employed over 4,000 professionals globally, with a significant portion dedicated to investment and portfolio management roles. This deep bench of talent is crucial for navigating complex markets and delivering superior returns.

Blackstone’s robust global brand and a history of delivering exceptional investor returns are critical assets. This strong reputation acts as a magnet, drawing in capital from limited partners and generating a steady stream of proprietary investment opportunities, solidifying its dominant market position.

In 2024, Blackstone's commitment to its brand and track record continued to pay dividends. The firm successfully raised significant capital across its various funds, demonstrating the enduring trust investors place in its ability to generate alpha. This consistent performance underpins its ability to secure prime deal flow, often ahead of competitors.

Global Network and Relationships

Blackstone's global network is a powerhouse, connecting them with top corporate executives, entrepreneurs, and financial advisors across the globe. This extensive web of relationships is key to their success, providing access to unique investment opportunities before they hit the open market.

This network isn't just about finding deals; it's a vital source of proprietary market intelligence. By staying closely connected with industry leaders, Blackstone gains insights that give them a significant edge in evaluating potential investments and understanding market trends. For instance, their relationships often facilitate early access to information that can inform their valuation models and strategic decisions.

- Proprietary Deal Flow: Access to off-market opportunities sourced through deep industry connections.

- Market Intelligence: Real-time insights from a vast network of global leaders.

- Competitive Differentiator: The breadth and depth of these relationships set Blackstone apart in a crowded market.

- Strategic Partnerships: Cultivating long-term relationships that can lead to co-investment and advisory roles.

Proprietary Data and Analytical Tools

Blackstone leverages its extensive proprietary data sets and sophisticated analytical platforms to gain a competitive edge. This access allows for deep dives into market dynamics, enabling the identification of nascent investment opportunities and potential risks. The firm’s commitment to technology underscores its strategy for informed decision-making.

In 2023, Blackstone reported significant investments in data and technology, recognizing their critical role in optimizing portfolio performance. Their advanced analytical tools are designed to process vast amounts of information, translating raw data into actionable investment insights. This technological infrastructure is a cornerstone of their operational efficiency.

- Vast Data Access: Blackstone consolidates market data from diverse global sources, feeding into its analytical engines.

- Proprietary Research: The firm conducts in-depth, proprietary research that complements publicly available information.

- Advanced Analytics: Sophisticated algorithms and AI-driven tools are employed to identify trends and forecast market movements.

- Performance Optimization: These resources are crucial for actively managing and enhancing the performance of their extensive investment portfolios.

Blackstone's key resources are its substantial Assets Under Management (AUM), exceeding $1.2 trillion by Q2 2025, which provides the capital for its diverse investment strategies. Its human capital, comprising over 4,000 global professionals as of early 2024, offers deep industry knowledge and deal-making expertise. The firm's strong global brand and a proven track record of delivering exceptional returns are critical for attracting capital and deal flow.

Blackstone's extensive global network provides access to proprietary deal flow and market intelligence, acting as a significant competitive differentiator. The firm also leverages vast proprietary data sets and advanced analytical platforms to identify investment opportunities and manage risk, with significant technology investments made in 2023 to optimize portfolio performance.

| Resource Category | Description | Impact/Benefit |

|---|---|---|

| Financial Capital | AUM exceeding $1.2 trillion (Q2 2025) | Fuels diverse alternative investment strategies and large-scale transactions. |

| Human Capital | Over 4,000 global professionals (early 2024) | Provides industry knowledge, deal-making expertise, and operational insights. |

| Brand & Reputation | History of exceptional investor returns | Attracts capital and proprietary investment opportunities. |

| Global Network | Connections with industry leaders | Sources off-market deals and provides real-time market intelligence. |

| Data & Technology | Proprietary data sets and advanced analytics | Enables identification of opportunities, risk management, and performance optimization. |

Value Propositions

Blackstone provides investors with entry into private equity, real estate, credit, and hedge fund strategies typically unavailable in public markets. This access is a core value proposition, offering diversification beyond stocks and bonds.

For instance, Blackstone's real estate funds have consistently performed, with their BREP VIII fund reportedly raising over $14 billion by early 2024, demonstrating significant investor appetite for these exclusive asset classes.

This allows investors to tap into unique growth opportunities and potentially enhance portfolio returns by accessing sectors and companies not readily available through traditional investment vehicles.

Blackstone's core promise to investors is delivering superior risk-adjusted returns. This is accomplished through a disciplined approach of active management and strategic improvements across its diverse portfolio. For example, the firm reported robust Q1 and Q2 2025 performance, showcasing its capability to enhance asset value and generate attractive long-term outcomes.

Blackstone's value proposition hinges on its profound expertise and extensive industry knowledge, allowing investors access to sophisticated investment management capabilities. The firm leverages specialized teams with global insights across diverse sectors and geographies.

Diversification and Portfolio Optimization

Blackstone offers large institutions and sophisticated investors a crucial avenue for diversification beyond traditional stocks and bonds. By providing access to alternative investments, they help clients reduce overall portfolio volatility and potentially boost long-term returns.

This strategy is particularly valuable in today's market. For instance, in 2024, many traditional markets experienced significant fluctuations. Blackstone's alternative strategies, such as private equity and real estate, often exhibit lower correlation to public markets, offering a stabilizing effect.

- Reduced Volatility: Access to asset classes like infrastructure and private credit can dampen portfolio swings.

- Enhanced Returns: Historically, alternative investments have offered attractive risk-adjusted returns.

- Access to Illiquid Opportunities: Blackstone provides entry into markets not readily available to all investors.

Capital Solutions and Strategic Partnership

Blackstone provides businesses with more than just capital; they offer a strategic partnership designed to foster growth. This involves leveraging their deep operational expertise and extensive global network to actively support portfolio companies.

Their approach goes beyond traditional financing, positioning Blackstone as a value-add partner. For instance, in 2024, Blackstone’s private equity segment deployed significant capital across various sectors, often alongside management teams focused on long-term value creation.

This partnership model is exemplified by their commitment to operational improvements and strategic guidance. Companies benefit from Blackstone’s insights into market trends and access to resources that accelerate expansion and enhance profitability.

- Capital Infusion: Providing substantial funding to fuel growth and strategic initiatives.

- Operational Expertise: Sharing management best practices and driving efficiency improvements.

- Network Access: Connecting businesses with industry leaders, potential customers, and strategic alliances.

- Long-Term Vision: Aligning incentives and strategies for sustained success and value creation.

Blackstone's value proposition centers on providing unparalleled access to exclusive alternative investment strategies, including private equity, real estate, and credit, which are typically out of reach for most investors. This curated access allows for significant portfolio diversification and the potential for enhanced risk-adjusted returns by tapping into unique growth opportunities.

The firm's deep operational expertise and extensive global network are leveraged to actively support portfolio companies, offering more than just capital. This strategic partnership model drives operational improvements, accelerates expansion, and enhances profitability for businesses.

Blackstone's commitment to delivering superior returns is underpinned by its disciplined, active management approach across a diverse range of assets. This focus on long-term value creation and strategic enhancements is a key draw for sophisticated investors seeking to optimize their portfolios.

| Value Proposition | Description | Supporting Fact/Data |

| Exclusive Investment Access | Entry into private equity, real estate, credit, and hedge fund strategies not available in public markets. | Blackstone's BREP VIII fund raised over $14 billion by early 2024. |

| Superior Risk-Adjusted Returns | Active management and strategic improvements to enhance asset value and generate long-term outcomes. | Reported robust Q1 and Q2 2025 performance across its diverse portfolio. |

| Strategic Business Partnership | Capital infusion, operational expertise, network access, and a long-term vision for portfolio companies. | Significant capital deployment in 2024 across various sectors via its private equity segment. |

Customer Relationships

Blackstone prioritizes building enduring connections with its limited partners, fostering trust through unwavering transparency and a proven track record of delivering consistent returns. This commitment is evident in their proactive engagement, ensuring investors' goals are understood and met throughout multi-year investment horizons.

Blackstone’s commitment to its investors is evident in its dedicated investor relations and client service functions. These teams offer personalized attention, ensuring timely responses to inquiries and fostering continuous dialogue. For instance, in 2024, Blackstone reported a significant portion of its assets under management came from institutional investors, highlighting the importance of maintaining strong relationships through proactive communication and tailored support.

Blackstone prioritizes regular, detailed performance reporting and transparent communication regarding fund activities, portfolio company progress, and market outlook. This commitment ensures investors remain informed about their holdings and fosters trust in Blackstone's management capabilities.

In 2024, Blackstone continued to emphasize this, providing investors with comprehensive updates that detailed the performance of its various funds and individual portfolio companies. For instance, its real estate division, a significant contributor, showcased strong asset appreciation and rental income growth across its global holdings, with specific reports detailing occupancy rates and net operating income for key properties.

Customized Solutions and Product Development

Blackstone excels at crafting tailored investment strategies for its major institutional clients. This often involves creating unique fund structures or customized solutions that precisely align with their specific needs and tolerance for risk. For instance, they have launched new private credit funds specifically designed for retail investors, demonstrating a commitment to expanding access to alternative investments.

This client-centric approach is a cornerstone of their business model, fostering deep relationships built on understanding and responsiveness. By actively listening to client requirements, Blackstone can innovate and adapt its product offerings. This was evident in 2024 as they continued to explore and develop new avenues for capital deployment, responding to evolving market demands and investor preferences.

- Customized Investment Solutions: Blackstone develops bespoke investment products to meet the unique needs of institutional clients.

- Bespoke Fund Structures: They create tailored fund vehicles, such as new private credit funds for retail investors, to address specific market opportunities.

- Risk Appetite Alignment: Solutions are designed to match the precise risk appetites and return objectives of their clientele.

- Client-Centric Innovation: Blackstone's product development is driven by a deep understanding of client requirements and market trends.

Annual Investor Conferences and Events

Blackstone’s annual investor conferences and events are pivotal for maintaining strong customer relationships. These gatherings, including exclusive investor conferences and webinars, are designed to foster direct engagement between investors and Blackstone’s leadership. They serve as a crucial platform for sharing market insights and discussing key trends.

These events enhance the sense of community among investors and provide them with valuable, up-to-date information directly from the source. For instance, in 2024, Blackstone continued its tradition of hosting these high-profile events, which are attended by a significant portion of its limited partners. The firm reported that feedback from these 2024 events highlighted increased investor confidence and a deeper understanding of Blackstone's strategic direction.

- Direct Engagement: Facilitates face-to-face or virtual interaction between investors and Blackstone’s senior management.

- Insight Sharing: Provides a forum for presenting market analysis, investment strategies, and performance updates.

- Community Building: Strengthens the investor base by fostering a shared understanding and connection.

- Transparency: Offers a transparent view into the firm's operations and future outlook, building trust.

Blackstone cultivates deep ties with its limited partners through consistent, transparent communication and a history of strong returns. This relationship management is crucial, especially as Blackstone continues to broaden its investor base. In 2024, the firm reported that a substantial percentage of its assets under management stemmed from institutional investors, underscoring the necessity of personalized service and ongoing dialogue to retain and grow these vital relationships.

Channels

Blackstone's direct sales and investor relations teams are crucial for connecting with institutional and high-net-worth clients. These teams actively engage in global outreach, delivering tailored presentations and fostering strong, ongoing relationships.

In 2024, Blackstone continued to leverage these direct channels, which are instrumental in building trust and understanding client needs. This personal engagement is key to their client acquisition and retention strategies, particularly for their diverse alternative investment offerings.

Blackstone leverages secure online investor portals and digital platforms to provide clients with real-time access to crucial fund documents, detailed performance reports, and timely investment updates. These channels are pivotal for efficient information dissemination, ensuring investors remain informed and engaged with their portfolios.

Blackstone actively participates in and hosts prominent industry conferences and thought leadership events. These gatherings are crucial for demonstrating their deep expertise in alternative investments and connecting with a broad range of potential investors.

In 2024, Blackstone executives were featured speakers at over 50 major global financial forums, including the Milken Institute Global Conference and the World Economic Forum. This extensive presence underscores their commitment to shaping industry dialogue and reinforcing their brand as a leading alternative investment manager.

Financial Advisors and Wealth Managers

Blackstone collaborates with external financial advisors and wealth management firms to reach specific client groups, notably high-net-worth individuals and family offices. This strategic channel is crucial for distributing alternative investment products, such as private credit funds, which require specialized knowledge and established client relationships. In 2024, the alternative asset management industry continued to see strong inflows, with private markets, including private credit, attracting significant capital from these intermediary channels.

These partnerships allow Blackstone to tap into a broader investor base that might not directly engage with the firm. Financial advisors act as a vital conduit, translating the complexities of alternative investments into understandable propositions for their clients. This distribution model is particularly effective for products like Blackstone's private credit offerings, which have seen substantial growth in demand from investors seeking yield enhancement and diversification.

- Client Reach: Accessing high-net-worth individuals and family offices through established advisor networks.

- Product Distribution: Facilitating the flow of Blackstone's alternative investment products, like private credit funds.

- Market Trends: Capitalizing on the increasing investor appetite for alternative assets, a trend robust in 2024.

- Intermediary Value: Leveraging the expertise and client relationships of financial advisors to onboard new investors.

Public Relations and Media Engagement

Strategic public relations and active media engagement are crucial channels for Blackstone. These efforts shape public perception and communicate key messages, directly impacting brand visibility and indirectly attracting investors and talent. For instance, in 2024, Blackstone's proactive media strategy likely played a role in its continued ability to raise significant capital across its various funds.

- Brand Visibility: Consistent positive media coverage enhances Blackstone's profile among potential limited partners and employees.

- Message Dissemination: PR efforts ensure that Blackstone's strategic direction and performance are clearly communicated to stakeholders.

- Investor Attraction: A strong media presence can build confidence and interest, making Blackstone a more attractive investment opportunity.

Blackstone utilizes a multi-faceted channel strategy, blending direct engagement with strategic partnerships. Their investor relations teams cultivate relationships with institutional clients, while online portals offer transparent access to fund data. Furthermore, participation in key industry events and collaborations with financial advisors broaden their reach, particularly for specialized alternative products.

| Channel | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales & Investor Relations | Personalized engagement with institutional and high-net-worth clients. | Fostering trust and understanding needs for alternative investments. |

| Online Investor Portals | Secure digital platforms for fund documents and performance reports. | Ensuring real-time information access and investor engagement. |

| Industry Conferences & Events | Thought leadership and networking opportunities. | Showcasing expertise, with executives speaking at over 50 global forums. |

| Financial Advisor Partnerships | Collaborating with wealth managers to reach HNWIs and family offices. | Distributing products like private credit, capitalizing on strong 2024 inflows. |

| Public Relations & Media | Shaping perception and brand visibility. | Enhancing brand confidence and attractiveness to investors. |

Customer Segments

Public and corporate pension funds represent a foundational customer segment for Blackstone. These entities manage vast pools of capital with a mandate to generate long-term growth and ensure they can meet their future pension obligations to retirees. In 2023, global pension fund assets under management reached an estimated $57 trillion, with a significant portion increasingly allocated to alternative investments like private equity and real estate, precisely the areas where Blackstone excels.

Sovereign wealth funds (SWFs), managing trillions in assets globally, are significant clients for Blackstone. These national entities, like Norway's Government Pension Fund Global which reported assets of approximately $1.3 trillion as of Q1 2024, seek long-term, stable returns from alternative investments such as infrastructure and private equity.

University endowments and charitable foundations represent a cornerstone customer segment for Blackstone. These institutions, managing substantial asset bases, are actively seeking to preserve and grow their capital through diversified and sophisticated investment strategies. In 2024, endowments at the largest US universities, such as Yale and Harvard, continued to be significant players in the alternative investment space, with Blackstone's real estate and private equity funds being particularly attractive.

High-Net-Worth Individuals and Family Offices

Blackstone increasingly caters to high-net-worth individuals and family offices seeking advanced investment avenues outside conventional public markets. These clients are actively looking for strategies to both protect and expand their capital, often turning to specialized products. For instance, Blackstone Real Estate Income Trust (BREIT) and Blackstone Credit Income Trust (BCRED) are designed to meet these sophisticated wealth management needs.

The firm's appeal to this segment is amplified by its ability to offer access to private markets and alternative investments, which can provide diversification and potentially higher returns. In 2024, Blackstone continued to highlight its expertise in managing complex portfolios for these discerning investors, aiming to deliver consistent growth and capital preservation.

- Targeting Sophisticated Investors: Blackstone actively pursues high-net-worth individuals and family offices seeking alternative investment strategies.

- Product Offerings: Products like BREIT and BCRED are key vehicles for this segment, providing access to real estate and credit markets.

- Wealth Preservation and Growth: The primary objective for these clients is the sophisticated management of their wealth for long-term preservation and appreciation.

- Market Trends: This segment's increasing interest in private markets reflects a broader trend of seeking opportunities beyond traditional public equities and bonds.

Insurance Companies

Insurance companies, holding significant long-term liabilities, represent a key customer segment. They actively seek investments in alternative assets to align with their long-duration obligations and boost investment income.

For instance, in 2024, the global insurance industry managed trillions of dollars in assets, with a growing allocation towards private equity and infrastructure, asset classes where Blackstone excels. This strategic shift is driven by the pursuit of yield in a persistently low-interest-rate environment, making alternative investments particularly attractive for matching long-dated policy payouts.

- Long-term liabilities matching: Insurers invest in assets with similar durations to their policy obligations.

- Yield enhancement: Alternative assets offer the potential for higher returns compared to traditional fixed income.

- Diversification benefits: These investments can reduce overall portfolio volatility.

- Capital efficiency: Certain alternative strategies can offer more favorable regulatory capital treatment.

Blackstone serves a diverse range of institutional investors, including public and corporate pension funds, sovereign wealth funds, and insurance companies. These entities collectively manage trillions of dollars and are increasingly allocating capital to alternative investments to enhance returns and meet long-term obligations.

University endowments and charitable foundations are also key clients, seeking to preserve and grow their capital through sophisticated strategies. Furthermore, Blackstone caters to high-net-worth individuals and family offices looking for access to private markets and specialized investment products.

| Customer Segment | Key Characteristics | Investment Objective | Approximate Global AUM (2024 Estimates) |

|---|---|---|---|

| Pension Funds | Manage retirement assets for employees | Long-term growth, meeting pension obligations | $60 trillion+ |

| Sovereign Wealth Funds | National investment funds | Long-term, stable returns, diversification | $10 trillion+ |

| Endowments & Foundations | Manage assets for educational/charitable purposes | Capital preservation, long-term growth | Trillions (combined) |

| High-Net-Worth Individuals & Family Offices | Affluent individuals and their advisors | Wealth preservation, enhanced returns, diversification | Significant portion of global wealth |

| Insurance Companies | Hold long-term liabilities | Yield enhancement, matching liabilities, diversification | Trillions |

Cost Structure

Employee compensation, encompassing salaries, bonuses, and carried interest, represents Blackstone's most significant cost. In 2023, compensation and benefits expenses for Blackstone amounted to $6.5 billion, reflecting the high value placed on attracting and retaining elite investment professionals who drive the firm's performance.

Operational and administrative expenses are the backbone of Blackstone's global operations, encompassing everything from prime office leases in major financial hubs to sophisticated IT systems that power its investment strategies. These costs are essential for maintaining a high-performing global infrastructure, facilitating seamless deal execution, and supporting client relationships worldwide.

In 2023, Blackstone reported total operating expenses of $5.4 billion, a significant portion of which falls under these operational and administrative categories. This figure reflects substantial investments in talent, technology, and the physical infrastructure necessary to manage a vast portfolio and serve a diverse client base across its various business segments.

Blackstone faces substantial legal, regulatory, and compliance expenses due to the stringent oversight of the financial services sector. These costs are essential for navigating complex global legal landscapes and ensuring adherence to diverse regulatory frameworks governing investment management and private equity.

In 2024, financial services firms, including those of Blackstone's scale, are expected to allocate a significant portion of their operating budget to compliance. For instance, reports indicate that compliance spending for large asset managers can range from 5% to 15% of revenue, reflecting the increasing complexity and enforcement actions in areas like data privacy and anti-money laundering.

Deal Sourcing and Due Diligence Costs

Blackstone's deal sourcing and due diligence efforts represent a significant expenditure. These costs are directly tied to identifying, evaluating, and ultimately closing new investment opportunities. Think of the expenses involved in researching potential acquisitions, assessing their financial health, and ensuring legal compliance. For instance, in 2023, private equity firms, including large players like Blackstone, often incurred millions in fees for legal counsel, accounting audits, and industry-specific consultants during the due diligence phase of major transactions.

These costs are not merely overhead; they are fundamental to the investment process. Without thorough due diligence, the risk of making a poor investment decision increases dramatically. Blackstone likely allocates substantial resources to its teams and external advisors who perform this critical work, ensuring that each potential deal is rigorously vetted before capital is committed. This investment in diligence is crucial for mitigating risk and maximizing the likelihood of successful investment outcomes.

Key components of these costs include:

- Advisory Fees: Payments to investment banks, brokers, and other intermediaries for identifying and facilitating deals.

- Legal Expenses: Costs associated with contract review, regulatory compliance checks, and structuring transactions.

- Consulting and Audit Fees: Payments to experts for financial, operational, and market due diligence.

- Travel and Accommodation: Expenses incurred by deal teams when visiting target companies or meeting with stakeholders.

Technology and Data Infrastructure Costs

Blackstone's investment in technology and data infrastructure is a significant and growing cost. This includes substantial outlays for advanced computing power, sophisticated data analytics platforms, and robust cybersecurity measures. These expenditures are vital for maintaining a competitive edge, optimizing operational efficiency, and effectively managing risks in today's data-driven financial landscape.

The company's commitment to proprietary software development also contributes to this cost base. These custom-built solutions are designed to enhance deal sourcing, portfolio management, and client reporting capabilities. In 2024, the technology sector saw continued significant investment, with many financial firms like Blackstone allocating a larger portion of their budgets to digital transformation initiatives to stay ahead.

- Technology Investment: Blackstone allocates significant capital to cutting-edge technology, including cloud computing and AI-driven analytics.

- Data Infrastructure: Costs are incurred for building and maintaining vast data warehouses and analytical tools to process market and portfolio information.

- Cybersecurity: Substantial resources are dedicated to protecting sensitive data and systems from evolving cyber threats.

- Proprietary Software: Development and maintenance of in-house software for trading, risk management, and operational efficiency represent a key expenditure.

Beyond compensation and operations, Blackstone's cost structure includes significant investments in deal sourcing and due diligence. These expenses are crucial for identifying and evaluating potential investments, often involving substantial fees for legal, accounting, and consulting services. In 2023, private equity firms frequently spent millions on these due diligence activities for major transactions, underscoring their importance in mitigating risk and ensuring successful outcomes.

Blackstone also incurs considerable costs related to technology and data infrastructure, essential for maintaining a competitive edge. This includes investments in advanced computing, data analytics platforms, and robust cybersecurity measures. The development of proprietary software for trading, risk management, and client reporting further contributes to these expenditures, with financial firms in 2024 continuing to prioritize digital transformation.

| Cost Category | 2023 Expense (USD Billions) | Key Components |

| Employee Compensation | 6.5 | Salaries, bonuses, carried interest |

| Operating & Administrative | 5.4 (Total Operating Expenses) | Office leases, IT systems, global infrastructure |

| Legal, Regulatory & Compliance | Significant Portion of OpEx | Navigating global legal and regulatory frameworks |

| Deal Sourcing & Due Diligence | Millions per major transaction | Advisory fees, legal expenses, consulting/audit fees |

| Technology & Data Infrastructure | Growing Investment | Cloud computing, AI analytics, cybersecurity, proprietary software |

Revenue Streams

Management fees represent Blackstone's core and most consistent revenue source, typically levied as a percentage of their substantial Assets Under Management (AUM). For instance, as of the first quarter of 2024, Blackstone reported total AUM of approximately $1.06 trillion, a figure that underscores the immense scale of these recurring fees.

These fees are crucial as they provide a predictable income stream, largely independent of the actual performance of their diverse investment funds. This stability allows for consistent operational planning and investment in their business infrastructure.

Blackstone heavily relies on performance fees, often called carried interest, which represent a share of profits from successful investments. This is a key driver, especially when funds outperform a predetermined hurdle rate. For instance, in the first quarter of 2024, Blackstone reported significant performance fees, contributing substantially to their overall revenue growth.

Blackstone generates significant revenue through transaction and advisory fees. These fees are often tied to specific deals, such as acquisition or disposition fees, as well as advisory services rendered to their portfolio companies or external clients. For instance, in 2023, Blackstone's fee-related earnings, which include these types of fees, reached $5.4 billion, demonstrating their importance to the firm's overall financial performance.

Investment Income and Realized Gains

Blackstone's revenue can also stem from investment income and realized gains on its own capital. While the majority of its income comes from fees generated by its funds, the firm itself may hold direct investments. These could be in companies or assets where Blackstone deploys its proprietary capital, leading to income from dividends, interest, or capital appreciation when these investments are sold.

For instance, in 2023, Blackstone reported total revenues of $17.8 billion. A portion of this would have included income and gains from its balance sheet activities, complementing the substantial fee-related earnings and carried interest generated from its vast fund management operations.

- Direct Investment Income: Earnings from dividends, interest, or other distributions on assets held directly on Blackstone's balance sheet.

- Realized Gains: Profits generated from the sale of investments made with the firm's own capital.

- Proprietary Capital Deployment: Blackstone's strategic use of its own funds alongside client capital in investment opportunities.

Fund Administration and Other Service Fees

Blackstone also generates revenue through fund administration and other specialized services. These fees, while typically a smaller portion of overall income compared to management and performance fees, contribute to the firm's diversified revenue streams.

For instance, in 2023, Blackstone's segment reporting often includes "Other revenue" which encompasses these administrative and service-related fees. While not broken out separately in all public disclosures, these ancillary services support the core investment operations and client relationships.

- Fund Administration: Fees for managing the operational and accounting aspects of investment funds.

- Specialized Services: Revenue from providing unique financial or advisory services to clients or portfolio companies.

- Ancillary Income: These fees complement the primary revenue sources, enhancing overall financial stability.

Blackstone's revenue streams are primarily driven by management fees, calculated as a percentage of its substantial Assets Under Management (AUM), and performance fees, commonly known as carried interest, which are a share of profits from successful investments. These two components form the bedrock of its earnings, providing both stability and significant upside potential.

Additional revenue is generated through transaction and advisory fees linked to specific deals and services, as well as income from the firm's direct investments and realized gains. Ancillary revenue from fund administration and other specialized services further diversifies its income.

| Revenue Stream | Description | 2023 Data/Context |

| Management Fees | Percentage of Assets Under Management (AUM) | AUM was approximately $1.06 trillion in Q1 2024, indicating substantial recurring fee income. |

| Performance Fees (Carried Interest) | Share of profits from successful investments | A key driver of growth, particularly when funds outperform hurdle rates. Significant contributions reported in Q1 2024. |

| Transaction & Advisory Fees | Fees for specific deals and services | Fee-related earnings, including these, reached $5.4 billion in 2023. |

| Direct Investment Income & Realized Gains | Earnings from firm's own capital deployment | Total revenues in 2023 were $17.8 billion, partly from balance sheet activities. |

| Fund Administration & Other Services | Fees for operational and specialized services | Contributes to diversified revenue streams, often included in "Other revenue" segments. |

Business Model Canvas Data Sources

The Blackstone Business Model Canvas is meticulously constructed using a blend of proprietary financial data, extensive market research reports, and internal strategic planning documents. These diverse sources ensure that each component of the canvas is grounded in actionable insights and verified information.