BlackRock Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlackRock Bundle

Unlock the full strategic blueprint behind BlackRock's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

BlackRock's strategic acquisitions are a cornerstone of its platform expansion, enabling it to enter new markets and bolster existing offerings. These moves are carefully chosen to align with long-term growth opportunities and client demand.

A prime illustration of this strategy is the October 2024 acquisition of Global Infrastructure Partners (GIP). This deal, valued at approximately $12.5 billion, significantly bolsters BlackRock's infrastructure investment capabilities, adding over $100 billion in assets under management to its platform.

This acquisition positions BlackRock to effectively tap into the substantial global investments anticipated in infrastructure over the coming decade, driven by energy transition and digitalization trends.

BlackRock leverages a vast network of financial intermediaries, including wealth advisors, brokers, and consultants worldwide. These partnerships are vital for getting BlackRock's wide array of investment products, like mutual funds and ETFs, into the hands of both individual and large institutional investors.

This extensive distribution system is a cornerstone of BlackRock's business, ensuring their investment solutions reach a broad market. For instance, in 2023, BlackRock's iShares ETFs alone saw significant inflows, underscoring the power of these intermediary relationships in driving asset growth.

BlackRock actively seeks technology and data collaborations to bolster its Aladdin platform. These partnerships are crucial for expanding its analytical and investment workflow capabilities, especially in the complex world of whole portfolio solutions.

A prime example is BlackRock's planned acquisition of Preqin, a prominent data provider for private markets. This move, along with the integration of HPS Investment Partners, underscores a strategic push to enrich its data analytics and streamline investment processes.

Joint Ventures for New Market Access

BlackRock strategically forms joint ventures to unlock new client segments and investment opportunities. A prime example is their H1 2025 collaboration with Partners Group to introduce a multi-private markets model solution. This initiative is designed to significantly alter how retail investors can access alternative investments, tapping into the burgeoning private wealth market.

This partnership aims to democratize access to private markets, a sector that has historically been more exclusive. By leveraging Partners Group's expertise in private markets and BlackRock's extensive distribution network, they anticipate capturing substantial growth. The venture underscores BlackRock's commitment to innovation and expanding its product offerings to meet evolving investor demands.

- Joint Venture with Partners Group: Targeting H1 2025 launch for a multi-private markets model solution.

- Objective: To transform retail investor access to alternative investments.

- Market Focus: Capturing growth opportunities within the private wealth segment.

Capital Market Participants and Fiduciaries

BlackRock cultivates robust alliances with key capital market participants, including major banks, custodians, and other fiduciaries. These collaborations are crucial for facilitating smooth capital movements, executing trades efficiently, and ensuring the utmost security and integrity of client assets. For instance, in 2024, BlackRock continued to leverage its extensive network of banking partners to manage liquidity and execute complex transactions across global markets, a necessity given the estimated $1.5 quadrillion in global assets under custody and administration as of Q1 2024.

These strategic relationships form the operational bedrock of BlackRock's investment management services, enabling seamless integration and reliable execution. The firm's reliance on these partners is evident in its operational efficiency, allowing it to manage trillions in assets under management (AUM). As of December 31, 2023, BlackRock reported $10.5 trillion in AUM, underscoring the scale at which these partnerships must function effectively.

- Banking Partnerships: Facilitate capital flows, lending, and trade settlement.

- Custodial Services: Ensure the safekeeping and administration of client assets.

- Fiduciary Relationships: Uphold trust and compliance in managing investments on behalf of beneficiaries.

- Operational Backbone: These partnerships are essential for the day-to-day functioning and scalability of BlackRock's offerings.

BlackRock's key partnerships are diverse, ranging from technology providers to financial intermediaries and strategic joint ventures. These alliances are critical for expanding its reach, enhancing its technological capabilities, and accessing new markets and client segments. The firm actively collaborates with data providers to enrich its analytics, as seen with the planned acquisition of Preqin, and forms joint ventures like the one with Partners Group to democratize access to alternative investments for retail investors, targeting a H1 2025 launch.

What is included in the product

A detailed framework outlining BlackRock's strategy, focusing on institutional investors and wealth managers as key customer segments, leveraging technology and global reach for its value proposition.

This model highlights BlackRock's diversified revenue streams from asset management and technology services, supported by robust partnerships and a scalable operational infrastructure.

BlackRock's Business Model Canvas acts as a pain point reliever by offering a structured, visual framework to dissect complex investment strategies, enabling clearer communication and faster decision-making across diverse teams.

Activities

BlackRock's core activity revolves around managing a vast spectrum of investment strategies. These strategies span diverse asset classes like equities, fixed income, alternatives, and money market instruments, catering to both institutional and individual investors globally. For instance, as of Q1 2024, BlackRock reported $10.5 trillion in Assets Under Management (AUM), showcasing the sheer scale of its investment management operations.

The firm employs a multi-faceted approach, encompassing active, passive, and systematic investment methodologies. This allows them to tailor portfolios to the unique financial goals and risk appetites of their clients. Their commitment to innovation is evident in their continuous development of new products and solutions to navigate dynamic market environments.

BlackRock's key activity revolves around the ongoing development, enhancement, and operation of its Aladdin technology platform. This sophisticated system is the backbone for managing portfolios, executing trades, and performing intricate risk analytics.

Aladdin serves a dual purpose: it's integral to BlackRock's internal operations and is also a significant revenue generator through technology services provided to external financial institutions. This dual role underscores its importance as a core business function.

In 2024, Aladdin continued to be a critical differentiator for BlackRock, powering its investment management capabilities and offering advanced solutions to clients. The platform's robust functionality and continuous upgrades are essential for maintaining a competitive edge in the rapidly evolving financial technology landscape.

BlackRock's strategic acquisitions are a cornerstone of its growth, aimed at broadening its investment capabilities and market reach. The company's recent acquisition of Global Infrastructure Partners (GIP) for $12.5 billion and HPS Investment Partners are prime examples, significantly enhancing its private markets and infrastructure investment expertise.

Successfully integrating these newly acquired entities is a critical ongoing activity. This process involves harmonizing operational systems, aligning investment strategies, and fostering a unified corporate culture to unlock the full synergistic potential and drive future growth.

Product Innovation and Development

BlackRock is heavily invested in creating and introducing new investment products that cater to changing investor needs. This dedication to innovation is a cornerstone of their business, ensuring they remain at the forefront of the asset management industry.

A prime example of this is their continued expansion and management of iShares exchange-traded funds (ETFs). In 2023, iShares saw substantial net inflows, contributing significantly to BlackRock's overall growth and solidifying its market leadership in the ETF space.

Furthermore, BlackRock is actively pioneering in the realm of tokenized funds, exemplified by the launch of the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) on the Ethereum blockchain. This move into digital assets demonstrates their commitment to embracing emerging technologies and offering novel investment solutions.

These product innovations are critical drivers of net inflows for BlackRock. For instance, the company reported record total net inflows of $963 billion in 2023, with ETFs being a major component, underscoring the success of their product development strategy.

- iShares ETF Growth: Continued expansion and management of iShares ETFs, a key driver of net inflows.

- Digital Asset Innovation: Pioneering tokenized funds like the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) on Ethereum.

- Net Inflow Contribution: Product innovation directly fuels BlackRock's substantial net inflows, reinforcing market leadership.

- 2023 Performance: BlackRock achieved record total net inflows of $963 billion in 2023, with ETFs playing a vital role.

Client Engagement and Investment Stewardship

BlackRock actively engages with clients to understand their investment needs and objectives. This direct interaction forms the bedrock of their client relationships, ensuring alignment and satisfaction.

The firm's Investment Stewardship team plays a crucial role by directly communicating with the boards and management of portfolio companies. This dialogue focuses on critical areas such as corporate governance, strategic direction, and financial resilience.

These engagements are vital for informing BlackRock’s voting decisions at shareholder meetings, thereby promoting long-term value creation for its clients. For instance, in 2024, BlackRock's Investment Stewardship team engaged with over 4,000 companies globally.

- Client Interaction: Direct communication to tailor investment solutions and build lasting relationships.

- Investment Stewardship: Engaging with company leadership on governance, strategy, and financial health.

- Voting Influence: Using proxy voting to drive positive change and long-term shareholder value.

- 2024 Engagement: Over 4,000 global company engagements to promote responsible corporate practices.

BlackRock's key activities center on managing investment portfolios and developing innovative financial products. They leverage technology, like their Aladdin platform, for operational efficiency and risk management, while also engaging directly with clients and portfolio companies to foster long-term value.

The firm's strategic acquisitions, such as GIP and HPS Investment Partners, are crucial for expanding its expertise, particularly in private markets and infrastructure. This growth is further fueled by continuous product innovation, notably in ETFs and digital assets, which drives significant net inflows and reinforces market leadership.

Their Investment Stewardship function actively engages with thousands of companies globally, influencing corporate governance and strategy through direct dialogue and proxy voting. This commitment to responsible investment practices is integral to their business model.

| Key Activity | Description | Recent Data/Impact |

| Investment Management | Managing diverse asset classes for institutional and individual clients. | $10.5 trillion in AUM (Q1 2024). |

| Technology Platform (Aladdin) | Developing and operating a comprehensive risk management and trading system. | Powers internal operations and provides services to external institutions. |

| Product Development & Innovation | Creating and managing investment products, including ETFs and digital assets. | Record $963 billion net inflows in 2023, with ETFs as a major contributor. Launched BUIDL tokenized fund. |

| Client Engagement & Stewardship | Direct client interaction and engagement with portfolio company leadership. | Over 4,000 company engagements in 2024 by Investment Stewardship. |

| Strategic Acquisitions | Acquiring companies to broaden capabilities and market reach. | Acquisition of Global Infrastructure Partners for $12.5 billion. |

Preview Before You Purchase

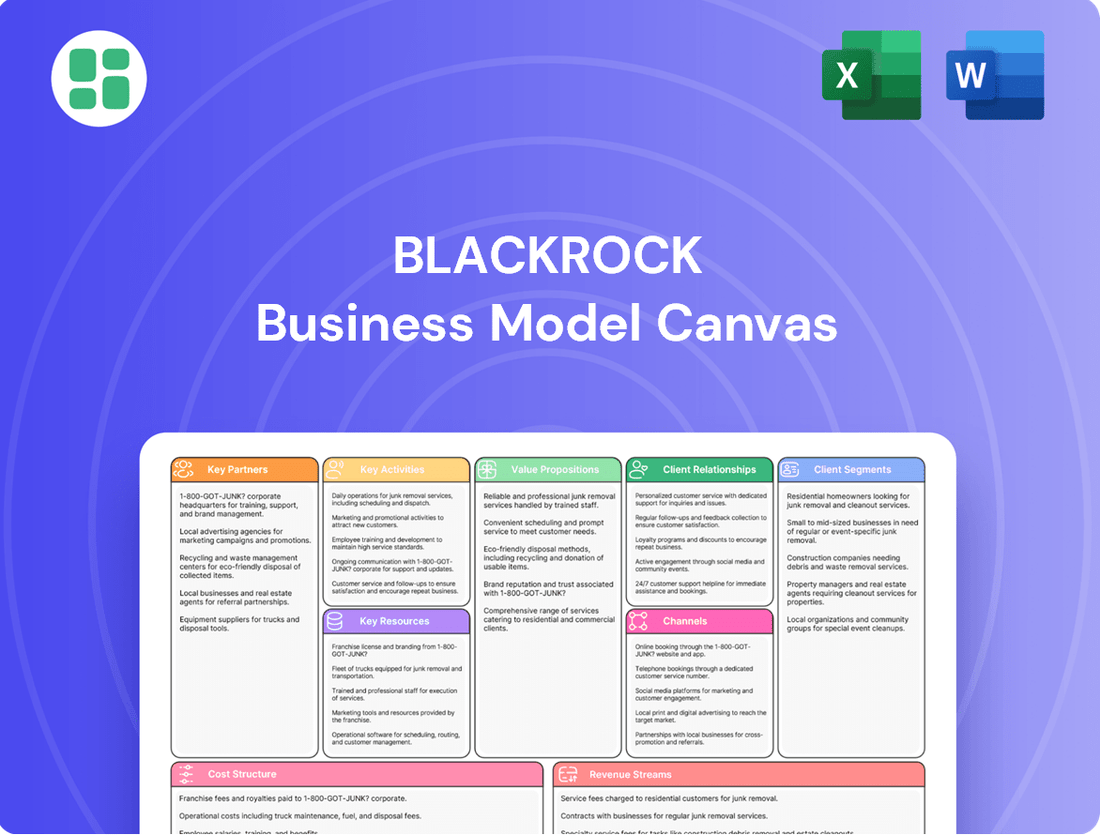

Business Model Canvas

The BlackRock Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This comprehensive overview details BlackRock's strategic framework, including its value propositions, customer segments, channels, revenue streams, key resources, activities, partnerships, and cost structure. You can be assured that the content and formatting you see here are precisely what will be delivered, providing a complete and ready-to-use resource for understanding BlackRock's operational blueprint.

Resources

BlackRock's most critical resource is its vast Assets Under Management (AUM), which stood at an impressive $11.6 trillion by the close of 2024. This substantial financial base continued its upward trajectory, reaching a new record of $12.52 trillion as of June 30, 2025.

This immense scale is not merely a number; it translates directly into significant market influence and powerful economies of scale for BlackRock. The sheer volume of assets managed provides a stable and predictable foundation for consistent fee income generation, solidifying its status as the premier global asset manager.

BlackRock's proprietary Aladdin technology platform is a cornerstone of its business model, serving as a critical intellectual property and technological asset. This comprehensive system manages risk and portfolios, giving BlackRock a significant competitive edge. It's used extensively by BlackRock's own funds and licensed to numerous external financial institutions, demonstrating its broad utility and market acceptance.

Aladdin's continuous innovation is directly linked to BlackRock's technology services revenue stream. As of the first quarter of 2024, BlackRock reported that its technology services segment, largely driven by Aladdin, contributed $476 million to its total revenue, highlighting its importance as a growth driver and a key differentiator in the financial technology landscape.

BlackRock's global talent pool, encompassing almost 23,000 employees across more than 30 countries by 2025, is a cornerstone of its business model. This vast network of investment professionals, technologists, and client service experts provides the intellectual capital necessary for developing cutting-edge investment strategies and managing intricate operational demands.

The sheer breadth of expertise allows BlackRock to offer sophisticated investment solutions tailored to diverse client needs worldwide. This human capital is not merely about numbers; it's about the collective knowledge and experience that drives innovation and ensures the delivery of high-quality services, from portfolio management to client engagement.

Strong Brand Reputation and Trust

BlackRock's strong brand reputation is a significant intangible asset, cultivated over decades of demonstrated reliability and industry leadership. This trust is paramount in attracting new clients and fostering loyalty among existing ones, directly fueling sustained organic growth and bolstering market confidence in the firm's stability and performance.

This reputation acts as a fundamental pillar supporting BlackRock's client relationships, ensuring a consistent flow of assets under management. As of the first quarter of 2024, BlackRock reported total assets under management (AUM) of $10.5 trillion, a testament to the enduring trust placed in its brand.

- Brand Strength: Decades of consistent performance and ethical conduct have cemented BlackRock's position as a trusted leader in investment management.

- Client Retention: The brand's reliability is a key driver for retaining a substantial portion of its AUM, minimizing client attrition.

- Market Confidence: A strong reputation translates into greater investor confidence, making BlackRock a preferred choice in volatile market conditions.

- Organic Growth Driver: Trust in the brand directly contributes to attracting new capital, supporting the company's ongoing expansion without relying solely on acquisitions.

Diversified Product Offerings

BlackRock's diversified product offerings are a cornerstone of its business model, acting as a critical resource. This extensive range includes iShares ETFs, active funds, private market solutions, and cash management instruments. This breadth allows BlackRock to serve a vast array of client needs, from individual investors seeking low-cost index exposure to institutional clients requiring sophisticated alternative investments.

This diversification is not just about variety; it's about capturing market share across different asset classes and client segments. As of the first quarter of 2024, BlackRock managed $10.5 trillion in assets, a testament to the appeal of its comprehensive product suite. This vast AUM underscores the effectiveness of their strategy in meeting diverse investment objectives and navigating varied market conditions.

- iShares ETFs: Offering broad market exposure and sector-specific investments, iShares remain a significant growth driver.

- Active Funds: Catering to clients seeking alpha generation, these funds cover a wide spectrum of asset classes and investment styles.

- Private Market Solutions: Including private equity, private credit, and real estate, these offerings tap into less liquid but potentially higher-return opportunities.

- Cash Management: Providing stable, liquid options for short-term needs, these instruments are crucial for many institutional clients.

BlackRock's core resources are its massive Assets Under Management (AUM), which reached $12.52 trillion by mid-2025, its proprietary Aladdin technology platform, a global workforce of nearly 23,000 employees, and its strong brand reputation built on trust and performance.

The Aladdin platform is not only critical for internal operations but also a significant revenue generator through licensing, contributing $476 million in Q1 2024 to its technology services segment. This technological prowess, combined with its vast human capital and diverse product offerings, enables BlackRock to cater to a wide spectrum of client needs and maintain its market leadership.

The firm's extensive product suite, encompassing iShares ETFs, active funds, private market solutions, and cash management, underpins its ability to attract and retain capital, as evidenced by its $10.5 trillion AUM in Q1 2024. This diversification is key to its sustained growth and ability to navigate various market conditions.

| Resource | Description | Key Data Point (as of mid-2025 or latest available) |

|---|---|---|

| Assets Under Management (AUM) | The total market value of investments BlackRock manages on behalf of its clients. | $12.52 trillion |

| Aladdin Technology Platform | Integrated risk management, portfolio construction, and trading system. | Contributed $476 million to technology services revenue (Q1 2024). |

| Human Capital | Global workforce of investment professionals, technologists, and client service experts. | Nearly 23,000 employees across 30+ countries. |

| Brand Reputation | Trust and recognition built through consistent performance and industry leadership. | Underpins client retention and organic growth. |

| Product Diversification | Wide range of investment products including ETFs, active funds, and alternatives. | Supports $10.5 trillion AUM (Q1 2024) across diverse client segments. |

Value Propositions

BlackRock provides clients with access to an extensive array of investment products spanning public and private markets, covering equities, fixed income, alternatives, and cash management. This wide-ranging platform allows clients to build comprehensive portfolios precisely aligned with their individual risk tolerances and financial goals.

In 2024, BlackRock's commitment to offering diverse solutions is evident in its management of trillions in assets across various classes, enabling clients to navigate complex market conditions effectively. Their goal is to adapt and provide adaptable investment strategies.

BlackRock's Aladdin platform offers sophisticated risk management and analytics, a core value proposition. It provides clients with unparalleled insights into portfolio risk, performance, and trading, fostering transparency and enabling more informed decisions. In 2024, Aladdin continued to be a significant driver of BlackRock's business, managing trillions in assets for a diverse client base.

BlackRock's value proposition centers on providing clients unparalleled access to global investment opportunities and a wealth of expertise. This global footprint, evident in its operations across 30+ countries, allows clients to tap into diverse markets and asset classes, from established public equities to burgeoning private markets. For instance, BlackRock's Aladdin platform, used by thousands of institutions worldwide, underpins this access by providing sophisticated risk management and portfolio analytics.

The firm's extensive research capabilities are a cornerstone of this offering. BlackRock employs a vast network of analysts and economists who generate deep insights into market trends and sector-specific developments. This allows clients to identify unique investment opportunities, such as those emerging in alternative investments and innovative products like tokenized assets, which represent a significant area of future growth for the industry.

Furthermore, BlackRock's deep expertise across a multitude of asset classes, including fixed income, equities, alternatives, and cash management, empowers clients with specialized investment solutions. This comprehensive approach facilitates effective diversification strategies and provides access to niche markets that might otherwise be inaccessible to individual investors or smaller institutions. As of the first quarter of 2024, BlackRock managed over $10.5 trillion in assets, a testament to the trust and value clients place in its global reach and expertise.

Cost-Efficiency and Accessibility through ETFs

BlackRock's iShares ETF business offers investors a cost-effective way to gain exposure to various markets. This accessibility is a key part of their offering, allowing more people to invest.

For example, as of early 2024, iShares ETFs continue to attract significant inflows, demonstrating their popularity and the demand for low-cost investment solutions. The transparency and liquidity of ETFs further enhance their appeal.

- Cost-Efficiency: ETFs typically have lower expense ratios compared to traditional mutual funds, making investing more affordable.

- Accessibility: iShares ETFs provide a broad range of market exposures, from broad market indices to niche sectors, catering to diverse investment goals.

- Transparency: The holdings of ETFs are disclosed daily, offering investors a clear view of what they own.

- Liquidity: ETFs trade on exchanges throughout the day, allowing investors to buy and sell shares easily at market prices.

Fiduciary Partnership and Long-Term Financial Well-being

BlackRock acts as a fiduciary, prioritizing client interests above all else to secure their long-term financial health. This means offering guidance, market intelligence, and personalized strategies that build confidence and align with client objectives.

The firm's commitment extends to empowering clients through education and insights, fostering informed decision-making. This approach cultivates a strong sense of trust, essential for a successful partnership focused on enduring financial well-being.

- Fiduciary Duty: BlackRock's core value is acting in the best interest of its clients, a commitment reinforced by its fiduciary status.

- Long-Term Focus: Strategies are designed to achieve sustainable growth and financial security, looking beyond short-term market fluctuations.

- Client Empowerment: Providing educational resources and tailored advice helps clients understand their investments and make confident choices.

- Trust and Shared Goals: The partnership is built on transparency and a mutual understanding of objectives, fostering a relationship of reliability.

BlackRock offers a vast range of investment products across public and private markets, enabling clients to construct portfolios aligned with their specific risk appetites and financial objectives. This extensive product suite, managed with deep expertise across asset classes, allows clients to navigate diverse market conditions effectively.

The firm's Aladdin platform provides sophisticated risk management and analytics, offering clients deep insights into portfolio performance and trading. This technological edge, managing trillions in assets for institutions globally, ensures transparency and facilitates informed decision-making.

BlackRock's value proposition is built on providing clients unparalleled access to global investment opportunities and extensive expertise. This global reach, coupled with deep research capabilities and a fiduciary commitment, empowers clients to achieve their long-term financial goals.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Comprehensive Investment Access | Broad range of products across public and private markets (equities, fixed income, alternatives). | Managed over $10.5 trillion in assets as of Q1 2024, demonstrating extensive client trust and market penetration. |

| Advanced Technology & Analytics (Aladdin) | Sophisticated risk management, portfolio analytics, and trading capabilities. | Aladdin manages trillions in assets, providing critical insights to thousands of institutions worldwide. |

| Global Expertise & Research | Deep market insights and access to diverse asset classes through a global network. | Operations in 30+ countries, employing numerous analysts and economists to identify emerging opportunities. |

| Cost-Effective Solutions (iShares ETFs) | Low-cost, accessible, transparent, and liquid investment vehicles. | iShares ETFs continue to attract significant inflows, highlighting strong investor demand for efficient market exposure. |

| Fiduciary Commitment & Client Empowerment | Prioritizing client interests with long-term strategies, education, and transparency. | Focus on building trust through personalized guidance and fostering informed investment decisions for sustainable financial well-being. |

Customer Relationships

BlackRock employs dedicated teams to foster strong client connections, serving both large institutions and individual investors. This personalized approach ensures specific client needs are met with tailored investment advice and solutions, building trust and loyalty.

In 2024, BlackRock's commitment to client relationships is underscored by its extensive global presence and its focus on providing consistent, high-quality service across all client segments. This strategy aims to cultivate long-term partnerships through proactive engagement and a deep understanding of evolving market demands.

BlackRock's Investment Stewardship team actively engages with company boards and management, focusing on critical areas like governance, strategy, and financial resilience. This proactive approach aims to protect and enhance the long-term value of client investments, reflecting a deep commitment to responsible ownership.

BlackRock actively engages clients through its digital platforms, providing access to market insights, research, and educational materials. This digital focus aims to equip clients with the knowledge needed for smart financial decisions, cultivating a community of well-informed investors.

In 2024, BlackRock continued to emphasize its digital strategy, with a significant portion of client interactions and resource dissemination occurring online. For instance, their iShares platform offers extensive educational content and tools, supporting millions of investors globally.

Partnership-Oriented Approach for Complex Needs

For large institutional clients and those with complex investment needs, BlackRock cultivates a deep partnership approach. This strategy goes beyond standard asset management, focusing on co-creation and tailored solutions.

This often involves integrating BlackRock’s proprietary Aladdin technology platform, which provides comprehensive risk management and portfolio analytics. This technological integration allows for a more sophisticated understanding and management of client portfolios, addressing highly specific and intricate requirements.

BlackRock's commitment extends to providing comprehensive portfolio advice, acting as a strategic advisor rather than just a fund manager. This high-touch service model is crucial for clients navigating intricate financial landscapes.

- Customized Solutions: Tailored investment strategies designed to meet unique client objectives.

- Aladdin Integration: Leveraging advanced technology for risk management, trading, and portfolio oversight.

- Comprehensive Advice: Offering strategic guidance that encompasses a client's entire financial picture.

- Partnership Focus: Building long-term relationships based on collaboration and mutual understanding of complex needs.

Transparency and Fiduciary Responsibility

A cornerstone of BlackRock's customer relationships is its unwavering commitment to transparency and fiduciary responsibility. This means they are legally and ethically bound to act in their clients' best interests. By clearly communicating investment strategies, performance metrics, and associated fees, BlackRock fosters an environment of trust and understanding. This open approach ensures clients are fully aware of how their assets are being managed, which is crucial for long-term partnerships.

This dedication to fiduciary duty is not just a talking point; it's embedded in their operational framework. For instance, in 2024, BlackRock continued to emphasize clear reporting on its ESG (Environmental, Social, and Governance) integration, providing clients with detailed insights into how sustainability factors influence investment decisions. This proactive disclosure helps clients align their investments with their values and understand the potential impact of these considerations on returns.

- Fiduciary Duty: BlackRock is legally obligated to act in the best interest of its clients.

- Transparency in Fees: Clear disclosure of all management and performance fees is provided.

- Performance Reporting: Regular and detailed updates on investment performance are shared.

- Strategy Communication: Investment methodologies and strategic allocations are explained to clients.

BlackRock cultivates deep client relationships through a blend of personalized service, technological integration, and a strong fiduciary commitment. In 2024, the firm continued to prioritize proactive engagement, offering tailored investment advice and leveraging its Aladdin platform for sophisticated portfolio management, ensuring clients' evolving needs are met with transparency and expertise.

| Aspect | Description | 2024 Focus/Data |

|---|---|---|

| Client Engagement | Dedicated teams for institutional and individual investors, digital platforms for insights and education. | Continued emphasis on digital channels; iShares platform supports millions globally with educational resources. |

| Service Model | Partnership approach for complex needs, co-creation of solutions, comprehensive portfolio advice. | Integration of Aladdin technology for advanced risk management and analytics in client solutions. |

| Trust & Transparency | Upholding fiduciary duty, clear communication on strategies, performance, and fees. | Increased transparency in ESG integration reporting, reinforcing alignment of investments with client values. |

Channels

BlackRock's direct sales force and institutional relationships are crucial for serving its massive client base, which includes major players like pension funds and sovereign wealth funds. In 2024, these relationships are key to delivering highly specialized investment strategies.

This direct approach allows for deep, customized interactions, ensuring that BlackRock's complex investment solutions meet the unique needs of each institutional client. It facilitates direct negotiation on terms and provides a tailored service experience.

Financial advisors and intermediary networks are a cornerstone for BlackRock, serving as a vital conduit to both retail and high-net-worth individuals. These partnerships are crucial for distributing BlackRock's extensive product suite, which includes popular iShares ETFs and a variety of mutual funds, thereby broadening market access.

BlackRock actively supports these networks by providing them with essential resources, training, and technology. This engagement ensures that advisors are well-equipped to offer BlackRock's solutions to their clients. In 2023, BlackRock's iShares ETFs alone saw significant inflows, underscoring the effectiveness of these distribution channels in reaching a vast investor base.

BlackRock's digital channels, including its corporate website and iShares.com, serve as primary touchpoints for clients seeking investment information and product details. These platforms are crucial for engaging a broad audience, offering market insights and tools that facilitate self-service portfolio management.

The Aladdin platform is another key digital channel, providing sophisticated portfolio management capabilities and analytics to institutional clients. This integrated technology solution underscores BlackRock's commitment to offering advanced digital tools for enhanced client experience and operational efficiency.

In 2024, BlackRock continued to invest heavily in its digital infrastructure, recognizing the critical role of online presence in client education and outreach. Their digital platforms are designed to provide a seamless user experience, supporting BlackRock's mission to make investing more accessible and understandable for a diverse client base.

Strategic Partnerships and Joint Ventures

BlackRock leverages strategic partnerships to open new distribution channels, notably its collaboration with Partners Group. This alliance aims to bring multi-private markets solutions to retail wealth clients, expanding access to previously exclusive asset classes.

These joint ventures are crucial for creating specialized avenues to reach specific client segments and distribute targeted products. For instance, by teaming up with firms possessing expertise in alternative investments, BlackRock can offer these complex strategies to a broader audience.

- Partners Group Collaboration: Enables access to private markets for retail investors.

- Specialized Distribution: Creates targeted channels for niche products.

- Client Segment Expansion: Reaches investor groups previously underserved by private market offerings.

- Product Innovation: Facilitates the development of new investment solutions through shared expertise.

Direct-to-Consumer Digital Initiatives (Emerging)

BlackRock is venturing into direct-to-consumer (D2C) digital channels, a strategic move to broaden its reach beyond traditional institutional and advised clients. This initiative is particularly evident with the launch of spot Bitcoin ETFs, offering retail investors direct access to this emerging asset class.

These D2C efforts aim to tap into a growing demand for self-directed investing and innovative products. By leveraging digital platforms, BlackRock can streamline the investment process and cater to a younger, more digitally native investor base.

- Expanded Market Access: D2C digital initiatives allow BlackRock to reach a wider audience, including individual investors who may not typically work with financial advisors.

- Product Innovation: The focus on products like spot Bitcoin ETFs demonstrates a commitment to offering cutting-edge investment opportunities directly to consumers.

- Investor Preference Alignment: This channel directly addresses the evolving preferences of investors who seek convenient, digital access to manage their portfolios.

- Competitive Landscape: As other asset managers develop their D2C capabilities, BlackRock's expansion in this area is crucial for maintaining market relevance and capturing new growth opportunities.

BlackRock's channels are multifaceted, encompassing direct sales, intermediary networks, digital platforms, and strategic partnerships. In 2024, the firm continues to leverage these diverse avenues to distribute its extensive product offerings, from iShares ETFs to specialized institutional strategies, ensuring broad market penetration and client engagement.

The direct sales force and institutional relationships are vital for bespoke solutions, while financial advisors and intermediaries extend reach to retail and high-net-worth clients. Digital channels, including the BlackRock website and the Aladdin platform, offer information and sophisticated tools, enhancing client experience and operational efficiency.

Strategic alliances, such as the one with Partners Group, are expanding access to alternative asset classes for retail investors. Furthermore, BlackRock's growing direct-to-consumer (D2C) digital presence, exemplified by its offering of spot Bitcoin ETFs in 2024, caters to the increasing demand for self-directed investing and innovative products.

| Channel Type | Key Function | Target Audience | 2024 Focus/Examples |

|---|---|---|---|

| Direct Sales & Institutional Relationships | Bespoke solutions, complex strategies | Pension funds, sovereign wealth funds, large institutions | Highly specialized investment strategies, direct negotiation |

| Intermediary Networks (Financial Advisors) | Broad product distribution, client acquisition | Retail investors, high-net-worth individuals | iShares ETFs, mutual funds, advisor support and training |

| Digital Channels (Website, iShares.com, Aladdin) | Information access, self-service, advanced analytics | All client segments, investors seeking market insights | Enhanced user experience, market insights, Aladdin platform capabilities |

| Strategic Partnerships | Access to new markets/asset classes | Specific client segments, retail wealth clients | Partners Group collaboration for private markets access |

| Direct-to-Consumer (D2C) Digital | Direct product access, self-directed investing | Individual retail investors | Spot Bitcoin ETFs, catering to digitally native investors |

Customer Segments

Institutional investors, a cornerstone of BlackRock's client base, encompass a broad range of entities including corporate and public pension funds, university endowments, charitable foundations, and significant sovereign wealth funds. These sophisticated clients, managing vast pools of capital, typically seek highly customized investment strategies and robust risk management frameworks. In 2024, BlackRock continued to serve these clients by offering tailored solutions and advanced reporting capabilities, reflecting the growing demand for specialized investment approaches within this segment.

Retail investors, individuals looking to grow their savings and manage their personal wealth, represent a significant customer base for BlackRock. This group is often guided by financial advisors and utilizes various intermediary platforms to access investment opportunities.

BlackRock caters to these individual investors by offering a broad spectrum of products designed for diverse financial objectives. Key offerings include their popular iShares ETFs and a wide array of mutual funds, making investing more accessible.

In 2023, BlackRock saw substantial inflows into its iShares ETFs, highlighting the continued appeal of these diversified investment vehicles among retail investors. The firm's commitment to providing accessible and cost-effective solutions continues to resonate with individuals seeking to build long-term wealth.

Wealth management firms and independent advisors, including RIAs and family offices, are a crucial customer segment for BlackRock. These entities leverage BlackRock's extensive product suite and its powerful Aladdin technology platform to effectively manage their clients' investment portfolios. In 2024, the demand for sophisticated portfolio management tools remained high as advisors sought to differentiate their services and navigate complex market conditions.

Corporations and Financial Institutions

BlackRock extends its services beyond asset management to corporations and financial institutions, offering its proprietary Aladdin platform. This technology suite is crucial for clients seeking to enhance their internal portfolio management, conduct sophisticated risk analytics, and streamline operational processes. As of early 2024, Aladdin supports trillions of dollars in assets, demonstrating its widespread adoption and critical role in the financial ecosystem.

The technology services offered through Aladdin represent a significant and distinct revenue stream for BlackRock. Clients leverage Aladdin for its comprehensive capabilities, which include data management, trading, and compliance tools. This segment highlights BlackRock's evolution into a technology provider, not solely an investment manager.

- Aladdin Platform: A cornerstone technology offering for risk management and portfolio analytics.

- Client Base: Serves a broad range of corporations and financial institutions.

- Key Benefits: Enhances internal portfolio management, risk analytics, and operational efficiency for clients.

- Market Impact: Manages trillions in assets, underscoring its critical role in the financial industry.

High-Net-Worth Individuals and Private Clients

High-net-worth individuals and private clients represent a crucial customer segment for BlackRock. This group is increasingly looking for more than just traditional stocks and bonds, showing a strong interest in alternative investments like private equity and real estate. For instance, by the end of 2023, BlackRock reported substantial growth in its alternatives business, managing over $250 billion in assets under management across various strategies, a testament to this demand.

BlackRock is actively enhancing its capabilities to serve these sophisticated investors. Strategic alliances, such as their collaboration with Partners Group, are key to this expansion. This partnership aims to provide clients with enhanced access to private market opportunities, a sector that has seen significant capital inflows. In 2024, BlackRock continued to emphasize its commitment to building out its private markets platform, recognizing the long-term growth potential and client demand in this area.

- Growing demand for alternative investments: Wealthy clients are diversifying beyond traditional assets.

- Strategic partnerships: Collaborations like the one with Partners Group expand access to private markets.

- Expanded offerings: BlackRock is developing more sophisticated investment solutions tailored to this segment.

- Focus on private markets: Significant capital is being directed towards private equity, debt, and real estate by this client base.

BlackRock serves a diverse clientele, from large institutional investors like pension funds and endowments to individual retail investors seeking accessible investment vehicles. The firm also partners with wealth management firms and financial advisors, providing them with technology and investment solutions to serve their own clients.

Cost Structure

Employee compensation and benefits represent a substantial cost for BlackRock, driven by its extensive global team of over 21,000 employees. This category encompasses base salaries, performance-based bonuses, and various incentive programs designed to align employee rewards with the firm's and individual achievements.

In 2023, compensation and benefits expense was approximately $6.7 billion. This figure directly correlates with the firm's financial performance; as operating income rises, so too does the allocation for incentive compensation, reflecting a commitment to rewarding success across the organization.

BlackRock dedicates significant capital to its technology infrastructure, particularly for its Aladdin platform. In 2023, technology and development expenses represented a substantial portion of its operating costs, reflecting ongoing investments in software, data, and cloud services to support its global investment and technology offerings.

BlackRock's sales, marketing, and distribution expenses are significant, reflecting the substantial investment required to acquire and retain clients across its diverse product offerings. These costs are crucial for expanding Assets Under Management (AUM) and driving product adoption in a competitive landscape.

In 2024, BlackRock likely continued to allocate substantial resources to advertising, client events, and sales commissions. For instance, the company's commitment to its iShares ETF business necessitates ongoing marketing efforts to maintain its market leadership. These expenditures are directly tied to growing its global client base and deepening relationships with financial intermediaries.

Acquisition and Integration Costs

BlackRock faces substantial acquisition and integration costs, particularly from strategic moves like the acquisition of Global Infrastructure Partners (GIP). These costs encompass transaction fees, legal expenses, and the complex process of merging operations and systems.

Integration expenses, including technology upgrades and staff restructuring, can significantly impact operating expenses for a period following an acquisition. Furthermore, the amortization of intangible assets acquired, such as brand names or customer relationships, also contributes to these costs.

- Transaction Fees: Costs associated with deal structuring, due diligence, and legal counsel for acquisitions.

- Integration Expenses: Costs related to merging systems, operations, and personnel post-acquisition.

- Amortization of Intangibles: The systematic expensing of acquired intangible assets over their useful lives.

- Impact on Profitability: These costs can temporarily reduce net income and earnings per share in the short to medium term.

General and Administrative Expenses

General and administrative (G&A) expenses are a critical component of BlackRock's cost structure, encompassing the essential overhead required to run a global financial powerhouse. These costs are fundamental to maintaining the company's extensive operational infrastructure and ensuring strict adherence to regulatory requirements across various jurisdictions.

In 2023, BlackRock reported total operating expenses of $10.7 billion. A significant portion of this is dedicated to G&A, which includes costs like:

- Office Leases and Facilities Management: Maintaining a global network of offices to support its workforce and client interactions.

- Legal and Compliance: Covering the significant expenses associated with navigating complex financial regulations and legal frameworks worldwide.

- Professional Services: Fees paid to external auditors, consultants, and other specialized service providers essential for corporate functions.

- Corporate Functions: Expenses related to human resources, IT infrastructure, and other support services that underpin the entire organization.

BlackRock's cost structure is heavily influenced by its significant investments in talent, technology, and client acquisition. Employee compensation, a major expense, directly reflects the firm's performance and growth ambitions. The ongoing development and maintenance of its proprietary Aladdin platform represent a substantial, recurring technology cost, crucial for its operational efficiency and competitive edge.

The company's commitment to expanding its Assets Under Management (AUM) necessitates considerable spending on sales, marketing, and distribution to reach and retain a global client base. Strategic acquisitions, such as the one involving Global Infrastructure Partners, introduce significant transaction and integration costs that can impact short-term profitability.

General and administrative expenses cover the essential overhead of operating a vast global financial services firm, including regulatory compliance, legal services, and maintaining its extensive office network. These costs are fundamental to supporting BlackRock's broad range of investment products and services.

| Cost Category | 2023 Approximate Expense (USD Billions) | Key Drivers |

| Employee Compensation & Benefits | 6.7 | Global workforce size, performance incentives |

| Technology & Development | Significant Investment | Aladdin platform, software, data, cloud services |

| Sales, Marketing & Distribution | Substantial | Client acquisition, AUM growth, product promotion |

| Acquisition & Integration Costs | Varies (e.g., GIP deal) | Transaction fees, legal, system integration |

| General & Administrative (G&A) | Portion of $10.7 Billion Total Operating Expenses | Office leases, legal, compliance, professional services |

Revenue Streams

BlackRock's core revenue comes from investment advisory and administration fees, essentially a percentage of the money they manage. In the first quarter of 2024, BlackRock reported total revenue of $4.7 billion, with a significant portion stemming from these fees, which are directly tied to their vast assets under management (AUM).

BlackRock's technology services and subscription revenue, primarily driven by its Aladdin platform, is a cornerstone of its business model. This segment captures recurring income from licensing its sophisticated risk management and portfolio analytics software to external financial institutions.

In the first quarter of 2024, BlackRock reported that technology services revenue reached $405 million, a notable increase from the previous year. This growth underscores the increasing demand for advanced technological solutions in the financial sector and highlights Aladdin's competitive advantage.

BlackRock generates performance fees, often called "incentive fees" or "performance allocation," from specific investment strategies, particularly in its active and alternative asset classes. These fees are earned when the funds managed by BlackRock surpass agreed-upon benchmarks or achieve predetermined performance hurdles. This revenue stream is inherently more volatile than management fees but can provide a substantial boost to earnings during periods of strong market performance or successful strategy execution.

For instance, BlackRock's private markets and liquid alternatives segments are key drivers of performance fee revenue. In 2023, BlackRock reported $1.1 billion in performance fees, a notable increase from $400 million in 2022, primarily driven by strong results in private equity and credit strategies. This highlights the significant impact this revenue stream can have, especially when market conditions favor these specialized investment approaches.

Securities Lending Revenue

BlackRock generates revenue through its securities lending program, where it lends out assets from client portfolios. This practice is a standard way for asset managers to earn additional income, supplementing their core management fees.

In 2023, BlackRock's securities lending revenue reached $1.1 billion, a notable increase from the previous year, reflecting strong market demand for borrowed securities. This revenue stream is particularly valuable as it leverages existing assets under management to create incremental income for both BlackRock and its clients.

- Securities Lending Income: BlackRock lends securities from client portfolios to generate fees.

- 2023 Performance: Securities lending revenue was $1.1 billion in 2023.

- Market Demand: Increased demand for borrowed securities boosted this revenue stream.

- Client Benefit: This activity provides additional income for clients as well as BlackRock.

Distribution and Shareholder Service Fees

BlackRock earns revenue from distribution and shareholder service fees, primarily for managing mutual funds and specific exchange-traded fund (ETF) share classes. These fees compensate the company for maintaining its broad distribution network, which includes financial advisors and other intermediaries, as well as for providing ongoing support to shareholders.

These fees are crucial for funding BlackRock's extensive client service operations and its partnerships within the financial ecosystem. For instance, in 2023, BlackRock's iShares ETFs, a significant portion of their business, continued to see substantial inflows, underscoring the importance of these distribution channels and the associated service fees.

- Distribution Fees: Compensate for the costs associated with marketing and selling investment products through various channels.

- Shareholder Service Fees: Cover the expenses of providing ongoing support and administrative services to investors.

- Intermediary Support: These fees facilitate relationships with financial advisors and institutions that recommend BlackRock products.

- Product Accessibility: Ensure that BlackRock's diverse range of investment solutions are readily available to a wide investor base.

BlackRock's revenue streams are diverse, primarily driven by asset management fees, technology services, and performance-based incentives. In Q1 2024, total revenue was $4.7 billion, showcasing the scale of their operations.

The Aladdin platform is a significant contributor, generating recurring revenue from software licensing, with Q1 2024 technology services revenue reaching $405 million. Performance fees, earned on outperforming benchmarks, added $1.1 billion in 2023, up from $400 million in 2022, particularly from private markets.

Securities lending brought in $1.1 billion in 2023, leveraging existing assets for additional income. Distribution and shareholder service fees further support revenue through broad product accessibility and intermediary relationships, especially with strong iShares ETF inflows in 2023.

| Revenue Stream | 2023 Revenue (Approx.) | Key Driver | Q1 2024 Update |

| Investment Advisory & Administration Fees | Vast majority of total revenue | Assets Under Management (AUM) | Total Revenue: $4.7 billion |

| Technology Services (Aladdin) | Not separately disclosed for full year 2023 | Software Licensing & Subscriptions | $405 million |

| Performance Fees | $1.1 billion | Outperformance vs. Benchmarks | - |

| Securities Lending | $1.1 billion | Demand for Borrowed Securities | - |

| Distribution & Shareholder Service Fees | Not separately disclosed for full year 2023 | Product Sales & Investor Support | - |

Business Model Canvas Data Sources

The BlackRock Business Model Canvas is built using a combination of internal financial performance data, extensive market research on investment trends, and strategic analyses of competitive landscapes. These diverse data sources ensure a comprehensive and accurate representation of BlackRock's operations and market positioning.