BlackRock Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlackRock Bundle

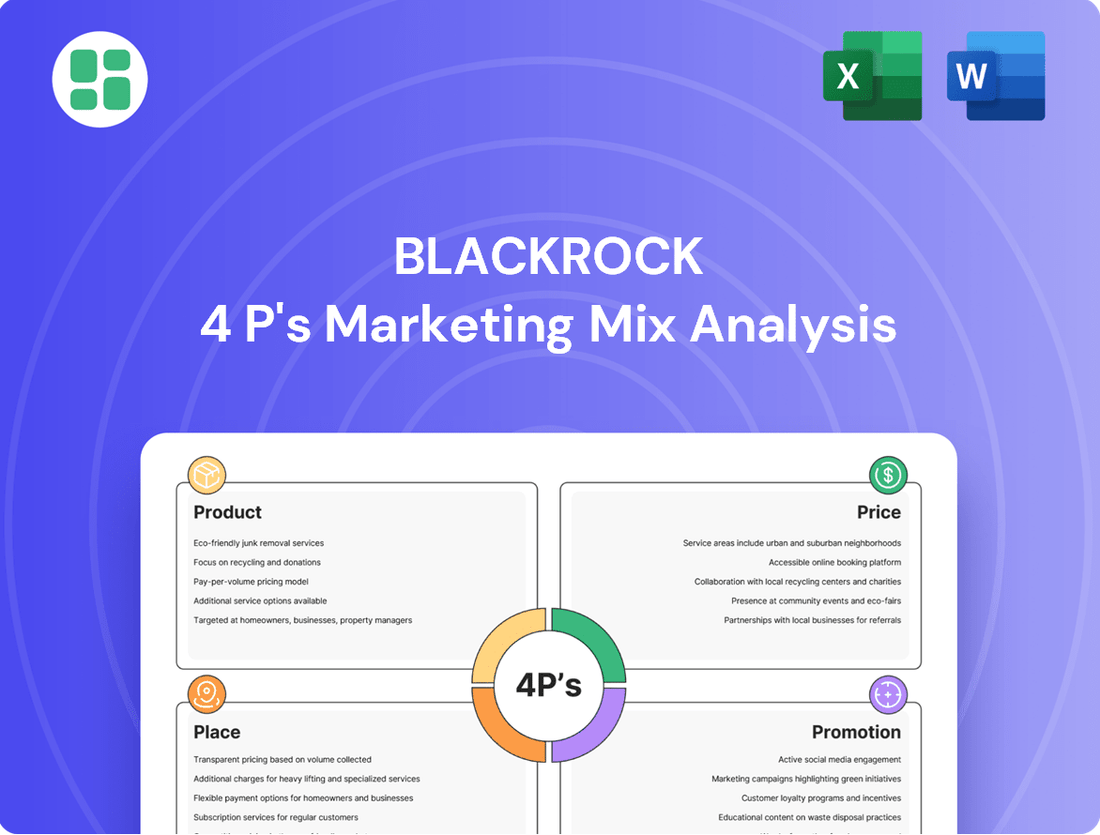

BlackRock's marketing prowess is built on a strategic foundation of Product, Price, Place, and Promotion. Understand how their diverse investment solutions, competitive fee structures, global distribution networks, and impactful communication strategies create a powerful market presence.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering BlackRock's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

BlackRock's diverse investment solutions are a cornerstone of its market strategy, offering everything from accessible iShares ETFs for passive investors to complex active strategies for institutional clients. This comprehensive range covers equities, fixed income, and alternative assets like private equity and real estate, ensuring broad market coverage.

As of early 2024, BlackRock's iShares ETFs alone managed over $1 trillion in assets, showcasing the immense scale and client adoption of its passive investment offerings. This vast product suite is continuously refined, with new solutions introduced to align with evolving market dynamics and client preferences, such as the growing demand for sustainable investing products.

iShares ETFs represent a significant pillar of BlackRock's product strategy, offering investors a diverse and cost-effective way to access global markets. As of the first quarter of 2024, iShares managed over $3.5 trillion in assets, underscoring its dominance in the ETF space. This growth is fueled by a consistent stream of new offerings, including thematic and sustainable investment options, catering to evolving investor preferences.

Aladdin is BlackRock's sophisticated technology platform, offering robust risk management, portfolio management, and trading capabilities to financial institutions worldwide. It provides clients with a unified view of their investments across diverse asset classes, including public and private markets.

As a significant revenue stream, Aladdin generated $1.5 billion in revenue for BlackRock in 2023, highlighting its importance beyond traditional investment products. This proprietary technology acts as a key differentiator, empowering clients with advanced analytical tools.

The platform's evolution is evident with the integration of AI-driven features such as Aladdin Copilot, launched in late 2023. This ongoing innovation ensures Aladdin remains at the forefront of financial technology, enhancing client efficiency and decision-making.

Alternative Investments and Private Markets

BlackRock's strategic push into alternative investments and private markets, bolstered by acquisitions like Global Infrastructure Partners and HPS Investment Partners, significantly broadens its product offering. This expansion is designed to give clients access to potentially higher-returning, less liquid assets, enhancing portfolio diversification.

The firm anticipates robust growth in these segments, projecting that private markets could reach $20 trillion in assets under management by 2030, up from an estimated $13 trillion in 2023. This growth is fueled by increasing investor demand for long-term capital solutions across various asset classes.

- Infrastructure Focus: BlackRock's acquisition of Global Infrastructure Partners, a major player in infrastructure equity, signals a commitment to this growing sector, which is crucial for global economic development.

- Private Credit Expansion: The addition of HPS Investment Partners strengthens BlackRock's capabilities in private credit, a market segment experiencing significant demand from both borrowers and investors seeking yield.

- Diversification Benefits: These alternative assets offer investors exposure to opportunities outside traditional public markets, potentially leading to enhanced risk-adjusted returns.

- Market Growth Projections: BlackRock's strategic positioning anticipates capturing a significant share of the projected expansion in private markets, driven by secular trends in global capital allocation.

Sustainable and Thematic Investment s

BlackRock's sustainable and thematic investment products directly address the surging investor demand for ESG integration. These offerings provide a pathway for clients to not only pursue financial objectives but also to align their capital with critical environmental, social, and governance principles.

The firm's commitment is evident in its expanding suite of solutions designed to meet this evolving market need. For instance, BlackRock reported that its sustainable fixed income assets under management reached $119 billion as of the first quarter of 2024, demonstrating significant client adoption.

Furthermore, the incorporation of advanced ESG analytics, such as those within the Aladdin Climate platform, bolsters the appeal of these specialized investments. This technological integration allows for more robust risk assessment and opportunity identification, enhancing the overall value proposition for investors prioritizing sustainability.

- Product: Sustainable and Thematic Investments

- Key Feature: Alignment with ESG goals and financial returns.

- Market Trend: Growing investor demand for ESG-focused strategies.

- BlackRock's Commitment: Expanding product suite and integrated analytics platforms.

BlackRock's product strategy is defined by its breadth and depth, encompassing a wide array of investment vehicles designed for diverse client needs. From the highly popular iShares ETFs, which managed over $3.5 trillion in assets as of Q1 2024, to sophisticated alternative investment solutions, the firm aims to provide comprehensive market access.

The integration of its proprietary Aladdin technology platform, which generated $1.5 billion in revenue in 2023 and is continuously enhanced with AI features like Aladdin Copilot, serves as a key differentiator. This technological backbone supports its extensive product suite, including a growing focus on private markets and sustainable investments.

BlackRock's strategic expansion into private markets, reinforced by acquisitions like Global Infrastructure Partners, targets a segment projected to reach $20 trillion by 2030. This move, alongside its commitment to sustainable and thematic investing, with sustainable fixed income assets reaching $119 billion in Q1 2024, underscores its adaptation to evolving investor preferences and market opportunities.

| Product Category | Key Offerings | Assets Under Management (Approx.) | Recent Developments |

|---|---|---|---|

| ETFs (iShares) | Global equity, fixed income, thematic, ESG | $3.5 trillion (Q1 2024) | Expansion of thematic and sustainable options |

| Technology Platform (Aladdin) | Risk management, portfolio management, trading | $1.5 billion revenue (2023) | Integration of AI (Aladdin Copilot) |

| Alternative Investments | Infrastructure, private equity, private credit | Projected $20 trillion market by 2030 | Acquisitions of GIP and HPS Investment Partners |

| Sustainable & Thematic | ESG integration, climate solutions | $119 billion in sustainable fixed income (Q1 2024) | Enhanced ESG analytics (Aladdin Climate) |

What is included in the product

This analysis provides a comprehensive breakdown of BlackRock's marketing strategies across Product, Price, Place, and Promotion, grounding the insights in actual brand practices and competitive context.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of understanding BlackRock's market approach.

Provides a clear, concise framework for navigating BlackRock's marketing efforts, easing the burden of strategic planning.

Place

BlackRock's global footprint, spanning over 30 countries, is a cornerstone of its direct sales strategy, fostering robust relationships with major institutional investors like pension funds and sovereign wealth funds. This extensive network allows for personalized service and a deep understanding of client needs, critical for managing vast sums of assets. In 2024, BlackRock reported over $10 trillion in assets under management, a testament to the success of these direct engagements.

BlackRock's distribution strategy heavily relies on its financial intermediary and advisory networks, reaching individual and high-net-worth clients through wealth managers and advisors. The firm actively supports these partners with extensive product details and analytical tools, ensuring they can effectively present BlackRock's investment offerings. For instance, collaborations like the one with Investment Navigator for Aladdin Wealth are designed to bolster advisors' proficiency in utilizing BlackRock's sophisticated solutions.

BlackRock leverages its proprietary digital platforms and collaborates with third-party online channels to broaden investor access to its offerings, particularly iShares ETFs. This dual approach includes direct-to-consumer digital interactions and seamless integration with robo-advisory services, significantly boosting convenience and market reach. For instance, BlackRock's Aladdin platform, a sophisticated technology solution, underpins many of these digital distribution efforts, serving institutional clients and enhancing operational efficiency across the firm.

Strategic Acquisitions for Expanded Reach

BlackRock's strategic acquisitions are a key driver for expanding its market reach. The recent acquisition of Global Infrastructure Partners (GIP) for approximately $12.5 billion, announced in early 2024, significantly bolsters its presence in the rapidly growing private markets sector. This move, alongside the acquisition of data provider Preqin, is designed to enhance BlackRock's product offerings and distribution capabilities, particularly in alternative investments.

These inorganic growth initiatives directly complement BlackRock's organic distribution strategies by providing access to new client segments and geographies. The integration of GIP's expertise and client base is expected to solidify BlackRock's position as a leading provider of integrated, whole-portfolio solutions across public and private markets.

- Global Infrastructure Partners (GIP) Acquisition: Valued at around $12.5 billion, this deal significantly expands BlackRock's private markets capabilities and client reach.

- Preqin Acquisition: Enhances data analytics and client solutions within alternative investments, supporting broader distribution.

- Strategic Rationale: Acquisitions aim to deepen product offerings and broaden distribution footprints in high-growth areas like private equity and infrastructure.

- Complementary Growth: These moves bolster organic growth by providing new avenues for client engagement and product penetration.

Broad-Based Client Segments

BlackRock's distribution strategy is meticulously crafted to serve a wide array of clients, encompassing both individual retail investors and substantial global institutions. This deliberate multi-segment approach ensures that BlackRock's investment products are accessible through the most effective channels for each distinct client category, thereby maximizing market penetration and engagement.

The firm's strategic emphasis on retirement solutions and its dedication to addressing the varied financial needs of different investor demographics underscore this extensive market reach. For instance, by Q1 2024, BlackRock reported approximately $10.5 trillion in assets under management (AUM), demonstrating its significant presence across numerous client segments.

- Retail Investors: Access through brokerage platforms, financial advisors, and direct-to-consumer channels.

- Institutional Clients: Serving pension funds, endowments, sovereign wealth funds, and corporations with tailored solutions.

- Retirement Market: Offering a comprehensive suite of products and services for defined contribution and defined benefit plans.

- Financial Advisors: Providing tools, research, and investment solutions to support their client needs.

BlackRock's extensive physical presence across more than 30 countries is a critical component of its 'Place' strategy, enabling direct engagement with large institutional clients. This global network facilitates personalized service and a deep understanding of diverse market needs, crucial for managing its vast asset base. By Q1 2024, BlackRock's assets under management had grown to approximately $10.5 trillion, reflecting the success of this widespread operational footprint.

Full Version Awaits

BlackRock 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive BlackRock 4P's Marketing Mix Analysis covers product, price, place, and promotion strategies. You'll gain immediate access to this ready-to-use analysis upon completing your order.

Promotion

BlackRock leverages thought leadership as a core component of its promotion strategy, showcasing its deep expertise and market influence. The firm consistently publishes insightful content like white papers, market outlooks, and influential CEO letters, positioning itself as a leading voice in finance.

Larry Fink's annual letters, for instance, are highly anticipated, offering BlackRock's perspective on global economic shifts and investment landscapes, thereby reinforcing its role as a trusted advisor. This strategic communication aims to shape market understanding and solidify BlackRock's reputation.

These valuable insights are broadly distributed through BlackRock's official website and strategic media collaborations, ensuring wide reach among its target audience. For example, in its 2024 outlook, BlackRock highlighted a shift towards a more diversified global investment landscape, emphasizing opportunities in emerging markets and sustainable investments.

BlackRock's digital marketing strategy is extensive, utilizing its website and social media platforms to connect with a broad investor base. They offer valuable online educational resources like webinars and articles, providing data-driven insights for investors of all experience levels.

In 2024, BlackRock continued to emphasize its digital footprint, aiming to boost brand recognition and client education. Their online content is meticulously crafted to drive engagement, reflecting a commitment to a data-informed approach in reaching diverse audiences.

BlackRock strategically leverages public relations and media engagement to cultivate a strong brand image and communicate its value proposition. The firm actively participates in industry forums and provides commentary to financial media outlets, aiming to shape public discourse around investment trends and its own market position.

In 2023, BlackRock's proactive media relations were crucial in navigating market volatility and communicating its approach to sustainable investing, a key differentiator. For instance, the firm's leadership frequently engaged with major financial news networks, discussing economic outlooks and BlackRock's investment strategies, thereby reinforcing its thought leadership.

This consistent external communication strategy helps manage perceptions, highlight BlackRock's commitment to innovation and responsible growth, and ultimately bolster investor confidence. Positive media sentiment is a vital component of its overall marketing mix, contributing to its status as a global investment management leader.

Client Events and Investor Relations

BlackRock leverages client events and investor relations to foster direct engagement, offering insights into performance and strategy. These interactions are crucial for building robust client relationships and gathering feedback for product innovation.

Key promotional activities include exclusive client forums, industry conferences, and regular investor calls. For instance, in 2024, BlackRock continued its tradition of hosting investor days, providing detailed strategic overviews and performance metrics to a global audience of institutional investors and analysts.

The firm's commitment to transparency is evident in its structured approach to investor relations, including:

- Annual Shareholder Meetings: Providing a platform for shareholders to engage with leadership and vote on key corporate matters.

- Quarterly Earnings Calls: Offering detailed financial results and outlooks, often accompanied by presentations from senior management.

- Dedicated Investor Relations Team: Ensuring timely and accurate communication with the investment community.

- Client-Specific Briefings: Tailored events to address the unique needs and interests of different client segments.

These engagements are vital for maintaining investor confidence and communicating BlackRock's evolving value proposition in the dynamic asset management landscape.

Focus on ESG and Sustainability Messaging

BlackRock prominently features its dedication to Environmental, Social, and Governance (ESG) principles in its marketing, highlighting how sustainability contributes to enduring value. This focus aligns with a significant and expanding investor base increasingly prioritizing ethical and responsible investment strategies.

The firm's promotional efforts consistently underscore the financial benefits of integrating ESG factors, aiming to attract clients seeking both performance and positive impact. This strategy is supported by tangible initiatives and reporting mechanisms.

- Sustainability Reporting: BlackRock publishes comprehensive sustainability reports, detailing its approach and performance in ESG. For instance, its 2023 report highlighted significant progress in its stewardship activities and engagement with portfolio companies on climate-related issues.

- Aladdin Climate: The firm leverages platforms like Aladdin Climate, a technology solution designed to help investors assess and manage climate-related risks and opportunities within their portfolios. This tool directly supports their ESG messaging by providing data-driven insights.

- Investor Demand: Data from 2024 indicates continued strong investor demand for sustainable products, with global sustainable fund flows showing robust growth, reinforcing the efficacy of BlackRock's ESG-centric promotional strategy.

BlackRock's promotional strategy centers on thought leadership, digital engagement, public relations, direct client interaction, and a strong emphasis on ESG principles. This multi-faceted approach aims to build trust, educate investors, and attract assets by showcasing expertise and aligning with evolving market demands.

In 2024, BlackRock continued to emphasize its digital presence, offering webinars and articles, while Larry Fink's annual letters remained a key channel for communicating the firm's global economic outlook. The firm's commitment to ESG is supported by tools like Aladdin Climate and robust sustainability reporting, reflecting strong investor demand for responsible investment options.

The firm's promotional activities are designed to reinforce its position as a trusted advisor and a leader in asset management, utilizing data-driven insights across all communication channels to engage a diverse investor base.

Price

BlackRock's revenue hinges on management fees, typically shown as expense ratios for products like ETFs and mutual funds. These fees are a percentage of the total assets under management (AUM). For instance, in Q1 2024, BlackRock reported $10.5 trillion in AUM, with a significant portion contributing to fee income.

The expense ratios differ based on the investment product's nature, its asset class, and whether it employs an active or passive management strategy. BlackRock aims to strike a balance between offering competitive fee structures and the substantial value derived from its extensive range of investment solutions.

Aladdin's technology licensing fees represent a crucial element of BlackRock's product strategy, positioning it as a valuable service beyond asset management. This model generates a substantial and growing revenue stream, with technology services revenue increasing by 11% in the first quarter of 2024, reaching $478 million. These fees are charged to external financial institutions, underscoring the platform's broad appeal and the strategic value it delivers for portfolio and risk management.

BlackRock utilizes performance-based fees for specific active strategies, especially in alternatives and institutional accounts. This means clients pay more if the investment significantly outperforms its benchmark. For instance, in 2024, many hedge funds and private equity strategies commonly employ a "2 and 20" model, where 2% is a management fee and 20% is a performance fee on profits above a certain threshold. This structure directly links BlackRock's compensation to client success, fostering a strong alignment of interests.

Tiered Pricing and Volume Discounts

BlackRock frequently employs tiered pricing and volume discounts, a strategy particularly beneficial for its institutional clients managing significant assets under management (AUM). This approach encourages larger investments and fosters enduring relationships by acknowledging the cost efficiencies inherent in managing substantial portfolios. For instance, BlackRock's ability to attract substantial net inflows, reaching billions in 2024, underscores the market's positive reception to its value-driven pricing models.

This tiered structure directly aligns with BlackRock's objective to capture and retain large-scale assets. By offering preferential rates for higher AUM, the firm incentivizes clients to consolidate their investments, thereby increasing BlackRock's overall assets under management and operational leverage. This is a key component in maintaining competitive pricing while ensuring profitability.

- Tiered Pricing: Fees decrease as AUM increases, rewarding larger clients.

- Volume Discounts: Explicit reductions in management fees for substantial investment volumes.

- Client Incentives: Encourages deeper client relationships and long-term commitment.

- 2024 Net Inflows: Demonstrates client trust in BlackRock's pricing and service value.

Competitive and Value-Based Pricing Strategy

BlackRock employs a competitive and value-based pricing strategy, a cornerstone of its marketing mix. This approach acknowledges the significant value clients place on BlackRock's established brand reputation, its deep investment expertise, and its advanced technological capabilities. The firm actively monitors industry trends, competitor fee structures, and evolving regulatory landscapes to ensure its pricing remains attractive and sustainable.

This strategic pricing allows BlackRock to maintain its market leadership by aligning fees with the tangible and intangible benefits clients receive. For instance, in early 2024, BlackRock continued to offer competitive expense ratios on its iShares ETFs, with many core equity ETFs holding expense ratios below 0.10%, reflecting this value-driven approach in a highly competitive ETF market.

- Competitive Edge: BlackRock's pricing is designed to be competitive, especially in the burgeoning ETF market.

- Value Perception: Fees reflect the perceived value of BlackRock's brand, expertise, and technology.

- Market Responsiveness: Continuous evaluation of market demand, competitor pricing, and regulations informs pricing decisions.

- Profitability Maintenance: The strategy aims to balance client attractiveness with the firm's profitability and market leadership.

BlackRock's pricing strategy centers on management fees derived from assets under management (AUM), with expense ratios varying by product type and management style. The firm also leverages technology licensing fees for its Aladdin platform, which saw an 11% increase in revenue to $478 million in Q1 2024. Performance-based fees are applied to select active strategies, aligning BlackRock's compensation with client investment success.

Tiered pricing and volume discounts are key, particularly for institutional clients, encouraging larger AUM and fostering long-term relationships. This approach is evident in BlackRock's ability to attract billions in net inflows throughout 2024. Many iShares ETFs, for example, maintained expense ratios below 0.10% in early 2024, underscoring a competitive, value-driven market stance.

| Pricing Component | Description | 2024 Data/Example |

| Management Fees | Percentage of AUM | Q1 2024 AUM: $10.5 trillion |

| Technology Licensing Fees | Aladdin platform access | Q1 2024 Revenue: $478 million (11% increase) |

| Performance Fees | Based on outperformance | Common in alternatives/institutional accounts (e.g., 2% management, 20% performance) |

| Tiered/Volume Pricing | Reduced fees for higher AUM | Encourages large client inflows |

| ETF Expense Ratios | Competitive market offering | Core equity ETFs often below 0.10% in early 2024 |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for BlackRock is constructed using a blend of proprietary market intelligence and publicly available data. This includes official company reports, investor communications, industry research, and analysis of their digital and physical distribution channels.