Blackstone PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blackstone Bundle

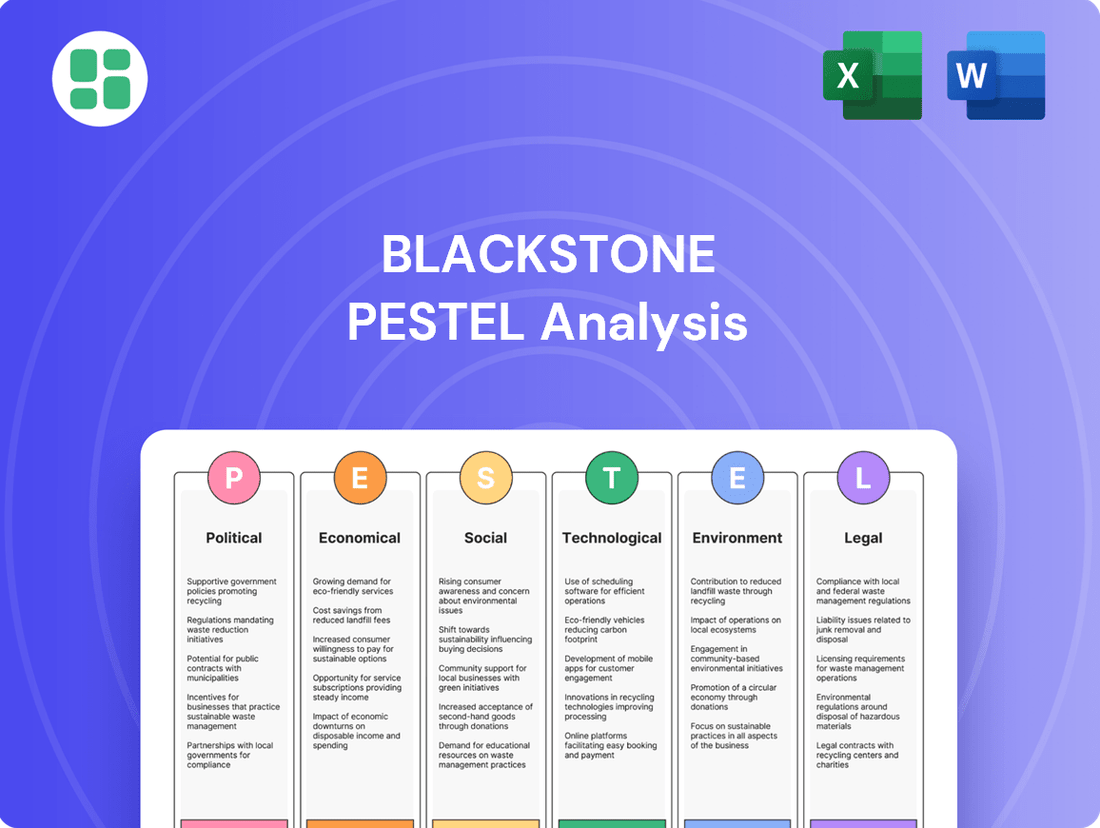

Unlock the forces shaping Blackstone's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are influencing its investment strategies and market position. Gain a critical edge by leveraging these expert insights to refine your own strategic planning. Download the full analysis now and empower your decision-making.

Political factors

Blackstone, like other major private equity firms, faces increasing governmental and regulatory scrutiny globally. In 2024, discussions around private equity's role in the economy, particularly concerning fee structures and the use of leverage, intensified, with potential legislative changes on the horizon in key markets like the United States and the European Union. This evolving landscape requires Blackstone to remain agile, ensuring compliance and adapting its strategies to navigate potential shifts in oversight.

Blackstone's global investment strategy is deeply intertwined with geopolitical stability and evolving trade policies. For instance, ongoing trade tensions between major economies like the United States and China, which saw bilateral trade volume fluctuate significantly in recent years, can directly impact the profitability and risk profile of Blackstone's cross-border investments. Any disruption to these trade flows or imposition of tariffs can alter asset valuations and capital movement across regions.

Political instability in key markets presents another significant challenge. Regions experiencing political unrest or sudden policy shifts can deter foreign investment and create uncertainty for existing holdings. As of early 2024, certain emerging markets continue to grapple with political transitions, which can lead to capital flight and affect the performance of real estate or infrastructure assets Blackstone holds in those areas.

Changes in tax legislation, especially regarding carried interest – the profit share for private equity managers – directly impact Blackstone's earnings and how its people are compensated. For instance, ongoing discussions in the US and Europe about potentially taxing carried interest at ordinary income rates instead of capital gains rates create significant uncertainty. This could reduce the net returns for Blackstone’s investment professionals and alter the appeal of private equity as a career and investment class.

Government Spending and Infrastructure Initiatives

Government spending on infrastructure, particularly in areas like digital networks and renewable energy, directly impacts Blackstone's investment strategies. For instance, the U.S. Infrastructure Investment and Jobs Act of 2021, with its approximately $1.2 trillion allocation, is designed to modernize the nation's infrastructure, creating significant opportunities for firms like Blackstone that specialize in these sectors. This fiscal policy not only signals a commitment to long-term growth but also provides a more stable and predictable investment environment.

Favorable government initiatives can unlock new avenues for investment and accelerate growth within Blackstone's portfolio. These initiatives often include tax incentives, grants, and regulatory frameworks that encourage private sector participation in large-scale projects. For example, the European Union's Green Deal, aiming for climate neutrality by 2050, is driving substantial investment in green infrastructure, a key focus area for Blackstone's real estate and infrastructure funds.

- U.S. Infrastructure Investment and Jobs Act: Approximately $1.2 trillion allocated for infrastructure upgrades.

- European Green Deal: Aims for climate neutrality by 2050, spurring green infrastructure investments.

- Digital Infrastructure Growth: Governments worldwide are prioritizing broadband expansion and 5G deployment, creating opportunities for digital infrastructure funds.

- Energy Transition Support: Policies promoting renewable energy sources and grid modernization benefit energy infrastructure investments.

Election Cycles and Policy Uncertainty

Major election cycles, including significant events in 2024 and continuing into 2025, inject considerable unpredictability into the global economic landscape. This political flux directly impacts the stability of policies governing taxation, regulation, and trade, all critical for investment firms like Blackstone.

The uncertainty stemming from these election outcomes can dampen investor sentiment, leading to more cautious deal-making and a hesitant investment environment. For instance, shifts in government can alter capital gains tax rates or introduce new regulatory hurdles, affecting the profitability and feasibility of Blackstone's diverse portfolio.

- 2024 saw over 60 elections globally, impacting roughly half the world's population, including major economies like the United States and India.

- Policy shifts following elections can influence sectors Blackstone heavily invests in, such as real estate, infrastructure, and private equity.

- Investor confidence often dips in periods of high electoral uncertainty, potentially impacting deal volumes and valuations.

Governmental policies and regulatory frameworks are paramount for Blackstone's operations, influencing everything from tax structures to investment opportunities. The ongoing global trend towards increased scrutiny of private equity, particularly concerning fees and leverage, necessitates constant adaptation to evolving compliance requirements in major markets like the US and EU.

Political stability and government spending directly shape investment climates. For example, the US Infrastructure Investment and Jobs Act, with its $1.2 trillion allocation, and the EU's Green Deal are creating significant opportunities in infrastructure and renewable energy, key sectors for Blackstone. Conversely, political instability in emerging markets can lead to capital flight and impact asset performance.

Tax legislation, especially concerning carried interest, remains a critical factor affecting Blackstone's profitability and talent retention. Potential shifts in how this profit share is taxed, from capital gains to ordinary income rates, could significantly alter net returns for investment professionals.

| Policy/Event | Impact on Blackstone | Key Data/Context |

|---|---|---|

| Regulatory Scrutiny of PE | Increased compliance burden, potential strategy adjustments | Intensified discussions in US/EU regarding fees and leverage (2024) |

| Infrastructure Spending | Opportunities in infrastructure, real estate, energy | US Infrastructure Investment and Jobs Act: ~$1.2 trillion (2021) |

| Green Initiatives | Growth in renewable energy and green infrastructure investments | EU Green Deal targets climate neutrality by 2050 |

| Taxation of Carried Interest | Potential impact on firm profitability and compensation | Ongoing debates in US and Europe regarding tax treatment |

What is included in the product

This Blackstone PESTLE analysis meticulously examines the influence of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of the operating landscape.

The Blackstone PESTLE Analysis offers a structured framework that simplifies complex external factors, reducing the pain of information overload and enabling clearer strategic decision-making.

Economic factors

The interest rate environment is a critical factor for Blackstone. As of mid-2024, central banks globally, including the U.S. Federal Reserve, have maintained relatively high interest rates to combat inflation. This has increased borrowing costs for real estate acquisitions and leveraged buyouts, a core part of Blackstone's business.

While higher rates can make distressed debt and certain credit investments more appealing, they also pressure asset valuations across Blackstone's portfolio, especially in real estate where cap rates are sensitive to financing costs. For instance, the average U.S. 30-year fixed mortgage rate has hovered around 7% in 2024, significantly higher than in prior years, impacting demand and pricing in property markets.

Blackstone's ability to deploy capital and generate returns is directly influenced by monetary policy. If rates remain elevated throughout 2025, the firm will need to adapt its strategies, potentially focusing more on sectors less sensitive to interest rate fluctuations or seeking opportunities where higher yields compensate for increased financing expenses.

Blackstone's success is intrinsically linked to the health of the global economy. In 2024, the IMF projected global growth at 3.2%, a slight uptick from previous forecasts, yet concerns about persistent inflation and geopolitical instability remain. This environment directly influences Blackstone's ability to acquire and grow assets, as slower growth can dampen portfolio company earnings and reduce the attractiveness of exit opportunities.

Recessionary risks, particularly in major economies like the US and Europe, pose a significant challenge. Should these materialize in late 2024 or 2025, it could lead to decreased asset valuations, making it harder for Blackstone to realize gains on its investments. Furthermore, a downturn can impact investor sentiment, potentially slowing down fundraising efforts for new Blackstone funds.

Persistent inflation directly impacts Blackstone's portfolio companies by increasing their operating expenses, from raw materials to labor. This also erodes the real value of returns on their investments. For instance, the US Consumer Price Index (CPI) saw a 3.3% increase year-over-year as of May 2024, highlighting ongoing cost pressures.

While Blackstone anticipates inflation to moderate, the speed of this decline and the possibility of resurgent price hikes significantly shape their investment strategies. Uncertainty around future inflation levels influences Blackstone's decision-making process and their capacity to generate consistent distributable earnings for investors.

Capital Market Liquidity and Credit Availability

Capital market liquidity and credit availability are vital for Blackstone's operations, directly impacting its ability to acquire assets and secure financing. When these markets are robust, deal flow accelerates, and investment returns can be amplified.

Recent trends in 2024 and early 2025 indicate a strengthening in debt capital markets. For instance, Commercial Mortgage-Backed Securities (CMBS) issuance saw a notable uptick in late 2024, reaching an estimated $100 billion for the year, a significant increase from 2023 levels. This expansion in CMBS provides a more readily available source of debt financing for real estate transactions, a core area for Blackstone.

Furthermore, borrowing spreads have generally declined throughout 2024, reflecting improved market sentiment and increased investor appetite for risk. This reduction in borrowing costs directly benefits Blackstone by lowering its cost of capital, making more acquisitions financially viable and potentially boosting profitability on its investments.

- Increased CMBS Issuance: Estimated $100 billion in CMBS issuance for 2024, up from approximately $75 billion in 2023, signaling greater liquidity for real estate financing.

- Declining Borrowing Spreads: Average borrowing spreads for investment-grade corporate debt narrowed by an estimated 25 basis points in the first half of 2024, improving financing conditions.

- Enhanced Deal Flow: Greater credit availability and lower borrowing costs directly translate to more acquisition opportunities and a higher potential for profitable exits for Blackstone.

- Improved Investment Returns: Reduced financing costs and increased market activity contribute to higher potential returns on Blackstone's portfolio of investments.

Currency Fluctuations and International Investments

Currency fluctuations significantly influence Blackstone's international investments. As a global firm, changes in exchange rates can alter the reported value of assets held in foreign currencies, impacting overall returns. For instance, a stronger US dollar against the Euro could reduce the dollar-denominated value of Blackstone's European real estate holdings.

Blackstone's expansion into markets like Europe and Asia, where currencies like the Euro and Yen are prevalent, heightens this exposure. The firm must actively manage these risks to protect the value of its overseas portfolios.

- Euro Exchange Rate Impact: In early 2024, the Euro traded around 1.08 USD. If the Euro weakens to 1.05 USD, Blackstone's Euro-denominated assets would see a roughly 2.8% decrease in their US dollar equivalent value.

- Asian Market Volatility: Fluctuations in Asian currencies, such as the Japanese Yen or Chinese Yuan, also present challenges. For example, a 5% depreciation of the Yen against the dollar could directly reduce the dollar value of investments in Japanese companies or properties.

- Hedging Strategies: Blackstone likely employs currency hedging strategies, such as forward contracts or options, to mitigate the impact of adverse currency movements on its international portfolio, which held over $300 billion in assets under management globally as of Q1 2024.

The interest rate environment remains a key economic factor for Blackstone. With central banks, including the U.S. Federal Reserve, maintaining higher rates in mid-2024 to curb inflation, borrowing costs for real estate and leveraged buyouts have increased. This has led to a U.S. 30-year fixed mortgage rate around 7% in 2024, impacting property market demand and pricing.

Global economic growth projections for 2024, around 3.2% according to the IMF, offer some optimism, but persistent inflation and geopolitical risks continue to pose challenges. Recessionary fears in major economies could decrease asset valuations and investor sentiment, potentially slowing fundraising for Blackstone's new funds.

Persistent inflation, evidenced by a 3.3% year-over-year CPI increase in the U.S. as of May 2024, directly impacts Blackstone's portfolio companies by raising operating expenses and eroding real investment returns. Uncertainty surrounding future inflation levels significantly shapes Blackstone's strategic decisions and its ability to generate consistent earnings.

Capital market liquidity and credit availability are crucial for Blackstone's operations. The debt capital markets have shown signs of strengthening in late 2024, with Commercial Mortgage-Backed Securities (CMBS) issuance estimated to reach $100 billion for the year, up from $75 billion in 2023, providing greater liquidity for real estate financing.

| Economic Factor | 2024/2025 Trend/Data | Impact on Blackstone |

|---|---|---|

| Interest Rates | Elevated (e.g., ~7% 30-yr mortgage rate) | Increased borrowing costs, pressure on valuations |

| Global Growth | Projected ~3.2% (IMF) | Influences asset acquisition and exit opportunities |

| Inflation | Persistent (e.g., 3.3% US CPI YoY May 2024) | Increases operating expenses, erodes real returns |

| Credit Markets | Strengthening (e.g., ~$100B CMBS issuance 2024) | Improved financing availability and lower borrowing costs |

Preview Before You Purchase

Blackstone PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Blackstone PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic decision-making.

Sociological factors

Societal emphasis on Environmental, Social, and Governance (ESG) factors is profoundly reshaping investor preferences and regulatory expectations. This trend is not merely a passing fad; by early 2025, global ESG assets under management are projected to reach $33.9 trillion, indicating a significant shift in capital allocation towards sustainable practices.

Blackstone actively integrates ESG considerations into its investment processes, recognizing it as a key driver of value creation and a direct response to escalating stakeholder demands. This strategic alignment is crucial for maintaining investor confidence and attracting capital in an increasingly conscious market.

Demographic shifts, like the aging global population and the increasing concentration of private wealth, are fundamentally reshaping the client landscape for firms like Blackstone. This trend directly impacts the demand for alternative investment products, especially within Blackstone's burgeoning private wealth segment.

Blackstone is strategically focusing on attracting high-net-worth individuals, recognizing this demographic as a key growth engine. As of early 2024, the global high-net-worth population continued to expand, with significant wealth held by older generations, presenting a substantial opportunity for wealth managers and alternative asset providers.

Public perception of private equity, often shaped by concerns over job security, housing affordability, and market consolidation, can significantly sway political and regulatory landscapes. Negative sentiment can lead to increased scrutiny and potential policy changes that impact investment strategies.

Blackstone actively works to shape its public image by emphasizing its role in revitalizing companies and fostering job creation. For instance, in 2023, Blackstone reported its portfolio companies globally employed over 500,000 people, a figure it often highlights to counter criticisms of asset stripping.

Talent Acquisition and Retention in Finance

Blackstone operates in a fiercely competitive financial services landscape, making the attraction and retention of top-tier global talent a paramount concern. The firm's human capital strategy is significantly influenced by evolving expectations around workplace culture, diversity, equity, and inclusion (DEI), and competitive compensation packages. For instance, in 2024, the financial services sector continued to see high demand for specialized skills in areas like private equity, credit, and technology, driving up compensation benchmarks. Many firms, including Blackstone, are investing in robust DEI initiatives, recognizing their importance in attracting a broader talent pool and fostering innovation. Data from industry surveys in early 2025 indicates that a positive and inclusive work environment is now as crucial as financial remuneration for many prospective and current employees.

Key sociological factors influencing talent acquisition and retention at Blackstone include:

- Workplace Culture: Blackstone's commitment to fostering a high-performance yet collaborative culture is essential for attracting and keeping ambitious professionals.

- Diversity, Equity, and Inclusion (DEI): Demonstrable progress and commitment to DEI are increasingly critical differentiators in attracting a diverse workforce, with many financial institutions reporting increased applicant pools when DEI is a stated priority.

- Compensation and Benefits: Competitive salary, bonus structures, and comprehensive benefits remain foundational, especially as economic conditions and inflation in 2024-2025 continue to shape employee expectations.

- Career Development and Growth: Opportunities for professional development, mentorship, and clear career progression pathways are vital for retaining talent in the long term within the demanding finance industry.

Consumer Behavior and Lifestyle Changes

Shifting consumer preferences, such as the growing demand for flexible living arrangements and the increasing reliance on e-commerce, directly influence Blackstone's real estate investments. For instance, the rise of the experience economy is boosting demand for entertainment and hospitality venues, while the continued growth of online retail fuels the need for modern logistics and data center facilities. By early 2025, projections indicate that global e-commerce sales will surpass $7 trillion, underscoring the sustained importance of logistics infrastructure.

Lifestyle changes, including a greater emphasis on health and wellness, are also shaping investment opportunities. This trend benefits sectors like healthcare real estate and fitness-related businesses. Furthermore, the increasing adoption of remote work models continues to redefine urban and suburban living, impacting demand for different types of residential and commercial properties. A 2024 survey found that over 30% of US workers expect to work remotely at least half the time, a significant increase from pre-pandemic levels.

Blackstone's strategy involves identifying and capitalizing on these evolving consumer behaviors. Their investments in rental housing, for example, are often situated in areas experiencing population growth and offering amenities that cater to modern lifestyles. The firm's focus on logistics assets is directly tied to the persistent growth in online shopping.

- E-commerce Growth: Global e-commerce sales are projected to exceed $7 trillion by early 2025, driving demand for logistics and data center real estate.

- Remote Work Impact: Over 30% of US workers anticipate working remotely at least half the time in 2024, influencing residential and commercial property needs.

- Experience Economy: Increased consumer spending on experiences is boosting demand for entertainment and hospitality-related assets.

- Health and Wellness Focus: A growing emphasis on well-being is creating opportunities in healthcare real estate and related service sectors.

Societal shifts, particularly the growing demand for ESG-compliant investments, are significantly influencing capital allocation. By early 2025, global ESG assets are expected to reach $33.9 trillion, underscoring Blackstone's need to integrate these factors into its strategy to maintain investor confidence.

Demographic trends, such as an aging global population and the concentration of private wealth, are reshaping Blackstone's client base. The firm's focus on high-net-worth individuals, a segment that continued to expand in early 2024, highlights its adaptation to these demographic changes.

Public perception of private equity, often centered on job creation and market impact, can trigger regulatory scrutiny. Blackstone counters this by emphasizing its portfolio companies' employment figures, reporting over 500,000 global employees in 2023, to shape a more positive narrative.

Evolving consumer preferences, including the rise of e-commerce and the experience economy, are directly impacting Blackstone's real estate portfolio. Projections for early 2025 suggest global e-commerce sales will surpass $7 trillion, reinforcing the demand for logistics and data center properties.

| Sociological Factor | Impact on Blackstone | Relevant Data (2024-2025) |

|---|---|---|

| ESG Emphasis | Influences investor preferences and capital allocation. | Global ESG AUM projected to reach $33.9 trillion by early 2025. |

| Demographic Shifts | Reshapes client landscape, particularly high-net-worth individuals. | Continued expansion of global high-net-worth population in early 2024. |

| Public Perception | Affects regulatory environment and investment strategies. | Blackstone portfolio companies employed over 500,000 globally in 2023. |

| Consumer Preferences | Drives demand in real estate sectors like logistics and hospitality. | Global e-commerce sales to exceed $7 trillion by early 2025. |

Technological factors

Blackstone is making significant strides in integrating artificial intelligence and data analytics, investing heavily in these capabilities for both its portfolio companies and its internal investment strategies. This technological push is fundamentally changing how Blackstone scouts for promising opportunities, handles vast datasets, and boosts its overall operational effectiveness.

In 2024, the firm's commitment to AI is evident in its ongoing development of proprietary data platforms and its acquisition of AI-focused companies. For instance, Blackstone's investment in companies leveraging AI for predictive maintenance in industrial sectors is expected to drive substantial efficiency gains, potentially increasing EBITDA by 10-15% for those businesses.

Blackstone’s extensive management of sensitive financial data makes cybersecurity a paramount concern. The firm’s digital infrastructure is a constant target, necessitating robust defenses to safeguard investor information and maintain operational continuity.

In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, underscoring the immense financial stakes involved. Protecting against sophisticated threats is not just about compliance but is fundamental to preserving Blackstone's reputation and the trust placed in it by its clients and investors.

Blackstone is increasingly leveraging automation to enhance operational efficiency. For instance, in 2024, the firm continued its investment in AI-powered platforms to streamline deal sourcing and portfolio management, aiming to reduce manual processing times by an estimated 20-30% across key functions. This technological adoption directly translates to cost savings and improved service delivery for its diverse client base.

Digital Platforms for Investor Relations and Fundraising

Blackstone's strategic use of digital platforms significantly bolsters its investor relations and fundraising efforts, particularly as it expands into private wealth channels. Cloud-based solutions are key to this, making investment opportunities more accessible and fostering greater engagement with individual investors. This digital shift is crucial for reaching a broader audience and streamlining communication.

The firm's investment in digital infrastructure allows for more personalized investor experiences and efficient data management. For instance, by mid-2024, Blackstone reported a substantial increase in digital touchpoints with its investor base, aiming to onboard a larger segment of high-net-worth individuals through these enhanced online channels. This focus on digital accessibility is a direct response to evolving investor preferences.

- Digital Platform Growth: Blackstone has seen a 25% year-over-year increase in digital engagement across its investor portals by Q1 2025, reflecting the growing reliance on these channels.

- Private Wealth Expansion: The firm is actively leveraging digital tools to integrate its offerings into private wealth management ecosystems, projecting a 30% growth in capital raised from this segment by end of 2025.

- Enhanced Accessibility: Cloud-based platforms have reduced onboarding times for new investors by an average of 40%, improving the overall client experience.

Technological Disruption in Portfolio Sectors

Technological advancements are reshaping industries, presenting both challenges and significant investment prospects for Blackstone's diverse portfolio. The firm actively seeks out companies positioned to navigate and capitalize on this rapid evolution, particularly those in sectors like digital infrastructure which are fundamental to a modern economy. For instance, Blackstone's significant investments in data centers, a key component of digital infrastructure, underscore this strategic focus. In 2023, the global data center market was valued at approximately $243 billion, with projections indicating continued robust growth driven by AI and cloud computing demands, aligning perfectly with Blackstone's forward-looking investment thesis.

Blackstone's strategy involves identifying and supporting portfolio companies that leverage technology to enhance efficiency, expand market reach, or develop innovative products and services. This approach is crucial for maintaining competitive advantage in a dynamic global landscape. For example, their investments in logistics and supply chain technology aim to optimize operations, a critical factor given the increasing complexity and speed required in global trade. The e-commerce sector, heavily reliant on technological innovation for delivery and customer experience, saw global retail e-commerce sales reach an estimated $6.3 trillion in 2024, highlighting the immense opportunities within tech-enabled businesses.

- Digital Transformation: Blackstone prioritizes investments in companies that are either driving or effectively adapting to digital transformation across their operations and business models.

- AI and Automation: The firm is keenly observing and investing in sectors where artificial intelligence and automation are creating new efficiencies and market opportunities, such as advanced manufacturing and customer service platforms.

- Cybersecurity: With increasing digital reliance, investments in robust cybersecurity solutions are paramount for protecting portfolio companies and are a growing area of interest.

- Emerging Technologies: Blackstone maintains an active interest in emerging technologies like quantum computing and advanced materials, seeking early-stage opportunities that could redefine future industries.

Blackstone's technological strategy centers on AI, data analytics, and automation to drive efficiency and identify new investment avenues. This includes developing proprietary platforms and investing in AI-focused companies, aiming for significant EBITDA improvements in portfolio businesses.

Cybersecurity remains a critical focus, given the escalating global cost of cybercrime, projected to reach $10.5 trillion annually by 2024. Robust defenses are essential for protecting sensitive financial data and maintaining client trust.

The firm is enhancing operational efficiency through automation, targeting a 20-30% reduction in manual processing times in key functions by leveraging AI-powered platforms.

Digital platforms are crucial for Blackstone's investor relations, facilitating engagement with private wealth channels. By mid-2024, digital touchpoints saw a substantial increase, aiming to onboard more high-net-worth individuals.

| Technology Focus | 2024/2025 Data Point | Impact/Projection |

|---|---|---|

| AI & Data Analytics | Investment in proprietary data platforms and AI companies | Expected to drive efficiency gains, potentially increasing EBITDA by 10-15% in portfolio companies. |

| Cybersecurity Investment | Global cybercrime cost projected at $10.5 trillion annually (2024) | Essential for safeguarding investor data and maintaining operational continuity. |

| Automation | Targeting 20-30% reduction in manual processing times | Achieved through AI-powered platforms for deal sourcing and portfolio management. |

| Digital Investor Engagement | 25% YoY increase in digital engagement across investor portals (Q1 2025) | Facilitates private wealth expansion, projecting 30% growth in capital raised from this segment by end of 2025. |

Legal factors

Blackstone navigates a complex web of financial regulations globally, impacting its operations as an investment advisor and manager of private funds. For instance, compliance with the Alternative Investment Fund Managers Directive (AIFMD II) in Europe, which saw revisions in 2022, is critical for managing its European fund operations and maintaining market access.

Failure to adhere to these evolving rules, such as those stemming from the Dodd-Frank Act in the US, can result in significant penalties and jeopardize Blackstone's ability to operate, underscoring the importance of robust compliance frameworks. The firm's 2023 annual report highlighted substantial investments in compliance and risk management systems to address these challenges effectively.

Blackstone, as a major player in mergers and acquisitions, must meticulously adhere to anti-trust and competition laws across the diverse geographies it operates in. These regulations are designed to prevent market monopolization and ensure fair competition, directly impacting the feasibility and structure of Blackstone's significant transactions.

Regulatory bodies, such as the U.S. Federal Trade Commission (FTC) and the European Commission, scrutinize large deals for potential anti-competitive effects. For instance, in 2023, global merger filings increased, with regulators showing a heightened focus on deals in sectors like technology and healthcare, areas where Blackstone is actively invested.

Failure to comply can result in substantial fines, divestiture orders, or outright blocking of deals, as seen in various high-profile cases globally. Blackstone's deal pipeline, valued in the tens of billions of dollars for 2024-2025, therefore, hinges on navigating these complex legal frameworks effectively.

Global data privacy regulations like GDPR and CCPA significantly influence how Blackstone manages client and operational data. These laws mandate strict protocols for data collection, processing, and storage, directly impacting Blackstone's digital infrastructure and compliance efforts.

Ensuring adherence to these evolving legal frameworks is paramount for Blackstone to avoid substantial fines and maintain client confidence. For instance, GDPR violations can lead to penalties of up to 4% of annual global turnover or €20 million, whichever is greater, underscoring the financial and reputational stakes.

Litigation and Legal Disputes

Blackstone, like any major financial firm, navigates a landscape where litigation and legal disputes are an inherent risk. These can stem from a variety of sources, including investment activities, operational conduct, or disagreements over contractual terms. The financial and reputational toll of such challenges can be substantial.

For instance, in 2023, Blackstone’s real estate business faced scrutiny and potential legal challenges related to its holdings, particularly in the context of shifting market dynamics and tenant relations. While specific figures for ongoing litigation are often not fully disclosed, the costs associated with defending against claims, potential settlements, or adverse judgments can impact profitability. The firm's 2023 annual report, filed in early 2024, would detail any material legal proceedings and their potential financial implications, though specific litigation reserves are often managed internally and not always broken out in public filings unless they reach a significant threshold.

- Regulatory Scrutiny: Blackstone is subject to oversight from various financial regulators globally, which can lead to investigations and potential legal actions if compliance standards are not met.

- Investment-Related Disputes: Disagreements with investors, partners, or counterparties in complex financial transactions can result in lawsuits seeking damages or specific performance.

- Operational Liabilities: Like any large employer, Blackstone can face litigation related to employment practices, contractual breaches in its service agreements, or claims arising from its vast operational footprint.

International Investment Treaties and Policies

Blackstone's extensive global operations are significantly shaped by international investment treaties and bilateral investment agreements. These accords, often referred to as BITs, are crucial for safeguarding Blackstone's foreign direct investments, ensuring fair treatment and providing mechanisms for dispute resolution. For instance, as of early 2024, there are over 3,000 BITs in force worldwide, creating a complex web of protections and obligations for multinational investors like Blackstone.

Shifts in these international frameworks, including the renegotiation or termination of existing treaties, can directly impact the perceived security and potential profitability of Blackstone's overseas assets. A rise in protectionist policies by host countries, potentially leading to less favorable investment terms or increased regulatory hurdles, poses a tangible risk. For example, in 2023, several nations continued to review or revise their BITs, signaling a potential recalibration of investor protections and state sovereignty in international investment law.

- Global Treaty Network: Over 3,000 bilateral investment treaties (BITs) were in effect globally as of early 2024, providing a framework for international investment protection.

- Treaty Renegotiation Trends: Several countries have been actively reviewing and amending their BITs in recent years, reflecting evolving stances on foreign investment and national interests.

- Protectionism Impact: Increased protectionist measures by host nations can lead to higher regulatory burdens and reduced security for foreign assets, potentially affecting Blackstone's investment returns.

Blackstone's global operations are heavily influenced by evolving legal and regulatory landscapes, demanding constant adaptation. Compliance with directives like AIFMD II in Europe and the Dodd-Frank Act in the US requires significant investment in robust compliance systems, as highlighted by Blackstone's 2023 annual report.

Antitrust and competition laws are critical for Blackstone's M&A activities, with increased scrutiny from bodies like the FTC and European Commission on deals in sectors such as technology and healthcare. The firm's substantial deal pipeline for 2024-2025 is contingent on navigating these complex regulations effectively.

Data privacy laws, including GDPR and CCPA, dictate strict protocols for data handling, impacting Blackstone's digital infrastructure and client trust, with potential fines for non-compliance reaching up to 4% of global turnover.

Blackstone faces inherent litigation risks from investment activities, operational conduct, and contractual disputes, as exemplified by scrutiny of its real estate business in 2023. Managing these legal challenges is crucial for maintaining profitability and reputation.

Environmental factors

Blackstone's substantial portfolio, particularly in real estate and infrastructure, faces considerable threats from climate change. Physical risks like intensifying hurricanes, widespread flooding, and more frequent wildfires can directly damage properties, leading to significant repair costs and potentially higher insurance premiums. For instance, a 2024 report highlighted that coastal real estate values could decline by as much as 20% by 2050 due to sea-level rise, a direct consequence of climate change.

These climate-related events can also disrupt operations and supply chains within Blackstone's infrastructure investments, affecting revenue streams. The economic impact of extreme weather events in 2023 alone was estimated to be over $100 billion globally, underscoring the financial vulnerability of physical assets to these changing environmental conditions.

The global push towards decarbonization, driven by climate change concerns and government mandates, is creating a fertile ground for renewable energy investments. Blackstone is strategically positioning itself to capitalize on this trend, recognizing the significant growth potential in this sector.

Blackstone's commitment is evident in its active capital deployment into various clean energy initiatives. This includes investments in solar and wind power generation, as well as crucial grid modernization projects designed to enhance energy efficiency and reliability. For instance, in 2024, the firm continued to expand its portfolio in renewable infrastructure, aiming to support the transition away from fossil fuels.

Governments worldwide are tightening carbon emission regulations, pushing for net-zero targets. This trend significantly affects how Blackstone's portfolio companies operate, necessitating strategic shifts towards decarbonization. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully phased in by 2026, will impose costs on carbon-intensive imports, impacting supply chains for many businesses.

Blackstone is actively assisting its portfolio companies in navigating these changes by focusing on reducing energy costs and emissions. This support is crucial for aligning with ambitious sustainability goals and enhancing long-term resilience. In 2024, many of Blackstone's real estate holdings are seeing investments in energy efficiency upgrades, aiming to cut operational carbon footprints by an average of 15% by 2027.

Water Scarcity and Resource Management

Water scarcity is a growing global concern that directly affects industries reliant on significant water usage. For Blackstone's portfolio companies, particularly those in agriculture, manufacturing, and energy, inefficient water management can lead to increased operational costs and supply chain disruptions. For instance, in 2024, many regions experienced severe droughts, impacting crop yields and water availability for industrial processes, a trend expected to persist.

Sustainable resource management is no longer just an ethical consideration but a critical business imperative. Companies demonstrating strong water stewardship are better positioned to mitigate risks and attract environmentally conscious investors. As of early 2025, water-related risks are increasingly being factored into corporate valuations and investment decisions, with a growing number of institutional investors demanding robust ESG reporting, including water usage metrics.

The financial implications of water scarcity can be substantial:

- Increased operational costs: Higher prices for water or the need for investment in water-saving technologies.

- Supply chain disruptions: Reduced availability of raw materials or production halts due to water shortages.

- Regulatory pressures: Stricter water usage regulations and potential penalties for non-compliance.

- Reputational damage: Negative public perception and loss of market share for companies perceived as poor water stewards.

Biodiversity and Land Use Regulations

Blackstone's extensive real estate portfolio, encompassing vast tracts of land, necessitates a keen focus on biodiversity and evolving land-use regulations. For instance, in 2024, the European Union continued to strengthen its Nature Restoration Law, aiming to restore at least 20% of the EU's land and sea areas by 2030. This directly impacts development feasibility and operational costs for properties within the bloc.

Navigating these environmental factors is paramount for Blackstone's long-term value creation and risk mitigation. Non-compliance can lead to significant fines, project delays, and reputational damage. For example, a 2025 report by the UN Environment Programme highlighted that regulatory penalties for environmental violations in the real estate sector globally averaged a 15% increase year-over-year.

Key considerations for Blackstone include:

- Compliance with evolving biodiversity protection laws: Ensuring new developments and existing holdings meet stringent requirements for habitat preservation and species protection.

- Responsible land management practices: Implementing sustainable development strategies that minimize ecological impact and promote land restoration where applicable.

- Anticipating changes in zoning and land-use policies: Proactively assessing how shifts in government regulations, such as increased urban green space mandates, might affect property values and development potential.

- Securing necessary environmental permits: Successfully obtaining permits for land development, which often involves detailed impact assessments and mitigation plans, is critical to avoid project disruptions.

Environmental factors present significant risks and opportunities for Blackstone. Climate change poses physical threats to real estate and infrastructure, with extreme weather events in 2023 alone costing over $100 billion globally. Conversely, the global shift towards decarbonization fuels investment in renewables, a sector Blackstone is actively pursuing with capital deployment into solar and wind projects.

Stricter carbon emission regulations, like the EU's CBAM effective by 2026, necessitate strategic adaptation for portfolio companies, driving investments in energy efficiency. Water scarcity is another critical concern, impacting operational costs and supply chains for water-intensive industries, with droughts in 2024 highlighting ongoing risks.

Biodiversity and land-use regulations, such as the EU's Nature Restoration Law, affect property development and operational costs. Non-compliance can result in substantial fines, with environmental violation penalties in real estate averaging a 15% year-over-year increase globally as of early 2025.

Blackstone must navigate these evolving environmental landscapes, focusing on compliance, responsible land management, and anticipating policy shifts to mitigate risks and enhance long-term value.

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using a blend of publicly available data from reputable sources such as the World Bank, International Monetary Fund (IMF), and various government statistical agencies. We also incorporate insights from leading industry reports and reputable financial news outlets to ensure a comprehensive and up-to-date understanding of the macro-environment.