Biomea Fusion Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Biomea Fusion Bundle

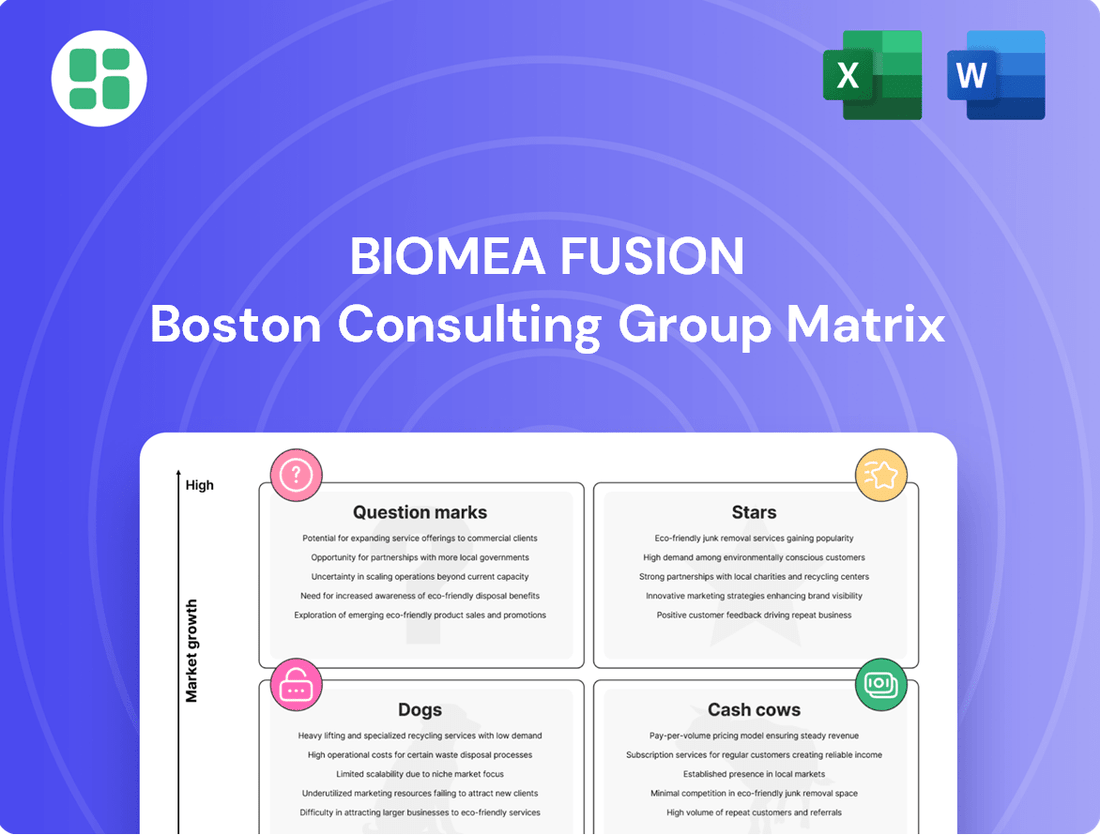

Unlock the strategic potential of your product portfolio with the Biomea Fusion BCG Matrix. This powerful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, offering a clear visual of market performance and growth opportunities.

Don't let your strategic decisions be based on guesswork. Purchase the full Biomea Fusion BCG Matrix to gain in-depth analysis, actionable insights, and a roadmap to optimize your investments and drive sustainable growth.

Stars

Biomea Fusion's lead product candidate, icovamenib (BMF-219), is gearing up for late-stage clinical trials in severe insulin-deficient type 2 diabetes. The company presented strong clinical data in 2024, highlighting its potential to significantly alter treatment paradigms for this patient group. This suggests a high-growth market with substantial unmet medical needs, positioning icovamenib as a potential leader in the future diabetes treatment landscape.

Icovamenib (BMF-219) is being investigated for type 1 diabetes through the COVALENT-112 study, with open-label data expected in the latter half of 2025. This expands BMF-219's addressable market into another significant area demanding disease-modifying treatments, complementing its potential in type 2 diabetes.

The type 1 diabetes indication represents a substantial growth opportunity, given the unmet need for innovative therapies. Positive clinical outcomes in this patient population could significantly enhance BMF-219's standing as a high-potential asset within Biomea Fusion's pipeline.

Biomea Fusion is making significant strides with BMF-650, a promising oral GLP-1 receptor agonist designed for the burgeoning obesity and diabetes markets. The company is gearing up to submit an Investigational New Drug (IND) application in the latter half of 2025, signaling a critical step towards clinical development. This strategic move positions BMF-650 to capitalize on the substantial growth anticipated in these therapeutic areas, which are projected to continue their upward trajectory in the coming years.

Proprietary FUSION™ System for Covalent Inhibitors

Biomea Fusion's proprietary FUSION™ System is a cornerstone technology, driving the discovery of innovative irreversible small molecule inhibitors. This platform offers a distinct, sustainable edge, aiming to build a robust pipeline of therapies that could be best-in-class or even first-in-class across diverse therapeutic areas.

The FUSION™ System's capacity to engineer molecules with exceptional potency and selectivity is crucial for cultivating future star products. For instance, the company's lead candidate, BMF-219, a covalent inhibitor targeting menin, is advancing through clinical trials for various cancers and metabolic diseases, showcasing the system's real-world application.

- Proprietary FUSION™ System: Enables discovery of novel irreversible small molecule inhibitors.

- Sustainable Competitive Advantage: Potential for a pipeline of best-in-class or first-in-class therapies.

- Key Molecule: BMF-219, a covalent inhibitor targeting menin, is in clinical development for oncology and metabolic diseases.

- Market Potential: The system underpins the development of highly potent and selective molecules, positioning them as potential future star products.

Strong Analyst Consensus and Price Targets

Analysts are largely optimistic about Biomea Fusion's future, with several issuing a 'Strong Buy' recommendation. The consensus price target suggests substantial upside potential, reflecting considerable market confidence in the company's trajectory.

This strong analyst sentiment, while inherently speculative for a company in the clinical stage, highlights the perceived high growth prospects of Biomea Fusion's lead programs. Such external validation bolsters the argument for its pipeline's 'Star' status.

- Analyst Rating: Multiple 'Strong Buy' ratings observed.

- Price Target Upside: Average target indicates significant growth potential.

- Market Confidence: Positive sentiment reflects belief in pipeline's future.

- Star Potential: External validation supports high-growth prospects.

Biomea Fusion's lead product candidates, icovamenib (BMF-219) and BMF-650, are positioned as potential Stars due to their development in high-growth markets with significant unmet needs, like type 2 and type 1 diabetes, and obesity. The company's proprietary FUSION™ System further solidifies this Star potential by enabling the creation of highly potent and selective molecules, fostering a pipeline of potentially best-in-class therapies. Strong analyst sentiment, with multiple 'Strong Buy' ratings and considerable upside potential indicated by price targets, underscores the market's confidence in these promising assets.

| Product Candidate | Therapeutic Area | Development Stage | Market Potential | Key Differentiator |

|---|---|---|---|---|

| Icovamenib (BMF-219) | Type 2 Diabetes (severe insulin-deficient), Type 1 Diabetes, Oncology | Late-stage clinical trials (Type 2 Diabetes), Open-label data expected H2 2025 (Type 1 Diabetes) | High growth, significant unmet need | Covalent inhibitor targeting menin, potential disease modification |

| BMF-650 | Obesity, Diabetes | IND submission expected H2 2025 | Burgeoning market, substantial growth anticipated | Oral GLP-1 receptor agonist |

What is included in the product

The Biomea Fusion BCG Matrix analyzes its product portfolio by market share and growth rate, guiding investment decisions.

Biomea Fusion's BCG Matrix provides a clear, visual roadmap for strategic resource allocation.

It simplifies complex portfolio decisions, acting as a pain point reliever for growth planning.

Cash Cows

Biomea Fusion's strategic realignment in early 2025, prioritizing diabetes and obesity programs, positions its existing operations as a cash cow. This focus allows for efficient resource allocation, generating stable internal funding for ongoing research and development.

Cost-reduction initiatives, including a significant workforce reduction of around 35% and operational consolidation, are key to this cash cow strategy. These measures are designed to extend the company's financial runway, ensuring operational continuity while awaiting future product revenues.

Biomea Fusion's cash reserves, totaling $36.2 million as of March 31, 2025, act as a crucial "cash cow" for the clinical-stage company. This funding runway is projected to sustain operations through the fourth quarter of 2025, allowing for continued research and development without immediate external financing needs.

Biomea Fusion is exploring strategic partnerships to bolster its oncology pipeline and enhance its FUSION™ System, especially concerning BMF-500. These collaborations can act as a way to generate cash or reduce spending on assets that are no longer central to their internal development plans. This strategy aims to secure non-dilutive funding or receive upfront payments, effectively leveraging these assets without the need for direct product sales.

Reduced Research and Development Expenses

Biomea Fusion's R&D expenses saw a notable decrease in Q1 2025 compared to the same period in 2024. This reduction was primarily driven by a strategic scaling back of clinical activities, a decrease in manufacturing costs, and a slowdown in preclinical research efforts.

This efficiency in managing cash burn is a critical factor for a clinical-stage biotechnology company like Biomea Fusion, directly impacting its financial runway. By conserving capital through optimized R&D spending, the company can better navigate its development pipeline.

- Reduced Q1 2025 R&D Expenses: A decrease compared to Q1 2024, reflecting strategic adjustments.

- Key Drivers of Reduction: Lower clinical activities, manufacturing costs, and preclinical work.

- Financial Runway Extension: Efficient R&D spending conserves capital for ongoing operations.

- Importance for Clinical-Stage Companies: Crucial for managing cash burn and advancing development.

Focus on High-Value Metabolic Disease Programs

Biomea Fusion's strategic pivot to exclusively focus on high-value metabolic disease programs, particularly advancing icovamenib and BMF-650, signals a deliberate concentration of capital on segments with robust market potential and more defined regulatory pathways.

This sharpened focus is designed to optimize capital allocation, aiming to cultivate profitable products that have the potential to evolve into significant cash cows for the company.

In 2024, the global metabolic disease market was valued at an estimated $2.3 trillion, with projections indicating continued growth driven by increasing prevalence of conditions like diabetes and obesity. Biomea's chosen therapeutic areas are at the forefront of addressing these expanding health challenges.

- Strategic Focus: Biomea is concentrating its efforts on metabolic disorders, specifically icovamenib and BMF-650.

- Market Potential: This focus targets areas with perceived higher market demand and clearer regulatory landscapes.

- Capital Allocation: The aim is to maximize return on investment by concentrating resources on these key programs.

- Cash Cow Potential: Successful advancement of these candidates is expected to yield profitable products that can become significant revenue generators.

Biomea Fusion's strategic concentration on diabetes and obesity programs, alongside cost-reduction measures and a $36.2 million cash reserve as of March 31, 2025, effectively positions its current operations as a cash cow. This strategy aims to generate stable internal funding for ongoing research and development, extending the company's financial runway through Q4 2025.

The company's reduced R&D expenses in Q1 2025, down from Q1 2024 due to scaled-back clinical activities and manufacturing costs, further supports this cash cow model. By optimizing spending, Biomea Fusion conserves capital, a crucial element for clinical-stage companies to manage cash burn and advance their development pipelines.

Biomea Fusion's focus on metabolic diseases, targeting icovamenib and BMF-650, aligns with the substantial global metabolic disease market, valued at $2.3 trillion in 2024. This strategic allocation of capital seeks to cultivate profitable products that can evolve into significant revenue generators, acting as future cash cows.

| Financial Metric | Q1 2025 | Q1 2024 | Change |

| Cash Reserves | $36.2 million | N/A | N/A |

| R&D Expenses | Reduced | Higher | Decrease |

| Projected Runway | Through Q4 2025 | N/A | N/A |

Preview = Final Product

Biomea Fusion BCG Matrix

The Biomea Fusion BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no demo content – just a professionally formatted, analysis-ready strategic tool ready for immediate application.

Dogs

Biomea Fusion has decided to halt all its ongoing oncology trials for icovamenib (BMF-219). This strategic move allows the company to shift its focus and internal resources towards speeding up development in its metabolic disease programs.

This termination indicates that the oncology applications for BMF-219 were likely viewed as having lower potential or were not considered central to Biomea Fusion's core strategy. Consequently, these oncology indications are now effectively considered 'dogs' within the company's product portfolio due to this strategic reprioritization.

The resources that were previously dedicated to these oncology programs are now being either sold off or redeployed to support the more promising metabolic disease initiatives.

Biomea Fusion is discontinuing internal development of BMF-500 in oncology after completing its dose escalation phase. This strategic shift suggests the company is seeking external partnerships or divestment for this asset, as it no longer aligns with their primary focus on metabolic diseases.

The decision to move BMF-500 out of internal development classifies it as a 'Dog' within the Biomea Fusion portfolio, indicating a low market share and low growth potential in its current oncology application. This move allows Biomea to reallocate resources to more promising areas within their metabolic disease pipeline.

The discontinuation of the COVALENT-101 study's CLL and DLBCL cohorts, which were investigating BMF-219 for liquid tumors, points to significant challenges. These cohorts were halted primarily due to insufficient patient enrollment.

This low enrollment suggests a limited market interest or substantial hurdles in patient recruitment for these specific indications of BMF-219. Consequently, these particular uses for BMF-219 are now viewed as having low market traction and an inability to advance efficiently.

General Preclinical and Exploratory Programs Being Closed or Partnered

Biomea Fusion is strategically shifting its focus, announcing that all preclinical and other clinical activities not central to its core strategy are either being partnered or closed. This move suggests a pruning of its earlier-stage or less advanced research programs. Such assets, if they aren't demonstrating significant promise, would typically fall into the Dogs quadrant of the BCG matrix, indicating low growth and low market share, making them candidates for divestment or discontinuation.

This strategic realignment is designed to concentrate resources on more promising avenues. For instance, in 2024, Biomea Fusion reported a net loss of $119.6 million, underscoring the financial pressure to optimize its pipeline. The decision to close or partner these less advanced programs aims to improve capital allocation and potentially generate value from these assets through external collaborations.

- Discontinuation of Non-Core Assets: Programs lacking strong preclinical data or clear development pathways are being phased out to conserve resources.

- Partnering Opportunities: Early-stage assets with potential but requiring external investment or expertise are being offered for partnership.

- Financial Prudence: This strategy aligns with managing burn rate, as evidenced by the company's reported net loss in 2024.

- Pipeline Optimization: The goal is to create a more focused and efficient research and development pipeline.

Suboptimal Clinical Trial Outcomes Leading to Prioritization Shifts

Biomea Fusion's strategic recalibration, moving from oncology to metabolic diseases, signals a likely reassessment of its clinical trial pipeline. While specific trial failures aren't always disclosed, this pivot suggests that previous oncology programs didn't meet internal benchmarks for progression.

This move implies that the oncology candidates, even with some early promise, weren't showing the robust efficacy or market potential to be classified as 'Stars' in a BCG-like framework. Consequently, these efforts likely transitioned to a '.' status, indicating they are not generating significant returns and may not warrant substantial ongoing investment.

- Shift in Focus: Biomea Fusion has publicly announced a strategic shift, prioritizing its development efforts in metabolic diseases over oncology.

- Oncology Pipeline Re-evaluation: This pivot suggests that prior oncology candidates may not have demonstrated sufficient clinical efficacy or commercial viability to justify continued internal resource allocation.

- BCG Matrix Implication: In a BCG matrix context, these underperforming oncology programs would likely be categorized as 'Dogs' ('.') due to their low market share and low growth potential, necessitating a strategic decision regarding their future.

- Resource Allocation: The company's decision to redirect resources underscores a commitment to areas with perceived higher potential for success and return on investment, a common strategy for optimizing R&D expenditure.

Biomea Fusion's strategic decision to halt oncology trials for BMF-219 and discontinue internal development of BMF-500 in oncology classifies these programs as 'Dogs' in the BCG matrix. This designation reflects their low growth potential and market share within the company's portfolio, especially given the shift in focus to metabolic diseases.

The insufficient patient enrollment in the COVALENT-101 study's CLL and DLBCL cohorts for BMF-219 further solidifies their 'Dog' status, indicating limited market traction and recruitment challenges. These moves are part of a broader strategy to prune less advanced research programs, partner or close non-core assets, and optimize resource allocation, as evidenced by the company's 2024 net loss of $119.6 million.

This pipeline optimization aims to concentrate efforts on more promising metabolic disease initiatives, a common approach for companies facing financial pressures and seeking to improve R&D expenditure efficiency. The company's overall strategy involves a significant recalibration, moving away from oncology to capitalize on perceived higher potential in metabolic health.

| Program | Indication | Status | BCG Category | Reason |

|---|---|---|---|---|

| BMF-219 | Oncology (Liquid Tumors) | Trials Halted | Dog | Insufficient patient enrollment, strategic shift to metabolic diseases |

| BMF-500 | Oncology | Discontinued Internal Development | Dog | No longer aligns with core focus on metabolic diseases, seeking external partnerships |

| Other Preclinical/Early Clinical | Various (Non-Core) | Partnered or Closed | Dog | Lack of strong preclinical data or clear development pathways, resource optimization |

Question Marks

Icovamenib, currently in Phase 2 trials for type 2 diabetes (COVALENT-111) and type 1 diabetes (COVALENT-112), fits the Question Mark category within the Biomea Fusion BCG matrix. These early-stage studies are crucial, with promising initial results that suggest potential, but the path to market is fraught with the inherent risks and significant capital demands of late-stage clinical development.

The success of these ongoing trials is the critical determinant for icovamenib's future. Positive outcomes in COVALENT-111 and COVALENT-112 are necessary for it to potentially graduate from a Question Mark to a Star, indicating strong market potential and growth. As of early 2024, Biomea Fusion has reported encouraging safety and efficacy signals in these early studies, fueling optimism for its progression.

BMF-650, Biomea Fusion's promising oral GLP-1 receptor agonist, is currently in the preclinical development phase. The company plans to submit an Investigational New Drug (IND) application by late 2025, signaling its progression towards human trials.

This candidate clearly falls into the 'Question Mark' category of the BCG matrix. The GLP-1 market is experiencing significant growth, with the global market size projected to reach tens of billions of dollars in the coming years, offering substantial upside potential for BMF-650.

However, its early stage necessitates considerable investment for clinical development, regulatory approvals, and market penetration. Success hinges on navigating these hurdles and demonstrating efficacy and safety to capture market share in a competitive landscape.

Biomea Fusion's strategic intent to pursue partnerships for its oncology portfolio and the FUSION™ System clearly places these assets in the 'Question Mark' category within a BCG-like analysis. This signifies a high-growth potential market segment where the company currently holds a low market share, necessitating external validation and investment to thrive.

The success of these ventures hinges on Biomea's ability to attract suitable partners who can provide the necessary capital, expertise, and market access. Without these collaborations, the future trajectory of the oncology portfolio and the FUSION™ System remains uncertain, leaving their long-term viability in question.

Future Pipeline Candidates from the FUSION™ System

Beyond the known BMF-219 and BMF-650, Biomea Fusion's FUSION™ System is capable of generating additional, undisclosed early-stage pipeline candidates. These potential novel irreversible inhibitors represent the system's innovative power, though each new discovery navigates a challenging path through extensive research and development.

The journey for these nascent candidates involves overcoming significant scientific hurdles and navigating inherent market uncertainties. Successfully bringing any new drug candidate to market requires substantial capital investment to validate its efficacy and safety, a process that can span many years and billions of dollars in development costs.

- FUSION™ System's Potential: The platform is designed to discover and develop novel irreversible inhibitors, expanding the company's therapeutic options beyond current lead programs.

- R&D Hurdles: Each new candidate faces rigorous preclinical and clinical testing, with high attrition rates common in drug development. For instance, the overall success rate for drugs entering Phase 1 trials is approximately 10%.

- Market Uncertainty: Even successful candidates must contend with competitive landscapes, regulatory approvals, and market adoption, factors that introduce significant commercial risk.

- Investment Requirements: Bringing a new drug from discovery to market can cost upwards of $2.6 billion, underscoring the substantial financial commitment needed for each FUSION™-generated candidate.

BMF-219 in Combination with GLP-1 Based Therapies (COVALENT-211)

Biomea Fusion's planned Phase II study, COVALENT-211, set for 2025, will investigate icovamenib combined with GLP-1 based therapies. This strategic move positions the combination as a 'Question Mark' within the BCG framework, signifying its potential for high growth but also its inherent uncertainties and resource demands.

The combination therapy aims to unlock enhanced efficacy by leveraging synergistic effects, a promising development that could significantly expand icovamenib's market reach. However, this novel therapeutic approach introduces new clinical trial complexities and regulatory hurdles that must be navigated successfully.

- High Potential: The combination of icovamenib with GLP-1 therapies could offer a more potent treatment option for metabolic diseases.

- Uncertainty: Clinical and regulatory pathways for such novel combinations are not yet fully defined, creating inherent risk.

- Investment Required: Significant R&D investment will be necessary to bring this combination to market, reflecting its 'Question Mark' status.

- Market Expansion: Successful development could lead to a substantial increase in Biomea Fusion's addressable market.

Question Marks represent Biomea Fusion's early-stage pipeline candidates and strategic initiatives with high growth potential but uncertain market success. These ventures require significant investment to advance through development and regulatory pathways. Their future trajectory hinges on overcoming scientific, clinical, and commercial hurdles.

For instance, BMF-650, an oral GLP-1 receptor agonist, is in preclinical development, aiming for an IND submission by late 2025. The GLP-1 market is booming, projected for tens of billions in value, but BMF-650 must prove its efficacy and safety in a competitive space.

Similarly, icovamenib's combination therapy with GLP-1 based treatments, slated for a Phase II study in 2025, represents a high-potential but uncertain venture. The FUSION™ System also generates new candidates, each facing the substantial cost of drug development, estimated at over $2.6 billion per drug.

| Asset/Initiative | Stage | Market Potential | Key Uncertainties | Investment Outlook |

| Icovamenib (Type 1/2 Diabetes) | Phase 2 | High (addressing metabolic diseases) | Clinical trial success, regulatory approval | Significant R&D funding required |

| BMF-650 (Oral GLP-1) | Preclinical | Very High (growing GLP-1 market) | Demonstrating efficacy/safety, market penetration | Substantial development costs |

| Oncology Portfolio/FUSION™ System | Early Stage/Platform | High (strategic partnerships sought) | Partnering success, clinical validation | Capital intensive, relies on external investment |

| Icovamenib + GLP-1 Combo | Planned Phase 2 (2025) | High (synergistic effects) | Complex clinical trials, regulatory pathway | Demands significant R&D investment |

BCG Matrix Data Sources

Our Biomea Fusion BCG Matrix leverages a comprehensive data ecosystem, integrating proprietary clinical trial results, real-world evidence, and market landscape analyses. This ensures a robust foundation for strategic decision-making.