BlackRock PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlackRock Bundle

Navigate the complex external forces shaping BlackRock's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for the world's largest asset manager. Equip yourself with actionable intelligence to refine your own investment strategies and gain a competitive edge. Download the full PESTLE analysis now for expert insights.

Political factors

BlackRock, as the world's largest asset manager, operates under intense political scrutiny and regulatory oversight globally. This is particularly evident in the United States, where the Federal Deposit Insurance Corporation (FDIC) has mandated a 'passivity agreement' for BlackRock by early 2025. This agreement signifies growing governmental interest in the potential influence of major institutional investors on the stability and operations of the financial system.

The FDIC's requirement for BlackRock to adhere to this passivity agreement underscores a trend of increased governmental oversight on large asset managers. The core of this agreement is to ensure BlackRock's compliance with commitments to refrain from influencing the business decisions of banks where it holds significant equity stakes. This development reflects a proactive stance by regulators to manage systemic risk associated with concentrated ownership in the financial sector.

BlackRock highlights escalating geopolitical tensions, including active conflicts and rising trade protectionism, as significant structural risks impacting investment strategies and global economic stability. These factors are crucial considerations for 2025, influencing capital allocation and potentially disrupting established supply chains.

The ongoing conflicts and protectionist measures, such as the imposition of tariffs and trade barriers, contribute to market volatility. For instance, the International Monetary Fund (IMF) projected in April 2024 that global growth would slow to 3.2% in 2024, a figure influenced by these geopolitical headwinds.

BlackRock has encountered substantial political opposition, primarily from Republican-led U.S. states, concerning its Environmental, Social, and Governance (ESG) investment strategies. This opposition has manifested in legal challenges, with accusations that BlackRock is collaborating to advance climate agendas that negatively impact coal production and energy costs.

These legal and political pressures are directly challenging BlackRock's ESG commitments. For instance, by mid-2024, over 20 Republican-led states had initiated actions or investigations into BlackRock's ESG practices, citing concerns about fiduciary duty and potential economic harm from these policies.

Influence on Policy-Making

BlackRock, as a significant global financial player, actively influences policy discussions, particularly concerning economic growth, market evolution, and retirement planning. Its perspectives often align with or challenge prevailing governmental approaches to these critical areas.

Larry Fink's 2025 Chairman's Letter to Investors underscores this engagement, highlighting BlackRock's commitment to reshaping retirement thinking and broadening access to capital markets. This proactive stance suggests a direct impact on policy formulation and implementation.

- Policy Influence: BlackRock's substantial assets under management, exceeding $10 trillion as of early 2024, grant it considerable leverage in shaping financial regulations and economic policies globally.

- Retirement Reform: The firm's focus on retirement solutions, as articulated by Fink, is likely to drive policy proposals aimed at improving retirement security and expanding investment opportunities for individuals.

- Capital Access: BlackRock's advocacy for expanded access to capital markets could lead to policy changes that facilitate investment in emerging markets and support business growth.

International Regulatory Divergence

BlackRock faces significant challenges due to varying international regulations, particularly in sustainable finance and antitrust. For instance, the U.S. Securities and Exchange Commission's (SEC) climate disclosure rules, finalized in March 2024, differ substantially from the EU's Sustainable Finance Disclosure Regulation (SFDR), creating compliance complexities for a global asset manager. This divergence impacts how BlackRock can market and manage ESG-focused funds across different jurisdictions, potentially limiting product standardization.

Antitrust scrutiny also presents a regulatory hurdle, with differing approaches in the U.S. and Europe. As of mid-2024, concerns regarding market concentration in asset management continue to be a focus for regulators, potentially influencing BlackRock's M&A activities and operational strategies. Navigating these distinct regulatory environments requires BlackRock to maintain flexible compliance frameworks and adapt its product development to meet local requirements.

- U.S. SEC Climate Disclosure Rules (Finalized March 2024): Focus on materiality and scope of emissions reporting.

- EU SFDR: Categorizes funds based on sustainability objectives, impacting labeling and marketing.

- Antitrust Investigations: Ongoing regulatory review of large asset managers' market share and influence in key regions.

- Data Reporting Mandates: Increasing demand for granular data on portfolio holdings and ESG metrics from various national regulators.

Political factors significantly shape BlackRock's operating environment, with regulatory oversight being a primary concern. The FDIC's early 2025 mandate for a passivity agreement highlights governmental efforts to manage systemic risk stemming from large institutional investors' influence on financial institutions.

Geopolitical tensions and trade protectionism, as noted by BlackRock, contribute to market volatility and impact investment strategies. The IMF's April 2024 projection of 3.2% global growth for 2024 underscores these economic headwinds.

BlackRock faces political opposition, particularly from U.S. states, regarding its ESG investment strategies. By mid-2024, over 20 Republican-led states had initiated actions or investigations into these practices, citing concerns over fiduciary duty.

The firm actively engages in policy discussions, influencing approaches to economic growth and retirement planning, as evidenced by Larry Fink's 2025 Chairman's Letter. BlackRock's over $10 trillion in assets under management as of early 2024 provides substantial leverage in shaping financial regulations.

What is included in the product

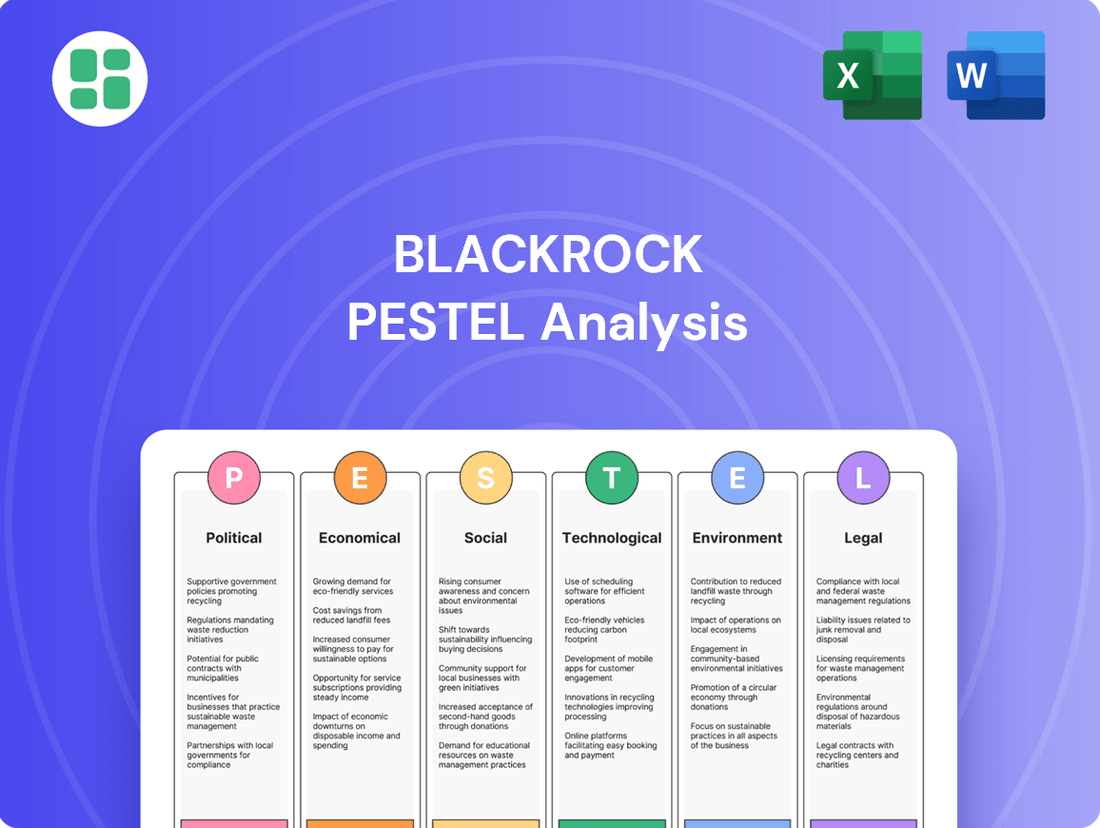

This BlackRock PESTLE analysis examines the impact of political, economic, social, technological, environmental, and legal factors on the company's operations and strategy.

Offers a clear, actionable overview of BlackRock's external environment, simplifying complex PESTLE factors into digestible insights for strategic decision-making.

Economic factors

BlackRock's 2025 Global Investment Outlook highlights a fundamental shift in the global economy, moving beyond cyclical patterns to a structural transformation driven by powerful forces like Artificial Intelligence. This perspective, as detailed in their outlook, suggests that these 'mega forces' are permanently altering economic landscapes. For instance, AI's projected impact on global GDP is substantial, with some estimates suggesting it could add trillions of dollars to the global economy by 2030, indicating a profound and lasting change.

This ongoing evolution means investors must adapt their strategies, as traditional approaches may no longer suffice in an economy characterized by increased macroeconomic volatility. The rapid advancement and adoption of AI, for example, are creating new industries while disrupting existing ones, leading to unpredictable economic swings and requiring a more dynamic investment approach.

BlackRock anticipates inflation and interest rates will persist above pre-pandemic averages, a significant shift impacting investment strategies. This 'higher for longer' outlook means borrowing costs remain elevated, directly affecting corporate profitability and the appeal of different investments. For instance, the US Federal Reserve's target inflation rate is 2%, but recent data shows inflation, while moderating, remains a concern.

The sustained higher interest rate environment reshapes the cost of capital for businesses, making expansion and investment more expensive. This also influences how investors value assets; for example, discounted cash flow (DCF) models will use higher discount rates, potentially lowering present values of future earnings. In 2024, major central banks, including the Fed and the European Central Bank, have maintained higher policy rates to combat persistent inflation, with expectations for gradual, data-dependent rate cuts rather than a swift return to near-zero levels.

BlackRock observes persistent market volatility, yet points to the robust resilience of U.S. corporations, which continue to demonstrate strong earnings growth despite potential economic slowdowns. This suggests that while the overall economic picture might be softening, the underlying strength of American businesses remains a key factor.

For investors, this dynamic necessitates a flexible and strategic approach. Instead of anticipating a return to traditional economic cycles, the focus should be on adapting to this new environment. For instance, the S&P 500's earnings per share (EPS) growth was projected to be around 9% for 2024, a figure that, while potentially moderating, still indicates corporate vitality.

Capital Markets and Private Investments

Mega forces like artificial intelligence are reshaping economies, and capital markets are crucial for funding this evolution. Private markets, in particular, are seeing significant growth as investors seek opportunities in these transformative sectors.

BlackRock's strategic move to acquire Global Infrastructure Partners (GIP) for $12.5 billion in early 2024 highlights its commitment to bolstering its private market offerings. This acquisition positions BlackRock to better leverage the increasing demand for infrastructure and alternative assets, which are often at the forefront of technological advancement.

- Private market fundraising reached record levels in 2023, exceeding $1.5 trillion globally, according to Preqin data.

- Infrastructure as an asset class attracted over $200 billion in new capital commitments in 2023.

- BlackRock's GIP acquisition is expected to add approximately $100 billion in infrastructure assets under management to its platform.

Technology Sector Contribution to Growth

The technology sector's robust earnings are a key engine for corporate profit expansion. BlackRock's analysis highlights artificial intelligence (AI) as a pivotal catalyst for market expansion, underpinning their overweight stance on U.S. equities.

This strategic positioning anticipates the AI trend's ripple effect, fostering new avenues for investment. For instance, the semiconductor industry, a direct beneficiary of AI demand, saw significant growth in 2024, with global semiconductor revenue projected to reach $689 billion by the end of the year, according to SIA.

- AI as a Growth Driver: BlackRock identifies AI as the primary force propelling market growth.

- Overweight U.S. Equities: This outlook leads to a preference for U.S. stocks due to AI's concentrated impact.

- Broadening Investment Opportunities: The expectation is that AI's influence will expand, creating diverse investment possibilities.

- Semiconductor Sector Performance: The semiconductor market, crucial for AI infrastructure, is experiencing substantial revenue increases.

The global economic landscape is undergoing a structural transformation, heavily influenced by mega forces like Artificial Intelligence, which is projected to add trillions to global GDP by 2030. Persistent inflation and higher interest rates, expected to remain above pre-pandemic averages, are reshaping corporate profitability and investment valuations, with central banks like the US Federal Reserve maintaining elevated policy rates throughout 2024. Despite potential economic slowdowns, U.S. corporations have shown remarkable resilience, with the S&P 500 earnings per share growth projected around 9% for 2024, underscoring the sector's vitality.

| Economic Factor | 2024/2025 Projection/Trend | Impact on Investment |

|---|---|---|

| AI Integration | Trillions added to global GDP by 2030 | Drives growth in tech, semiconductors; necessitates dynamic strategies |

| Inflation & Interest Rates | Persistently above pre-pandemic averages | Increases cost of capital, impacts asset valuations (higher discount rates) |

| Corporate Resilience (U.S.) | S&P 500 EPS growth ~9% (2024 projection) | Suggests underlying strength despite broader economic concerns |

| Private Markets Growth | Global fundraising >$1.5 trillion (2023) | Increased demand for infrastructure and alternative assets |

Preview the Actual Deliverable

BlackRock PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This BlackRock PESTLE analysis provides a comprehensive overview of the external factors impacting the company. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental influences.

Sociological factors

BlackRock has long championed ESG investing, aligning with a significant societal shift towards responsible financial practices. This commitment is evident as the firm continues to integrate ESG factors into its investment analysis, even amidst political scrutiny, recognizing their growing importance to clients seeking sustainable options.

In 2024, BlackRock reported over $10 trillion in assets under management, a substantial portion of which is influenced by ESG considerations. The firm's stance reflects a market where investors, particularly younger demographics, increasingly prioritize environmental, social, and governance criteria, driving demand for sustainable investment products and strategies.

Global demographic shifts, like the aging populations in developed nations and the expanding youth demographic in emerging markets, significantly shape investment product demand. For instance, by 2050, the proportion of people aged 65 and over is projected to reach 16% globally, up from 10% in 2020, driving demand for retirement solutions and healthcare-focused investments.

These trends create opportunities for BlackRock to tailor offerings, such as increased demand for income-generating assets and long-term care financing products in aging societies. Conversely, a growing young workforce in lower-income economies may fuel demand for savings vehicles and education-focused investment strategies.

BlackRock emphasizes workforce diversity and inclusion, viewing it as a catalyst for innovation and superior performance. However, a significant shift occurred in early 2025 when the company decided not to renew its aspirational workforce representation goals, which concluded in 2024. This decision was attributed to evolving legal and policy landscapes in the United States concerning Diversity, Equity, and Inclusion (DEI) initiatives.

Public Perception and Corporate Responsibility

BlackRock's public perception is significantly shaped by its active engagement in environmental, social, and governance (ESG) matters. The company's commitment to sustainable investing, including its role in advocating for climate action through initiatives like the Climate Action 100+ engagement, draws both praise and scrutiny. This balancing act is crucial for maintaining the trust of its global client base, which includes pension funds, endowments, and individual investors.

Navigating public opinion requires BlackRock to address concerns about its influence on corporate behavior and its investment strategies. For instance, in 2023, BlackRock managed over $9 trillion in assets, underscoring the substantial impact its investment decisions have on corporate governance and environmental policies worldwide. The firm's approach to shareholder engagement, particularly on climate-related resolutions, is closely watched by regulators, activists, and investors alike.

- ESG Integration: BlackRock's 2024 sustainability report highlighted a continued focus on integrating ESG factors into investment processes, aiming to deliver long-term financial returns.

- Stakeholder Engagement: The firm actively engages with companies on issues ranging from climate risk to diversity and inclusion, reflecting a growing demand for corporate responsibility.

- Public Scrutiny: BlackRock faces ongoing debate regarding its role in energy investments versus climate advocacy, a dynamic that influences its brand reputation and client acquisition.

- Asset Under Management: With over $10 trillion in assets under management as of early 2024, BlackRock's decisions carry significant weight in shaping corporate sustainability practices.

Evolving Client Preferences

Clients, especially large institutional investors, are increasingly focused on reducing financial risks and capitalizing on the opportunities presented by the global shift towards a low-carbon economy. This growing demand for sustainable and transition-focused investment strategies is a significant driver for BlackRock. For instance, BlackRock reported a substantial increase in its sustainable assets under management, reaching over $500 billion by the end of 2024, reflecting this evolving client preference.

This trend necessitates that BlackRock continually enhances its sustainable fund offerings and tailors solutions to meet specific client decarbonization targets. By aligning its product development with these client objectives, BlackRock aims to remain competitive and responsive to market shifts.

- Growing Demand for ESG: Institutional investors are prioritizing Environmental, Social, and Governance (ESG) factors in their investment decisions.

- Low-Carbon Transition: Clients seek investments that mitigate risks and capture opportunities related to the global transition to a net-zero economy.

- Sustainable Fund Growth: BlackRock's sustainable assets under management surpassed $500 billion in late 2024, demonstrating client appetite for these products.

- Decarbonization Goals: A key client preference is for investment partners to help them achieve their specific carbon reduction objectives.

Societal expectations are increasingly pushing financial institutions towards greater transparency and accountability, particularly concerning their environmental and social impact. BlackRock's extensive engagement in ESG investing, managing over $10 trillion in assets as of early 2024, positions it at the forefront of this shift, responding to a growing demand for sustainable financial products from a diverse client base.

Demographic changes are also a significant sociological factor, influencing investment product demand. As global populations age, there's a rising need for retirement and healthcare-focused investments, while younger demographics in emerging markets drive demand for savings and education vehicles.

Public perception significantly impacts BlackRock's operations, with its stance on ESG and climate action drawing both support and criticism. The firm's active role in shareholder engagement, managing over $9 trillion in assets in 2023, means its decisions carry substantial weight in shaping corporate governance and environmental policies globally.

While BlackRock previously set aspirational workforce representation goals, these concluded in 2024, with the company citing evolving legal landscapes in the US regarding DEI initiatives as a reason for not renewing them in early 2025. This reflects a broader societal debate and regulatory environment surrounding diversity and inclusion efforts.

Technological factors

BlackRock views Artificial Intelligence (AI) as a 'mega force' that is fundamentally changing economies and markets, creating substantial investment prospects. The firm is actively investing in and utilizing AI, recognizing it as a primary market driver and a crucial element for its future expansion.

In 2023, BlackRock reported that its AI-driven investment strategies contributed to its strong performance. For instance, its Aladdin platform, a sophisticated technology suite that utilizes AI and machine learning, manages over $1 trillion in assets, demonstrating the tangible impact of AI on its operations and client offerings.

BlackRock's Aladdin platform is a significant technological asset, offering robust risk management capabilities to financial institutions worldwide. This proprietary system is crucial for institutional investors, providing tools to analyze sustainability data, incorporate climate-related risk assessments, and consolidate information from various external sources, thereby streamlining investment and risk management workflows.

Cybersecurity risks are a significant technological factor for BlackRock. As a global investment manager, the firm's operations and client data rely heavily on sophisticated technological infrastructure. In 2024, the financial services sector continued to be a prime target for cyberattacks, with the average cost of a data breach reaching an estimated $4.45 million globally, according to IBM's 2024 Cost of a Data Breach Report. This underscores the critical need for BlackRock to maintain robust defenses to protect sensitive client information and ensure operational continuity, as any breach could severely damage its reputation and client trust.

Fintech Innovation and Competition

Fintech innovation, particularly in areas like blockchain and digital assets, is reshaping the financial services industry. This dynamic environment presents BlackRock with both significant opportunities for enhanced service delivery and considerable competitive pressures from agile fintech firms. For instance, by the end of 2024, the global fintech market was projected to reach over $33 trillion, underscoring the scale of this transformation.

BlackRock's strategic imperative is to continuously innovate its offerings and digital platforms. This is crucial to not only remain competitive but also to effectively cater to the evolving demands of its diverse client base in an increasingly digitized financial landscape. The firm's investment in technology, including its Aladdin platform, aims to address these challenges and leverage new technological advancements.

Key technological factors influencing BlackRock include:

- Blockchain and Digital Assets: Advancements in these areas offer potential for greater efficiency in trading, settlement, and asset management, but also introduce new competitors and regulatory considerations.

- AI and Machine Learning: The integration of AI and ML is enhancing data analysis, risk management, and personalized client solutions, driving operational improvements and competitive differentiation.

- Digital Platforms and Client Experience: Fintech’s focus on user-friendly digital interfaces and seamless client experiences necessitates BlackRock’s ongoing investment in its own digital infrastructure and service delivery models.

- Data Analytics and Big Data: The ability to harness and analyze vast amounts of data is becoming a critical competitive advantage, influencing investment strategies and client engagement.

Data Analytics and Insights

BlackRock’s strategic advantage is heavily reliant on its sophisticated data analytics capabilities, transforming raw information into actionable investment intelligence. This focus on data allows for more informed and precise decision-making across its diverse investment strategies.

The company's commitment to a data-driven approach is clearly demonstrated by its ongoing integration of environmental, social, and governance (ESG) data. For instance, by December 2024, BlackRock plans to integrate over 16,000 ESG metrics into its Aladdin platform. This extensive data integration is crucial for meeting evolving investor demands for sustainable and transparent investment practices.

- Data-Driven Insights: BlackRock utilizes advanced analytics to uncover patterns and trends, informing investment strategies and risk management.

- ESG Integration: By December 2024, the Aladdin platform will incorporate over 16,000 ESG metrics, reflecting a significant push towards data-backed sustainable investing.

- Enhanced Decision-Making: The ability to process and analyze vast datasets allows for more nuanced and effective investment decisions.

Technological advancements are a cornerstone of BlackRock's strategy, with AI and machine learning driving significant operational improvements and client solutions. The firm's Aladdin platform, a testament to this, manages over $1 trillion in assets and is set to integrate over 16,000 ESG metrics by December 2024, enhancing data-driven insights for sustainable investing.

The rapid growth of fintech, projected to exceed $33 trillion globally by the end of 2024, necessitates BlackRock's continuous investment in digital platforms to maintain competitiveness and meet evolving client expectations. Cybersecurity remains a critical technological factor, with the average cost of a data breach in financial services estimated at $4.45 million in 2024, highlighting the need for robust defenses.

| Technology Area | BlackRock's Engagement | Market Context (2024/2025) |

| Artificial Intelligence (AI) | 'Mega force' driving investment and operational efficiency; Aladdin platform utilizes AI/ML. | AI adoption accelerating across financial services for predictive analytics and automation. |

| Fintech & Digital Assets | Adapting to blockchain and digital asset innovations; facing competitive pressures. | Global fintech market projected to exceed $33 trillion; increasing interest in digital asset infrastructure. |

| Cybersecurity | Critical focus due to reliance on technological infrastructure and client data. | Financial services sector remains a prime target; average data breach cost $4.45 million (IBM 2024). |

| Data Analytics & ESG Integration | Leveraging data for investment intelligence; integrating over 16,000 ESG metrics by Dec 2024. | Growing demand for data-backed ESG investing; sophisticated data analytics a key competitive advantage. |

Legal factors

BlackRock navigates a complex web of regulations, overseen by entities such as the U.S. Securities and Exchange Commission (SEC) and the European Securities and Markets Authority (ESMA). In 2023, the firm, like others in the asset management sector, continued to adapt to evolving rules concerning ESG disclosures and digital asset oversight. Failure to comply with these stringent requirements, which include anti-money laundering and data protection mandates, can result in significant penalties and reputational damage.

BlackRock and other large asset managers are currently embroiled in antitrust lawsuits initiated by Republican-led states. These legal battles, ongoing through 2024 and into 2025, center on allegations of coordinated efforts to advance climate-focused agendas and consequently hinder coal production.

These suits are not merely about ESG policies; they directly question the legality of collaborative action among institutional investors. The outcomes could significantly reshape how large financial entities engage with environmental, social, and governance initiatives and influence future regulatory frameworks governing their operations.

BlackRock's global operations necessitate strict adherence to data privacy regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. The firm must continuously update its data handling protocols to safeguard client information and maintain trust, especially as data breaches remain a persistent threat across the financial industry.

Fiduciary Duty and Shareholder Advocacy

BlackRock's legal defense in antitrust cases often centers on its position as a passive investor, prioritizing client financial interests. However, ongoing lawsuits challenge whether its environmental, social, and governance (ESG) advocacy constitutes anticompetitive behavior, potentially redefining fiduciary duties for asset managers.

This legal scrutiny could lead to broader interpretations of what constitutes a breach of fiduciary duty, impacting how asset managers engage with portfolio companies on ESG matters. For instance, in 2023, BlackRock faced multiple antitrust investigations in various U.S. states related to its ESG initiatives.

- Antitrust Scrutiny: BlackRock's ESG policies are under examination for potential anticompetitive effects.

- Fiduciary Duty Reinterpretation: Lawsuits may broaden the understanding of asset managers' fiduciary obligations.

- Client Interests vs. ESG Advocacy: The core legal question is whether ESG advocacy aligns with or conflicts with maximizing client financial returns.

- Regulatory Impact: Adverse rulings could set precedents for ESG integration across the asset management industry.

Changes in DEI Legal Environment

The U.S. legal and policy landscape concerning Diversity, Equity, and Inclusion (DEI) has seen significant shifts, compelling BlackRock to re-evaluate its internal strategies. These changes, including executive orders targeting DEI initiatives and increased scrutiny over potential religious discrimination claims, have directly influenced corporate approaches.

In response, BlackRock opted not to renew aspirational workforce representation goals that concluded in 2024. This decision reflects a broader trend among financial institutions to adapt their DEI frameworks amidst evolving legal interpretations and potential litigation risks.

- Legal Scrutiny: Increased legal challenges and regulatory reviews of DEI programs are a primary driver for corporate adjustments.

- Executive Orders: Recent executive orders have reshaped the federal approach to DEI, impacting compliance requirements for companies.

- Risk Mitigation: Companies are actively reviewing their DEI practices to mitigate risks associated with potential discrimination lawsuits, particularly concerning religious objections.

- Policy Adaptation: BlackRock's decision not to renew certain workforce representation goals highlights a strategic pivot to align with the current legal environment.

Legal factors significantly shape BlackRock's operational landscape, demanding strict adherence to a growing body of regulations. The firm faces ongoing antitrust scrutiny in 2024 and 2025 concerning its ESG initiatives, with lawsuits alleging anticompetitive behavior impacting coal production. These legal challenges could redefine fiduciary duties for asset managers, influencing how they engage with environmental, social, and governance matters. Furthermore, BlackRock must navigate evolving data privacy laws like GDPR, where non-compliance can lead to substantial financial penalties, potentially up to 4% of global annual revenue.

| Legal Area | Key Developments (2023-2025) | Potential Impact |

|---|---|---|

| Antitrust & ESG | Ongoing lawsuits in US states alleging anticompetitive ESG practices; scrutiny of collaborative investor action. | Redefinition of fiduciary duties; potential restrictions on ESG advocacy; precedent-setting rulings. |

| Data Privacy | Continued enforcement of GDPR and CCPA; increasing risk of data breaches. | Significant fines for non-compliance (up to 4% of global revenue for GDPR); reputational damage; need for robust data protection protocols. |

| DEI Policies | Shifts in US legal and policy landscape; executive orders impacting DEI initiatives. | Re-evaluation of workforce representation goals; risk mitigation against discrimination claims; adaptation of DEI frameworks. |

Environmental factors

BlackRock views climate change not just as an environmental issue, but as a fundamental financial risk that significantly impacts a company's long-term viability. The firm has explicitly stated that climate change is a defining factor in assessing a company's future prospects, influencing investment decisions across its vast portfolio.

To manage these risks, BlackRock integrates climate analysis directly into its investment and risk management frameworks. Tools like Aladdin Climate are employed to quantify climate-related exposures and to help design effective decarbonization pathways for investment portfolios, reflecting a proactive approach to this evolving landscape.

This focus is particularly relevant as global efforts to combat climate change intensify. For instance, in 2024, the financial sector is increasingly scrutinizing Scope 3 emissions, which can represent the majority of a company's carbon footprint, adding another layer of complexity to investment risk assessment.

BlackRock's commitment to ESG and sustainable investing is substantial, managing over $1 trillion in related assets. This includes a vast global platform of more than 500 sustainable and transition investment strategies, reflecting significant client interest and a proactive response to evolving market demands.

The firm is actively improving the sustainability profiles of numerous funds. This strategic enhancement is driven by both direct client requests and the increasingly stringent regulatory environment, especially within Europe, which is shaping the future of investment practices.

BlackRock has also clarified its stance on 'transition investing'. This focus acknowledges the need to support companies moving towards more sustainable operations, aligning with the growing global imperative to address climate change and other environmental, social, and governance factors.

BlackRock is actively pursuing decarbonization, targeting a 67% reduction in its Scope 1 and 2 greenhouse gas emissions by 2030, benchmarked against 2019 levels. This commitment extends to its supply chain, encouraging partners to adopt science-aligned emission reduction targets.

The company is also investing in renewable energy to power its own operations, demonstrating a practical approach to mitigating its environmental footprint. These initiatives align with broader global efforts to combat climate change and transition to a lower-carbon economy.

Reporting Standards and Transparency

BlackRock champions robust reporting standards, advocating for companies to disclose climate-related risks and opportunities. This aligns with frameworks like the Task Force on Climate-Related Financial Disclosures (TCFD) and the International Sustainability Standards Board (ISSB). For instance, as of early 2024, a significant majority of S&P 500 companies have begun reporting on climate-related matters, with many aligning their disclosures with TCFD recommendations.

This emphasis on transparency is crucial for BlackRock to effectively assess a company's readiness for the low-carbon transition and to guide its stewardship activities. The growing adoption of ISSB standards globally, with countries like the UK and Singapore moving towards implementation in 2024 and 2025 respectively, further solidifies this trend towards standardized environmental reporting.

- BlackRock supports TCFD and ISSB frameworks for climate disclosure.

- Transparency aids in assessing low-carbon transition preparedness.

- ISSB adoption is expanding globally, influencing reporting for 2024-2025.

- Enhanced disclosure supports BlackRock's stewardship activities.

Controversies and Greenwashing Concerns

BlackRock, despite its significant sustainability commitments, faces ongoing criticism regarding the genuine impact of its climate risk management and engagement strategies. Skepticism around 'greenwashing' and the firm's actual contribution to real-economy decarbonization remains a persistent challenge.

These concerns have prompted adjustments in BlackRock's public communications and policy stances, notably its U.S. arm's withdrawal from the Climate Action 100+ initiative in mid-2024. This move, while framed as a strategic realignment, has amplified scrutiny from various stakeholders.

- Investor Scrutiny: Critics question whether BlackRock's investment decisions align with its stated climate goals, particularly concerning continued investments in fossil fuel companies.

- Policy Evolution: The firm's shifting approach to climate initiatives, including its stance on shareholder proposals, has led to accusations of inconsistency and a dilution of its environmental commitments.

- Reputational Risk: Persistent greenwashing accusations can damage BlackRock's brand, potentially impacting client trust and its ability to attract and retain assets under management in an increasingly ESG-conscious market.

BlackRock views environmental factors, particularly climate change, as material financial risks impacting investment valuations and long-term company performance. The firm actively integrates climate analysis into its investment processes, utilizing tools like Aladdin Climate to assess portfolio exposures and support decarbonization efforts.

The increasing global focus on sustainability and decarbonization, evidenced by widespread adoption of reporting frameworks like TCFD and ISSB, directly influences BlackRock's investment strategies and stewardship activities. For instance, by early 2024, a substantial majority of S&P 500 companies were reporting on climate matters, with many adopting TCFD recommendations, and the ISSB standards are gaining traction globally, with countries like the UK and Singapore implementing them in 2024-2025.

BlackRock is also committed to reducing its own operational emissions, targeting a 67% reduction in Scope 1 and 2 greenhouse gas emissions by 2030 against 2019 levels, and encourages its supply chain partners to adopt similar science-aligned targets.

Despite these efforts, BlackRock faces scrutiny regarding the efficacy of its climate engagement and the potential for greenwashing, a challenge amplified by its mid-2024 withdrawal from the Climate Action 100+ initiative.

PESTLE Analysis Data Sources

Our PESTLE Analysis for BlackRock is built on a robust foundation of data sourced from leading financial institutions, economic research firms, and regulatory bodies. We incorporate insights from global economic indicators, environmental policy updates, technological advancements, and socio-political trends to provide a comprehensive view.