BlackRock Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlackRock Bundle

BlackRock's BCG Matrix offers a powerful framework for understanding its diverse portfolio, categorizing assets into Stars, Cash Cows, Dogs, and Question Marks. This initial glimpse highlights key areas for strategic consideration, but to truly unlock actionable insights and drive informed investment decisions, a deeper dive is essential.

To gain a comprehensive understanding of BlackRock's strategic positioning and identify opportunities for growth and resource optimization, purchase the full BCG Matrix. This detailed analysis will provide the clarity needed to navigate complex market dynamics and make confident, data-driven choices.

Stars

BlackRock's iShares Spot Bitcoin ETF (IBIT) exemplifies a Star in the BCG Matrix, demonstrating rapid growth and a strong market position within the burgeoning cryptocurrency ETF sector. As of early 2024, IBIT quickly became a leader, attracting billions in assets under management, highlighting its success in a high-demand market.

The ETF's substantial inflows and rapid asset accumulation underscore its status as a Star, benefiting from BlackRock's established brand and extensive distribution network to capture a significant share of this emerging market.

BlackRock is aggressively expanding its private markets footprint, particularly in infrastructure, private credit, and private equity. This push is underscored by significant strategic acquisitions, such as Global Infrastructure Partners (GIP) and HPS Investment Partners, aimed at bolstering these offerings.

The firm is positioning these private market capabilities as key growth drivers, anticipating substantial sector expansion. BlackRock's strategic investments are designed to secure a leading market share, with a target for these segments to contribute over 20% of its total revenue.

These private markets strategies are particularly attractive to investors seeking differentiated returns in an evolving financial landscape. Investor demand for these alternative asset classes remains robust, driven by the potential for higher yields and diversification benefits compared to traditional public markets.

Aladdin, BlackRock's robust risk management and investment technology platform, is experiencing significant global adoption by institutional clients. Its revenue saw a healthy 16% year-over-year increase in the first quarter of 2025, underscoring its growing client base and its crucial function in streamlining investment operations across diverse markets.

This strong performance and expanding reach solidify Aladdin's status as a Star performer within the financial technology sector. Its ability to consolidate investment processes and manage risk effectively positions it for continued dominance in an evolving market landscape.

Thematic ETFs (e.g., AI, Digital Infrastructure)

BlackRock is actively positioning its thematic ETFs, such as those focused on artificial intelligence and digital infrastructure, as potential Stars within the BCG framework. These funds are designed to capitalize on powerful, long-term global trends, or 'mega forces,' that are reshaping economies and industries.

Thematic ETFs targeting areas like AI infrastructure are attracting significant investor capital due to the perceived high growth potential in these emerging sectors. For instance, the global AI market size was valued at USD 136.6 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 37.3% from 2023 to 2030, according to Grand View Research.

BlackRock's extensive distribution network and marketing efforts further bolster the prospects of these thematic ETFs. By aligning with rapidly evolving and high-growth sectors, these ETFs aim to capture substantial market share and deliver strong returns, fitting the 'Star' quadrant's characteristics of high growth and high relative market share potential.

- AI Market Growth: The AI market is experiencing exponential growth, projected to reach significant valuations in the coming years.

- Digital Infrastructure Demand: Investments in digital infrastructure are crucial for supporting AI advancements and other technological shifts.

- BlackRock's Strategic Focus: The company is strategically channeling resources into these thematic areas to capture future growth.

- Investor Interest: These themes resonate strongly with investors seeking exposure to innovation and disruptive technologies.

Sustainable and Transition Investing Solutions

BlackRock's Sustainable and Transition Investing Solutions are positioned as Stars within the BCG Matrix, reflecting their significant market share and high growth potential. Despite some recent fund reclassifications, the firm managed over $1 trillion in sustainable and transition assets as of early 2024, demonstrating its substantial commitment and scale in this rapidly expanding sector. This segment is a key focus for BlackRock as global demand for Environmental, Social, and Governance (ESG) integrated solutions continues to surge, driven by an increasing emphasis on climate transition and responsible investment practices.

The firm's ongoing enhancements to its sustainable investing platform are designed to meet this escalating client demand. BlackRock's substantial assets under management in this area underscore its leadership and influence in shaping the future of finance towards more sustainable outcomes.

- Market Leadership: BlackRock manages over $1 trillion in sustainable and transition assets, solidifying its position as a dominant force.

- High Growth Potential: The sustainable investing landscape is a high-growth area, fueled by global shifts towards climate transition and responsible investment.

- Platform Enhancement: The firm actively invests in and improves its ESG-integrated solutions to cater to evolving client needs.

- Strategic Importance: This segment is critical for BlackRock's long-term strategy, aligning with global megatrends and investor preferences.

BlackRock's iShares Spot Bitcoin ETF (IBIT) is a prime example of a Star in the BCG Matrix, showcasing rapid growth and a dominant market position in the cryptocurrency ETF space. By early 2024, IBIT had rapidly ascended to a leading role, attracting billions in assets under management, a clear indicator of its success in a high-demand market.

The substantial inflows and swift accumulation of assets by IBIT highlight its Star status, bolstered by BlackRock's reputable brand and extensive distribution capabilities to secure a significant share of this emerging market.

| Product/Service | BCG Category | Key Metrics | Rationale |

| iShares Spot Bitcoin ETF (IBIT) | Star | Billions in AUM (early 2024), rapid asset growth | High growth in crypto ETF sector, strong market share |

| Private Markets (Infrastructure, Credit, Equity) | Star | Targeting over 20% of total revenue, significant acquisitions (GIP, HPS) | High investor demand for alternatives, strategic expansion |

| Aladdin (Technology Platform) | Star | 16% YoY revenue increase (Q1 2025), global institutional adoption | Strong client adoption, essential for investment operations |

| Thematic ETFs (AI, Digital Infrastructure) | Star | Capitalizing on mega forces, AI market CAGR 37.3% (2023-2030) | High growth potential in emerging sectors, strong investor interest |

| Sustainable & Transition Investing | Star | Over $1 trillion in AUM (early 2024), surging ESG demand | Market leadership, high growth in sustainable finance |

What is included in the product

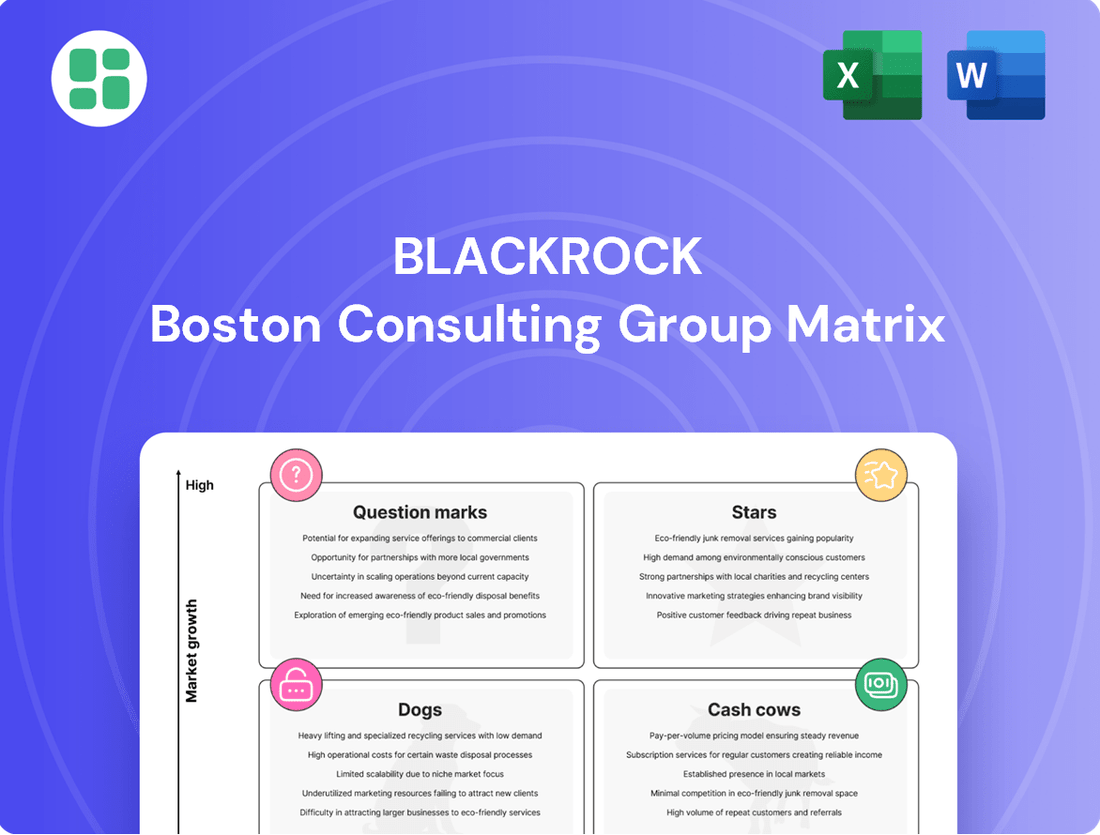

The BlackRock BCG Matrix analyzes a company's portfolio by product, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

A clear, visual BlackRock BCG Matrix simplifies complex portfolios, reducing the pain of strategic decision-making.

Cash Cows

The iShares Core S&P 500 ETF (IVV) and similar broad market index funds are BlackRock's quintessential Cash Cows within the BCG Matrix. These ETFs command vast assets under management, with IVV alone holding over $500 billion as of early 2024.

Their consistent, substantial fee revenue stems from widespread adoption and exceptionally low expense ratios, making them highly profitable. These funds are market leaders in a mature but stable segment, needing minimal new investment to defend their dominant positions.

Traditional institutional index funds represent a significant portion of BlackRock's Assets Under Management (AUM), acting as stable anchors in their portfolio. These large-scale mandates generate consistent base fee income with very low operational costs, even though their fee percentages are typically lower than actively managed products.

As of the first quarter of 2024, BlackRock's iShares ETFs, which largely comprise index-tracking products, saw substantial inflows, underscoring the continued demand for these foundational investments. This steady revenue stream from index funds is crucial for BlackRock's overall profitability and AUM expansion, solidifying their position as a core business segment.

BlackRock's established money market funds are solid cash cows, providing a steady stream of fee income. These funds are a go-to for clients prioritizing safety and easy access to their money, operating in a well-established market where BlackRock holds a significant position.

While not experiencing rapid expansion, the substantial assets under management within these money market funds ensure consistent demand and robust cash flow for BlackRock. As of the first quarter of 2024, BlackRock reported over $1.6 trillion in cash management assets, a testament to the stability and scale of these offerings.

LifePath Index Target-Date Funds

LifePath Index Target-Date Funds are a cornerstone of BlackRock's retirement offerings, functioning as significant cash cows within their portfolio. These funds, designed to automatically adjust asset allocation as investors approach their target retirement date, benefit from consistent and substantial inflows, often serving as the default investment choice in many employer-sponsored retirement plans.

This steady stream of assets provides BlackRock with a predictable and stable revenue base in a market segment that, while mature, remains critically important for long-term financial security. The inherent long-term investment horizon and diversified strategy of these funds mean they require less aggressive marketing, further contributing to their profitability and low operational costs.

As of the first quarter of 2024, BlackRock's iShares and LifePath products collectively managed trillions of dollars in assets, with target-date funds representing a substantial portion of this. For instance, BlackRock's total assets under management (AUM) surpassed $10 trillion by early 2024, underscoring the scale of their retirement solutions.

- Market Dominance: Target-date funds are the leading investment vehicle in defined contribution plans, with BlackRock being a major player in this space.

- Stable Inflows: Automatic enrollment and opt-out features in retirement plans ensure consistent contributions to LifePath funds.

- Mature Market: This segment is well-established, offering predictable revenue rather than high-growth potential.

- Low Marketing Costs: Their status as default options reduces the need for extensive promotional spending.

Legacy Active Fixed Income Strategies

BlackRock's legacy active fixed income strategies, especially core bond offerings, are the company's dependable cash cows. Despite a focus on expanding into alternatives, these established products continue to bring in steady fee revenue from significant institutional clients. In 2023, BlackRock managed approximately $1.5 trillion in fixed income assets, with a substantial portion attributed to these mature core strategies.

These strategies operate in a market with limited growth potential, yet BlackRock's deep expertise and strong existing client connections allow them to maintain a dominant market share. This stability makes them reliable generators of income for the firm, even as the company diversifies its investment offerings.

- Stable Fee Income: These strategies provide consistent revenue streams from substantial institutional mandates.

- High Market Share: BlackRock's established expertise and client relationships ensure continued dominance in core bond markets.

- Mature Product Lifecycle: While not high-growth, their reliability makes them valuable assets in the portfolio.

- Foundation for Growth: The income generated supports investment in newer, higher-growth areas like alternatives.

BlackRock's iShares Core S&P 500 ETF (IVV) and similar broad market index funds are prime examples of cash cows. These ETFs manage hundreds of billions in assets, generating consistent fee revenue due to their widespread adoption and low costs. They dominate a mature market, requiring minimal new investment to maintain their leading positions.

Traditional institutional index funds are foundational to BlackRock's AUM, providing stable fee income with low operational expenses. Despite lower fee percentages than active products, their sheer scale makes them highly profitable. As of Q1 2024, iShares ETFs saw significant inflows, highlighting the sustained demand for these core investments.

BlackRock's money market funds are also strong cash cows, offering reliable fee income by catering to clients seeking safety and liquidity. While not experiencing rapid growth, their substantial AUM ensures consistent demand and robust cash flow. By Q1 2024, BlackRock's cash management assets exceeded $1.6 trillion.

LifePath Index Target-Date Funds are significant cash cows in BlackRock's retirement offerings. These funds benefit from consistent inflows as default options in retirement plans, providing a predictable revenue base. Their long-term nature and diversified strategy mean lower marketing costs and operational expenses, boosting profitability.

| Category | Example Product | Approximate AUM (Early 2024) | Key Characteristics | Revenue Driver |

| Index ETFs | iShares Core S&P 500 ETF (IVV) | >$500 Billion | Market Leader, Mature Market, Low Expense Ratio | Management Fees |

| Institutional Index Funds | Broad Market Index Mandates | Trillions (Total BlackRock) | Stable Inflows, Low Operational Costs | Base Fee Income |

| Money Market Funds | BlackRock Money Market Funds | >$1.6 Trillion (Cash Management) | High Liquidity, Safety Focus, Established Market | Management Fees |

| Target-Date Funds | LifePath Index Funds | Substantial Portion of Trillions (Total Retirement) | Default Retirement Options, Consistent Inflows, Long-Term Horizon | Management Fees |

| Active Fixed Income | Core Bond Strategies | ~ $1.5 Trillion (Fixed Income Assets 2023) | Dominant Market Share, Institutional Clients, Stable Revenue | Management Fees |

What You’re Viewing Is Included

BlackRock BCG Matrix

The BlackRock BCG Matrix report you are currently previewing is the identical, fully unlocked document you will receive immediately after purchase. This means you get the complete strategic analysis, free from any watermarks or demo limitations, ready for immediate application in your business planning. You can confidently use this preview as a true representation of the professional, ready-to-deploy BCG Matrix analysis that will be yours to edit, present, and leverage for informed decision-making.

Dogs

BlackRock's decision to liquidate several U.S.-domiciled mutual funds and ETFs in 2024 and 2025, including niche sustainable and specialized products, signals a strategic portfolio adjustment. These funds likely faced challenges such as low assets under management (AUM) or waning investor demand, making them candidates for the Dogs category in a BCG-like analysis. For instance, funds with AUM below a certain threshold often become less viable due to fixed operational costs.

Underperforming niche actively managed funds, particularly those in crowded or slow-growing sectors, can be categorized as Dogs within the BlackRock BCG Matrix. These funds often struggle to beat their benchmarks, as evidenced by many actively managed equity funds in 2024 failing to outperform passive index funds, with Morningstar data showing a significant percentage lagging their benchmarks over multiple years.

Some thematic or sector-specific ETFs that are no longer popular with investors, or whose underlying trends have reversed, can become question marks in a portfolio. For example, several ETFs focused on specific climate or technology trends faced liquidation in 2024, signaling a failure to attract or retain investor interest.

Less Popular International or Currency-Hedged ETFs

Certain iShares ETFs targeting less popular international markets or utilizing intricate currency-hedging mechanisms might fall into the question mark category of the BCG Matrix. These products may not have achieved widespread investor adoption, leading to lower asset flows and market presence.

The liquidation of the iShares Currency Hedged MSCI Germany ETF serves as a concrete example of this classification. This action suggests a lack of sufficient demand and a diminished market share for such specialized offerings, indicating they require careful strategic consideration.

- Low Investor Demand: ETFs focused on niche international markets or complex hedging often struggle to attract a broad investor base.

- Liquidation Example: The closure of the iShares Currency Hedged MSCI Germany ETF highlights the challenges these products face in maintaining viability.

- Strategic Re-evaluation: Products in this segment may require strategic decisions regarding their future, such as product development, repositioning, or potential divestment.

Funds Impacted by Regulatory Changes Requiring Significant Restructuring

Funds undergoing significant restructuring due to regulatory shifts, like those impacted by the EU's Sustainable Finance Disclosure Regulation (SFDR) in 2024, may exhibit characteristics of a question mark. For instance, some ESG funds previously marketed with broad environmental claims had to refine their methodologies or even rebrand to align with stricter definitions, potentially causing temporary investor hesitancy. This uncertainty can lead to outflows, impacting their market position.

The need for substantial operational or strategic adjustments can place a fund in a challenging spot. Consider the situation where new regulations in 2024 mandated clearer disclosures or specific investment criteria for certain thematic funds. Funds that were slow to adapt or whose core strategies became misaligned with these new rules might have experienced performance dips or seen assets under management decline as investors sought more compliant alternatives. This can push them towards the question mark quadrant if their future growth prospects become uncertain.

- Regulatory Compliance Costs: Funds facing significant regulatory changes may incur higher operational costs for restructuring, impacting profitability and potentially deterring new investment.

- Investor Confidence Erosion: Rebranding or methodology changes due to regulations can create investor uncertainty, leading to temporary outflows as clients reassess their positions.

- Market Re-positioning Challenges: Funds that must adapt to new regulatory frameworks might struggle to regain market traction if their new positioning is not clearly communicated or resonates less with investors.

- ESMA's SFDR Updates: In 2024, European regulators continued to refine SFDR guidelines, requiring many funds to adjust their sustainability claims and reporting, directly impacting their operational structure and investor appeal.

Dogs in BlackRock's strategic framework represent funds with low market share and low growth prospects. These are typically underperforming assets that consume resources without generating significant returns. BlackRock's 2024 actions, including the liquidation of certain niche ETFs, align with identifying and divesting these less viable products. For instance, the closure of iShares Currency Hedged MSCI Germany ETF in 2024 exemplifies a product that failed to gain sufficient traction, fitting the Dog profile.

Question Marks

BlackRock's interest in new digital asset products, like potential spot ETFs for XRP and Solana, signals a move into a high-growth, transformative market. This diversification beyond established cryptocurrencies taps into the burgeoning world of tokenization, which is expected to see significant expansion in the coming years.

While the digital asset market is rapidly evolving, the market share for these specific products remains nascent. Success hinges on regulatory clarity and wider market acceptance, making them high-potential but also high-risk ventures within BlackRock's strategic portfolio.

BlackRock's ambition to open private markets to everyday investors, possibly through target-date funds, represents a significant growth opportunity. This initiative aims to democratize access to asset classes previously reserved for institutions.

However, the path forward is fraught with challenges. Operational complexities, navigating evolving regulations, and the crucial need for investor education contribute to a currently low market share for this specific distribution model, positioning it as a Question Mark within their strategic matrix.

Newly launched niche thematic ETFs in emerging sectors often reside in the Question Mark quadrant of the BCG Matrix. These ETFs, targeting highly speculative areas like advanced AI infrastructure or quantum computing applications, are characterized by their nascent stage and low current market share. For instance, ETFs focused on the burgeoning metaverse technology, while promising long-term growth, might have seen only a few hundred million dollars in assets under management as of early 2024, indicating a small but potentially growing investor base.

These products represent significant potential but face considerable uncertainty regarding adoption and future market dominance. Their success hinges on substantial investment in investor education and marketing to build awareness and confidence. Without this support, their growth trajectory remains speculative, much like early-stage ventures that require careful nurturing to transition into Stars.

Investments in Early-Stage AI Infrastructure and Data Centers

BlackRock's strategic emphasis on AI infrastructure, including data centers and power solutions, positions them within a high-growth sector. Their approach often involves acquiring established players, indicating a preference for less nascent stages of development.

Direct investments into very early-stage AI infrastructure projects might be considered a Question Mark within the BlackRock BCG Matrix. This is due to the developing nature of these specific ventures and BlackRock's potentially low initial market share in such nascent projects.

- Market Maturity: The market for highly specialized, early-stage AI infrastructure is still evolving, making it difficult to predict future market share or dominance.

- Risk Profile: Investments in unproven technologies or early-stage companies carry higher risks compared to established infrastructure assets.

- BlackRock's Strategy: While BlackRock is actively investing in AI infrastructure, their current acquisitions and investments appear to favor more mature or scalable operations.

- Potential for Growth: Despite the current positioning as a Question Mark, successful early-stage investments could eventually transition into Stars if they capture significant market share and demonstrate strong growth.

Bespoke Client Solutions Leveraging New Technologies

BlackRock is enhancing its client solutions by integrating advanced technologies beyond its core Aladdin platform. This involves leveraging complex data analytics and emerging financial tools to create highly customized, whole-portfolio strategies. These bespoke offerings are a strategic move towards high-value growth, though currently in early adoption stages with limited widespread market reach.

These initiatives are crucial for BlackRock's competitive edge, allowing them to cater to sophisticated client needs for personalized investment management. For instance, by Q1 2024, BlackRock reported that its Aladdin platform supported over $30 trillion in assets under management, with ongoing investments in AI and machine learning to further refine these bespoke solutions.

- Advanced Data Analytics: Utilizing AI and machine learning for deeper insights into market trends and client portfolios.

- Emerging Financial Tools: Incorporating new technologies like blockchain for enhanced efficiency and transparency.

- Whole-Portfolio Approach: Moving beyond single asset classes to offer integrated, customized investment strategies.

- Early Adoption Phase: These innovative solutions are still being refined and tested, indicating potential for significant future growth.

BlackRock's exploration into niche digital assets like XRP and Solana ETFs places them in a category of high potential but uncertain future dominance. These products are in their infancy, with market share yet to be established, making them prime candidates for the Question Mark quadrant.

The success of these digital asset ventures hinges on regulatory approvals and broader investor adoption, factors that are currently unpredictable. As of early 2024, the combined market capitalization of these emerging digital assets, while growing, still represents a small fraction of the overall digital asset market, underscoring their Question Mark status.

These nascent digital asset products require significant strategic investment and careful navigation of regulatory landscapes. Their transition from Question Marks to Stars depends on BlackRock's ability to foster market acceptance and secure a substantial market share in a rapidly evolving space.

BlackRock's foray into offering private market access to retail investors through products like target-date funds is another strategic initiative falling into the Question Mark category. While the potential for democratizing access to alternative assets is vast, the current market share for these specific distribution models remains low due to operational hurdles and regulatory complexities.

| Initiative | Description | Current Market Share | Potential | Status |

| Niche Digital Asset ETFs (e.g., XRP, Solana) | Exploring new digital asset products beyond established cryptocurrencies. | Nascent / Low | High growth, transformative market | Question Mark |

| Democratizing Private Markets Access | Opening private markets to everyday investors via products like target-date funds. | Low | Significant growth opportunity | Question Mark |

| Early-Stage AI Infrastructure Investments | Direct investments into unproven AI infrastructure projects. | Low initial share | High growth potential if successful | Question Mark |

| Advanced Client Solutions (AI/ML Integration) | Customized, whole-portfolio strategies leveraging advanced analytics. | Early adoption / Limited reach | Competitive edge, high-value growth | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from public company filings, proprietary market research, and economic indicators to provide a robust strategic overview.