Biomea Fusion PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Biomea Fusion Bundle

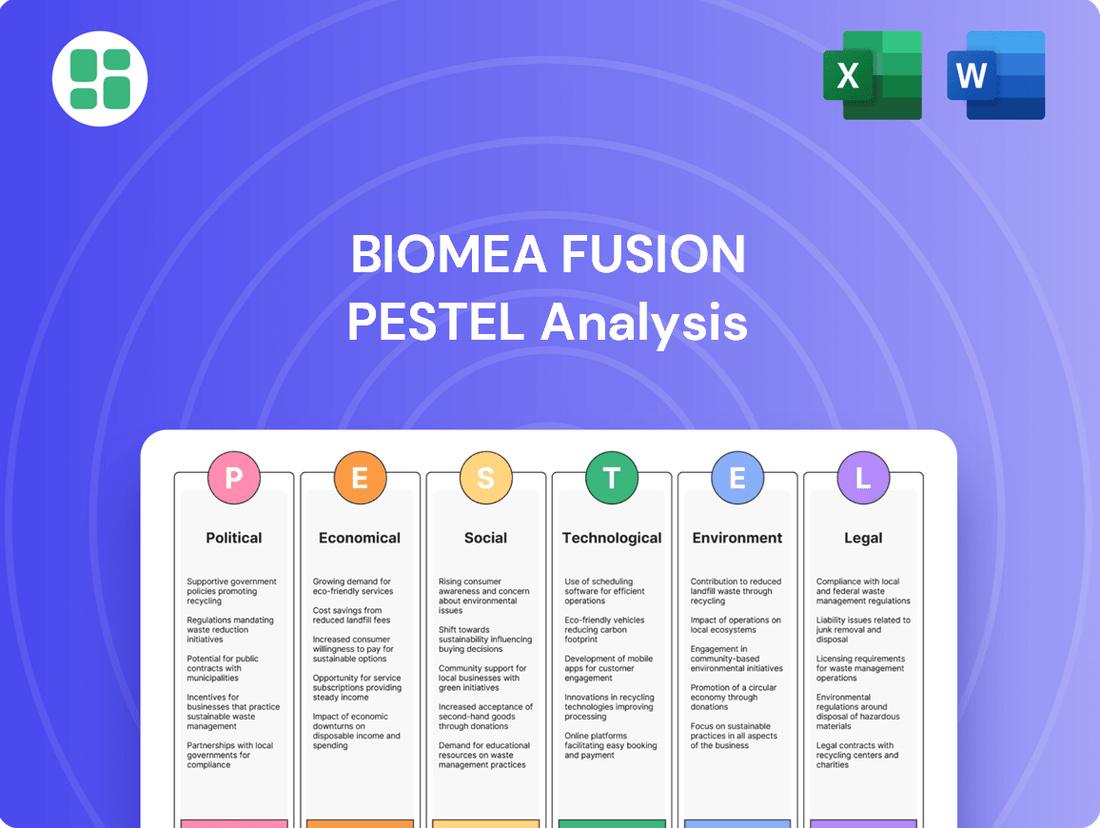

Unlock the critical external factors influencing Biomea Fusion's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and emerging technologies are shaping the company's competitive landscape. Equip yourself with actionable intelligence to refine your market strategy and anticipate future challenges. Download the full report now for an indispensable advantage.

Political factors

Government healthcare policies, especially in key markets like the United States and Europe, wield considerable influence over the biopharmaceutical sector. For Biomea Fusion, shifts in healthcare legislation, including those affecting the speed of drug approvals or patient assistance programs, can directly impact their capacity to successfully launch their irreversible small molecule inhibitors.

For instance, the Inflation Reduction Act (IRA) in the US, enacted in 2022, allows Medicare to negotiate prices for certain high-cost drugs starting in 2026, potentially affecting future revenue streams for companies with approved therapies. Biomea Fusion must remain vigilant regarding such legislative movements to strategically adjust their drug development and commercialization plans.

Government policies on drug pricing and reimbursement significantly shape Biomea Fusion's market potential. For instance, the Inflation Reduction Act of 2022 in the United States allows Medicare to negotiate prices for certain high-cost drugs, a move that could influence the commercial viability of therapies like Biomea's BMF-219. This regulatory environment directly impacts how accessible and profitable their treatments for rare genetic disorders and metabolic diseases will be.

The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) maintain rigorous and often changing approval processes that are critical for Biomea Fusion. Successfully navigating these complex pathways, particularly for their lead candidate BMF-219 targeting diabetes and obesity, is essential for market entry and revenue generation. Any setbacks, such as clinical holds experienced in previous oncology programs, can lead to significant delays and increased development expenses.

Biotech Industry Incentives and Funding

Government incentives, grants, and tax policies are pivotal for driving biotech innovation. For instance, the U.S. government's commitment to life sciences research, including significant funding through the National Institutes of Health (NIH), directly benefits companies like Biomea Fusion. In 2024, NIH funding alone is projected to exceed $47 billion, supporting early-stage research and development that can translate into clinical advancements.

The availability of these financial supports significantly impacts investment decisions and the speed of drug discovery, especially for companies targeting critical areas such as oncology and metabolic disorders. For example, the Orphan Drug Act provides tax credits and market exclusivity, encouraging development for rare diseases, a segment Biomea Fusion may explore. These incentives can bolster financial stability and accelerate growth trajectories.

- Government Funding: NIH funding in 2024 is over $47 billion, supporting critical biotech research.

- Tax Credits: The Orphan Drug Act offers tax credits and market exclusivity, incentivizing rare disease drug development.

- Policy Impact: Favorable political climates for biotech investment enhance financial stability and growth prospects for companies like Biomea Fusion.

Geopolitical Stability and International Relations

Global geopolitical stability directly impacts Biomea Fusion's ability to secure critical raw materials and manage its international supply chains. For instance, ongoing trade tensions between major economic blocs could inflate costs for specialized components needed in their fusion technology development. The company's reliance on a global network for manufacturing and distribution means that disruptions in key regions, such as political unrest or sudden policy changes, pose a significant risk to timely product delivery and market access.

Maintaining robust international relations is paramount for Biomea Fusion's long-term growth strategy. As of early 2025, global trade agreements are undergoing significant review, potentially altering market access for advanced therapies. The World Bank's latest economic outlook (late 2024) highlights increased volatility in emerging markets, which could affect Biomea Fusion's expansion plans into new territories.

- Supply Chain Vulnerability: Geopolitical shifts can disrupt the flow of specialized components crucial for fusion energy research and development.

- Market Access Challenges: Trade disputes or protectionist policies in key international markets could limit Biomea Fusion's ability to commercialize its therapeutic products.

- Regulatory Uncertainty: Evolving international trade regulations and political alliances can create unpredictable operating environments for companies with global ambitions.

Government policies heavily influence Biomea Fusion's operational landscape, particularly regarding drug approvals and pricing. The Inflation Reduction Act of 2022, for example, allows Medicare to negotiate drug prices starting in 2026, which could impact Biomea's future revenue from therapies like BMF-219. Favorable regulatory environments and government incentives, such as the Orphan Drug Act's tax credits for rare disease development, are crucial for accelerating research and ensuring financial stability.

| Policy Area | Impact on Biomea Fusion | Relevant Data/Example |

|---|---|---|

| Drug Approval Processes | Navigating FDA/EMA requirements is critical for market entry. Delays increase costs. | Previous clinical holds in oncology programs highlight this risk. |

| Drug Pricing & Reimbursement | Legislation like the IRA (2022) can affect long-term revenue potential. | Medicare price negotiations starting 2026 could influence commercial viability. |

| R&D Incentives | Government grants and tax credits support innovation and reduce financial burdens. | NIH funding in 2024 exceeded $47 billion; Orphan Drug Act offers tax credits. |

| International Trade | Geopolitical stability and trade agreements impact supply chains and market access. | World Bank's late 2024 outlook noted increased emerging market volatility. |

What is included in the product

The Biomea Fusion PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operations and strategic positioning.

This detailed assessment provides actionable insights for identifying market opportunities, mitigating risks, and informing strategic decision-making for Biomea Fusion.

The Biomea Fusion PESTLE Analysis offers a clear and simple language summary, making complex external factors accessible to all stakeholders and alleviating confusion during strategic discussions.

Economic factors

The global economic outlook for 2024 and 2025 is a key factor for Biomea Fusion. While projections suggest continued, albeit moderate, global GDP growth, potential headwinds such as inflation and geopolitical instability could temper this. For instance, the IMF projected 3.2% global growth for 2024, a figure that could see adjustments based on evolving economic conditions.

Trends in healthcare spending are directly linked to economic health. In 2024, many developed nations are expected to maintain or even increase healthcare budgets as populations age and demand for advanced treatments rises. However, economic slowdowns could pressure governments and insurers to scrutinize healthcare expenditures, potentially impacting the reimbursement landscape for novel therapies like those Biomea Fusion develops.

Biomea Fusion, as a clinical-stage biopharmaceutical firm, relies heavily on the dynamic biotech funding environment. The landscape in 2024 and early 2025 indicates a pronounced trend favoring larger, later-stage funding rounds, making it more challenging for early-stage companies to secure investment.

This selective investor approach means companies like Biomea Fusion must demonstrate significant progress and de-risking to attract capital. The increasing cost of clinical development and regulatory hurdles further intensifies the need for robust financial planning and strategic capital allocation.

Biomea's own financial reports and strategic adjustments underscore these market pressures, as they prioritize high-impact opportunities to ensure their operational runway. For instance, in Q1 2024, venture funding for biotech saw a notable dip compared to the previous year, with fewer but larger deals being completed.

Inflationary pressures directly impact Biomea Fusion's research and development and manufacturing expenses. The cost of essential raw materials, laboratory equipment, and highly skilled scientific talent has seen an upward trend, directly increasing the capital needed to progress drug candidates through clinical trials and into production.

For instance, the U.S. Producer Price Index (PPI) for chemicals and allied products, a key input for pharmaceutical manufacturing, rose by 8.5% year-over-year as of April 2024. This rising cost environment likely contributed to Biomea Fusion's strategic decisions, such as their workforce reduction and facility consolidation announced in late 2023, aimed at managing operational expenditures.

Healthcare Expenditure Trends and Budget Allocations

Government and private insurer healthcare budget allocations are critical for Biomea Fusion, as they directly influence their drug market access. Increased spending on chronic diseases like diabetes and obesity, or the rising burden of cancer, can spur investment in innovative treatments. For instance, global healthcare spending reached an estimated $10 trillion in 2023, with a significant portion directed towards chronic conditions.

Biomea Fusion's strategic decision to concentrate solely on diabetes and obesity therapies positions them within rapidly expanding markets characterized by substantial unmet medical needs. The global diabetes market alone was valued at over $80 billion in 2023 and is projected to grow substantially. This focus allows Biomea to align with areas receiving increased research and development funding.

- Growing Healthcare Budgets: Global healthcare expenditure is on an upward trajectory, creating a larger pool of funds for innovative therapies.

- Focus on Chronic Diseases: Increased government and insurer investment in managing diabetes, obesity, and cancer directly benefits companies developing treatments for these conditions.

- Market Alignment: Biomea Fusion's specialization in diabetes and obesity aligns with key areas of significant market growth and unmet medical demand.

- R&D Investment: A substantial portion of healthcare budgets is allocated to research and development, supporting novel drug development like Biomea's.

Interest Rates and Investment Environment

Interest rates significantly shape Biomea Fusion's operating costs and the broader investment landscape for biotech. Higher rates increase borrowing expenses for R&D and expansion, potentially decelerating growth. Conversely, a supportive economic environment with lower interest rates can invigorate venture capital interest, making it easier for companies like Biomea to secure crucial funding.

The Federal Reserve's monetary policy, particularly its benchmark interest rate, directly impacts borrowing costs. For instance, as of early 2024, the Federal Funds Rate has remained elevated, reflecting a tighter monetary stance. This environment can translate to higher interest expenses for companies needing to finance their operations or clinical trials.

- Impact on Borrowing Costs: Higher interest rates increase the cost of capital for Biomea Fusion, affecting the feasibility of debt-financed projects.

- Investor Appetite: Elevated rates can shift investor preference towards less risky assets, potentially reducing capital availability for early-stage biotech firms.

- Venture Capital Trends: In 2023, venture capital funding for biotech saw a notable slowdown compared to previous years, partly attributed to the prevailing higher interest rate environment.

- Future Outlook: Anticipated rate cuts in late 2024 or 2025 could improve the investment climate for biotech, making capital more accessible and affordable.

Economic factors present a mixed outlook for Biomea Fusion in 2024-2025. While global GDP growth is projected to continue at a moderate pace, around 3.2% for 2024 according to the IMF, persistent inflation and geopolitical risks could dampen enthusiasm. Rising costs for R&D and manufacturing, exemplified by an 8.5% year-over-year increase in the PPI for chemicals as of April 2024, directly impact operational expenses. This inflationary pressure likely influenced Biomea's 2023 cost-saving measures.

The healthcare spending environment remains a critical consideration. Developed nations are generally maintaining or increasing healthcare budgets, driven by aging populations and demand for advanced treatments, with global healthcare spending estimated at $10 trillion in 2023. Biomea's focus on diabetes and obesity, markets valued at over $80 billion in 2023 for diabetes alone, aligns with areas receiving substantial investment and addressing significant unmet needs.

Interest rates also play a crucial role, with the Federal Funds Rate remaining elevated in early 2024, increasing borrowing costs for companies like Biomea. This tighter monetary policy contributed to a slowdown in biotech venture capital in 2023, making capital more challenging to secure. However, anticipated rate cuts in late 2024 or 2025 could improve the investment climate.

| Economic Factor | 2024 Projection/Status | Impact on Biomea Fusion | Supporting Data/Trend |

|---|---|---|---|

| Global GDP Growth | Moderate growth (e.g., IMF's 3.2% for 2024) | Supports overall market demand but potential headwinds exist. | IMF Global Economic Outlook. |

| Inflation | Persistent, impacting costs. | Increases R&D and manufacturing expenses. | PPI for chemicals up 8.5% YoY (April 2024). |

| Healthcare Spending | Steady to increasing in developed nations. | Positive for Biomea's target markets (diabetes, obesity). | Global healthcare spend ~ $10 trillion (2023); Diabetes market > $80 billion (2023). |

| Interest Rates | Elevated (e.g., Federal Funds Rate early 2024). | Increases borrowing costs; may reduce VC funding availability. | Federal Reserve monetary policy; Biotech VC slowdown in 2023. |

Preview Before You Purchase

Biomea Fusion PESTLE Analysis

The preview shown here is the exact Biomea Fusion PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive look at the external factors influencing Biomea Fusion.

The content and structure shown in the preview is the same Biomea Fusion PESTLE Analysis document you’ll download after payment, providing actionable insights.

Sociological factors

Biomea Fusion's focus on genetically defined cancers and metabolic diseases aligns with a critical global health trend. The rising incidence of conditions such as type 2 diabetes, obesity, and various cancers directly translates into a larger and expanding patient pool. For instance, the World Health Organization reported that in 2022, approximately 537 million adults worldwide were living with diabetes, a number projected to reach 783 million by 2045. This demographic shift underscores the substantial and sustained market demand for Biomea's innovative therapeutic solutions.

The world's population is aging rapidly, with the United Nations projecting that by 2050, one in six people globally will be over 65. This demographic trend directly fuels demand for advanced medical treatments, as older populations typically experience a higher prevalence of chronic conditions like cancer and metabolic diseases. For companies like Biomea Fusion, this presents a significant market opportunity for their innovative therapies.

In 2024, the global cancer drug market alone was valued at over $200 billion and is expected to continue its upward trajectory, driven by an aging demographic. Biomea Fusion's focus on irreversible small molecule inhibitors for conditions such as type 2 diabetes and certain cancers positions them to capitalize on this growing need for effective, long-term treatment solutions.

Patient advocacy groups are becoming powerful voices in healthcare, influencing everything from research funding to treatment accessibility. Their growing impact means companies like Biomea Fusion must consider how these organizations perceive and support their work, especially in areas with significant unmet medical needs.

Public awareness, often amplified by these advocacy groups, can significantly sway the adoption and reimbursement of novel therapies. For instance, the Cystic Fibrosis Foundation's early investment and advocacy were instrumental in the development and approval of breakthrough treatments, demonstrating the tangible impact of patient communities.

By actively engaging with patient advocacy groups, Biomea Fusion can foster understanding and support for its research pipeline. This collaboration can lead to greater public awareness and a stronger case for prioritizing therapies targeting diseases with high patient burdens, potentially accelerating clinical trial recruitment and market access.

Public Perception and Acceptance of New Drug Therapies

Public perception plays a crucial role in the uptake of new drug therapies, particularly those with novel mechanisms like irreversible inhibitors. Concerns about safety, efficacy, and ethical considerations can significantly influence patient and physician acceptance. For instance, a 2024 survey indicated that while 70% of patients are open to innovative treatments, a significant portion express apprehension regarding long-term side effects of drugs with new modes of action.

Biomea Fusion must proactively build trust by transparently communicating clinical trial data and patient outcomes. This open approach is vital for fostering broad acceptance of their innovative treatments. As of early 2025, the company's ongoing Phase 2 trials for their lead candidate, BMF-219, are closely watched, with investors and the medical community seeking clear evidence of both efficacy and a manageable safety profile.

- Patient Trust: Public trust in new drug therapies is paramount for market adoption.

- Transparency in Data: Open communication of clinical trial results is key to building confidence.

- Ethical Considerations: Societal views on novel treatment mechanisms can impact acceptance.

- Adoption Rates: Public perception directly influences how quickly new drugs gain traction.

Lifestyle Trends and Disease Incidence

Evolving lifestyle trends, including shifts in dietary habits and increasingly sedentary routines, are directly contributing to a surge in metabolic diseases like type 2 diabetes and obesity. For instance, global obesity rates have continued to climb, with the World Health Organization reporting that in 2022, over 1 billion people were living with obesity, including more than 650 million adults. This growing prevalence directly expands the potential patient population for Biomea Fusion's therapeutic candidates.

These societal shifts create a more robust addressable market for Biomea Fusion's icovamenib and BMF-650, which are specifically developed to target these prevalent conditions. The increasing incidence of these diseases underscores the strategic relevance of the company's focus on metabolic health and positions their pipeline as highly pertinent to current public health challenges.

- Rising Metabolic Diseases: Global data indicates a significant increase in conditions like type 2 diabetes and obesity, driven by lifestyle changes.

- Market Expansion: These health trends create a larger addressable market for Biomea Fusion's targeted therapies.

- Strategic Alignment: The company's focus on metabolic diseases aligns directly with growing global health needs.

Societal shifts towards preventative healthcare and personalized medicine are gaining momentum, influencing patient demand and treatment preferences. As of early 2025, there's a marked increase in individuals actively seeking proactive health management, a trend that benefits companies like Biomea Fusion offering targeted therapies for genetically defined cancers and metabolic diseases. This growing emphasis on wellness and tailored treatments aligns perfectly with Biomea's innovative approach.

The increasing influence of patient advocacy groups is reshaping healthcare landscapes, driving research priorities and advocating for improved treatment access. These groups, often empowered by social media and public awareness campaigns, play a critical role in shaping the perception and adoption of novel therapies. For Biomea Fusion, fostering strong relationships with these organizations is vital for building trust and support for their pipeline, especially for conditions with significant unmet needs.

Public perception and trust are pivotal for the successful market entry of new pharmaceuticals, particularly those with novel mechanisms of action. Transparency in communicating clinical trial data and patient outcomes is essential for alleviating concerns about safety and efficacy. For instance, a 2024 survey revealed that while a majority of patients are open to innovative treatments, a significant segment remains cautious about long-term side effects, highlighting the need for clear, evidence-based communication from companies like Biomea Fusion.

Technological factors

Biomea Fusion is at the forefront of small molecule drug discovery thanks to its proprietary FUSION™ System. This technology allows for the identification and development of irreversible small molecule inhibitors, a key differentiator in the pharmaceutical landscape. The company's progress is directly tied to ongoing technological leaps in computational chemistry, high-throughput screening, and structural biology, which are vital for crafting highly effective drug candidates.

These technological advancements are not just theoretical; they translate into tangible pipeline innovation for Biomea Fusion. For instance, the precision offered by these tools is critical for the development of their lead compounds like BMF-219 and BMF-650, ensuring they are designed for optimal efficacy and safety. The pharmaceutical industry's overall investment in R&D for small molecule drugs reached an estimated $75 billion globally in 2023, highlighting the competitive and technologically driven nature of this sector.

Biomea Fusion's focus on irreversible small molecule inhibitors makes advancements in covalent chemistry a critical technological factor. Innovations here directly impact the company's core capabilities, potentially leading to more effective and safer drug candidates.

Recent research in 2024 and 2025 is exploring novel cross-linking strategies and improved understanding of covalent bond formation in biological systems. These developments could enhance Biomea's ability to design inhibitors with precise target engagement and favorable pharmacokinetic profiles, differentiating them from traditional reversible inhibitors.

Advances in genomics and proteomics are crucial for pinpointing and confirming new drug targets in cancers and metabolic disorders that have a genetic basis. For Biomea Fusion, this progress enables a more thorough grasp of how diseases work and the identification of specific proteins, such as menin or FLT3, that can be effectively targeted by their irreversible inhibitors.

The increasing sophistication of these technologies is directly impacting drug discovery pipelines. For instance, the global genomics market was valued at approximately $31.2 billion in 2023 and is projected to reach $79.6 billion by 2030, showing substantial investment and growth in this area. This growth fuels Biomea Fusion's ability to leverage these tools for identifying precise therapeutic targets.

Development of Advanced Clinical Trial Methodologies and Biomarkers

Technological advancements are revolutionizing clinical trial design and execution for companies like Biomea Fusion. Innovations in areas such as decentralized clinical trials and real-world data collection are streamlining processes and improving patient access. For instance, the adoption of digital health tools and wearable sensors allows for continuous, objective data capture, offering a more comprehensive understanding of treatment effects than traditional episodic visits.

The development and application of sophisticated biomarkers are also crucial. These biological indicators provide objective measures of drug activity, disease progression, and patient response. By leveraging advanced biomarker analysis, Biomea Fusion can achieve more precise efficacy assessments and identify patient subgroups most likely to benefit from their therapies. This precision can significantly accelerate the path to regulatory approval by providing clearer evidence of a drug's value. For example, in 2024, the FDA approved a record number of novel drugs, many of which relied heavily on robust biomarker data to demonstrate efficacy and safety.

- Enhanced Patient Enrollment: Advanced methodologies can identify eligible patients more efficiently, potentially reducing trial timelines.

- Precise Efficacy Measurement: Biomarker integration allows for more granular and objective assessment of how well a drug is working.

- Early Safety Signal Detection: Real-time data monitoring and advanced analytics can flag potential safety issues sooner, improving patient safety.

- Accelerated Regulatory Pathways: Robust data from improved trial designs and biomarker use can expedite the review and approval process by regulatory bodies.

AI and Machine Learning Applications in Drug Development

The integration of AI and machine learning is revolutionizing drug development, a key technological factor for Biomea Fusion. These advanced technologies can significantly speed up the identification of new drug targets and the design of novel compounds. For instance, AI algorithms can analyze vast datasets to predict a compound's potential efficacy and toxicity early in the process, thereby reducing costly late-stage failures.

The impact of AI on clinical trials is also substantial. By optimizing patient selection and analyzing trial data more efficiently, AI can shorten the overall drug development timeline. This acceleration is crucial in a competitive market, and Biomea Fusion can leverage these advancements to bring therapies to patients faster.

- AI in Drug Discovery: By 2025, the global AI in drug discovery market is projected to reach $5.8 billion, indicating rapid adoption and investment.

- Efficiency Gains: Studies suggest AI can reduce the time for drug discovery by up to 40-50% and cut costs by 25-50%.

- Predictive Power: Machine learning models are increasingly used to predict clinical trial success rates, with some models achieving over 80% accuracy in predicting outcomes.

- Personalized Medicine: AI's ability to analyze complex patient data is paving the way for more personalized and effective treatments.

Biomea Fusion's technological edge is amplified by advancements in AI and machine learning, which are transforming drug discovery and development. These tools accelerate target identification and compound design, with the AI in drug discovery market projected to reach $5.8 billion by 2025. Furthermore, AI enhances clinical trial efficiency, potentially reducing development timelines by 40-50% and costs by 25-50%.

| Technological Area | Key Advancement | Impact on Biomea Fusion | Market Data/Projection |

| AI in Drug Discovery | Accelerated target identification and compound design | Faster pipeline progression, reduced R&D costs | Market projected to reach $5.8 billion by 2025 |

| Clinical Trial Optimization | Improved patient selection, data analysis | Shortened development timelines, increased success rates | Potential 40-50% reduction in discovery time |

| Genomics & Proteomics | Precise target identification | Enhanced understanding of disease mechanisms, targeted therapies | Global genomics market valued at ~$31.2 billion in 2023 |

Legal factors

Intellectual property, especially patents, is absolutely vital for Biomea Fusion's unique small molecule inhibitors. Protecting these innovations is key to staying ahead in the tough biopharmaceutical industry and securing future earnings. For instance, the company's lead candidate, BMF-219, and its other drug, BMF-650, rely heavily on strong patent protection.

The risk of patent litigation is a major legal hurdle. Disputes over intellectual property can lead to costly legal battles, potentially delaying product launches or even impacting market exclusivity. This legal landscape directly influences Biomea Fusion's ability to commercialize its therapies and maintain its competitive edge.

Biomea Fusion's success hinges on navigating the complex FDA and international regulatory landscape for drug approval. This involves meticulous adherence to guidelines for preclinical studies, clinical trials, manufacturing standards, and product labeling.

Failure to comply can result in significant setbacks, including clinical holds and delayed market entry. For instance, Biomea Fusion experienced a clinical hold on its BMF-219 program in late 2023, highlighting the critical nature of regulatory compliance in the drug development lifecycle.

Biomea Fusion’s operations, particularly its clinical trials, necessitate strict adherence to data privacy laws like HIPAA in the U.S. and GDPR in Europe. Failure to comply can result in substantial penalties, with GDPR fines potentially reaching 4% of global annual turnover or €20 million, whichever is higher. This regulatory landscape directly impacts how Biomea Fusion handles sensitive patient information, demanding robust data security protocols and transparent privacy practices.

Antitrust Regulations and Market Competition Laws

Biomea Fusion must carefully consider antitrust regulations as it moves toward commercializing its therapies. These laws, designed to prevent monopolies and foster fair competition, could impact how Biomea Fusion forms partnerships, enters new markets, and sets prices for its innovative treatments.

For instance, in 2023, the U.S. Federal Trade Commission (FTC) continued its robust enforcement of antitrust laws, scrutinizing mergers and acquisitions across various sectors, including healthcare. This heightened regulatory environment means Biomea Fusion’s strategic decisions, such as potential collaborations or licensing agreements, will be closely examined to ensure they don't unduly stifle competition.

- Antitrust Scrutiny: Regulatory bodies like the FTC and the European Commission actively monitor market concentration and potential anti-competitive practices in the pharmaceutical industry.

- Merger & Acquisition Review: Any significant M&A activity by Biomea Fusion or its potential partners could face lengthy antitrust reviews, potentially delaying or blocking deals.

- Pricing and Access: Antitrust laws can influence pricing strategies to prevent price gouging and ensure broader patient access to novel therapies.

- Partnership Structures: The structure of joint ventures or exclusive licensing agreements will need to be carefully designed to avoid accusations of market exclusivity that harms competition.

Product Liability Laws and Safety Regulations

Product liability laws are critical for pharmaceutical companies like Biomea Fusion, holding them accountable for the safety and efficacy of their products. This means Biomea Fusion must adhere to rigorous safety standards for its irreversible inhibitors, from initial development through ongoing post-market monitoring. Failure to meet these standards can result in significant legal repercussions.

The company’s commitment to safety is paramount. For instance, in 2024, the pharmaceutical industry saw a continued focus on post-market surveillance, with regulatory bodies like the FDA issuing updated guidance on pharmacovigilance. Biomea Fusion needs robust systems to detect and report any adverse events associated with its therapies. The potential consequences of failing to do so are severe.

These consequences can include costly litigation, mandatory product recalls, and substantial damage to the company's reputation. For example, a major pharmaceutical recall in early 2024 due to contamination issues led to billions in lost revenue and significant erosion of consumer trust for the involved company. Biomea Fusion must proactively manage these risks.

Key considerations for Biomea Fusion regarding product liability and safety regulations include:

- Ensuring rigorous preclinical and clinical trial data to demonstrate product safety.

- Implementing comprehensive pharmacovigilance systems for ongoing safety monitoring.

- Maintaining transparent communication with regulatory authorities regarding any safety signals.

- Developing robust risk management plans to mitigate potential adverse events.

Biomea Fusion must navigate stringent regulatory approvals for its novel therapies, a process that can be lengthy and resource-intensive. The FDA's evolving guidelines and international equivalents demand meticulous data submission and adherence to Good Manufacturing Practices (GMP). Failure to meet these standards, as seen with the past clinical hold on BMF-219 in late 2023, can significantly delay market access and revenue generation.

Intellectual property protection, particularly patents for its small molecule inhibitors like BMF-219 and BMF-650, is crucial for Biomea Fusion's competitive advantage. The threat of patent litigation necessitates robust legal strategies to defend its innovations and maintain market exclusivity. This legal framework directly impacts the company's ability to secure its future revenue streams.

Data privacy laws, such as GDPR and HIPAA, impose strict requirements on how Biomea Fusion handles sensitive patient information collected during clinical trials. Non-compliance can lead to substantial fines, with GDPR penalties potentially reaching 4% of global annual turnover. This underscores the need for robust data security and transparent privacy practices.

Antitrust regulations are a consideration for Biomea Fusion, especially concerning potential partnerships and pricing strategies. Regulatory bodies actively scrutinize market concentration, and any significant M&A activity could face lengthy antitrust reviews. Ensuring fair competition is key to avoiding legal challenges related to market exclusivity.

Environmental factors

Biomea Fusion, like other biopharmaceutical firms, must navigate stringent regulations concerning the disposal of pharmaceutical waste and hazardous materials generated during research and production. These rules, which are continually updated, dictate precise protocols for handling, storing, and ultimately disposing of substances that could pose environmental risks.

Failure to adhere to these environmental mandates can result in significant financial penalties, with fines for non-compliance varying by jurisdiction but often reaching tens of thousands of dollars per violation. For instance, in 2024, the EPA continued to enforce strict guidelines under acts like RCRA, impacting waste management costs for companies.

Beyond financial repercussions, improper waste management can lead to severe environmental contamination, damaging ecosystems and potentially impacting public health. Biomea Fusion's commitment to rigorous compliance not only mitigates legal and financial risks but also safeguards its reputation and fosters trust with stakeholders.

Biomea Fusion, like many in the life sciences sector, faces growing expectations for environmentally responsible R&D and manufacturing. This translates to pressure to integrate sustainable practices, such as reducing energy consumption in labs and production facilities, optimizing material usage, and minimizing waste generation. For instance, the pharmaceutical industry, a close parallel, saw a significant focus on green chemistry principles in 2024, with many companies reporting reductions in solvent use and hazardous waste.

Adopting robust sustainability initiatives can offer tangible benefits beyond regulatory compliance. By optimizing energy efficiency and resource utilization, Biomea Fusion could potentially achieve operational cost savings. Furthermore, a strong commitment to environmental stewardship in 2024 and 2025 is increasingly viewed as a key differentiator, enhancing corporate reputation and potentially attracting environmentally conscious investors and partners.

The pharmaceutical industry, including companies like Biomea Fusion, is increasingly scrutinized for the ethical and environmental sourcing of its raw materials. This involves ensuring that the origins of ingredients avoid deforestation and pollution.

For instance, the demand for plant-derived compounds in drug manufacturing can put pressure on biodiversity. Companies are now expected to demonstrate supply chain transparency, with many aiming for certifications that guarantee responsible harvesting practices, a trend likely to intensify through 2025.

Failure to address these concerns can lead to reputational damage and potential regulatory action. By 2024, many major pharmaceutical firms had already implemented supplier codes of conduct emphasizing environmental stewardship and fair labor, a benchmark Biomea Fusion would likely need to meet or exceed.

Climate Change Impact on Health and Supply Chain Resilience

Climate change presents a subtle yet significant challenge for Biomea Fusion, primarily through its indirect effects on public health and supply chain integrity. Shifts in disease patterns, potentially exacerbated by changing climate conditions, could influence healthcare demands and research priorities. For instance, the World Health Organization (WHO) has highlighted that climate change is projected to cause approximately 250,000 additional deaths per year between 2030 and 2050 due to malnutrition, malaria, diarrhoea and heat stress.

The stability of Biomea Fusion's global supply chain for critical drug components could also be compromised by extreme weather events. Disruptions caused by floods, droughts, or severe storms can impede the sourcing and transportation of raw materials and finished products. A report by the McKinsey Global Institute in 2024 estimated that supply chain disruptions could cost the global economy trillions of dollars annually, underscoring the need for robust resilience planning.

- Increased disease prevalence: Climate-sensitive diseases like malaria and dengue fever are expanding their geographic range, potentially impacting public health infrastructure and research focus.

- Supply chain vulnerability: Extreme weather events in key agricultural or manufacturing regions can disrupt the availability of specialized chemical precursors or biological materials.

- Operational adaptation: Companies like Biomea Fusion may need to invest in more diversified sourcing strategies and advanced logistics to mitigate climate-related supply chain risks.

Corporate Social Responsibility (CSR) Expectations Regarding Environmental Footprint

Stakeholders, from investors to employees and the general public, are increasingly scrutinizing companies for robust Corporate Social Responsibility (CSR), with a particular emphasis on environmental stewardship. Biomea Fusion's environmental performance directly influences its public image, its appeal to investors, and its capacity to attract and retain skilled personnel, all vital for sustained business success.

The growing demand for sustainability is reshaping investment landscapes. For instance, in 2024, the global sustainable investment market was projected to exceed $50 trillion, reflecting a significant shift in capital allocation towards environmentally conscious businesses.

Biomea Fusion's commitment to reducing its environmental footprint can translate into tangible benefits:

- Enhanced Brand Reputation: Demonstrating environmental responsibility can foster trust and loyalty among consumers and partners.

- Investor Attractiveness: Environmental, Social, and Governance (ESG) factors are becoming critical for institutional investors; companies with strong ESG scores, including environmental performance, often see better access to capital. For example, many large pension funds now have mandates to invest in companies meeting specific sustainability criteria.

- Talent Acquisition and Retention: Younger generations of employees, in particular, prioritize working for companies that align with their values, including environmental protection.

Biomea Fusion must manage strict regulations for pharmaceutical waste, with fines for non-compliance potentially reaching tens of thousands of dollars, as seen with EPA enforcement in 2024. Beyond legal and financial risks, improper waste handling can lead to environmental contamination, impacting public health and ecosystems, making rigorous compliance crucial for reputation and stakeholder trust.

PESTLE Analysis Data Sources

Our Biomea Fusion PESTLE Analysis is meticulously constructed using a blend of public and proprietary data, drawing from leading market research firms, government regulatory bodies, and reputable economic forecasting agencies. This comprehensive approach ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in current, verifiable business conditions.